Food Service Sales Update – Apr ’21

Executive Summary

COVID-19 has resulted in a pronounced divergence in grocery store and food service & drinking place sales. U.S. grocery store sales have remained at record high seasonal levels throughout the early months of 2021 while signs point to food service sales beginning to ramp up throughout the second quarter of 2021 as dine-in restrictions ease, weather improves and vaccination efforts continue to advance. Important points to consider include:

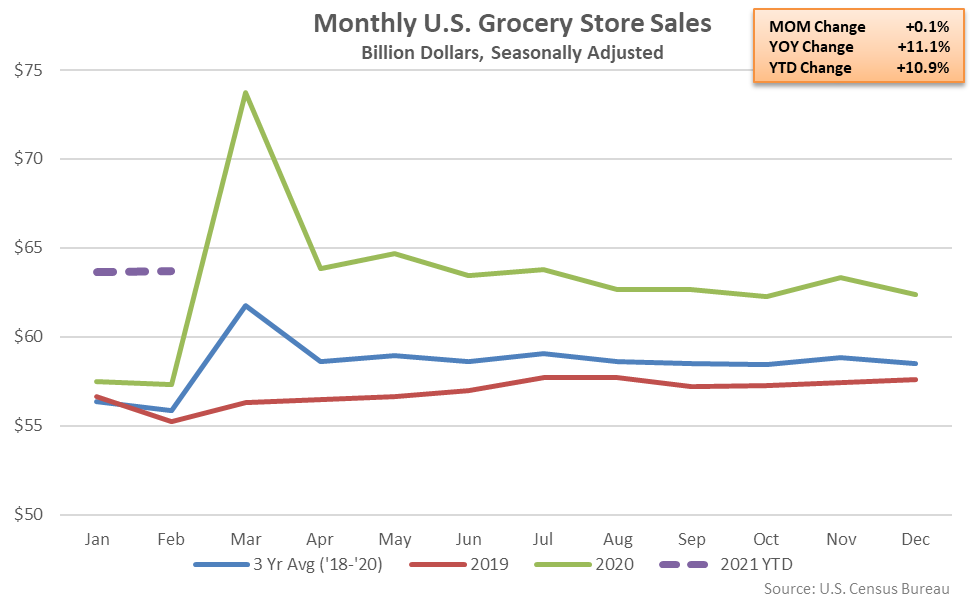

