New Zealand Milk Production Update – Oct ’15

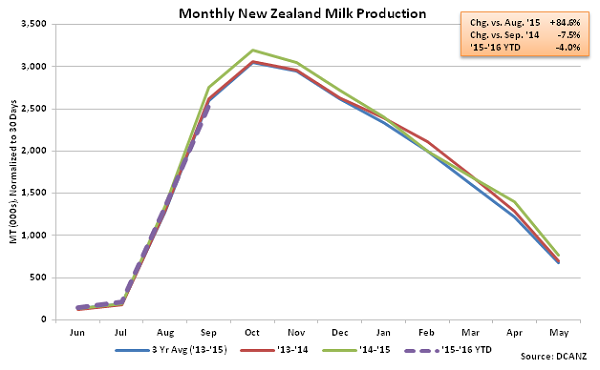

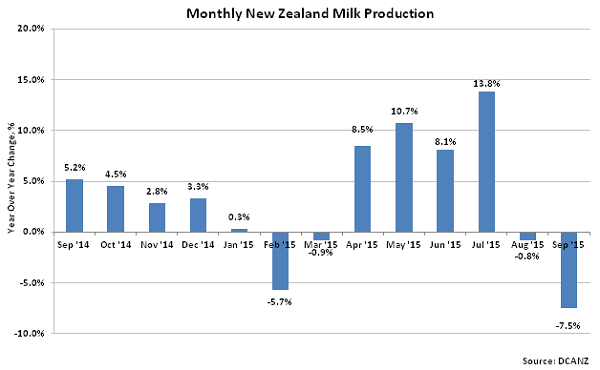

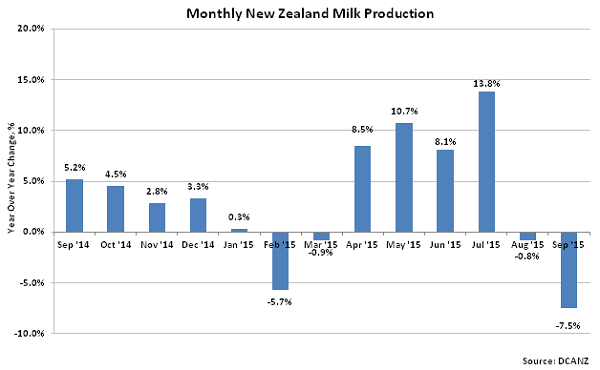

According to Dairy Companies Association of New Zealand (DCANZ), Sep ’15 New Zealand milk production declined YOY for the second consecutive month, finishing 7.5% below the previous year. The YOY decline in New Zealand milk production was the largest experienced in the past 28 months and comes at a time when production is approaching seasonal peak production levels typically reached in October.

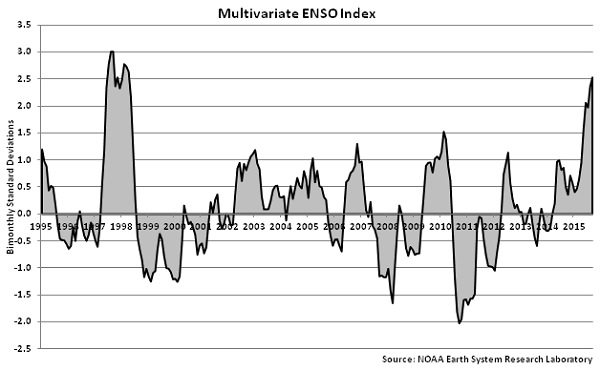

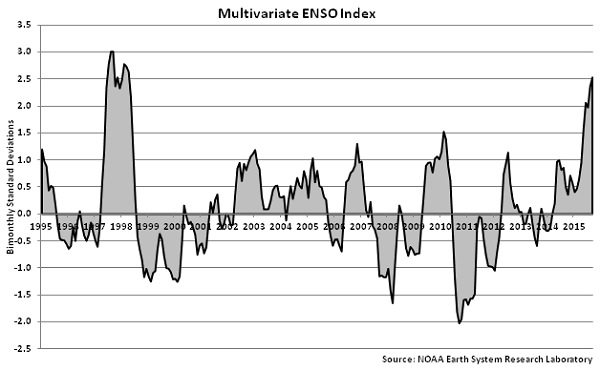

Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather is affecting forage conditions across New Zealand, contributing to the recent YOY declines in milk production. Although precipitation has remained above historical levels, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Aug – Sep ’15, indicating that a significant El Niño event remains in development.

Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather is affecting forage conditions across New Zealand, contributing to the recent YOY declines in milk production. Although precipitation has remained above historical levels, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Aug – Sep ’15, indicating that a significant El Niño event remains in development.

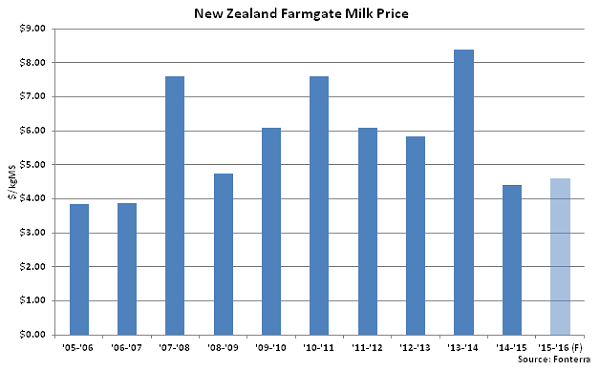

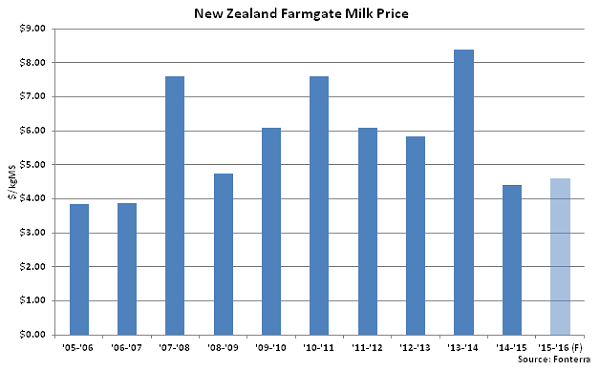

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In Sep ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season upward from the previous ten year low of$3.85/kgMS to $4.60/kgMS, as Fonterra expects production to decline by approximately 5% YOY throughout the season. The current forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price.

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In Sep ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season upward from the previous ten year low of$3.85/kgMS to $4.60/kgMS, as Fonterra expects production to decline by approximately 5% YOY throughout the season. The current forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price.

