Chinese Dairy Imports Update – Mar ’15

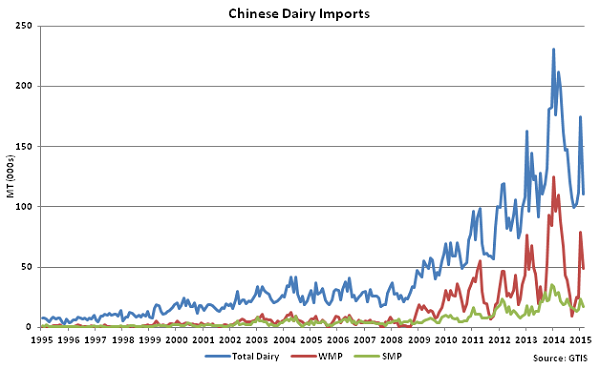

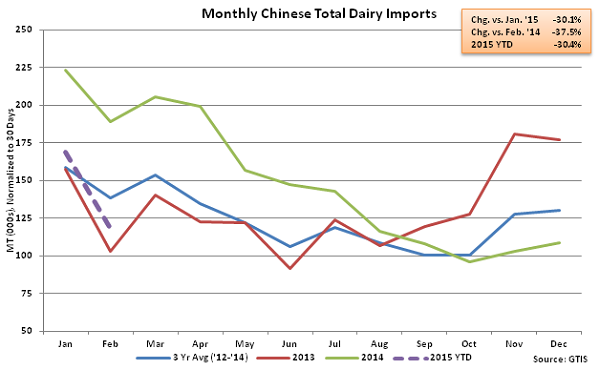

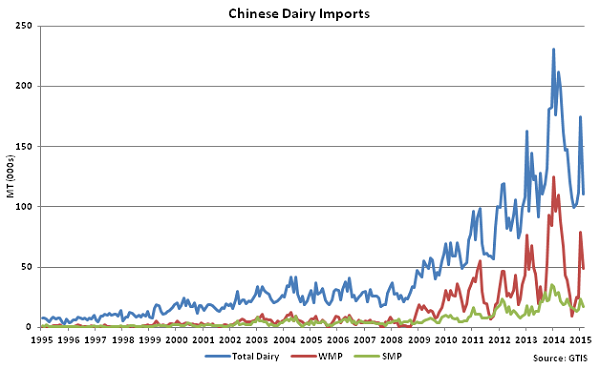

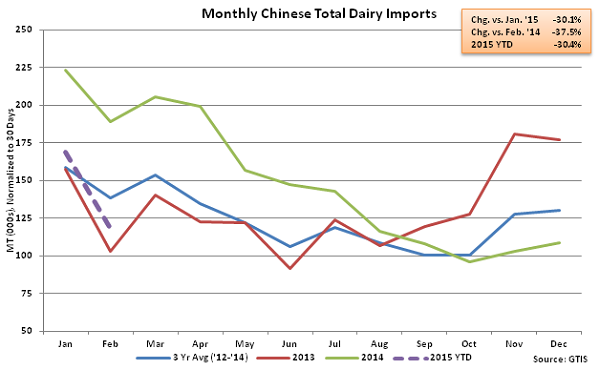

According to GTIS, Feb ’15 total Chinese dairy import volumes remained weak, finishing down 37.5% YOY and 30.1% MOM on a daily average basis. Total Chinese dairy import volumes have declined YOY for six consecutive months at an average rate of 29.7% over the period. Feb ’15 total Chinese import volumes also declined below three year average volumes for the month of February, finishing 14.5% lower. The January – February MOM decline of 30.1% was significantly larger than the five year average January – February seasonal decline of 11.1%.

