U.S. Livestock & Meat Trade Update – May ’16

Executive Summary

U.S. livestock and meat trade figures provided by USDA were recently updated with values spanning through Mar ’16. Highlights from the updated report include:

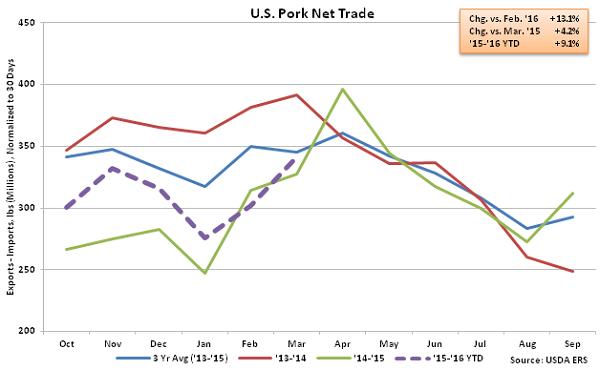

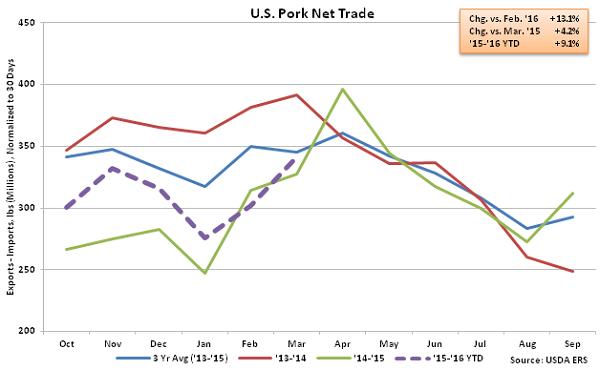

• Net pork trade remained higher on a YOY basis for the seventh time in the past eight months during Mar ’16, finishing 4.2% above the previous year as export volumes increased and import volumes declined from record seasonal highs experienced during the previous year.

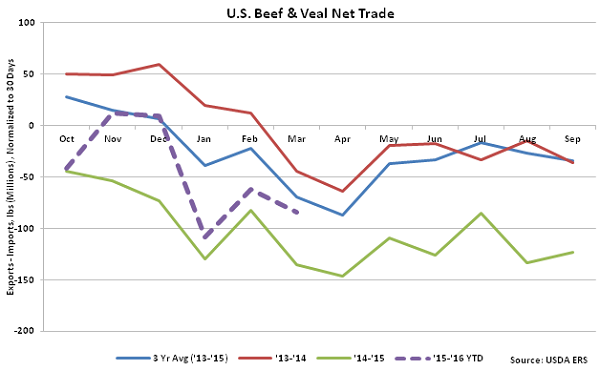

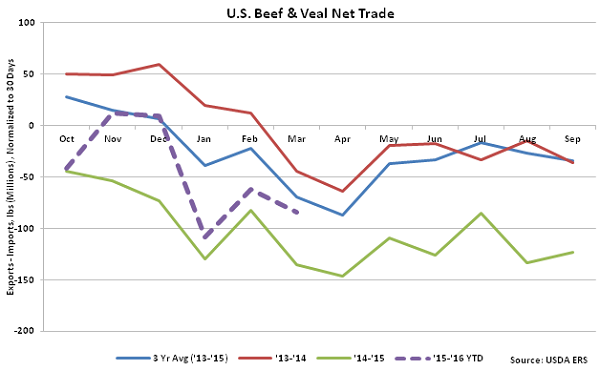

• Net beef & veal trade remained negative for the third consecutive month during Mar ’16, despite import volumes declining on a YOY basis for the sixth consecutive month.

