Mexican Milk Production Update – Jul ’21

Executive Summary

Mexican milk production figures provided by the Mexican Agri-Food and Fisheries Information Service were recently updated with values spanning through the end of the first half of the 2021 calendar year. Important points to consider include:

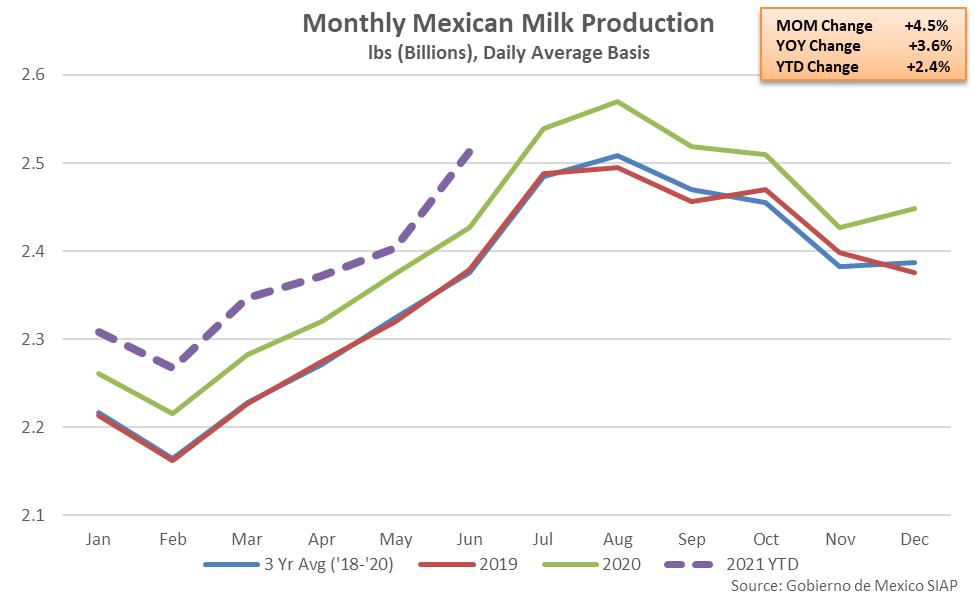

- Mexican milk production increased on a YOY basis for the 91st consecutive month during Jun ’21, finishing up 3.6%. Recently experienced dry conditions experienced throughout Mexico’s major milk producing regions have not yet resulted in a slowdown in milk production volumes.

- The Mexican dairy cow herd is projected to rebound to a 15 year high level throughout 2021, finishing above previous year levels for the sixth time in the past eight years.

