Global Dairy Trade Results Update – 2/16/16

Executive Summary

Dairy product prices continued to decline within the GDT event held February 16th. Highlights from the most recent auction include:

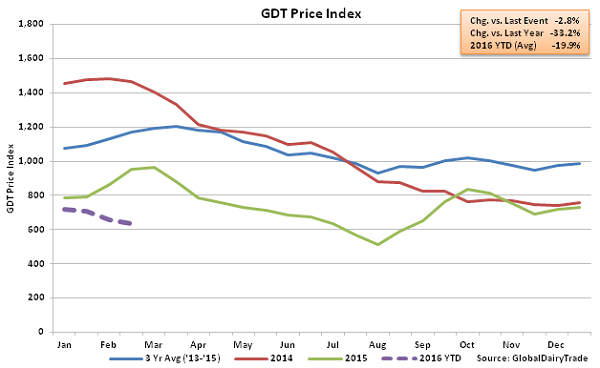

• The GDT Price Index declined for the fourth consecutive auction at the February 16th event, finishing down 2.6%.

• Whole milk powder (-3.7%), skim milk powder (-1.4%), cheddar cheese (-5.6%) and butter (-2.3%) prices all declined within the February 16th event.

• Price declines continued despite quantities sold remaining lower on a YOY basis. February 16th quantities sold were the second lowest amount experienced since Mar ’15.

Additional Report Details

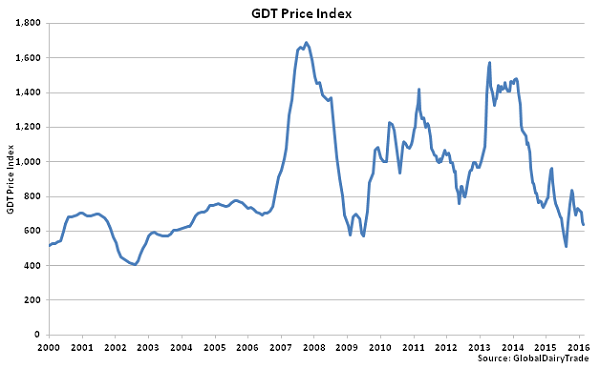

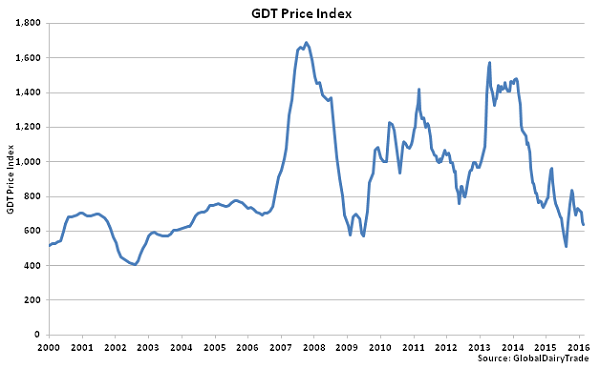

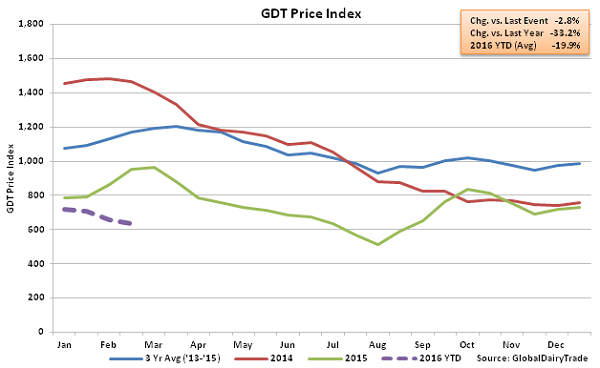

Dairy product prices fell within the Global Dairy Trade (GDT) for the fourth consecutive auction as the GDT Price Index declined 2.6% in the auction held February 16th. The GDT Price Index declined by 46.8% in total over the ten auctions spanning Mar ’15 – Aug ’15 but had gained back nearly three quarters of the decline from Aug ’15 to Oct ’15. The most recent decline resulted in the GDT Price Index falling back to a 12 auction low. The GDT Price Index represents a weighted-average of the percentage changes in prices between trading events for all products offered. The GDT Price Index finished 33.2% below the previous year figures and 45.5% below the three year average price for the second auction of February.