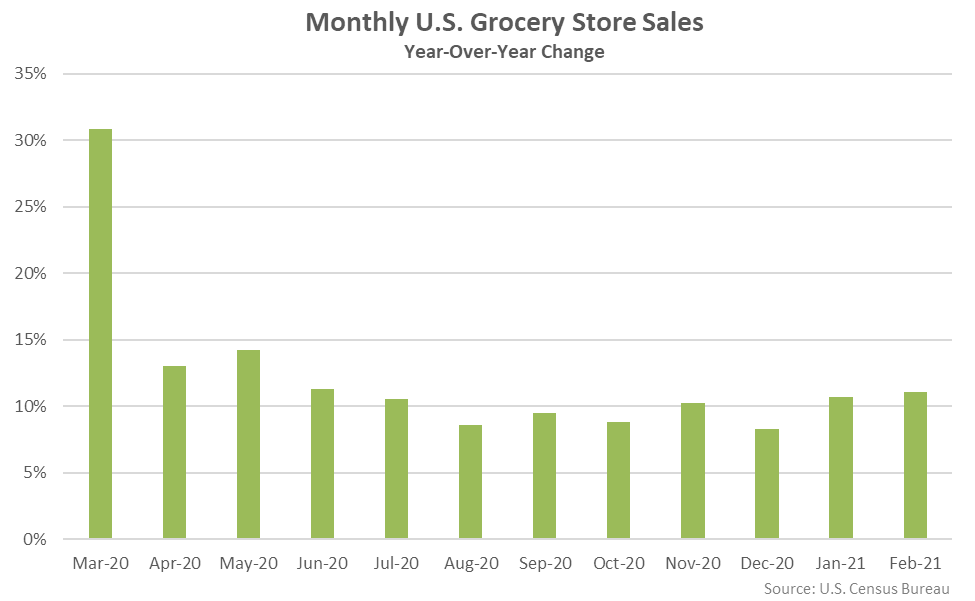

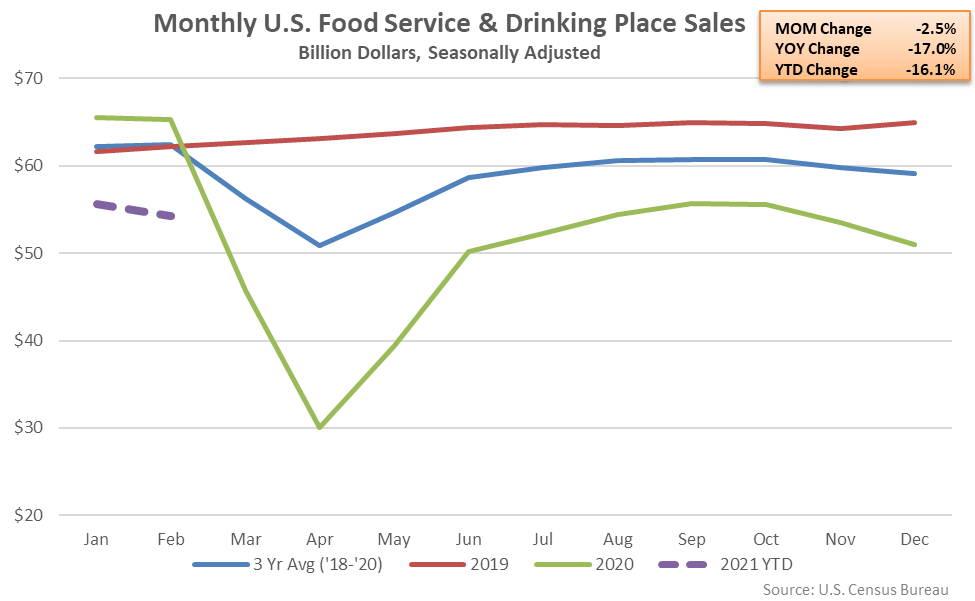

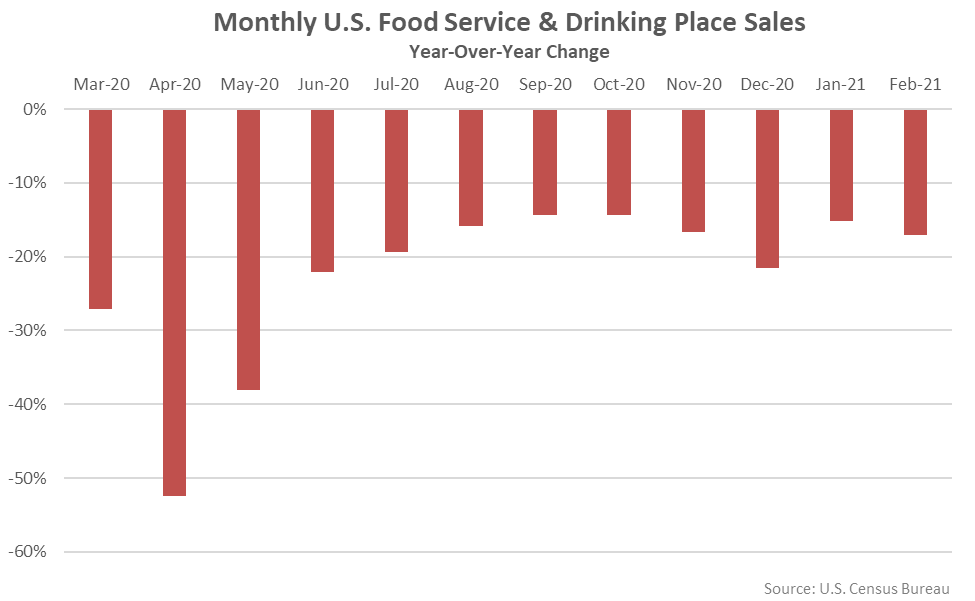

- U.S. grocery store sales reached a record high level throughout Mar ’20 and have remained significantly higher on a YOY basis through Feb ’21. Food service & drinking place sales declined to a 16 year low level throughout Apr ’20, however, and have remained lower on a YOY basis through the early months of 2021. 2020 annual food service & drinking place sales declined to a six year low level.

