U.S. Dairy Cold Storage Update – Mar ’15

Butter – Stocks Increase on YOY Basis for Second Consecutive Month

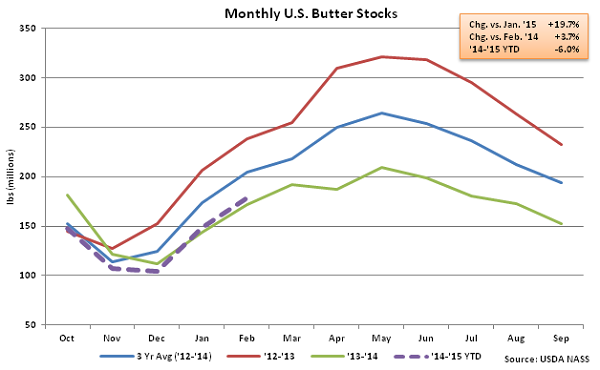

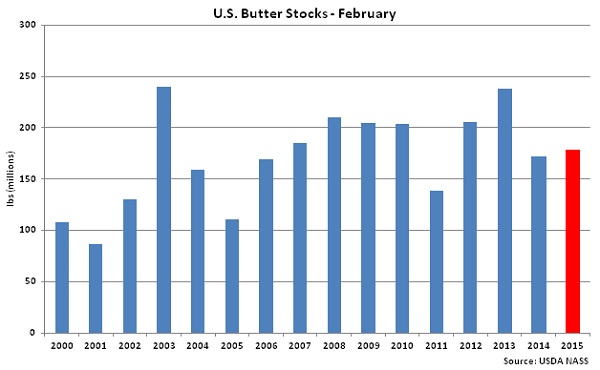

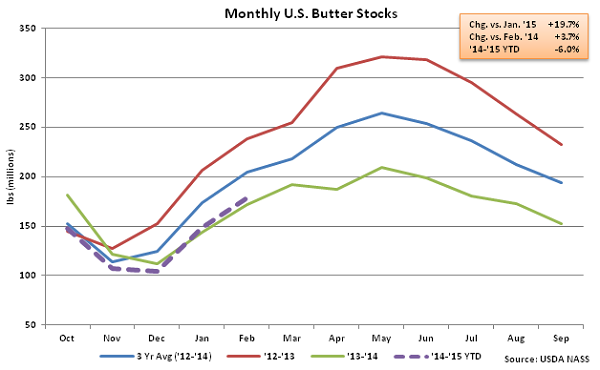

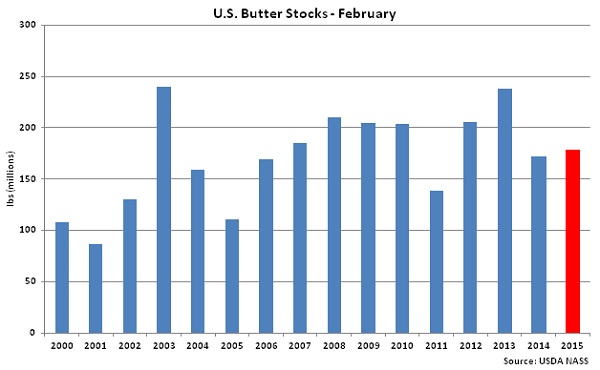

According to USDA, Feb ’15 U.S. butter stocks of 178.2 million pounds finished up 19.7% MOM and 3.7% YOY. Butter stocks increased YOY for the second month in a row following 14 consecutive months of YOY declines experienced from Nov ’13 – Dec ’14. Despite the YOY gains, Feb ’15 butter stocks remain 13.1% below the three year average February butter stocks. The MOM increase in butter stocks of 29.3 million pounds was slightly less than the ten year average Jan – Feb seasonal build of 31.4 million pounds.

The May ’14 – Dec ’14 seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Despite U.S. butter prices converging downward towards international prices, domestic butterfat exports remained weak in Jan ’15, down 74.8% YOY.

According to USDA, Feb ’15 U.S. butter stocks of 178.2 million pounds finished up 19.7% MOM and 3.7% YOY. Butter stocks increased YOY for the second month in a row following 14 consecutive months of YOY declines experienced from Nov ’13 – Dec ’14. Despite the YOY gains, Feb ’15 butter stocks remain 13.1% below the three year average February butter stocks. The MOM increase in butter stocks of 29.3 million pounds was slightly less than the ten year average Jan – Feb seasonal build of 31.4 million pounds.

