U.S. Milk Production Projected Higher – Jun ’16

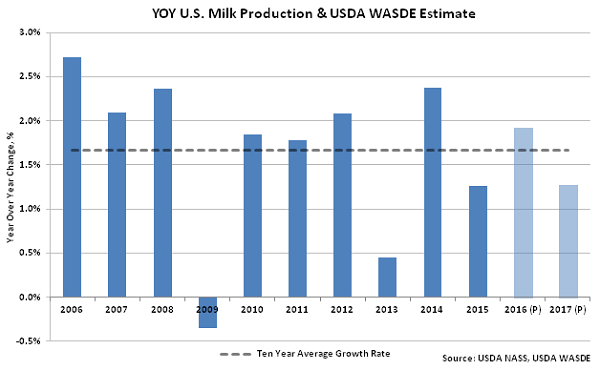

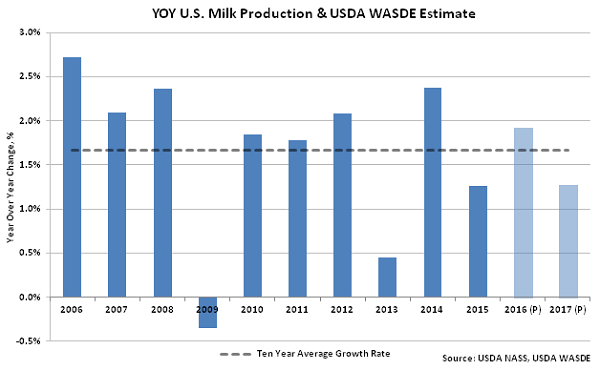

According to the June USDA World Agricultural Supply and Demand Estimate (WASDE) report, the 2016 U.S. milk production projection was raised for the third consecutive month as the cow inventory continues to expand by more than anticipated levels. 2016 projected milk production of 212.6 billion pounds was raised by 0.2 billion pounds, finishing at a seven month high. 2016 projected production translates to a 1.9% increase from the 2015 production levels, which would be slightly higher than the ten year average growth rate. Projected milk production is expected to increase an additional 1.3% throughout 2017, finishing at an estimated level of 215.3 billion pounds, up 0.1 billion pounds from the previous month’s projection.

