Chinese Dairy Imports Update – Oct ’19

Executive Summary

Chinese dairy import figures provided by IHS Markit were recently updated with values spanning through Sep ‘19. Highlights from the updated report include:

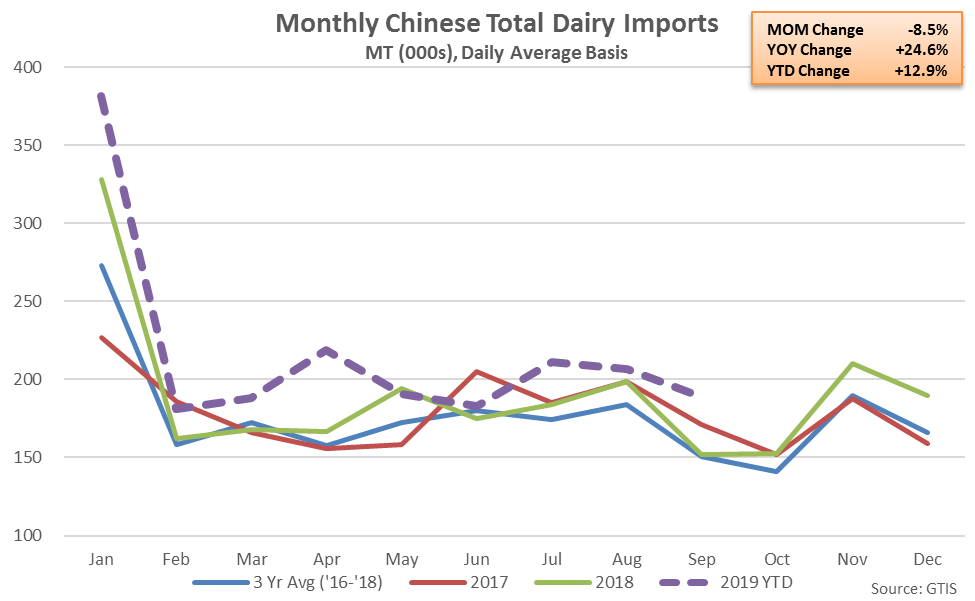

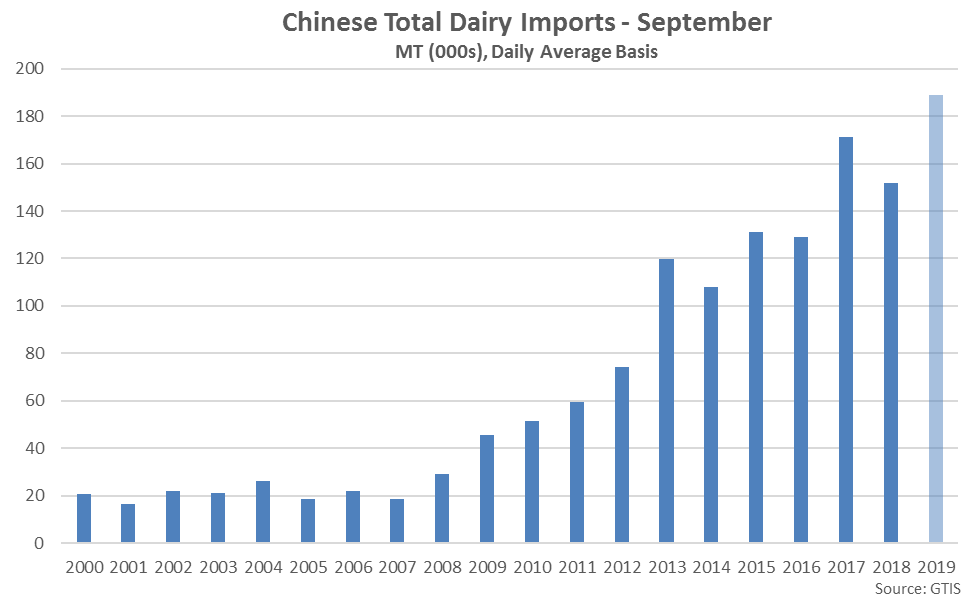

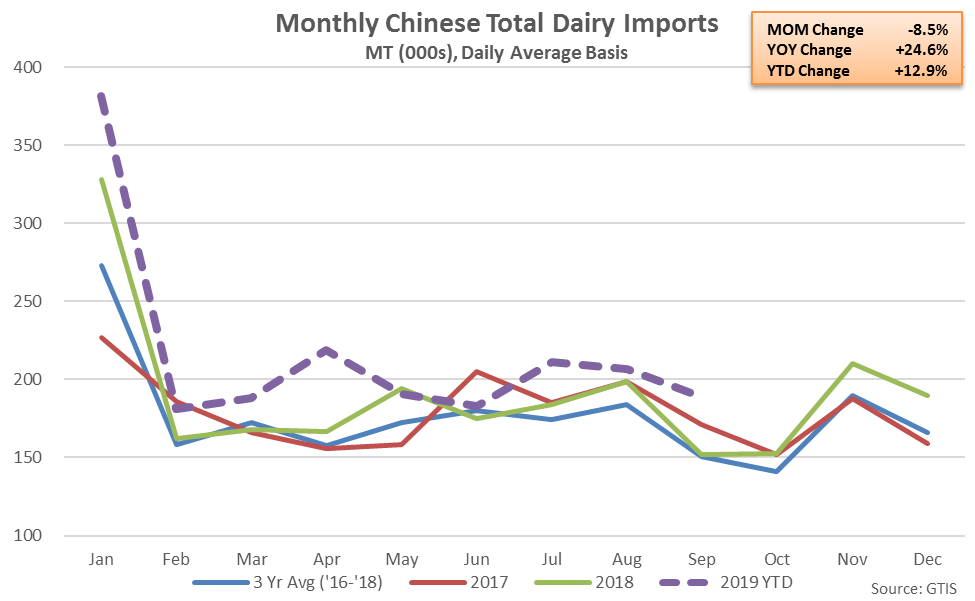

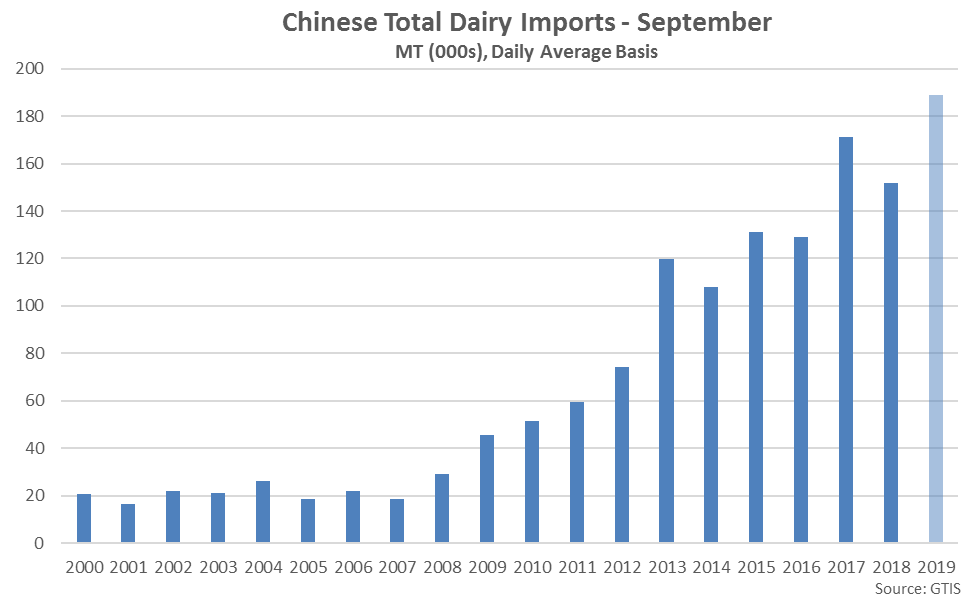

Sep ’19 Chinese Dairy Import Volumes Declined 8.5% MOM but Remained up 24.6% YOY

Sep ’19 Chinese Dairy Import Volumes Declined 8.5% MOM but Remained up 24.6% YOY

Sep ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Sep ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

