Chinese Dairy Imports Update – Feb ’17

Executive Summary

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Jan ’17. Highlights from the updated report include:

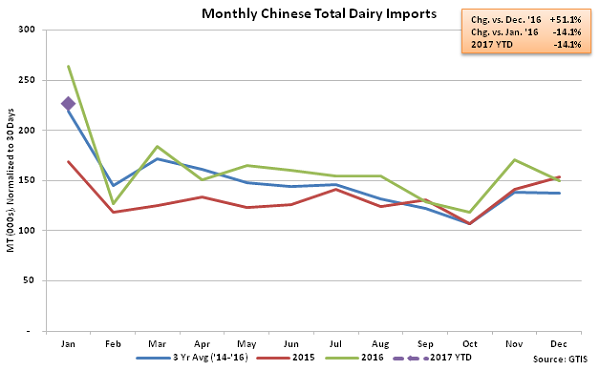

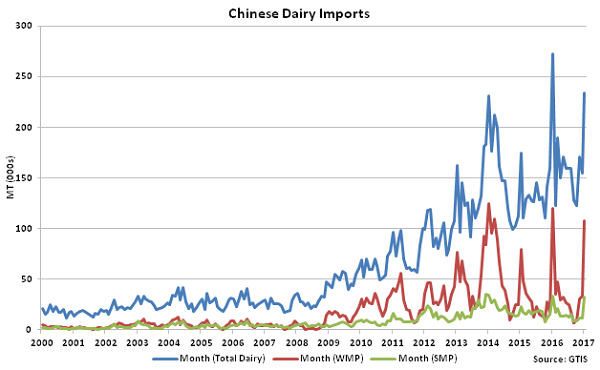

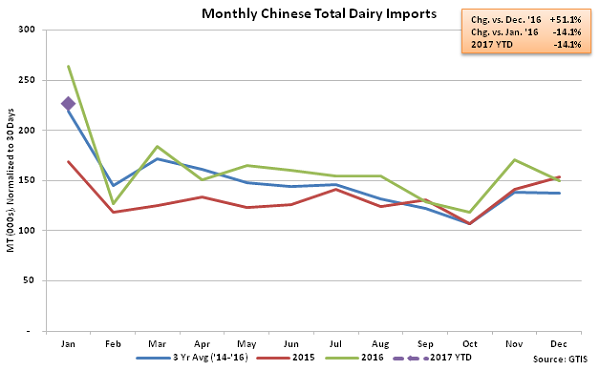

Jan ’17 Total Chinese Dairy Import Volumes Increased 51.1% MOM but Declined 14.1% YOY

Jan ’17 Total Chinese Dairy Import Volumes Increased 51.1% MOM but Declined 14.1% YOY

