Global Dairy Trade Results Update – 3/15/16

Executive Summary

Dairy product prices continued to decline within the GDT event held March 15th. Highlights from the most recent auction include:

• The GDT Price Index declined for the fifth time in the past six auctions at the March 15th event, finishing down 2.9%.

• Declines in prices were fairly widespread across products during the March 15th auction. Cheddar cheese, butter, skim milk powder and whole milk powder prices all declined throughout the event.

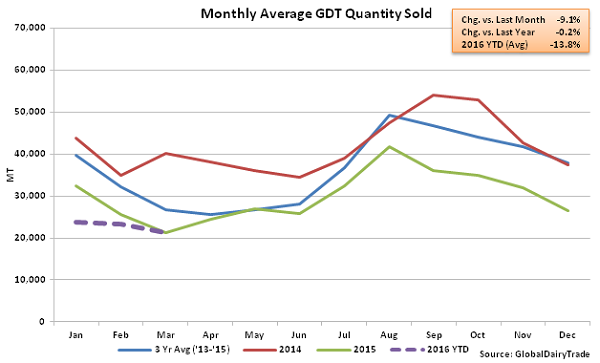

• Quantities sold during the March 15th event were the lowest experienced in the past 12 months, finishing 6.7% below the previous auction.

Additional Report Details

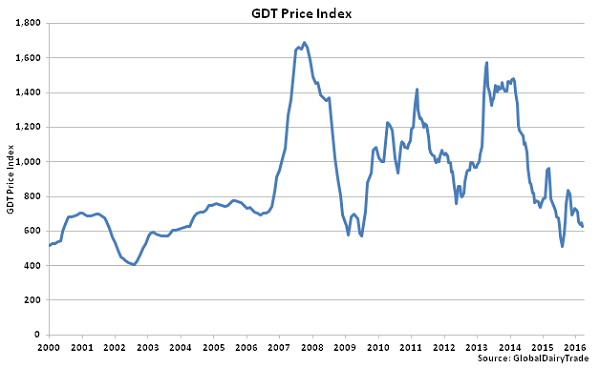

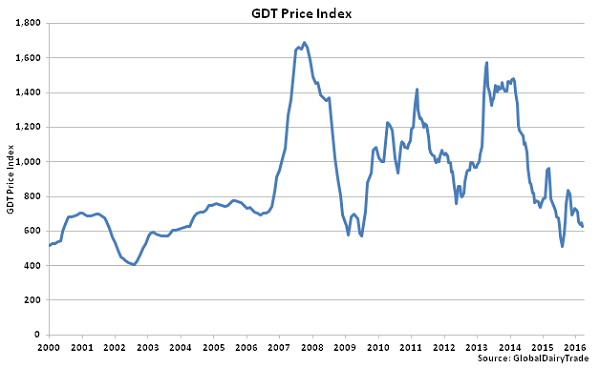

Dairy product prices declined within the Global Dairy Trade (GDT) for the fifth time in the past six auctions as the GDT Price Index declined 2.9% at the auction held March 15th. The GDT Price Index declined by 46.8% in total over the ten auctions spanning Mar ’15 – Aug ’15 but had gained back nearly three quarters of the decline from Aug ’15 to Oct ’15. The GDT Price Index fell back to a 14 auction low during the most recent event. The GDT Price Index represents a weighted-average of the percentage changes in prices between trading events for all products offered.

The GDT Price Index finished the March 15th event 28.7% below the previous year and 47.7% below the three year average price for the second auction of March. The GDT Price Index has finished lower on a YOY basis for ten consecutive events through March 15th.

The GDT Price Index finished the March 15th event 28.7% below the previous year and 47.7% below the three year average price for the second auction of March. The GDT Price Index has finished lower on a YOY basis for ten consecutive events through March 15th.