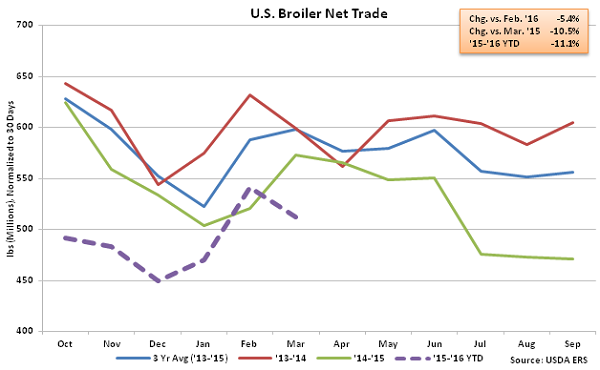

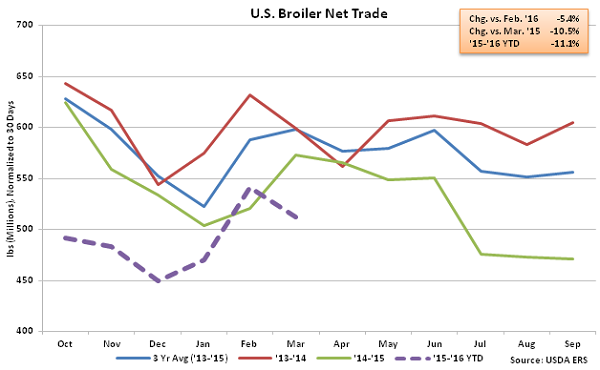

• Net broiler trade remained lower on a YOY basis for the 10th time in the past 12 months during Mar ’16, finishing 10.5% below the previous year.

Additional Report Details

Pork – Net Trade Finishes Higher on a YOY Basis for the Seventh Time in the Past Eight Months

According to USDA, Mar ’16 U.S. pork export volumes increased 9.6% MOM on a daily average basis and 2.9% YOY, finishing higher for the seventh time in the past eight months. Of the major export destinations, YOY increases in export volumes were led by shipments to Hong Kong, Taiwan and China (+103.2%) and Japan (+19.5%). The YOY increases in shipments to China and Japan more than offset YOY declines in U.S. pork exports volumes destined to South Korea (-18.2%), Mexico (-17.0%) and Canada (-2.4%). U.S. pork export volumes destined to the aforementioned countries accounted for nearly 85% of all pork export volumes during Mar ’16.

Mar ’16 U.S. pork imports declined by 1.4% YOY from the record seasonal high experienced during the previous year. The decline in pork imports, coupled with the increase in export volumes, resulted in Mar ’16 U.S. net pork trade finishing up 4.2% YOY. ’14-’15 annual net pork trade finished down 10.0% to a new five year low, however ’15-’16 net pork trade is up 9.1% YOY throughout the first half of the production season.

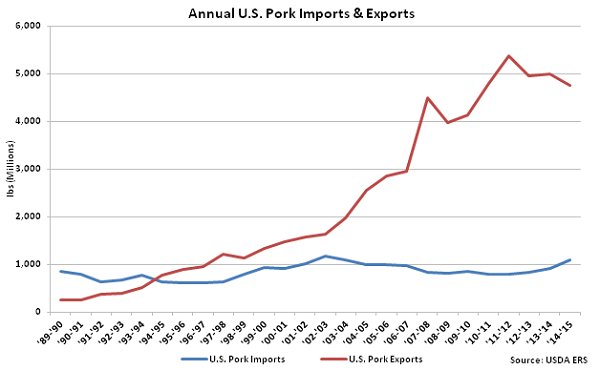

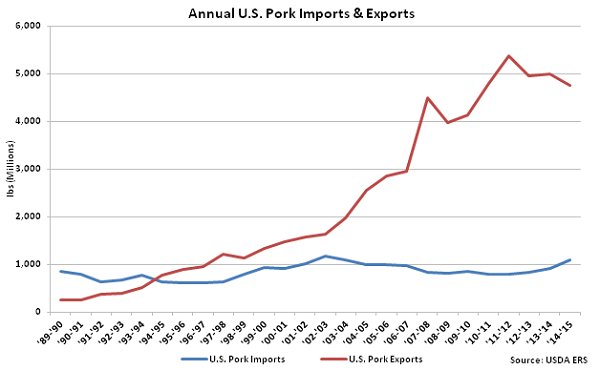

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes remained over four times as large as import volumes throughout the ’14-’15 production season, despite declining to a five year low on an absolute basis.

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes remained over four times as large as import volumes throughout the ’14-’15 production season, despite declining to a five year low on an absolute basis.

Beef & Veal – Net Trade Remains Negative for the Third Consecutive Month

According to USDA, Mar ’16 U.S. beef & veal export volumes increased on a YOY basis for only the second time in the past 18 months, finishing up 0.9%. Of the major export destinations, YOY increases in export volumes were led by shipments destined to South Korea (+11.8%), Mexico (+7.4%), Japan (+3.6%) and Hong Kong, Taiwan and China (+1.4%). Export volumes destined to Canada declines on a YOY basis for the fourth consecutive month, however, finishing down 9.0%. U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Mar ’16.

