Quarterly Canadian Milk Production Update – Jan ’22

Executive Summary

Canadian milk production figures provided by Statistics Canada were recently updated with values spanning through the end of the first quarter of the ’21-’22 production season. Highlights from the updated report include:

- Canadian milk sold off farms increased on a YOY basis for the 25th time in the past 27 months throughout Oct ’21, finishing up 0.2% and remaining at a record high seasonal level.

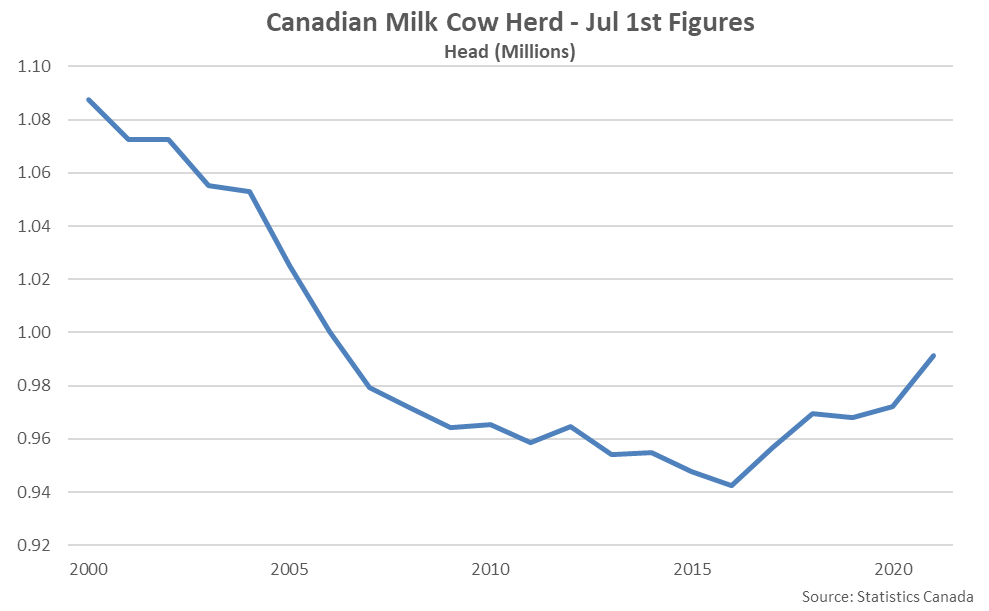

- The Canadian milk cow herd has plateaued over the past several years following significant declines experienced since the beginning of the Canadian dairy supply management system. The Canadian milk cow herd finished 2.0% above previous year levels as of Jul 1st, 2021, however, reaching a 15 year high seasonal level.

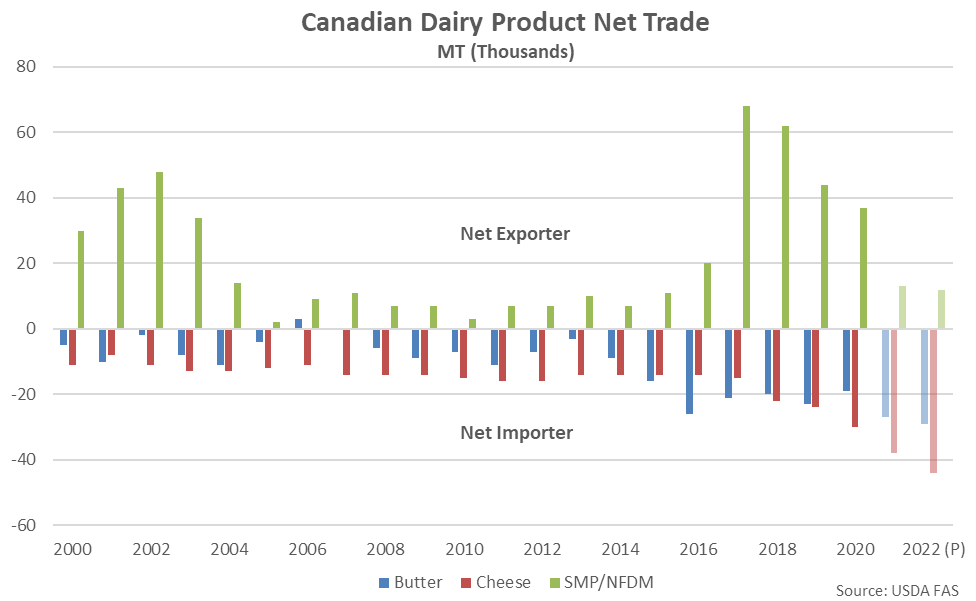

- The USDA expects Canadian net exports of skim milk powder/nonfat dry milk will decline to a seven year low level throughout 2022, aided by the elimination of the Class 7 milk class as part of the United States-Mexico-Canada Agreement.