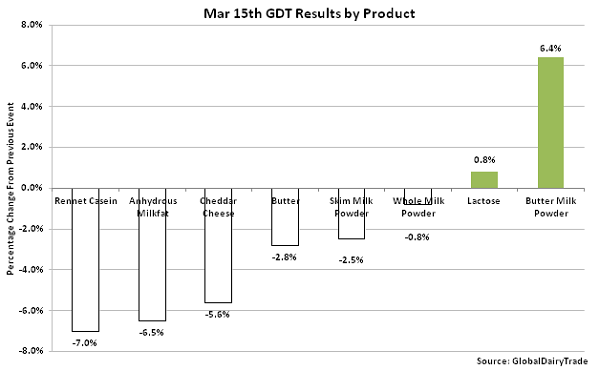

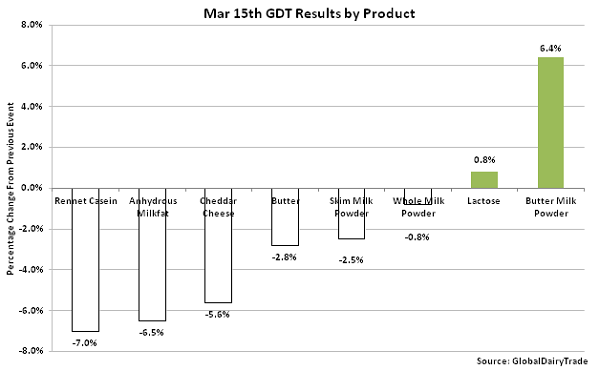

Declines in prices were led by rennet casein (-7.0%), followed by anhydrous milkfat (-6.5%), cheddar cheese (-5.6%), butter (-2.8%), skim milk powder (-2.5%) and whole milk powder (-0.8%). Gains in prices were experienced in butter milk powder (+6.4%) and lactose (+0.8%). U.S. SMP and butter did not trade for the 39th and 40th consecutive times, respectively, at the March 15th event.

Declines in prices were led by rennet casein (-7.0%), followed by anhydrous milkfat (-6.5%), cheddar cheese (-5.6%), butter (-2.8%), skim milk powder (-2.5%) and whole milk powder (-0.8%). Gains in prices were experienced in butter milk powder (+6.4%) and lactose (+0.8%). U.S. SMP and butter did not trade for the 39th and 40th consecutive times, respectively, at the March 15th event.

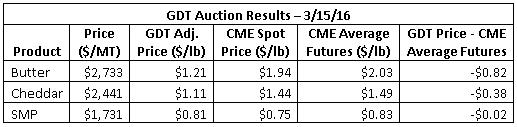

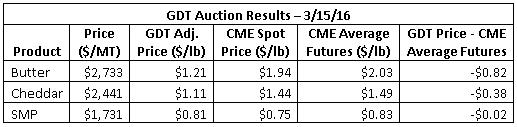

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on March 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on March 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