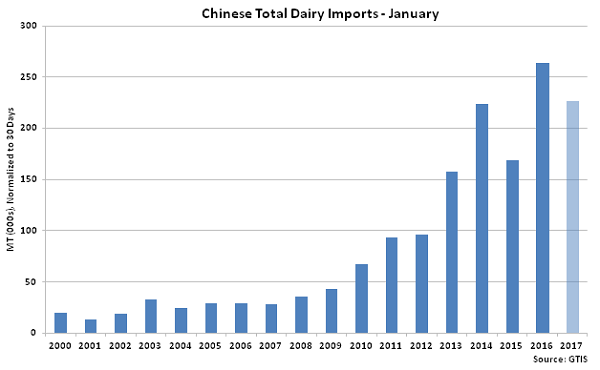

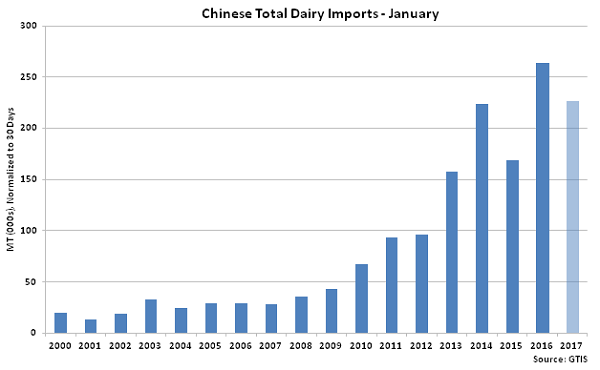

Total Chinese Dairy Import Volumes Remained at the Second Highest January Figure

Total Chinese Dairy Import Volumes Remained at the Second Highest January Figure

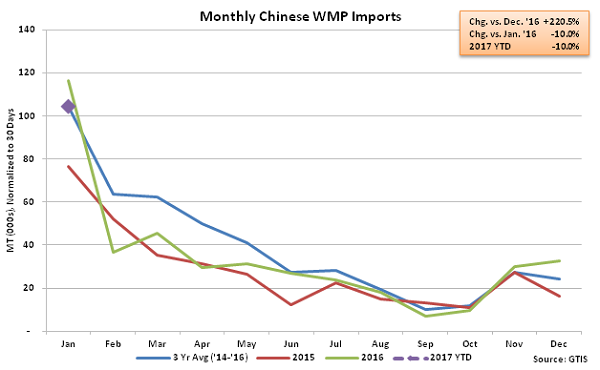

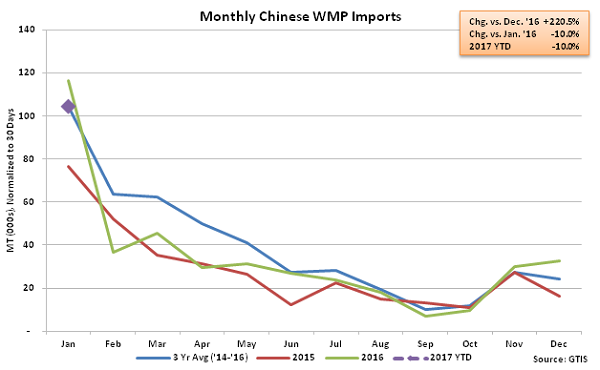

Jan ’17 Chinese WMP Import Volumes Increased 220.5% MOM but Declined 10.0% YOY

Jan ’17 Chinese WMP Import Volumes Increased 220.5% MOM but Declined 10.0% YOY

