Chinese Dairy Imports Update – Nov ’19

Executive Summary

Chinese dairy import figures provided by IHS Markit were recently updated with values spanning through Oct ‘19. Highlights from the updated report include:

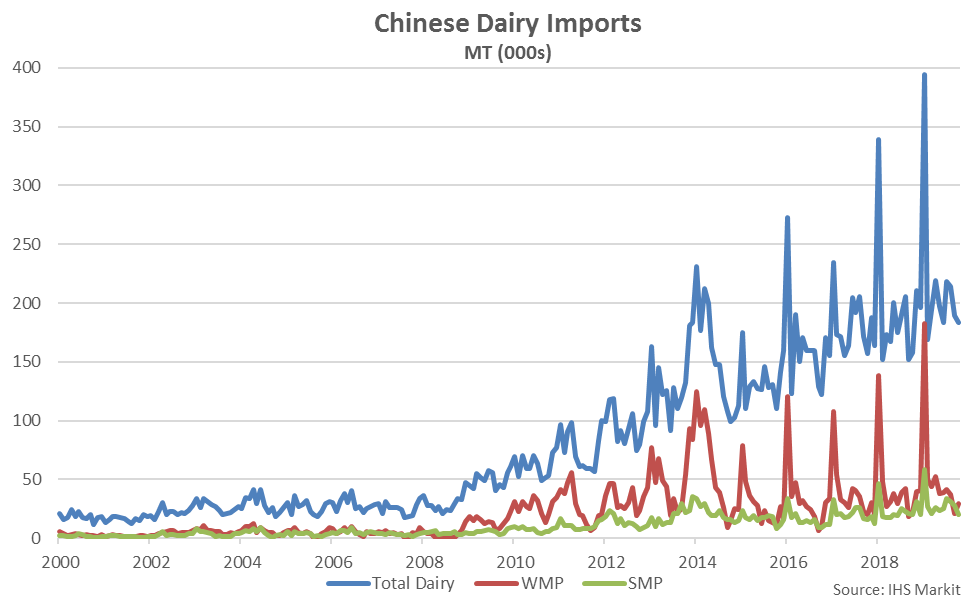

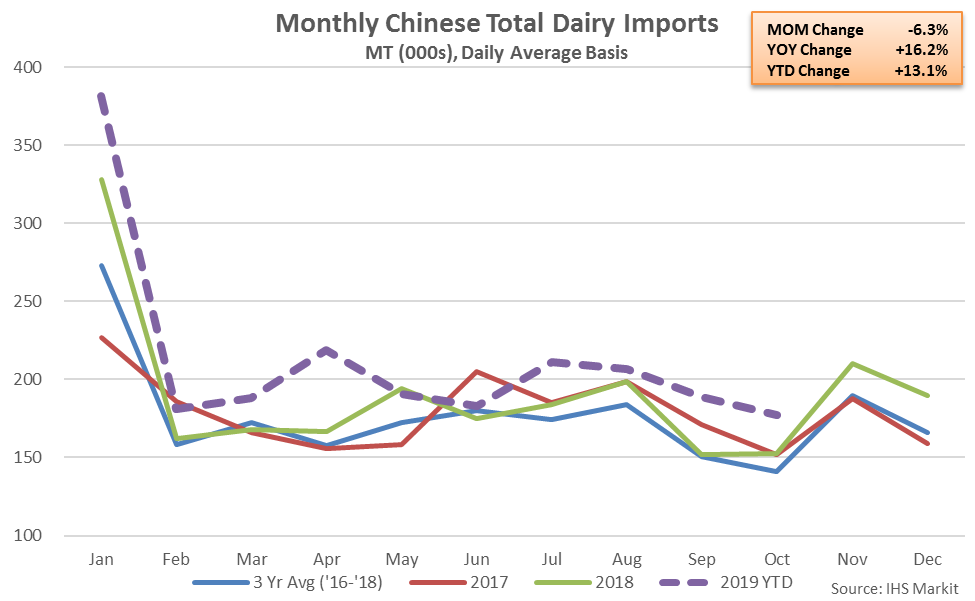

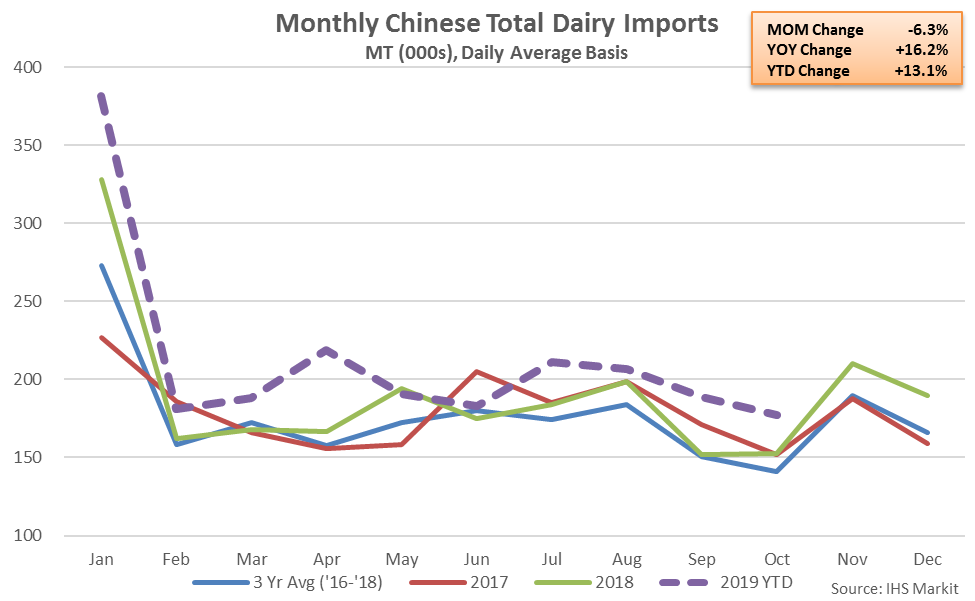

Oct ’19 Chinese Dairy Import Volumes Declined 6.3% MOM but Remained up 16.2% YOY