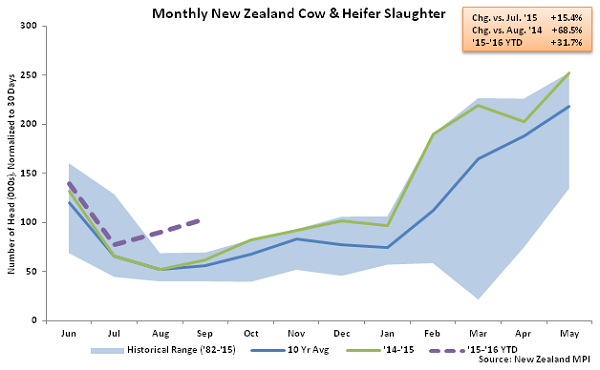

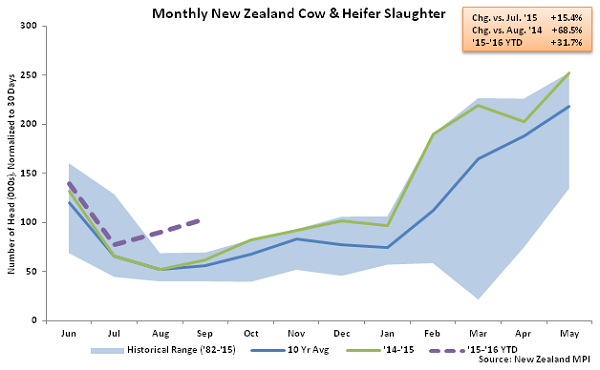

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Sep ’15 New Zealand cow & heifer slaughter increased 68.5% YOY, finishing at the largest overall slaughter rate on record for the month of September.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Sep ’15 New Zealand cow & heifer slaughter increased 68.5% YOY, finishing at the largest overall slaughter rate on record for the month of September.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past two months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past two months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

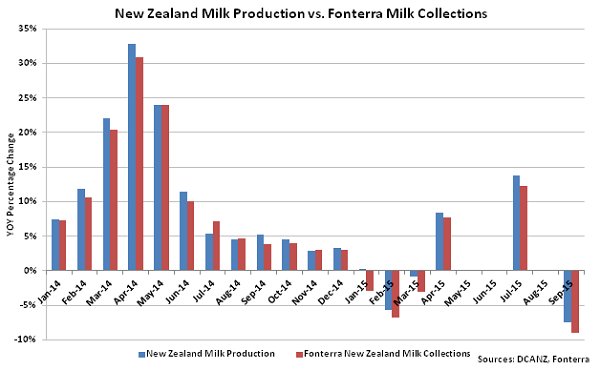

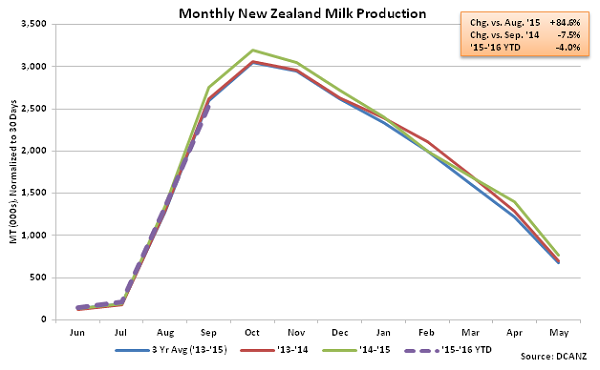

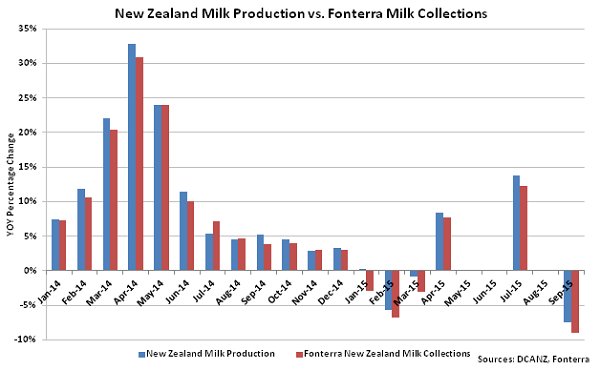

’15-’16 YTD New Zealand milk production is down 4.0% YOY throughout the first four months of the production season, however the declines to date are less than half of the projected 8-10% annual YOY decline noted in Rabobank’s Sep ’15 Agribusiness Monthly update. Sep ’15 Fonterra milk collection figures noted within the Oct ’15 Fonterra Global Dairy Update were consistent with the midpoint of the Rabobank projected annual decline, finishing 9.0% lower YOY. Historically, Fonterra milk collection figures have been highly correlated with official New Zealand milk production figures, although Fonterra milk collection figures have been on average 1.0% lower per month over the period.

