New Zealand Milk Production Update – Sep ’15

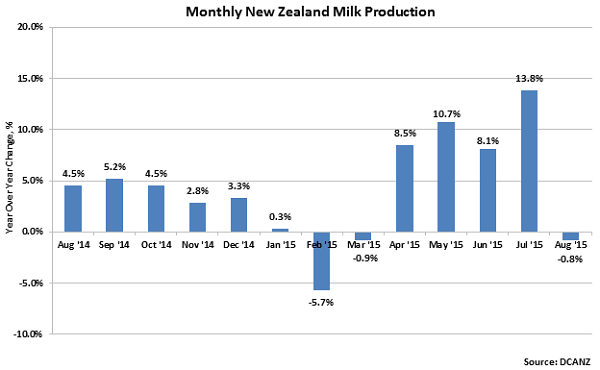

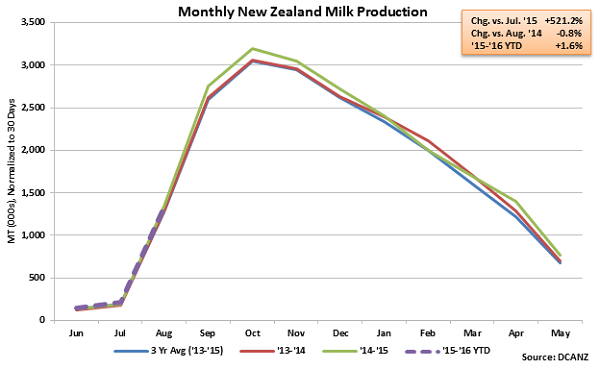

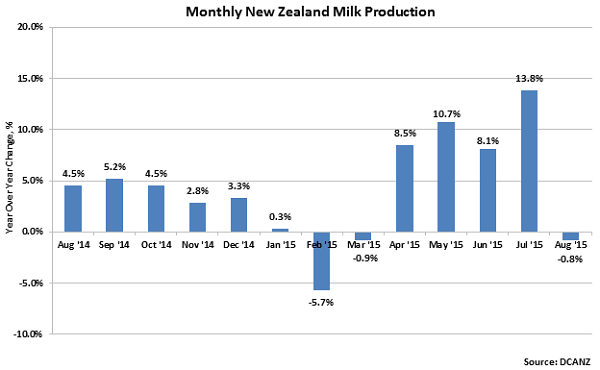

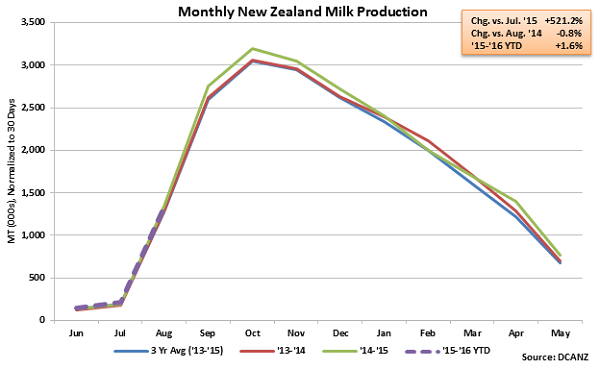

According to Dairy Companies Association of New Zealand (DCANZ), Aug ’15 New Zealand milk production declined YOY for the first time in five months, finishing 0.8% below the previous year. The Aug ’15 production figure was the most meaningful data point released since the Apr ’15 figure, as New Zealand milk production reaches its seasonal lows throughout the Northern Hemisphere summer months.

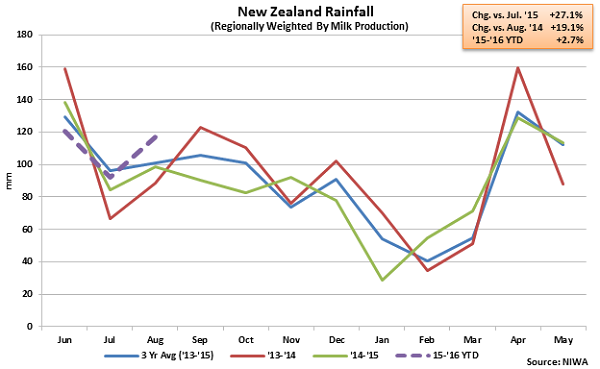

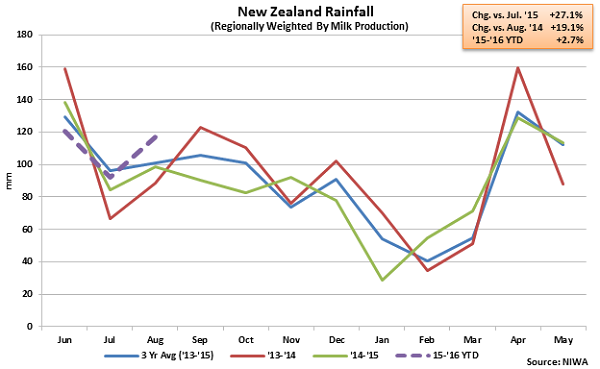

New Zealand milk production growth was tempered throughout the first quarter of 2015 due to low Farmgate Milk Prices and dry conditions. More recently, soil moisture levels have been restored to near normal levels, particularly on New Zealand’s North Island. Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, Aug ’15 rainfall regionally weighted by milk production across New Zealand finished at a five year high for the month of August, driving soil moisture deficits lower.

