Atten Babler Meat FX Indices – Aug ’20

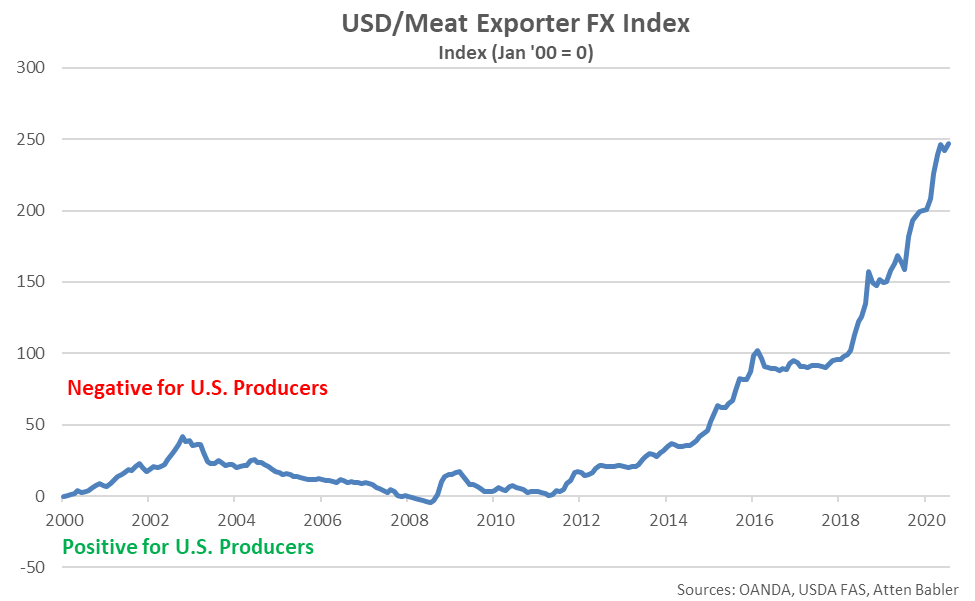

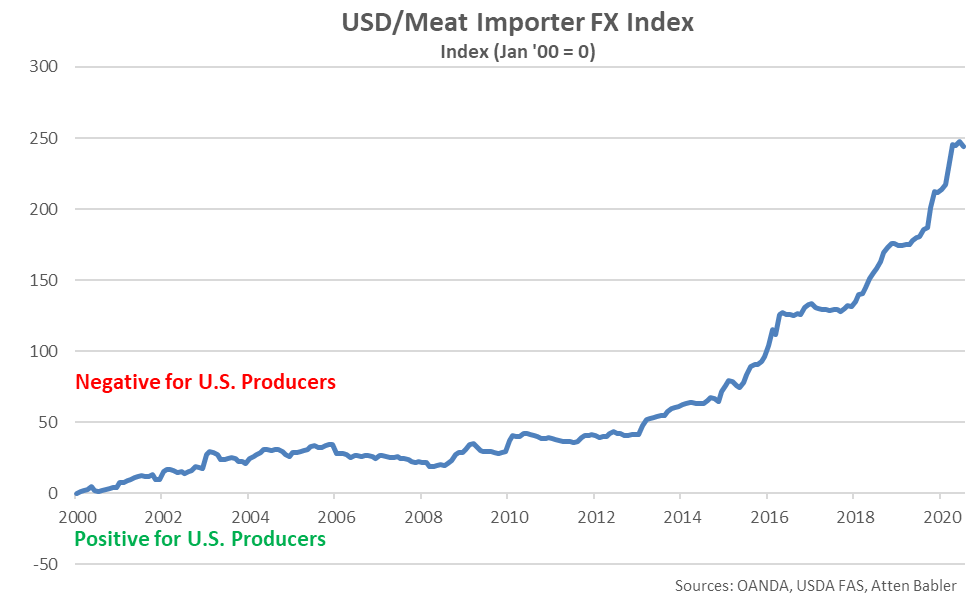

The Atten Babler Commodities Meat Foreign Exchange (FX) Indices were mixed throughout Jul ’20. The USD/Meat Exporter FX Index increased to a record high level however the USD/Meat Importer FX Index and USD/Domestic Meat Importer FX Index each declined to four month low levels throughout the month.

