U.S. Dairy Exports Update – Sep ’16

Executive Summary

U.S. dairy export figures provided by USDA were recently updated with values spanning through Jul ’16. Highlights from the updated report include:

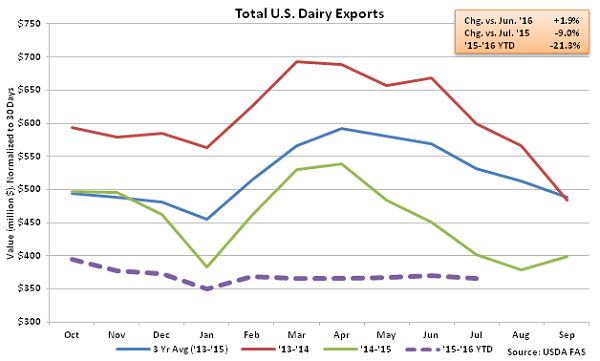

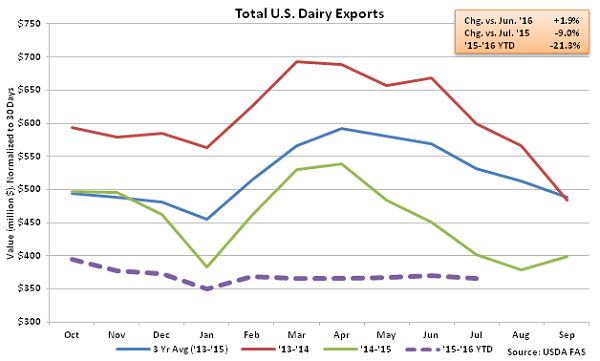

• The total value of U.S. dairy exports declined on a YOY basis for the 24th consecutive month during Jul ’16, finishing down 9.0%.

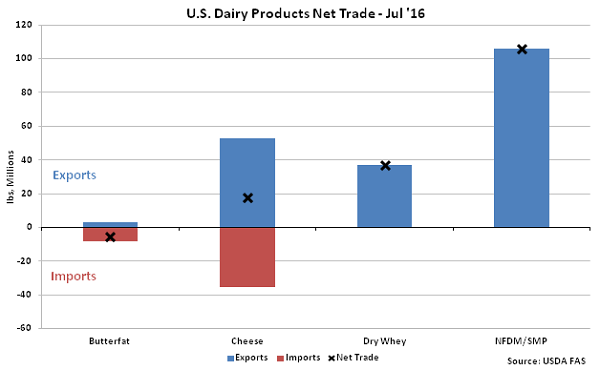

• The U.S. remained a net importer of butter for the 18th consecutive month during Jul ’16 as domestic prices remain at a significant premium to international prices.

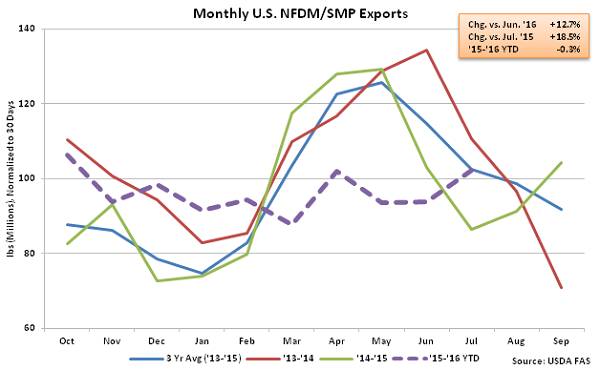

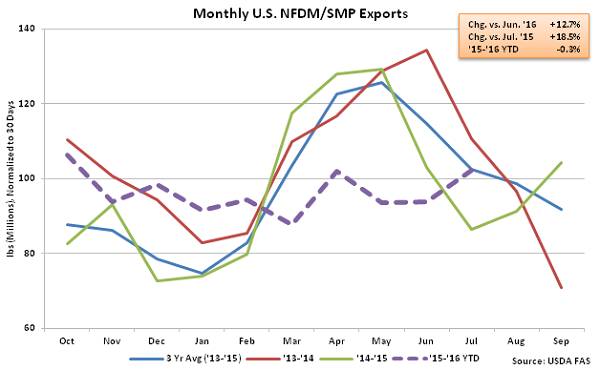

• NFDM/SMP export volumes increased on a YOY basis for the first time in five months as U.S. price continue to remain competitive within international markets.

Additional Report Details

According to USDA, the Jul ’16 total value of all U.S. dairy exports increased 1.9% MOM on a daily average basis but remained lower on a YOY basis for the 24th consecutive month, finishing down 9.0%. U.S. high milkfat dairy product prices continued to remain significantly above international prices throughout Jul ’16, contributing to the lower international demand for U.S. dairy products.

