U.S. Commercial Disappearance Update – Apr ’15

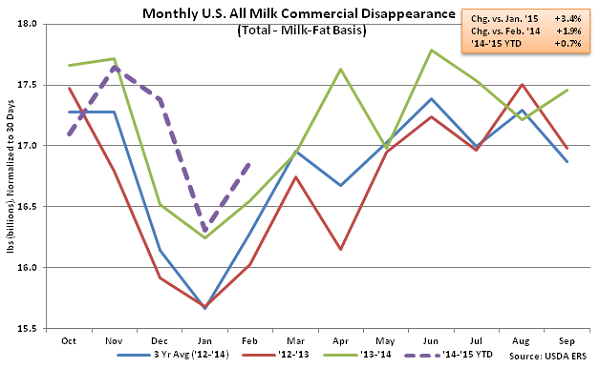

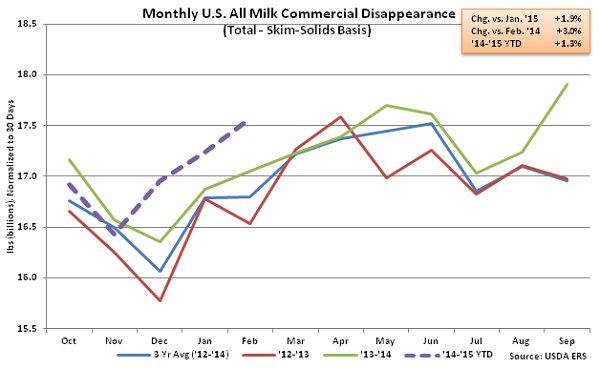

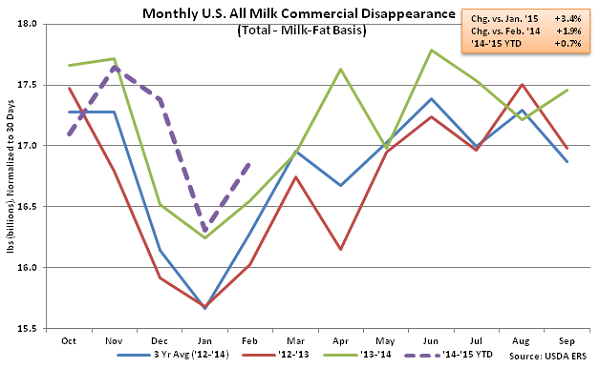

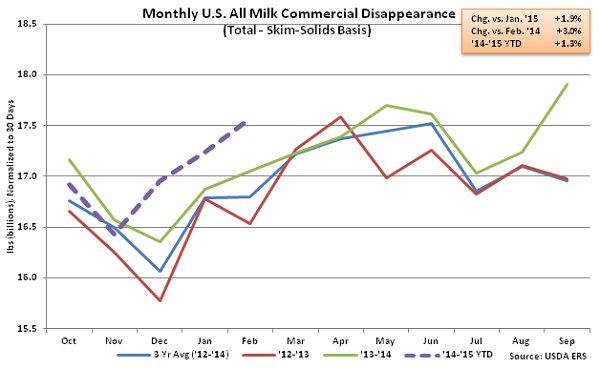

All Milk – YOY Disappearance Continues to Increase on Milk-Fat and Skim-Solids Bases

According to USDA, Feb ’15 U.S. commercial disappearance for milk used in all products increased YOY for the third consecutive month on both a milk-fat and skim-solids basis, finishing up 1.9% and 3.0%, respectively. Domestic demand continued to outpace international demand, finishing up 4.8% YOY on a milk-fat basis and 6.1% YOY on a skim-solids basis. ’14-’15 YTD commercial disappearance for milk used in all products is up 0.7% YOY on a milk-fat basis and 1.3% YOY on a skim-solids basis through the first five months of the production season, with domestic demand up 3.3% and 3.1% YOY, respectively over the same period.