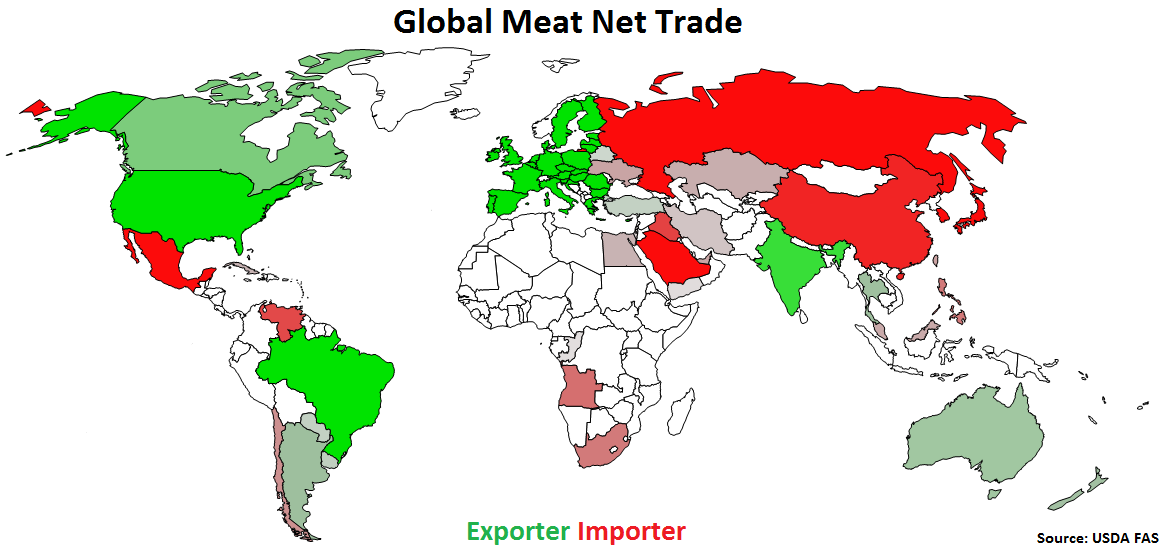

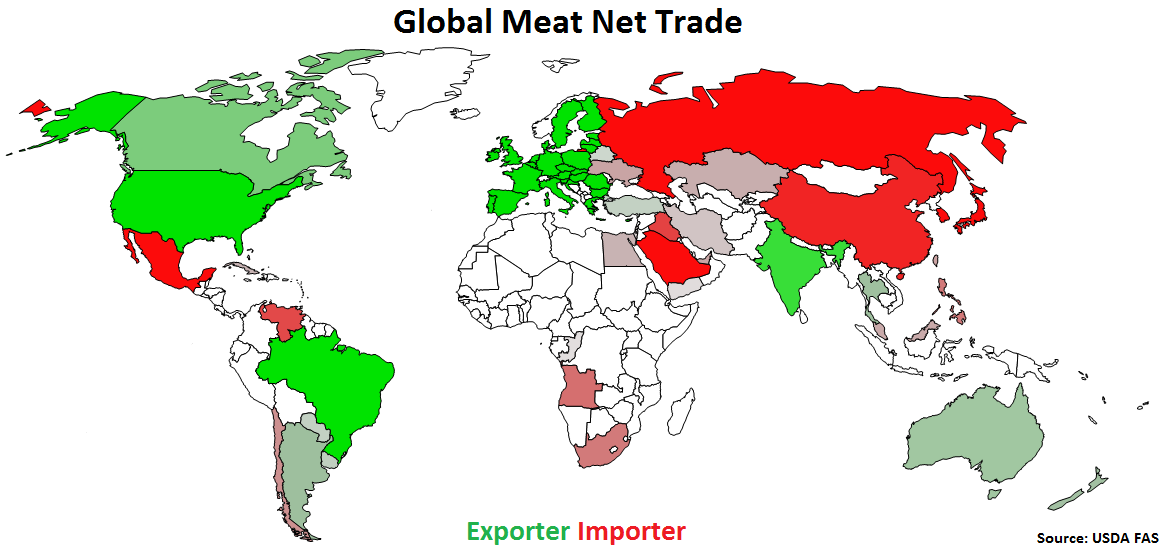

Global Meat Net Trade:

Major net meat exporters are led by the U.S., followed by Brazil, the EU-28, India, Canada and Australia (represented in green in the chart below). Major net meat importers are led by Japan, followed by Russia, Mexico, the U.S., China, the EU-28, Hong Kong and Saudi Arabia (represented in red in the chart below).

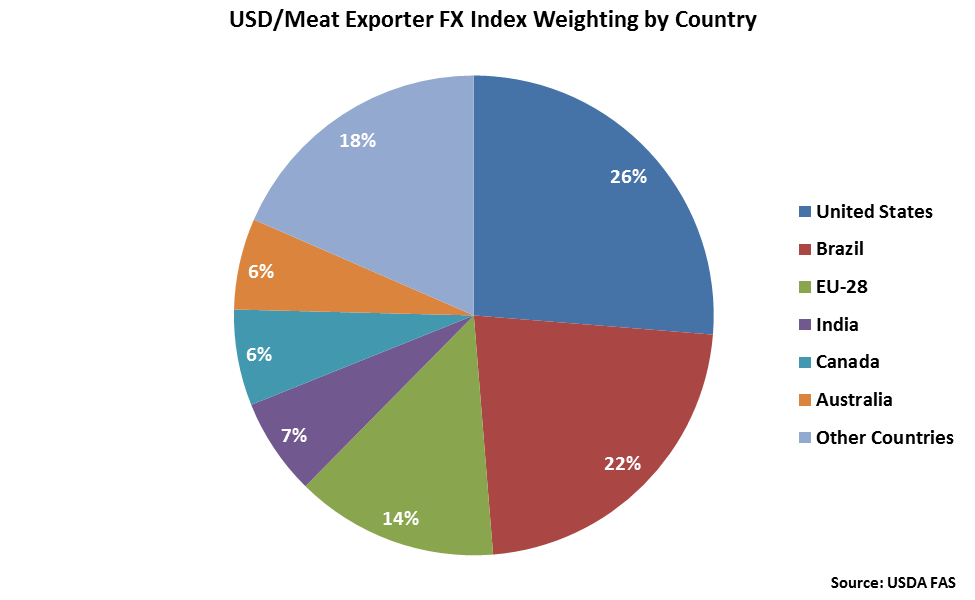

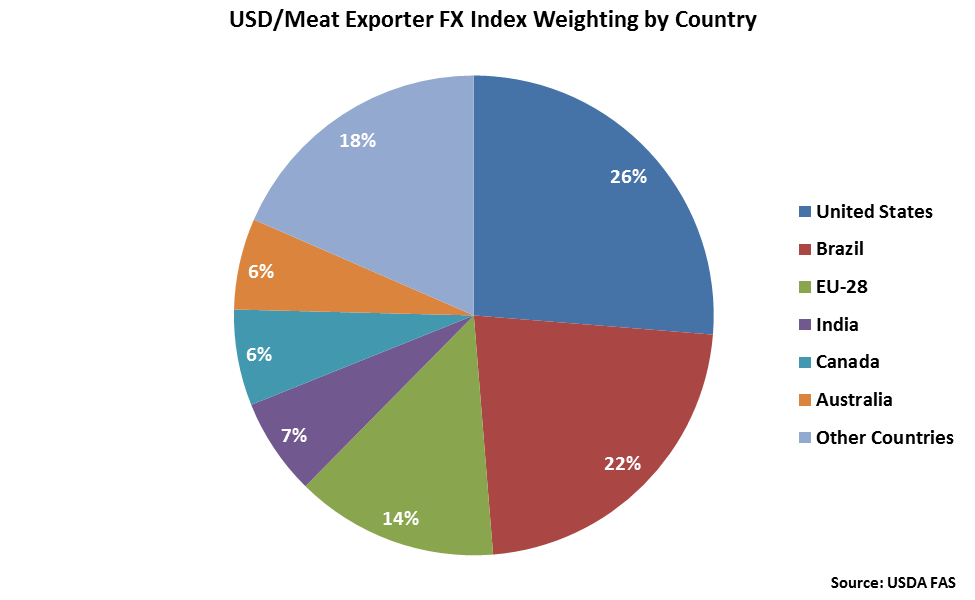

The United States accounts for over a quarter of the USD/Meat Exporter FX Index, followed by Brazil at 22% and the EU-28 at 14%. India, Canada and Australia each account for between 5-10% of the index.

The United States accounts for over a quarter of the USD/Meat Exporter FX Index, followed by Brazil at 22% and the EU-28 at 14%. India, Canada and Australia each account for between 5-10% of the index.