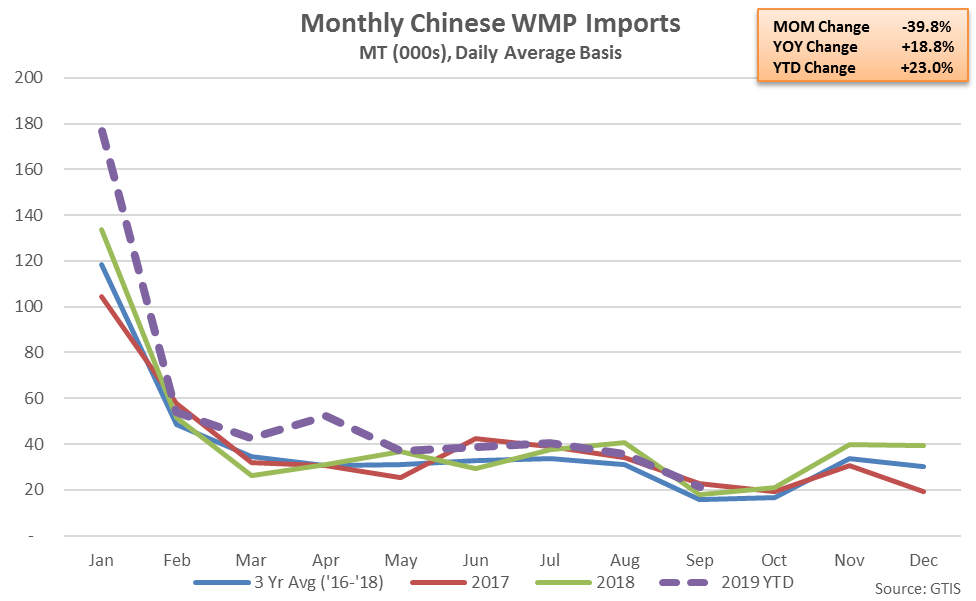

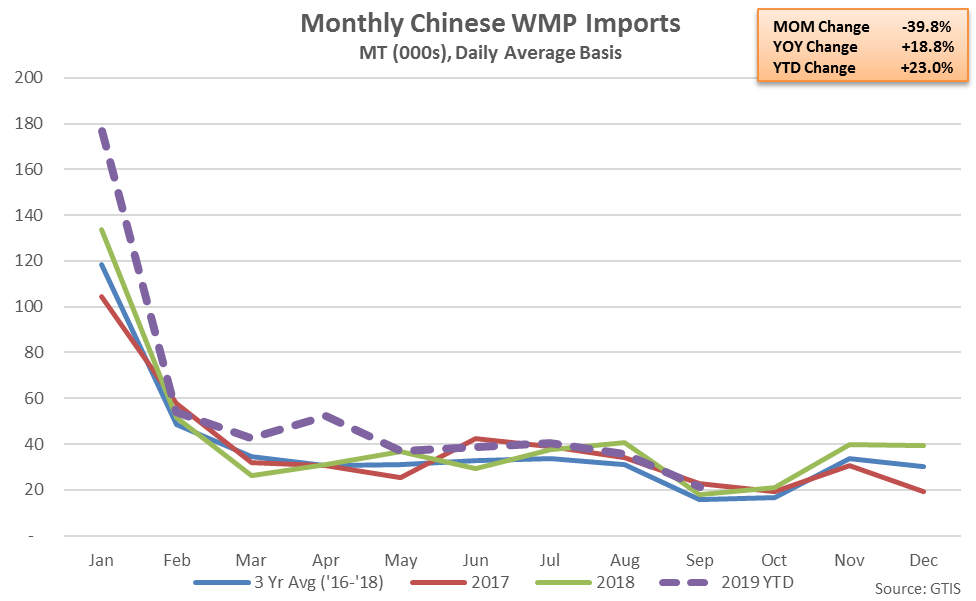

Sep ’19 Chinese WMP Import Volumes Declined 39.8% MOM but Remained up 18.8% YOY

Sep ’19 Chinese WMP Import Volumes Declined 39.8% MOM but Remained up 18.8% YOY

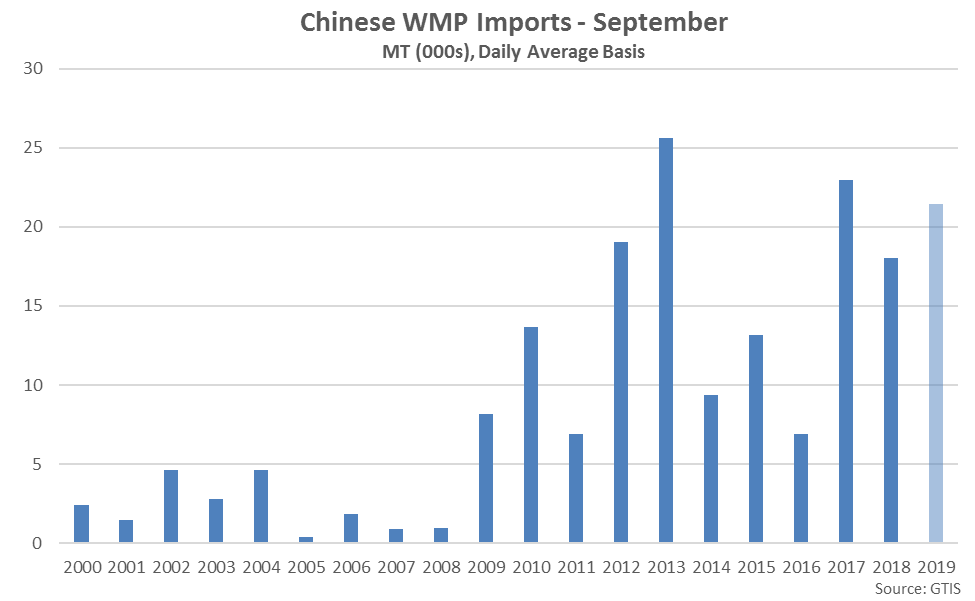

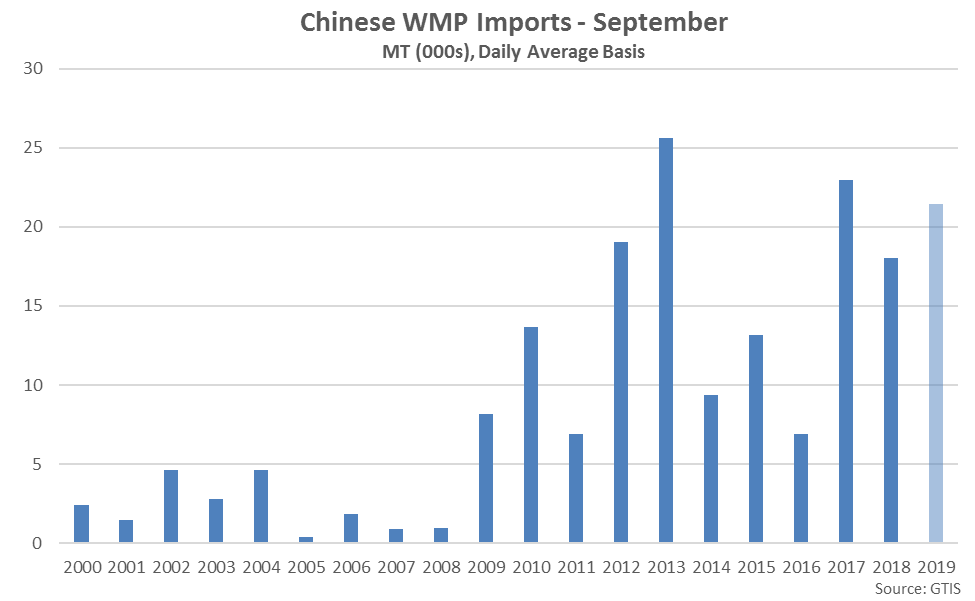