Additional Report Details

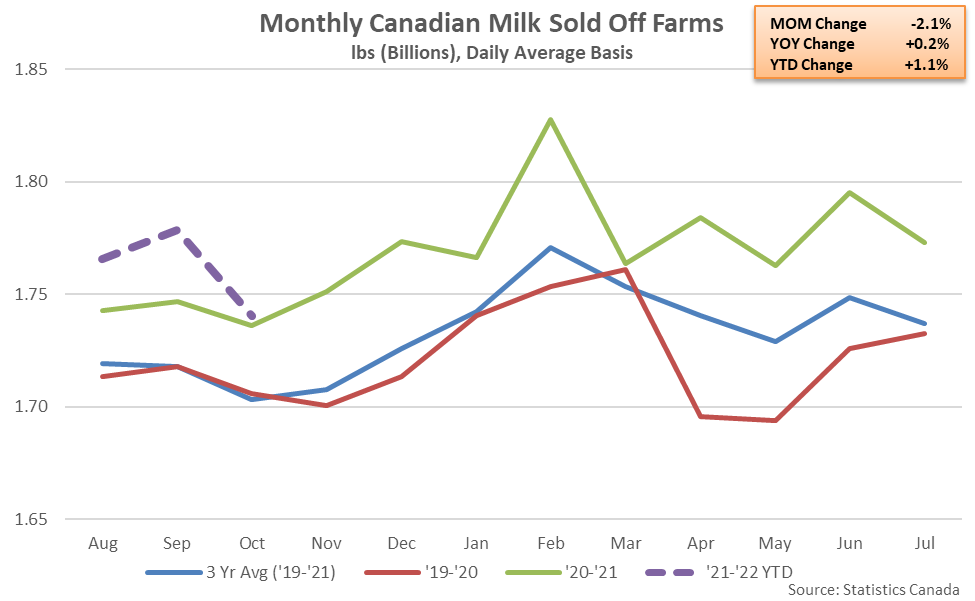

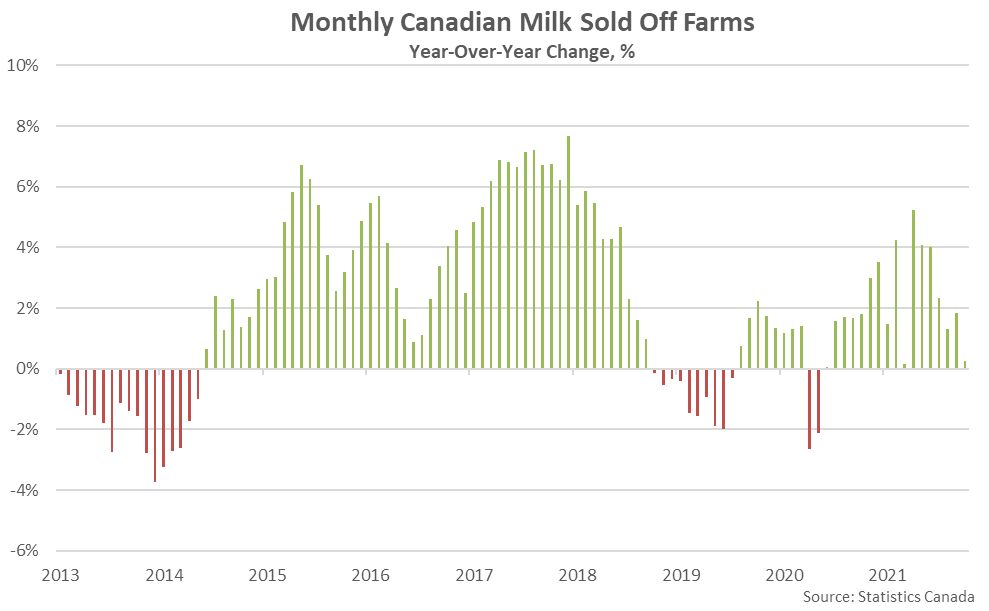

According to Statistics Canada, Oct ’21 Canadian milk sold off farms remained higher on a YOY basis for the 25th time in the past 27 months, finishing 0.2% above the previous year volumes and remaining at a record high seasonal level. Canadian milk sold off farms declined on a YOY basis throughout the months of Apr-May 2020 due to COVID-19 disruptions but rebounded to levels above previous year figures over the 15 most recent months of data. The Oct ’21 YOY increase in Canadian milk sold off farms was the smallest experienced throughout the past 14 months, however.

Milk sold off farm figures typically account for approximately 95% of the milk produced within Canada, while on-farm use is estimated to account for approximately five percent of total milk produced. Canadian milk production has been historically tempered by a supply management system up until recent years when additional production quotas were implemented in an attempt to meet increasing domestic dairy demand. Increased milk production quotas have resulted in production levels finishing at record high levels over recent years.

’20-’21 annual Canadian milk sold off farms increased 2.8% on a YOY basis, reaching a record high annual level for the second consecutive year. ’21-’22 YTD Canadian milk sold off farms has increased by an additional 1.1% on a YOY basis throughout the first quarter of the production season.