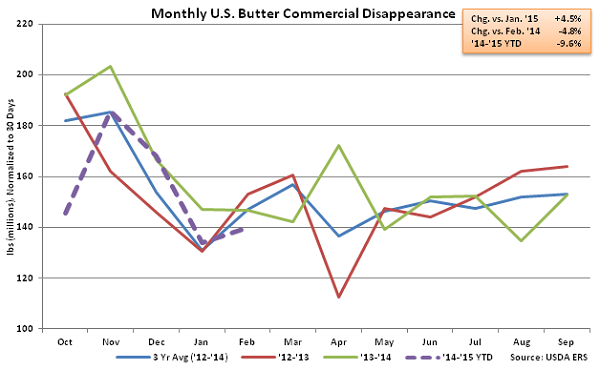

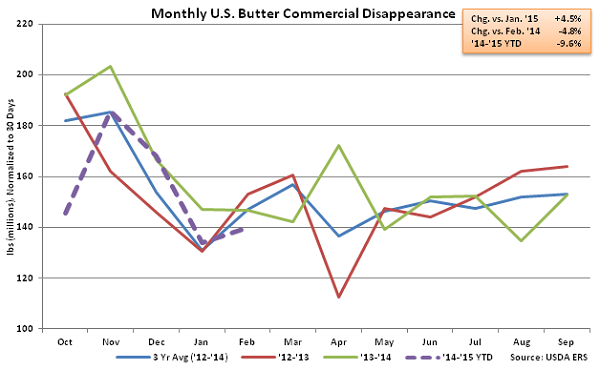

Butter – Lower Disappearance Continues on Weak International Demand

Feb ’15 U.S. butter commercial disappearance declined YOY for the sixth time in the last seven months, finishing 4.8% lower. Domestic butter demand increased 4.6% YOY however international demand remained weak, finishing down 74.6% YOY. U.S. butterfat exports have declined YOY for ten consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.6% YOY through the first five months of the production season, with domestic demand down 1.7% and international demand down 78.1% over the period.

Butter – Lower Disappearance Continues on Weak International Demand

Feb ’15 U.S. butter commercial disappearance declined YOY for the sixth time in the last seven months, finishing 4.8% lower. Domestic butter demand increased 4.6% YOY however international demand remained weak, finishing down 74.6% YOY. U.S. butterfat exports have declined YOY for ten consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.6% YOY through the first five months of the production season, with domestic demand down 1.7% and international demand down 78.1% over the period.

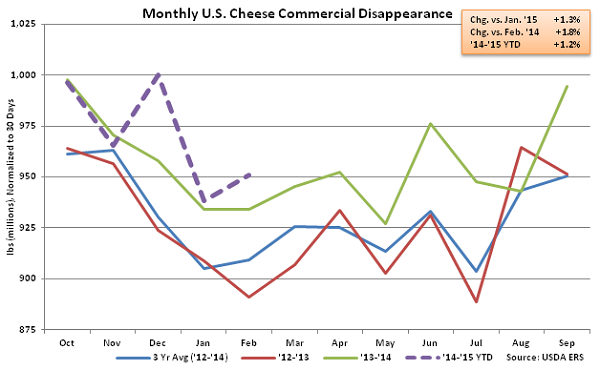

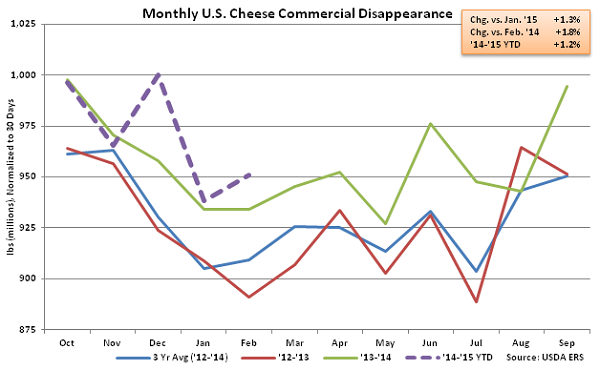

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New February Record High

Feb ’15 U.S. butter commercial disappearance increased YOY for the third consecutive month, finishing 1.8% higher. Feb ’15 cheese commercial disappearance was the largest ever recorded for the month of February, despite American cheese disappearance declining by 0.3% YOY. Domestic cheese demand remained strong, increasing 2.4% YOY while export volumes declined for the fifth consecutive month on a YOY basis, falling 5.4%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.2% YOY through the first five months of the production season.

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New February Record High

Feb ’15 U.S. butter commercial disappearance increased YOY for the third consecutive month, finishing 1.8% higher. Feb ’15 cheese commercial disappearance was the largest ever recorded for the month of February, despite American cheese disappearance declining by 0.3% YOY. Domestic cheese demand remained strong, increasing 2.4% YOY while export volumes declined for the fifth consecutive month on a YOY basis, falling 5.4%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.2% YOY through the first five months of the production season.