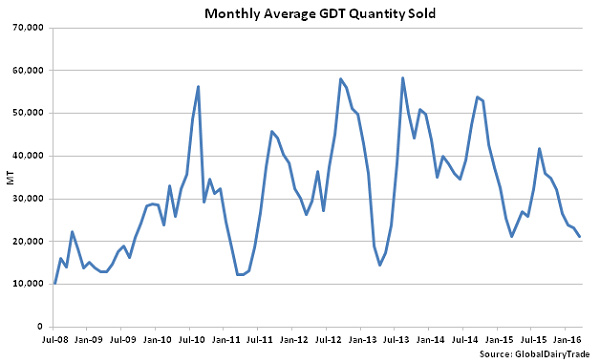

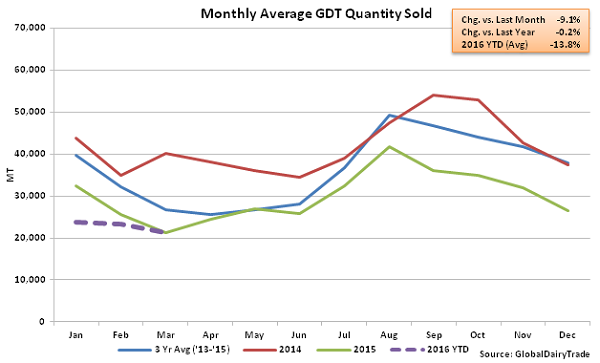

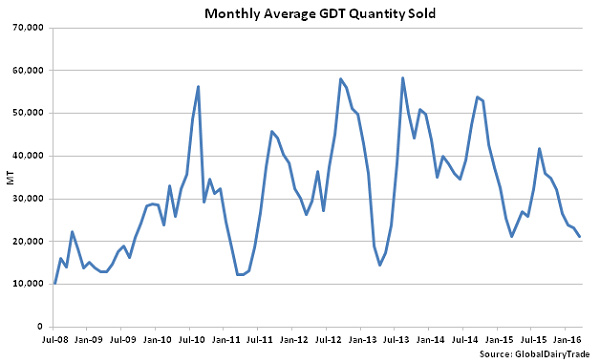

Total quantities sold for all products at the March 15th event of 20,406 MT were 6.7% less than the previous auction and the lowest amount of product sold in the past 12 months.

Total quantities sold for all products at the March 15th event of 20,406 MT were 6.7% less than the previous auction and the lowest amount of product sold in the past 12 months.

Volumes also remained slightly lower on a seasonal basis as total quantities sold for all products within the March auctions were 0.2% below last year’s average volumes sold for the month of March and 20.9% below the previous three year average March quantities sold.

Volumes also remained slightly lower on a seasonal basis as total quantities sold for all products within the March auctions were 0.2% below last year’s average volumes sold for the month of March and 20.9% below the previous three year average March quantities sold.

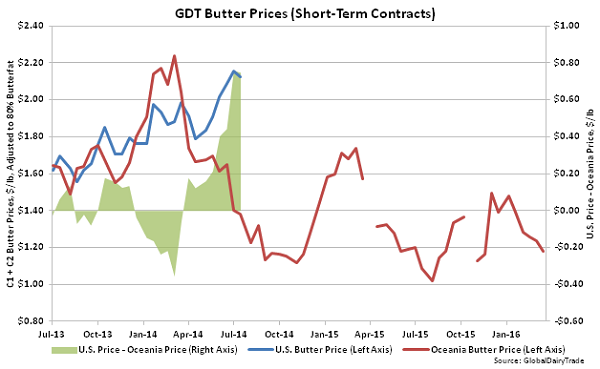

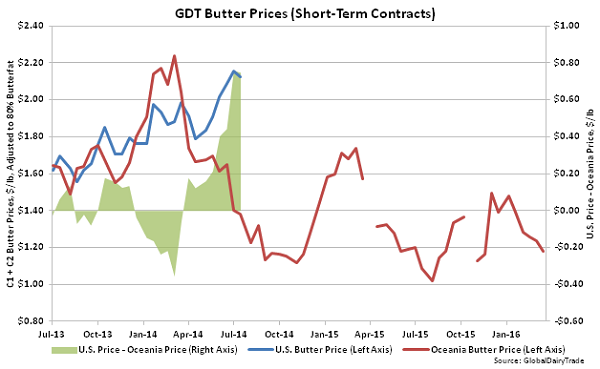

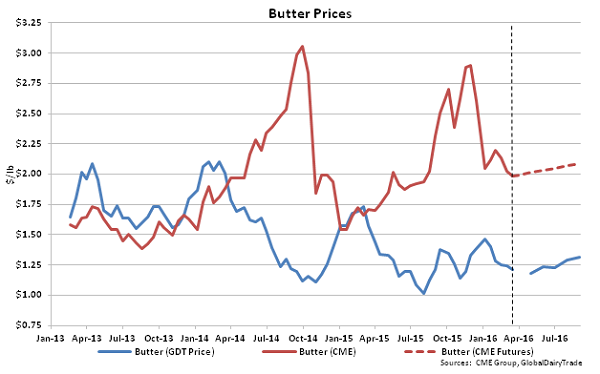

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 40th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to an eight auction low during the most recent event.