Sep ’19 Chinese WMP Imports Reached the Third Highest Seasonal Level on Record

Sep ’19 Chinese WMP Imports Reached the Third Highest Seasonal Level on Record

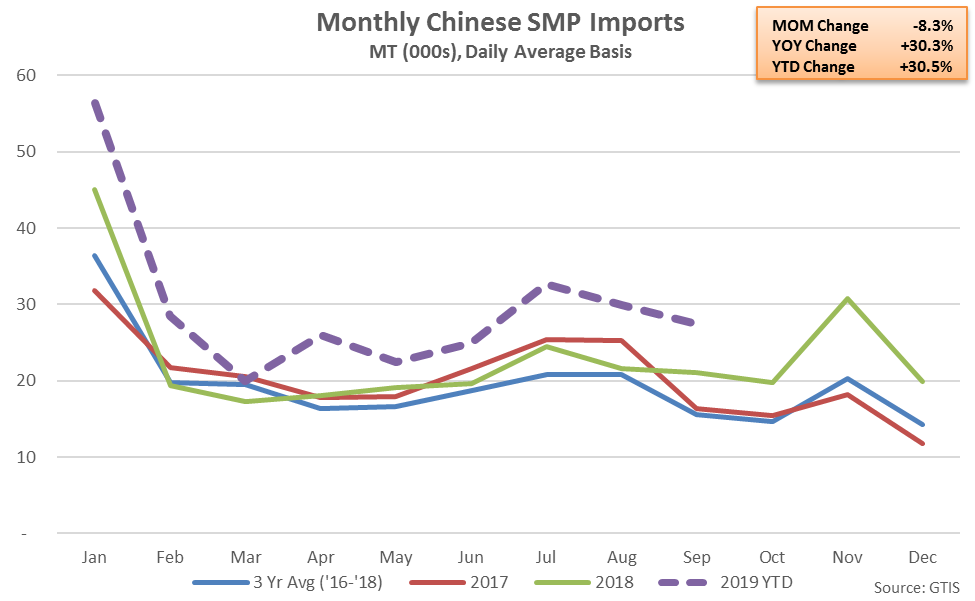

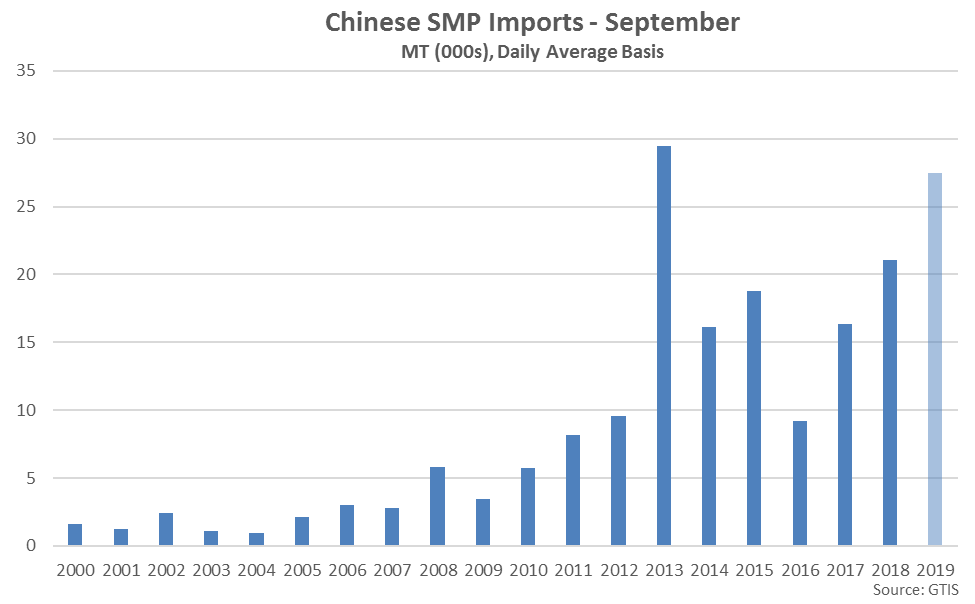

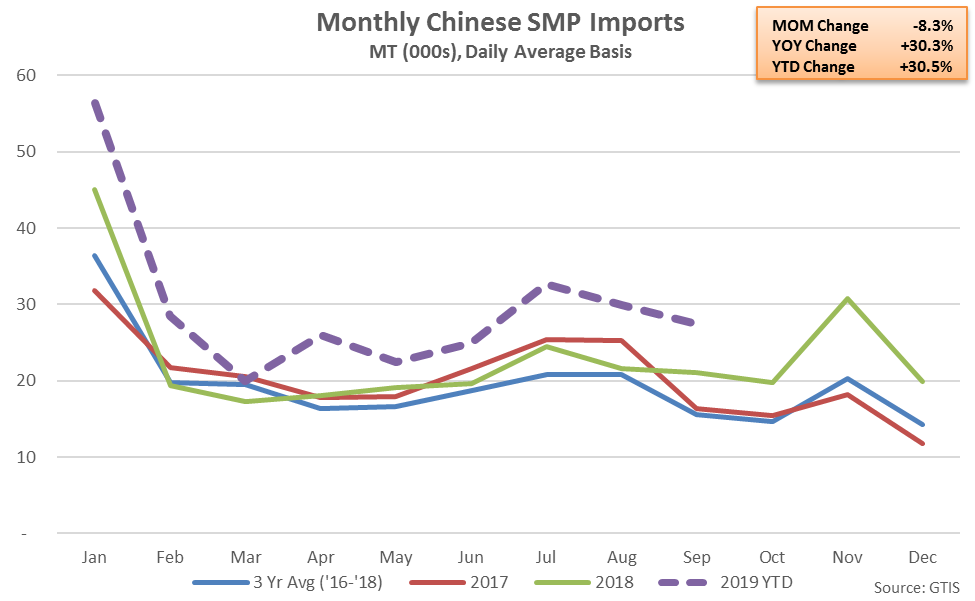

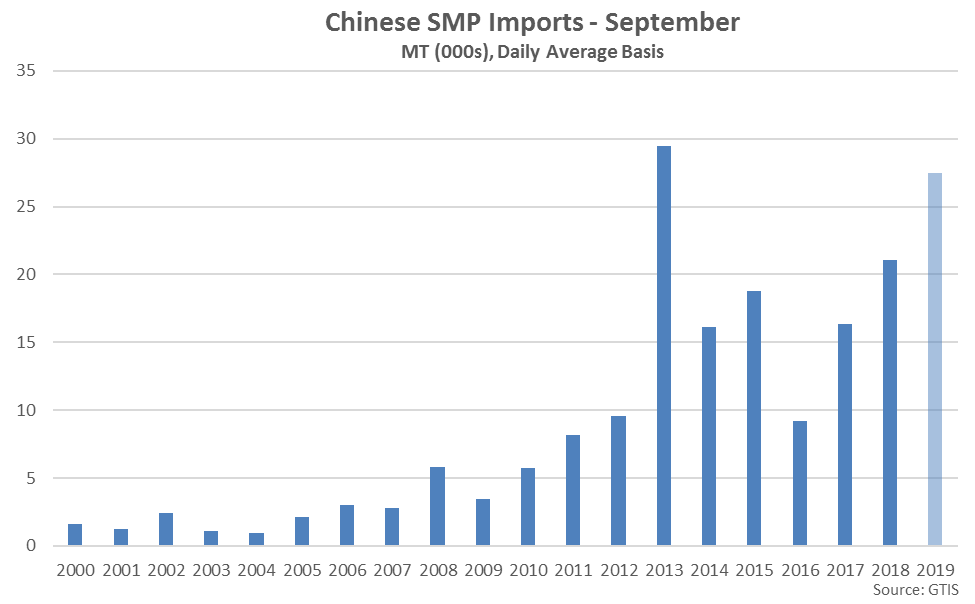

Sep ’19 Chinese SMP Import Volumes Declined 8.3% MOM but Remained up 30.3% YOY