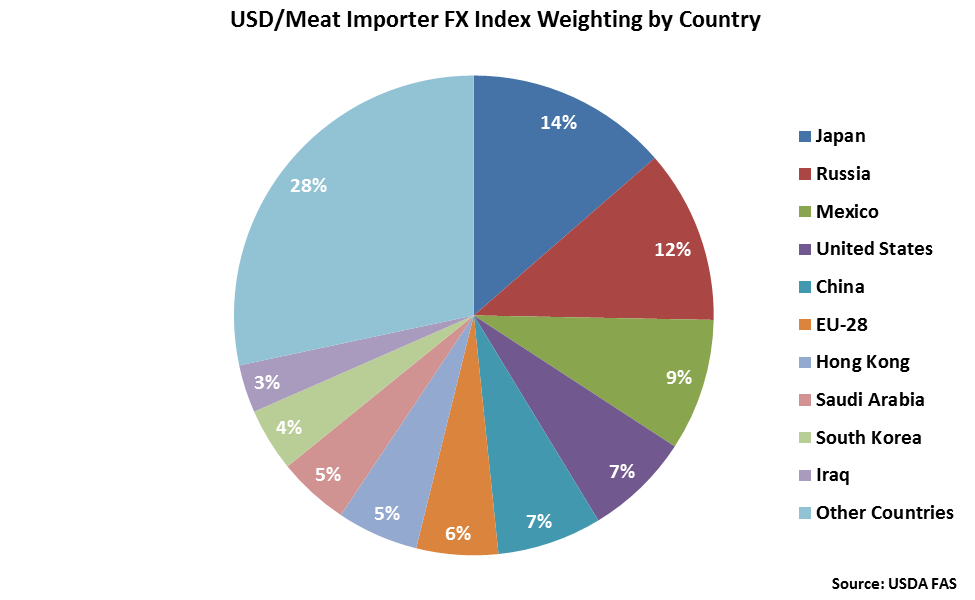

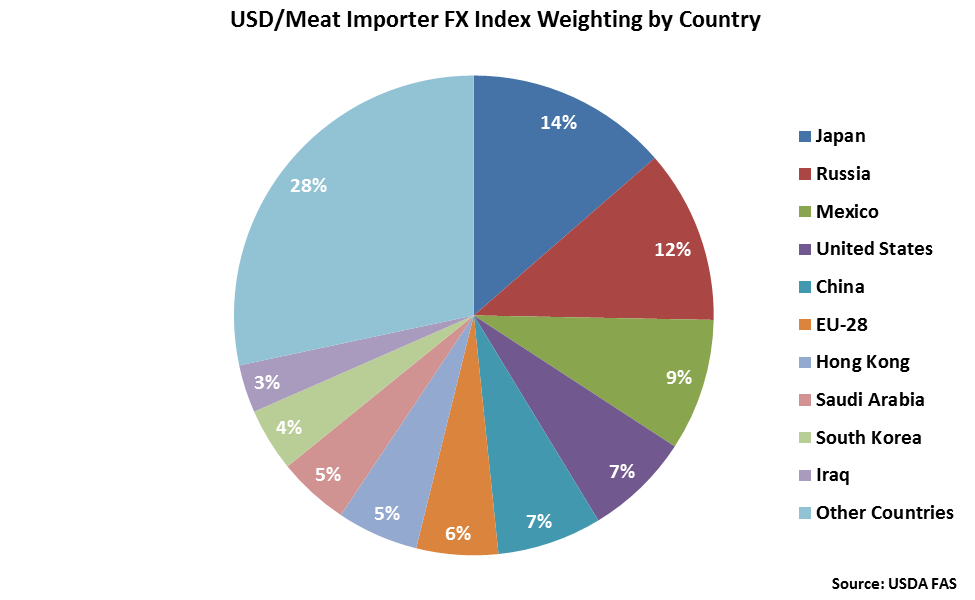

Japan accounts for 14% of the USD/Meat Importer FX Index, followed by Russia at 12%. Mexico, the United States, China, the EU-28, Hong Kong and Saudi Arabia each account for between 5-10% of the index.

Japan accounts for 14% of the USD/Meat Importer FX Index, followed by Russia at 12%. Mexico, the United States, China, the EU-28, Hong Kong and Saudi Arabia each account for between 5-10% of the index.