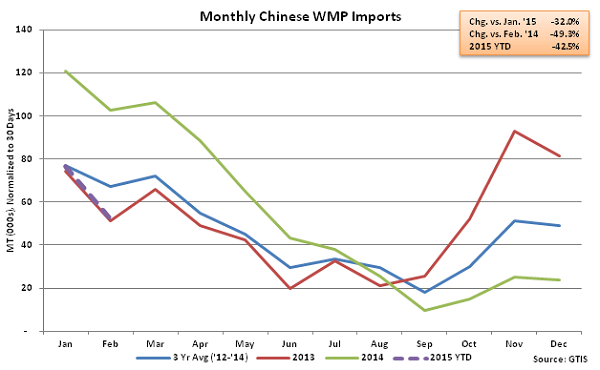

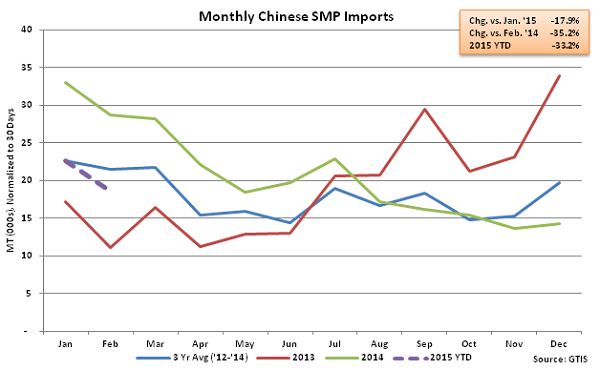

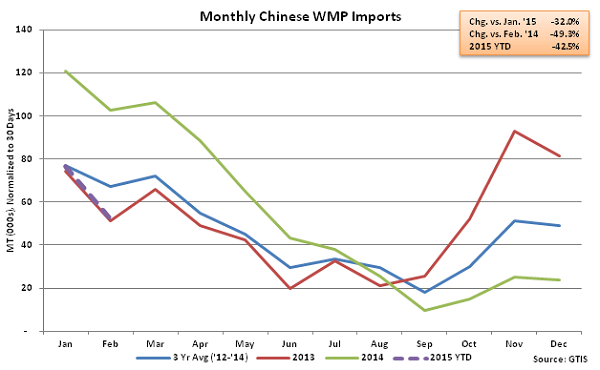

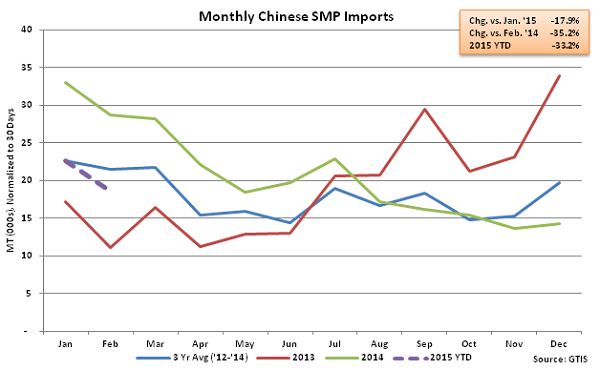

Feb ’15 Chinese milk powder imports followed the same general trend as total dairy import volumes, declining on both a YOY and MOM basis. Feb ’15 whole milk powder (WMP) imports finished down 49.3% YOY and 32.0% MOM on a daily average basis while skim milk powder (SMP) imports finished down 35.2% YOY and 17.9% MOM on a daily average basis. WMP and SMP import volumes remained below three year average volumes, finishing 22.6% and 13.4% lower, respectively.

Feb ’15 Total Chinese Dairy Imports Declined Seasonally off of the Recent Nine Month High

