New Zealand Milk Production Update – Mar ’16

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Feb ’16. Highlights from the updated report include:

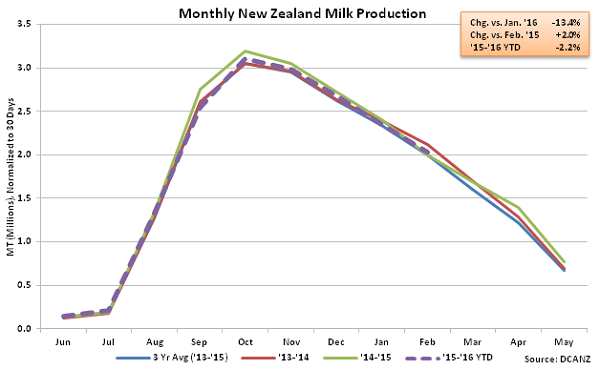

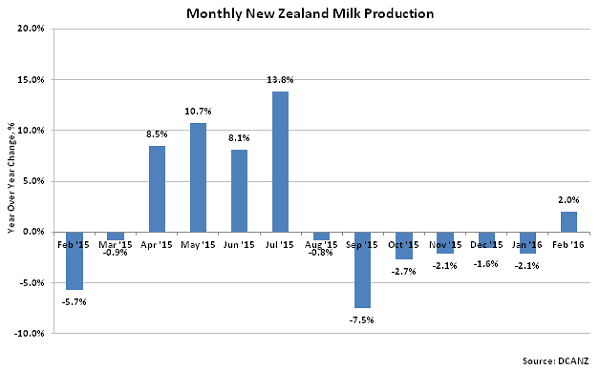

• New Zealand milk production increased on a YOY basis for the first time in seven months during Feb ’16, finishing 2.0% above the previous year when adjusting for leap year.

• Concerns of a significant El Niño event negatively affecting pasture conditions have largely been reduced and although producers have reduced stocking rates and supplementary feeding, YTD milk production declines are unlikely to reach Fonterra’s projection of 4.0%.

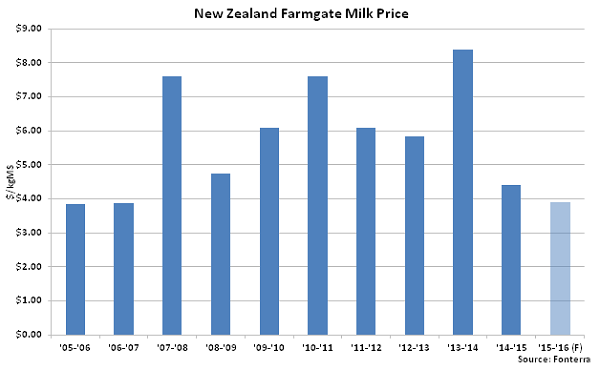

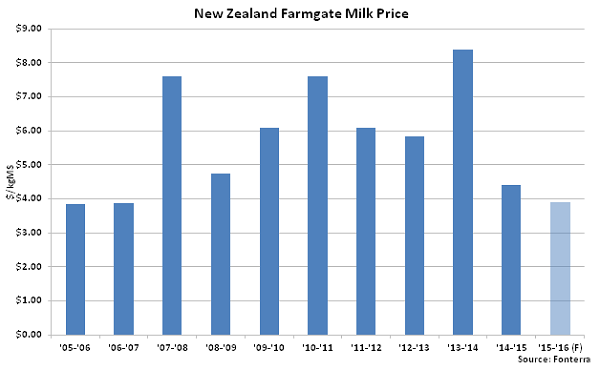

• ’15-’16 New Zealand Farmgate Milk Price projections were revised downward to a nine year low however the recently announced $0.20/kgMS cash dividend set to be paid in April is expected to provide temporary relief to producers.