Butter – U.S. Remains a Net Importer of Butter for the 18th Consecutive Month

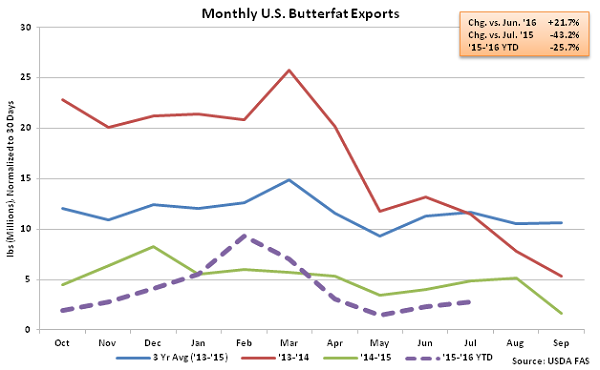

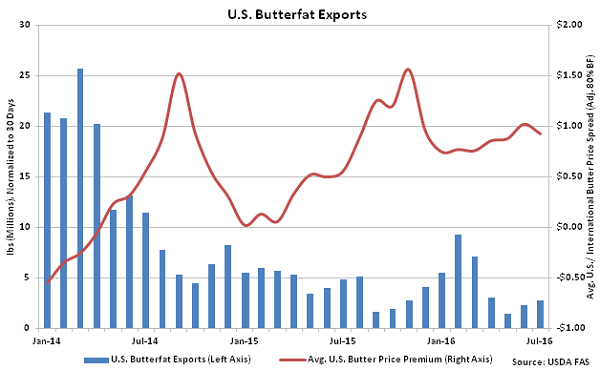

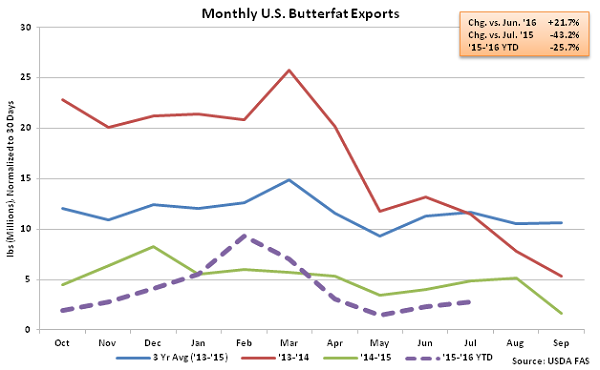

Jul ’16 U.S. export volumes of butterfat continued to rebound from the six and a half year low experienced during May ’16 but remained significantly lower on a YOY basis, declining by 43.2%. Jul ’16 butterfat imports exceeded export volumes for the 18th consecutive month, as total butterfat import volumes finished at nearly three times the export volumes experienced throughout the month.

Butter – U.S. Remains a Net Importer of Butter for the 18th Consecutive Month

Jul ’16 U.S. export volumes of butterfat continued to rebound from the six and a half year low experienced during May ’16 but remained significantly lower on a YOY basis, declining by 43.2%. Jul ’16 butterfat imports exceeded export volumes for the 18th consecutive month, as total butterfat import volumes finished at nearly three times the export volumes experienced throughout the month.

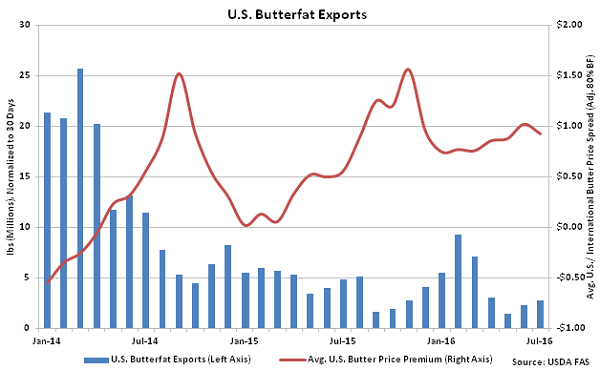

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since Jul ’14, reducing export demand. The U.S. / international butter price spread reached an 11 year high during Nov ’15 prior to declining but remained at a significant premium throughout more recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5% YOY.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since Jul ’14, reducing export demand. The U.S. / international butter price spread reached an 11 year high during Nov ’15 prior to declining but remained at a significant premium throughout more recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5% YOY.