New Zealand milk production growth was tempered throughout the first quarter of 2015 due to low Farmgate Milk Prices and dry conditions. More recently, soil moisture levels have been restored to near normal levels, particularly on New Zealand’s North Island. Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, Aug ’15 rainfall regionally weighted by milk production across New Zealand finished at a five year high for the month of August, driving soil moisture deficits lower.

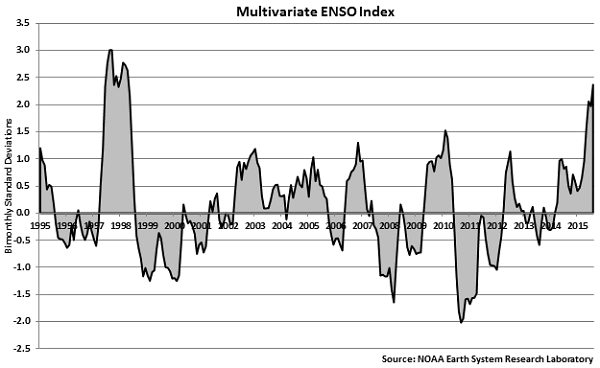

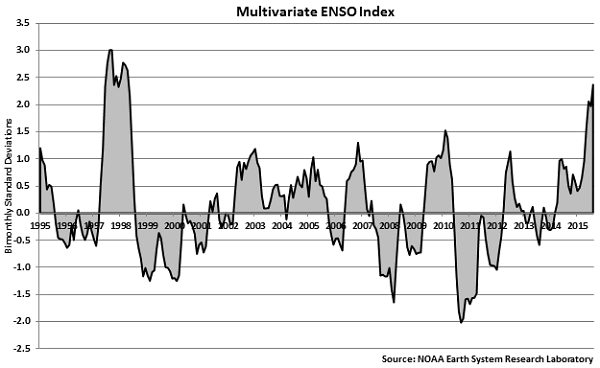

Although precipitation has increased throughout August, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Jul – Aug ’15, indicating that a significant El Niño event remains in development.

Although precipitation has increased throughout August, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Jul – Aug ’15, indicating that a significant El Niño event remains in development.

In addition to the potential for adverse weather conditions, New Zealand Farmgate Milk Prices continue to remain weak, possibly driving milk production lower in future months. In early Aug ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season from $5.25/kgMS to $3.85/kgMS, a ten year low, noting the continued imbalance in supply and demand within global dairy markets. A $0.50/kgMS support payment to farmers was made available by Fonterra in hopes of boosting cashflows and farm confidence, however the support payments may delay or slow the dairy price recovery within the largest dairy exporting nation. The support payments made will be interest free for two years and paid back when the Farmgate Milk Price or Advance Rate goes above $6.00/kgMS.

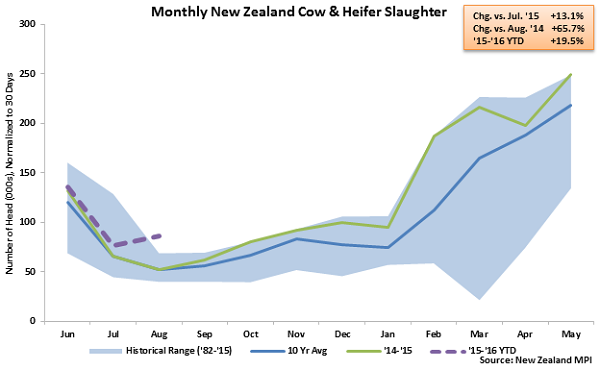

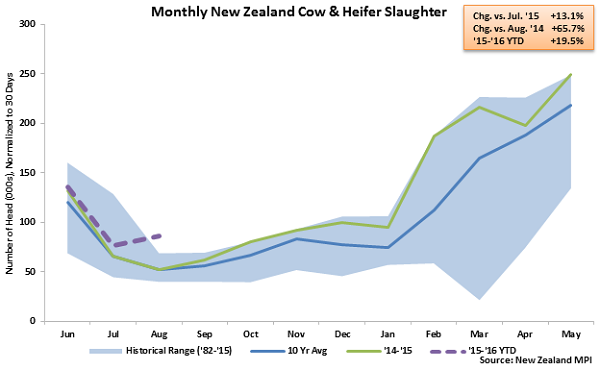

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers culled at a heavy pace throughout the off-season, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Aug ’15 New Zealand cow & heifer slaughter increased 65.7% YOY, finishing at the largest overall slaughter rate on record for the month of August.