Oct ’19 Chinese Dairy Import Volumes Declined 6.3% MOM but Remained up 16.2% YOY

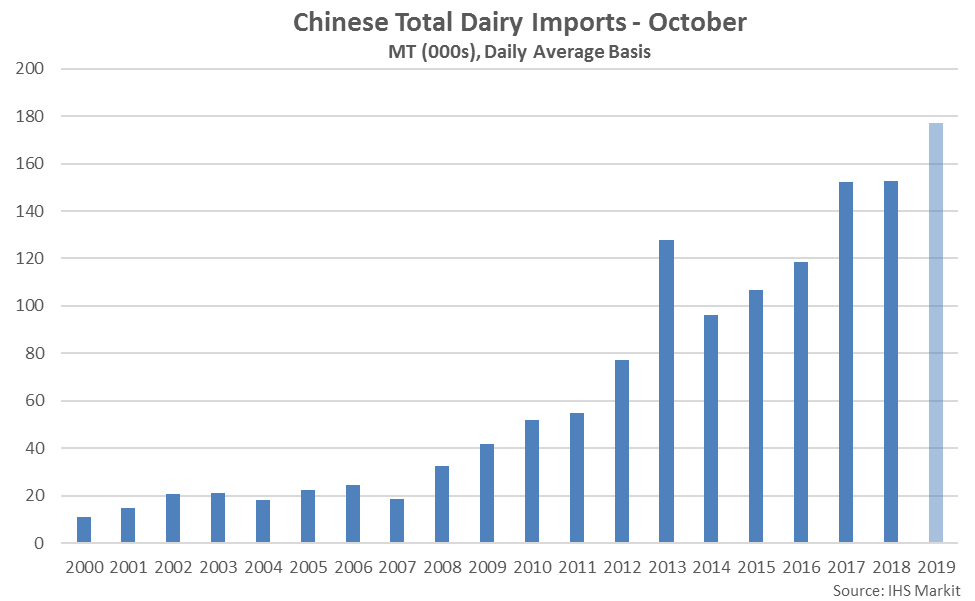

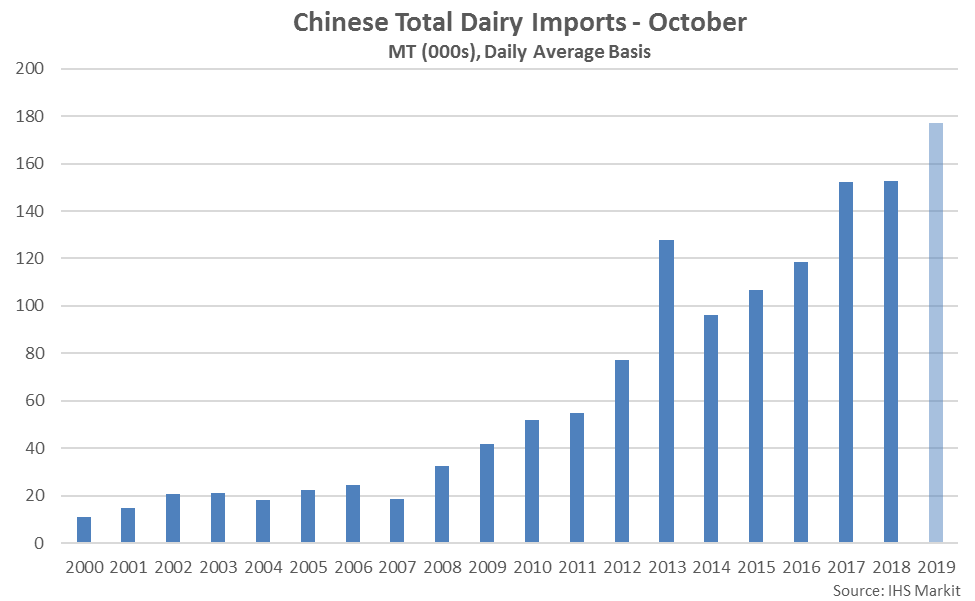

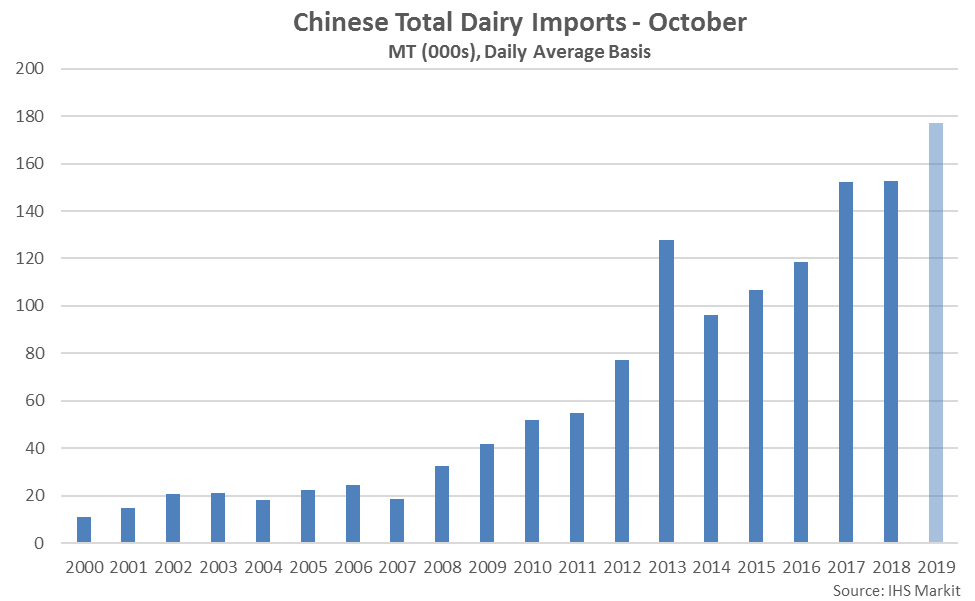

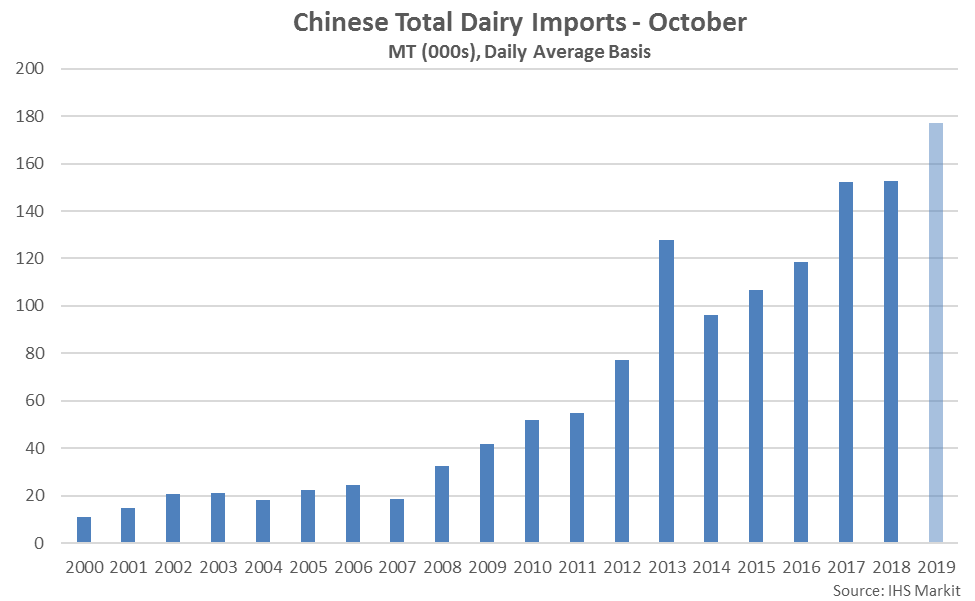

Oct ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Oct ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

