U.S. Commercial Disappearance Update – Jun ’15

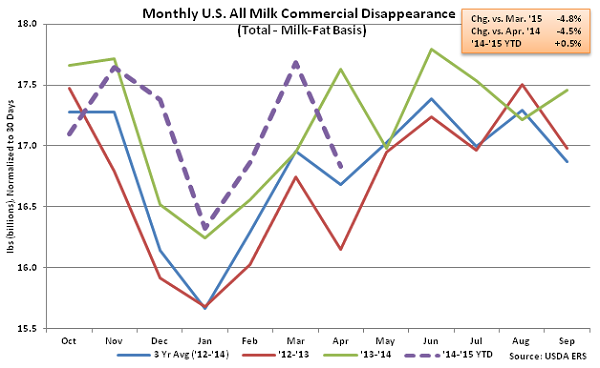

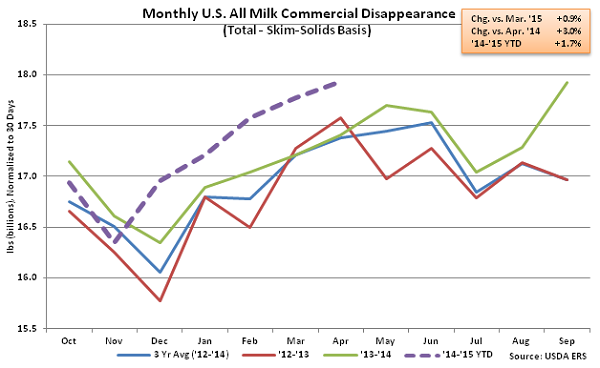

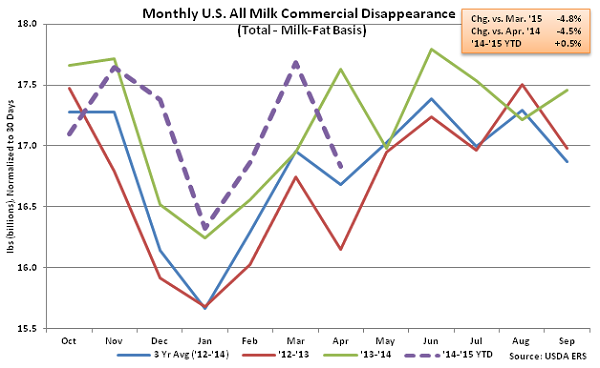

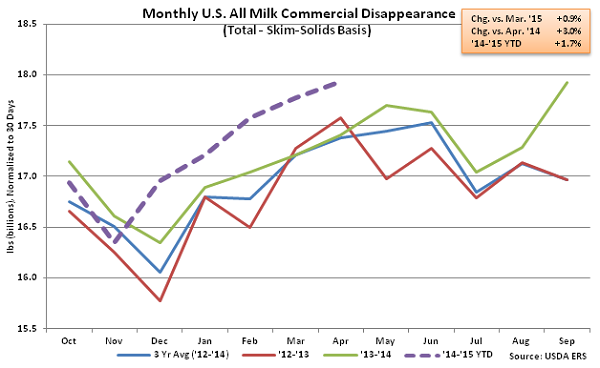

All Milk – YOY Disappearance Remains Strong on Skim-Solids Basis, Declines YOY on Milk-Fat Basis

According to USDA, Apr ’15 U.S. commercial disappearance for milk used in all products finished higher YOY on a skim-solids basis for the fifth consecutive month but declined on a milk-fat basis for the first time in five months. Commercial disappearance on a skim-solids basis finished 3.0% higher than the previous year despite domestic demand increasing by only 2.0% YOY. Commercial disappearance on a milk-fat basis declined 4.5%, with domestic demand falling YOY for the first time in six months, finishing 2.7% below the previous year. ’14-’15 YTD commercial disappearance for milk used in all products remains up 0.5% YOY on a milk-fat basis and 1.7% YOY on a skim-solids basis through the first seven months of the production season, with domestic demand up 3.1% for both milk-fat and skim-solids bases over the same period.

