Quarterly Australian Milk Production Update – Feb ’21

Executive Summary

Australian milk production figures provided by Dairy Australia were recently updated with values spanning through the end of the first half of the ’20-’21 production season. Highlights from the updated report include:

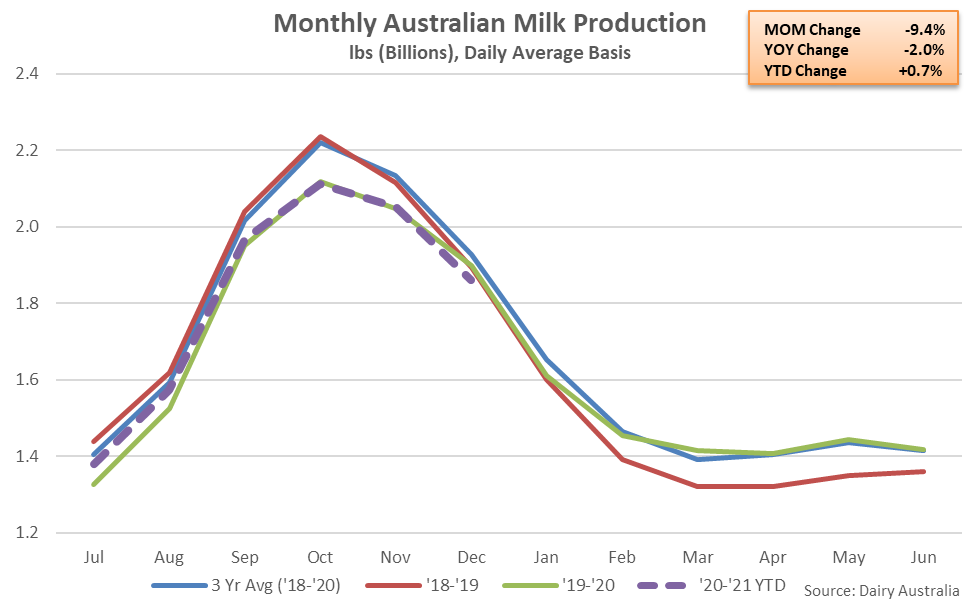

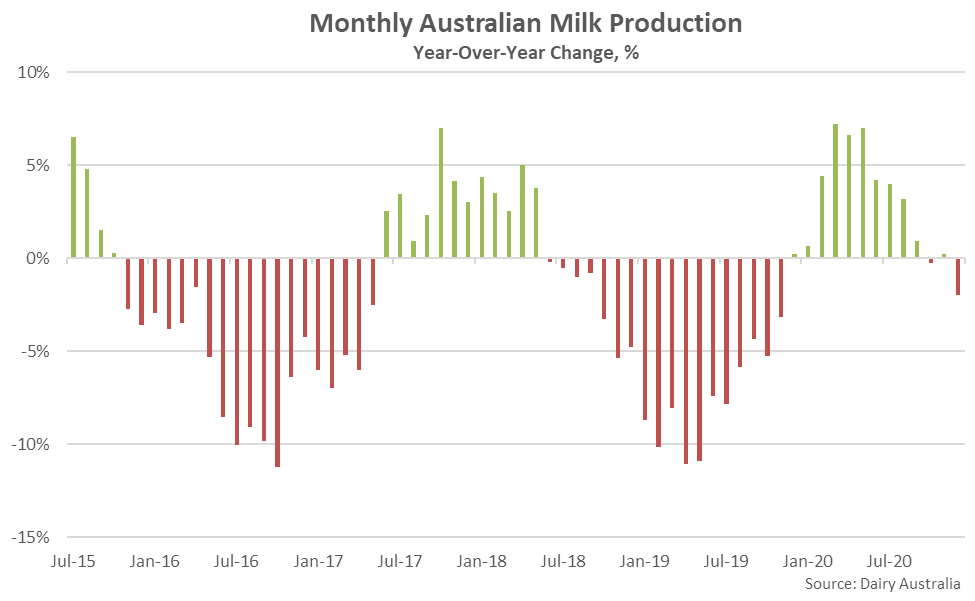

- Australian milk production declined on a YOY basis for the second time in the past three months during Dec ’20, finishing down 2.0%. ’19-’20 annual production volumes declined by 0.4% on a YOY basis however ’20-’21 YTD production volumes have rebounded by 0.7% on a YOY throughout the first half of the production season, despite the recently experienced declines. The USDA is projecting Australian milk production volumes will rebound to a three year high level throughout the 2021 calendar year.

