U.S. Dairy Product Production Update – Mar ’22

Executive Summary

U.S. dairy product production figures provided by the USDA were recently updated with values spanning through Jan ’22. Highlights from the updated report include:

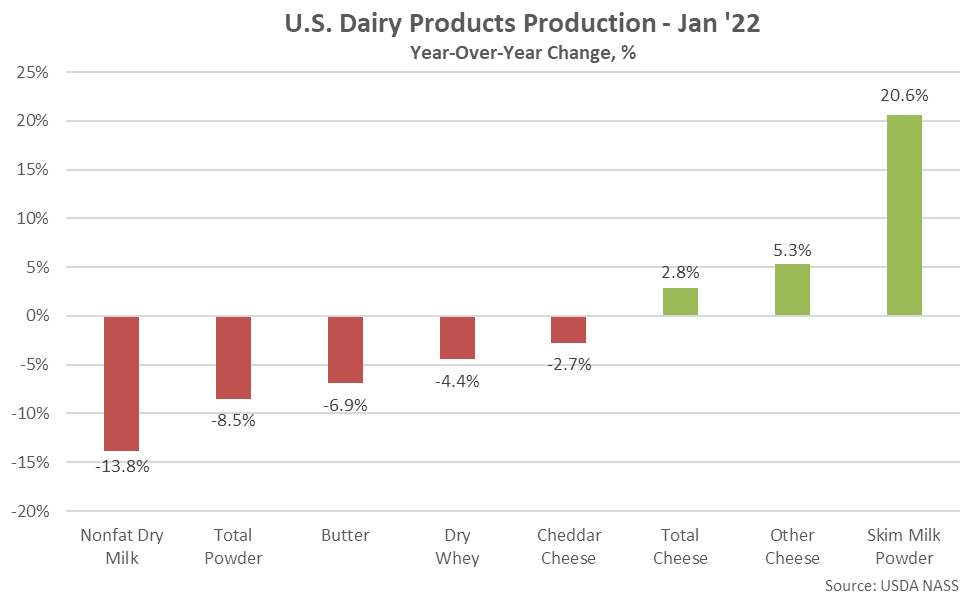

- U.S. butter production finished 6.9% below previous year levels throughout Jan ’22, remaining lower for the seventh consecutive month.

- U.S. cheese production finished 2.8% above previous year levels throughout Jan ’22, remaining at a record high seasonal level for the ninth time in the past 12 months. Dry whey production finished 4.4% below previous year levels, however, reaching a seven year low seasonal level.

