New Zealand Milk Production Update – Mar ’22

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Feb ’22. Highlights from the updated report include:

- New Zealand milk production volumes declined 8.2% on a YOY basis throughout Feb ’22, reaching a nine year low seasonal level. The YOY decline in New Zealand milk production volumes was the seventh experienced in a row and the largest experienced throughout the past six years on an absolute basis.

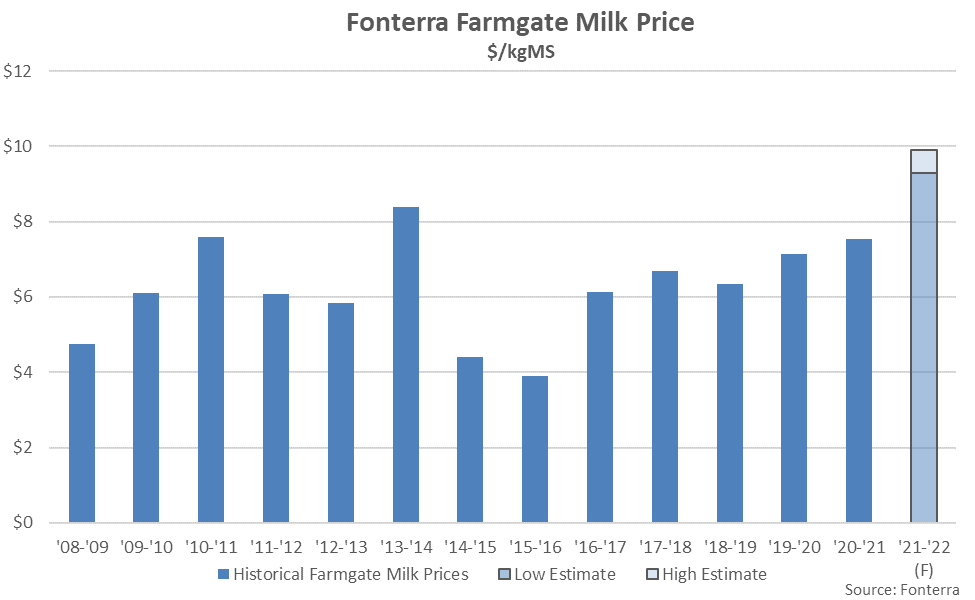

- Fonterra’s ’21-’22 farmgate milk price forecast of $9.30-$9.90/kgMS is currently 27.3% above the seven year high level experienced throughout the previous season at the midpoint of the forecast and is on pace to reach a record high level.

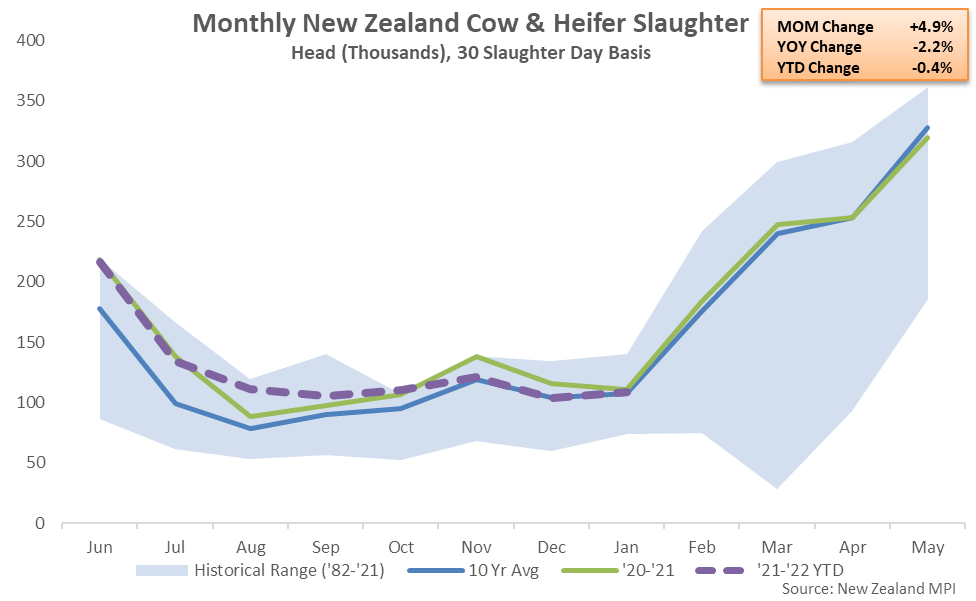

- New Zealand cow & heifer slaughter rates declined 2.2% on a YOY basis throughout Jan ’22 when normalizing for slaughter days, remaining at a three year low seasonal level for the third consecutive month.