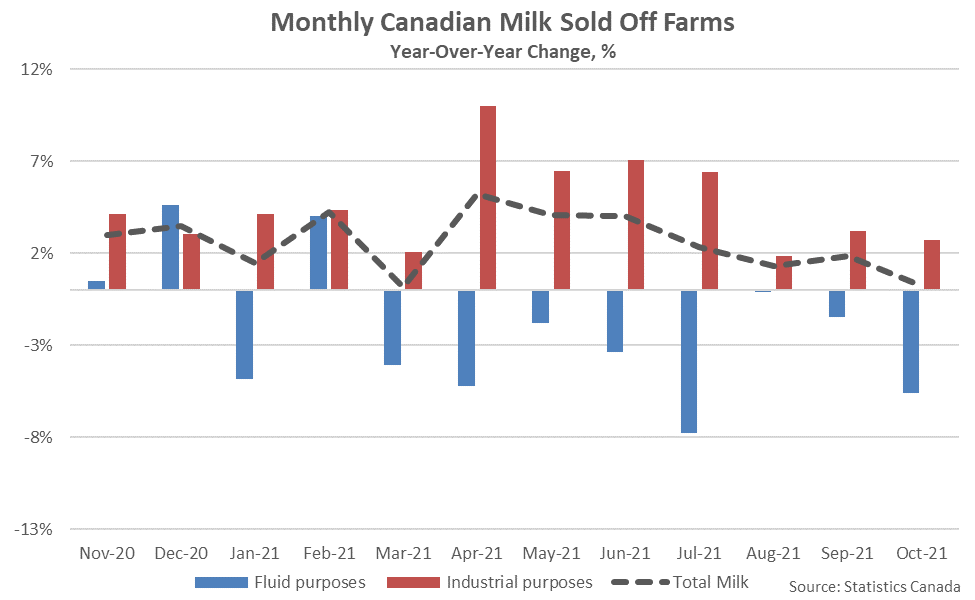

Milk produced within Canada supplies two markets – the fluid milk market, which includes milk used for direct consumption, creams and flavored milks, and the industrial milk market, which includes milk used to make dairy products including butter, cheese, milk powder, yogurt and ice cream. Over the past five years, the industrial milk market has accounted for over two-thirds of the total Canadian milk sold off farms.

’20-’21 annual Canadian milk sold for industrial purposes increased 4.8% on a YOY basis, more than offsetting a 2.0% YOY decline in milk sold for fluid purposes. Canadian milk sold for industrial purposes remained above previous year figures for the 16th consecutive month throughout Oct ’21, finishing 2.7% above previous year figures, while milk sold for fluid purposes remained lower on a YOY basis for the eighth consecutive month, down 5.6%.

Canadian milk production has reached record high levels over recent years despite milk cow figures remaining at or near the lowest figures on record. The Canadian milk cow herd has plateaued over the past several years following significant declines experienced since the beginning of the Canadian dairy supply management system. The Canadian milk cow herd finished 2.0% above previous year levels as of Jul 1st, 2021, rebounding to a 15 year high seasonal level.