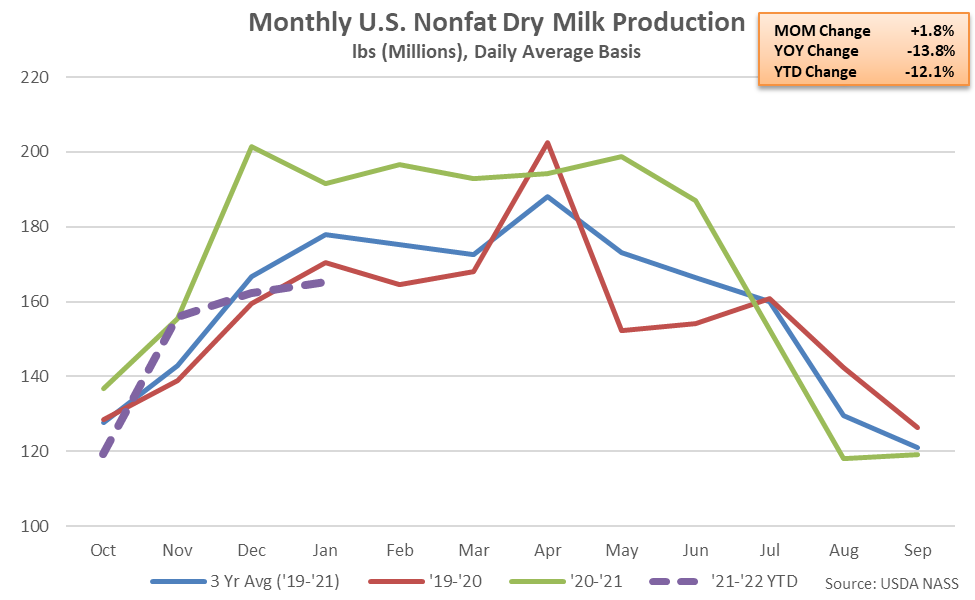

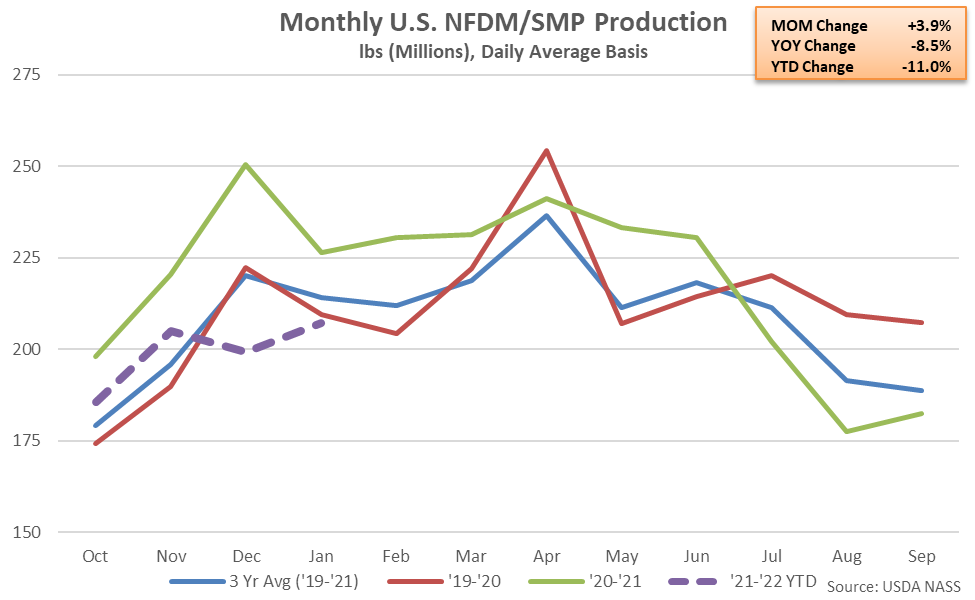

- Combined production of U.S. nonfat dry milk and skim milk powder declined 8.5% on a YOY basis throughout Jan ’22, finishing below previous year levels for the seventh consecutive month and remaining at a three year low seasonal level. Nonfat dry milk production declined 13.8% on a YOY basis throughout the month, more than offsetting a 20.6% YOY increase in skim milk powder production.

Additional Report Details

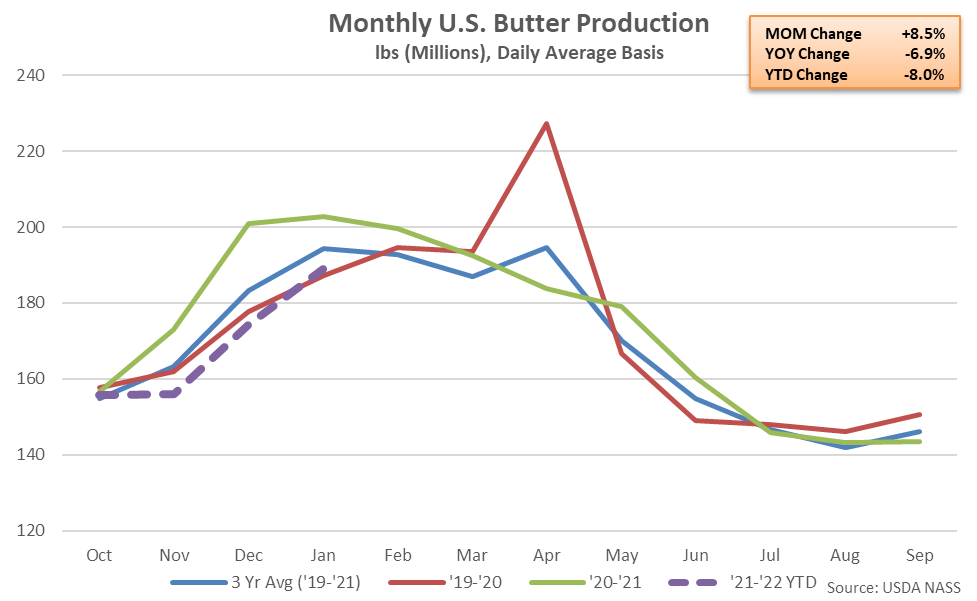

Butter – Production Remains Below Previous Year Levels for the Seventh Consecutive Month