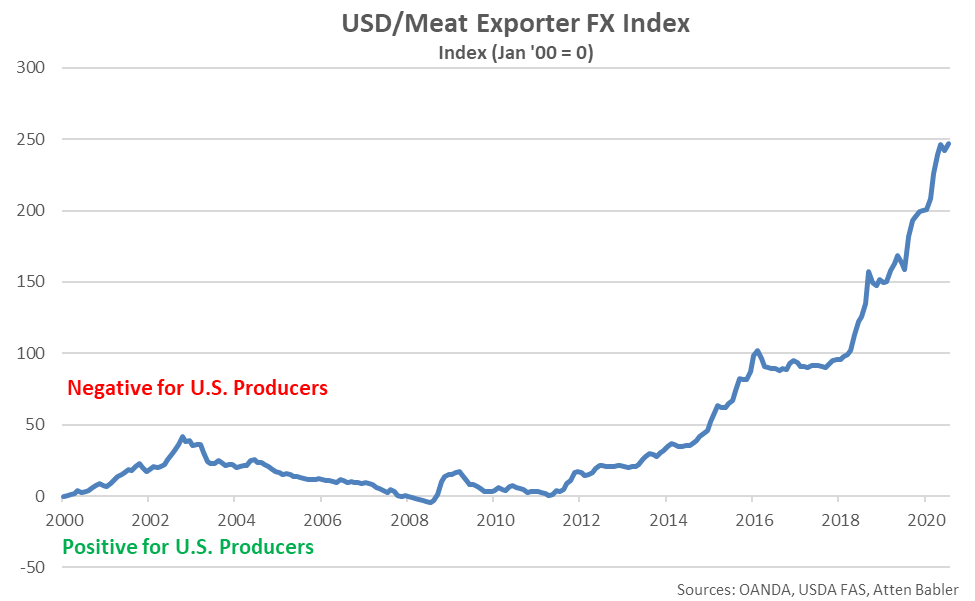

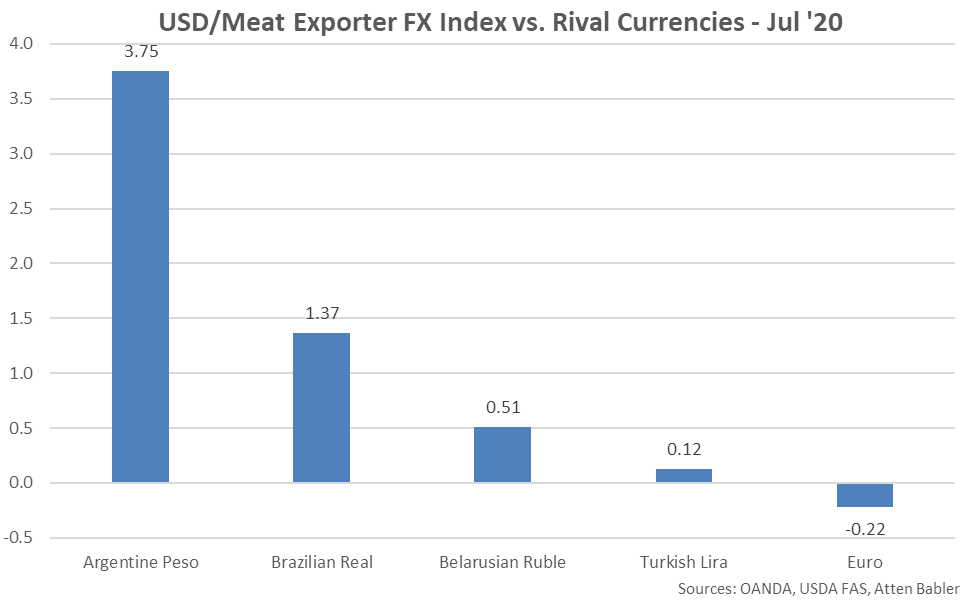

USD/Meat Exporter FX Index:

The USD/Meat Exporter FX Index increased 5.3 points during Jul ’20, finishing at a record high value of 247.3. The USD/Meat Exporter FX Index has increased 46.4 points throughout the past six months and 215.4 points since the beginning of 2014. A strong USD/Meat Exporter FX Index reduces the competitiveness of U.S. meat relative to other exporting regions (represented in green in the Global Meat Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Meat Exporter FX Index:

The USD/Meat Exporter FX Index increased 5.3 points during Jul ’20, finishing at a record high value of 247.3. The USD/Meat Exporter FX Index has increased 46.4 points throughout the past six months and 215.4 points since the beginning of 2014. A strong USD/Meat Exporter FX Index reduces the competitiveness of U.S. meat relative to other exporting regions (represented in green in the Global Meat Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

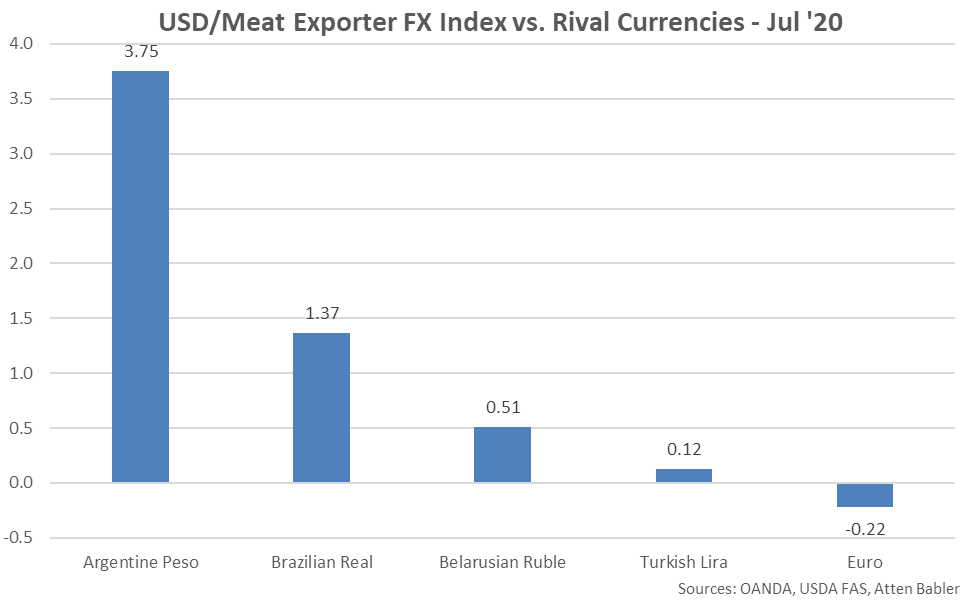

USD appreciation within the USD/Meat Exporter FX Index during Jul ’20 was led by gains against the Argentine peso, followed by gains against the Brazilian real, Belarusian ruble and Turkish lira. USD declines were exhibited against the euro.

USD appreciation within the USD/Meat Exporter FX Index during Jul ’20 was led by gains against the Argentine peso, followed by gains against the Brazilian real, Belarusian ruble and Turkish lira. USD declines were exhibited against the euro.

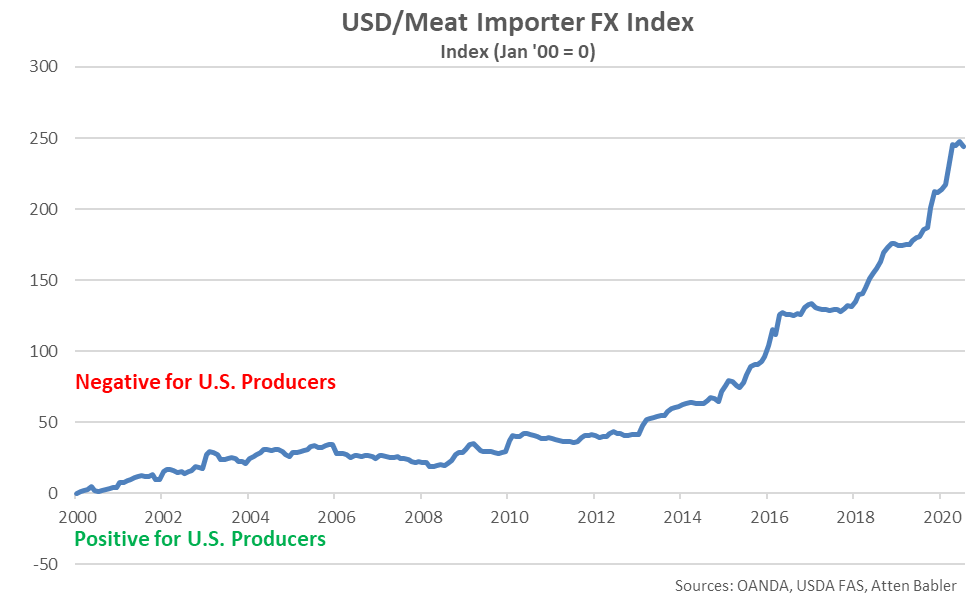

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 3.7 points during Jul ’20, finishing at a four month low value of 244.1. The USD/Meat Importer FX Index remains up 30.2 points throughout the past six months and 182.9 points since the beginning of 2014, despite the most recent decline. A strong USD/Meat Importer FX Index results in less purchasing power for major meat importing countries (represented in red in the Global Meat Net Trade chart), making U.S. meat more expensive to import. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 3.7 points during Jul ’20, finishing at a four month low value of 244.1. The USD/Meat Importer FX Index remains up 30.2 points throughout the past six months and 182.9 points since the beginning of 2014, despite the most recent decline. A strong USD/Meat Importer FX Index results in less purchasing power for major meat importing countries (represented in red in the Global Meat Net Trade chart), making U.S. meat more expensive to import. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