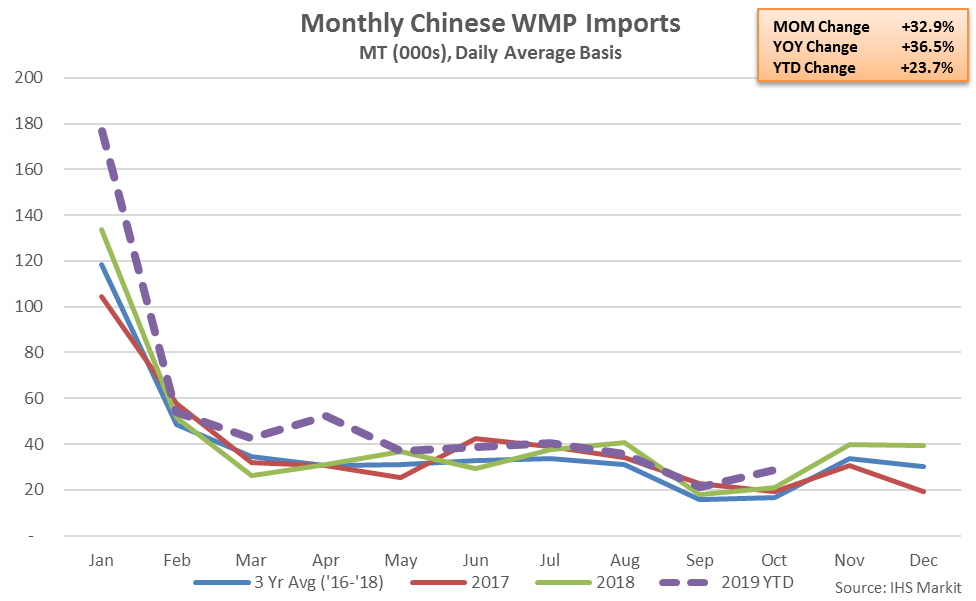

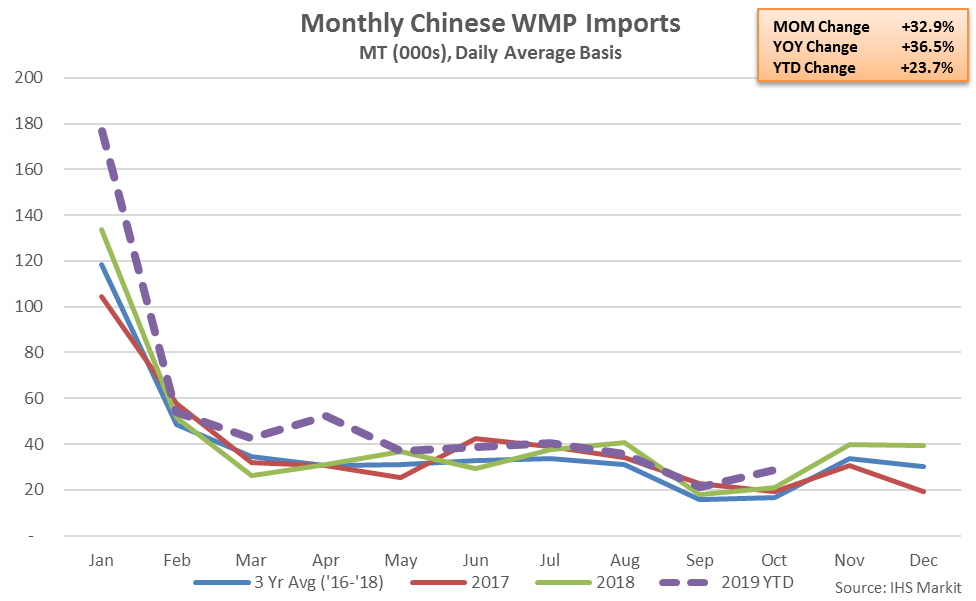

Oct ’19 Chinese WMP Import Volumes Increased 32.9% MOM and 36.5% YOY

Oct ’19 Chinese WMP Import Volumes Increased 32.9% MOM and 36.5% YOY

Oct ’19 Chinese WMP Imports Reached a Record High Seasonal Level

Oct ’19 Chinese WMP Imports Reached a Record High Seasonal Level