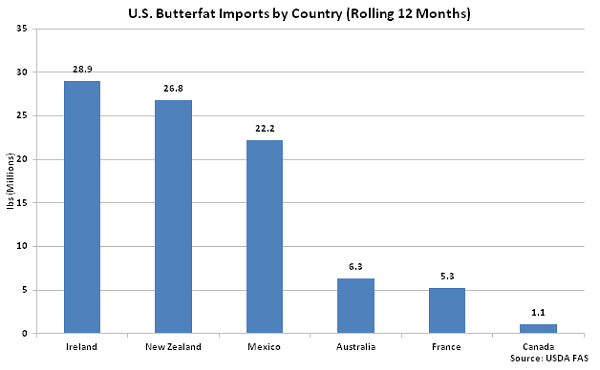

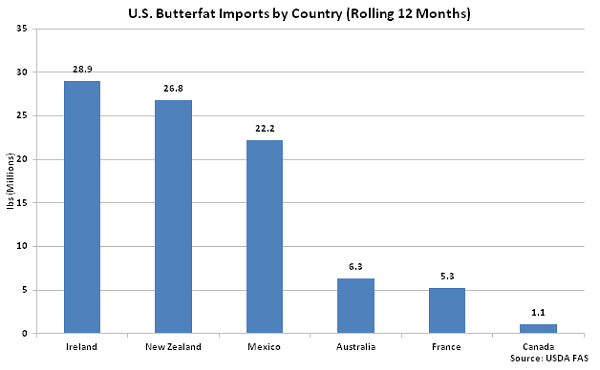

Overall, ’14-’15 annual U.S. butterfat import volumes reached a new nine year high. ’15-’16 YTD butterfat imports have increased an additional 29.5% throughout the first ten months of the production season, while butter exports have declined 25.7% YOY over the same period. Growth in butterfat imports over the past 12 months has been led by product shipped from Ireland, followed by imports of butterfat from New Zealand and Mexico.

Overall, ’14-’15 annual U.S. butterfat import volumes reached a new nine year high. ’15-’16 YTD butterfat imports have increased an additional 29.5% throughout the first ten months of the production season, while butter exports have declined 25.7% YOY over the same period. Growth in butterfat imports over the past 12 months has been led by product shipped from Ireland, followed by imports of butterfat from New Zealand and Mexico.

Cheese – Export Volumes Remain Lower on a YOY Basis for the 22nd Consecutive Month

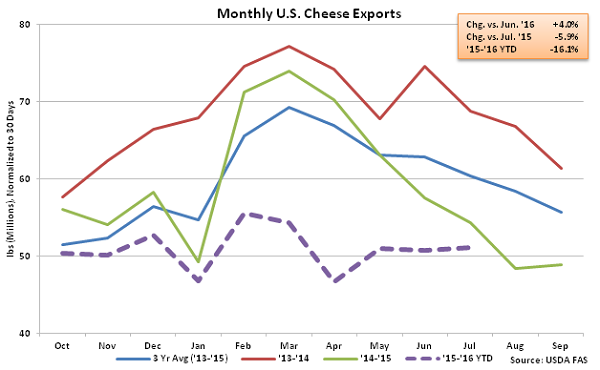

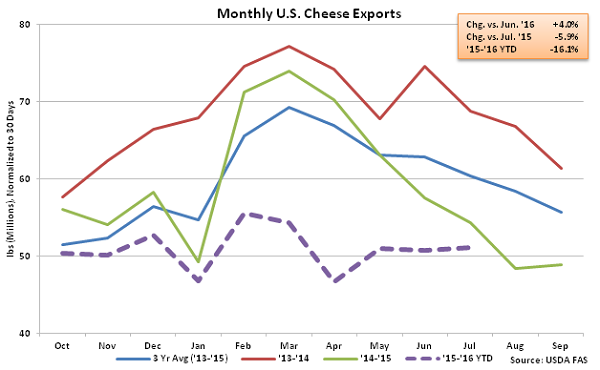

Jul ’16 U.S. cheese export volumes increased 4.0% MOM on a daily average basis but remained lower on a YOY basis for the 22nd consecutive month, finishing down 5.9%. Cheddar cheese exports remained particularly weak, declining by 24.0% YOY throughout the month. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for 16 consecutive months through Jul ’16.

YOY declines in Jul ’16 cheese export volumes were led by volumes shipped to Mexico (-18.0%) and Japan (-20.8%), which more than offset an increase in export volumes destined to South Korea (+11.3%). Cheese volumes destined to Mexico, Japan and South Korea consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% and other-than-cheddar cheese finishing down 4.6%. ’15-’16 YTD cheese exports have declined an additional 16.1% throughout the first ten months of the production season.

Cheese – Export Volumes Remain Lower on a YOY Basis for the 22nd Consecutive Month

Jul ’16 U.S. cheese export volumes increased 4.0% MOM on a daily average basis but remained lower on a YOY basis for the 22nd consecutive month, finishing down 5.9%. Cheddar cheese exports remained particularly weak, declining by 24.0% YOY throughout the month. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for 16 consecutive months through Jul ’16.

YOY declines in Jul ’16 cheese export volumes were led by volumes shipped to Mexico (-18.0%) and Japan (-20.8%), which more than offset an increase in export volumes destined to South Korea (+11.3%). Cheese volumes destined to Mexico, Japan and South Korea consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% and other-than-cheddar cheese finishing down 4.6%. ’15-’16 YTD cheese exports have declined an additional 16.1% throughout the first ten months of the production season.