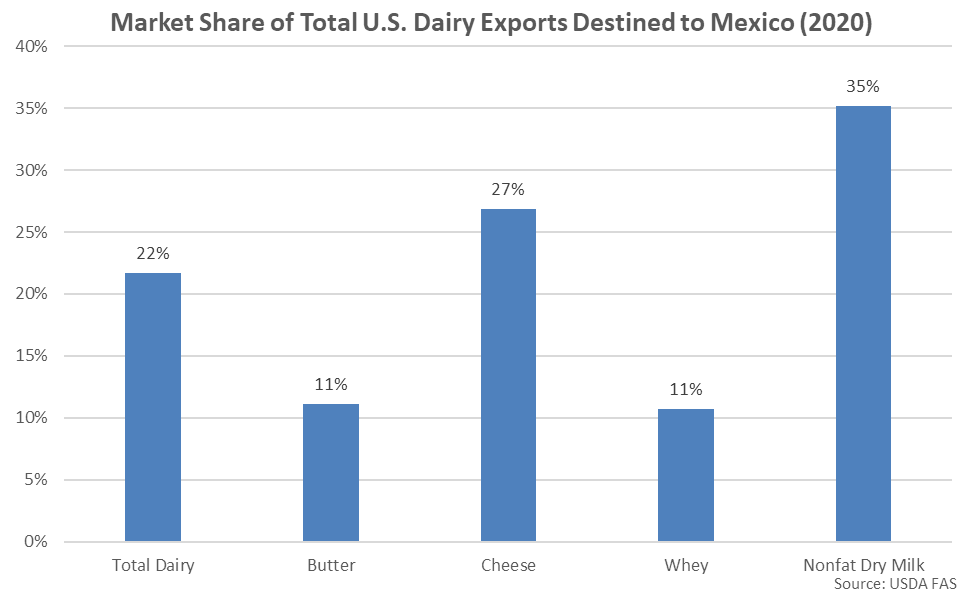

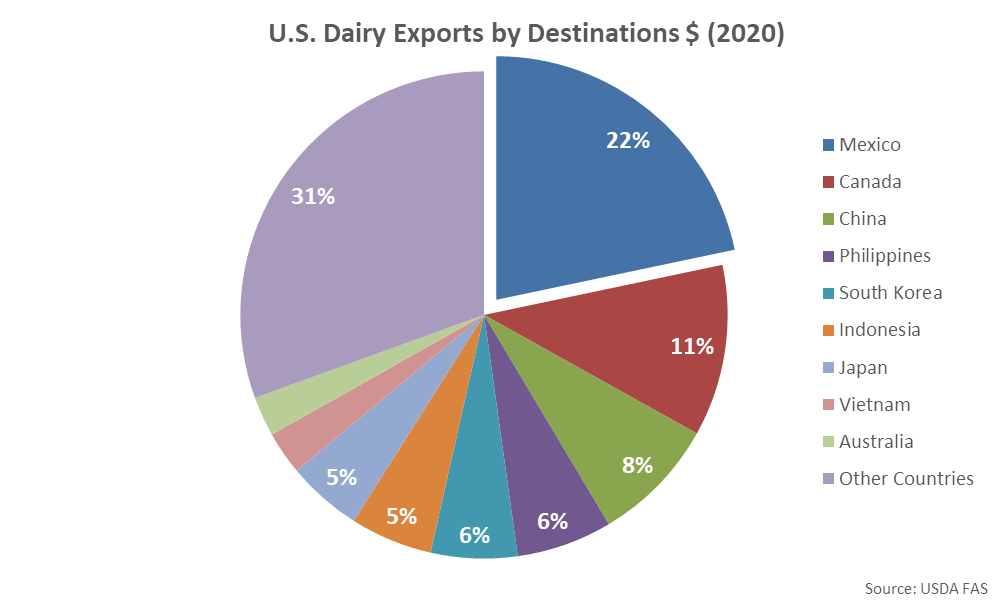

- Mexico has been the largest importer of U.S. dairy products over 18 consecutive years through 2020. From a dairy product perspective, nonfat dry milk and cheese may be most affected by a potential slowdown in Mexican milk production if drought conditions continue to persist. Mexico was the largest importer of both U.S. nonfat dry milk and cheese throughout 2020, while accounting for a considerably smaller market share of U.S. butter and whey export volumes.

Additional Report Details

According to the Mexican Agri-Food and Fisheries Information Service, Jun ’21 Mexican milk production volumes increased on a YOY basis for the 91st consecutive month, finishing up 3.6%. Recently experienced dry conditions experienced throughout Mexico’s major milk producing regions have not yet resulted in a slowdown in milk production volumes. Mexico is currently experiencing one of its most widespread and intense droughts in decades according to the NASA Earth Observatory. Over two-thirds of Mexico is currently in a long-term drought, with reservoir levels currently below 25% capacity in over one third of Mexico’s principal reservoirs accounting to government data. The next several months are a crucial for the Mexican agricultural industry. The North American Monsoon season, running from July – September, typically accounts for 50 percent to 80 percent of annual rainfall throughout much of Mexico.

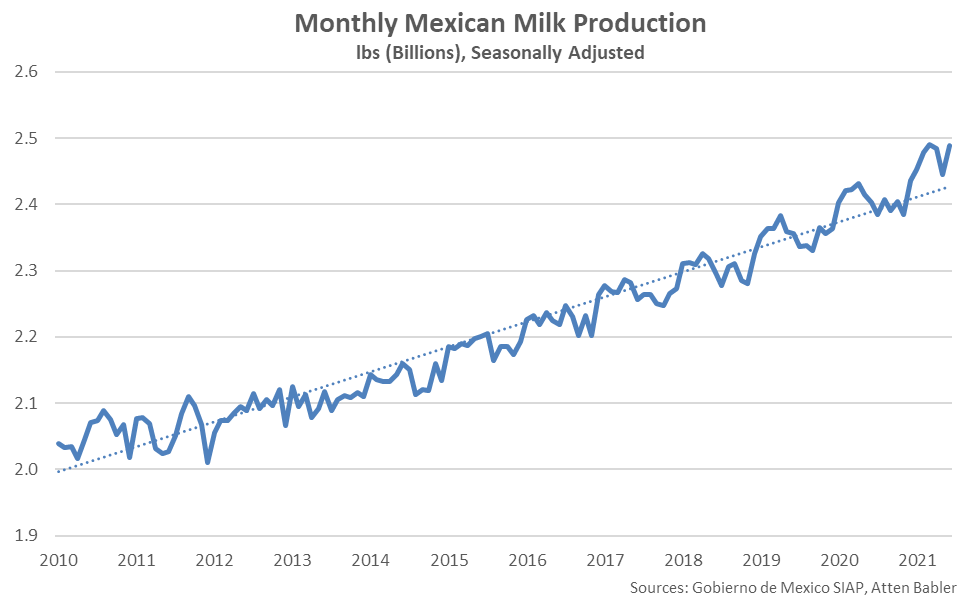

Mexican milk production volumes have increased by a compound annual growth rate of 1.6% over the past ten years. Mexican milk production volumes have finished above long-term average growth rates over 19 of the past 21 months through Jun ’21 as better herd genetics and improved technology have more offset recently experienced adverse economic conditions. 2021 YTD production volumes have increased by 2.4% on a YOY basis throughout the first half of the production season and are on pace to reach a six year high growth rate.