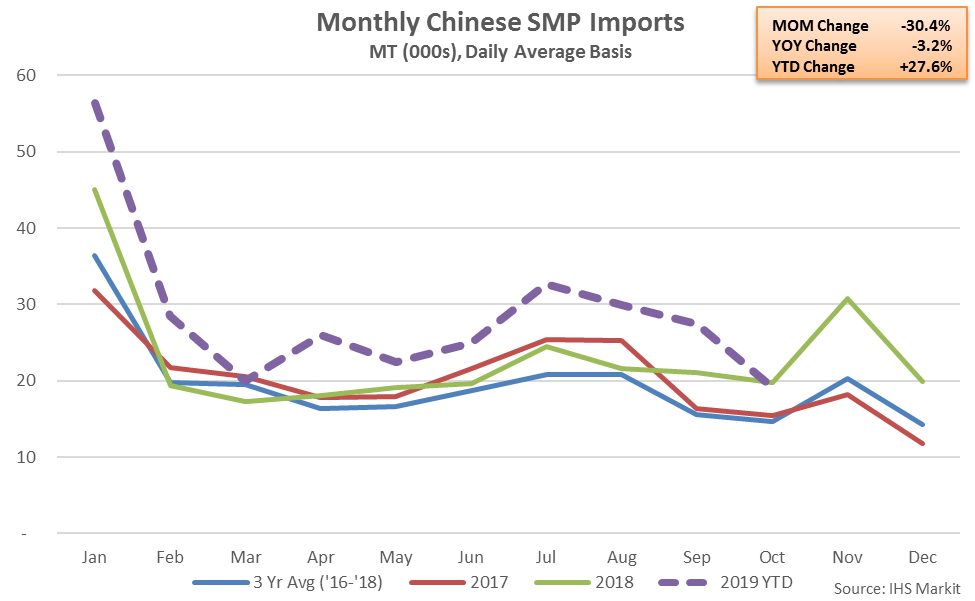

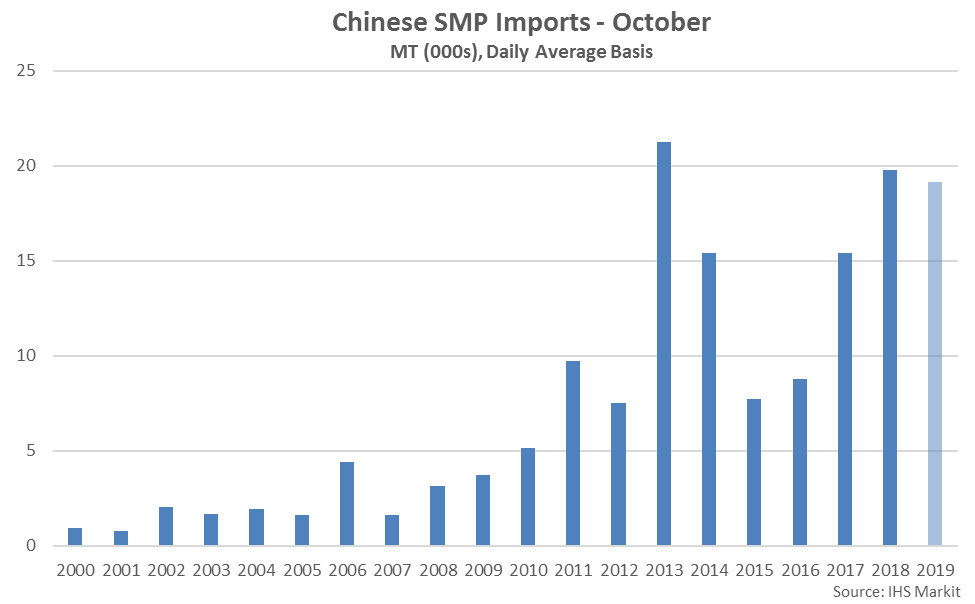

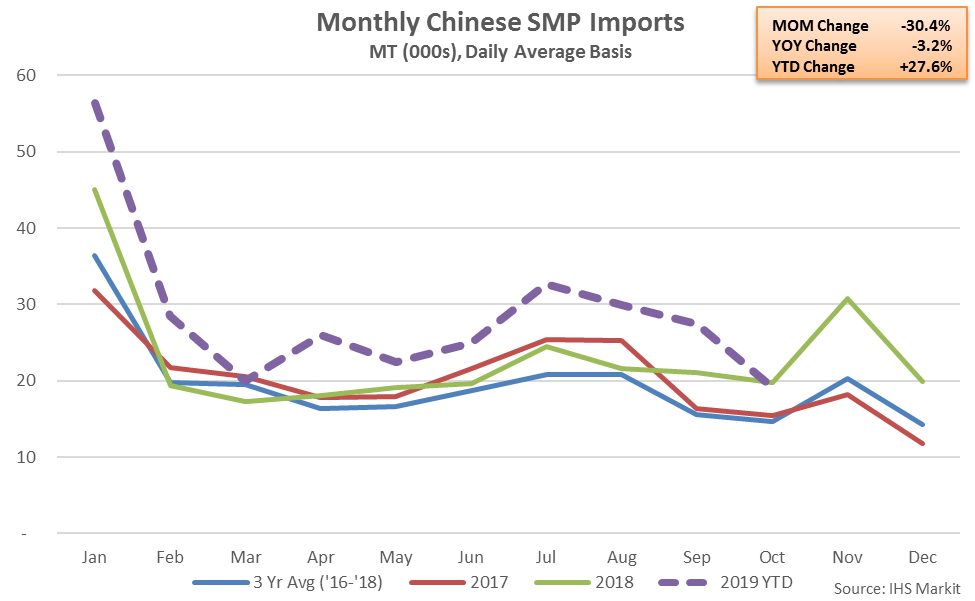

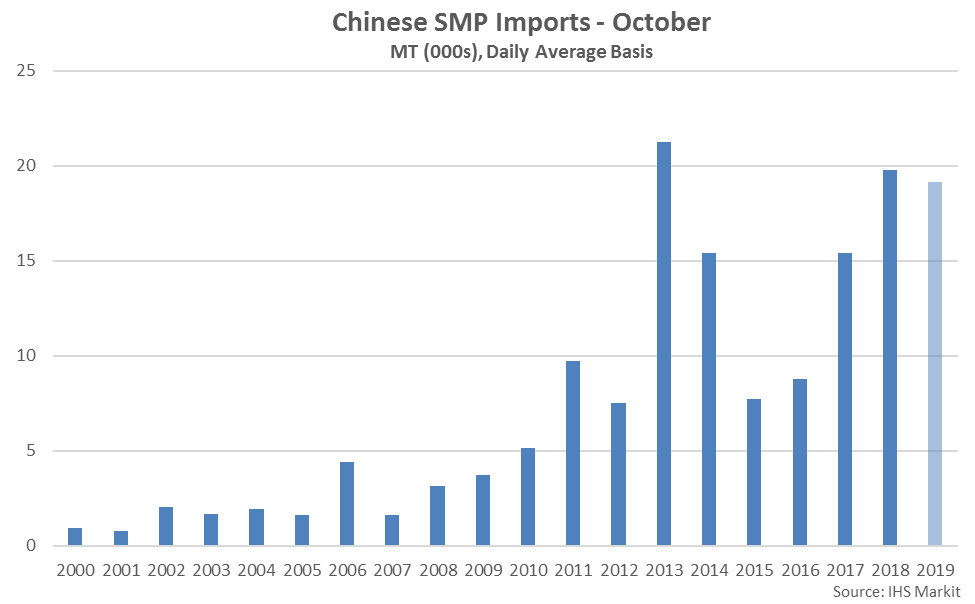

Oct ’19 Chinese SMP Import Volumes Declined 30.4% MOM and 3.2% YOY

Oct ’19 Chinese SMP Import Volumes Declined 30.4% MOM and 3.2% YOY

Oct ’19 Chinese SMP Imports Remained at the Third Highest Seasonal Level on Record

