Chinese Dairy Imports Update – Mar ’16

Executive Summary

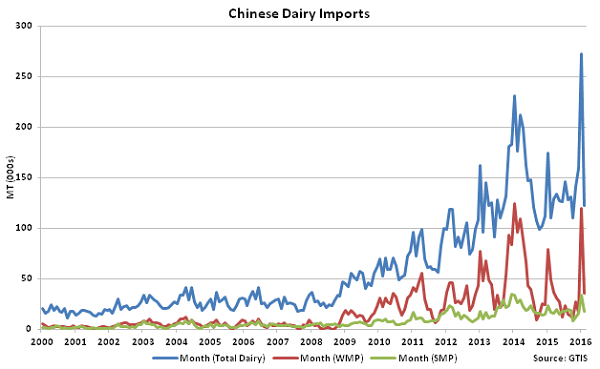

Chinese dairy import figures provided by GTIS were recently updated with values spanning through Feb ’16. Highlights from the updated report include:

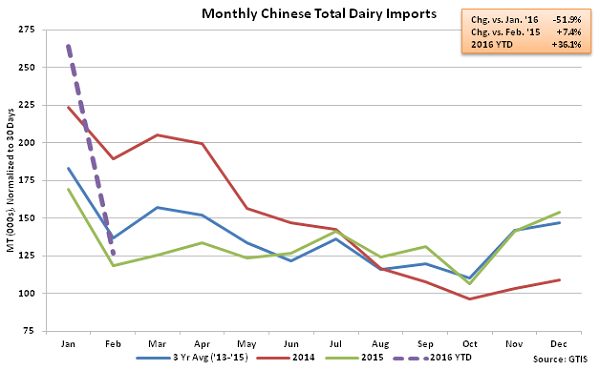

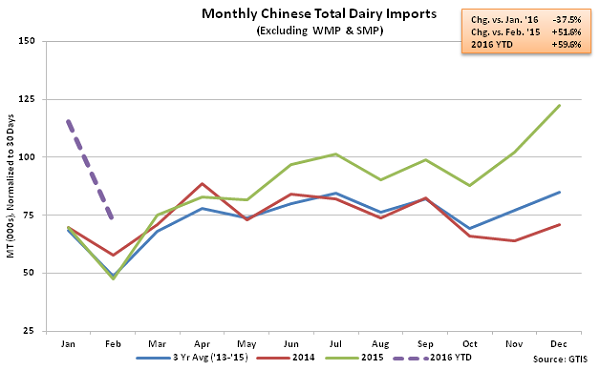

• Feb ’16 total Chinese dairy import volumes declined sharply from the monthly record high experienced during Jan ’16 but remained higher on a YOY basis, finishing up 7.4%.