Feb ’15 Chinese Dairy Import Volumes Down 30.1% MOM and 37.5% YOY

Feb ’15 Chinese Dairy Import Volumes Down 30.1% MOM and 37.5% YOY

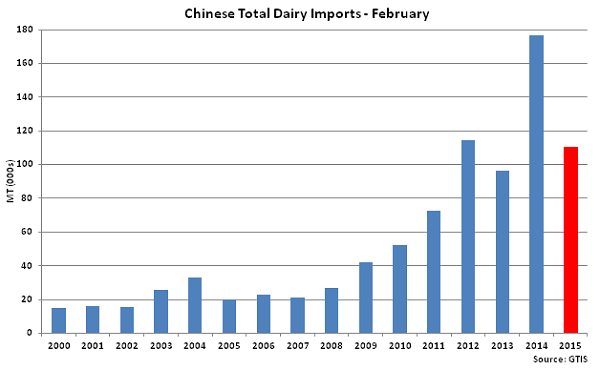

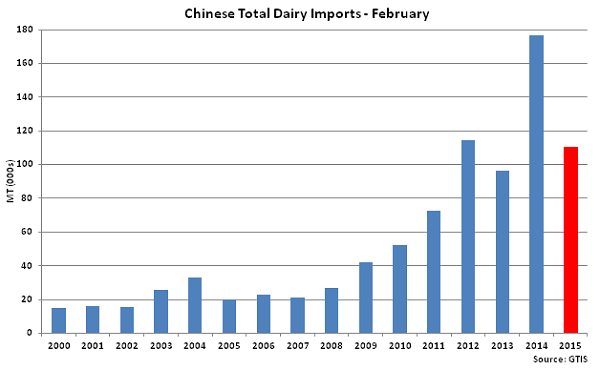

Feb ’15 Chinese Dairy Import Volumes Remained the Third Largest Feb Volume on Record

Feb ’15 Chinese Dairy Import Volumes Remained the Third Largest Feb Volume on Record

Feb ’15 Chinese WMP Import Volumes Down 32.0% MOM and 49.3% YOY

Feb ’15 Chinese WMP Import Volumes Down 32.0% MOM and 49.3% YOY

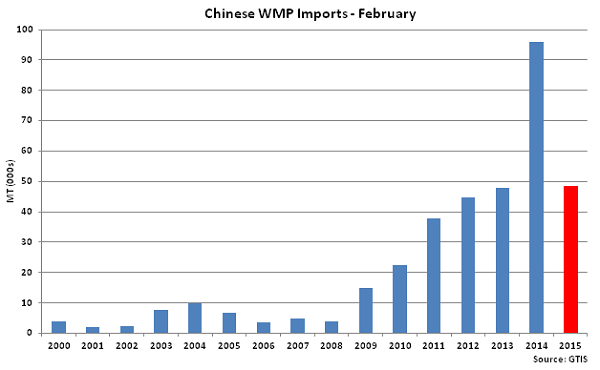

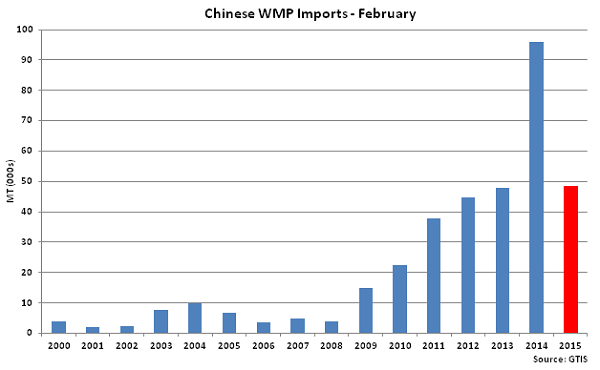

Feb ’15 Chinese WMP Import Volumes Remained the Second Largest Feb Volume on Record

Feb ’15 Chinese WMP Import Volumes Remained the Second Largest Feb Volume on Record

