EU-28 Milk Production Update – Feb ’15

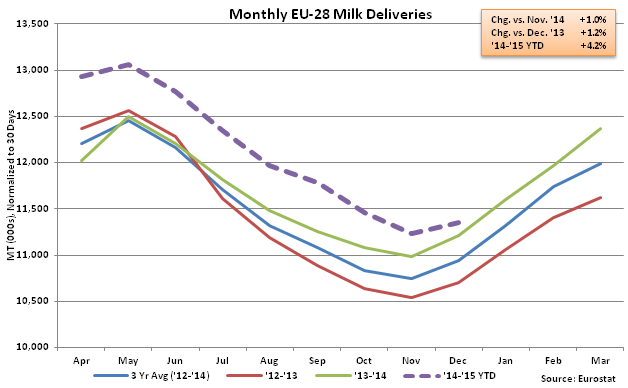

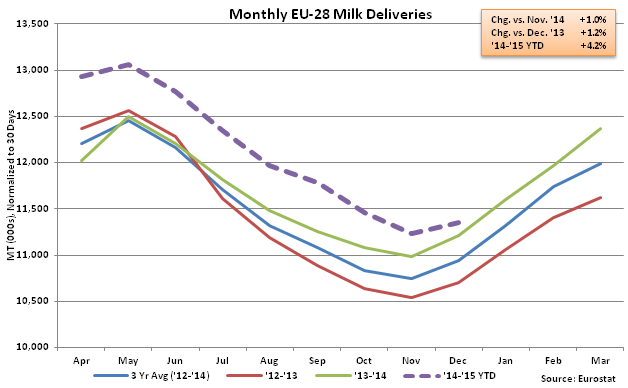

According to Eurostat, EU-28 milk production continues to remain higher on a YOY basis, with Dec ’14 production finishing 1.2% higher than the previous year. Monthly production of 11.7 million MT (25.9 billion lbs) set a new record high for December, while production also increased 1.0% MOM on a daily average basis from the seasonal low experienced in Nov ’14. EU-28 milk production typically increases on a MOM basis from December until May, when seasonal highs are reached.

Italy (+75,850 MT) and the U.K. (+42,700 MT) accounted for over 80% of the total Dec ’14 YOY production gains. Ireland, Denmark, Greece, the Netherlands, Spain, Germany, Austria, Cyprus, Croatia, Belgium and Malta experienced lower YOY production. The 11 member states with lower YOY production accounted for 44.9% of total EU-28 production in Dec ’14.

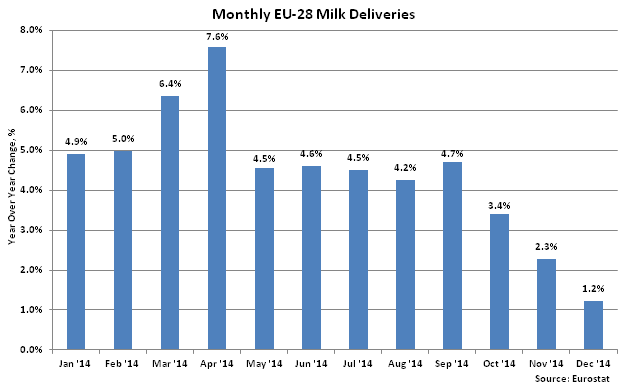

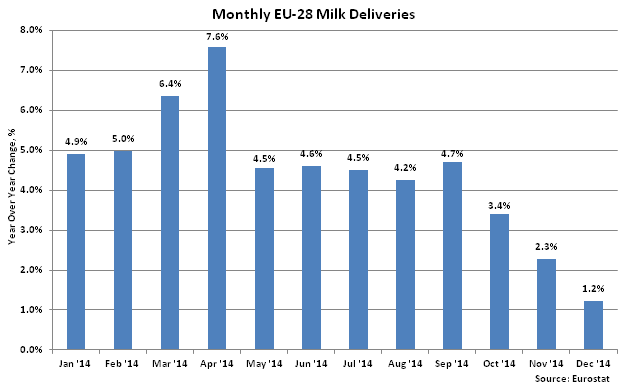

The EU-28 has experienced 18 consecutive months of YOY production gains. Strong production throughout the first three quarters of 2014 was attributed to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. The Dec ’14 YOY gain of 1.2%, however, was the lowest increase on a percentage basis over the 18 month period. According to USDA, lower pay prices and the likelihood of levee payments for exceeding milk production quota levels are the main causes for the weaker trend in milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland are all trending over quota levels.

