New Zealand Milk Production Update – Feb ’16

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Jan ’16. Highlights from the updated report include:

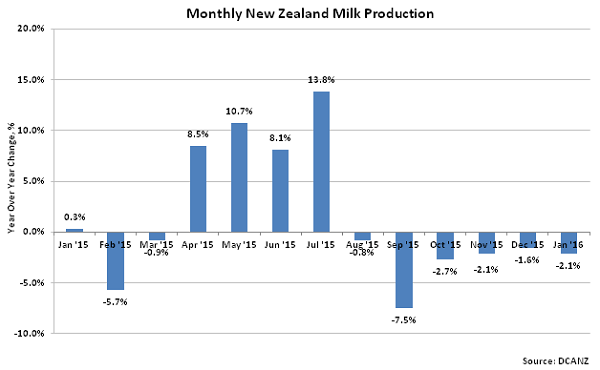

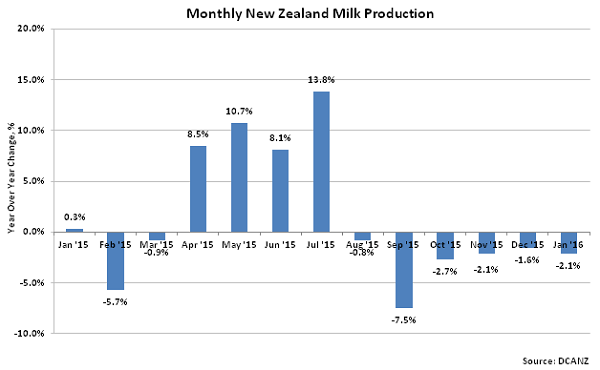

• New Zealand milk production declined on a YOY basis for the sixth consecutive month in Jan ’16, finishing 2.1% below the previous year.

• YOY declines in milk production continue to be less than expected, however, as concerns of a significant El Niño event negatively affecting pasture conditions have been reduced.

• ’15-’16 New Zealand Farmgate Milk Price projections were revised downward to a nine year low however slaughter rates finished 16.7% below the previous year during Dec ’15.

Additional Report Details

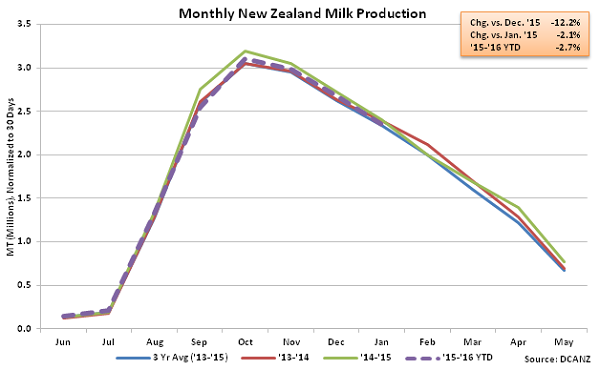

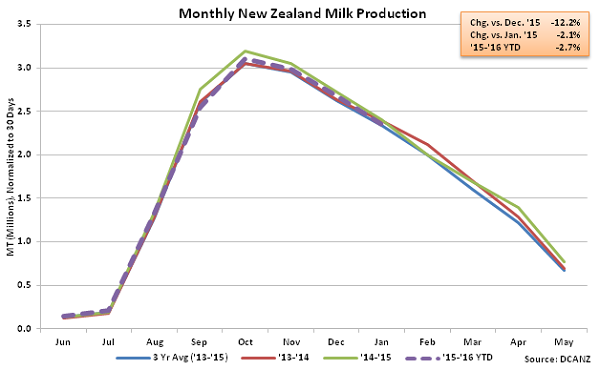

According to DCANZ, Jan ’16 New Zealand milk production declined YOY for the sixth consecutive month, finishing 2.1% below the previous year. Milk production also declined 12.2% MOM on a daily average basis as production continues to seasonally decline until lows are reached in the Northern Hemisphere summer months. The MOM decline was greater than the five year average December – January seasonal decline of 9.4%.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.7% throughout the first two thirds of the production season, significantly less than Fonterra’s Dec ’15 projected annual YOY decline of 6.0%. New Zealand milk production would need to decline by approximately 15.2% YOY over the final third of the ’15-’16 production season to reach Fonterra’s most recent projected annual decline.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.7% throughout the first two thirds of the production season, significantly less than Fonterra’s Dec ’15 projected annual YOY decline of 6.0%. New Zealand milk production would need to decline by approximately 15.2% YOY over the final third of the ’15-’16 production season to reach Fonterra’s most recent projected annual decline.