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 40th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to an eight auction low during the most recent event.

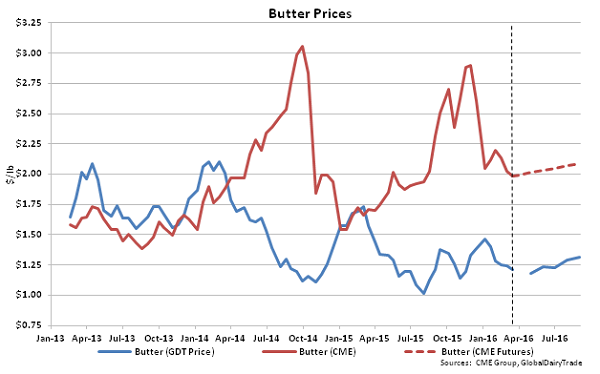

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices beginning in 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 60.4% premium to GDT prices while CME futures prices are trading at a 64.2% premium to GDT prices from May ’16 – Sep ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Apr ’16).

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices beginning in 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 60.4% premium to GDT prices while CME futures prices are trading at a 64.2% premium to GDT prices from May ’16 – Sep ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Apr ’16).

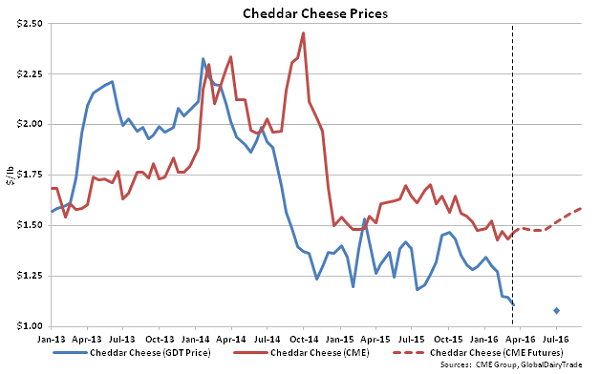

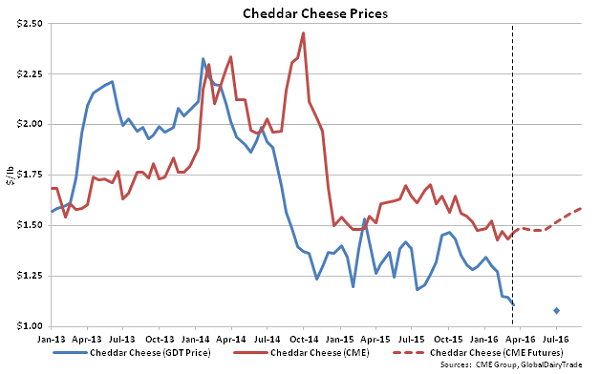

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 30.3% premium to GDT prices while CME futures prices are trading at a 40.5% premium to GDT prices during Jul ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Apr ’16), Contract 2 (May ’16), Contract 3 (Jun ’16), Contract 5 (Aug ’16) and Contract 6 (Sep ’16).

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 30.3% premium to GDT prices while CME futures prices are trading at a 40.5% premium to GDT prices during Jul ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Apr ’16), Contract 2 (May ’16), Contract 3 (Jun ’16), Contract 5 (Aug ’16) and Contract 6 (Sep ’16).