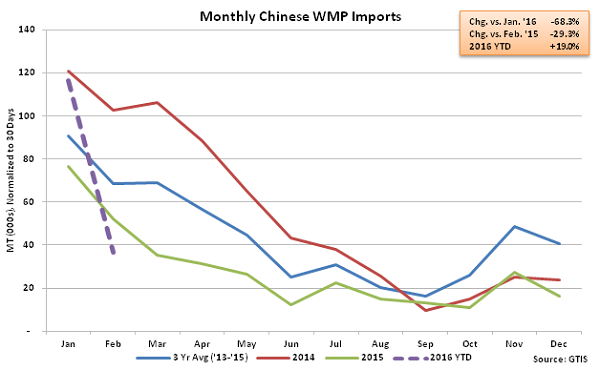

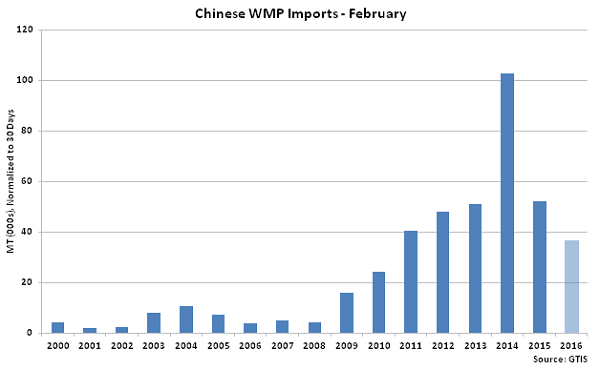

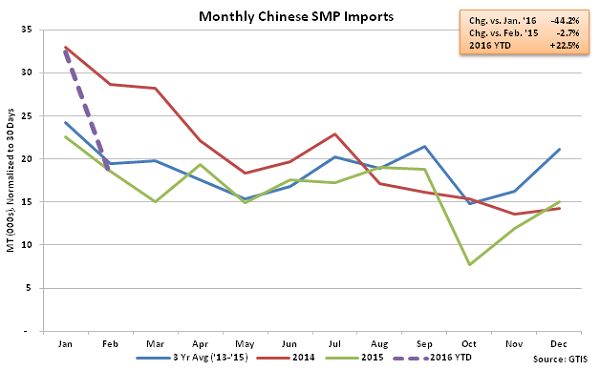

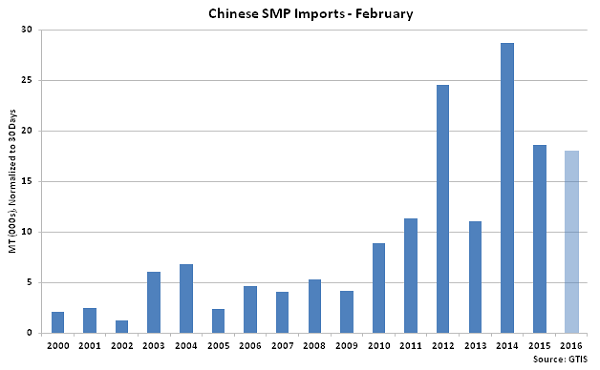

• Feb ’16 Chinese whole milk powder and skim milk powder import volumes finished below the previous year’s levels as importers exceeded annual reduced-tariff milk powder volume quotas during the previous month.

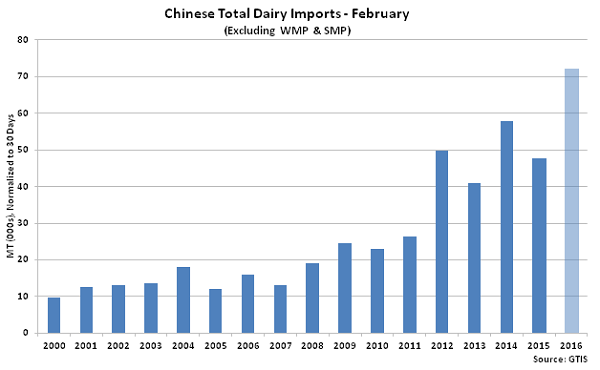

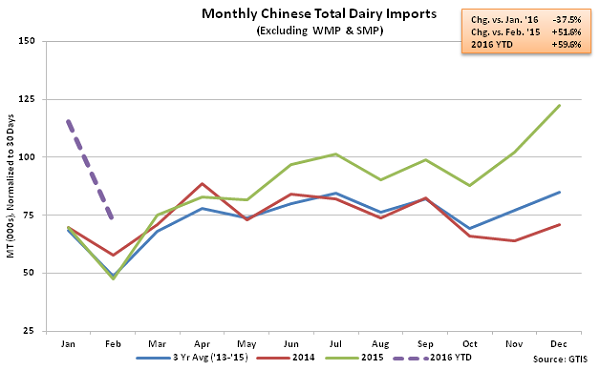

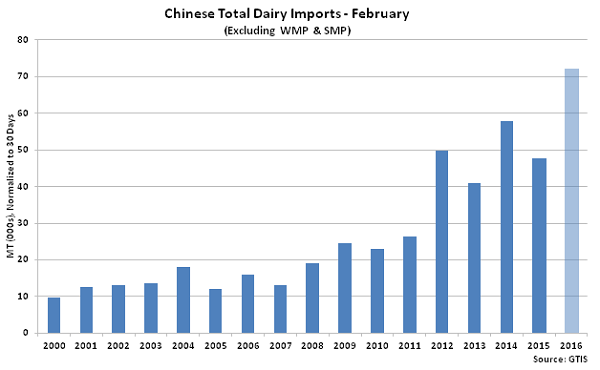

• Feb ’16 Chinese dairy imports excluding whole milk powder and skim milk powder remained strong, finishing up 51.6% YOY to a new record high for the month of February.