Oct ’19 Chinese SMP Imports Remained at the Third Highest Seasonal Level on Record

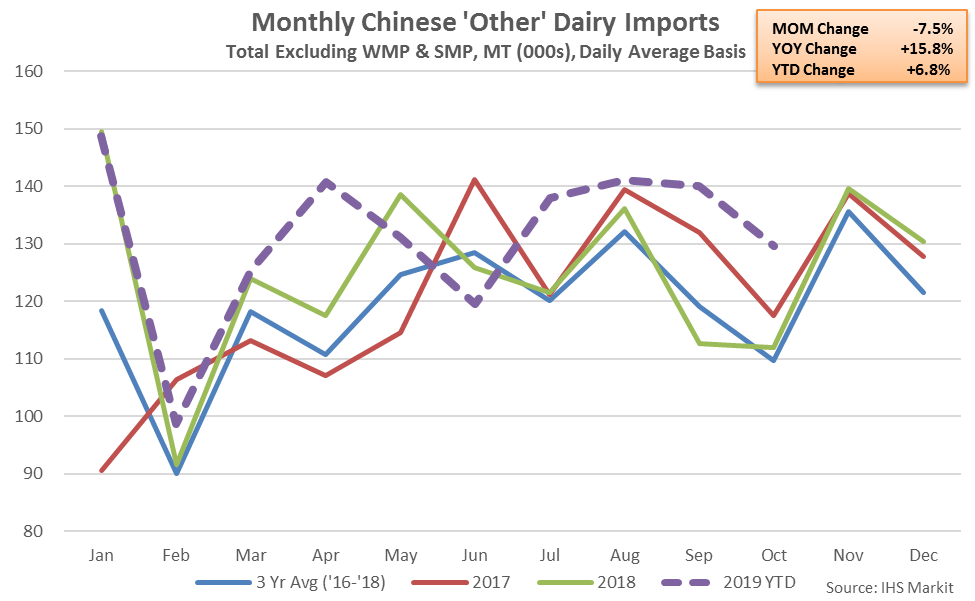

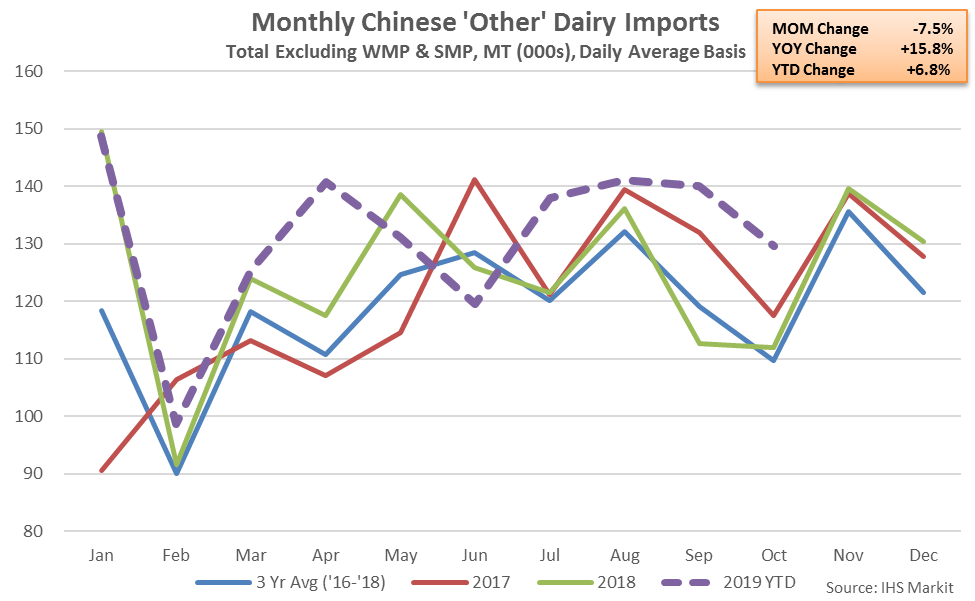

Oct ’19 Chinese Dairy Imports Excluding WMP & SMP Down 7.5% MOM but up 15.8% YOY

Oct ’19 Chinese Dairy Imports Excluding WMP & SMP Down 7.5% MOM but up 15.8% YOY

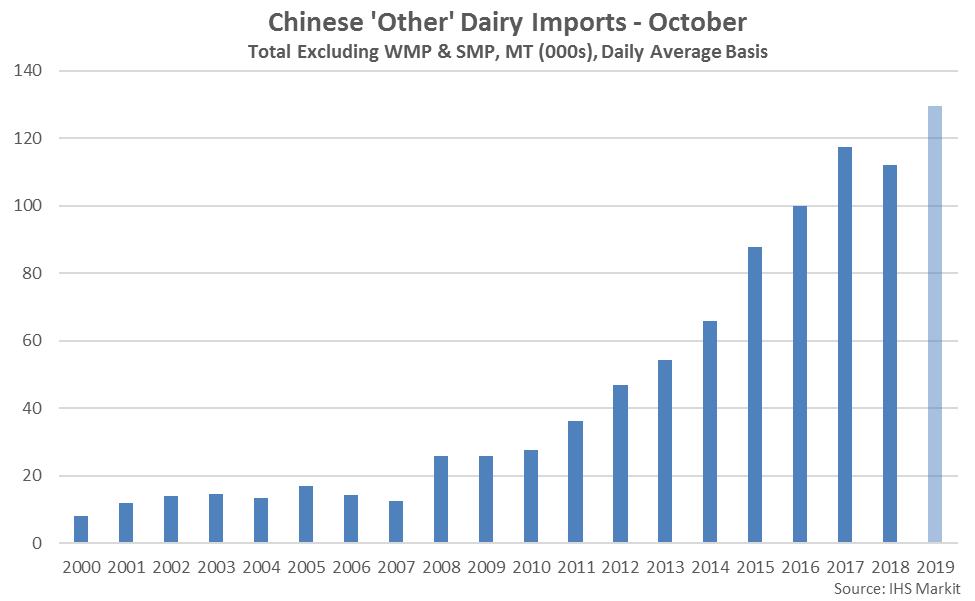

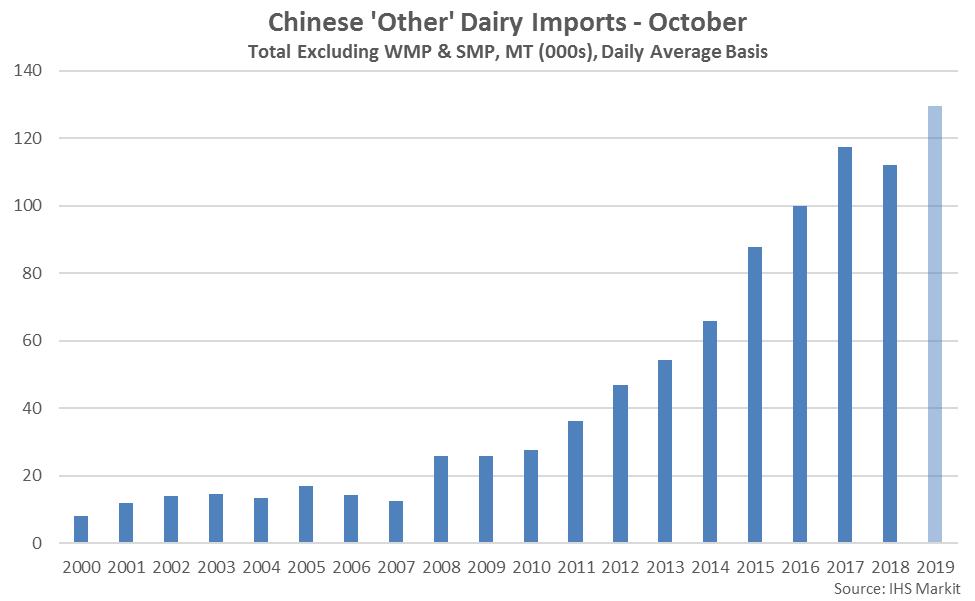

Oct ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Oct ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