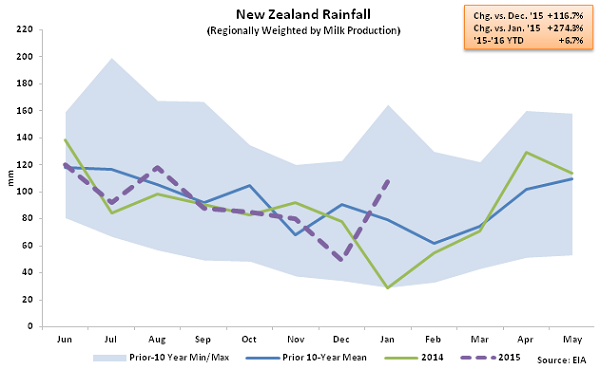

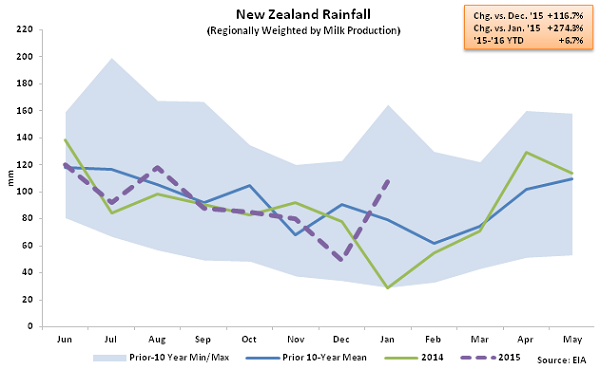

YOY declines in milk production have remained less than expected as weather conditions have improved across the majority of New Zealand. When regionally weighted by milk production, Jan ’16 New Zealand rainfall reached a five year high for the month of January, finishing at over two and a half times the previous year’s level.

YOY declines in milk production have remained less than expected as weather conditions have improved across the majority of New Zealand. When regionally weighted by milk production, Jan ’16 New Zealand rainfall reached a five year high for the month of January, finishing at over two and a half times the previous year’s level.

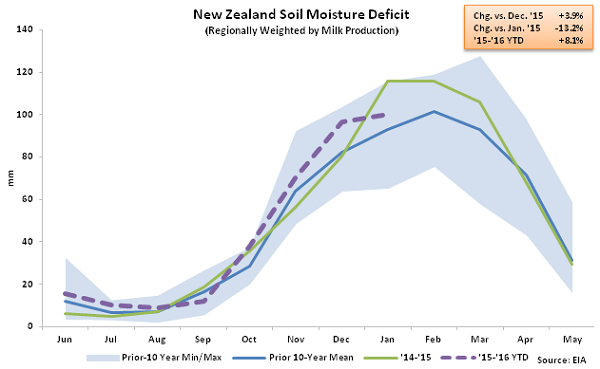

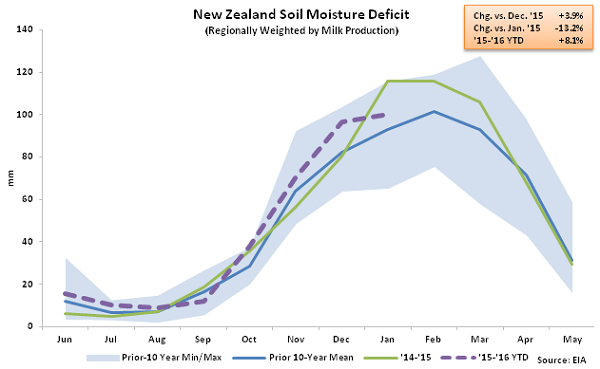

Increased precipitation levels have resulted in a sharp reduction in YOY soil moisture deficits. Jan ’16 soil moisture deficits declined by 13.2% YOY when regionally weighted by milk production. Regionally weighted soil moisture deficits had reached five year seasonal highs throughout each of the past three months prior to the most recent YOY decline.

Increased precipitation levels have resulted in a sharp reduction in YOY soil moisture deficits. Jan ’16 soil moisture deficits declined by 13.2% YOY when regionally weighted by milk production. Regionally weighted soil moisture deficits had reached five year seasonal highs throughout each of the past three months prior to the most recent YOY decline.

