Dairy WASDE Update – Oct ’21

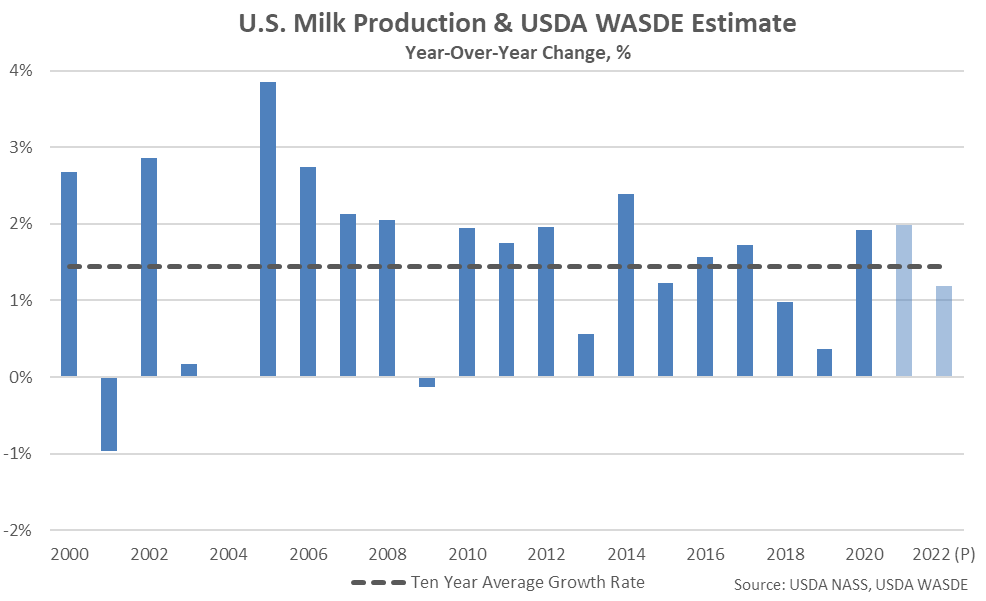

According to the October USDA World Agricultural Supply and Demand Estimate (WASDE) report, the 2021 milk production projection was reduced eight million pounds from the previous month on smaller dairy cow numbers and lower milk per cow yields, reaching a nine month low projected level. 2021 projected milk production equates to a 2.0% YOY increase from 2020 levels, which would remain the largest growth rate experienced throughout the past seven years.

U.S. milk production volumes are expected to increase by an additional 1.2% throughout 2022, although the 2022 milk production projection was reduced nine million pounds from the previous month as lower forecasted cow numbers and milk per cow yields were carried forward.

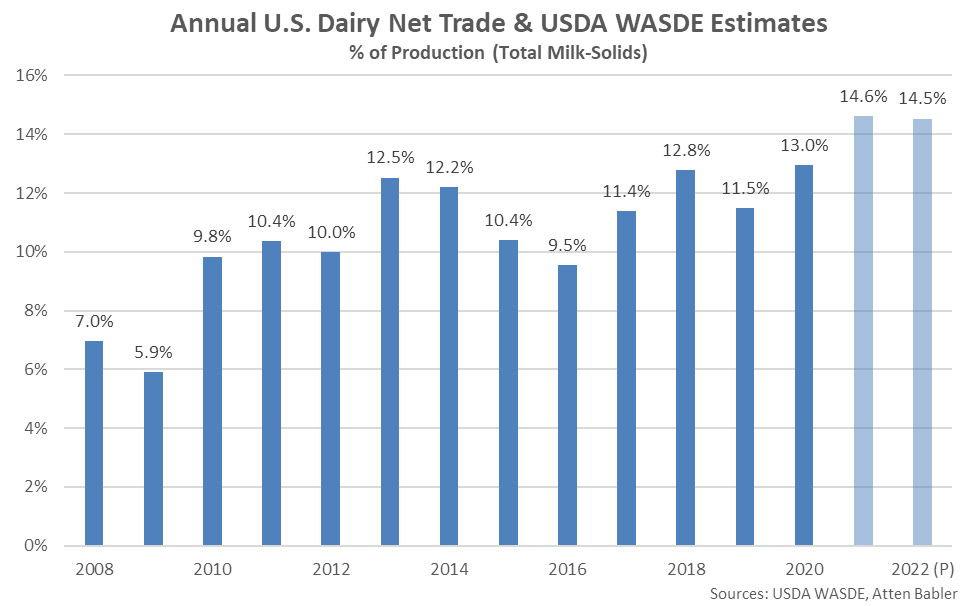

2021 dairy export forecasts were raised from the previous month on a milk-fat basis on stronger expected sales of cheese and butterfat containing products but reduced on a skim-solids basis on weaker sales of skim milk powder, whey and lactose. 2021 dairy import forecasts remained unchanged on a milk-fat basis while being reduced on a skim-solids basis on weaker expected imports of milk protein concentrates.