Declines in prices were widespread and led by rennet casein (-11.5%), followed by cheddar cheese (-5.6%), whole milk powder (-3.7%), butter (-2.3%), skim milk powder (-1.4%) and butter milk powder (-1.2%). Anhydrous milkfat (+1.5%) was the only product to increase in price while lactose prices were unchanged at the event. U.S. SMP and butter did not trade at the event for the 37th and 38th straight times, respectively.

Declines in prices were widespread and led by rennet casein (-11.5%), followed by cheddar cheese (-5.6%), whole milk powder (-3.7%), butter (-2.3%), skim milk powder (-1.4%) and butter milk powder (-1.2%). Anhydrous milkfat (+1.5%) was the only product to increase in price while lactose prices were unchanged at the event. U.S. SMP and butter did not trade at the event for the 37th and 38th straight times, respectively.

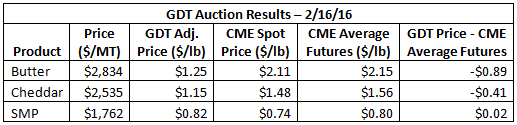

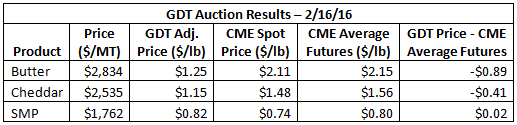

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on February 12th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on February 12th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

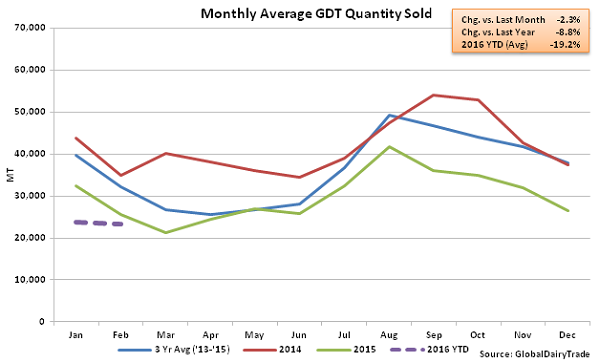

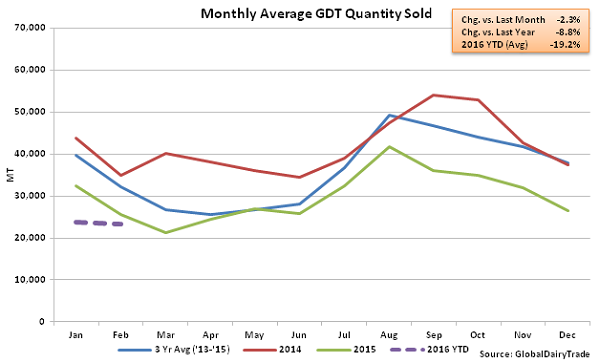

Total quantities sold for all products at the February 16th event of 22,021 MT were 10.0% less than the previous auction and the second lowest amount of product sold since Mar ’15.

Total quantities sold for all products at the February 16th event of 22,021 MT were 10.0% less than the previous auction and the second lowest amount of product sold since Mar ’15.

Volumes also remained lower on a seasonal basis as total quantities sold for all products within the February auctions were 8.8% below last year’s average volumes sold for the month of February and 27.6% below the previous three year average February quantities sold.

Volumes also remained lower on a seasonal basis as total quantities sold for all products within the February auctions were 8.8% below last year’s average volumes sold for the month of February and 27.6% below the previous three year average February quantities sold.