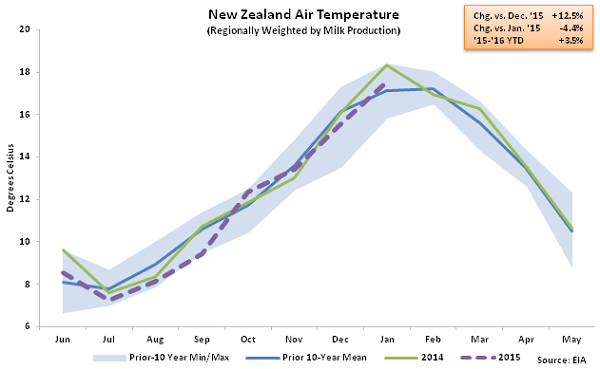

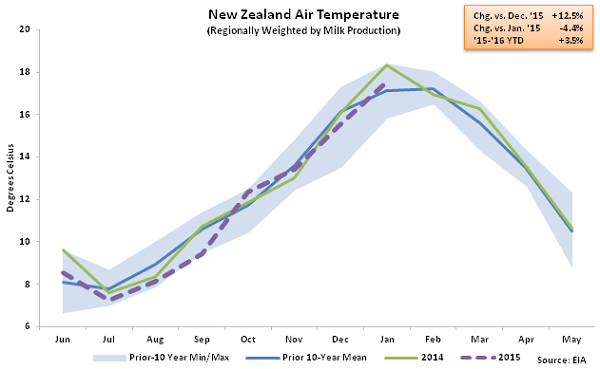

New Zealand air temperatures have also trended lower on a YOY basis throughout the warmest of the Southern Hemisphere’s summer months. When regionally weighted by milk production, New Zealand air temperatures finished down 4.4% YOY during Jan ’16.

New Zealand air temperatures have also trended lower on a YOY basis throughout the warmest of the Southern Hemisphere’s summer months. When regionally weighted by milk production, New Zealand air temperatures finished down 4.4% YOY during Jan ’16.

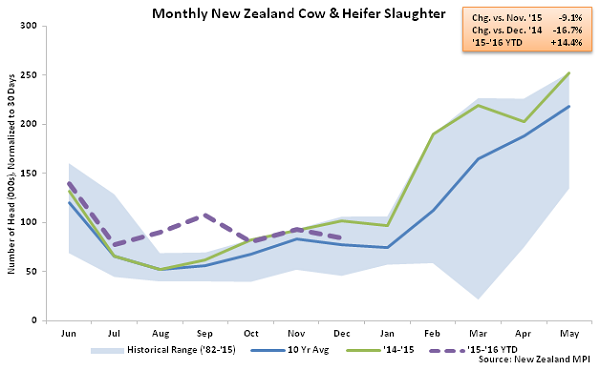

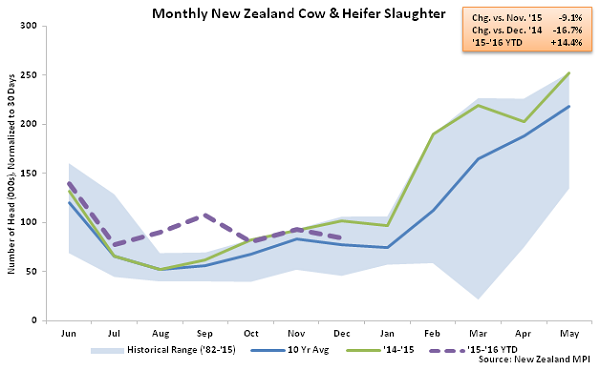

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

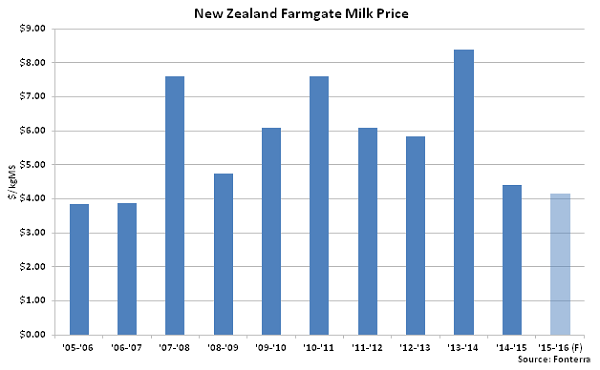

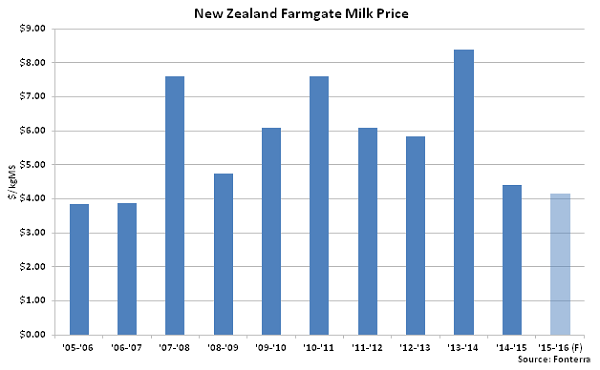

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In late Jan ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.45/kgMS, or 9.8%, to $4.15/kgMS, a nine year low. The current price forecast would be $0.25/kgMS, or 5.7%, below the ’14-’15 pay price and $1.70/kgMS, or 29.0%, below the ten year average price.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In late Jan ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.45/kgMS, or 9.8%, to $4.15/kgMS, a nine year low. The current price forecast would be $0.25/kgMS, or 5.7%, below the ’14-’15 pay price and $1.70/kgMS, or 29.0%, below the ten year average price.

