U.S. Commercial Disappearance Update – Mar ’15

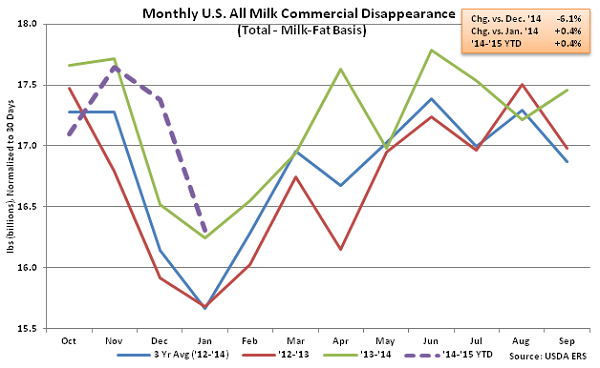

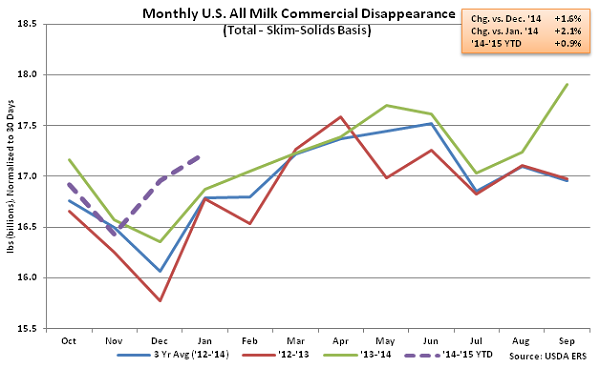

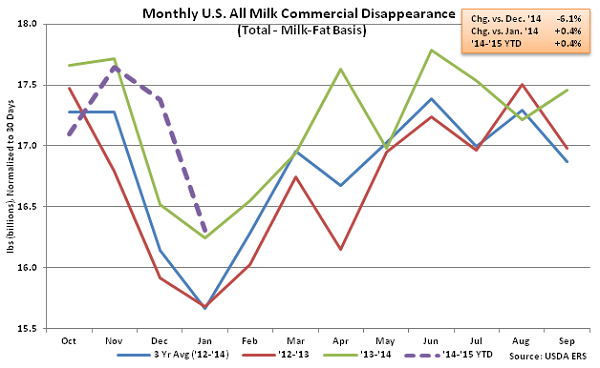

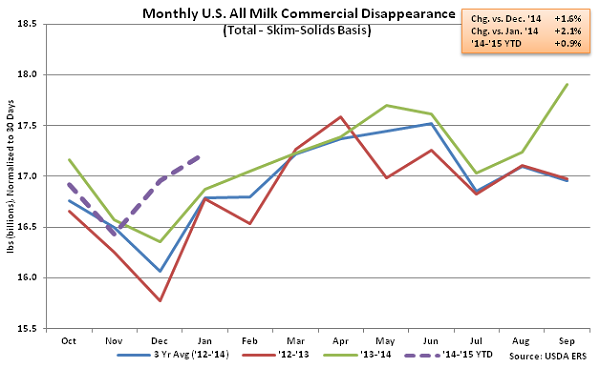

All Milk – YOY Disappearance Continues to Increase on Milk-Fat and Skim-Solids Bases

According to USDA, Jan ’15 U.S. commercial disappearance for milk used in all products increased YOY for the second consecutive month on both a milk-fat and skim-solids basis, finishing up 0.4% and 2.1%, respectively. Domestic demand continued to outpace international demand, finishing up 3.8% YOY on a milk-fat basis and 6.2% YOY on a skim-solids basis. ’14-’15 YTD commercial disappearance for milk used in all products is up 0.4% YOY on a milk-fat basis and 0.9% YOY on a skim-solids basis through the first third of the production season, with domestic demand up 3.0% and 2.3% YOY, respectively over the same period.