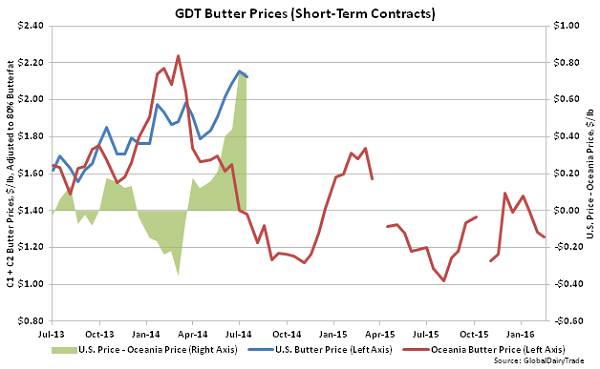

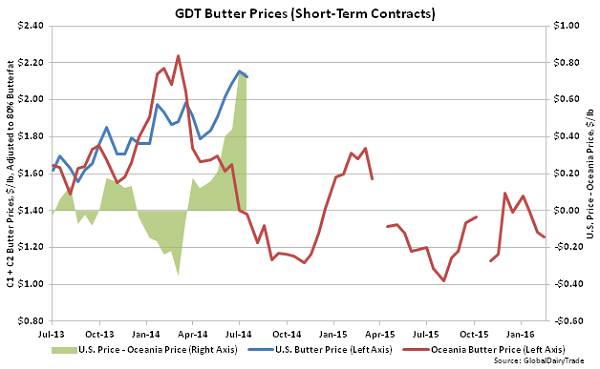

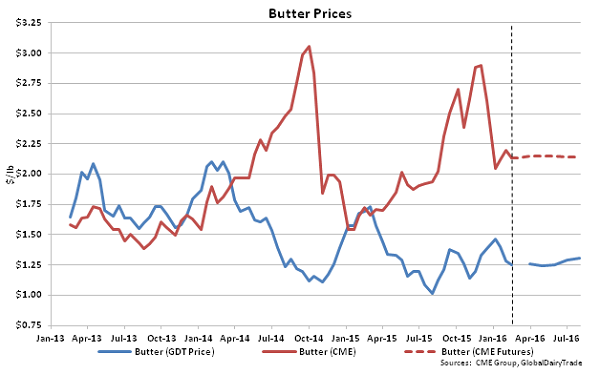

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 38th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to a six auction low during the most recent event.

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 38th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to a six auction low during the most recent event.

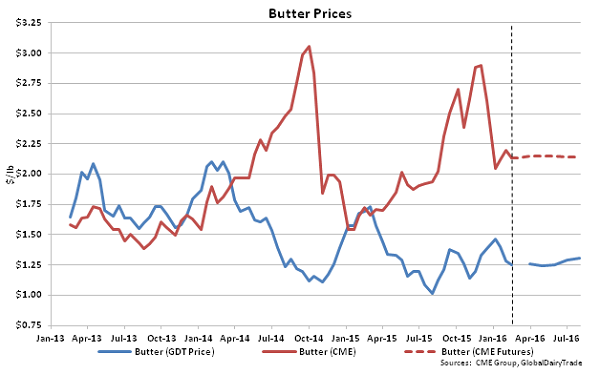

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices over much of 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 68.2% premium to GDT prices while CME futures prices are trading at a 69.0% premium to GDT prices from Apr ’16 – Aug ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Mar ’16).

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices over much of 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 68.2% premium to GDT prices while CME futures prices are trading at a 69.0% premium to GDT prices from Apr ’16 – Aug ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Mar ’16).