Feb ’15 Chinese SMP Import Volumes Down 17.9% MOM and 35.2% YOY

Feb ’15 Chinese SMP Import Volumes Down 17.9% MOM and 35.2% YOY

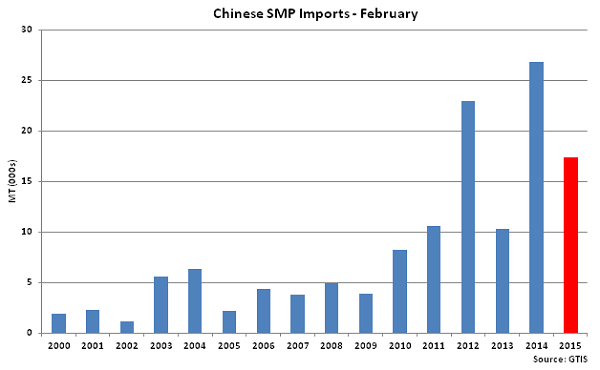

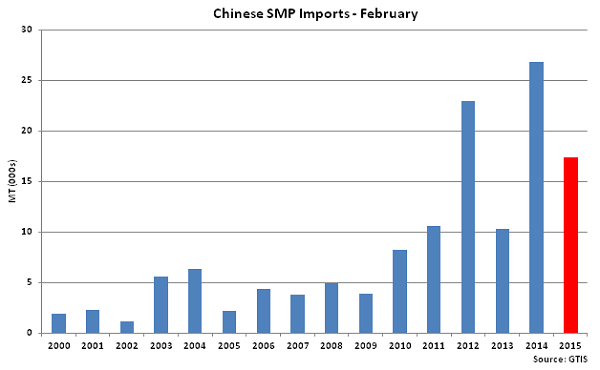

Feb ’15 Chinese SMP Import Volumes Remained the Third Largest Feb Volume on Record

Feb ’15 Chinese SMP Import Volumes Remained the Third Largest Feb Volume on Record

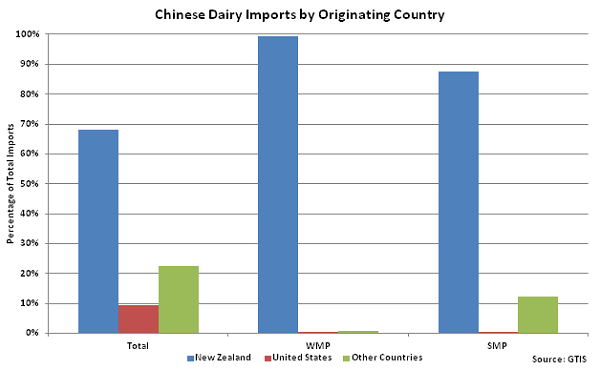

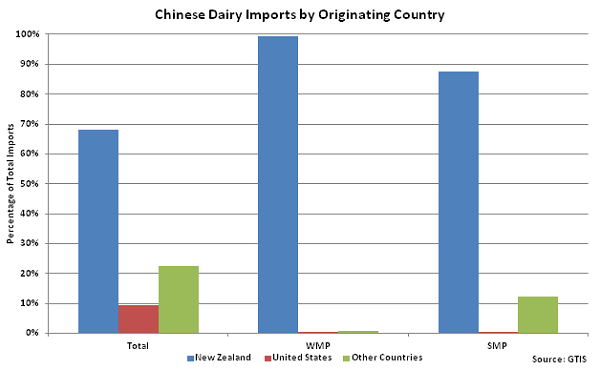

New Zealand Accounted for Over Two Thirds of Total Feb ’15 Chinese Dairy Import Volumes

New Zealand Accounted for Over Two Thirds of Total Feb ’15 Chinese Dairy Import Volumes

Feb ’15 Chinese Dairy Import Volumes Down 30.1% MOM and 37.5% YOY

Feb ’15 Chinese Dairy Import Volumes Down 30.1% MOM and 37.5% YOY

Feb ’15 Chinese Dairy Import Volumes Remained the Third Largest Feb Volume on Record

Feb ’15 Chinese Dairy Import Volumes Remained the Third Largest Feb Volume on Record

Feb ’15 Chinese WMP Import Volumes Down 32.0% MOM and 49.3% YOY

Feb ’15 Chinese WMP Import Volumes Down 32.0% MOM and 49.3% YOY

Feb ’15 Chinese WMP Import Volumes Remained the Second Largest Feb Volume on Record

Feb ’15 Chinese WMP Import Volumes Remained the Second Largest Feb Volume on Record

Feb ’15 Chinese SMP Import Volumes Down 17.9% MOM and 35.2% YOY

Feb ’15 Chinese SMP Import Volumes Down 17.9% MOM and 35.2% YOY

Feb ’15 Chinese SMP Import Volumes Remained the Third Largest Feb Volume on Record

Feb ’15 Chinese SMP Import Volumes Remained the Third Largest Feb Volume on Record

New Zealand Accounted for Over Two Thirds of Total Feb ’15 Chinese Dairy Import Volumes

New Zealand Accounted for Over Two Thirds of Total Feb ’15 Chinese Dairy Import Volumes