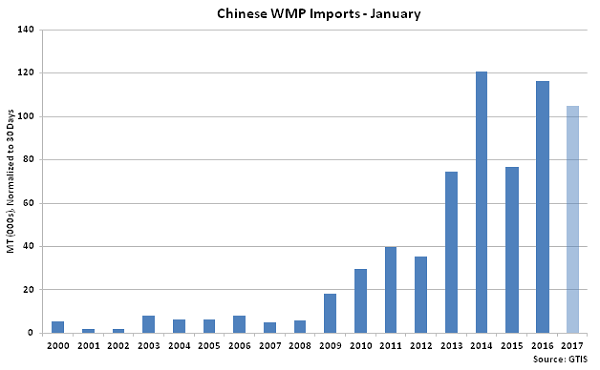

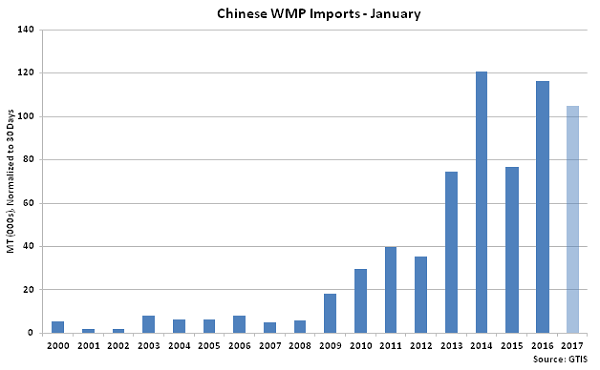

Chinese WMP Imports Remained at the Third Highest January Figure

Chinese WMP Imports Remained at the Third Highest January Figure

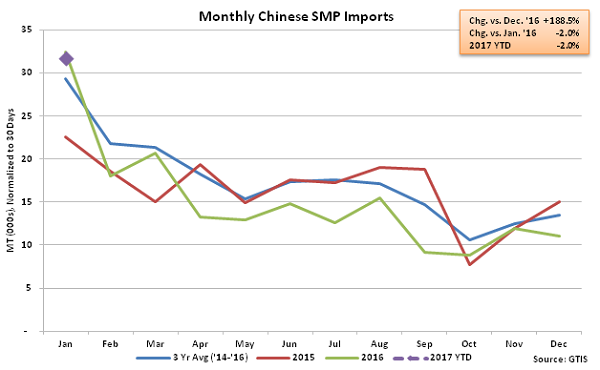

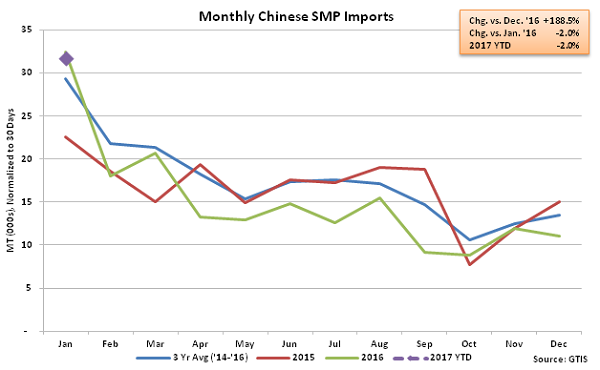

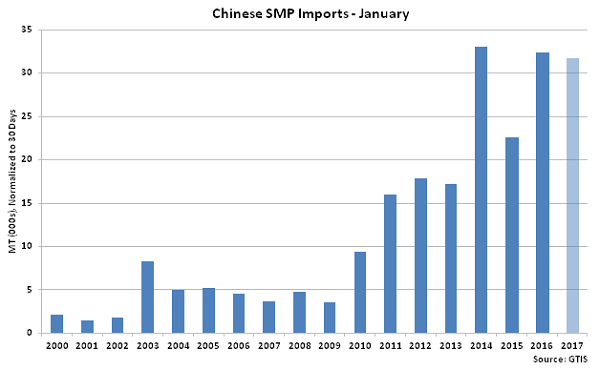

Jan ’17 Chinese SMP Import Volumes Increased 188.5% MOM but Declined 2.0% YOY

Jan ’17 Chinese SMP Import Volumes Increased 188.5% MOM but Declined 2.0% YOY