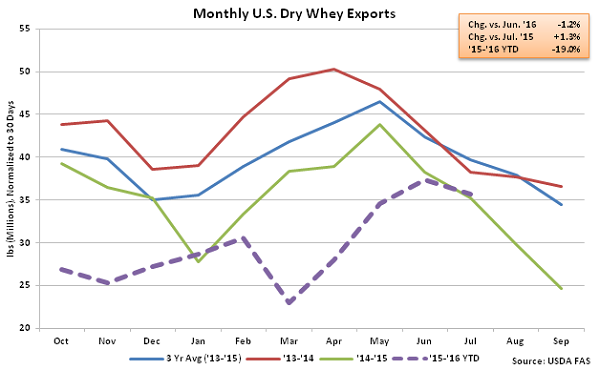

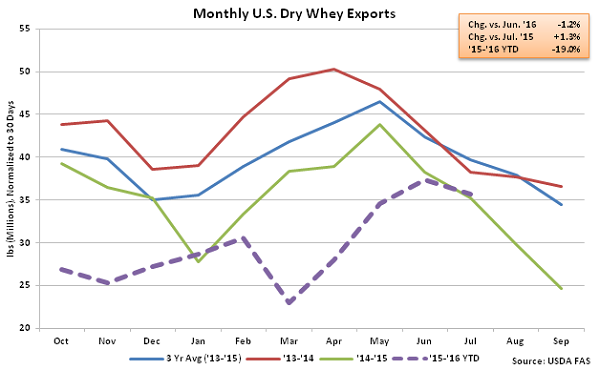

Dry Whey – Export Volumes Finish Higher on a YOY Basis for the Second Time in 26 Months

Jul ’16 U.S. dry whey export volumes declined 1.2% MOM on a daily average basis from the 12 month high experienced during the previous month but finished 1.3% higher YOY. The YOY increase in dry whey export volumes was only the second experienced in the past 26 months. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low while ’15-’16 YTD dry whey exports have declined an additional 19.0% throughout the first ten months of the production season, despite the most recent YOY gain.

Dry Whey – Export Volumes Finish Higher on a YOY Basis for the Second Time in 26 Months

Jul ’16 U.S. dry whey export volumes declined 1.2% MOM on a daily average basis from the 12 month high experienced during the previous month but finished 1.3% higher YOY. The YOY increase in dry whey export volumes was only the second experienced in the past 26 months. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low while ’15-’16 YTD dry whey exports have declined an additional 19.0% throughout the first ten months of the production season, despite the most recent YOY gain.

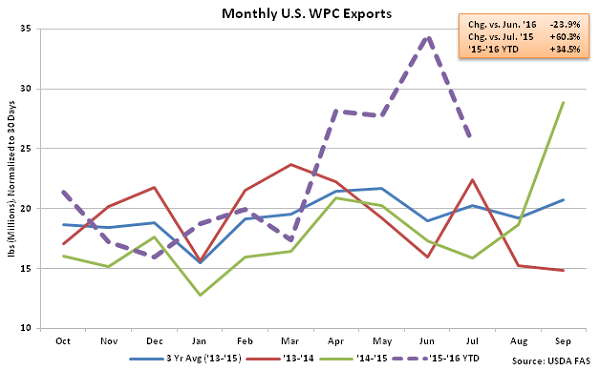

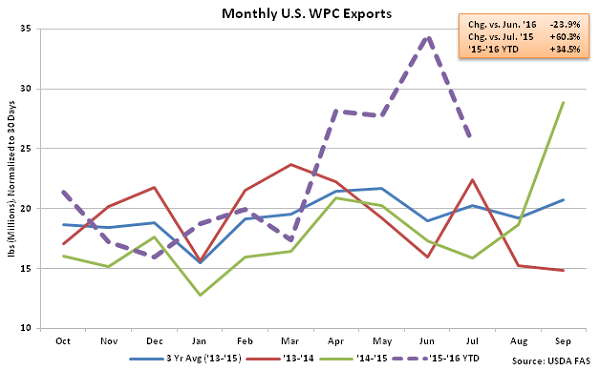

WPC – Export Volumes Remain Higher on a YOY Basis for the Seventh Consecutive Month

Jul ’16 whey protein concentrate (WPC) export volumes declined 23.9% MOM from the record high experienced during the previous month but remained higher on a YOY basis, finishing up 60.3%. WPC export volumes have finished higher on a YOY basis for seven consecutive months through July, increasing by 43.9% in total over the period. ’14-’15 annual WPC export volumes declined to a six year low however ’15-’16 YTD WPC exports have rebounded by 34.5% throughout the first ten months of the production season and are on pace to reach an annual record high.

WPC – Export Volumes Remain Higher on a YOY Basis for the Seventh Consecutive Month

Jul ’16 whey protein concentrate (WPC) export volumes declined 23.9% MOM from the record high experienced during the previous month but remained higher on a YOY basis, finishing up 60.3%. WPC export volumes have finished higher on a YOY basis for seven consecutive months through July, increasing by 43.9% in total over the period. ’14-’15 annual WPC export volumes declined to a six year low however ’15-’16 YTD WPC exports have rebounded by 34.5% throughout the first ten months of the production season and are on pace to reach an annual record high.