Sep ’19 Chinese SMP Import Volumes Declined 8.3% MOM but Remained up 30.3% YOY

Sep ’19 Chinese SMP Imports Reached the Second Highest Seasonal Level on Record

Sep ’19 Chinese SMP Imports Reached the Second Highest Seasonal Level on Record

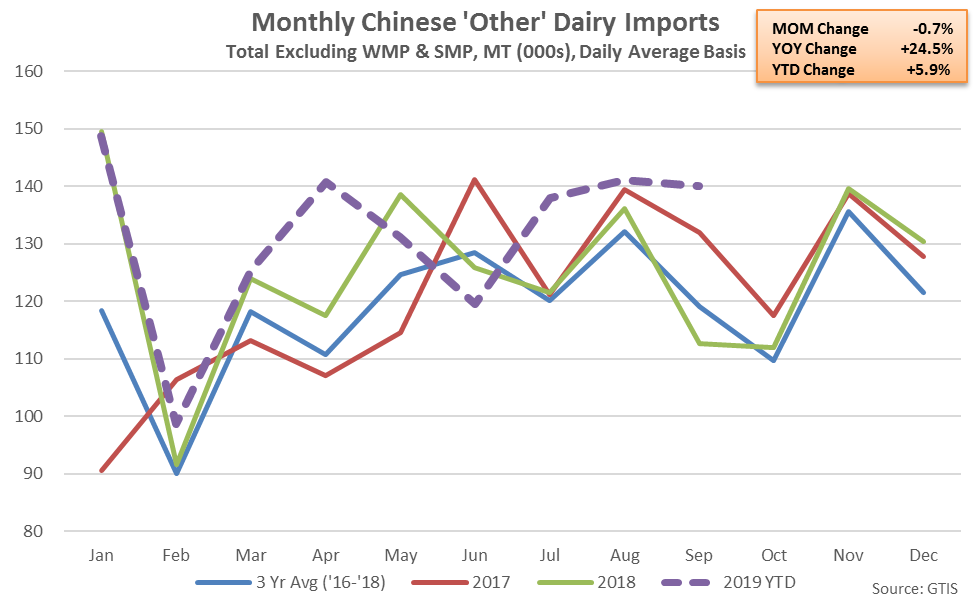

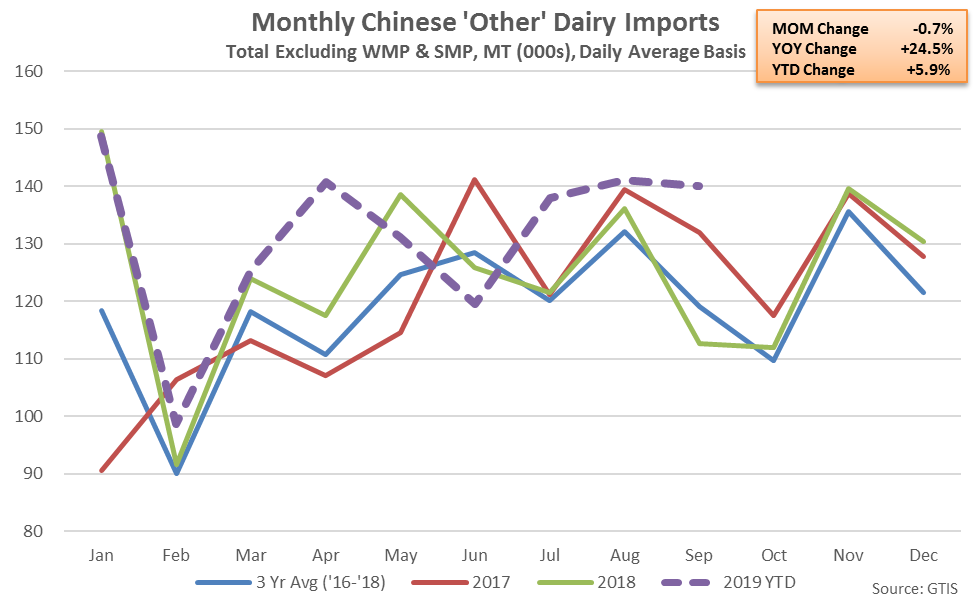