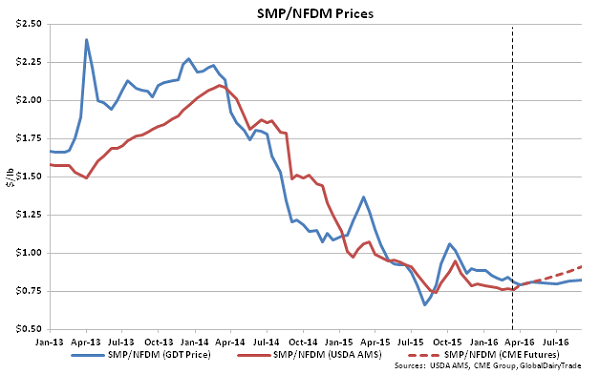

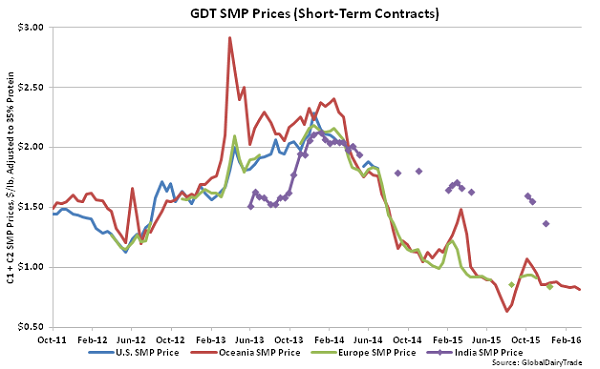

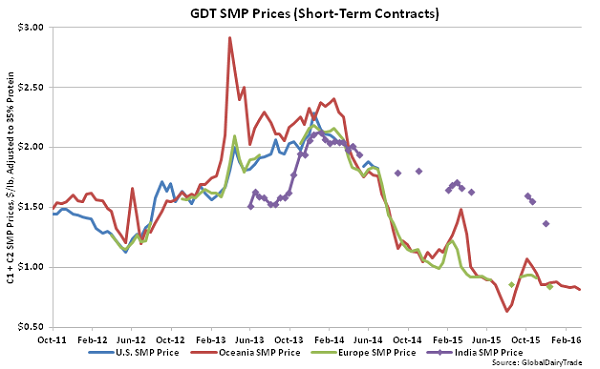

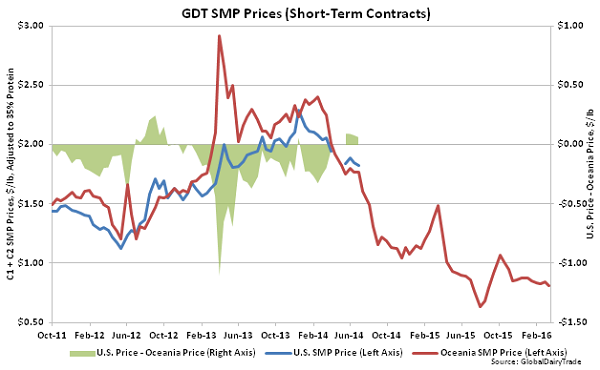

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the sixth consecutive time at the March 1st event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 39th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as Land O’ Lakes has formally withdrawn from the global auction platform. India SMP, representing product sold by Amul, also did not trade at the March 15th event.

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the sixth consecutive time at the March 1st event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 39th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as Land O’ Lakes has formally withdrawn from the global auction platform. India SMP, representing product sold by Amul, also did not trade at the March 15th event.

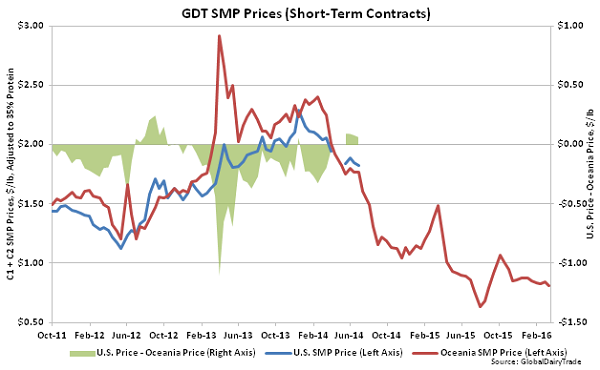

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to trending higher throughout October and then declining once again to a 13 auction low during the March 15th event.

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to trending higher throughout October and then declining once again to a 13 auction low during the March 15th event.