Additional Report Details

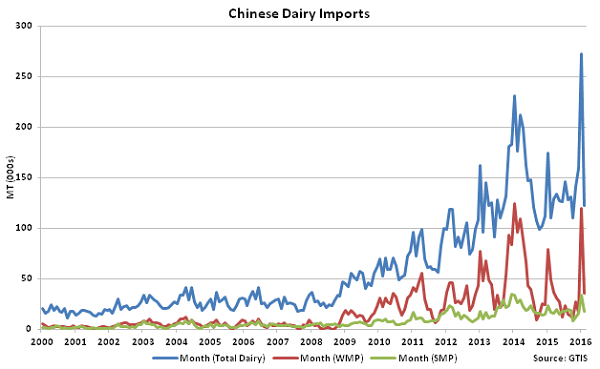

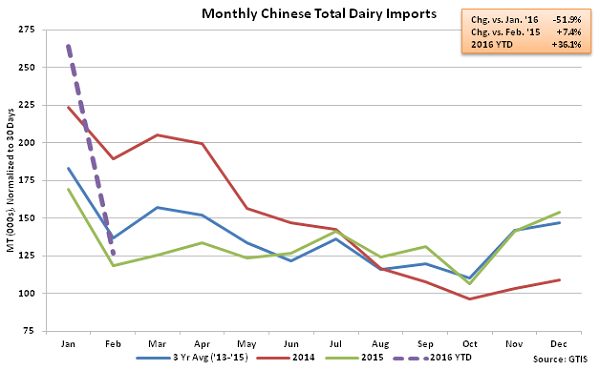

According to GTIS, Feb ’16 total Chinese dairy import volumes declined 51.9% MOM on a daily average basis from the monthly record high experienced during Jan ’16 but remained 7.4% higher on a YOY basis. Total Chinese dairy import volumes have increased YOY for seven consecutive months through February. The January – February MOM decline in import volumes of 51.9% was significantly larger than the ten year average seasonal decline of 13.9%. Total Chinese dairy import volumes have reached seasonal highs in the month of January over each of the past three years.