2022 dairy export forecasts were raised slightly from the previous month on a milk-fat basis on stronger expected sales of cheese and butterfat containing products while remaining unchanged on a skim-solids basis. 2022 dairy import forecasts remained unchanged on both a milk-fat and skim-solids basis.

2022 projected dairy export volumes equated to 18.1% of total U.S. milk solids production, down slightly from the record high level projected throughout the previous year, while import volumes were equivalent to 3.6% of total U.S. milk solids production, on pace to reach a four year low level. 2022 net dairy trade is projected to finish slightly below the record high level projected throughout 2021 but remain at the second highest annual level on record.

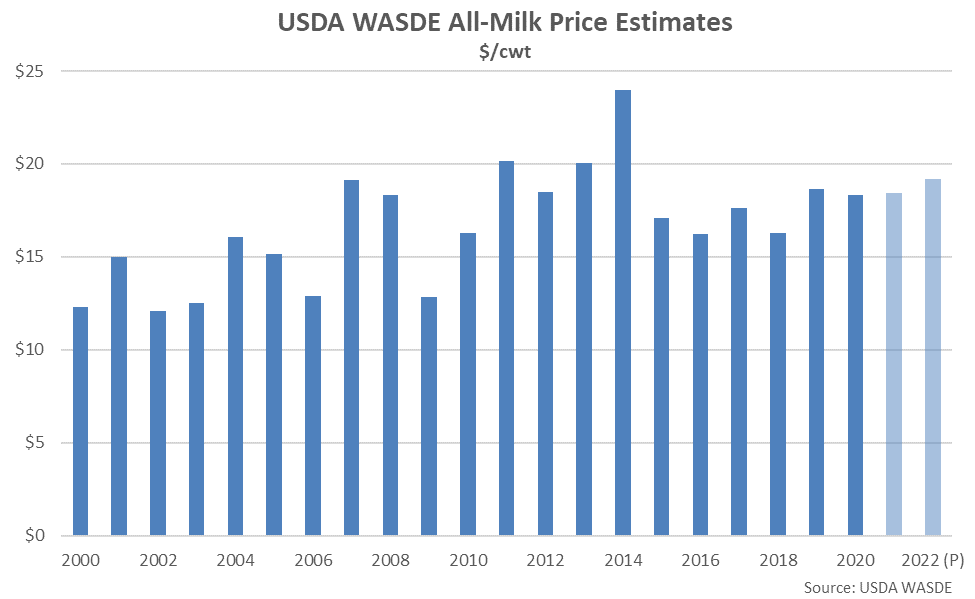

2021 cheese, dry whey and nonfat dry milk price forecasts were raised from the previous month on current prices and lower expected production, while the butter price was lowered slightly on current prices. The 2021 Class III milk price forecast of $17.05/cwt was raised $0.40/cwt from the previous forecast but remained 6.1% below the previous year price level. The 2021 Class IV milk price forecast of $15.70/cwt was raised $0.15/cwt from the previous forecast, finishing 16.4% above the previous year price level. The 2021 All-Milk price forecast of $18.45/cwt was raised $0.30/cwt from the previous forecast, finishing 0.7% above the 2020 price level.

2022 butter, cheese, dry whey and nonfat dry milk price forecasts were all raised from the previous month, largely on tighter anticipated supplies. The 2022 Class III milk price forecast of $17.10/cwt was raised $0.65/cwt from the previous forecast, finishing 0.3% above the previous year’s projected price level. The 2022 Class IV milk price forecast of $17.15/cwt was raised $1.10/cwt from the previous forecast, finishing 9.2% above the previous year’s projected price level. The 2022 All-Milk price forecast of $19.20/cwt was raised $0.80/cwt from the previous month, finishing 4.1% above the previous year’s projected price level and reaching an eight year high level, overall.