Additional Report Details

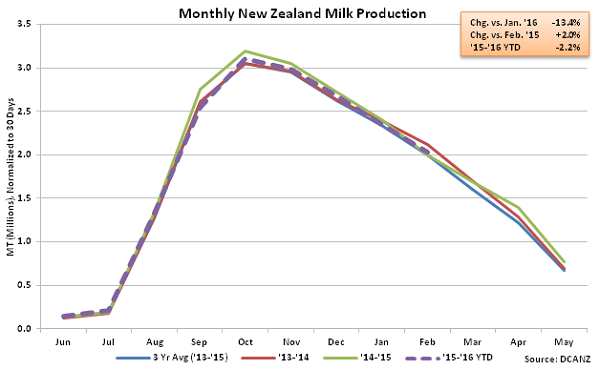

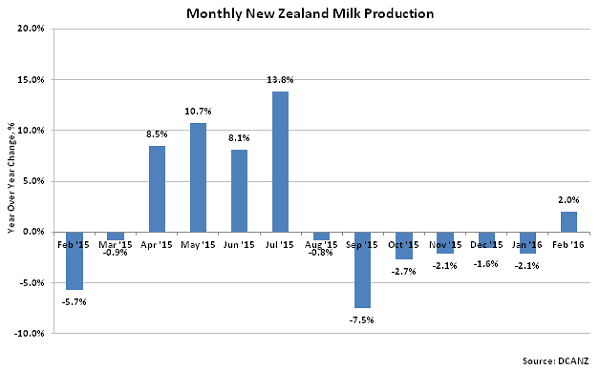

According to DCANZ, Jan ’16 New Zealand milk production increased on a YOY basis for the first time in seven months, finishing 2.0% above the previous year. Milk production continued to decline seasonally, however, finishing 13.4% lower MOM on a daily average basis. The MOM decline was slightly larger than the five year average January – February seasonal decline of 12.2%.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.2% throughout the first three quarters of the production season, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%. Reduced stocking rates and supplementary feeding is expected to result in additional YOY declines throughout the duration of the ’15-’16 New Zealand production season according to Fonterra, however Fonterra collections would need to decline by 6.3% YOY over the final quarter of the ’15-’16 production season to reach the projected 4.0% annual decline.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.2% throughout the first three quarters of the production season, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%. Reduced stocking rates and supplementary feeding is expected to result in additional YOY declines throughout the duration of the ’15-’16 New Zealand production season according to Fonterra, however Fonterra collections would need to decline by 6.3% YOY over the final quarter of the ’15-’16 production season to reach the projected 4.0% annual decline.

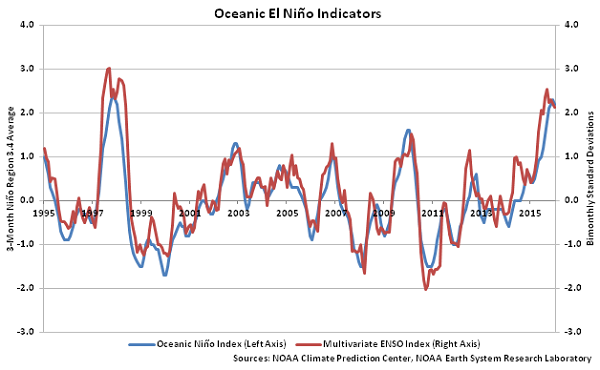

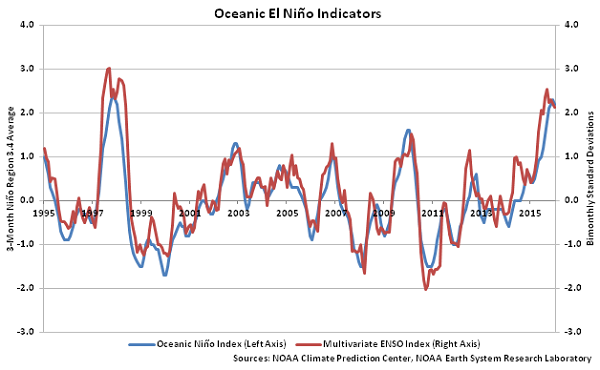

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each declined off of 17 year highs experienced during late 2015 over recent months.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each declined off of 17 year highs experienced during late 2015 over recent months.