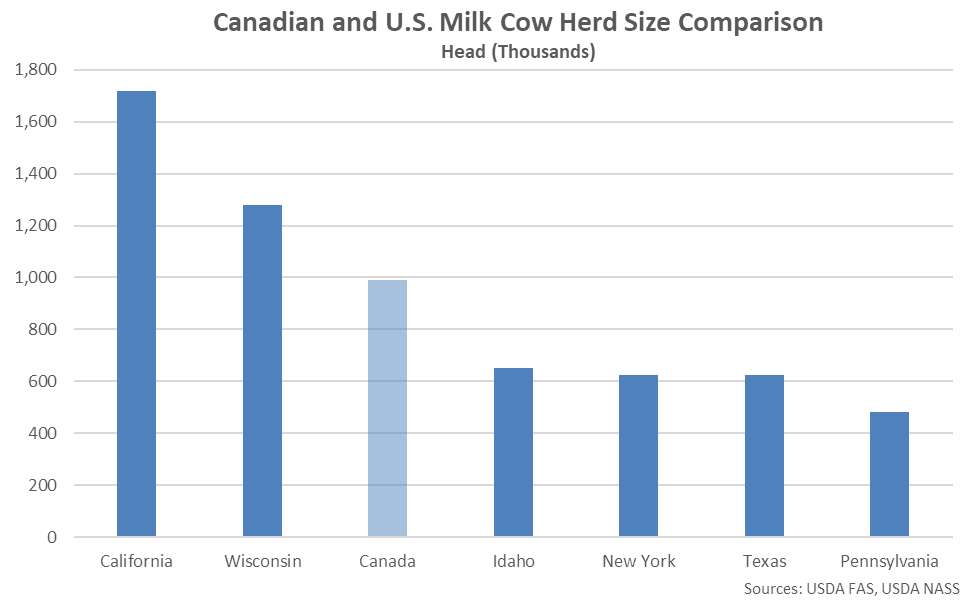

Overall, the Canadian milk cow herd is equivalent to just over 10% of the total U.S. milk cow herd. When compared on a state-by-state basis, the Canadian milk cow herd is equivalent to approximately 58% of the California milk cow herd and 78% of the Wisconsin milk cow herd.