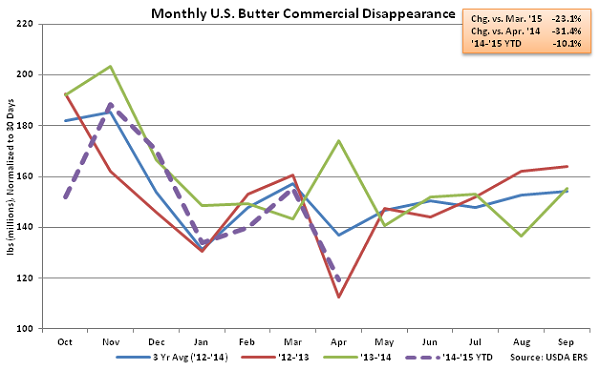

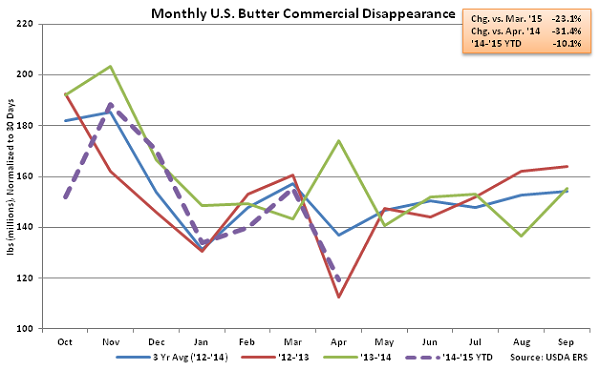

Butter – Disappearance Declines Sharply on YOY Basis

Apr ’15 U.S. butter commercial disappearance declined sharply YOY, finishing 31.4% below the previous year. The YOY decline was the largest experienced in 18 years on a percentage basis. Domestic butter demand declined YOY for the first time in five months, falling 27.1%, while international demand continued to struggle, finishing down 71.8% YOY. The YOY decline in disappearance may be partially due to the later than normal Easter season experienced in 2014, resulting in a net decline in commercial butter stocks during Apr ’14 vs. a 48 million pound increase in commercial butter stocks experienced in Apr ’15. U.S. butterfat exports have declined YOY for 12 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.1% YOY through the first seven months of the production season, with domestic demand down 1.6% and international demand down 77.8% over the period.

Butter – Disappearance Declines Sharply on YOY Basis

Apr ’15 U.S. butter commercial disappearance declined sharply YOY, finishing 31.4% below the previous year. The YOY decline was the largest experienced in 18 years on a percentage basis. Domestic butter demand declined YOY for the first time in five months, falling 27.1%, while international demand continued to struggle, finishing down 71.8% YOY. The YOY decline in disappearance may be partially due to the later than normal Easter season experienced in 2014, resulting in a net decline in commercial butter stocks during Apr ’14 vs. a 48 million pound increase in commercial butter stocks experienced in Apr ’15. U.S. butterfat exports have declined YOY for 12 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.1% YOY through the first seven months of the production season, with domestic demand down 1.6% and international demand down 77.8% over the period.