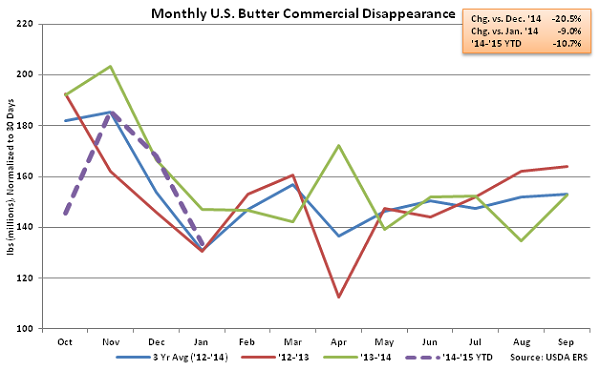

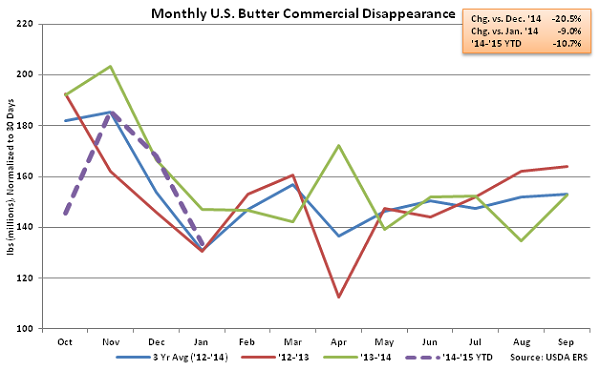

Butter – Lower Disappearance Continues on Weak International Demand

Jan ’15 U.S. butter commercial disappearance declined YOY for the fifth time in the last six months, finishing 9.0% lower. Domestic butter demand increased 1.2% YOY however international demand remained weak, finishing down 82.1%. U.S. butterfat exports have declined YOY for nine consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.7% YOY through the first third of the production season, with domestic demand down 2.8% and international demand down 78.8% over the period.

Butter – Lower Disappearance Continues on Weak International Demand

Jan ’15 U.S. butter commercial disappearance declined YOY for the fifth time in the last six months, finishing 9.0% lower. Domestic butter demand increased 1.2% YOY however international demand remained weak, finishing down 82.1%. U.S. butterfat exports have declined YOY for nine consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.7% YOY through the first third of the production season, with domestic demand down 2.8% and international demand down 78.8% over the period.