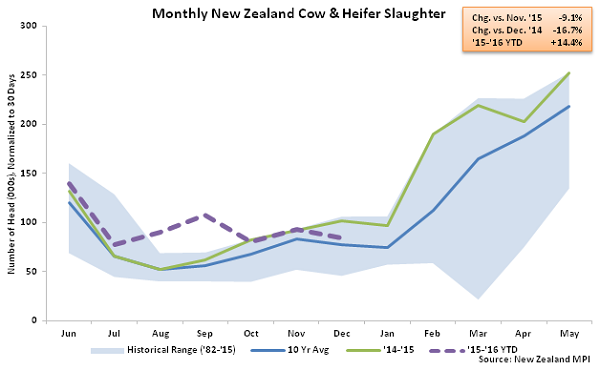

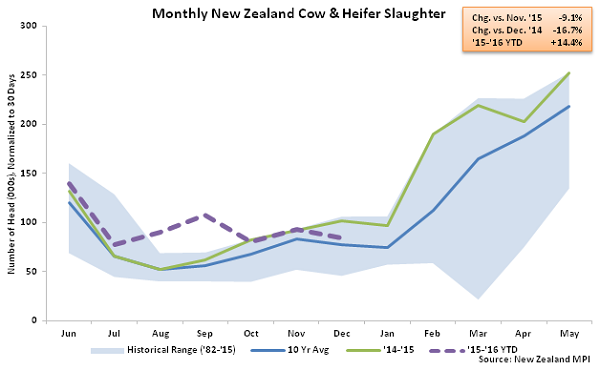

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In early Mar ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.25/kgMS, or 6.0%, to $3.90/kgMS, a nine year low. The current price forecast would be $0.50/kgMS, or 11.4%, below the ’14-’15 pay price and $1.95/kgMS, or 33.3%, below the ten year average price. The Fonterra forecasted ’15-’16 Farmgate Milk Price has been revised a total of $0.70/kgMS lower throughout the early months of 2016 as oversupplied global markets have been slow to respond with production cuts, particularly within the EU-28. Fonterra announced that it would bring forward cash a $0.20/kgMS cash dividend to producers paid in April, with two additional $0.10/kgMS payments being made in May and August to help smooth out cash flow deficits experienced due to low farmgate milk prices.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In early Mar ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.25/kgMS, or 6.0%, to $3.90/kgMS, a nine year low. The current price forecast would be $0.50/kgMS, or 11.4%, below the ’14-’15 pay price and $1.95/kgMS, or 33.3%, below the ten year average price. The Fonterra forecasted ’15-’16 Farmgate Milk Price has been revised a total of $0.70/kgMS lower throughout the early months of 2016 as oversupplied global markets have been slow to respond with production cuts, particularly within the EU-28. Fonterra announced that it would bring forward cash a $0.20/kgMS cash dividend to producers paid in April, with two additional $0.10/kgMS payments being made in May and August to help smooth out cash flow deficits experienced due to low farmgate milk prices.

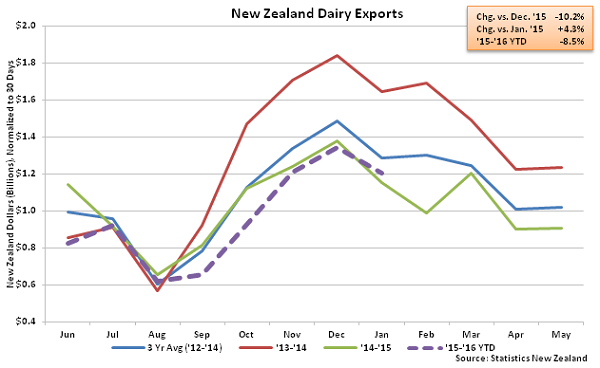

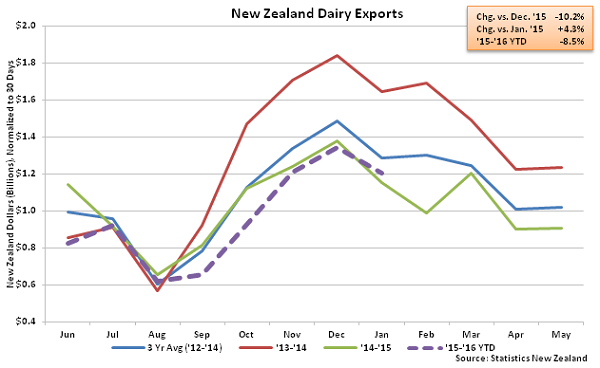

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports increased on a YOY basis for the first time in six months during Jan ‘16, finishing 4.3% below the previous year, however ’15-’16 YTD export volumes remain down 8.5% YOY throughout the first two thirds of the production season.