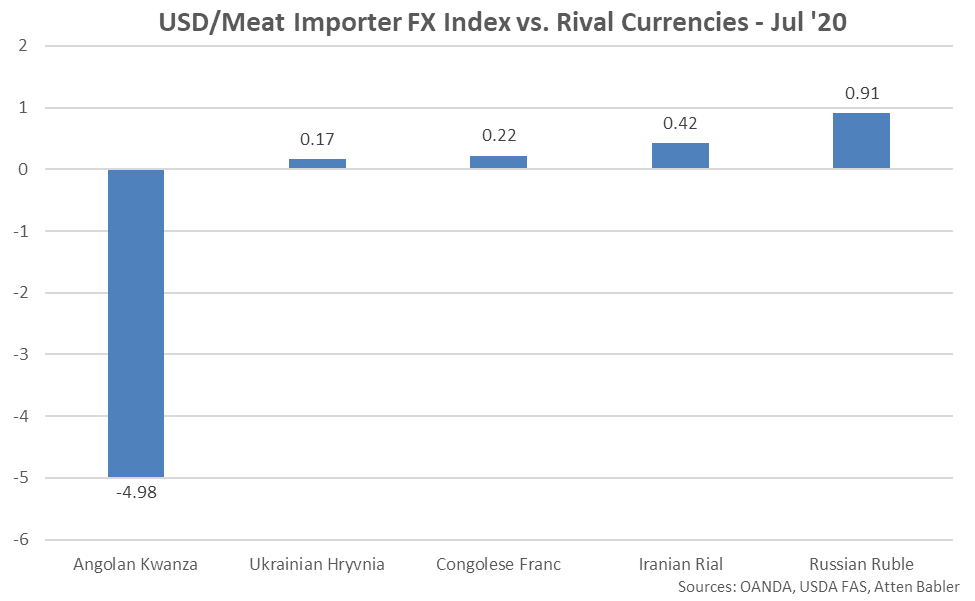

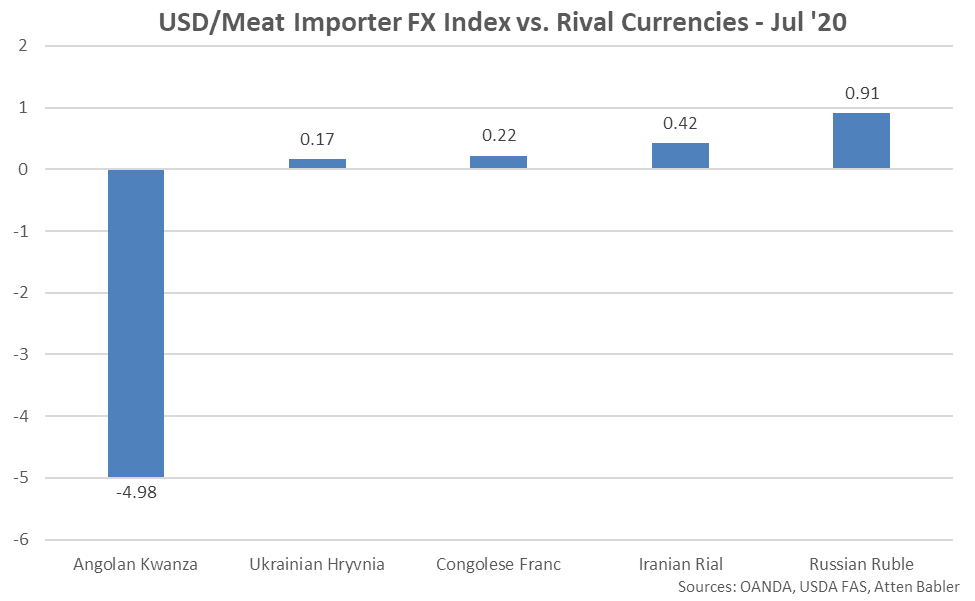

Appreciation against the USD within the USD/Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Russian ruble, Iranian rial, Congolese franc and Ukrainian hryvnia.

Appreciation against the USD within the USD/Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Russian ruble, Iranian rial, Congolese franc and Ukrainian hryvnia.