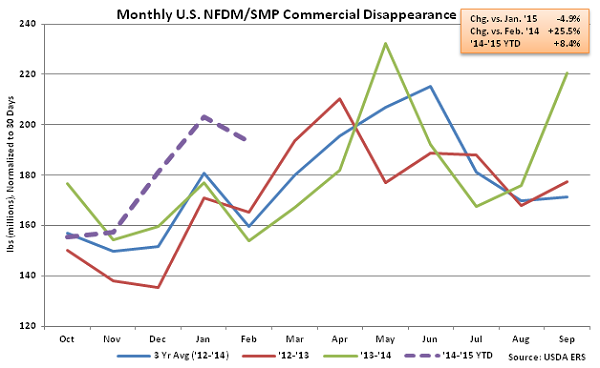

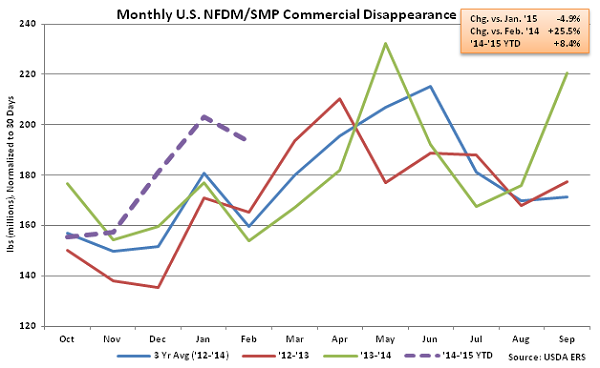

NFDM/SMP –Commercial Disappearance Increases to New February Record High

Feb ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fourth consecutive month, finishing 25.5% higher. Feb ’15 NFDM/SMP commercial disappearance was the largest ever recorded for the month of February, while the 25.5% YOY increase was the largest experienced in nine months. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the seventh consecutive month and finishing 59.1% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the seventh consecutive month, finishing 1.5% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 8.4% YOY through the first five months of the production season.

NFDM/SMP –Commercial Disappearance Increases to New February Record High

Feb ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fourth consecutive month, finishing 25.5% higher. Feb ’15 NFDM/SMP commercial disappearance was the largest ever recorded for the month of February, while the 25.5% YOY increase was the largest experienced in nine months. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the seventh consecutive month and finishing 59.1% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the seventh consecutive month, finishing 1.5% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 8.4% YOY through the first five months of the production season.

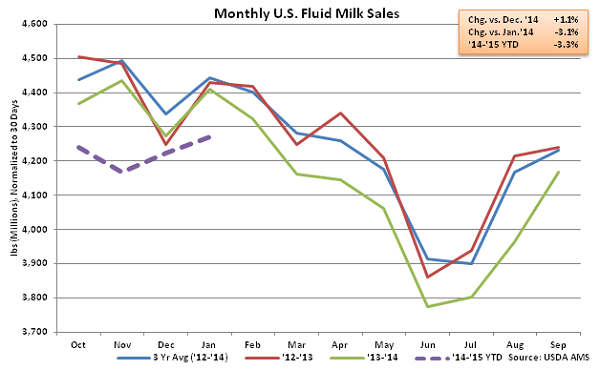

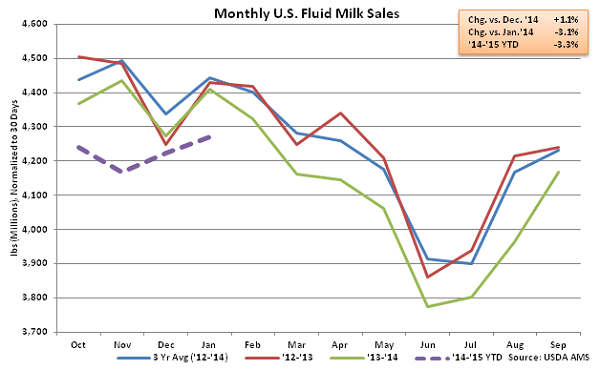

Fluid Milk Sales – YOY Sales Continue to Decline

Jan ’15 U.S. fluid milk sales of 4.41 billion pounds continued to decline on a YOY basis, falling 3.1%. Monthly fluid milk sales have declined YOY for 13 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.3% YOY through the first third of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Jan ’15 U.S. fluid milk sales of 4.41 billion pounds continued to decline on a YOY basis, falling 3.1%. Monthly fluid milk sales have declined YOY for 13 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.3% YOY through the first third of the production season.