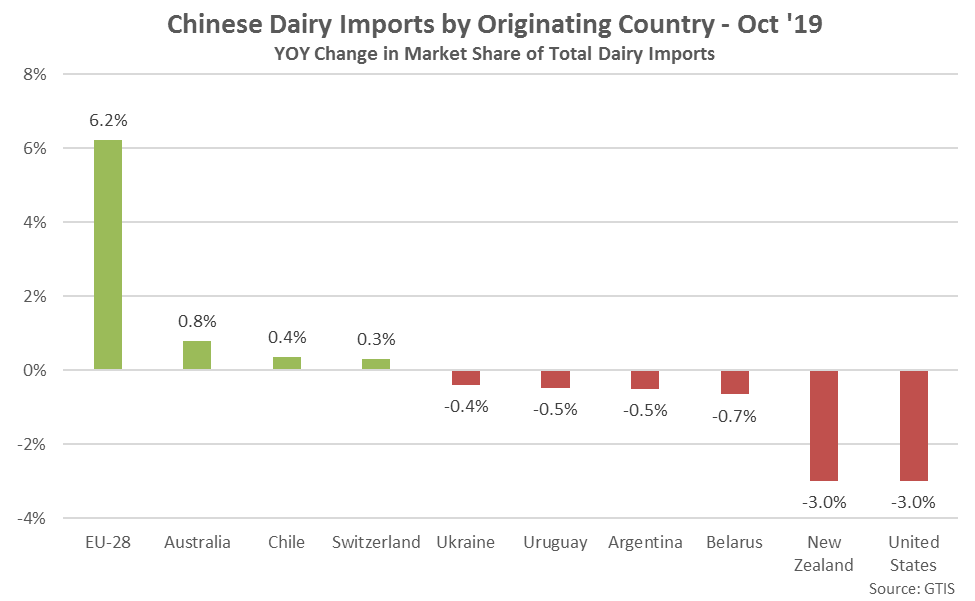

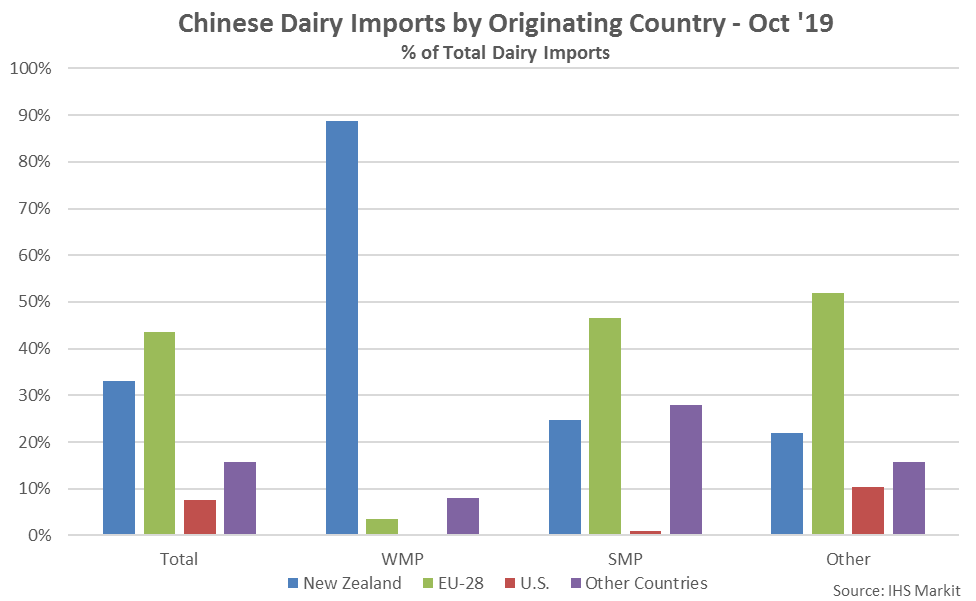

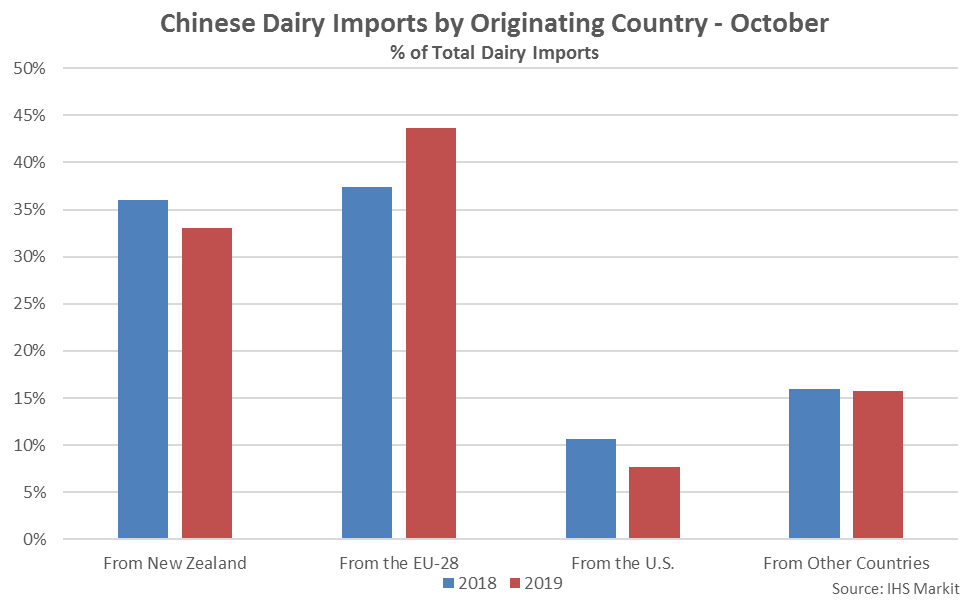

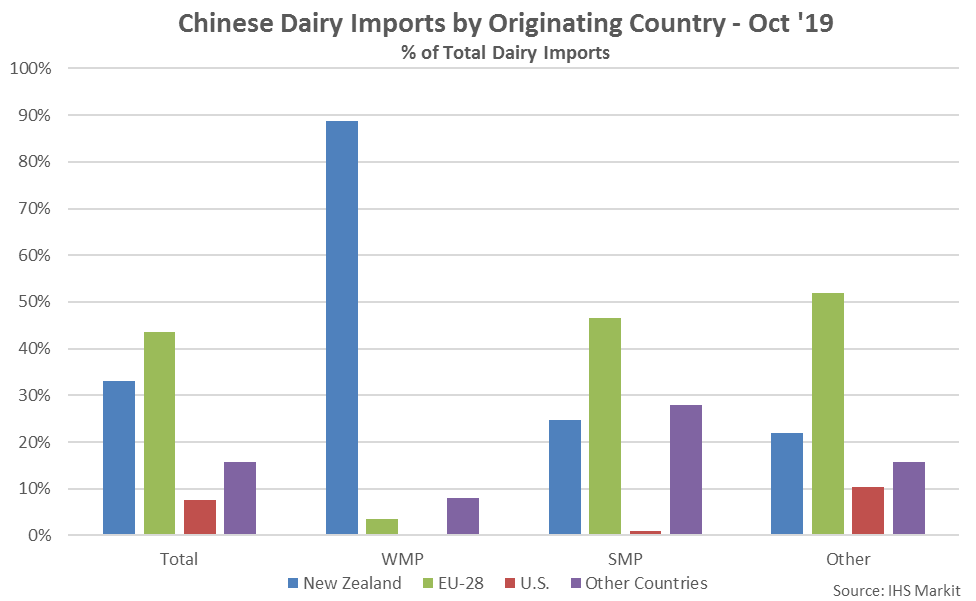

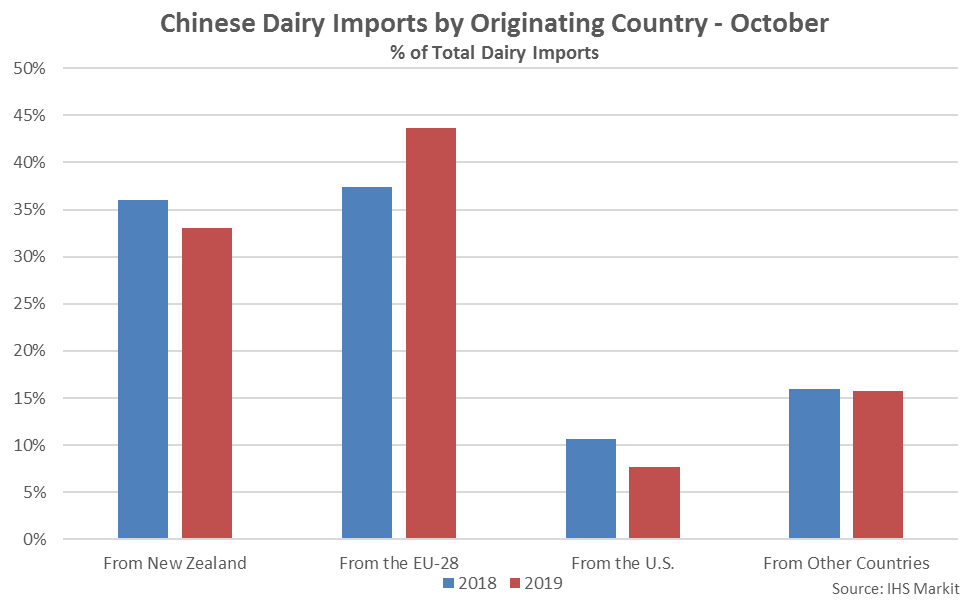

The EU-28 Accounted for Over 40% of All Oct ’19 Chinese Imports

The EU-28 Accounted for Over 40% of All Oct ’19 Chinese Imports

Oct ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Oct ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