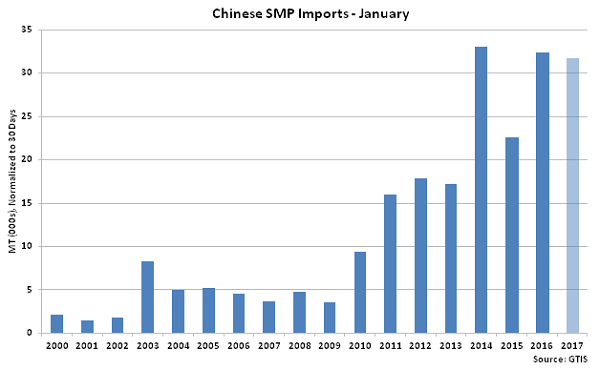

Chinese SMP Imports Remained at the Third Highest January Figure

Chinese SMP Imports Remained at the Third Highest January Figure

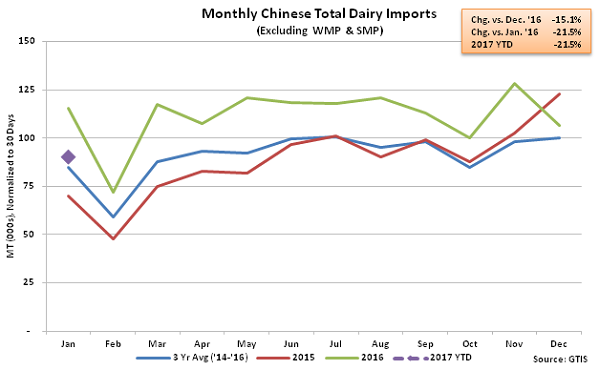

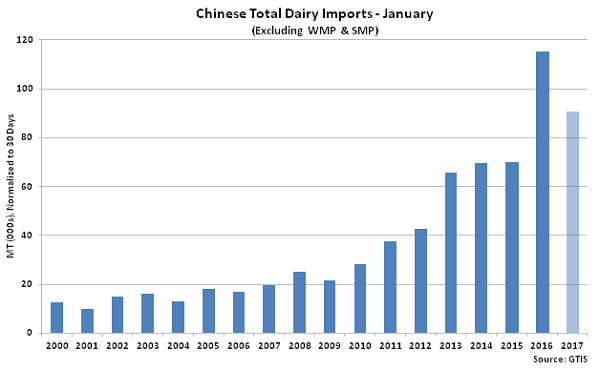

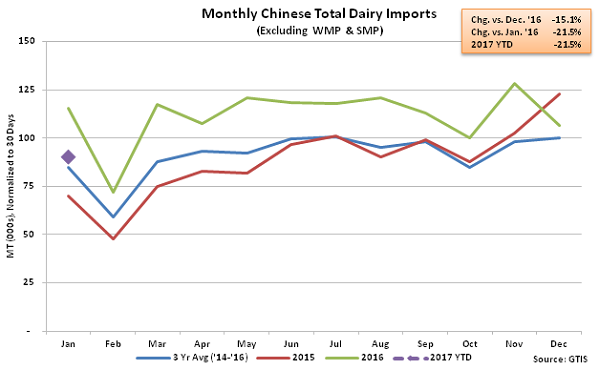

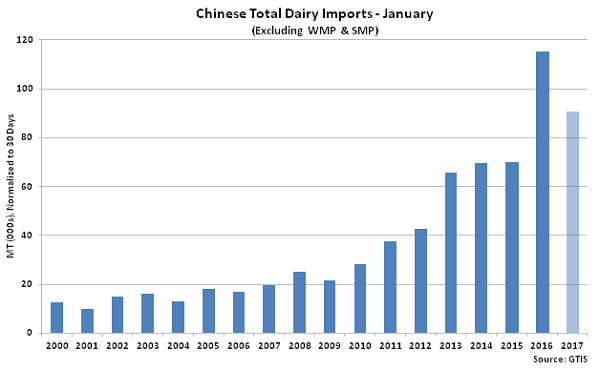

Jan ’17 Chinese Dairy Imports Excluding WMP & SMP Declined 15.1% MOM and 21.5% YOY

Jan ’17 Chinese Dairy Imports Excluding WMP & SMP Declined 15.1% MOM and 21.5% YOY