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports increased on a YOY basis for the first time in six months during Jan ‘16, finishing 4.3% below the previous year, however ’15-’16 YTD export volumes remain down 8.5% YOY throughout the first two thirds of the production season.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.2% throughout the first three quarters of the production season, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%. Reduced stocking rates and supplementary feeding is expected to result in additional YOY declines throughout the duration of the ’15-’16 New Zealand production season according to Fonterra, however Fonterra collections would need to decline by 6.3% YOY over the final quarter of the ’15-’16 production season to reach the projected 4.0% annual decline.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, better than anticipated growing conditions have resulted in only moderate YOY declines in milk production over recent months. ’15-’16 YTD New Zealand milk production is down just 2.2% throughout the first three quarters of the production season, significantly less than Fonterra’s Mar ’16 projected annual YOY decline in milk collections of 4.0%. Reduced stocking rates and supplementary feeding is expected to result in additional YOY declines throughout the duration of the ’15-’16 New Zealand production season according to Fonterra, however Fonterra collections would need to decline by 6.3% YOY over the final quarter of the ’15-’16 production season to reach the projected 4.0% annual decline.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each declined off of 17 year highs experienced during late 2015 over recent months.

Timely rainfall was experienced across the majority of New Zealand during the early months of 2016, reducing seasonally higher than average soil moisture deficits experienced in late 2015. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each declined off of 17 year highs experienced during late 2015 over recent months.

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Improving weather conditions contributed to a sharp YOY decline in New Zealand cow & heifer slaughter rates throughout Dec ’15. Dec ’15 slaughter rates finished 16.7% below the previous year, which was the largest YOY decline experienced in the past 22 months. ’15-’16 YTD slaughter rates remain up 14.4% throughout the first seven months of the production season however, historically, nearly two thirds of total annual New Zealand cow & heifer slaughter occurs from January – April as production declines seasonally throughout the Southern Hemisphere winter months.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In early Mar ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.25/kgMS, or 6.0%, to $3.90/kgMS, a nine year low. The current price forecast would be $0.50/kgMS, or 11.4%, below the ’14-’15 pay price and $1.95/kgMS, or 33.3%, below the ten year average price. The Fonterra forecasted ’15-’16 Farmgate Milk Price has been revised a total of $0.70/kgMS lower throughout the early months of 2016 as oversupplied global markets have been slow to respond with production cuts, particularly within the EU-28. Fonterra announced that it would bring forward cash a $0.20/kgMS cash dividend to producers paid in April, with two additional $0.10/kgMS payments being made in May and August to help smooth out cash flow deficits experienced due to low farmgate milk prices.

Despite the YOY decline experienced in Dec ’15, slaughter rates have remained higher YTD as New Zealand Farmgate Milk Prices remain weak. In early Mar ’16, Fonterra revised its forecasted ’15-’16 Farmgate Milk Price lower by $0.25/kgMS, or 6.0%, to $3.90/kgMS, a nine year low. The current price forecast would be $0.50/kgMS, or 11.4%, below the ’14-’15 pay price and $1.95/kgMS, or 33.3%, below the ten year average price. The Fonterra forecasted ’15-’16 Farmgate Milk Price has been revised a total of $0.70/kgMS lower throughout the early months of 2016 as oversupplied global markets have been slow to respond with production cuts, particularly within the EU-28. Fonterra announced that it would bring forward cash a $0.20/kgMS cash dividend to producers paid in April, with two additional $0.10/kgMS payments being made in May and August to help smooth out cash flow deficits experienced due to low farmgate milk prices.

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports increased on a YOY basis for the first time in six months during Jan ‘16, finishing 4.3% below the previous year, however ’15-’16 YTD export volumes remain down 8.5% YOY throughout the first two thirds of the production season.

In addition to lower Farmgate Milk Prices, weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports increased on a YOY basis for the first time in six months during Jan ‘16, finishing 4.3% below the previous year, however ’15-’16 YTD export volumes remain down 8.5% YOY throughout the first two thirds of the production season.