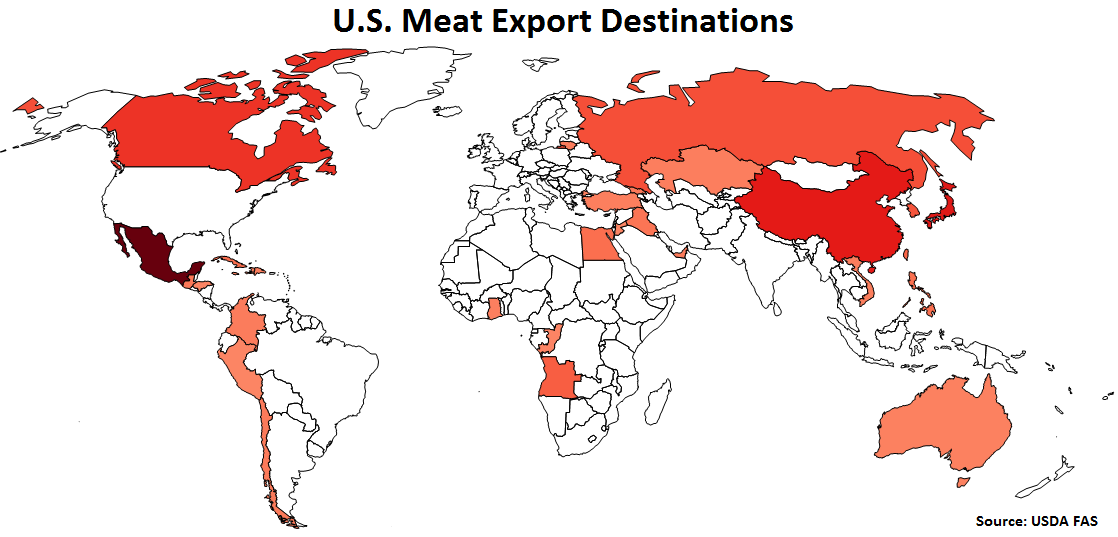

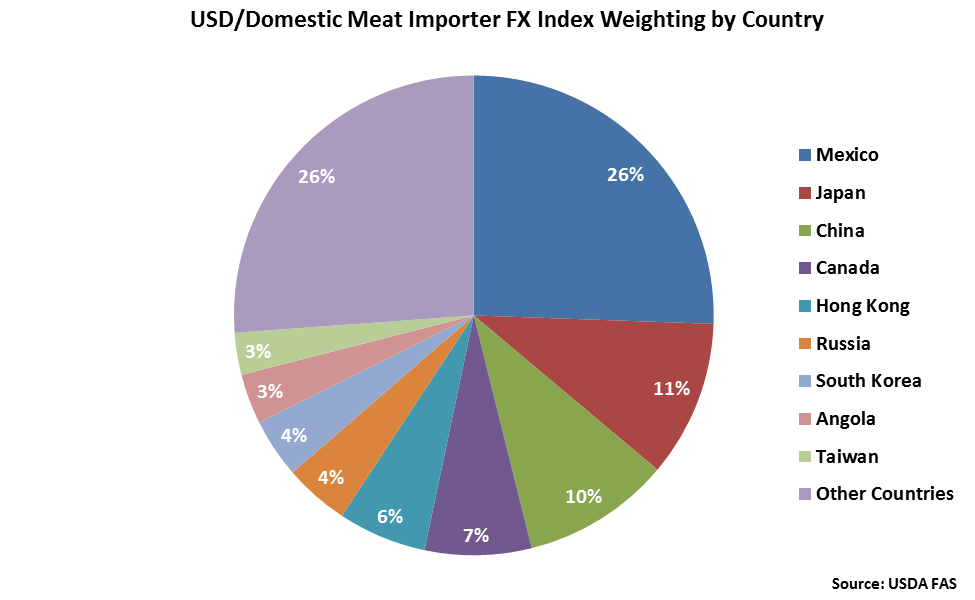

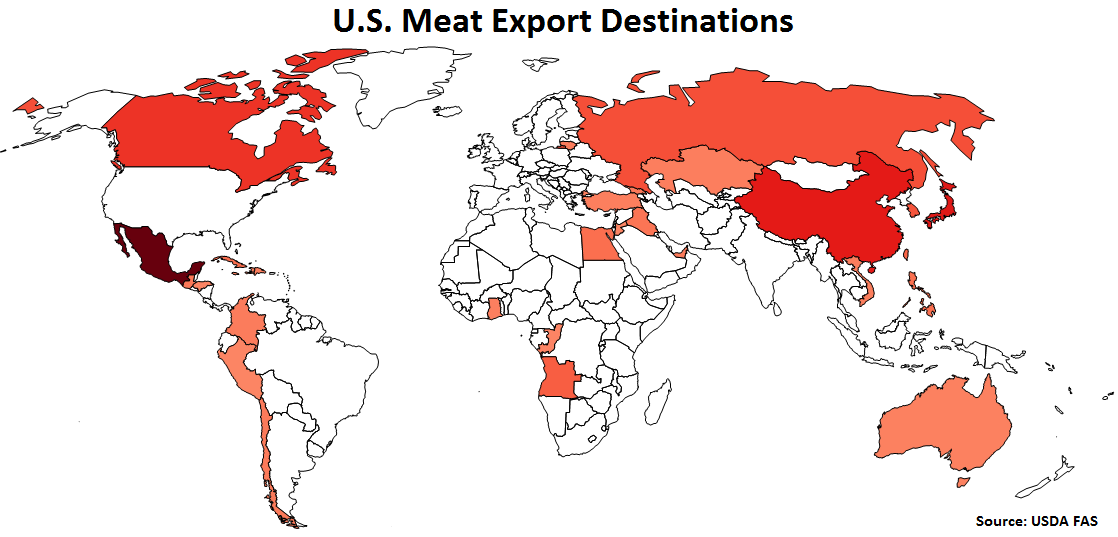

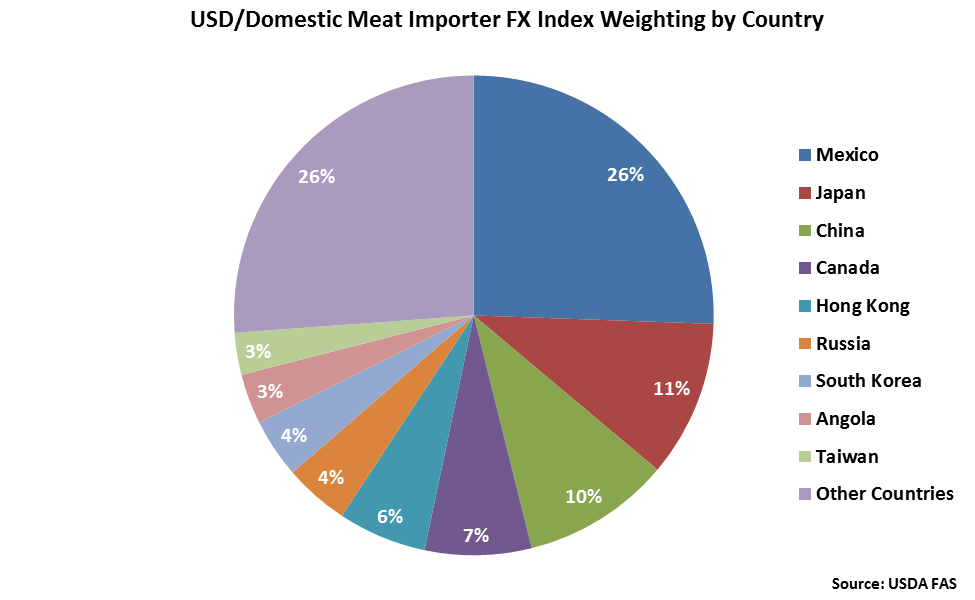

U.S. Meat Export Destinations:

Major destinations for U.S. meat exports are led by Mexico, followed by Japan, China, Canada, and Hong Kong.

U.S. Meat Export Destinations:

Major destinations for U.S. meat exports are led by Mexico, followed by Japan, China, Canada, and Hong Kong.

Mexico accounts for over a quarter of the USD/Domestic Meat Importer FX Index, followed by Japan at 11%. China, Canada and Hong Kong each account for between 5-10% of the index.

Mexico accounts for over a quarter of the USD/Domestic Meat Importer FX Index, followed by Japan at 11%. China, Canada and Hong Kong each account for between 5-10% of the index.