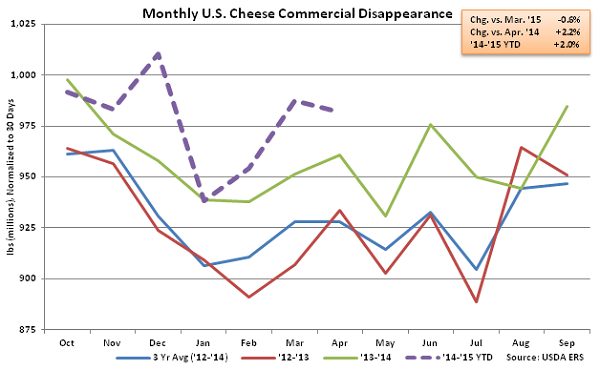

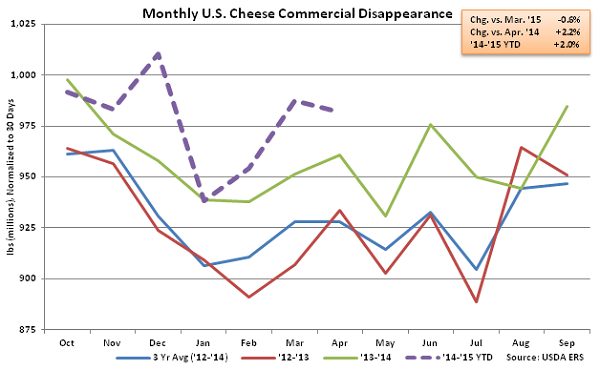

Cheese – Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. cheese commercial disappearance increased YOY for the third consecutive month, finishing 2.2% higher than the previous year. Apr ’15 cheese commercial disappearance was the seventh largest monthly figure on record and the largest ever recorded for the month of April. Other-than-American cheese disappearance was particularly strong, increasing by 2.6% YOY, while American cheese disappearance increased by 1.6% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 2.9%, while export volumes declined for the seventh consecutive month on a YOY basis, falling 6.2%. ’14-’15 YTD U.S. cheese commercial disappearance is up 2.0% YOY through the first seven months of the production season.

Cheese – Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. cheese commercial disappearance increased YOY for the third consecutive month, finishing 2.2% higher than the previous year. Apr ’15 cheese commercial disappearance was the seventh largest monthly figure on record and the largest ever recorded for the month of April. Other-than-American cheese disappearance was particularly strong, increasing by 2.6% YOY, while American cheese disappearance increased by 1.6% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 2.9%, while export volumes declined for the seventh consecutive month on a YOY basis, falling 6.2%. ’14-’15 YTD U.S. cheese commercial disappearance is up 2.0% YOY through the first seven months of the production season.

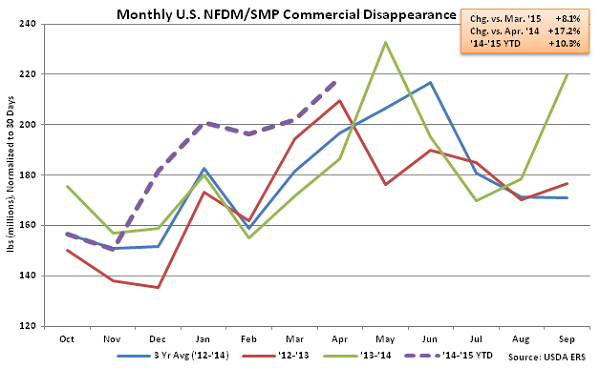

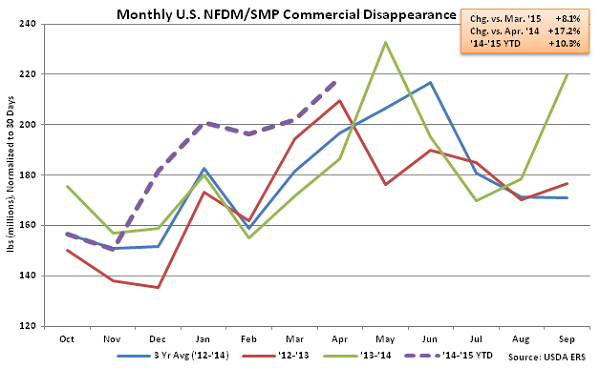

NFDM/SMP – YOY Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fifth consecutive month, finishing 17.2% higher than the previous year. Apr ’15 NFDM/SMP commercial disappearance was the fourth largest monthly figure on record and the largest ever recorded for the month of April, driven higher by continued strong domestic demand. U.S. NFDM/SMP domestic commercial disappearance increased YOY for the ninth consecutive month, finishing 32.6% higher than a year ago, while NFDM/SMP exports increased for the second consecutive month, finishing 8.0% higher than a year ago. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 10.3% YOY through the first seven months of the production season.