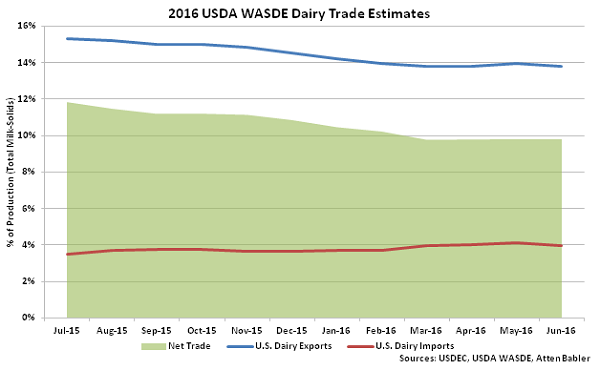

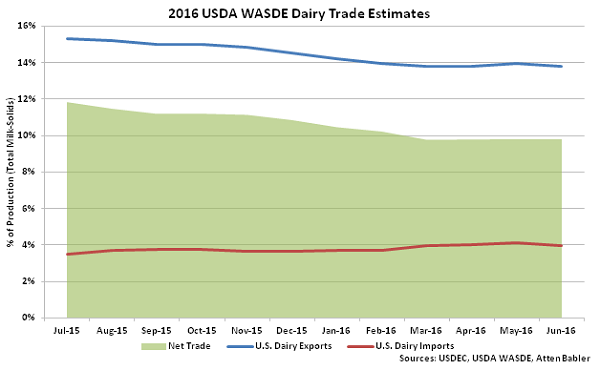

2016 and 2017 export forecasts on both a milk-fat and skim-solids basis were lowered as international supplies of dairy products remain abundant and U.S. prices remain at a premium. 2016 milk-fat export volume projections declined the most, finishing 4.5% below the previous month’s estimated figure. Import volumes were also forecast lower on a milk-fat basis for both 2016 and 2017 on expectations of slower imports of butterfat products, and to a lesser extent, cheese. Projected import volumes on a skim-solids basis remained unchanged throughout the month. The 2016 projected dairy export volumes translated to 13.8% of total U.S. milk solids production while import volumes were equivalent to 4.0% of total U.S. milk solids production. U.S. net dairy trade projections remained flat for the fourth consecutive month during the June report.

2016 and 2017 export forecasts on both a milk-fat and skim-solids basis were lowered as international supplies of dairy products remain abundant and U.S. prices remain at a premium. 2016 milk-fat export volume projections declined the most, finishing 4.5% below the previous month’s estimated figure. Import volumes were also forecast lower on a milk-fat basis for both 2016 and 2017 on expectations of slower imports of butterfat products, and to a lesser extent, cheese. Projected import volumes on a skim-solids basis remained unchanged throughout the month. The 2016 projected dairy export volumes translated to 13.8% of total U.S. milk solids production while import volumes were equivalent to 4.0% of total U.S. milk solids production. U.S. net dairy trade projections remained flat for the fourth consecutive month during the June report.

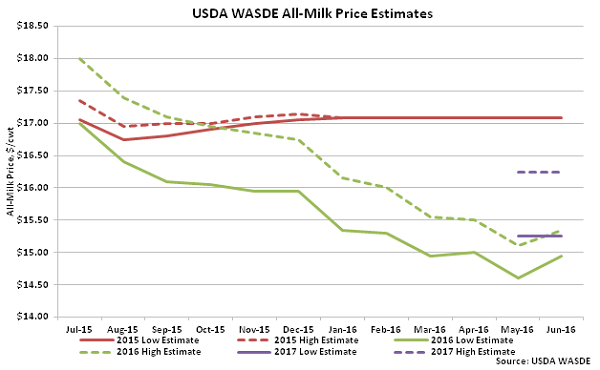

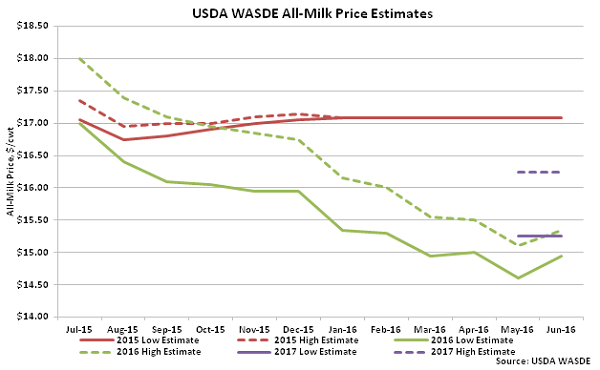

Cheese, butter and nonfat dry milk (NFDM) price forecasts were raised for 2016 on recent price strength and lower forecasted imports, while whey prices were unchanged at the midpoint. Forecasted cheese prices were lowered for 2017 as relatively high stocks are expected to pressure the market, but butter, dry whey and NFDM prices were unchanged. The 2016 Class III price estimate was raised by $0.20/cwt at the midpoint, finishing at $13.40-$13.80/cwt, while the 2016 Class IV price estimate was raised by $0.45/cwt at the midpoint, finishing at $13.15-$13.65/cwt. The 2016 All-Milk price forecast of $14.95-$15.35/cwt was raised by $0.30/cwt at the midpoint but remained 11.3% below 2015 price levels. The 2017 projected All-Milk price of $15.25-$16.25/cwt is expected to rebound by 4.0%, unchanged from the previous month.