According to the USDA, Jan ’22 U.S. butter production increased seasonally to a ten month high level but remained 6.9% below previous year levels. The YOY decline in butter production was the seventh experienced in a row. YOY declines in butter production were widespread regionally and led by the Central U.S. (-9.3%), followed by the Atlantic U.S. (-5.5%) and the Western U.S. (-5.3%).

’20-’21 annual butter production finished 1.0% above previous year levels, reaching the highest annual level on record for the fourth consecutive year. ’21-’22 YTD butter production has declined by 8.0% on a YOY basis throughout the first third of the production season, however, and is on pace to reach a three year low level.

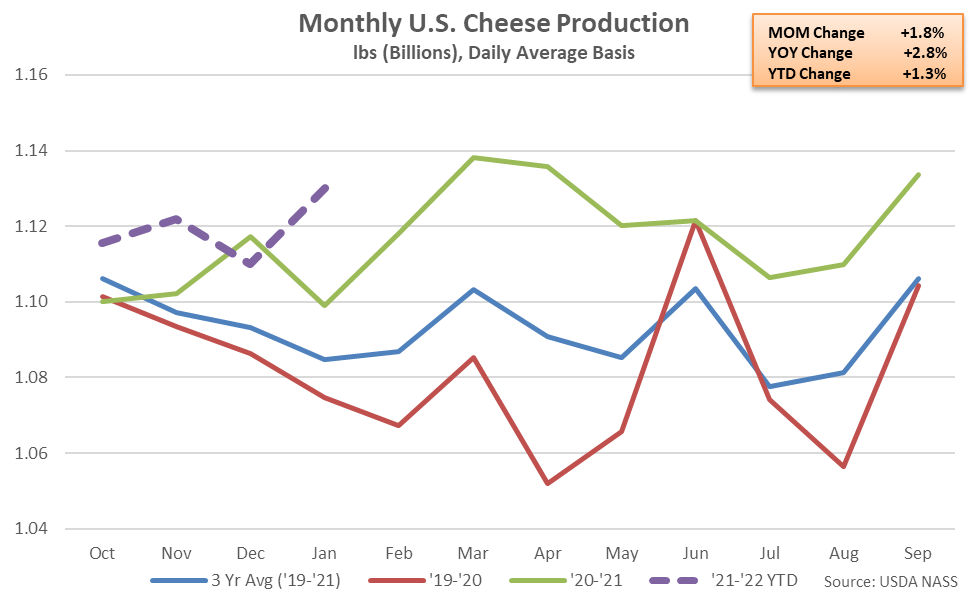

Cheese – Production Remains at a Record High Seasonal Level, Finishes 2.8% Higher YOY

U.S. cheese production finished 2.8% higher on a YOY basis throughout Jan ’22, remaining at a record high seasonal level for the ninth time in the past 12 months. YOY increases in Central U.S. (+6.6%) and Atlantic U.S. (+1.5%) cheese production more than offset lower production experienced throughout the Western U.S. (-1.1%).

Other-than-cheddar cheese production increased 5.3% on a YOY basis throughout the month, more than offsetting a 2.7% YOY decline in cheddar cheese production. The YOY decline in cheddar cheese production was the fourth experienced in a row. Cheddar cheese production had finished above previous year levels over 14 of 15 months through Sep ’21, prior to declining throughout the four most recent months of available data.

’20-’21 annual cheese production finished 3.2% above previous year levels, increasing on a YOY basis for the 20th consecutive year and reaching a record high annual level. Cheddar cheese production increased 4.3% on a YOY basis throughout the year while other-than-cheddar cheese production finished 2.8% above previous year levels. ’21-’22 YTD cheese production has increased by an additional 1.3% on a YOY basis throughout the first third of the production season.