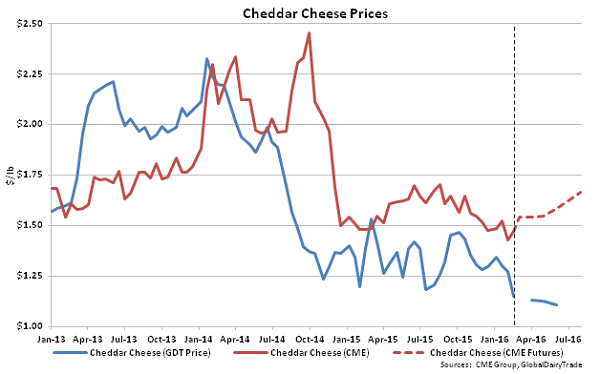

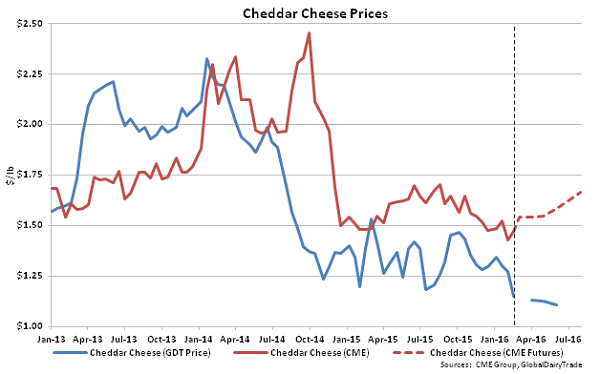

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 28.7% premium to GDT prices while CME futures prices are trading at a 38.8% premium to GDT prices from Apr ’16 – Jun ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Mar ’16), Contract 5 (Jul ’16) and Contract 6 (Aug ’16).

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 28.7% premium to GDT prices while CME futures prices are trading at a 38.8% premium to GDT prices from Apr ’16 – Jun ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Mar ’16), Contract 5 (Jul ’16) and Contract 6 (Aug ’16).

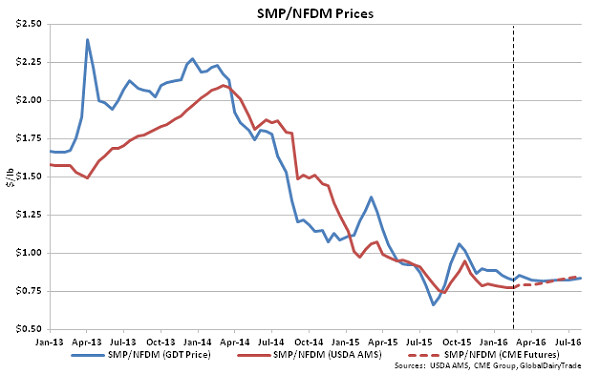

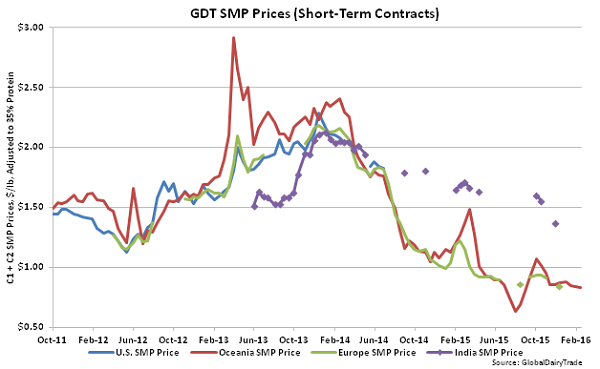

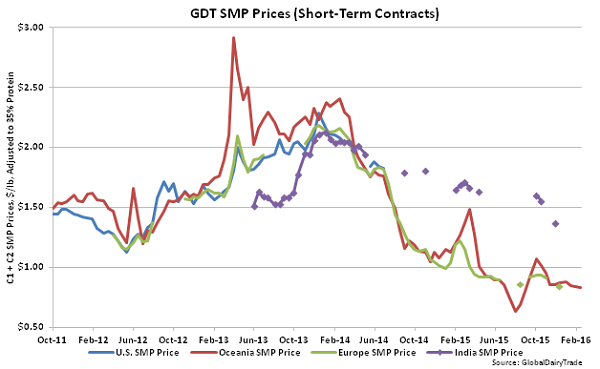

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the fourth consecutive time at the February 16th event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 37th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as it was recently announced that Land O’ Lakes has formally withdrawn from the global auction platform. Land O’ Lakes first joined GDT in Mar ’14 but had not sold product via the GDT platform since Jan ’15. India SMP, representing product sold by Amul, also did not trade at the February 16th event.