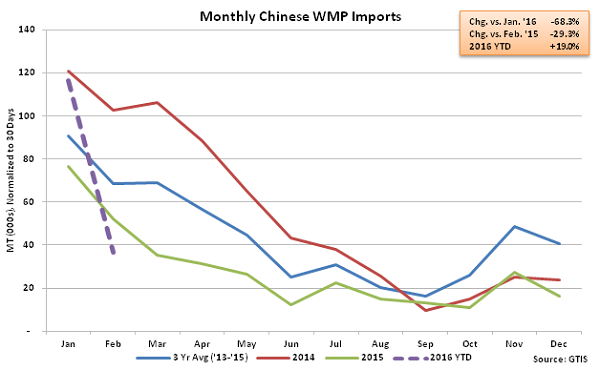

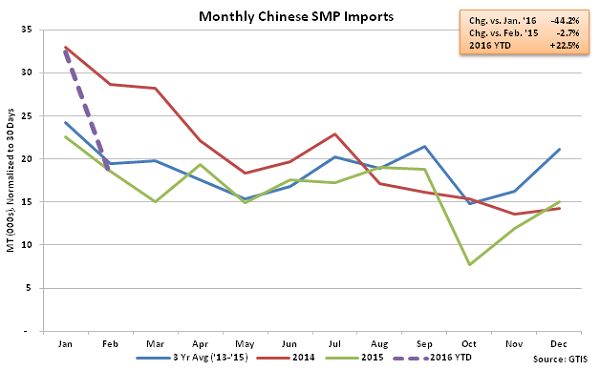

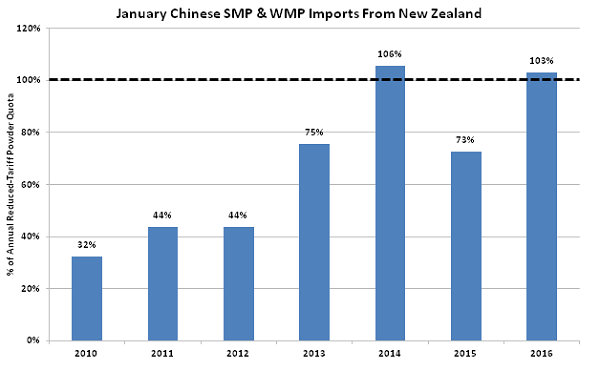

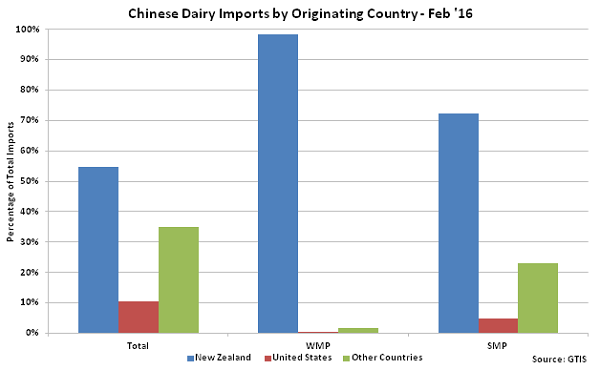

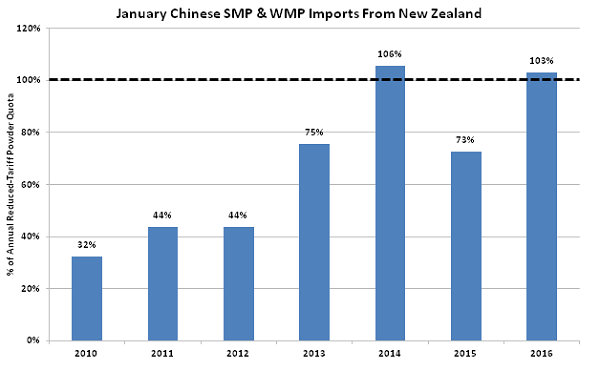

Chinese dairy import volumes typically decline seasonally during February as January volumes are artificially inflated by lower tariff rates offered as part of the New Zealand – China Free Trade Agreement. Jan ’16 combined whole milk powder (WMP) and skim milk powder (SMP) import volumes originating from New Zealand exceeded the total 2016 annual reduced-tariff milk powder volume quota while the 2015 reduced-tariff powder import volume quota was not fully consumed until February. The lack of available reduced-tariff milk powder import availability during Feb ’16 contributed to Chinese WMP and SMP imports declining on a YOY basis by 29.3% and 2.7%, respectively. Feb ’16 Chinese dairy imports excluding WMP and SMP remained strong, however, increasing by 51.6% YOY and finishing at a new record high for the month of February.

Feb ’16 Total Chinese Dairy Import Volumes Declined Sharply From Previous Record Highs

Feb ’16 Total Chinese Dairy Import Volumes Declined 51.9% MOM but Remain up 7.4% YOY

Feb ’16 Total Chinese Dairy Import Volumes Declined 51.9% MOM but Remain up 7.4% YOY