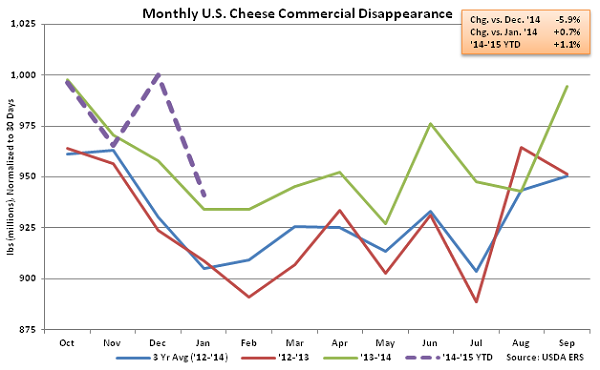

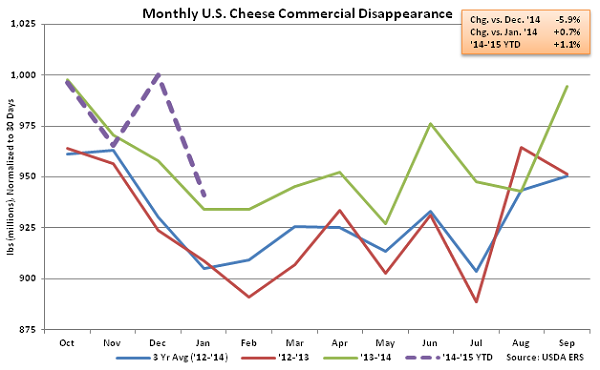

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New January Record High

Jan ’15 U.S. cheese commercial disappearance increased 0.7% YOY but declined 5.9% MOM on a daily average basis from the record high disappearance experienced in Dec ’14. The MOM decline of 5.9% was nearly double the ten year average December – January seasonal decline of 3.0%. Despite the larger than average MOM decline, Jan ’15 cheese commercial disappearance was the largest ever recorded for the month of January. Jan ’15 U.S. American cheese commercial disappearance increased 5.4% YOY but declined 2.3% MOM on a daily average basis while U.S. other-than-American cheese commercial disappearance declined 2.2% YOY and 8.2% MOM on a daily average basis. Domestic cheese demand remained strong, increasing 2.8% YOY while export volumes declined for the fourth consecutive month on a YOY basis, falling 26.0%. Domestic American cheese demand was particularly strong, finishing 9.7% higher than the previous year. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.1% YOY through the first third of the production season.

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New January Record High

Jan ’15 U.S. cheese commercial disappearance increased 0.7% YOY but declined 5.9% MOM on a daily average basis from the record high disappearance experienced in Dec ’14. The MOM decline of 5.9% was nearly double the ten year average December – January seasonal decline of 3.0%. Despite the larger than average MOM decline, Jan ’15 cheese commercial disappearance was the largest ever recorded for the month of January. Jan ’15 U.S. American cheese commercial disappearance increased 5.4% YOY but declined 2.3% MOM on a daily average basis while U.S. other-than-American cheese commercial disappearance declined 2.2% YOY and 8.2% MOM on a daily average basis. Domestic cheese demand remained strong, increasing 2.8% YOY while export volumes declined for the fourth consecutive month on a YOY basis, falling 26.0%. Domestic American cheese demand was particularly strong, finishing 9.7% higher than the previous year. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.1% YOY through the first third of the production season.

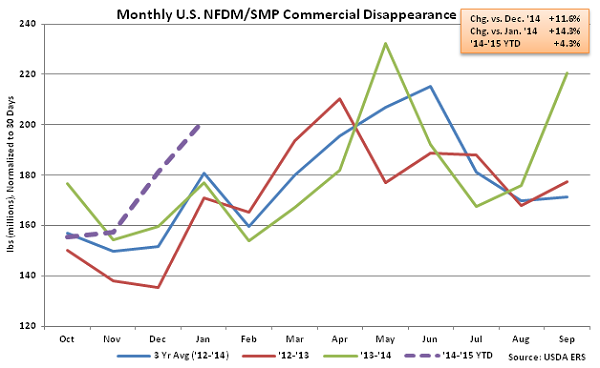

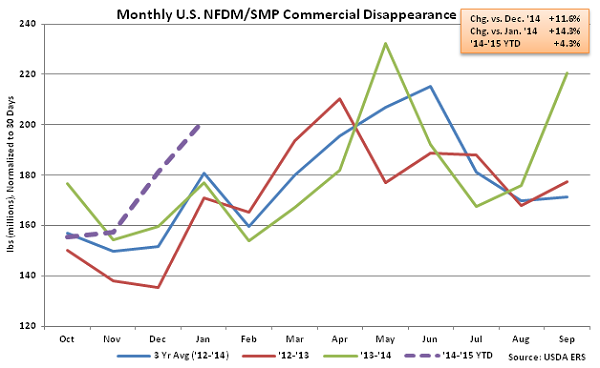

NFDM/SMP –Commercial Disappearance Increases to New January Record High

Jan ’15 U.S. NFDM/SMP commercial disappearance increased 14.3% YOY and 11.6% MOM on a daily average basis to the largest January figure on record. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the sixth consecutive month and finishing 35.5% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the sixth consecutive month, finishing 9.8% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 4.3% YOY through the first third of the production season.

NFDM/SMP –Commercial Disappearance Increases to New January Record High

Jan ’15 U.S. NFDM/SMP commercial disappearance increased 14.3% YOY and 11.6% MOM on a daily average basis to the largest January figure on record. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the sixth consecutive month and finishing 35.5% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the sixth consecutive month, finishing 9.8% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 4.3% YOY through the first third of the production season.