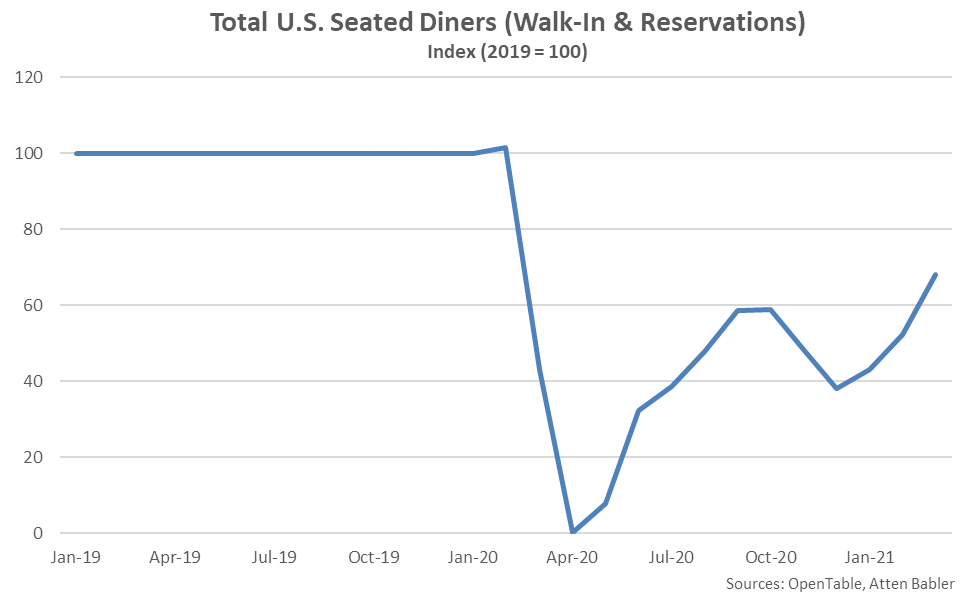

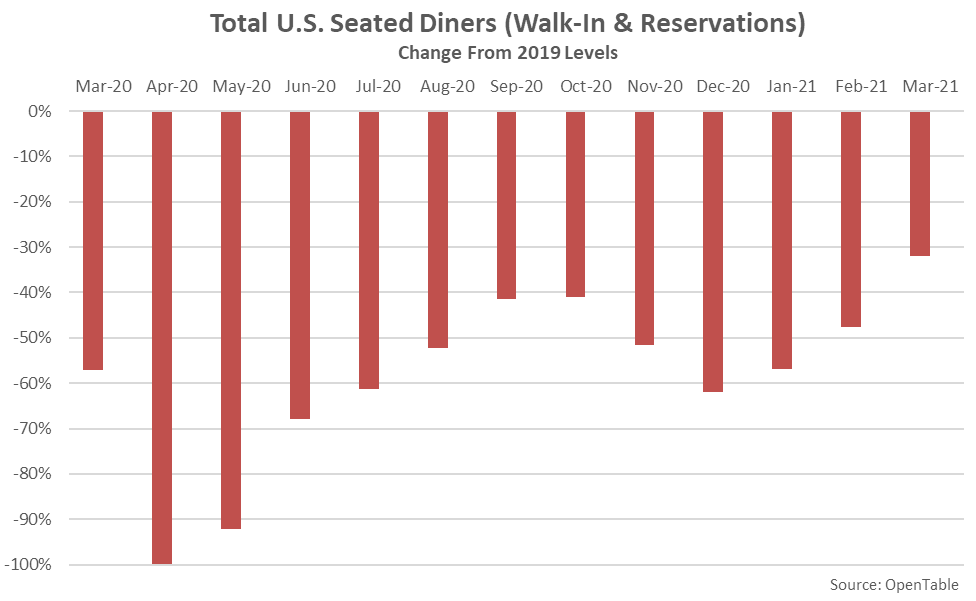

- U.S. seated diner figures provided by OpenTable exhibited a similar pattern to the food service & drinking place sales throughout 2020, steadily rebounding from the Apr ’20 lows through September before declining again throughout the final quarter of the calendar year. Mar ’21 seated diners rebounded to a 13 month high level, however, although they remain significantly below pre-pandemic levels.