Sep ’19 Chinese Dairy Imports Excluding WMP & SMP Down 0.7% MOM but up 24.5% YOY

Sep ’19 Chinese Dairy Imports Excluding WMP & SMP Down 0.7% MOM but up 24.5% YOY

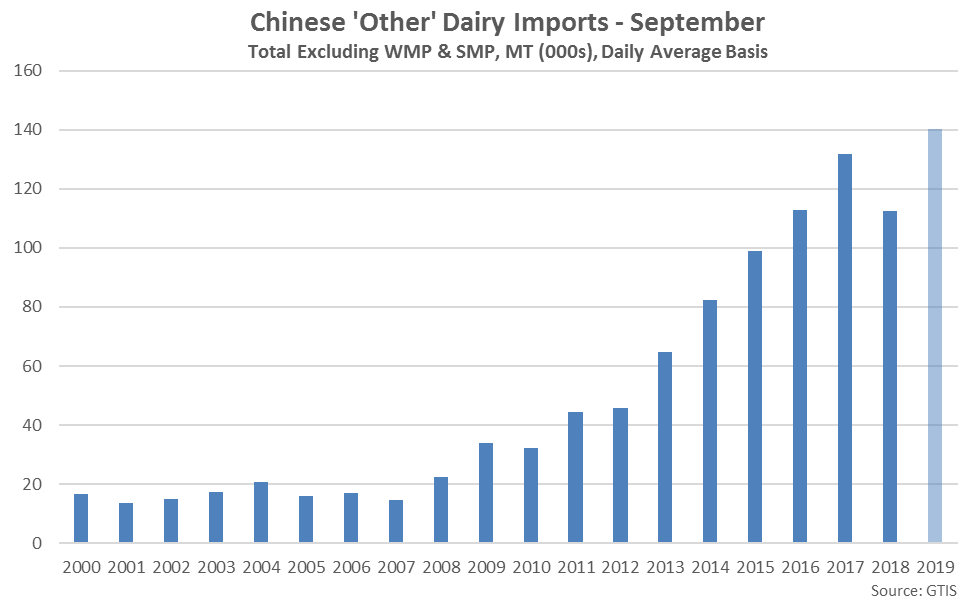

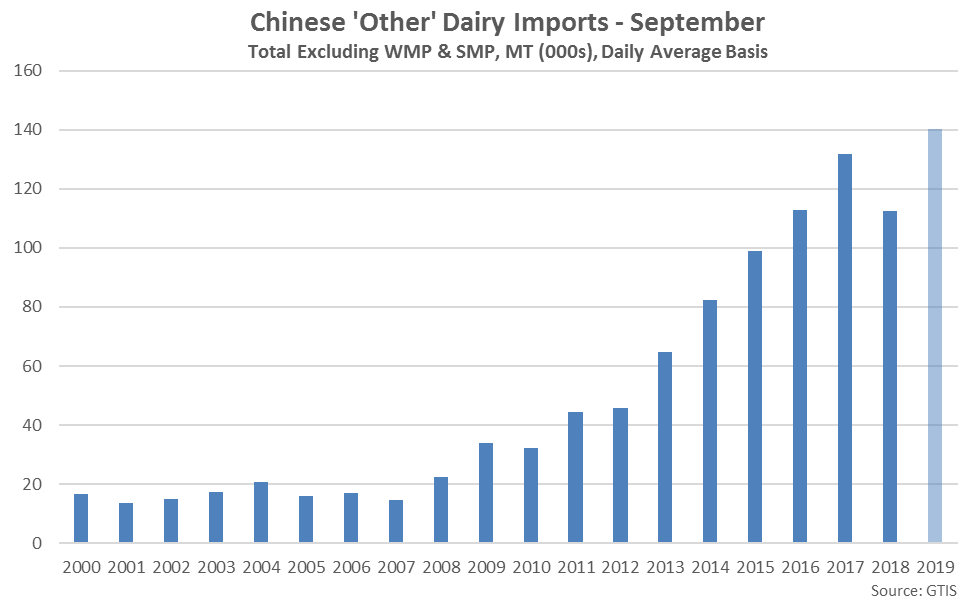

Sep ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Sep ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