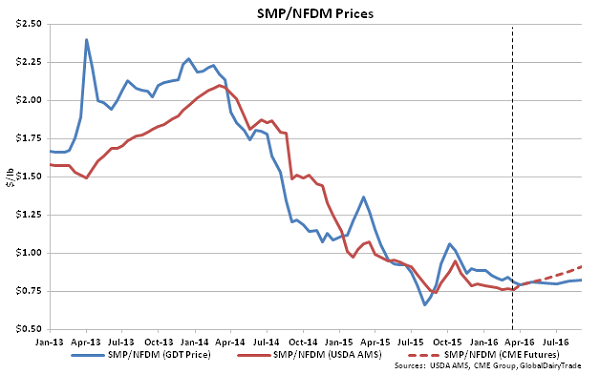

U.S. NFDM spot prices are currently trading 7.8% below GDT SMP prices however U.S. NFDM prices are expected to regain a premium to GDT SMP prices during future months, as U.S. prices are trading at a 4.8% average premium to GDT prices from Apr ’15 – Sep ’15.

U.S. NFDM spot prices are currently trading 7.8% below GDT SMP prices however U.S. NFDM prices are expected to regain a premium to GDT SMP prices during future months, as U.S. prices are trading at a 4.8% average premium to GDT prices from Apr ’15 – Sep ’15.

The GDT Price Index finished the March 15th event 28.7% below the previous year and 47.7% below the three year average price for the second auction of March. The GDT Price Index has finished lower on a YOY basis for ten consecutive events through March 15th.

The GDT Price Index finished the March 15th event 28.7% below the previous year and 47.7% below the three year average price for the second auction of March. The GDT Price Index has finished lower on a YOY basis for ten consecutive events through March 15th.

Declines in prices were led by rennet casein (-7.0%), followed by anhydrous milkfat (-6.5%), cheddar cheese (-5.6%), butter (-2.8%), skim milk powder (-2.5%) and whole milk powder (-0.8%). Gains in prices were experienced in butter milk powder (+6.4%) and lactose (+0.8%). U.S. SMP and butter did not trade for the 39th and 40th consecutive times, respectively, at the March 15th event.

Declines in prices were led by rennet casein (-7.0%), followed by anhydrous milkfat (-6.5%), cheddar cheese (-5.6%), butter (-2.8%), skim milk powder (-2.5%) and whole milk powder (-0.8%). Gains in prices were experienced in butter milk powder (+6.4%) and lactose (+0.8%). U.S. SMP and butter did not trade for the 39th and 40th consecutive times, respectively, at the March 15th event.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on March 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

The table below provides a summary of the most recent GDT weighted average winning prices for key products. Butter has been adjusted to 80% butterfat and SMP has been adjusted to 35% protein content (equivalent to U.S. NFDM) in the $/lb columns below. CME spot and average futures prices are based on March 14th figures. CME average futures prices are weighted average prices based on the most recently reported percentage of the total quantity sold in each GDT contract period.

Total quantities sold for all products at the March 15th event of 20,406 MT were 6.7% less than the previous auction and the lowest amount of product sold in the past 12 months.

Total quantities sold for all products at the March 15th event of 20,406 MT were 6.7% less than the previous auction and the lowest amount of product sold in the past 12 months.

Volumes also remained slightly lower on a seasonal basis as total quantities sold for all products within the March auctions were 0.2% below last year’s average volumes sold for the month of March and 20.9% below the previous three year average March quantities sold.

Volumes also remained slightly lower on a seasonal basis as total quantities sold for all products within the March auctions were 0.2% below last year’s average volumes sold for the month of March and 20.9% below the previous three year average March quantities sold.

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 40th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to an eight auction low during the most recent event.

Within the GDT auction, butter offered by U.S. sellers, representing product sold by Dairy America, did not trade for the 40th straight auction after trading at each auction since being offered in Jul ’13. Butter offered by U.S. sellers for short-term contract periods has recently traded at a significant premium to butter offered by Oceania sellers for short-term contract periods, representing product sold by Fonterra. Jul ’14 U.S. / Oceania butter price premiums within the GDT auction were the highest ever experienced. After declining to record lows during Aug ’15, Fonterra butter prices for short-term contract periods increased to an eight month high during the December 1st auction before once again declining to an eight auction low during the most recent event.

