EU-28 Milk Production Update – Aug ’15

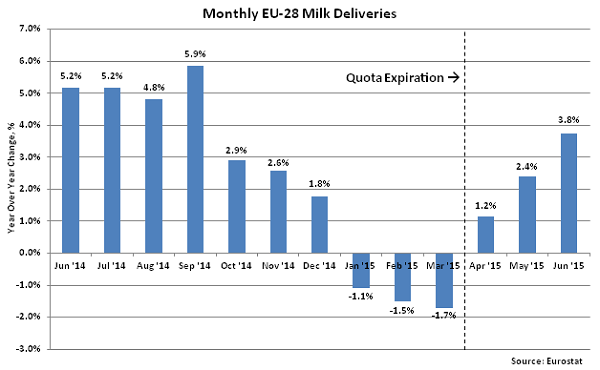

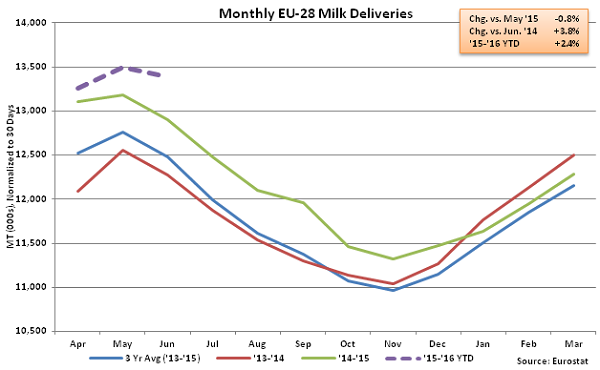

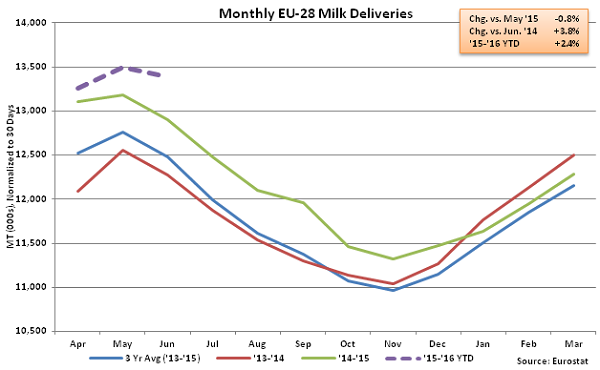

According to Eurostat, Jun ’15 EU-28 milk production increased YOY for the third consecutive month, finishing 3.8% above the previous year and setting a new production record for the month of June. The recent increases in production have corresponded with the expiration of the EU-28 milk production quota system at the end of Mar ’15. Monthly production growth had decelerated throughout the six months leading up to the quota expiration as over-quota producers attempted to limit superlevy penalties for exceeding milk production quota levels.

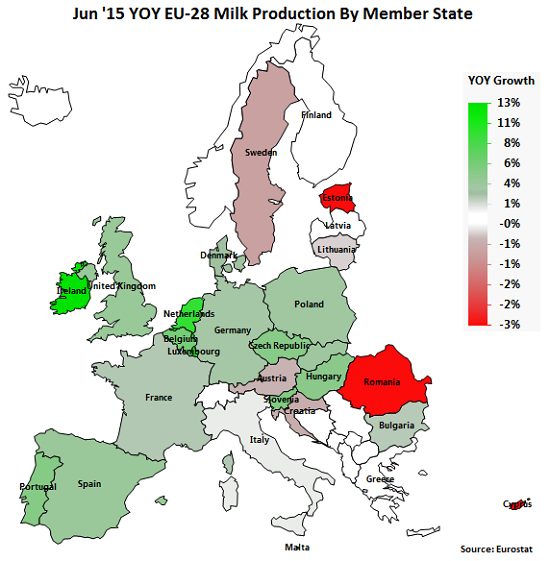

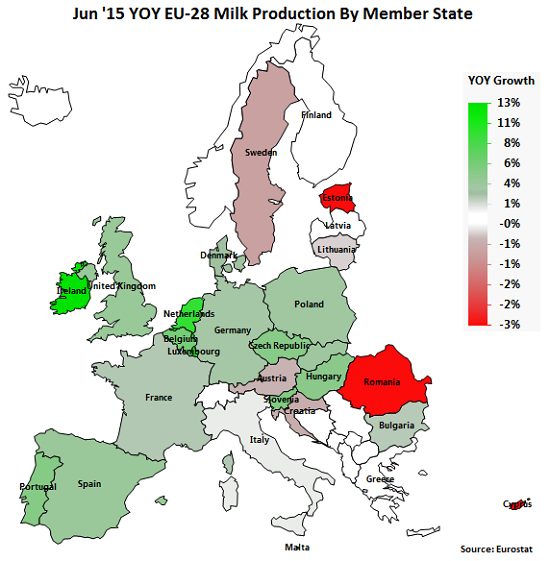

YOY increases in production were led by the Netherlands (+100,000 MT), followed by Ireland (+98,870 MT), the Germany (+83,710 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Jun ’15. YOY increases in production on a percentage basis were led by Ireland (+13.2%), Luxembourg (+10.7%) and the Netherlands (+9.6%).

YOY increases in production were led by the Netherlands (+100,000 MT), followed by Ireland (+98,870 MT), the Germany (+83,710 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Jun ’15. YOY increases in production on a percentage basis were led by Ireland (+13.2%), Luxembourg (+10.7%) and the Netherlands (+9.6%).

Production growth throughout the EU-28 remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. Culling rates have increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. Continued growth in milk production throughout the ’15-’16 production season is expected, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.

Production growth throughout the EU-28 remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. Culling rates have increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. Continued growth in milk production throughout the ’15-’16 production season is expected, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.

YOY increases in production were led by the Netherlands (+100,000 MT), followed by Ireland (+98,870 MT), the Germany (+83,710 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Jun ’15. YOY increases in production on a percentage basis were led by Ireland (+13.2%), Luxembourg (+10.7%) and the Netherlands (+9.6%).

YOY increases in production were led by the Netherlands (+100,000 MT), followed by Ireland (+98,870 MT), the Germany (+83,710 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Jun ’15. YOY increases in production on a percentage basis were led by Ireland (+13.2%), Luxembourg (+10.7%) and the Netherlands (+9.6%).

Production growth throughout the EU-28 remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. Culling rates have increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. Continued growth in milk production throughout the ’15-’16 production season is expected, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.

Production growth throughout the EU-28 remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies however lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of superlevy penalties resulted in decelerating milk production during the months leading up to quota expiration. Culling rates have increased in Europe as many producers culled their lower producing cows in the final months leading up to the quota expiration, however the recent uptick in culling may be short lived in the post-quota environment. Continued growth in milk production throughout the ’15-’16 production season is expected, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.