NFDM/SMP – Export Volumes Increase on a YOY Basis for the First Time in Five Months

U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) increased 12.7% MOM on a daily average basis while also finishing up 18.5% YOY. The YOY increase in NFDM/SMP export volumes was the first experienced in the past five months. U.S. NFDM/SMP prices have remained competitive with international prices, trading at a 6.4% discount to average Oceania and EU-28 prices throughout the month.

U.S. NFDM/SMP export volumes destined to Mexico declined 8.5% YOY throughout the month however declines were more than offset by a 45.3% YOY increase in volumes destined to all other countries. U.S. NFDM/SMP export volumes destined to Mexico accounted for over a third of total NFDM/SMP volumes shipped during Jul ’16. U.S. NDFM/SMP export volumes destined to Mexico increased 24.1% YOY throughout 2015 while export volumes shipped to all other destinations declined by 10.1% over the same period. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY while volumes remain down an additional 0.3% throughout the first ten months of the ’15-’16 production season, despite the most recent YOY gain.

NFDM/SMP – Export Volumes Increase on a YOY Basis for the First Time in Five Months

U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) increased 12.7% MOM on a daily average basis while also finishing up 18.5% YOY. The YOY increase in NFDM/SMP export volumes was the first experienced in the past five months. U.S. NFDM/SMP prices have remained competitive with international prices, trading at a 6.4% discount to average Oceania and EU-28 prices throughout the month.

U.S. NFDM/SMP export volumes destined to Mexico declined 8.5% YOY throughout the month however declines were more than offset by a 45.3% YOY increase in volumes destined to all other countries. U.S. NFDM/SMP export volumes destined to Mexico accounted for over a third of total NFDM/SMP volumes shipped during Jul ’16. U.S. NDFM/SMP export volumes destined to Mexico increased 24.1% YOY throughout 2015 while export volumes shipped to all other destinations declined by 10.1% over the same period. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY while volumes remain down an additional 0.3% throughout the first ten months of the ’15-’16 production season, despite the most recent YOY gain.

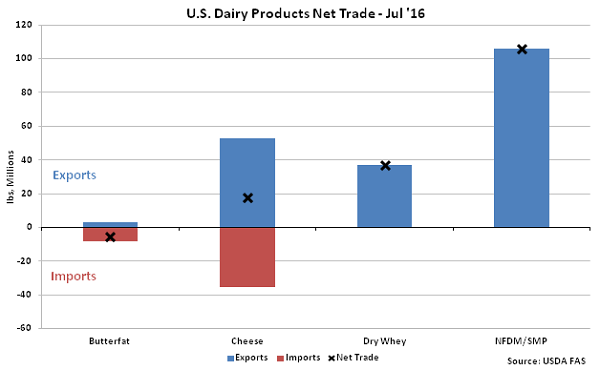

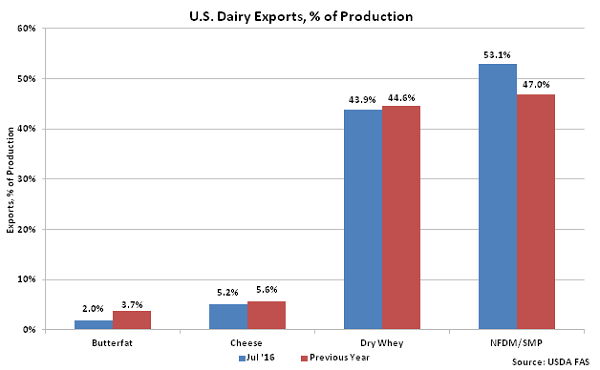

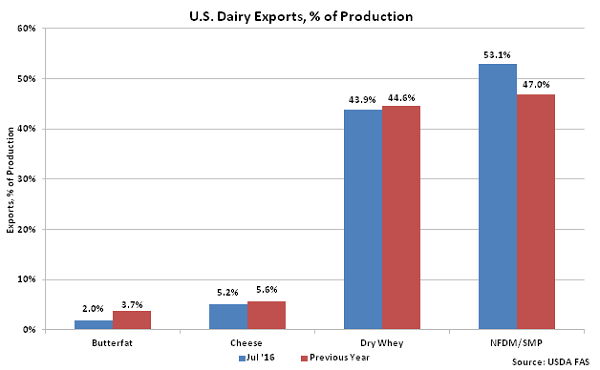

U.S. butterfat, cheese and dry whey export volumes as a percentage of production finished lower than the previous year during Jul ’16 while NFDM/SMP export volumes as a percentage of production finished higher on a YOY basis for the first time in five months.