NFDM/SMP – YOY Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fifth consecutive month, finishing 17.2% higher than the previous year. Apr ’15 NFDM/SMP commercial disappearance was the fourth largest monthly figure on record and the largest ever recorded for the month of April, driven higher by continued strong domestic demand. U.S. NFDM/SMP domestic commercial disappearance increased YOY for the ninth consecutive month, finishing 32.6% higher than a year ago, while NFDM/SMP exports increased for the second consecutive month, finishing 8.0% higher than a year ago. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 10.3% YOY through the first seven months of the production season.

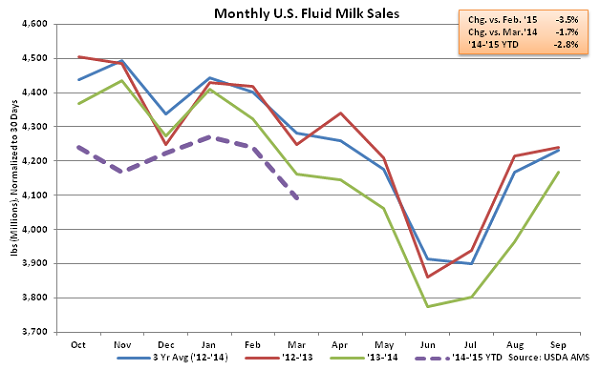

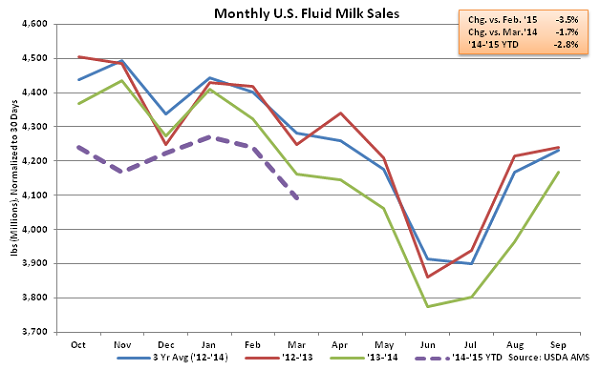

Fluid Milk Sales – YOY Sales Continue to Decline

Mar ’15 U.S. fluid milk sales of 4.23 billion pounds continued to decline on a YOY basis, falling 1.7%. Monthly fluid milk sales have declined YOY for 15 consecutive months at an average rate of 2.9% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first half of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Mar ’15 U.S. fluid milk sales of 4.23 billion pounds continued to decline on a YOY basis, falling 1.7%. Monthly fluid milk sales have declined YOY for 15 consecutive months at an average rate of 2.9% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first half of the production season.

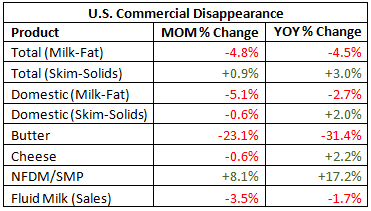

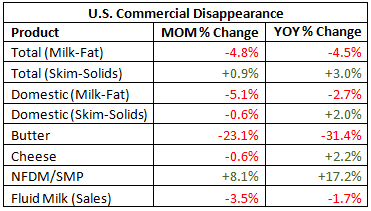

See the table below for a summary of key Apr ’15 U.S. dairy commercial disappearance figures in addition to the Mar ’15 U.S. fluid milk sales figure.

See the table below for a summary of key Apr ’15 U.S. dairy commercial disappearance figures in addition to the Mar ’15 U.S. fluid milk sales figure.

Butter – Disappearance Declines Sharply on YOY Basis

Apr ’15 U.S. butter commercial disappearance declined sharply YOY, finishing 31.4% below the previous year. The YOY decline was the largest experienced in 18 years on a percentage basis. Domestic butter demand declined YOY for the first time in five months, falling 27.1%, while international demand continued to struggle, finishing down 71.8% YOY. The YOY decline in disappearance may be partially due to the later than normal Easter season experienced in 2014, resulting in a net decline in commercial butter stocks during Apr ’14 vs. a 48 million pound increase in commercial butter stocks experienced in Apr ’15. U.S. butterfat exports have declined YOY for 12 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.1% YOY through the first seven months of the production season, with domestic demand down 1.6% and international demand down 77.8% over the period.