Cheese, butter and nonfat dry milk (NFDM) price forecasts were raised for 2016 on recent price strength and lower forecasted imports, while whey prices were unchanged at the midpoint. Forecasted cheese prices were lowered for 2017 as relatively high stocks are expected to pressure the market, but butter, dry whey and NFDM prices were unchanged. The 2016 Class III price estimate was raised by $0.20/cwt at the midpoint, finishing at $13.40-$13.80/cwt, while the 2016 Class IV price estimate was raised by $0.45/cwt at the midpoint, finishing at $13.15-$13.65/cwt. The 2016 All-Milk price forecast of $14.95-$15.35/cwt was raised by $0.30/cwt at the midpoint but remained 11.3% below 2015 price levels. The 2017 projected All-Milk price of $15.25-$16.25/cwt is expected to rebound by 4.0%, unchanged from the previous month.

2016 and 2017 export forecasts on both a milk-fat and skim-solids basis were lowered as international supplies of dairy products remain abundant and U.S. prices remain at a premium. 2016 milk-fat export volume projections declined the most, finishing 4.5% below the previous month’s estimated figure. Import volumes were also forecast lower on a milk-fat basis for both 2016 and 2017 on expectations of slower imports of butterfat products, and to a lesser extent, cheese. Projected import volumes on a skim-solids basis remained unchanged throughout the month. The 2016 projected dairy export volumes translated to 13.8% of total U.S. milk solids production while import volumes were equivalent to 4.0% of total U.S. milk solids production. U.S. net dairy trade projections remained flat for the fourth consecutive month during the June report.

2016 and 2017 export forecasts on both a milk-fat and skim-solids basis were lowered as international supplies of dairy products remain abundant and U.S. prices remain at a premium. 2016 milk-fat export volume projections declined the most, finishing 4.5% below the previous month’s estimated figure. Import volumes were also forecast lower on a milk-fat basis for both 2016 and 2017 on expectations of slower imports of butterfat products, and to a lesser extent, cheese. Projected import volumes on a skim-solids basis remained unchanged throughout the month. The 2016 projected dairy export volumes translated to 13.8% of total U.S. milk solids production while import volumes were equivalent to 4.0% of total U.S. milk solids production. U.S. net dairy trade projections remained flat for the fourth consecutive month during the June report.

Cheese, butter and nonfat dry milk (NFDM) price forecasts were raised for 2016 on recent price strength and lower forecasted imports, while whey prices were unchanged at the midpoint. Forecasted cheese prices were lowered for 2017 as relatively high stocks are expected to pressure the market, but butter, dry whey and NFDM prices were unchanged. The 2016 Class III price estimate was raised by $0.20/cwt at the midpoint, finishing at $13.40-$13.80/cwt, while the 2016 Class IV price estimate was raised by $0.45/cwt at the midpoint, finishing at $13.15-$13.65/cwt. The 2016 All-Milk price forecast of $14.95-$15.35/cwt was raised by $0.30/cwt at the midpoint but remained 11.3% below 2015 price levels. The 2017 projected All-Milk price of $15.25-$16.25/cwt is expected to rebound by 4.0%, unchanged from the previous month.

Cheese, butter and nonfat dry milk (NFDM) price forecasts were raised for 2016 on recent price strength and lower forecasted imports, while whey prices were unchanged at the midpoint. Forecasted cheese prices were lowered for 2017 as relatively high stocks are expected to pressure the market, but butter, dry whey and NFDM prices were unchanged. The 2016 Class III price estimate was raised by $0.20/cwt at the midpoint, finishing at $13.40-$13.80/cwt, while the 2016 Class IV price estimate was raised by $0.45/cwt at the midpoint, finishing at $13.15-$13.65/cwt. The 2016 All-Milk price forecast of $14.95-$15.35/cwt was raised by $0.30/cwt at the midpoint but remained 11.3% below 2015 price levels. The 2017 projected All-Milk price of $15.25-$16.25/cwt is expected to rebound by 4.0%, unchanged from the previous month.