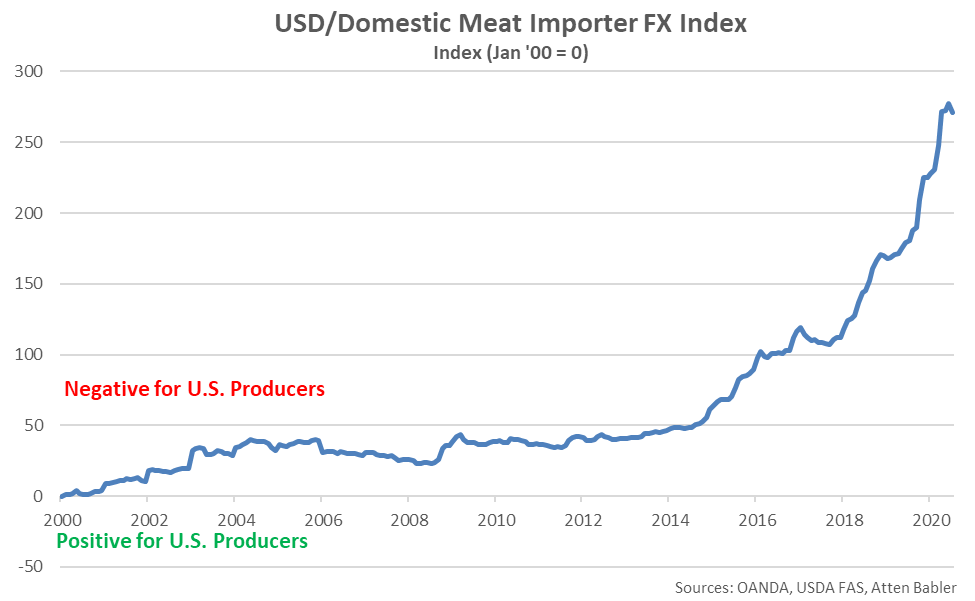

USD/Domestic Meat Importer FX Index:

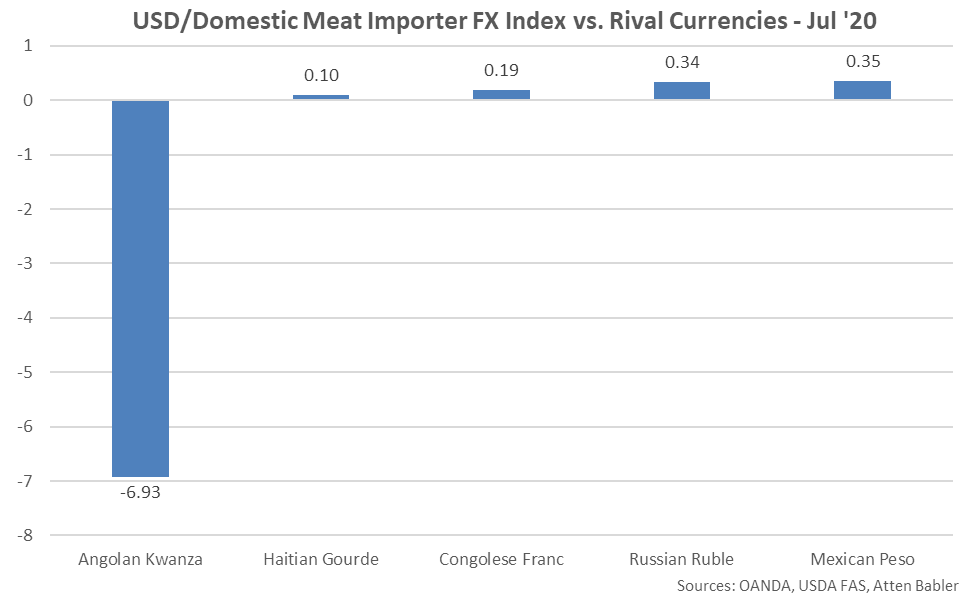

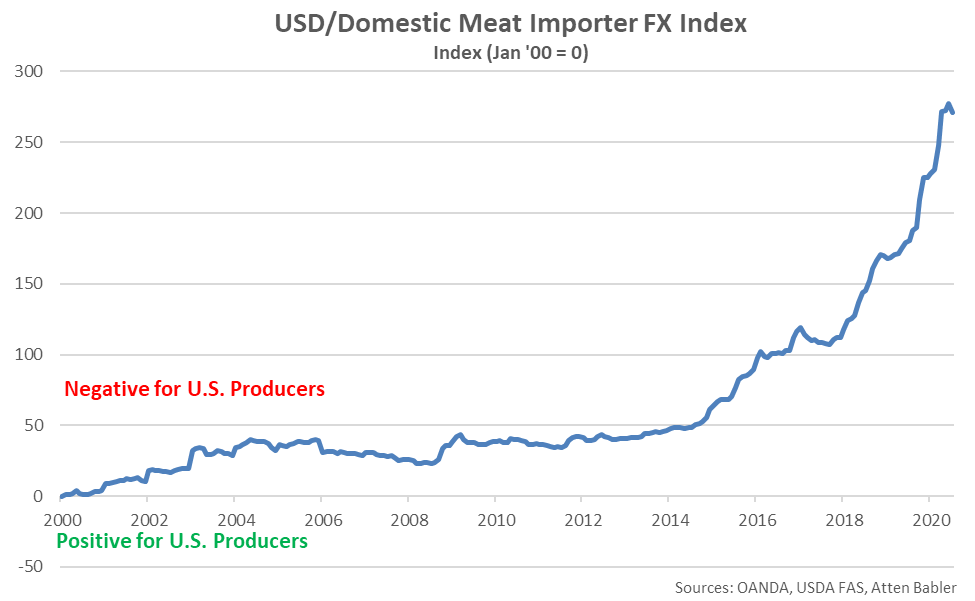

The USD/Domestic Meat Importer FX Index declined 6.2 points during Jul ’20, finishing at a four month low value of 271.0. The USD/Domestic Meat Importer FX Index remains up 43.1 points throughout the past six months and 224.6 points since the beginning of 2014, despite the most recent decline. A strong USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat (represented in red in the U.S. Meat Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Meat Importer FX Index:

The USD/Domestic Meat Importer FX Index declined 6.2 points during Jul ’20, finishing at a four month low value of 271.0. The USD/Domestic Meat Importer FX Index remains up 43.1 points throughout the past six months and 224.6 points since the beginning of 2014, despite the most recent decline. A strong USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat (represented in red in the U.S. Meat Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