Butter – Disappearance Declines Sharply on YOY Basis

Apr ’15 U.S. butter commercial disappearance declined sharply YOY, finishing 31.4% below the previous year. The YOY decline was the largest experienced in 18 years on a percentage basis. Domestic butter demand declined YOY for the first time in five months, falling 27.1%, while international demand continued to struggle, finishing down 71.8% YOY. The YOY decline in disappearance may be partially due to the later than normal Easter season experienced in 2014, resulting in a net decline in commercial butter stocks during Apr ’14 vs. a 48 million pound increase in commercial butter stocks experienced in Apr ’15. U.S. butterfat exports have declined YOY for 12 consecutive months as U.S. butter prices have traded at a premium to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.1% YOY through the first seven months of the production season, with domestic demand down 1.6% and international demand down 77.8% over the period.

Cheese – Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. cheese commercial disappearance increased YOY for the third consecutive month, finishing 2.2% higher than the previous year. Apr ’15 cheese commercial disappearance was the seventh largest monthly figure on record and the largest ever recorded for the month of April. Other-than-American cheese disappearance was particularly strong, increasing by 2.6% YOY, while American cheese disappearance increased by 1.6% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 2.9%, while export volumes declined for the seventh consecutive month on a YOY basis, falling 6.2%. ’14-’15 YTD U.S. cheese commercial disappearance is up 2.0% YOY through the first seven months of the production season.

Cheese – Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. cheese commercial disappearance increased YOY for the third consecutive month, finishing 2.2% higher than the previous year. Apr ’15 cheese commercial disappearance was the seventh largest monthly figure on record and the largest ever recorded for the month of April. Other-than-American cheese disappearance was particularly strong, increasing by 2.6% YOY, while American cheese disappearance increased by 1.6% YOY. Domestic cheese demand remained higher on a YOY basis, increasing 2.9%, while export volumes declined for the seventh consecutive month on a YOY basis, falling 6.2%. ’14-’15 YTD U.S. cheese commercial disappearance is up 2.0% YOY through the first seven months of the production season.

NFDM/SMP – YOY Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fifth consecutive month, finishing 17.2% higher than the previous year. Apr ’15 NFDM/SMP commercial disappearance was the fourth largest monthly figure on record and the largest ever recorded for the month of April, driven higher by continued strong domestic demand. U.S. NFDM/SMP domestic commercial disappearance increased YOY for the ninth consecutive month, finishing 32.6% higher than a year ago, while NFDM/SMP exports increased for the second consecutive month, finishing 8.0% higher than a year ago. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 10.3% YOY through the first seven months of the production season.

NFDM/SMP – YOY Disappearance Remains Strong, Reaches New April Record High

Apr ’15 U.S. NFDM/SMP commercial disappearance increased YOY for the fifth consecutive month, finishing 17.2% higher than the previous year. Apr ’15 NFDM/SMP commercial disappearance was the fourth largest monthly figure on record and the largest ever recorded for the month of April, driven higher by continued strong domestic demand. U.S. NFDM/SMP domestic commercial disappearance increased YOY for the ninth consecutive month, finishing 32.6% higher than a year ago, while NFDM/SMP exports increased for the second consecutive month, finishing 8.0% higher than a year ago. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 10.3% YOY through the first seven months of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Mar ’15 U.S. fluid milk sales of 4.23 billion pounds continued to decline on a YOY basis, falling 1.7%. Monthly fluid milk sales have declined YOY for 15 consecutive months at an average rate of 2.9% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first half of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Mar ’15 U.S. fluid milk sales of 4.23 billion pounds continued to decline on a YOY basis, falling 1.7%. Monthly fluid milk sales have declined YOY for 15 consecutive months at an average rate of 2.9% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 2.8% YOY through the first half of the production season.

See the table below for a summary of key Apr ’15 U.S. dairy commercial disappearance figures in addition to the Mar ’15 U.S. fluid milk sales figure.

See the table below for a summary of key Apr ’15 U.S. dairy commercial disappearance figures in addition to the Mar ’15 U.S. fluid milk sales figure.