U.S. butterfat, cheese and dry whey export volumes as a percentage of production finished lower than the previous year during Jul ’16 while NFDM/SMP export volumes as a percentage of production finished higher on a YOY basis for the first time in five months.

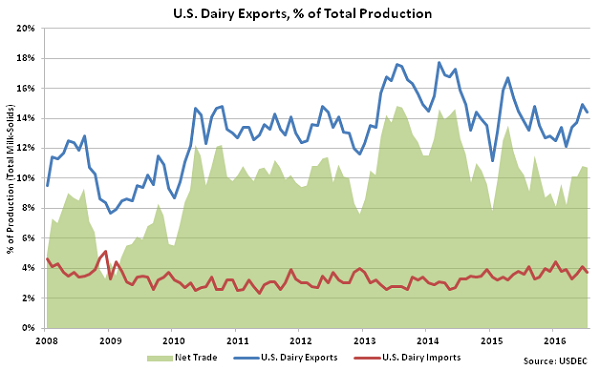

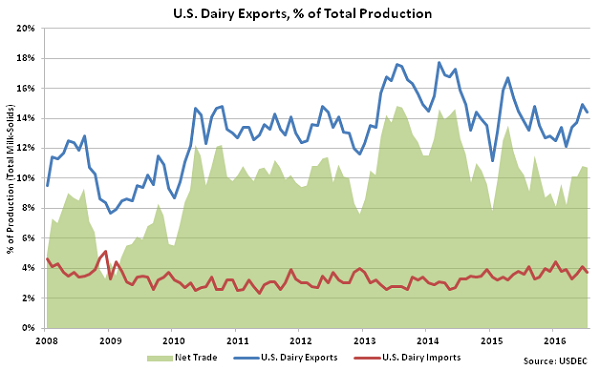

Overall, U.S. dairy export volumes were equivalent to 14.4% of total U.S. milk solids production during Jul ’16, while dairy import volumes were equivalent to 3.7% of total U.S. milk solids production. Net dairy trade finished slightly below the nine month high experienced during Jun ’16.

Overall, U.S. dairy export volumes were equivalent to 14.4% of total U.S. milk solids production during Jul ’16, while dairy import volumes were equivalent to 3.7% of total U.S. milk solids production. Net dairy trade finished slightly below the nine month high experienced during Jun ’16.

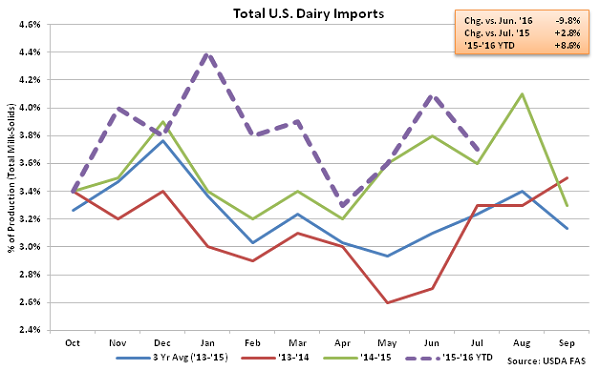

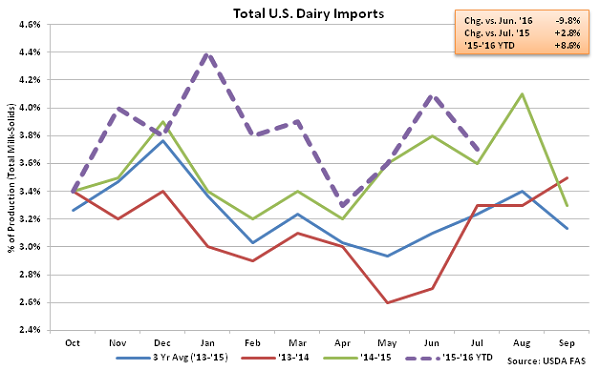

Jul ’16 U.S. dairy imports as a percentage of production finished 9.8% below the previous month but remained 2.8% higher a YOY basis. ’15-’16 YTD dairy imports as a percentage of production are up 8.6% YOY throughout the first ten months of the production season.

Jul ’16 U.S. dairy imports as a percentage of production finished 9.8% below the previous month but remained 2.8% higher a YOY basis. ’15-’16 YTD dairy imports as a percentage of production are up 8.6% YOY throughout the first ten months of the production season.

Net trade of U.S. NFDM/SMP and dry whey continues to outpace that of cheese and butter as dry product import volumes remain minimal. U.S. cheese imports offset over two thirds of total export volumes throughout the month while butter import volumes continued to exceed export volumes.

Net trade of U.S. NFDM/SMP and dry whey continues to outpace that of cheese and butter as dry product import volumes remain minimal. U.S. cheese imports offset over two thirds of total export volumes throughout the month while butter import volumes continued to exceed export volumes.