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Jan Figure

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Jan Figure

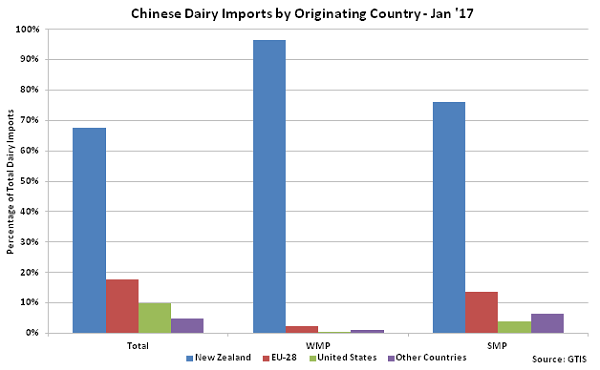

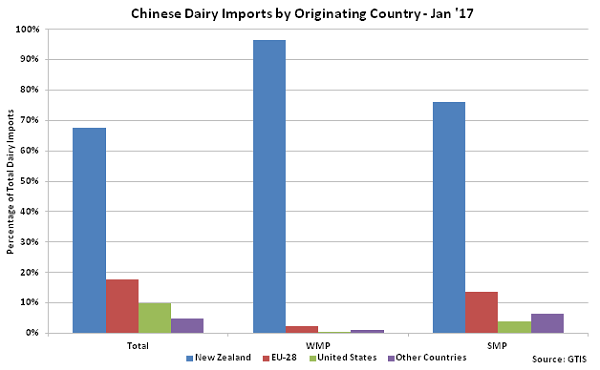

New Zealand Accounted for Over Two Thirds of the Jan ’17 Chinese Dairy Import Volumes

New Zealand Accounted for Over Two Thirds of the Jan ’17 Chinese Dairy Import Volumes

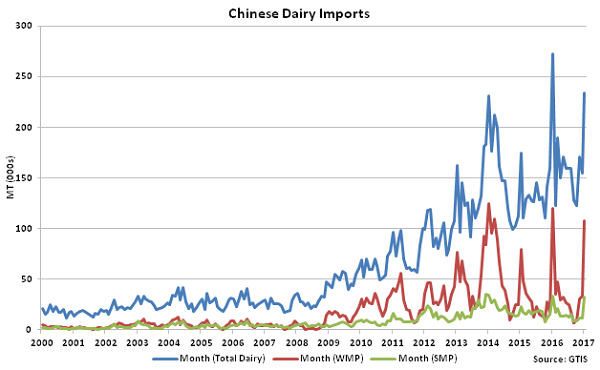

- Jan ’17 total Chinese dairy import volumes declined on a YOY basis for the second consecutive month, finishing 14.1% below the monthly record high experienced during the previous year. The YOY decline in total Chinese dairy imports was the largest experienced throughout the past 19 months on a percentage basis.

- Jan ’17 Chinese powder imports increased seasonally as importers looked to take advantage of lower tariff rates offered as part of the New Zealand – China Free Trade Agreement. Chinese whole milk powder and skim milk powder imports increased 220.5% and 188.5% MOM on a daily average basis, respectively, but remained 10.0% and 2.0% lower on a YOY basis.

- Jan ’17 Chinese dairy imports excluding whole milk powder and skim milk powder declined a YOY basis for second consecutive month, finishing down 21.5%, but remained at the second highest January figure on record.

Jan ’17 Total Chinese Dairy Import Volumes Increased 51.1% MOM but Declined 14.1% YOY

Jan ’17 Total Chinese Dairy Import Volumes Increased 51.1% MOM but Declined 14.1% YOY

Total Chinese Dairy Import Volumes Remained at the Second Highest January Figure

Total Chinese Dairy Import Volumes Remained at the Second Highest January Figure

Jan ’17 Chinese WMP Import Volumes Increased 220.5% MOM but Declined 10.0% YOY

Jan ’17 Chinese WMP Import Volumes Increased 220.5% MOM but Declined 10.0% YOY

Chinese WMP Imports Remained at the Third Highest January Figure

Chinese WMP Imports Remained at the Third Highest January Figure

Jan ’17 Chinese SMP Import Volumes Increased 188.5% MOM but Declined 2.0% YOY

Jan ’17 Chinese SMP Import Volumes Increased 188.5% MOM but Declined 2.0% YOY

Chinese SMP Imports Remained at the Third Highest January Figure

Chinese SMP Imports Remained at the Third Highest January Figure

Jan ’17 Chinese Dairy Imports Excluding WMP & SMP Declined 15.1% MOM and 21.5% YOY

Jan ’17 Chinese Dairy Imports Excluding WMP & SMP Declined 15.1% MOM and 21.5% YOY

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Jan Figure

Chinese Dairy Imports Excluding WMP & SMP Remained at the Second Highest Jan Figure

New Zealand Accounted for Over Two Thirds of the Jan ’17 Chinese Dairy Import Volumes

New Zealand Accounted for Over Two Thirds of the Jan ’17 Chinese Dairy Import Volumes