’15-’16 YTD New Zealand milk production is down 4.0% YOY throughout the first four months of the production season, however the declines to date are less than half of the projected 8-10% annual YOY decline noted in Rabobank’s Sep ’15 Agribusiness Monthly update. Sep ’15 Fonterra milk collection figures noted within the Oct ’15 Fonterra Global Dairy Update were consistent with the midpoint of the Rabobank projected annual decline, finishing 9.0% lower YOY. Historically, Fonterra milk collection figures have been highly correlated with official New Zealand milk production figures, although Fonterra milk collection figures have been on average 1.0% lower per month over the period.

Fonterra milk collection figures are typically released earlier than official milk production figures provided by DCANZ, although Fonterra has only released sporadic updates over recent months. If a Nov ’15 Fonterra Global Update is released within coming weeks, it would provide a strong indication of how peak production fared across New Zealand.

Fonterra milk collection figures are typically released earlier than official milk production figures provided by DCANZ, although Fonterra has only released sporadic updates over recent months. If a Nov ’15 Fonterra Global Update is released within coming weeks, it would provide a strong indication of how peak production fared across New Zealand.

Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather is affecting forage conditions across New Zealand, contributing to the recent YOY declines in milk production. Although precipitation has remained above historical levels, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Aug – Sep ’15, indicating that a significant El Niño event remains in development.

Despite the recent warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather is affecting forage conditions across New Zealand, contributing to the recent YOY declines in milk production. Although precipitation has remained above historical levels, an El Niño event remains a distinct possibility throughout coming months. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, have increased to five and 17 year highs, respectively throughout Aug – Sep ’15, indicating that a significant El Niño event remains in development.

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In Sep ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season upward from the previous ten year low of$3.85/kgMS to $4.60/kgMS, as Fonterra expects production to decline by approximately 5% YOY throughout the season. The current forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price.

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In Sep ’15, Fonterra revised its forecasted Farmgate Milk Price for the ’15-’16 season upward from the previous ten year low of$3.85/kgMS to $4.60/kgMS, as Fonterra expects production to decline by approximately 5% YOY throughout the season. The current forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Sep ’15 New Zealand cow & heifer slaughter increased 68.5% YOY, finishing at the largest overall slaughter rate on record for the month of September.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Sep ’15 New Zealand cow & heifer slaughter increased 68.5% YOY, finishing at the largest overall slaughter rate on record for the month of September.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past two months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past two months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

’15-’16 YTD New Zealand milk production is down 4.0% YOY throughout the first four months of the production season, however the declines to date are less than half of the projected 8-10% annual YOY decline noted in Rabobank’s Sep ’15 Agribusiness Monthly update. Sep ’15 Fonterra milk collection figures noted within the Oct ’15 Fonterra Global Dairy Update were consistent with the midpoint of the Rabobank projected annual decline, finishing 9.0% lower YOY. Historically, Fonterra milk collection figures have been highly correlated with official New Zealand milk production figures, although Fonterra milk collection figures have been on average 1.0% lower per month over the period.

’15-’16 YTD New Zealand milk production is down 4.0% YOY throughout the first four months of the production season, however the declines to date are less than half of the projected 8-10% annual YOY decline noted in Rabobank’s Sep ’15 Agribusiness Monthly update. Sep ’15 Fonterra milk collection figures noted within the Oct ’15 Fonterra Global Dairy Update were consistent with the midpoint of the Rabobank projected annual decline, finishing 9.0% lower YOY. Historically, Fonterra milk collection figures have been highly correlated with official New Zealand milk production figures, although Fonterra milk collection figures have been on average 1.0% lower per month over the period.

Fonterra milk collection figures are typically released earlier than official milk production figures provided by DCANZ, although Fonterra has only released sporadic updates over recent months. If a Nov ’15 Fonterra Global Update is released within coming weeks, it would provide a strong indication of how peak production fared across New Zealand.

Fonterra milk collection figures are typically released earlier than official milk production figures provided by DCANZ, although Fonterra has only released sporadic updates over recent months. If a Nov ’15 Fonterra Global Update is released within coming weeks, it would provide a strong indication of how peak production fared across New Zealand.