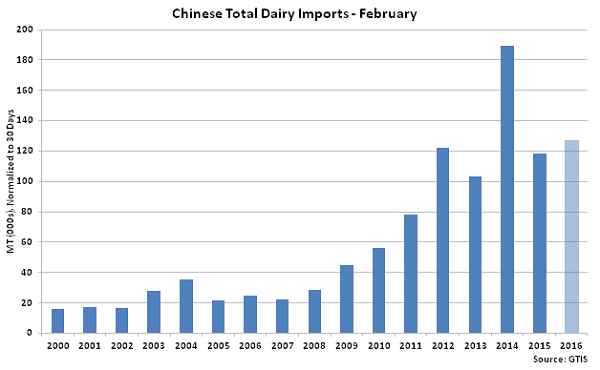

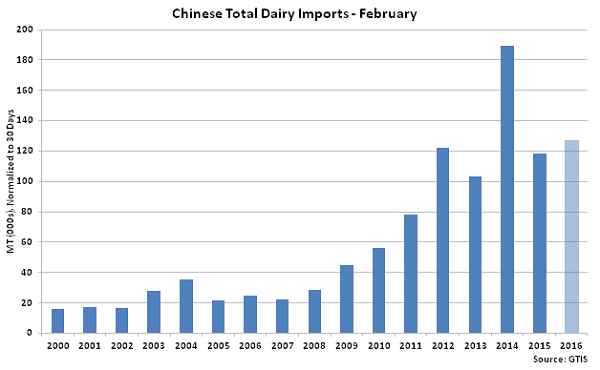

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of February

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of February

Feb ’16 Chinese WMP Import Volumes Declined 68.3% MOM and 29.3% YOY

Feb ’16 Chinese WMP Import Volumes Declined 68.3% MOM and 29.3% YOY

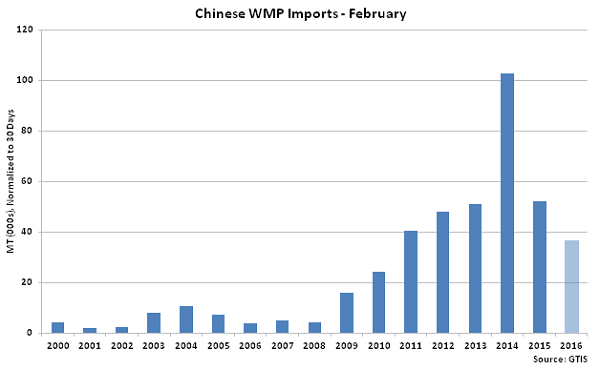

Feb ’16 Chinese WMP Imports Declined to a Six Year Low for the Month of February

Feb ’16 Chinese WMP Imports Declined to a Six Year Low for the Month of February

Feb ’16 Chinese SMP Import Volumes Declined 44.2% MOM and 2.7% YOY

Feb ’16 Chinese SMP Import Volumes Declined 44.2% MOM and 2.7% YOY

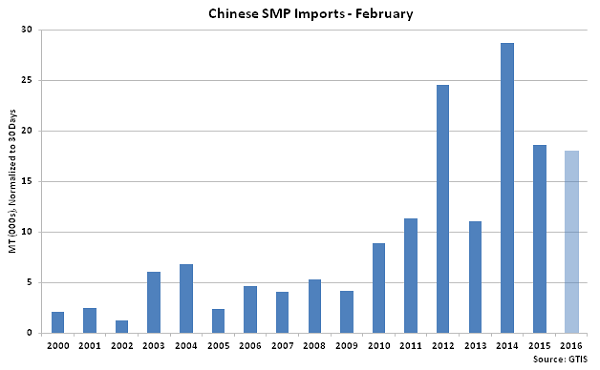

Feb ’16 Chinese SMP Imports Declined to a Three Year Low for the Month of February

Feb ’16 Chinese SMP Imports Declined to a Three Year Low for the Month of February

Chinese Imported Powder Aggressively in Jan ’16 to Take Advantage of Reduced Tariff Rates

Chinese Imported Powder Aggressively in Jan ’16 to Take Advantage of Reduced Tariff Rates

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Down 37.5% MOM but up 51.6% YOY

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Down 37.5% MOM but up 51.6% YOY

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Finished at a February Record High

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Finished at a February Record High

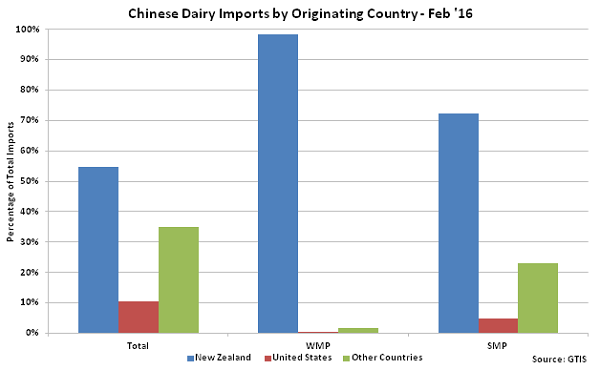

New Zealand Accounted for Over Half of the Total Feb ’16 Chinese Dairy Import Volumes

New Zealand Accounted for Over Half of the Total Feb ’16 Chinese Dairy Import Volumes

Feb ’16 Total Chinese Dairy Import Volumes Declined 51.9% MOM but Remain up 7.4% YOY

Feb ’16 Total Chinese Dairy Import Volumes Declined 51.9% MOM but Remain up 7.4% YOY

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of February

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of February

Feb ’16 Chinese WMP Import Volumes Declined 68.3% MOM and 29.3% YOY

Feb ’16 Chinese WMP Import Volumes Declined 68.3% MOM and 29.3% YOY

Feb ’16 Chinese WMP Imports Declined to a Six Year Low for the Month of February

Feb ’16 Chinese WMP Imports Declined to a Six Year Low for the Month of February

Feb ’16 Chinese SMP Import Volumes Declined 44.2% MOM and 2.7% YOY

Feb ’16 Chinese SMP Import Volumes Declined 44.2% MOM and 2.7% YOY

Feb ’16 Chinese SMP Imports Declined to a Three Year Low for the Month of February

Feb ’16 Chinese SMP Imports Declined to a Three Year Low for the Month of February

Chinese Imported Powder Aggressively in Jan ’16 to Take Advantage of Reduced Tariff Rates

Chinese Imported Powder Aggressively in Jan ’16 to Take Advantage of Reduced Tariff Rates

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Down 37.5% MOM but up 51.6% YOY

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Down 37.5% MOM but up 51.6% YOY

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Finished at a February Record High

Feb ’16 Chinese Dairy Imports Excluding WMP & SMP Finished at a February Record High

New Zealand Accounted for Over Half of the Total Feb ’16 Chinese Dairy Import Volumes

New Zealand Accounted for Over Half of the Total Feb ’16 Chinese Dairy Import Volumes