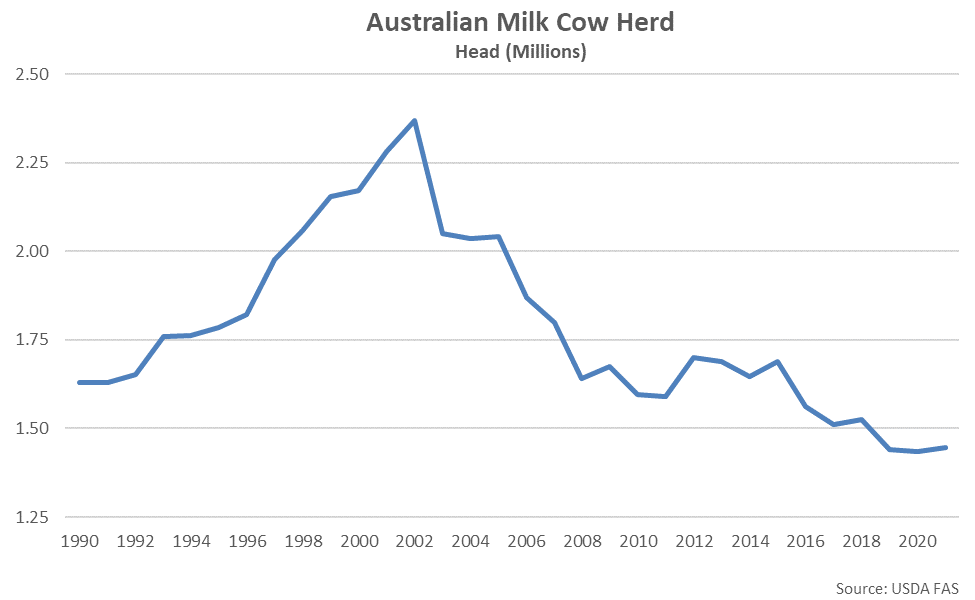

- The Australian dairy cow herd is estimated to have declined to a record low level throughout 2020 as biological lags in herd rebuilding more than offset the effects of recent improvements in pasture conditions. The USDA is projecting the Australian dairy cow herd will rebound by 0.7% throughout 2021, however, reaching a three year high level.