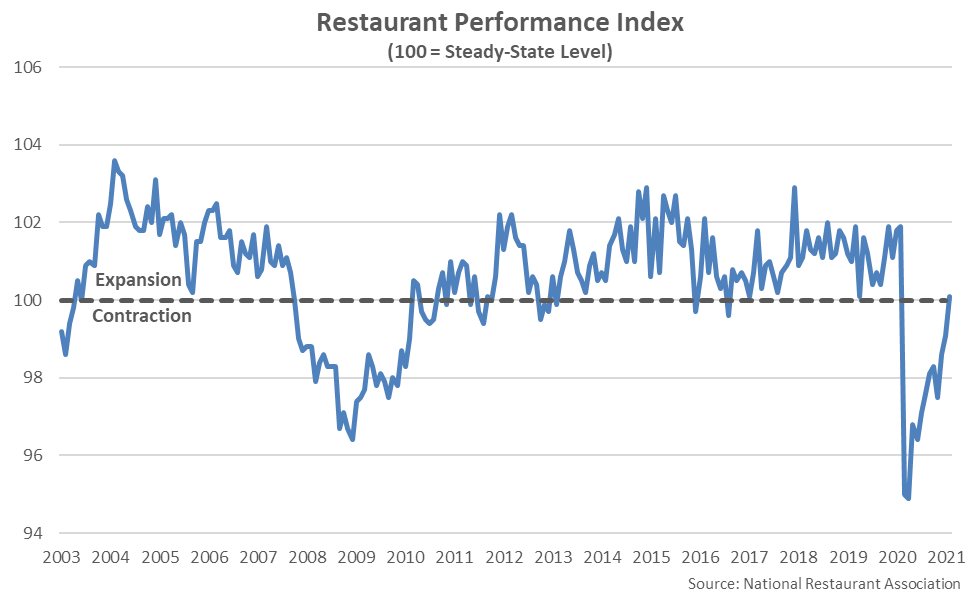

- The National Restaurant Association’s Restaurant Performance Index has indicated that the U.S. restaurant industry expanded over three and a half consecutive years through Feb ’20, prior to contracting throughout 11 consecutive months through Jan ’21. The Restaurant Performance Index rebounded to a 12 month high level throughout Feb ’21, however, while the National Restaurant Association’s Restaurant Expectations Index reached the highest monthly figure on record, indicating an expectation for improved food service sales in months to come.