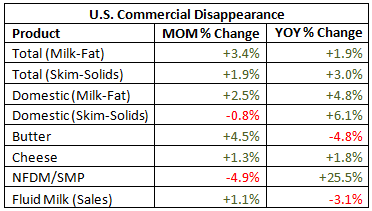

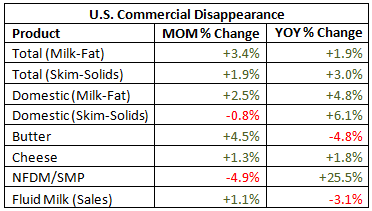

See the table below for a summary of key Feb ’15 U.S. dairy commercial disappearance figures in addition to the Jan ’15 U.S. fluid milk sales figure.

See the table below for a summary of key Feb ’15 U.S. dairy commercial disappearance figures in addition to the Jan ’15 U.S. fluid milk sales figure.

Butter – Lower Disappearance Continues on Weak International Demand

Feb ’15 U.S. butter commercial disappearance declined YOY for the sixth time in the last seven months, finishing 4.8% lower. Domestic butter demand increased 4.6% YOY however international demand remained weak, finishing down 74.6% YOY. U.S. butterfat exports have declined YOY for ten consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.6% YOY through the first five months of the production season, with domestic demand down 1.7% and international demand down 78.1% over the period.

Butter – Lower Disappearance Continues on Weak International Demand

Feb ’15 U.S. butter commercial disappearance declined YOY for the sixth time in the last seven months, finishing 4.8% lower. Domestic butter demand increased 4.6% YOY however international demand remained weak, finishing down 74.6% YOY. U.S. butterfat exports have declined YOY for ten consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 9.6% YOY through the first five months of the production season, with domestic demand down 1.7% and international demand down 78.1% over the period.

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New February Record High

Feb ’15 U.S. butter commercial disappearance increased YOY for the third consecutive month, finishing 1.8% higher. Feb ’15 cheese commercial disappearance was the largest ever recorded for the month of February, despite American cheese disappearance declining by 0.3% YOY. Domestic cheese demand remained strong, increasing 2.4% YOY while export volumes declined for the fifth consecutive month on a YOY basis, falling 5.4%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.2% YOY through the first five months of the production season.

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New February Record High

Feb ’15 U.S. butter commercial disappearance increased YOY for the third consecutive month, finishing 1.8% higher. Feb ’15 cheese commercial disappearance was the largest ever recorded for the month of February, despite American cheese disappearance declining by 0.3% YOY. Domestic cheese demand remained strong, increasing 2.4% YOY while export volumes declined for the fifth consecutive month on a YOY basis, falling 5.4%. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.2% YOY through the first five months of the production season.

NFDM/SMP –Commercial Disappearance Increases to New February Record High

Feb ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fourth consecutive month, finishing 25.5% higher. Feb ’15 NFDM/SMP commercial disappearance was the largest ever recorded for the month of February, while the 25.5% YOY increase was the largest experienced in nine months. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the seventh consecutive month and finishing 59.1% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the seventh consecutive month, finishing 1.5% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 8.4% YOY through the first five months of the production season.

NFDM/SMP –Commercial Disappearance Increases to New February Record High

Feb ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fourth consecutive month, finishing 25.5% higher. Feb ’15 NFDM/SMP commercial disappearance was the largest ever recorded for the month of February, while the 25.5% YOY increase was the largest experienced in nine months. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the seventh consecutive month and finishing 59.1% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the seventh consecutive month, finishing 1.5% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 8.4% YOY through the first five months of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Jan ’15 U.S. fluid milk sales of 4.41 billion pounds continued to decline on a YOY basis, falling 3.1%. Monthly fluid milk sales have declined YOY for 13 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.3% YOY through the first third of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Jan ’15 U.S. fluid milk sales of 4.41 billion pounds continued to decline on a YOY basis, falling 3.1%. Monthly fluid milk sales have declined YOY for 13 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.3% YOY through the first third of the production season.

See the table below for a summary of key Feb ’15 U.S. dairy commercial disappearance figures in addition to the Jan ’15 U.S. fluid milk sales figure.

See the table below for a summary of key Feb ’15 U.S. dairy commercial disappearance figures in addition to the Jan ’15 U.S. fluid milk sales figure.