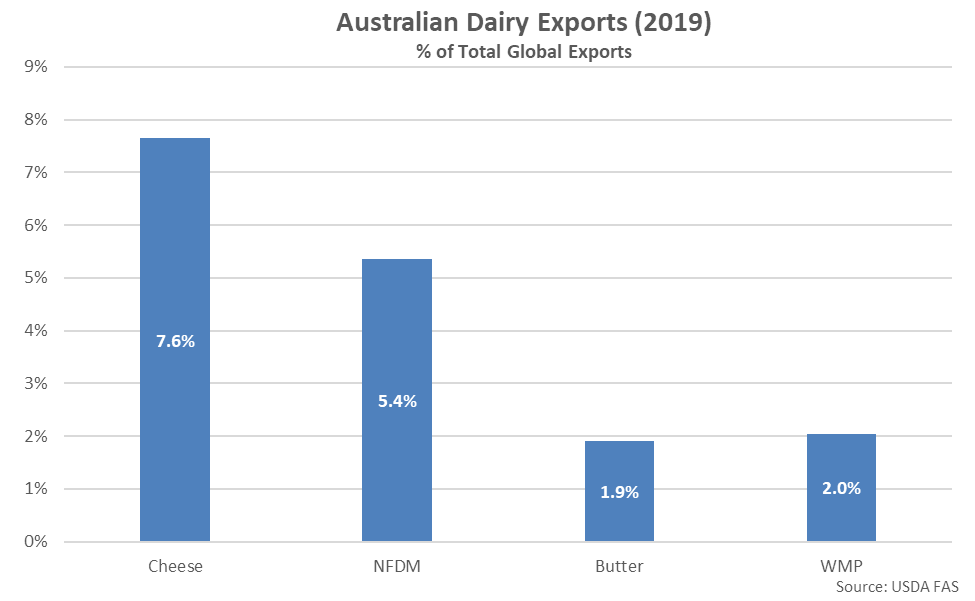

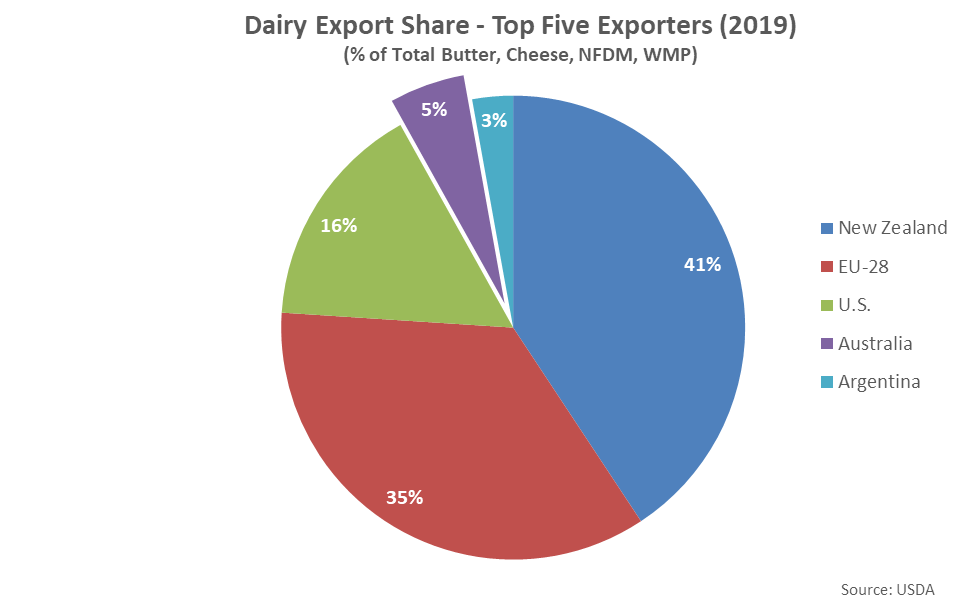

- Australia is the fourth largest global dairy exporter, accounting for 5.2% of combined butter, cheese, nonfat dry milk and whole milk powder exports throughout 2019. The bulk of Australian dairy exports are in the form of cheese and nonfat dry milk. From a global perspective, cheese and nonfat dry milk markets may be most affected by a continued rebound in Australian milk production.

Additional Report Details

According to Dairy Australia, Dec ’20 Australian milk production volumes declined on a YOY basis for the second time in the past three months, finishing down 2.0%. The YOY decline in Australian milk production volumes was the largest experienced throughout the past 13 months on a percentage basis. Recently experienced dry conditions have raised concerns about pasture growth throughout Australia.

Australian milk production volumes had steadied throughout the first three quarters 2020 calendar year as rainfall helped to partially counter the early season impact of drought and fires. Australian milk production volumes had increased on a YOY basis over ten consecutive months prior to finishing lower over two of the past three months.

’19-’20 annual Australian milk production volumes declined by 0.4% on a YOY basis, reaching a 24 year low level, as a 4.3% YOY decline in production volumes experienced throughout the first half of the production season more than offset a 4.9% YOY rebound in production experienced throughout the final six months of the production season. Dry weather conditions experienced throughout the first half of the ’19-’20 production season resulted in reduced production volumes however improved rainfall led to better pasture growth throughout the second half of the year. ’20-’21 YTD production volumes have rebounded by 0.7% on a YOY basis throughout the first half of the production season, despite the recently experienced declines. The USDA is projecting Australian milk production volumes will rebound to a three year high level throughout the 2021 calendar year.

Recently experienced low pasture volumes and supplementary feed on hand contributed to the Australian dairy cow herd contracting by 5.6% throughout 2019, while herd figures are expected to decline by an additional 0.3% throughout 2020, despite improvements in pasture conditions, due to biological lags in herd rebuilding. The USDA is projecting the Australian dairy cow herd will rebound by 0.7% throughout 2021, however, reaching a three year high level.

Australia is the fourth largest global dairy exporter, trailing only New Zealand, the EU-28 and the U.S. Of the top five dairy exporting regions accounting for over 90% of total global dairy exports, Australia accounts for 3.0% of total combined milk production and 5.2% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2019.

The bulk of Australian dairy exports are in the form of cheese and NFDM. Australia was the fourth largest exporter of both cheese and NFDM throughout 2019, accounting for 7.6% of global cheese export volumes and 5.4% of global NFDM export volumes. From a global perspective, cheese and NFDM markets may be most affected by a continued rebound in Australian milk production.