Grocery Store & Food Service Sales

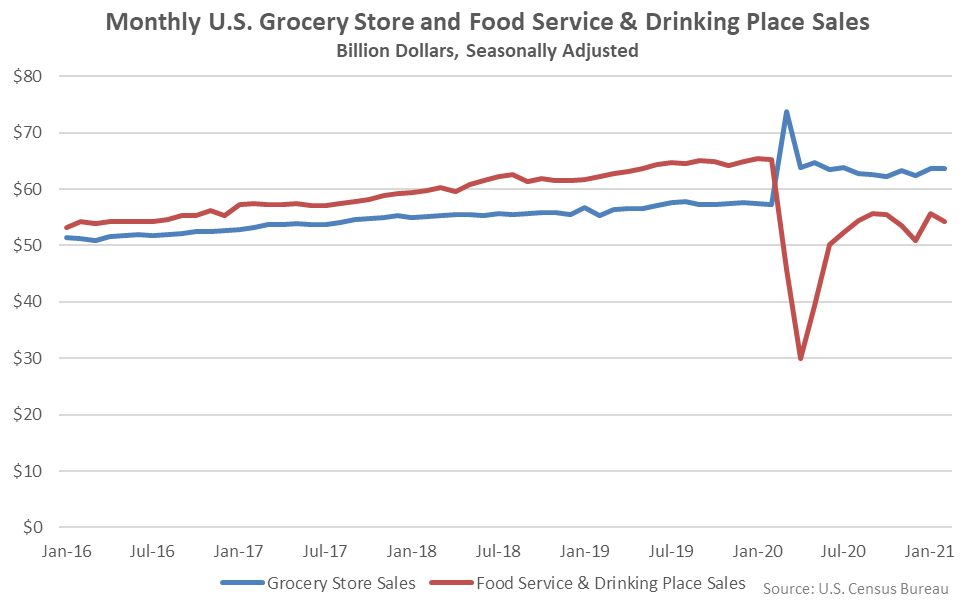

COVID-19 has resulted in a pronounced divergence in grocery store and food service & drinking place sales. Grocery stores sales reached a record high monthly level throughout Mar ’20 as many stocked up on staples in anticipation of lockdowns while food service & drinking place sales declined to a 16 year low level throughout Apr ’20 as stay-at-home orders were placed.

Grocery store sales have declined from the Mar ’20 highs over more recent months but have remained at record high seasonal levels through Feb ’21. Feb ’21 grocery store sales finished 11.1% above previous year levels, reaching an eight month high growth rate. 2020 annual grocery store sales finished 10.8% higher on a YOY basis.

Food service & drinking place sales have rebounded from the 16 year low level experienced throughout Apr ’20 but remained significantly below previous year levels. Feb ’21 food service & drinking place sales finished 17.0% below previous year levels, reaching a six year low seasonal level. 2020 annual food service & drinking place sales finished 19.2% lower on a YOY basis, reaching a six year low level.

OpenTable Seated Diners

Total U.S. seated diner figures provided by OpenTable exhibited a similar pattern to the food service & drinking place sales throughout 2020. Seated diner figures showed YOY restaurant activity steadily rebounding from the Apr ’20 lows through the month of September, prior to remaining largely flat throughout the month of October and slipping once again throughout the months of November and December. More recently, declines in seated diners have decelerated as figures have steadily rebounded throughout the first quarter of 2021. When indexed to 2019 levels, Mar ’21 seated diners rebounded to a 13 month high level, but remain significantly below pre-pandemic levels.

Restaurant Performance Index

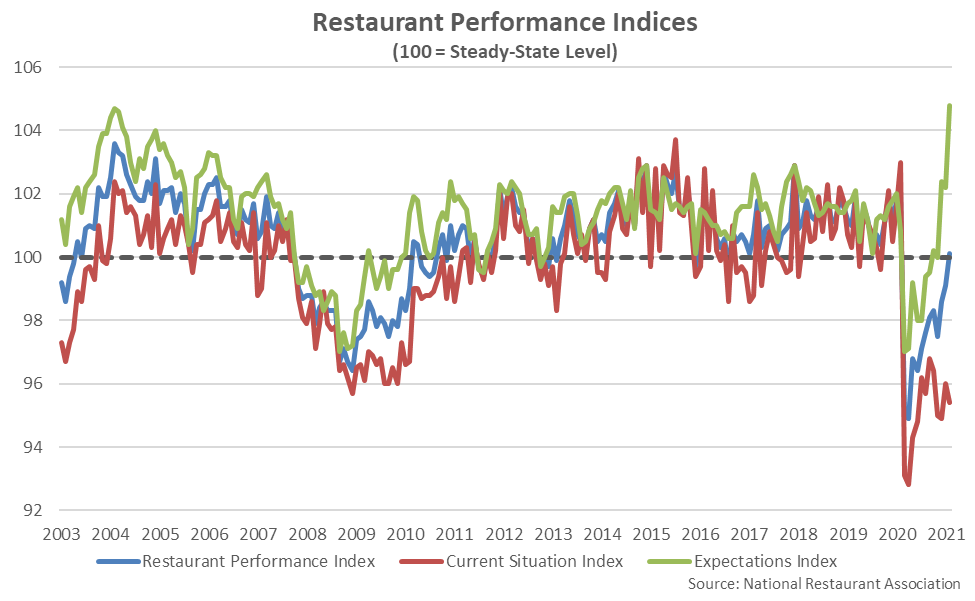

The National Restaurant Association’s Restaurant Performance Index (RPI) rebounded to a 12 month high level of 100.1 throughout Feb ’21. The RPI is a statistical barometer that measures the overall health of the U.S. restaurant industry. A value above 100 signals a period of expansion while a value below 100 signals a period of contraction, with the distance from 100 signifying the magnitude of the expansion or contraction.