Additional Report Details

Milk Production

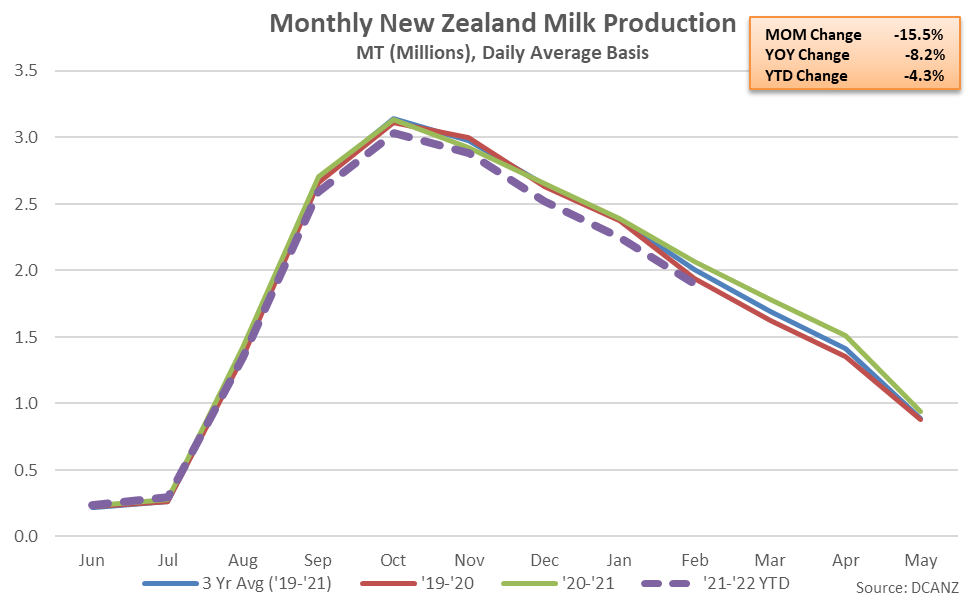

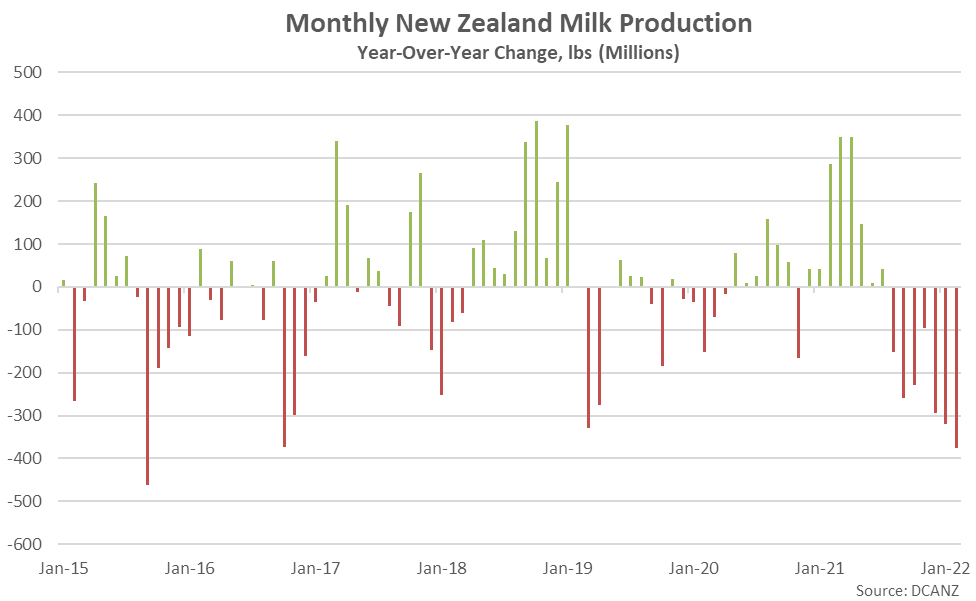

According to Dairy Companies Association of New Zealand (DCANZ), Feb ’22 New Zealand milk production volumes declined seasonally to a six month low level while finishing 8.2% below previous year levels. New Zealand milk production volumes reached a nine year low seasonal level for the month of February. On a milk-solids basis, production declined 7.2% YOY, also reaching a nine year low seasonal level.