Mar ’16 U.S. beef & veal import volumes remained lower on a YOY basis for the sixth consecutive month, finishing down 15.8%. Despite YOY declines in beef & veal import volumes, Mar ’16 net beef & veal trade remained negative for the third consecutive month as U.S. beef & veal import volumes continued to exceed export volumes.

Beef & Veal – Net Trade Remains Negative for the Third Consecutive Month

According to USDA, Mar ’16 U.S. beef & veal export volumes increased on a YOY basis for only the second time in the past 18 months, finishing up 0.9%. Of the major export destinations, YOY increases in export volumes were led by shipments destined to South Korea (+11.8%), Mexico (+7.4%), Japan (+3.6%) and Hong Kong, Taiwan and China (+1.4%). Export volumes destined to Canada declines on a YOY basis for the fourth consecutive month, however, finishing down 9.0%. U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Mar ’16.

Mar ’16 U.S. beef & veal import volumes remained lower on a YOY basis for the sixth consecutive month, finishing down 15.8%. Despite YOY declines in beef & veal import volumes, Mar ’16 net beef & veal trade remained negative for the third consecutive month as U.S. beef & veal import volumes continued to exceed export volumes.

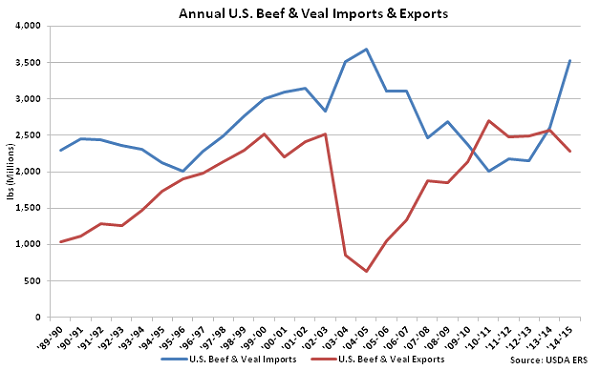

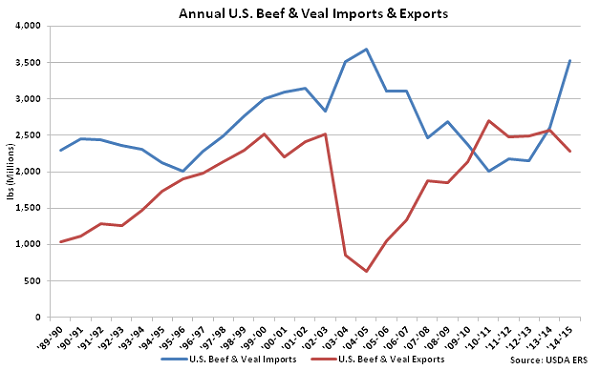

’13-’14 annual U.S. beef & veal imports finished higher than annual U.S. beef & veal exports for the first time in four years. This trend continued into the ’14-’15 production season as annual imports increased to a ten year high and beef & veal net trade declined to an eight year low.

’13-’14 annual U.S. beef & veal imports finished higher than annual U.S. beef & veal exports for the first time in four years. This trend continued into the ’14-’15 production season as annual imports increased to a ten year high and beef & veal net trade declined to an eight year low.

Chicken –Net Broiler Trade Declines on a YOY Basis for the Tenth Time in the Past 12 Months

Mar ’16 U.S. broiler export volumes declined 5.2% MOM on a daily average basis while also finishing 10.2% below the previous year. Broiler export volumes have declined on a YOY basis over ten of the past 12 months through March. YOY declines in broiler export volumes were widespread across major export destinations, led by combined shipments to Hong Kong, Taiwan and China (-43.0%), Mexico (-9.6%) and Canada (-7.1%).

Mar ’16 U.S. broiler imports continued to increase on a YOY basis, finishing up 9.2%. Broiler imports remain at insignificant levels relative to export volumes, with Mar ’16 imports amounting to only 2.3% of export volumes. YOY declines in broiler export volumes, coupled with YOY increases in broiler import volumes, resulting in U.S. broiler net trade finishing 10.5% lower YOY. Net broiler trade declined 10.9% throughout the ’14-’15 production season and is down an additional 11.1% throughout the first half of the ’15-’16 production season.