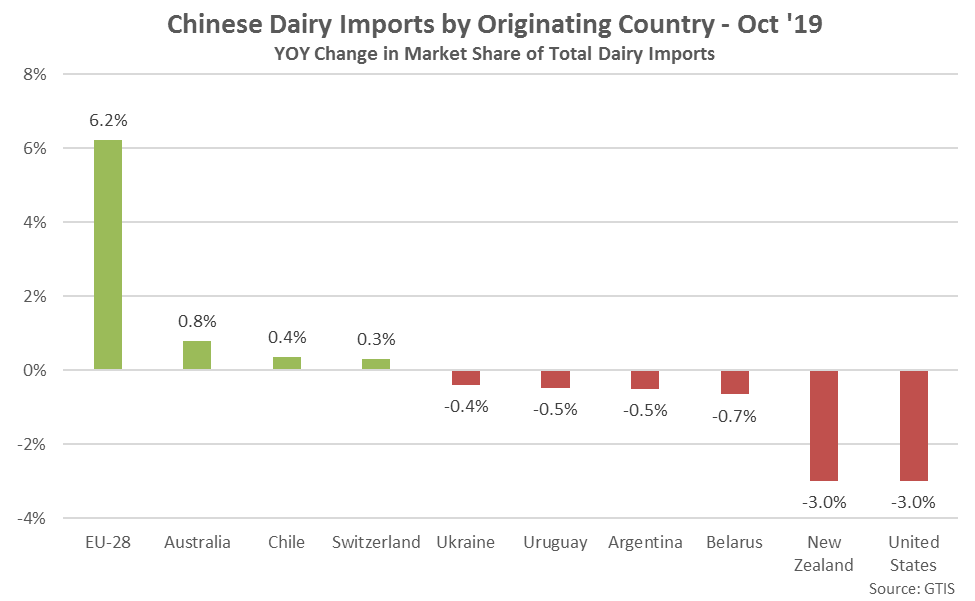

Oct ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Oct ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

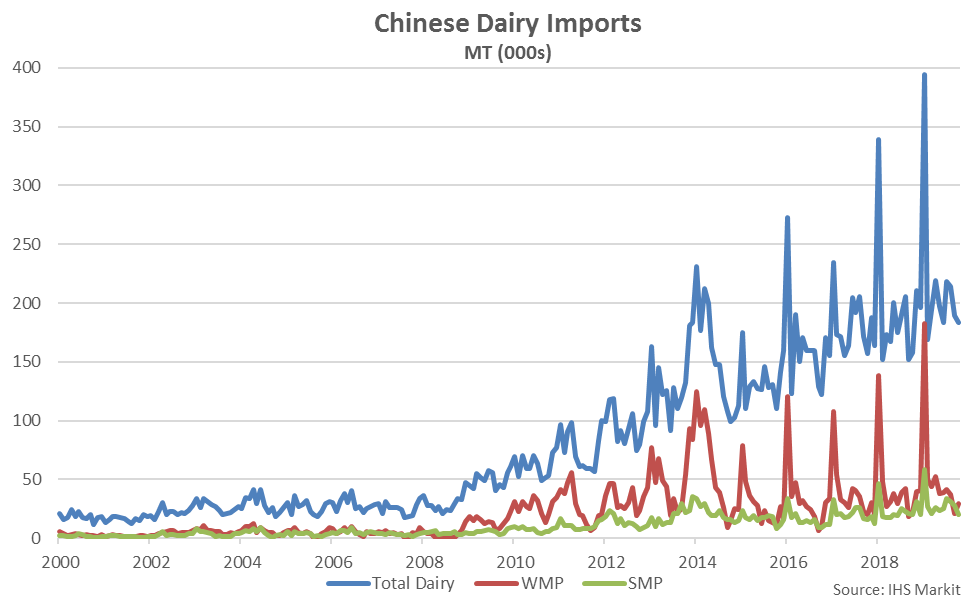

- Oct ’19 Chinese dairy import volumes increased on a YOY basis for the 12th time in the past 13 months, finishing up 16.2% to a record high seasonal level for the month of October.

- Oct ’19 Chinese whole milk powder increased 36.5% YOY, reaching a record high seasonal level, however Oct ’19 Chinese skim milk powder imports declined 3.2% YOY, finishing lower on a YOY basis for the first time in the past 14 months. Oct ’19 Chinese dairy imports excluding whole milk powder and skim milk powder increased 15.8% YOY, also reaching a record high seasonal level.

- Oct ’19 Chinese dairy imports originating from within the EU-28 gained market share from the previous year, while the U.S. and New Zealand market shares finished most significantly below previous year levels.

Oct ’19 Chinese Dairy Import Volumes Declined 6.3% MOM but Remained up 16.2% YOY

Oct ’19 Chinese Dairy Import Volumes Declined 6.3% MOM but Remained up 16.2% YOY

Oct ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Oct ’19 Total Chinese Dairy Imports Reached a Record High Seasonal Level

Oct ’19 Chinese WMP Import Volumes Increased 32.9% MOM and 36.5% YOY

Oct ’19 Chinese WMP Import Volumes Increased 32.9% MOM and 36.5% YOY

Oct ’19 Chinese WMP Imports Reached a Record High Seasonal Level

Oct ’19 Chinese WMP Imports Reached a Record High Seasonal Level

Oct ’19 Chinese SMP Import Volumes Declined 30.4% MOM and 3.2% YOY

Oct ’19 Chinese SMP Import Volumes Declined 30.4% MOM and 3.2% YOY

Oct ’19 Chinese SMP Imports Remained at the Third Highest Seasonal Level on Record

Oct ’19 Chinese SMP Imports Remained at the Third Highest Seasonal Level on Record

Oct ’19 Chinese Dairy Imports Excluding WMP & SMP Down 7.5% MOM but up 15.8% YOY

Oct ’19 Chinese Dairy Imports Excluding WMP & SMP Down 7.5% MOM but up 15.8% YOY

Oct ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

Oct ’19 Chinese Dairy ‘Other’ Imports Reached a Record High Seasonal Level

The EU-28 Accounted for Over 40% of All Oct ’19 Chinese Imports

The EU-28 Accounted for Over 40% of All Oct ’19 Chinese Imports

Oct ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Oct ’19 U.S. Share of Total Chinese Dairy Imports Declined Significantly YOY

Oct ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY

Oct ’19 EU-28 Share of Total Chinese Dairy Imports Increased Most Significantly YOY