In addition to the potential for adverse weather conditions, New Zealand Farmgate Milk Prices continue to remain weak, possibly driving milk production lower in future months. In early Aug ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season from $5.25/kgMS to $3.85/kgMS, a ten year low, noting the continued imbalance in supply and demand within global dairy markets. A $0.50/kgMS support payment to farmers was made available by Fonterra in hopes of boosting cashflows and farm confidence, however the support payments may delay or slow the dairy price recovery within the largest dairy exporting nation. The support payments made will be interest free for two years and paid back when the Farmgate Milk Price or Advance Rate goes above $6.00/kgMS.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers culled at a heavy pace throughout the off-season, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Aug ’15 New Zealand cow & heifer slaughter increased 65.7% YOY, finishing at the largest overall slaughter rate on record for the month of August.

The YOY increase in New Zealand cow & heifer slaughter corresponded with the YOY decline in milk production exhibited throughout Aug ’15. Additional heavy culling is expected to continue to reduce milk production in coming months. According to the Sep ’15 Fonterra Milk Volume Forecast, collections across New Zealand are expected to decline by 2-3% YOY throughout the 2015-16 production season.

The YOY increase in New Zealand cow & heifer slaughter corresponded with the YOY decline in milk production exhibited throughout Aug ’15. Additional heavy culling is expected to continue to reduce milk production in coming months. According to the Sep ’15 Fonterra Milk Volume Forecast, collections across New Zealand are expected to decline by 2-3% YOY throughout the 2015-16 production season.

New Zealand milk production growth was tempered throughout the first quarter of 2015 due to low Farmgate Milk Prices and dry conditions. More recently, soil moisture levels have been restored to near normal levels, particularly on New Zealand’s North Island. Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, Aug ’15 rainfall regionally weighted by milk production across New Zealand finished at a five year high for the month of August, driving soil moisture deficits lower.

New Zealand milk production growth was tempered throughout the first quarter of 2015 due to low Farmgate Milk Prices and dry conditions. More recently, soil moisture levels have been restored to near normal levels, particularly on New Zealand’s North Island. Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, Aug ’15 rainfall regionally weighted by milk production across New Zealand finished at a five year high for the month of August, driving soil moisture deficits lower.

Although precipitation has increased throughout August, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Jul – Aug ’15, indicating that a significant El Niño event remains in development.

Although precipitation has increased throughout August, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Jul – Aug ’15, indicating that a significant El Niño event remains in development.

In addition to the potential for adverse weather conditions, New Zealand Farmgate Milk Prices continue to remain weak, possibly driving milk production lower in future months. In early Aug ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season from $5.25/kgMS to $3.85/kgMS, a ten year low, noting the continued imbalance in supply and demand within global dairy markets. A $0.50/kgMS support payment to farmers was made available by Fonterra in hopes of boosting cashflows and farm confidence, however the support payments may delay or slow the dairy price recovery within the largest dairy exporting nation. The support payments made will be interest free for two years and paid back when the Farmgate Milk Price or Advance Rate goes above $6.00/kgMS.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers culled at a heavy pace throughout the off-season, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Aug ’15 New Zealand cow & heifer slaughter increased 65.7% YOY, finishing at the largest overall slaughter rate on record for the month of August.

In addition to the potential for adverse weather conditions, New Zealand Farmgate Milk Prices continue to remain weak, possibly driving milk production lower in future months. In early Aug ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season from $5.25/kgMS to $3.85/kgMS, a ten year low, noting the continued imbalance in supply and demand within global dairy markets. A $0.50/kgMS support payment to farmers was made available by Fonterra in hopes of boosting cashflows and farm confidence, however the support payments may delay or slow the dairy price recovery within the largest dairy exporting nation. The support payments made will be interest free for two years and paid back when the Farmgate Milk Price or Advance Rate goes above $6.00/kgMS.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers culled at a heavy pace throughout the off-season, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Aug ’15 New Zealand cow & heifer slaughter increased 65.7% YOY, finishing at the largest overall slaughter rate on record for the month of August.

The YOY increase in New Zealand cow & heifer slaughter corresponded with the YOY decline in milk production exhibited throughout Aug ’15. Additional heavy culling is expected to continue to reduce milk production in coming months. According to the Sep ’15 Fonterra Milk Volume Forecast, collections across New Zealand are expected to decline by 2-3% YOY throughout the 2015-16 production season.

The YOY increase in New Zealand cow & heifer slaughter corresponded with the YOY decline in milk production exhibited throughout Aug ’15. Additional heavy culling is expected to continue to reduce milk production in coming months. According to the Sep ’15 Fonterra Milk Volume Forecast, collections across New Zealand are expected to decline by 2-3% YOY throughout the 2015-16 production season.