Chicken –Net Broiler Trade Declines on a YOY Basis for the Tenth Time in the Past 12 Months

Mar ’16 U.S. broiler export volumes declined 5.2% MOM on a daily average basis while also finishing 10.2% below the previous year. Broiler export volumes have declined on a YOY basis over ten of the past 12 months through March. YOY declines in broiler export volumes were widespread across major export destinations, led by combined shipments to Hong Kong, Taiwan and China (-43.0%), Mexico (-9.6%) and Canada (-7.1%).

Mar ’16 U.S. broiler imports continued to increase on a YOY basis, finishing up 9.2%. Broiler imports remain at insignificant levels relative to export volumes, with Mar ’16 imports amounting to only 2.3% of export volumes. YOY declines in broiler export volumes, coupled with YOY increases in broiler import volumes, resulting in U.S. broiler net trade finishing 10.5% lower YOY. Net broiler trade declined 10.9% throughout the ’14-’15 production season and is down an additional 11.1% throughout the first half of the ’15-’16 production season.

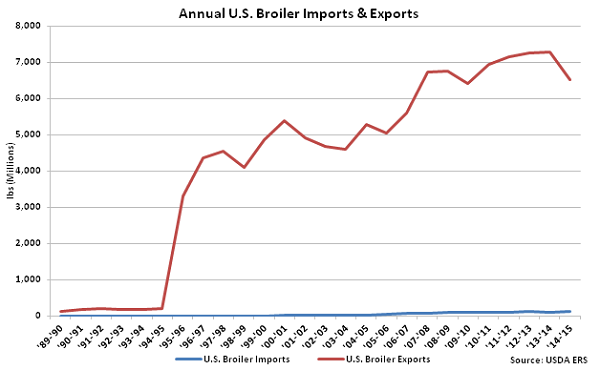

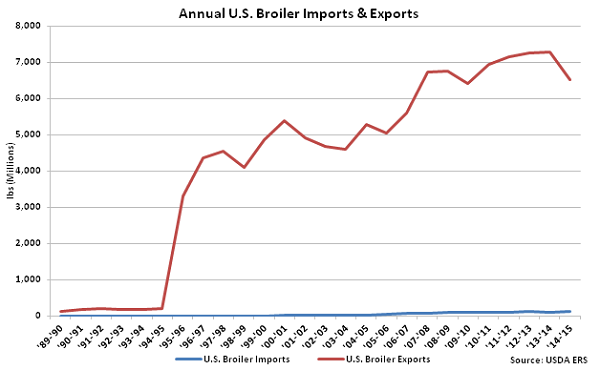

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes remained 54 times as large as import volumes throughout the ’14-’15 production season despite declining to a five year low on an absolute basis.

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes remained 54 times as large as import volumes throughout the ’14-’15 production season despite declining to a five year low on an absolute basis.

Combined net trade of U.S. pork, beef and broilers increased YOY for the fifth consecutive month during Mar ’16 as increases in the net trade of beef and pork more than offset a decline in broiler net trade. Combined net trade of pork, beef and broilers had declined for 19 consecutive months from Apr ’14 – Oct ’15 and finished down 21.4% YOY throughout the ’14-’15 production season.

Combined net trade of U.S. pork, beef and broilers increased YOY for the fifth consecutive month during Mar ’16 as increases in the net trade of beef and pork more than offset a decline in broiler net trade. Combined net trade of pork, beef and broilers had declined for 19 consecutive months from Apr ’14 – Oct ’15 and finished down 21.4% YOY throughout the ’14-’15 production season.

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes remained over four times as large as import volumes throughout the ’14-’15 production season, despite declining to a five year low on an absolute basis.

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes remained over four times as large as import volumes throughout the ’14-’15 production season, despite declining to a five year low on an absolute basis.

Beef & Veal – Net Trade Remains Negative for the Third Consecutive Month

According to USDA, Mar ’16 U.S. beef & veal export volumes increased on a YOY basis for only the second time in the past 18 months, finishing up 0.9%. Of the major export destinations, YOY increases in export volumes were led by shipments destined to South Korea (+11.8%), Mexico (+7.4%), Japan (+3.6%) and Hong Kong, Taiwan and China (+1.4%). Export volumes destined to Canada declines on a YOY basis for the fourth consecutive month, however, finishing down 9.0%. U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Mar ’16.

Mar ’16 U.S. beef & veal import volumes remained lower on a YOY basis for the sixth consecutive month, finishing down 15.8%. Despite YOY declines in beef & veal import volumes, Mar ’16 net beef & veal trade remained negative for the third consecutive month as U.S. beef & veal import volumes continued to exceed export volumes.