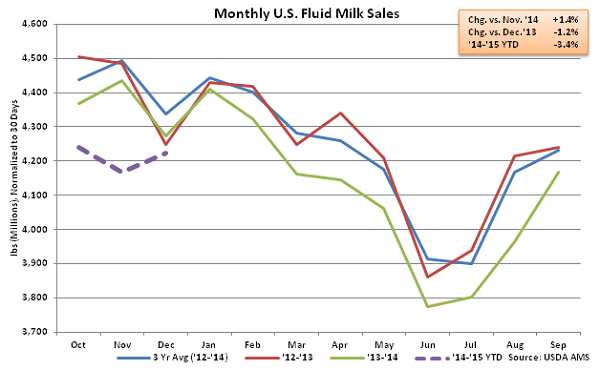

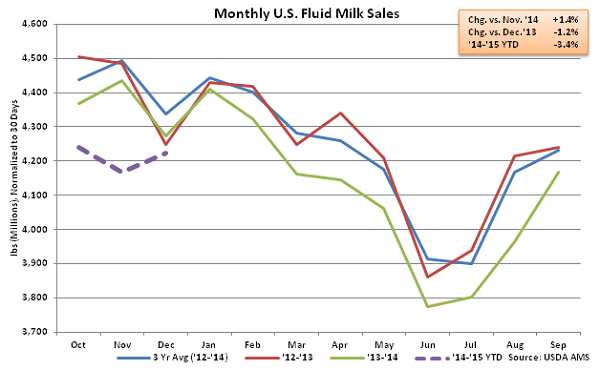

Fluid Milk Sales – YOY Sales Continue to Decline

Dec ’14 U.S. fluid milk sales of 4.37 billion pounds continued to decline on a YOY basis, falling 1.2%. Monthly fluid milk sales have declined YOY for 12 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.4% YOY through the first quarter of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Dec ’14 U.S. fluid milk sales of 4.37 billion pounds continued to decline on a YOY basis, falling 1.2%. Monthly fluid milk sales have declined YOY for 12 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.4% YOY through the first quarter of the production season.

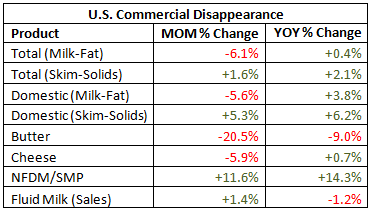

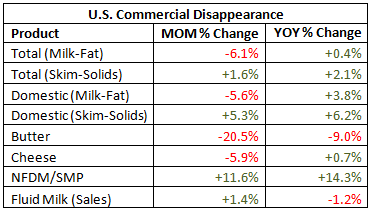

See the table below for a summary of key Jan ’15 U.S. dairy commercial disappearance figures in addition to the Dec ’14 fluid milk sales figure.

See the table below for a summary of key Jan ’15 U.S. dairy commercial disappearance figures in addition to the Dec ’14 fluid milk sales figure.

Butter – Lower Disappearance Continues on Weak International Demand

Jan ’15 U.S. butter commercial disappearance declined YOY for the fifth time in the last six months, finishing 9.0% lower. Domestic butter demand increased 1.2% YOY however international demand remained weak, finishing down 82.1%. U.S. butterfat exports have declined YOY for nine consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.7% YOY through the first third of the production season, with domestic demand down 2.8% and international demand down 78.8% over the period.

Butter – Lower Disappearance Continues on Weak International Demand

Jan ’15 U.S. butter commercial disappearance declined YOY for the fifth time in the last six months, finishing 9.0% lower. Domestic butter demand increased 1.2% YOY however international demand remained weak, finishing down 82.1%. U.S. butterfat exports have declined YOY for nine consecutive months as U.S. butter prices have traded at significant premiums to international prices and the USD has appreciated vs. rival currencies. ’14-’15 YTD U.S. butter commercial disappearance is down 10.7% YOY through the first third of the production season, with domestic demand down 2.8% and international demand down 78.8% over the period.