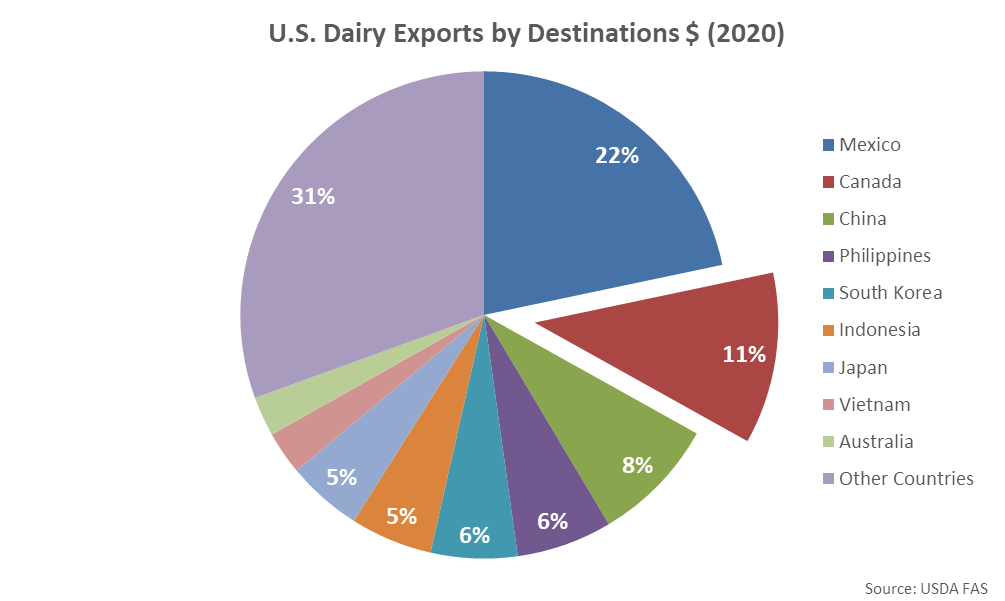

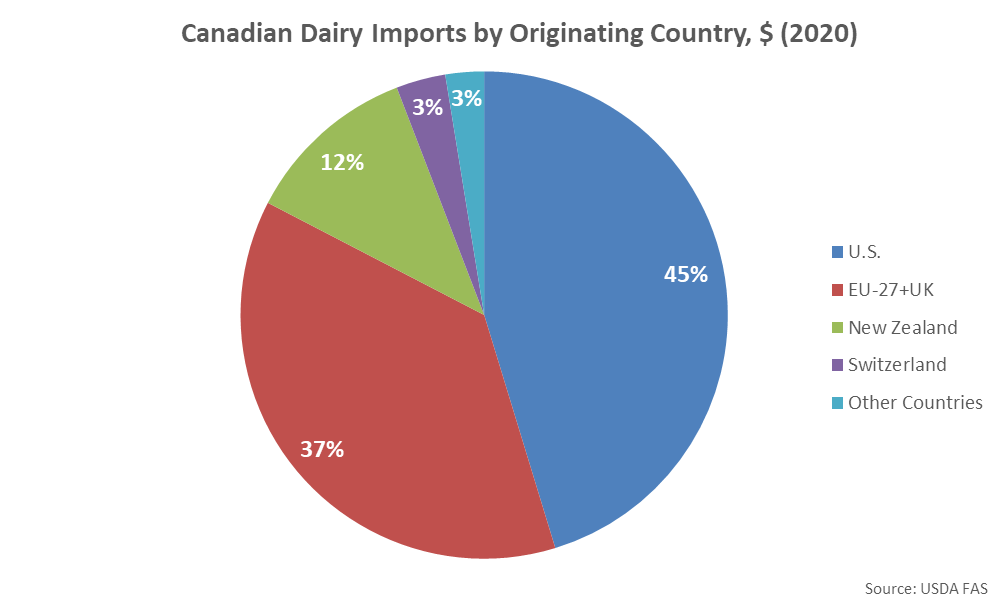

Because of the close proximity of the two countries, the U.S. has been the largest trade partner for both Canadian exports and imports of dairy products over the past several years. Canada has traditionally been a net importer of dairy products, despite heavy import tariffs, with the majority of import volumes originating from within the United States. Overall, Canada finished as the second largest importer of U.S. dairy products throughout 2020, trailing only Mexico.

Throughout 2020, the U.S. and the EU-27+UK combined to account for over 80% of Canada’s total dairy import volumes. The U.S. market share of Canadian dairy import volumes continued to outpace the EU-27+UK market share throughout the year.

Canadian net dairy imports have traditionally been led by butter and cheese, while Canada has traditionally remained a net exporter of skim milk powder/nonfat dry milk (SMP/NFDM). Canadian SMP/NFDM export volumes increased significantly throughout 2017, aided by the introduction of the newly created Class 7 milk pricing scheme used to price skim milk powder, milk protein concentrate and infant formula. The Class 7 milk pricing scheme priced the products at the lower of skim milk powder or whole milk powder prices observed throughout major dairy exporting regions, effectively guaranteeing that Canadian product will always be competitive globally.

The USDA expects Canadian net exports of SMP/NFDM will decline to a seven year low level throughout 2022, largely due to the elimination of the Class 7 milk class as part of the United States-Mexico-Canada Agreement (USMCA). Under the USMCA, Canadian skim milk powder, milk protein concentrate and infant formula will be priced at U.S. nonfat dry milk price levels instead of the lowest of prices experienced throughout the major dairy exporting regions. Expanded quota levels under the Comprehensive Economic and Trade Agreement (CETA) with the European Union and the Comprehensive Progressive Agreement for Trans-Pacific Partnership (CPTPP) are expected to partially offset the elimination of the Class 7 milk class, however.

In addition to abolishing Canada’s Class 7 milk class, the USMCA also provides U.S. producers with access of up to 3.6% of Canada’s dairy market under a tariff-free quota, up from the previous level of approximately 1.0%. The distribution of Canada’s tariff-free quotas has been criticized, however, as allocations have discouraged high value food service and retail product imports. In early Jan ’22, U.S. Trade Representatives claimed victory in the first dispute settlement brought under the USMCA after it was found Canada reserved 80-85% of the tariff-free quota volumes to processors.