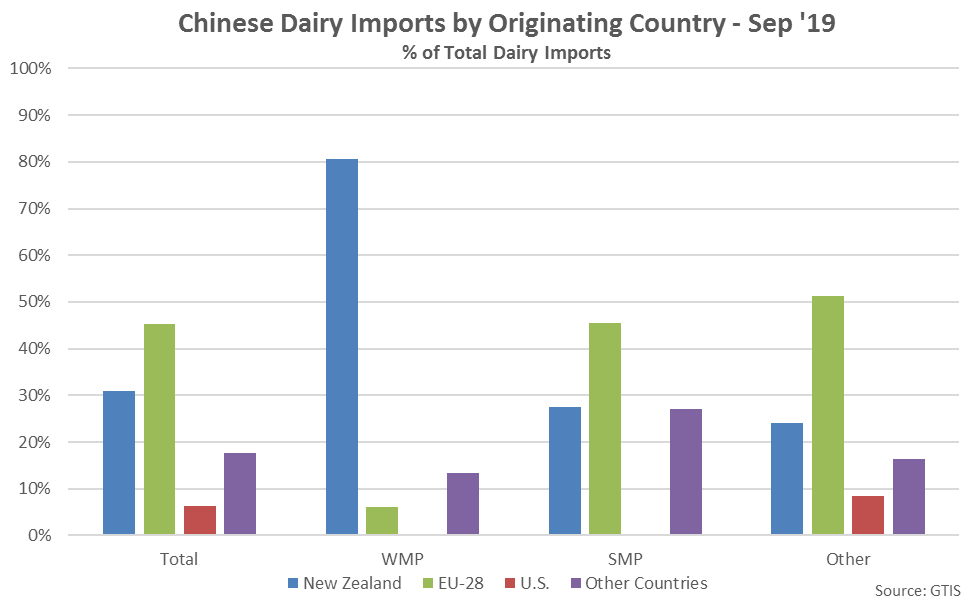

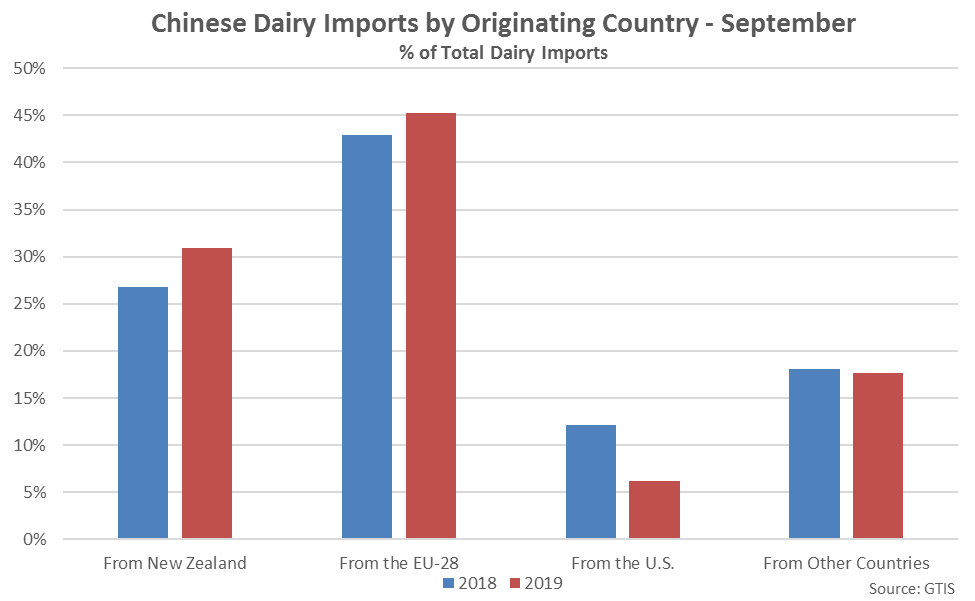

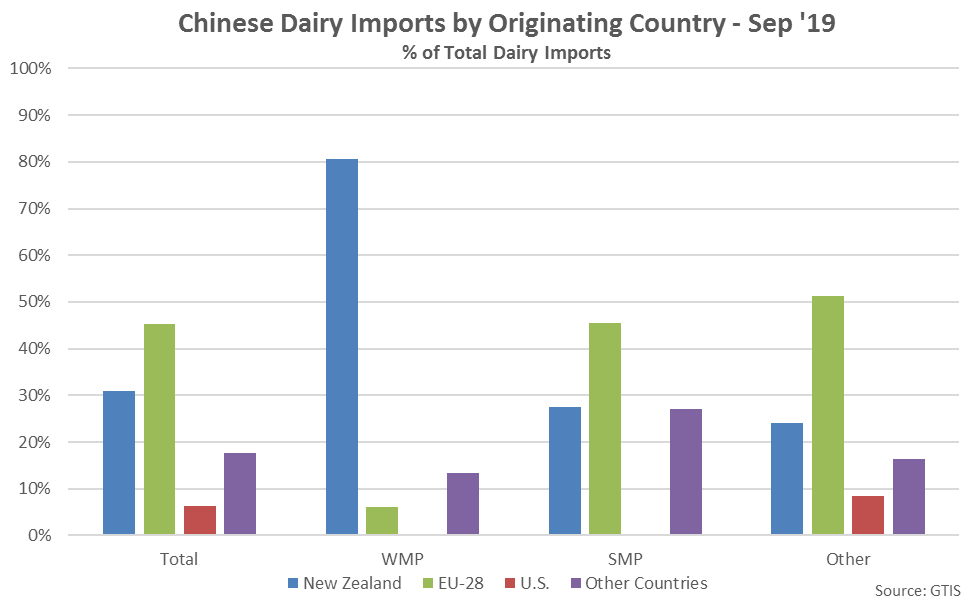

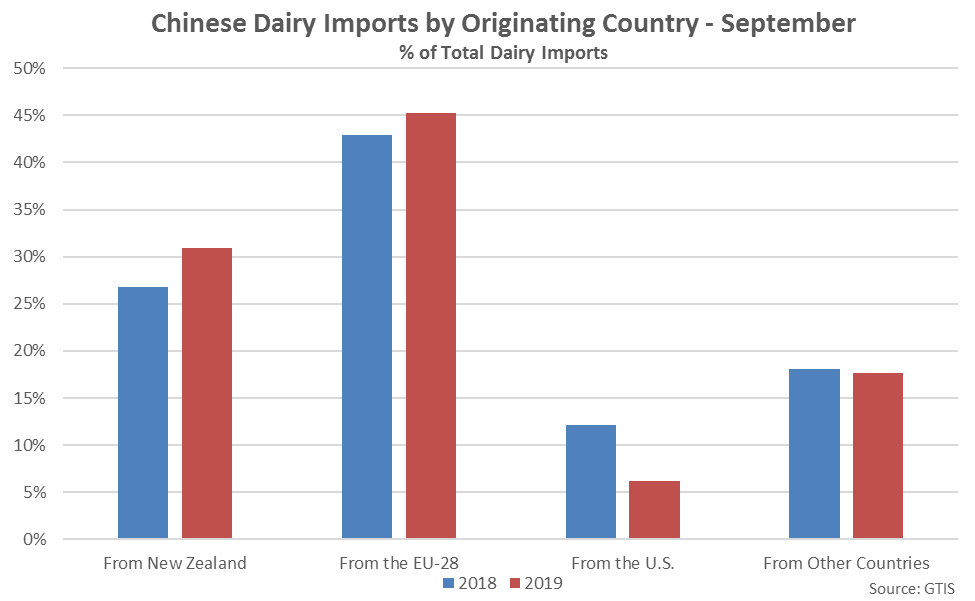

The EU-28 Accounted for Over 45% of All Sep ’19 Chinese Imports

The EU-28 Accounted for Over 45% of All Sep ’19 Chinese Imports

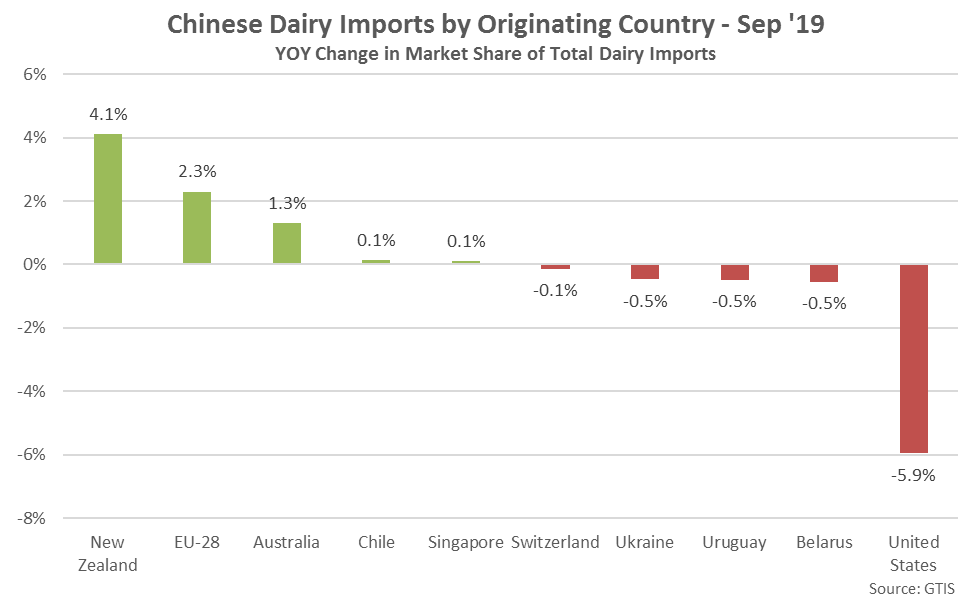