The RPI has indicated that the U.S. restaurant industry expanded over three and a half consecutive years through Feb ’20, prior to contracting throughout the 12 months of data through Jan ’21. RPI figures reached record low levels throughout Mar-Apr ’20, consistent with the declines experienced in food service & drinking place sales. RPI figures have been provided since early 2002.

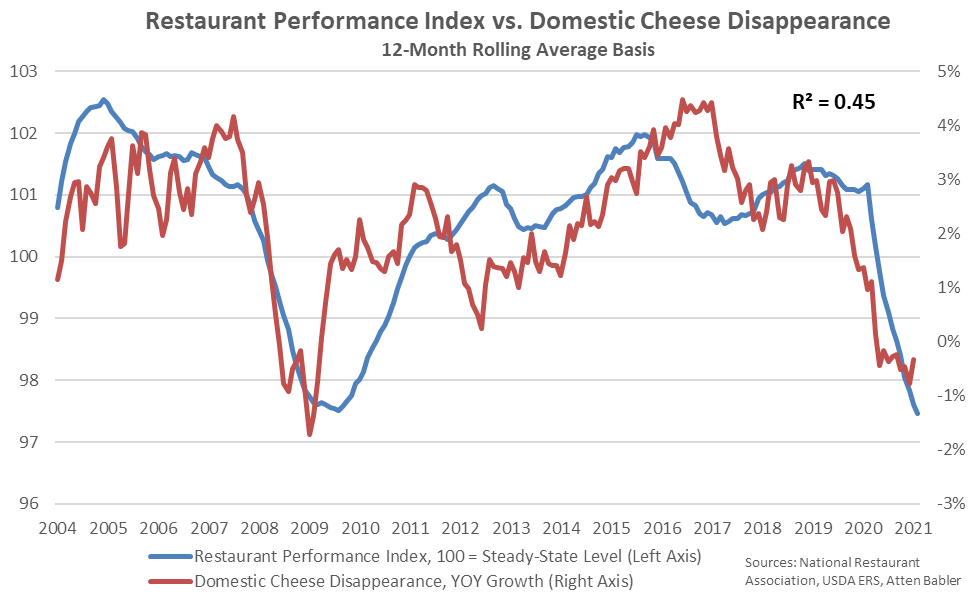

The RPI has exhibited a moderate correlation with domestic cheese demand, historically, as the restaurant industry has been a main source of consumption growth. The correlation in the RPI and YOY growth in domestic cheese demand was most pronounced following the financial crisis of 2008, when both declined significantly, each reaching record low levels on a 12-month rolling average basis. Similar declines have been exhibited through the COVID-19 pandemic.

The RPI Current Situation Index, which measures current industry trend indicators, remained at a depressed level of 95.4 throughout Feb ’21. The RPI Current Situation Index has ranged from values of 92.8 – 96.8 throughout the past 12 months. The RPI Expectations Index, which measures restaurant operators’ six-month outlook on industry indicators, reached a record high level of 104.8 throughout Feb ’21, however.