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the fourth consecutive time at the February 16th event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 37th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as it was recently announced that Land O’ Lakes has formally withdrawn from the global auction platform. Land O’ Lakes first joined GDT in Mar ’14 but had not sold product via the GDT platform since Jan ’15. India SMP, representing product sold by Amul, also did not trade at the February 16th event.

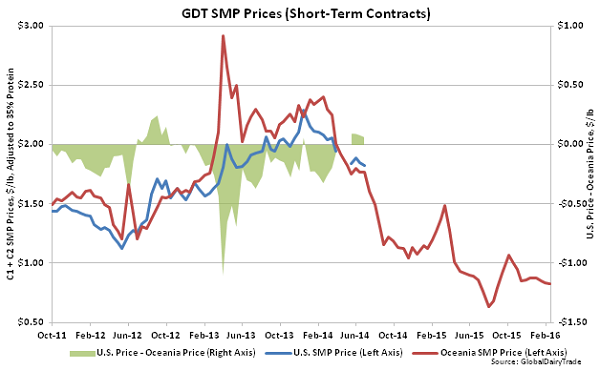

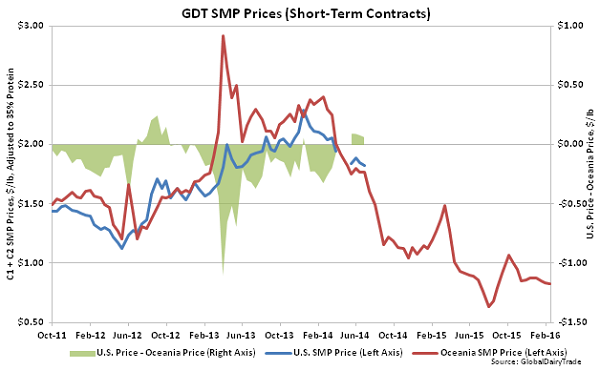

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to more recent increases in prices.

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to more recent increases in prices.

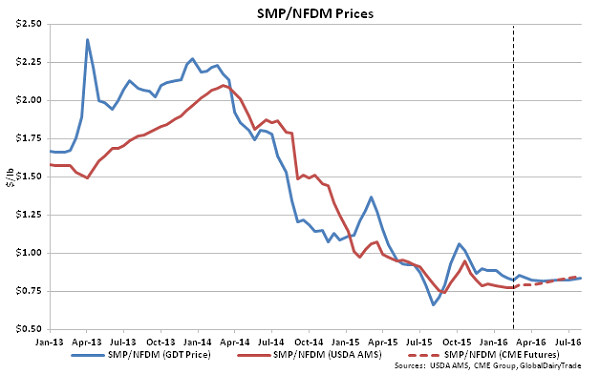

U.S. NFDM spot prices are currently trading 10.4% below GDT SMP prices while GDT SMP future month winning prices are trading at a 3.5% average premium to CME NFDM futures prices from Mar ’16 – Jun ’16. U.S. NFDM prices are expected to regain a premium to GDT SMP prices on average heading into the second half of 2016, however, trading at a 1.8% premium from Jul ’15 – Aug ’15.

U.S. NFDM spot prices are currently trading 10.4% below GDT SMP prices while GDT SMP future month winning prices are trading at a 3.5% average premium to CME NFDM futures prices from Mar ’16 – Jun ’16. U.S. NFDM prices are expected to regain a premium to GDT SMP prices on average heading into the second half of 2016, however, trading at a 1.8% premium from Jul ’15 – Aug ’15.