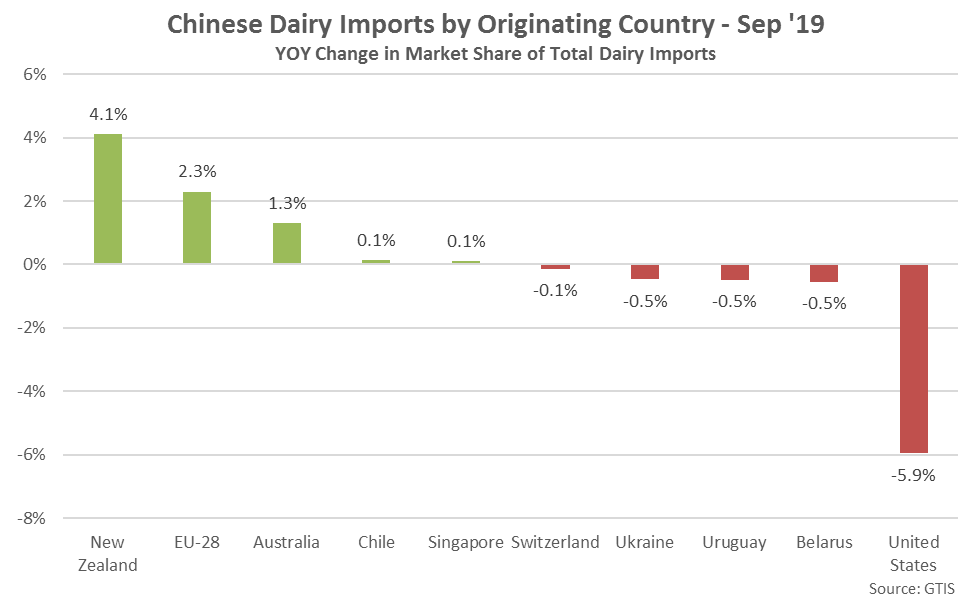

Sep ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Sep ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Sep ’19 NZ & EU-28 Shares of Total Chinese Dairy Imports Increased Most Significantly YOY

Sep ’19 NZ & EU-28 Shares of Total Chinese Dairy Imports Increased Most Significantly YOY