The May ’14 – Dec ’14 seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Despite U.S. butter prices converging downward towards international prices, domestic butterfat exports remained weak in Jan ’15, down 74.8% YOY.

Cheese – Stocks Increase on YOY Basis for Fourth Consecutive Month

Cheese – Stocks Increase on YOY Basis for Fourth Consecutive Month

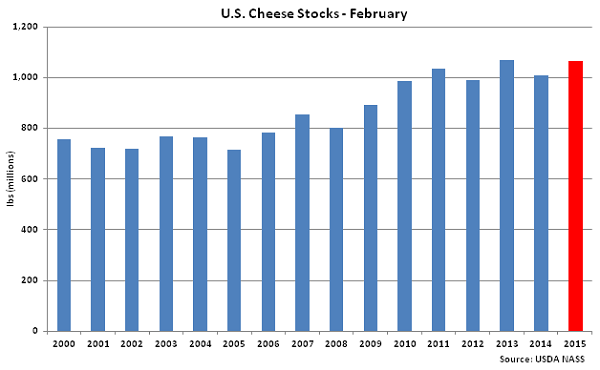

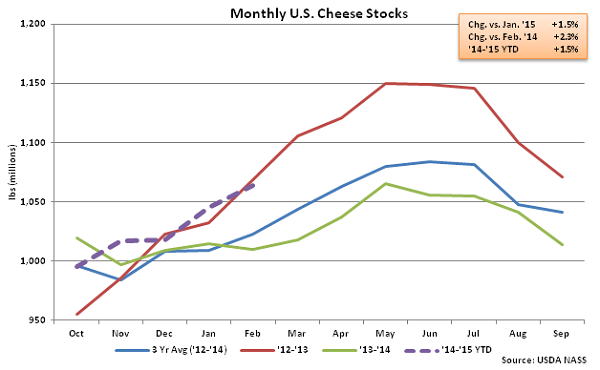

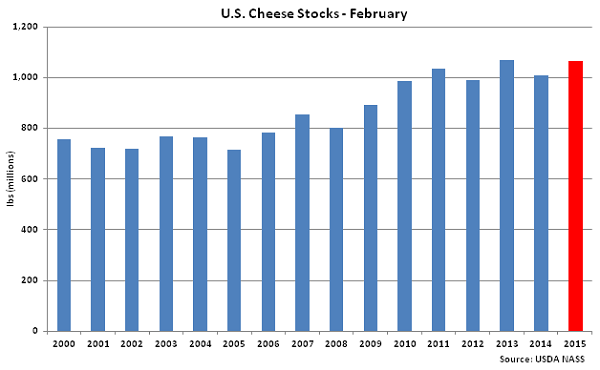

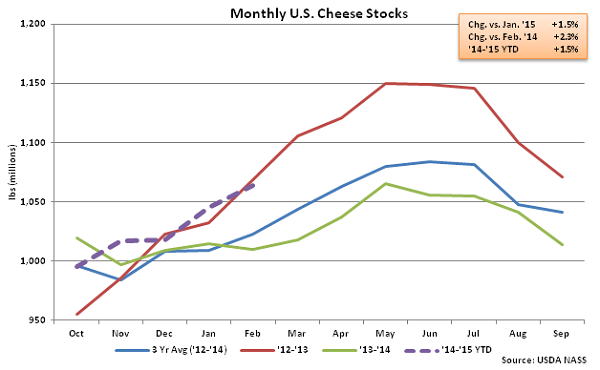

Feb ’15 U.S. cheese stocks of 1.06 billion pounds finished up 1.8% MOM and 5.3% YOY. The monthly YOY increase in cheese stocks was the fourth in a row after ten consecutive months of YOY declines were experienced from Dec ’13 to Sep ’14. American cheese stocks also increased YOY for the fourth consecutive month, finishing up 2.3% YOY. Declines in YOY U.S. cheese stocks accelerated throughout the spring and summer months of 2014 as milk production in key cheese producing states declined and U.S. cheese exports increased. This trend has continued to reverse course as milk production has stabilized in Midwestern cheese producing states while cheese exports declined YOY from Oct ’14 – Jan ’15 for the first times in 18 months. The Nov ’14 – Jan ’15 YOY declines in cheese exports were the largest in over five years on a percentage basis, although export volumes remain higher than historical levels.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.