Butter – U.S. Remains a Net Importer of Butter for the 18th Consecutive Month

Jul ’16 U.S. export volumes of butterfat continued to rebound from the six and a half year low experienced during May ’16 but remained significantly lower on a YOY basis, declining by 43.2%. Jul ’16 butterfat imports exceeded export volumes for the 18th consecutive month, as total butterfat import volumes finished at nearly three times the export volumes experienced throughout the month.

Butter – U.S. Remains a Net Importer of Butter for the 18th Consecutive Month

Jul ’16 U.S. export volumes of butterfat continued to rebound from the six and a half year low experienced during May ’16 but remained significantly lower on a YOY basis, declining by 43.2%. Jul ’16 butterfat imports exceeded export volumes for the 18th consecutive month, as total butterfat import volumes finished at nearly three times the export volumes experienced throughout the month.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since Jul ’14, reducing export demand. The U.S. / international butter price spread reached an 11 year high during Nov ’15 prior to declining but remained at a significant premium throughout more recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5% YOY.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since Jul ’14, reducing export demand. The U.S. / international butter price spread reached an 11 year high during Nov ’15 prior to declining but remained at a significant premium throughout more recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5% YOY.

Overall, ’14-’15 annual U.S. butterfat import volumes reached a new nine year high. ’15-’16 YTD butterfat imports have increased an additional 29.5% throughout the first ten months of the production season, while butter exports have declined 25.7% YOY over the same period. Growth in butterfat imports over the past 12 months has been led by product shipped from Ireland, followed by imports of butterfat from New Zealand and Mexico.

Overall, ’14-’15 annual U.S. butterfat import volumes reached a new nine year high. ’15-’16 YTD butterfat imports have increased an additional 29.5% throughout the first ten months of the production season, while butter exports have declined 25.7% YOY over the same period. Growth in butterfat imports over the past 12 months has been led by product shipped from Ireland, followed by imports of butterfat from New Zealand and Mexico.

Cheese – Export Volumes Remain Lower on a YOY Basis for the 22nd Consecutive Month

Jul ’16 U.S. cheese export volumes increased 4.0% MOM on a daily average basis but remained lower on a YOY basis for the 22nd consecutive month, finishing down 5.9%. Cheddar cheese exports remained particularly weak, declining by 24.0% YOY throughout the month. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for 16 consecutive months through Jul ’16.

YOY declines in Jul ’16 cheese export volumes were led by volumes shipped to Mexico (-18.0%) and Japan (-20.8%), which more than offset an increase in export volumes destined to South Korea (+11.3%). Cheese volumes destined to Mexico, Japan and South Korea consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% and other-than-cheddar cheese finishing down 4.6%. ’15-’16 YTD cheese exports have declined an additional 16.1% throughout the first ten months of the production season.

Cheese – Export Volumes Remain Lower on a YOY Basis for the 22nd Consecutive Month

Jul ’16 U.S. cheese export volumes increased 4.0% MOM on a daily average basis but remained lower on a YOY basis for the 22nd consecutive month, finishing down 5.9%. Cheddar cheese exports remained particularly weak, declining by 24.0% YOY throughout the month. U.S. cheddar cheese prices have traded at a premium to international cheddar cheese prices for 16 consecutive months through Jul ’16.

YOY declines in Jul ’16 cheese export volumes were led by volumes shipped to Mexico (-18.0%) and Japan (-20.8%), which more than offset an increase in export volumes destined to South Korea (+11.3%). Cheese volumes destined to Mexico, Japan and South Korea consisted of over half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% and other-than-cheddar cheese finishing down 4.6%. ’15-’16 YTD cheese exports have declined an additional 16.1% throughout the first ten months of the production season.

Dry Whey – Export Volumes Finish Higher on a YOY Basis for the Second Time in 26 Months

Jul ’16 U.S. dry whey export volumes declined 1.2% MOM on a daily average basis from the 12 month high experienced during the previous month but finished 1.3% higher YOY. The YOY increase in dry whey export volumes was only the second experienced in the past 26 months. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low while ’15-’16 YTD dry whey exports have declined an additional 19.0% throughout the first ten months of the production season, despite the most recent YOY gain.

Dry Whey – Export Volumes Finish Higher on a YOY Basis for the Second Time in 26 Months

Jul ’16 U.S. dry whey export volumes declined 1.2% MOM on a daily average basis from the 12 month high experienced during the previous month but finished 1.3% higher YOY. The YOY increase in dry whey export volumes was only the second experienced in the past 26 months. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low while ’15-’16 YTD dry whey exports have declined an additional 19.0% throughout the first ten months of the production season, despite the most recent YOY gain.

WPC – Export Volumes Remain Higher on a YOY Basis for the Seventh Consecutive Month

Jul ’16 whey protein concentrate (WPC) export volumes declined 23.9% MOM from the record high experienced during the previous month but remained higher on a YOY basis, finishing up 60.3%. WPC export volumes have finished higher on a YOY basis for seven consecutive months through July, increasing by 43.9% in total over the period. ’14-’15 annual WPC export volumes declined to a six year low however ’15-’16 YTD WPC exports have rebounded by 34.5% throughout the first ten months of the production season and are on pace to reach an annual record high.