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New January Record High

Jan ’15 U.S. cheese commercial disappearance increased 0.7% YOY but declined 5.9% MOM on a daily average basis from the record high disappearance experienced in Dec ’14. The MOM decline of 5.9% was nearly double the ten year average December – January seasonal decline of 3.0%. Despite the larger than average MOM decline, Jan ’15 cheese commercial disappearance was the largest ever recorded for the month of January. Jan ’15 U.S. American cheese commercial disappearance increased 5.4% YOY but declined 2.3% MOM on a daily average basis while U.S. other-than-American cheese commercial disappearance declined 2.2% YOY and 8.2% MOM on a daily average basis. Domestic cheese demand remained strong, increasing 2.8% YOY while export volumes declined for the fourth consecutive month on a YOY basis, falling 26.0%. Domestic American cheese demand was particularly strong, finishing 9.7% higher than the previous year. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.1% YOY through the first third of the production season.

Cheese – Disappearance Remains Higher on YOY Basis, Reaches New January Record High

Jan ’15 U.S. cheese commercial disappearance increased 0.7% YOY but declined 5.9% MOM on a daily average basis from the record high disappearance experienced in Dec ’14. The MOM decline of 5.9% was nearly double the ten year average December – January seasonal decline of 3.0%. Despite the larger than average MOM decline, Jan ’15 cheese commercial disappearance was the largest ever recorded for the month of January. Jan ’15 U.S. American cheese commercial disappearance increased 5.4% YOY but declined 2.3% MOM on a daily average basis while U.S. other-than-American cheese commercial disappearance declined 2.2% YOY and 8.2% MOM on a daily average basis. Domestic cheese demand remained strong, increasing 2.8% YOY while export volumes declined for the fourth consecutive month on a YOY basis, falling 26.0%. Domestic American cheese demand was particularly strong, finishing 9.7% higher than the previous year. ’14-’15 YTD U.S. cheese commercial disappearance is up 1.1% YOY through the first third of the production season.

NFDM/SMP –Commercial Disappearance Increases to New January Record High

Jan ’15 U.S. NFDM/SMP commercial disappearance increased 14.3% YOY and 11.6% MOM on a daily average basis to the largest January figure on record. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the sixth consecutive month and finishing 35.5% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the sixth consecutive month, finishing 9.8% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 4.3% YOY through the first third of the production season.

NFDM/SMP –Commercial Disappearance Increases to New January Record High

Jan ’15 U.S. NFDM/SMP commercial disappearance increased 14.3% YOY and 11.6% MOM on a daily average basis to the largest January figure on record. U.S. NFDM/SMP domestic commercial disappearance was particularly strong, increasing YOY for the sixth consecutive month and finishing 35.5% higher than last year. Continued weak international demand offset a portion of the domestic gains as exports fell for the sixth consecutive month, finishing 9.8% lower YOY. ’14-’15 YTD U.S. NFDM/SMP commercial disappearance is up 4.3% YOY through the first third of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Dec ’14 U.S. fluid milk sales of 4.37 billion pounds continued to decline on a YOY basis, falling 1.2%. Monthly fluid milk sales have declined YOY for 12 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.4% YOY through the first quarter of the production season.

Fluid Milk Sales – YOY Sales Continue to Decline

Dec ’14 U.S. fluid milk sales of 4.37 billion pounds continued to decline on a YOY basis, falling 1.2%. Monthly fluid milk sales have declined YOY for 12 consecutive months at an average rate of 3.0% over the period. YOY declines in fluid milk sales are on top of historically weak demand last production season. ’13-’14 annual fluid milk sales declined 2.4% YOY, which was the largest annual YOY decline on record. ’14-’15 YTD fluid milk sales are down 3.4% YOY through the first quarter of the production season.

See the table below for a summary of key Jan ’15 U.S. dairy commercial disappearance figures in addition to the Dec ’14 fluid milk sales figure.

See the table below for a summary of key Jan ’15 U.S. dairy commercial disappearance figures in addition to the Dec ’14 fluid milk sales figure.