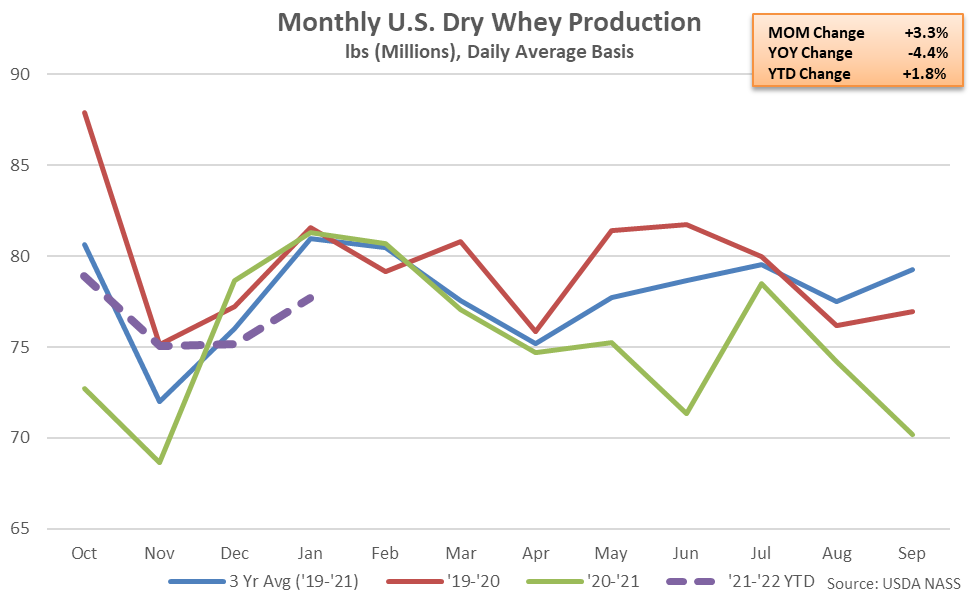

Dry Whey – Production Declines to a Seven Year Low Seasonal Level, Down 4.4% YOY

U.S. dry whey production declined 4.4% on a YOY basis throughout Jan ’22, reaching a seven year low seasonal level. The YOY decline in dry whey production was the second experienced in a row and the ninth experienced throughout the past 11 months. YOY declines in dry whey production experienced throughout the Western U.S. (-15.8%) and Central U.S. (-8.6%) more than offset higher Atlantic U.S. (+7.8%) production.

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production volumes remained higher on a YOY basis for the fourth consecutive month throughout Jan ’22, however, increasing by 8.7%. Combined production of dry whey, WPC and WPI increase 0.7% on a YOY basis throughout Jan ’22, reaching a four year high seasonal level.

’20-’21 annual dry whey production finished 5.3% below previous year levels, reaching a seven year low annual level. ’20-’21 annual combined production of dry whey, WPC and WPI declined 2.3% on a YOY basis, reaching an eight year low annual level. ’21-’22 YTD dry whey production has rebounded by 1.8% on a YOY basis throughout the first third of the production season, however, despite the most recent decline.

NFDM/SMP – Combined Production Remains at a Three Year Low Seasonal Level, Down 8.5% YOY

Jan ’22 U.S. nonfat dry milk (NFDM) production declined 13.8% on a YOY basis, finishing below previous year levels for the sixth time in the past seven months. YOY declines in NFDM production experienced throughout the Western U.S. (-18.3%) and Atlantic U.S. (-11.7%) more than offset higher Central U.S. (+4.7%) production.

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished higher on a YOY basis for just the second time in the past 14 months during Jan ’22, increasing by 20.6%. The decline in NFDM production more than offset the increase in SMP production volumes experienced throughout the month, however. Combined production of NFDM and SMP production finished 8.5% below previous year levels, declining on a YOY basis for the seventh consecutive month and remaining at a three year low seasonal level.

’20-’21 annual combined production of NFDM and SMP increased 3.5% YOY, reaching a record high annual level for the fifth consecutive year. Annual NFDM production volumes finished 9.4% above previous year levels, more than offsetting a 13.1% YOY decline in SMP production volumes. ’21-’22 YTD combined production of NFDM and SMP production has declined by 11.0% on a YOY basis throughout the first third of the production season, however.

Overall, nonfat dry milk production finished most significantly lower YOY on a percentage basis throughout Jan ’22, while skim milk powder production increased most significantly on a percentage basis throughout the month.