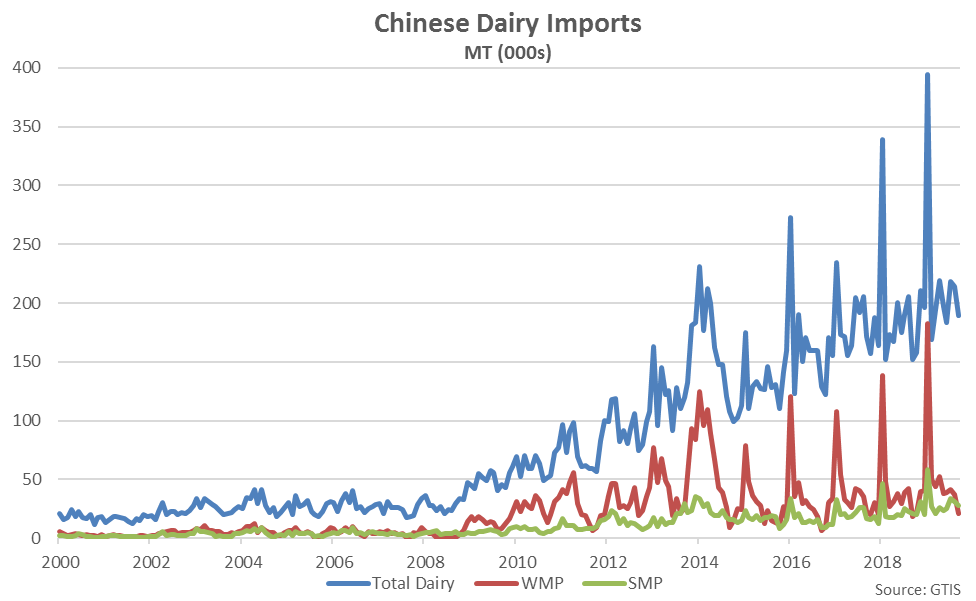

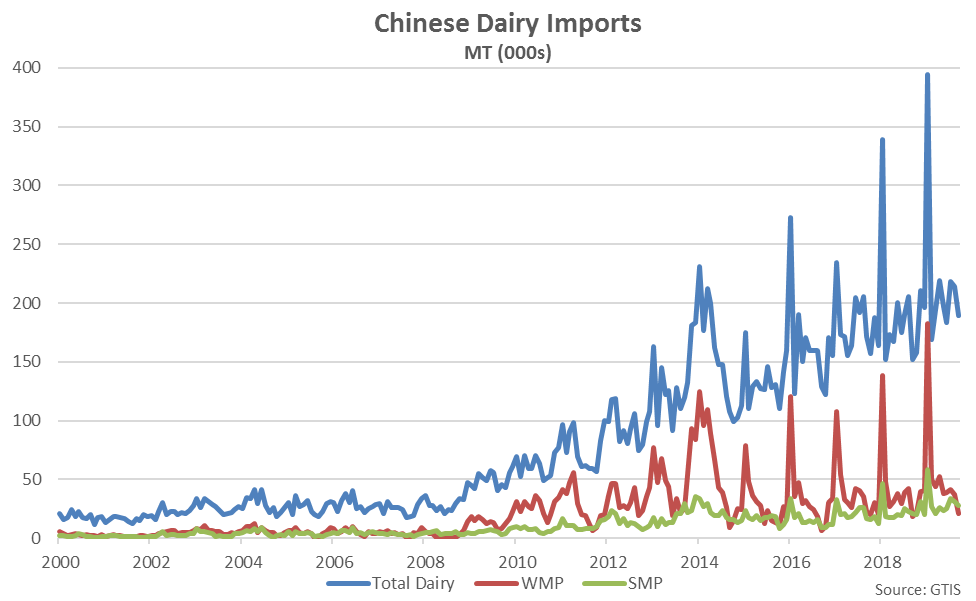

- Sep ’19 Chinese dairy import volumes increased on a YOY basis for the 11th time in the past 12 months, finishing up 24.6% to a record high seasonal level for the month of September.

- Sep ’19 Chinese whole milk powder increased 18.8% YOY, reaching the third highest seasonal level on record, while Sep ’19 Chinese skim milk powder imports increased 30.3% YOY, finishing at the second highest seasonal level on record. Sep ’19 Chinese dairy imports excluding whole milk powder and skim milk powder increased 24.5% YOY, reaching a record high seasonal level.

- Sep ’19 Chinese dairy imports originating from within New Zealand and the EU-28 gained market share from the previous year, while the U.S. market share finished most significantly below previous year levels.

Sep ’19 Chinese Dairy Import Volumes Declined 8.5% MOM but Remained up 24.6% YOY

Sep ’19 Chinese Dairy Import Volumes Declined 8.5% MOM but Remained up 24.6% YOY

Sep ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Sep ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Sep ’19 Chinese WMP Import Volumes Declined 39.8% MOM but Remained up 18.8% YOY

Sep ’19 Chinese WMP Import Volumes Declined 39.8% MOM but Remained up 18.8% YOY

Sep ’19 Chinese WMP Imports Reached the Third Highest Seasonal Level on Record

Sep ’19 Chinese WMP Imports Reached the Third Highest Seasonal Level on Record

Sep ’19 Chinese SMP Import Volumes Declined 8.3% MOM but Remained up 30.3% YOY

Sep ’19 Chinese SMP Import Volumes Declined 8.3% MOM but Remained up 30.3% YOY

Sep ’19 Chinese SMP Imports Reached the Second Highest Seasonal Level on Record

Sep ’19 Chinese SMP Imports Reached the Second Highest Seasonal Level on Record

Sep ’19 Chinese Dairy Imports Excluding WMP & SMP Down 0.7% MOM but up 24.5% YOY

Sep ’19 Chinese Dairy Imports Excluding WMP & SMP Down 0.7% MOM but up 24.5% YOY

Sep ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Sep ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

The EU-28 Accounted for Over 45% of All Sep ’19 Chinese Imports

The EU-28 Accounted for Over 45% of All Sep ’19 Chinese Imports

Sep ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Sep ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Sep ’19 NZ & EU-28 Shares of Total Chinese Dairy Imports Increased Most Significantly YOY

Sep ’19 NZ & EU-28 Shares of Total Chinese Dairy Imports Increased Most Significantly YOY