Declines in prices were widespread and led by rennet casein (-11.5%), followed by cheddar cheese (-5.6%), whole milk powder (-3.7%), butter (-2.3%), skim milk powder (-1.4%) and butter milk powder (-1.2%). Anhydrous milkfat (+1.5%) was the only product to increase in price while lactose prices were unchanged at the event. U.S. SMP and butter did not trade at the event for the 37th and 38th straight times, respectively.

Declines in prices were widespread and led by rennet casein (-11.5%), followed by cheddar cheese (-5.6%), whole milk powder (-3.7%), butter (-2.3%), skim milk powder (-1.4%) and butter milk powder (-1.2%). Anhydrous milkfat (+1.5%) was the only product to increase in price while lactose prices were unchanged at the event. U.S. SMP and butter did not trade at the event for the 37th and 38th straight times, respectively.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on February 12th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on February 12th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

Total quantities sold for all products at the February 16th event of 22,021 MT were 10.0% less than the previous auction and the second lowest amount of product sold since Mar ’15.

Total quantities sold for all products at the February 16th event of 22,021 MT were 10.0% less than the previous auction and the second lowest amount of product sold since Mar ’15.

Volumes also remained lower on a seasonal basis as total quantities sold for all products within the February auctions were 8.8% below last year’s average volumes sold for the month of February and 27.6% below the previous three year average February quantities sold.

Volumes also remained lower on a seasonal basis as total quantities sold for all products within the February auctions were 8.8% below last year’s average volumes sold for the month of February and 27.6% below the previous three year average February quantities sold.

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 38th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to a six auction low during the most recent event.

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 38th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to a six auction low during the most recent event.

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices over much of 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 68.2% premium to GDT prices while CME futures prices are trading at a 69.0% premium to GDT prices from Apr ’16 – Aug ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Mar ’16).

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices over much of 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 68.2% premium to GDT prices while CME futures prices are trading at a 69.0% premium to GDT prices from Apr ’16 – Aug ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Mar ’16).

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 28.7% premium to GDT prices while CME futures prices are trading at a 38.8% premium to GDT prices from Apr ’16 – Jun ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Mar ’16), Contract 5 (Jul ’16) and Contract 6 (Aug ’16).

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 28.7% premium to GDT prices while CME futures prices are trading at a 38.8% premium to GDT prices from Apr ’16 – Jun ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Mar ’16), Contract 5 (Jul ’16) and Contract 6 (Aug ’16).

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the fourth consecutive time at the February 16th event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 37th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as it was recently announced that Land O’ Lakes has formally withdrawn from the global auction platform. Land O’ Lakes first joined GDT in Mar ’14 but had not sold product via the GDT platform since Jan ’15. India SMP, representing product sold by Amul, also did not trade at the February 16th event.

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the fourth consecutive time at the February 16th event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 37th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as it was recently announced that Land O’ Lakes has formally withdrawn from the global auction platform. Land O’ Lakes first joined GDT in Mar ’14 but had not sold product via the GDT platform since Jan ’15. India SMP, representing product sold by Amul, also did not trade at the February 16th event.

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to more recent increases in prices.

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to more recent increases in prices.

U.S. NFDM spot prices are currently trading 10.4% below GDT SMP prices while GDT SMP future month winning prices are trading at a 3.5% average premium to CME NFDM futures prices from Mar ’16 – Jun ’16. U.S. NFDM prices are expected to regain a premium to GDT SMP prices on average heading into the second half of 2016, however, trading at a 1.8% premium from Jul ’15 – Aug ’15.

U.S. NFDM spot prices are currently trading 10.4% below GDT SMP prices while GDT SMP future month winning prices are trading at a 3.5% average premium to CME NFDM futures prices from Mar ’16 – Jun ’16. U.S. NFDM prices are expected to regain a premium to GDT SMP prices on average heading into the second half of 2016, however, trading at a 1.8% premium from Jul ’15 – Aug ’15.