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices beginning in 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 60.4% premium to GDT prices while CME futures prices are trading at a 64.2% premium to GDT prices from May ’16 – Sep ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Apr ’16).

GDT winning prices in butter have been historically higher than U.S. butter prices until the run-up in domestic butter prices beginning in 2014. Over the past 27 bi-weekly events leading up to April ’14, GDT butter prices traded at a $0.19 average premium to U.S. butter prices. From Apr ’14 – Dec ’14, however, U.S. butter prices traded at a $0.92 average premium to GDT butter prices. The U.S. butter price premium was reduced throughout the early months of 2015 but has rebounded over more recent auctions. U.S. spot butter prices are currently trading at a 60.4% premium to GDT prices while CME futures prices are trading at a 64.2% premium to GDT prices from May ’16 – Sep ’16. U.S. butter prices traded at an 83.3% premium to GDT butter prices over the second half of 2014 and a 53.9% premium to GDT butter prices throughout 2015. Butter was not sold at the GDT auction for Contract 1 (Apr ’16).

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 30.3% premium to GDT prices while CME futures prices are trading at a 40.5% premium to GDT prices during Jul ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Apr ’16), Contract 2 (May ’16), Contract 3 (Jun ’16), Contract 5 (Aug ’16) and Contract 6 (Sep ’16).

Cheddar cheese available for purchase at GDT auctions is currently offered only by Fonterra, so GDT winning prices in cheddar cheese are a viable metric for Oceania prices. U.S. cheddar cheese prices have traded at a premium to GDT prices for the majority of the bimonthly events since Jan ’14 after trading at a discount for nearly all of 2013. U.S. spot cheddar cheese prices are currently trading at a 30.3% premium to GDT prices while CME futures prices are trading at a 40.5% premium to GDT prices during Jul ’16. Cheddar cheese was not sold at the GDT auction for Contract 1 (Apr ’16), Contract 2 (May ’16), Contract 3 (Jun ’16), Contract 5 (Aug ’16) and Contract 6 (Sep ’16).

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the sixth consecutive time at the March 1st event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 39th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as Land O’ Lakes has formally withdrawn from the global auction platform. India SMP, representing product sold by Amul, also did not trade at the March 15th event.

Oceania and Europe GDT SMP prices have converged since mid-2014 as prices have moved downward in tandem. Europe SMP did not trade for the sixth consecutive time at the March 1st event, however EU prices at the most recently traded December 15th auction finished at a 3.9% discount to Oceania SMP prices. U.S. SMP, representing product sold by Dairy America, did not trade for the 39th straight auction after trading at 69 consecutive auctions from Oct ’11 to Aug ’14. Dairy America is currently the only U.S. seller offering SMP within the GDT as Land O’ Lakes has formally withdrawn from the global auction platform. India SMP, representing product sold by Amul, also did not trade at the March 15th event.

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to trending higher throughout October and then declining once again to a 13 auction low during the March 15th event.

Although SMP offered by U.S. sellers has not traded since Aug ’14, the most recent U.S. / Oceania SMP price premiums experienced within the GDT auction have been the highest experienced since Sep ’12. Oceania SMP prices for short-term contract periods reached a new low at the August 4th auction prior to trending higher throughout October and then declining once again to a 13 auction low during the March 15th event.

U.S. NFDM spot prices are currently trading 7.8% below GDT SMP prices however U.S. NFDM prices are expected to regain a premium to GDT SMP prices during future months, as U.S. prices are trading at a 4.8% average premium to GDT prices from Apr ’15 – Sep ’15.

U.S. NFDM spot prices are currently trading 7.8% below GDT SMP prices however U.S. NFDM prices are expected to regain a premium to GDT SMP prices during future months, as U.S. prices are trading at a 4.8% average premium to GDT prices from Apr ’15 – Sep ’15.