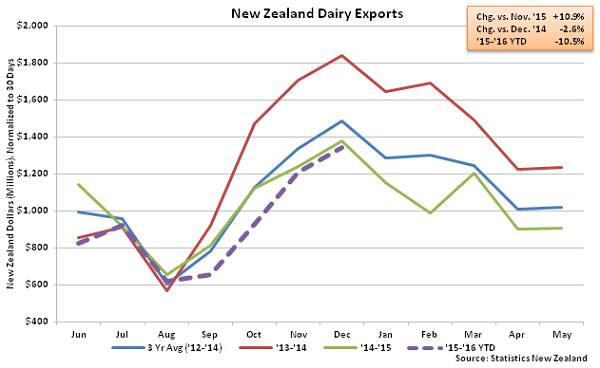

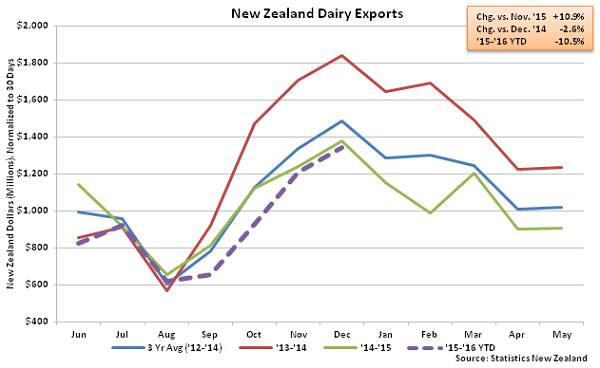

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fifth consecutive month in Dec ’15, finishing 2.6% below the previous year.

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fifth consecutive month in Dec ’15, finishing 2.6% below the previous year.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.7% throughout the first two thirds of the production season, significantly less than Fonterra’s Dec ’15 projected annual YOY decline of 6.0%. New Zealand milk production would need to decline by approximately 15.2% YOY over the final third of the ’15-’16 production season to reach Fonterra’s most recent projected annual decline.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.7% throughout the first two thirds of the production season, significantly less than Fonterra’s Dec ’15 projected annual YOY decline of 6.0%. New Zealand milk production would need to decline by approximately 15.2% YOY over the final third of the ’15-’16 production season to reach Fonterra’s most recent projected annual decline.

YOY declines in milk production have remained less than expected as weather conditions have improved across the majority of New Zealand. When regionally weighted by milk production, Jan ’16 New Zealand rainfall reached a five year high for the month of January, finishing at over two and a half times the previous year’s level.

YOY declines in milk production have remained less than expected as weather conditions have improved across the majority of New Zealand. When regionally weighted by milk production, Jan ’16 New Zealand rainfall reached a five year high for the month of January, finishing at over two and a half times the previous year’s level.

Increased precipitation levels have resulted in a sharp reduction in YOY soil moisture deficits. Jan ’16 soil moisture deficits declined by 13.2% YOY when regionally weighted by milk production. Regionally weighted soil moisture deficits had reached five year seasonal highs throughout each of the past three months prior to the most recent YOY decline.

Increased precipitation levels have resulted in a sharp reduction in YOY soil moisture deficits. Jan ’16 soil moisture deficits declined by 13.2% YOY when regionally weighted by milk production. Regionally weighted soil moisture deficits had reached five year seasonal highs throughout each of the past three months prior to the most recent YOY decline.

New Zealand air temperatures have also trended lower on a YOY basis throughout the warmest of the Southern Hemisphere’s summer months. When regionally weighted by milk production, New Zealand air temperatures finished down 4.4% YOY during Jan ’16.

New Zealand air temperatures have also trended lower on a YOY basis throughout the warmest of the Southern Hemisphere’s summer months. When regionally weighted by milk production, New Zealand air temperatures finished down 4.4% YOY during Jan ’16.

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In late Jan ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.45/kgMS, or 9.8%, to $4.15/kgMS, a nine year low. The current price forecast would be $0.25/kgMS, or 5.7%, below the ’14-’15 pay price and $1.70/kgMS, or 29.0%, below the ten year average price.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In late Jan ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.45/kgMS, or 9.8%, to $4.15/kgMS, a nine year low. The current price forecast would be $0.25/kgMS, or 5.7%, below the ’14-’15 pay price and $1.70/kgMS, or 29.0%, below the ten year average price.

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fifth consecutive month in Dec ’15, finishing 2.6% below the previous year.

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fifth consecutive month in Dec ’15, finishing 2.6% below the previous year.