EU-28 milk production may have also been affected by the Russian ban of EU dairy exports announced in early Aug ’14. According to USDA, in 2013 Russia accounted for 33% of EU cheese exports, 25% of EU butter exports, and 27% of EU AMF exports with total 2013 EU exports into Russia estimated to equal 1.5% of EU’s milk production.

The EU-28 has experienced 18 consecutive months of YOY production gains. Strong production throughout the first three quarters of 2014 was attributed to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. The Dec ’14 YOY gain of 1.2%, however, was the lowest increase on a percentage basis over the 18 month period. According to USDA, lower pay prices and the likelihood of levee payments for exceeding milk production quota levels are the main causes for the weaker trend in milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland are all trending over quota levels.

EU-28 milk production may have also been affected by the Russian ban of EU dairy exports announced in early Aug ’14. According to USDA, in 2013 Russia accounted for 33% of EU cheese exports, 25% of EU butter exports, and 27% of EU AMF exports with total 2013 EU exports into Russia estimated to equal 1.5% of EU’s milk production.

Despite the recent below-trendline production growth, ’14-’15 YTD EU-28 production remains up 4.2% throughout the first nine months of the production season. EU-28 milk production quotas expire at the beginning on Apr ’15, likely resulting in continued growth in milk deliveries throughout the ’15-’16 EU-28 milk production season.

Despite the recent below-trendline production growth, ’14-’15 YTD EU-28 production remains up 4.2% throughout the first nine months of the production season. EU-28 milk production quotas expire at the beginning on Apr ’15, likely resulting in continued growth in milk deliveries throughout the ’15-’16 EU-28 milk production season.

The EU-28 has experienced 18 consecutive months of YOY production gains. Strong production throughout the first three quarters of 2014 was attributed to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. The Dec ’14 YOY gain of 1.2%, however, was the lowest increase on a percentage basis over the 18 month period. According to USDA, lower pay prices and the likelihood of levee payments for exceeding milk production quota levels are the main causes for the weaker trend in milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland are all trending over quota levels.

EU-28 milk production may have also been affected by the Russian ban of EU dairy exports announced in early Aug ’14. According to USDA, in 2013 Russia accounted for 33% of EU cheese exports, 25% of EU butter exports, and 27% of EU AMF exports with total 2013 EU exports into Russia estimated to equal 1.5% of EU’s milk production.

The EU-28 has experienced 18 consecutive months of YOY production gains. Strong production throughout the first three quarters of 2014 was attributed to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. The Dec ’14 YOY gain of 1.2%, however, was the lowest increase on a percentage basis over the 18 month period. According to USDA, lower pay prices and the likelihood of levee payments for exceeding milk production quota levels are the main causes for the weaker trend in milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland are all trending over quota levels.

EU-28 milk production may have also been affected by the Russian ban of EU dairy exports announced in early Aug ’14. According to USDA, in 2013 Russia accounted for 33% of EU cheese exports, 25% of EU butter exports, and 27% of EU AMF exports with total 2013 EU exports into Russia estimated to equal 1.5% of EU’s milk production.

Despite the recent below-trendline production growth, ’14-’15 YTD EU-28 production remains up 4.2% throughout the first nine months of the production season. EU-28 milk production quotas expire at the beginning on Apr ’15, likely resulting in continued growth in milk deliveries throughout the ’15-’16 EU-28 milk production season.

Despite the recent below-trendline production growth, ’14-’15 YTD EU-28 production remains up 4.2% throughout the first nine months of the production season. EU-28 milk production quotas expire at the beginning on Apr ’15, likely resulting in continued growth in milk deliveries throughout the ’15-’16 EU-28 milk production season.