WPC – Export Volumes Remain Higher on a YOY Basis for the Seventh Consecutive Month

Jul ’16 whey protein concentrate (WPC) export volumes declined 23.9% MOM from the record high experienced during the previous month but remained higher on a YOY basis, finishing up 60.3%. WPC export volumes have finished higher on a YOY basis for seven consecutive months through July, increasing by 43.9% in total over the period. ’14-’15 annual WPC export volumes declined to a six year low however ’15-’16 YTD WPC exports have rebounded by 34.5% throughout the first ten months of the production season and are on pace to reach an annual record high.

NFDM/SMP – Export Volumes Increase on a YOY Basis for the First Time in Five Months

U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) increased 12.7% MOM on a daily average basis while also finishing up 18.5% YOY. The YOY increase in NFDM/SMP export volumes was the first experienced in the past five months. U.S. NFDM/SMP prices have remained competitive with international prices, trading at a 6.4% discount to average Oceania and EU-28 prices throughout the month.

U.S. NFDM/SMP export volumes destined to Mexico declined 8.5% YOY throughout the month however declines were more than offset by a 45.3% YOY increase in volumes destined to all other countries. U.S. NFDM/SMP export volumes destined to Mexico accounted for over a third of total NFDM/SMP volumes shipped during Jul ’16. U.S. NDFM/SMP export volumes destined to Mexico increased 24.1% YOY throughout 2015 while export volumes shipped to all other destinations declined by 10.1% over the same period. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY while volumes remain down an additional 0.3% throughout the first ten months of the ’15-’16 production season, despite the most recent YOY gain.

NFDM/SMP – Export Volumes Increase on a YOY Basis for the First Time in Five Months

U.S. export volumes of nonfat dry milk (NFDM) and skim milk powder (SMP) increased 12.7% MOM on a daily average basis while also finishing up 18.5% YOY. The YOY increase in NFDM/SMP export volumes was the first experienced in the past five months. U.S. NFDM/SMP prices have remained competitive with international prices, trading at a 6.4% discount to average Oceania and EU-28 prices throughout the month.

U.S. NFDM/SMP export volumes destined to Mexico declined 8.5% YOY throughout the month however declines were more than offset by a 45.3% YOY increase in volumes destined to all other countries. U.S. NFDM/SMP export volumes destined to Mexico accounted for over a third of total NFDM/SMP volumes shipped during Jul ’16. U.S. NDFM/SMP export volumes destined to Mexico increased 24.1% YOY throughout 2015 while export volumes shipped to all other destinations declined by 10.1% over the same period. ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY while volumes remain down an additional 0.3% throughout the first ten months of the ’15-’16 production season, despite the most recent YOY gain.

U.S. butterfat, cheese and dry whey export volumes as a percentage of production finished lower than the previous year during Jul ’16 while NFDM/SMP export volumes as a percentage of production finished higher on a YOY basis for the first time in five months.

U.S. butterfat, cheese and dry whey export volumes as a percentage of production finished lower than the previous year during Jul ’16 while NFDM/SMP export volumes as a percentage of production finished higher on a YOY basis for the first time in five months.

Overall, U.S. dairy export volumes were equivalent to 14.4% of total U.S. milk solids production during Jul ’16, while dairy import volumes were equivalent to 3.7% of total U.S. milk solids production. Net dairy trade finished slightly below the nine month high experienced during Jun ’16.

Overall, U.S. dairy export volumes were equivalent to 14.4% of total U.S. milk solids production during Jul ’16, while dairy import volumes were equivalent to 3.7% of total U.S. milk solids production. Net dairy trade finished slightly below the nine month high experienced during Jun ’16.

Jul ’16 U.S. dairy imports as a percentage of production finished 9.8% below the previous month but remained 2.8% higher a YOY basis. ’15-’16 YTD dairy imports as a percentage of production are up 8.6% YOY throughout the first ten months of the production season.

Jul ’16 U.S. dairy imports as a percentage of production finished 9.8% below the previous month but remained 2.8% higher a YOY basis. ’15-’16 YTD dairy imports as a percentage of production are up 8.6% YOY throughout the first ten months of the production season.

Net trade of U.S. NFDM/SMP and dry whey continues to outpace that of cheese and butter as dry product import volumes remain minimal. U.S. cheese imports offset over two thirds of total export volumes throughout the month while butter import volumes continued to exceed export volumes.

Net trade of U.S. NFDM/SMP and dry whey continues to outpace that of cheese and butter as dry product import volumes remain minimal. U.S. cheese imports offset over two thirds of total export volumes throughout the month while butter import volumes continued to exceed export volumes.