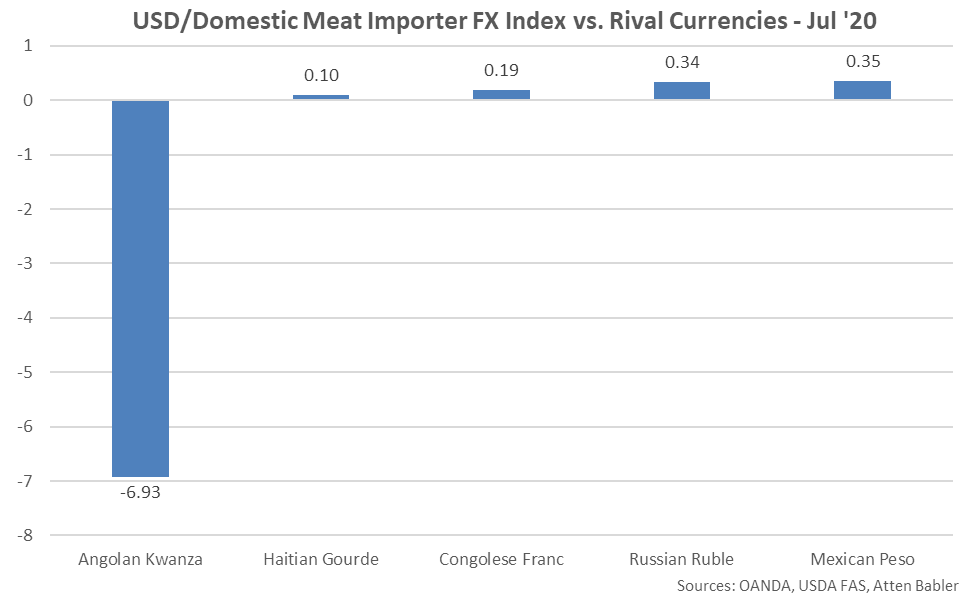

Appreciation against the USD within the USD/Domestic Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Mexican peso, Russian ruble, Congolese franc and Haitian gourde.

Appreciation against the USD within the USD/Domestic Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Mexican peso, Russian ruble, Congolese franc and Haitian gourde.

The United States accounts for over a quarter of the USD/Meat Exporter FX Index, followed by Brazil at 22% and the EU-28 at 14%. India, Canada and Australia each account for between 5-10% of the index.

The United States accounts for over a quarter of the USD/Meat Exporter FX Index, followed by Brazil at 22% and the EU-28 at 14%. India, Canada and Australia each account for between 5-10% of the index.

Japan accounts for 14% of the USD/Meat Importer FX Index, followed by Russia at 12%. Mexico, the United States, China, the EU-28, Hong Kong and Saudi Arabia each account for between 5-10% of the index.

Japan accounts for 14% of the USD/Meat Importer FX Index, followed by Russia at 12%. Mexico, the United States, China, the EU-28, Hong Kong and Saudi Arabia each account for between 5-10% of the index.

USD/Meat Exporter FX Index:

The USD/Meat Exporter FX Index increased 5.3 points during Jul ’20, finishing at a record high value of 247.3. The USD/Meat Exporter FX Index has increased 46.4 points throughout the past six months and 215.4 points since the beginning of 2014. A strong USD/Meat Exporter FX Index reduces the competitiveness of U.S. meat relative to other exporting regions (represented in green in the Global Meat Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD/Meat Exporter FX Index:

The USD/Meat Exporter FX Index increased 5.3 points during Jul ’20, finishing at a record high value of 247.3. The USD/Meat Exporter FX Index has increased 46.4 points throughout the past six months and 215.4 points since the beginning of 2014. A strong USD/Meat Exporter FX Index reduces the competitiveness of U.S. meat relative to other exporting regions (represented in green in the Global Meat Net Trade chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Argentine peso has accounted for the majority of the gains since the beginning of 2014.

USD appreciation within the USD/Meat Exporter FX Index during Jul ’20 was led by gains against the Argentine peso, followed by gains against the Brazilian real, Belarusian ruble and Turkish lira. USD declines were exhibited against the euro.

USD appreciation within the USD/Meat Exporter FX Index during Jul ’20 was led by gains against the Argentine peso, followed by gains against the Brazilian real, Belarusian ruble and Turkish lira. USD declines were exhibited against the euro.

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 3.7 points during Jul ’20, finishing at a four month low value of 244.1. The USD/Meat Importer FX Index remains up 30.2 points throughout the past six months and 182.9 points since the beginning of 2014, despite the most recent decline. A strong USD/Meat Importer FX Index results in less purchasing power for major meat importing countries (represented in red in the Global Meat Net Trade chart), making U.S. meat more expensive to import. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

USD/Meat Importer FX Index:

The USD/Meat Importer FX Index declined 3.7 points during Jul ’20, finishing at a four month low value of 244.1. The USD/Meat Importer FX Index remains up 30.2 points throughout the past six months and 182.9 points since the beginning of 2014, despite the most recent decline. A strong USD/Meat Importer FX Index results in less purchasing power for major meat importing countries (represented in red in the Global Meat Net Trade chart), making U.S. meat more expensive to import. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Russian ruble, Iranian rial, Congolese franc and Ukrainian hryvnia.

Appreciation against the USD within the USD/Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Russian ruble, Iranian rial, Congolese franc and Ukrainian hryvnia.

U.S. Meat Export Destinations:

Major destinations for U.S. meat exports are led by Mexico, followed by Japan, China, Canada, and Hong Kong.

U.S. Meat Export Destinations:

Major destinations for U.S. meat exports are led by Mexico, followed by Japan, China, Canada, and Hong Kong.

Mexico accounts for over a quarter of the USD/Domestic Meat Importer FX Index, followed by Japan at 11%. China, Canada and Hong Kong each account for between 5-10% of the index.

Mexico accounts for over a quarter of the USD/Domestic Meat Importer FX Index, followed by Japan at 11%. China, Canada and Hong Kong each account for between 5-10% of the index.

USD/Domestic Meat Importer FX Index:

The USD/Domestic Meat Importer FX Index declined 6.2 points during Jul ’20, finishing at a four month low value of 271.0. The USD/Domestic Meat Importer FX Index remains up 43.1 points throughout the past six months and 224.6 points since the beginning of 2014, despite the most recent decline. A strong USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat (represented in red in the U.S. Meat Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Meat Importer FX Index:

The USD/Domestic Meat Importer FX Index declined 6.2 points during Jul ’20, finishing at a four month low value of 271.0. The USD/Domestic Meat Importer FX Index remains up 43.1 points throughout the past six months and 224.6 points since the beginning of 2014, despite the most recent decline. A strong USD/Domestic Meat Importer FX Index results in less purchasing power for the traditional buyers of U.S. meat (represented in red in the U.S. Meat Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Angolan kwanza has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Domestic Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Mexican peso, Russian ruble, Congolese franc and Haitian gourde.

Appreciation against the USD within the USD/Domestic Meat Importer FX Index during Jul ’20 was led by gains by the Angolan kwanza. USD gains were exhibited against the Mexican peso, Russian ruble, Congolese franc and Haitian gourde.