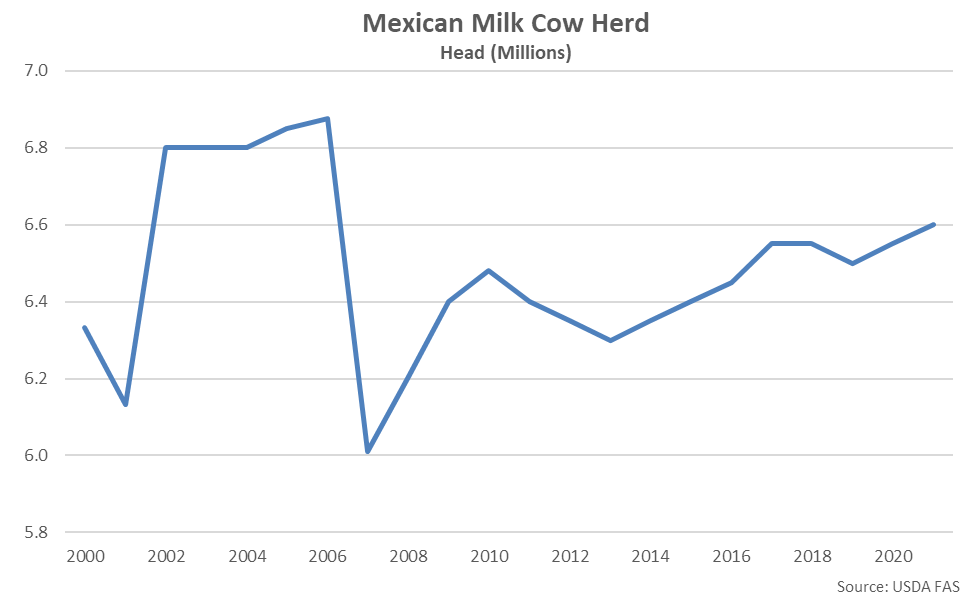

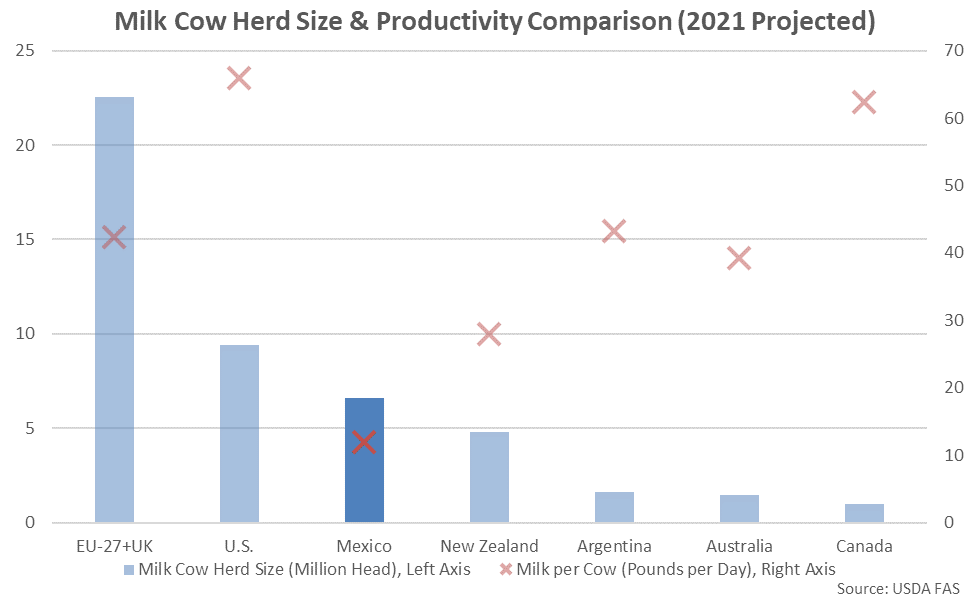

The USDA is projecting the Mexican milk cow herd will reach a 15 year high level of 6.6 million head throughout 2021, finishing 0.8% above previous year levels. The YOY increase in the Mexican milk cow herd would be the sixth experienced throughout the past eight years.

The Mexican milk cow herd is equivalent to approximately 70% of the total U.S. milk cow herd and is nearly seven times as large as the Canadian milk cow herd. Per cow productivity remains poor compared to the U.S., Canada and major dairy exporting regions, however, despite recent improvements in herd genetics and technology. U.S. and Canadian milk cows each produce greater than five times the yields Mexican cows do, on average. Mexican milk per cow yields have increased by a compound annual growth rate of 1.3% throughout the past ten years, trailing the average annual growth rate of 1.6% experienced throughout U.S., Canada and major dairy exporting regions.

Because of the close proximity of the two countries, Mexico has been the largest importer of U.S. dairy products, historically. Mexico accounted for 22% of total U.S. dairy exports throughout 2020, finishing as the largest importer of U.S. dairy products for the 18th consecutive year.

From a dairy product perspective, nonfat dry milk and cheese may be most affected by a potential slowdown in Mexican milk production if drought conditions continue to persist. Mexico was the largest importer of both U.S. nonfat dry milk and cheese throughout 2020. Mexico accounts for a considerably smaller market share of U.S. butter (third behind Canada and Saudi Arabia) and whey (second behind China) imports.