The Feb ’22 YOY decline in New Zealand milk production volumes was the seventh experienced in a row and the largest experienced throughout the past six years on an absolute basis. New Zealand milk production volumes had finished above previous year levels over eight consecutive months through Jul ’21, prior to declining on a YOY basis over the seven most recent months of available data.

‘20-’21 annual New Zealand milk production volumes increased by 3.0% on a YOY basis, reaching a record high annual level. The 3.0% annual growth rate was the largest experienced throughout the past seven years. ‘21-’22 YTD New Zealand milk production volumes have declined by 4.3% on a YOY basis throughout the first three quarters of the production season, however, and are pace to reach a four year low level.

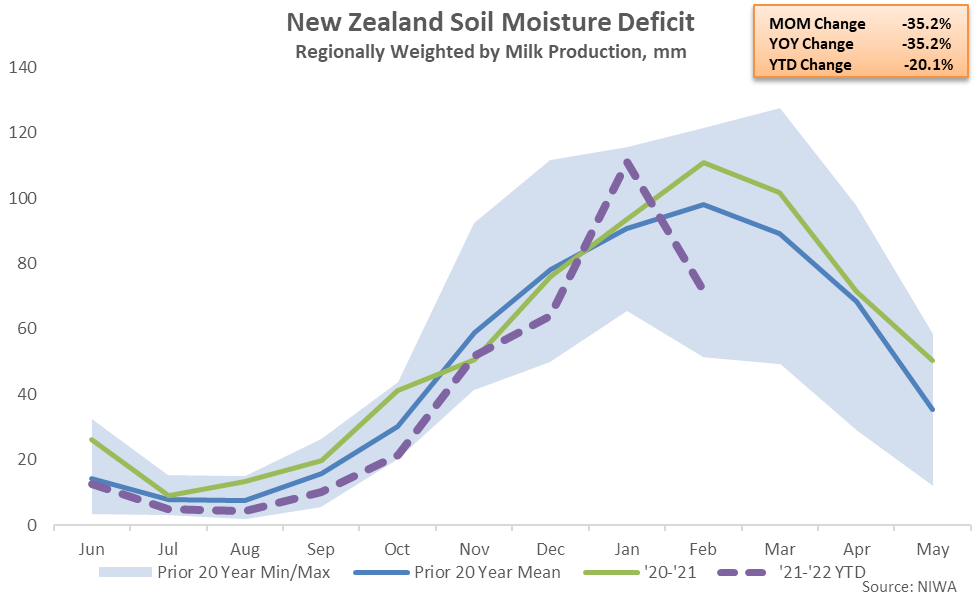

Rainfall & Soil Moisture Deficits

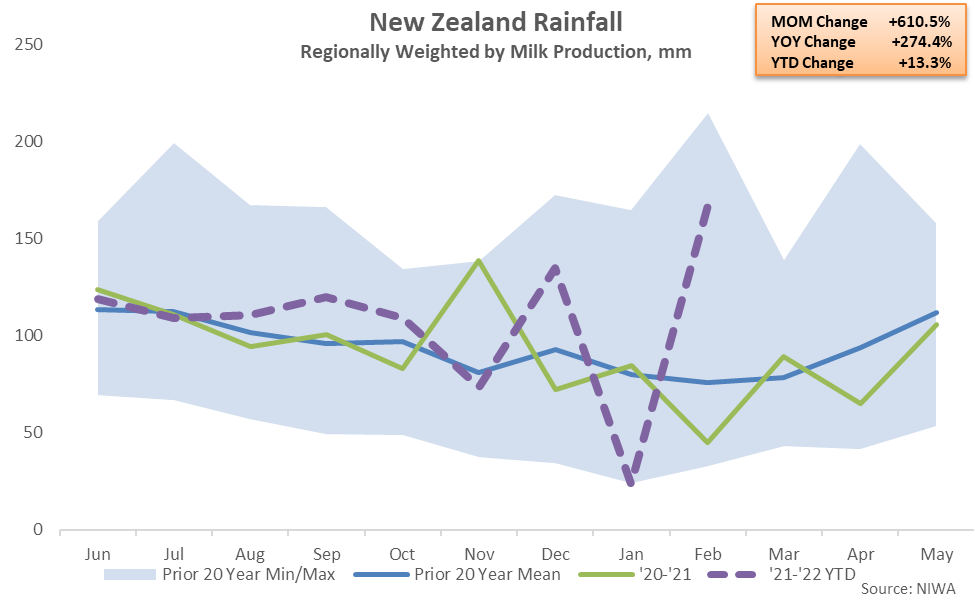

New Zealand rainfall levels rebounded to an 18 year high seasonal level throughout Feb ’22 when regionally weighted by milk production volumes. Feb ’22 rainfall levels finished 274.4% above previous year levels and 121.2% above 20 year average seasonal levels for the month of February. Rainfall levels throughout the North Island of New Zealand reached an 18 year high seasonal level while rainfall levels experienced throughout the South Island of New Zealand reached a four year high seasonal level. Rainfall levels had declined sharply throughout the month of January, prior to rebounding throughout Feb ’22.

Significant rainfall levels experienced throughout the month of February contributed to New Zealand soil moisture deficits declining sharply throughout the month when regionally weighted by milk production volumes. Soil moisture deficits finished 35.2% below previous year levels and 26.7% below 20 year average seasonal levels for the month of February, reaching a four year low seasonal level.