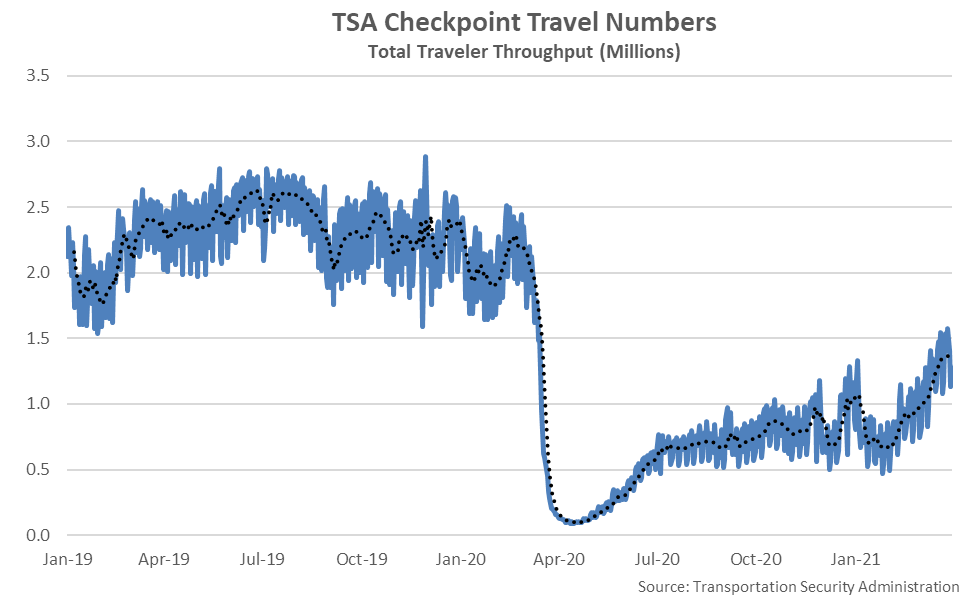

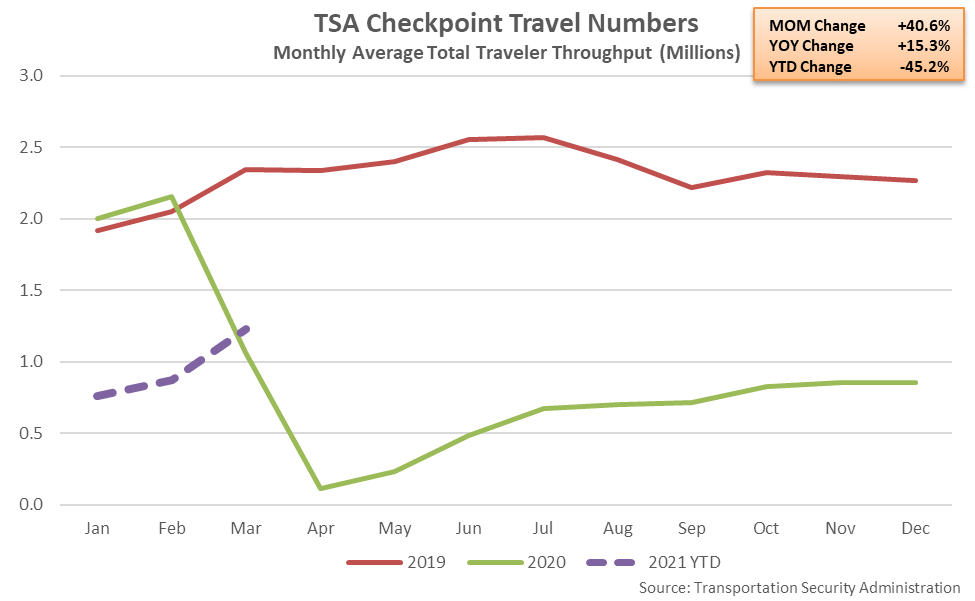

TSA Checkpoint Travel Numbers

Monthly TSA checkpoint travel numbers, a data series tangentially related to the rebound in food service sales, also reached a 13 month high level throughout Mar ’21. Mar ’21 TSA checkpoint travel numbers finished 15.3% above previous year figures but remained 47.7% below 2019 seasonal levels.

Summary

COVID-19 has resulted in a pronounced divergence in grocery store and food service & drinking place sales. U.S. grocery store sales have remained at record high seasonal levels throughout the early months of 2021 while signs point to food service sales beginning to ramp up throughout the second quarter of 2021.

From a dairy perspective, declines in restaurant performance have historically been associated most closely with declines in domestic cheese demand. Declines in food service cheese demand have been partially offset by government intervention programs including the Farmers to Families Food Box Program, however the current round of purchases only runs through the end of Apr ’21 and additional funding remains uncertain.

Food service figures have improved of late as dine-in restrictions ease, weather improves and vaccination efforts continue to advance. OpenTable seated diners reached a 13 month high level throughout Mar ’21 while TSA checkpoint travel numbers, a data series tangentially related to the rebound in food service sales, also reached a 13 month high level throughout Mar ’21. Looking forward, the National Restaurant Association’s Expectations Index indicates an expectation for improved food service sales in months to come.