Beef & Veal – Net Trade Remains Negative for the Third Consecutive Month

According to USDA, Mar ’16 U.S. beef & veal export volumes increased on a YOY basis for only the second time in the past 18 months, finishing up 0.9%. Of the major export destinations, YOY increases in export volumes were led by shipments destined to South Korea (+11.8%), Mexico (+7.4%), Japan (+3.6%) and Hong Kong, Taiwan and China (+1.4%). Export volumes destined to Canada declines on a YOY basis for the fourth consecutive month, however, finishing down 9.0%. U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Mar ’16.

Mar ’16 U.S. beef & veal import volumes remained lower on a YOY basis for the sixth consecutive month, finishing down 15.8%. Despite YOY declines in beef & veal import volumes, Mar ’16 net beef & veal trade remained negative for the third consecutive month as U.S. beef & veal import volumes continued to exceed export volumes.

’13-’14 annual U.S. beef & veal imports finished higher than annual U.S. beef & veal exports for the first time in four years. This trend continued into the ’14-’15 production season as annual imports increased to a ten year high and beef & veal net trade declined to an eight year low.

’13-’14 annual U.S. beef & veal imports finished higher than annual U.S. beef & veal exports for the first time in four years. This trend continued into the ’14-’15 production season as annual imports increased to a ten year high and beef & veal net trade declined to an eight year low.

Chicken –Net Broiler Trade Declines on a YOY Basis for the Tenth Time in the Past 12 Months

Mar ’16 U.S. broiler export volumes declined 5.2% MOM on a daily average basis while also finishing 10.2% below the previous year. Broiler export volumes have declined on a YOY basis over ten of the past 12 months through March. YOY declines in broiler export volumes were widespread across major export destinations, led by combined shipments to Hong Kong, Taiwan and China (-43.0%), Mexico (-9.6%) and Canada (-7.1%).

Mar ’16 U.S. broiler imports continued to increase on a YOY basis, finishing up 9.2%. Broiler imports remain at insignificant levels relative to export volumes, with Mar ’16 imports amounting to only 2.3% of export volumes. YOY declines in broiler export volumes, coupled with YOY increases in broiler import volumes, resulting in U.S. broiler net trade finishing 10.5% lower YOY. Net broiler trade declined 10.9% throughout the ’14-’15 production season and is down an additional 11.1% throughout the first half of the ’15-’16 production season.

Chicken –Net Broiler Trade Declines on a YOY Basis for the Tenth Time in the Past 12 Months

Mar ’16 U.S. broiler export volumes declined 5.2% MOM on a daily average basis while also finishing 10.2% below the previous year. Broiler export volumes have declined on a YOY basis over ten of the past 12 months through March. YOY declines in broiler export volumes were widespread across major export destinations, led by combined shipments to Hong Kong, Taiwan and China (-43.0%), Mexico (-9.6%) and Canada (-7.1%).

Mar ’16 U.S. broiler imports continued to increase on a YOY basis, finishing up 9.2%. Broiler imports remain at insignificant levels relative to export volumes, with Mar ’16 imports amounting to only 2.3% of export volumes. YOY declines in broiler export volumes, coupled with YOY increases in broiler import volumes, resulting in U.S. broiler net trade finishing 10.5% lower YOY. Net broiler trade declined 10.9% throughout the ’14-’15 production season and is down an additional 11.1% throughout the first half of the ’15-’16 production season.

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes remained 54 times as large as import volumes throughout the ’14-’15 production season despite declining to a five year low on an absolute basis.

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes remained 54 times as large as import volumes throughout the ’14-’15 production season despite declining to a five year low on an absolute basis.

Combined net trade of U.S. pork, beef and broilers increased YOY for the fifth consecutive month during Mar ’16 as increases in the net trade of beef and pork more than offset a decline in broiler net trade. Combined net trade of pork, beef and broilers had declined for 19 consecutive months from Apr ’14 – Oct ’15 and finished down 21.4% YOY throughout the ’14-’15 production season.

Combined net trade of U.S. pork, beef and broilers increased YOY for the fifth consecutive month during Mar ’16 as increases in the net trade of beef and pork more than offset a decline in broiler net trade. Combined net trade of pork, beef and broilers had declined for 19 consecutive months from Apr ’14 – Oct ’15 and finished down 21.4% YOY throughout the ’14-’15 production season.