In addition to highly volatile weather conditions experienced throughout the months of January and February, local sources indicate that there is a shortage of 4,000 to 6,000 dairy workers throughout New Zealand, contributing to the challenging production environment.

Farmgate Milk Prices

Fonterra’s final ’20-’21 farmgate milk price of $7.54/kgMS reached a seven year high level on strong Chinese and Southeast Asian powder demand. Fonterra raised their ’21-’22 farmgate milk price forecast to a value of $9.30-$9.90/kgMS in late Feb ’22, up $0.40/kgMS, or 4.3%, at the midpoint of the forecast. The midpoint of the ’21-’22 farmgate milk price forecast is currently 27.3% above previous year levels and is on pace to reach a record high level.

Cow & Heifer Slaughter

New Zealand cow & heifer slaughter rates declined 2.2% on a YOY basis throughout Jan ’22 when normalizing for slaughter days, remaining at a three year low seasonal level for the third consecutive month. Jan ’22 dairy cow & heifer slaughter, which has more limited historical data available, finished 3.0% below previous year levels.

’20-’21 annual New Zealand cow & heifer slaughter finished 4.0% above the previous year, reaching a five year high level and the third highest annual figure on record. ’21-’22 YTD New Zealand cow & heifer slaughter rates have declined by 0.4% throughout the first two thirds of the production season, however.

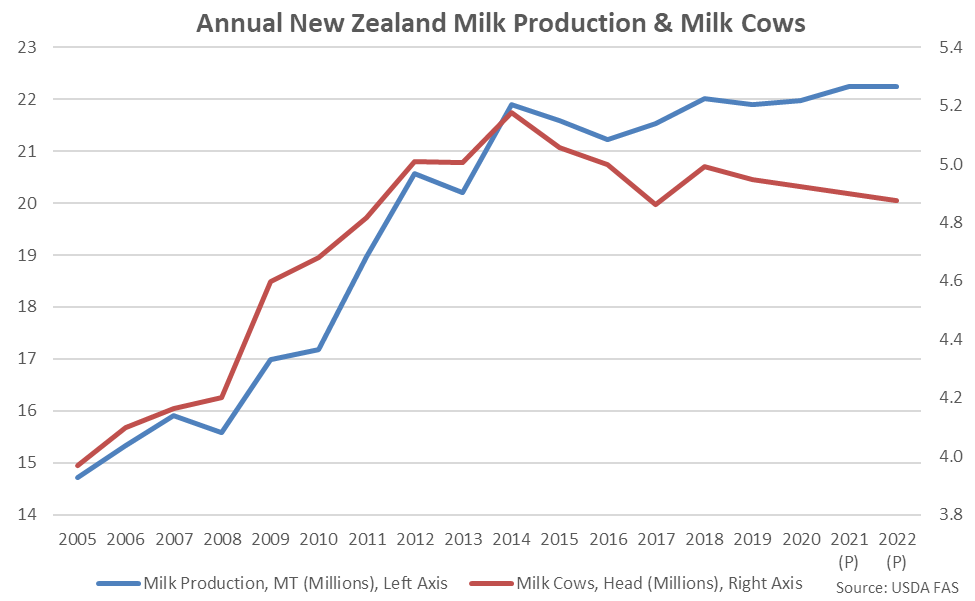

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but growth has moderated over more recent years as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline 0.5% on a YOY basis throughout the 2022 calendar year, reaching a five year low level.