Feb ’15 U.S. cheese stocks of 1.06 billion pounds finished up 1.8% MOM and 5.3% YOY. The monthly YOY increase in cheese stocks was the fourth in a row after ten consecutive months of YOY declines were experienced from Dec ’13 to Sep ’14. American cheese stocks also increased YOY for the fourth consecutive month, finishing up 2.3% YOY. Declines in YOY U.S. cheese stocks accelerated throughout the spring and summer months of 2014 as milk production in key cheese producing states declined and U.S. cheese exports increased. This trend has continued to reverse course as milk production has stabilized in Midwestern cheese producing states while cheese exports declined YOY from Oct ’14 – Jan ’15 for the first times in 18 months. The Nov ’14 – Jan ’15 YOY declines in cheese exports were the largest in over five years on a percentage basis, although export volumes remain higher than historical levels.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.

According to USDA, Feb ’15 U.S. butter stocks of 178.2 million pounds finished up 19.7% MOM and 3.7% YOY. Butter stocks increased YOY for the second month in a row following 14 consecutive months of YOY declines experienced from Nov ’13 – Dec ’14. Despite the YOY gains, Feb ’15 butter stocks remain 13.1% below the three year average February butter stocks. The MOM increase in butter stocks of 29.3 million pounds was slightly less than the ten year average Jan – Feb seasonal build of 31.4 million pounds.

The May ’14 – Dec ’14 seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Despite U.S. butter prices converging downward towards international prices, domestic butterfat exports remained weak in Jan ’15, down 74.8% YOY.

According to USDA, Feb ’15 U.S. butter stocks of 178.2 million pounds finished up 19.7% MOM and 3.7% YOY. Butter stocks increased YOY for the second month in a row following 14 consecutive months of YOY declines experienced from Nov ’13 – Dec ’14. Despite the YOY gains, Feb ’15 butter stocks remain 13.1% below the three year average February butter stocks. The MOM increase in butter stocks of 29.3 million pounds was slightly less than the ten year average Jan – Feb seasonal build of 31.4 million pounds.

The May ’14 – Dec ’14 seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Despite U.S. butter prices converging downward towards international prices, domestic butterfat exports remained weak in Jan ’15, down 74.8% YOY.

Cheese – Stocks Increase on YOY Basis for Fourth Consecutive Month

Cheese – Stocks Increase on YOY Basis for Fourth Consecutive Month

Feb ’15 U.S. cheese stocks of 1.06 billion pounds finished up 1.8% MOM and 5.3% YOY. The monthly YOY increase in cheese stocks was the fourth in a row after ten consecutive months of YOY declines were experienced from Dec ’13 to Sep ’14. American cheese stocks also increased YOY for the fourth consecutive month, finishing up 2.3% YOY. Declines in YOY U.S. cheese stocks accelerated throughout the spring and summer months of 2014 as milk production in key cheese producing states declined and U.S. cheese exports increased. This trend has continued to reverse course as milk production has stabilized in Midwestern cheese producing states while cheese exports declined YOY from Oct ’14 – Jan ’15 for the first times in 18 months. The Nov ’14 – Jan ’15 YOY declines in cheese exports were the largest in over five years on a percentage basis, although export volumes remain higher than historical levels.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.

Feb ’15 U.S. cheese stocks of 1.06 billion pounds finished up 1.8% MOM and 5.3% YOY. The monthly YOY increase in cheese stocks was the fourth in a row after ten consecutive months of YOY declines were experienced from Dec ’13 to Sep ’14. American cheese stocks also increased YOY for the fourth consecutive month, finishing up 2.3% YOY. Declines in YOY U.S. cheese stocks accelerated throughout the spring and summer months of 2014 as milk production in key cheese producing states declined and U.S. cheese exports increased. This trend has continued to reverse course as milk production has stabilized in Midwestern cheese producing states while cheese exports declined YOY from Oct ’14 – Jan ’15 for the first times in 18 months. The Nov ’14 – Jan ’15 YOY declines in cheese exports were the largest in over five years on a percentage basis, although export volumes remain higher than historical levels.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.