EU-28 Milk Production Update – May ’15

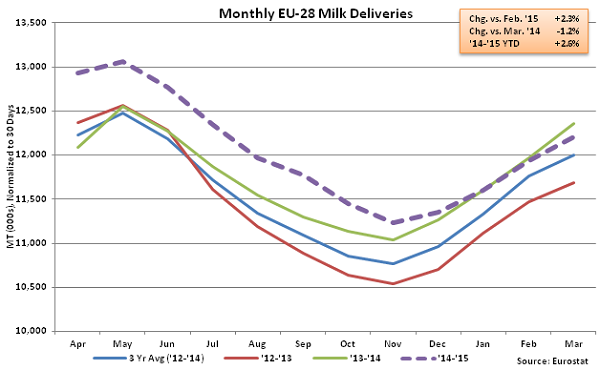

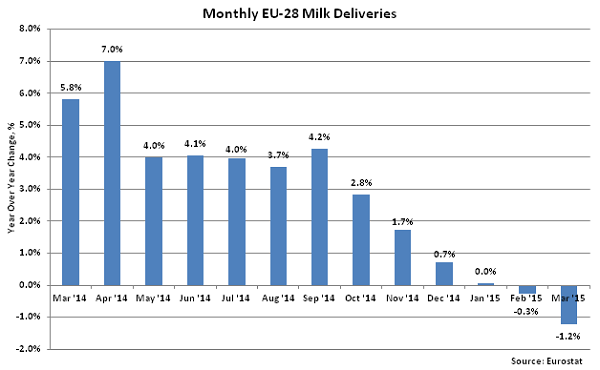

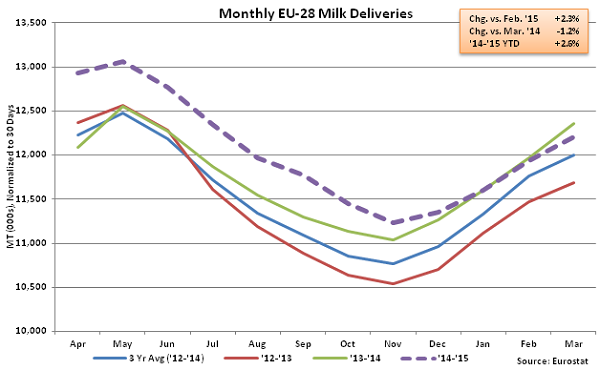

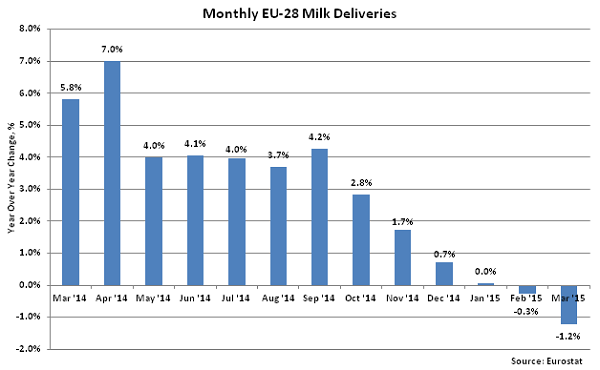

According to Eurostat, Mar ’15 EU-28 milk production finished lower on a YOY basis for the second consecutive month, finishing 1.2% below the previous year. Monthly production growth has decelerated throughout the fourth quarter of 2014 and into 2015, with the YOY growth rate declining throughout six consecutive months.

YOY declines in production were led by France (-93,580 MT), Germany (-56,110 MT) and the Netherlands (-22,400 MT). Production in Italy remained significantly higher than a year ago (+68,320 MT) while Hungary (+9,730 MT) and Portugal (+9,020 MT) also experienced YOY gains in production. Production figures for Spain have not yet been released and were estimated at the overall Mar ’15 EU-28 YOY growth rate. Spain accounted for only 4.2% of total EU-28 annual production throughout the ’13-’14 production season.

Production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. More recently, lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of levee payments for exceeding milk production quota levels have resulted in decelerating milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland have all trended over quota levels.

Production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. More recently, lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of levee payments for exceeding milk production quota levels have resulted in decelerating milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland have all trended over quota levels.

Despite the poor recent production growth, ’14-’15 annual EU-28 production finished up 2.6% YOY. EU-28 milk production quotas expired at the beginning on Apr ’15, likely resulting in continued growth in milk production throughout the ’15-’16 production season, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.

Despite the poor recent production growth, ’14-’15 annual EU-28 production finished up 2.6% YOY. EU-28 milk production quotas expired at the beginning on Apr ’15, likely resulting in continued growth in milk production throughout the ’15-’16 production season, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.

Production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. More recently, lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of levee payments for exceeding milk production quota levels have resulted in decelerating milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland have all trended over quota levels.

Production growth remained strong throughout the first three quarters of 2014 due to high milk prices, favorable weather, expanding dairy herds and more than adequate feed and forage supplies. More recently, lower farmgate milk prices, the Russian ban on EU dairy exports, and the likelihood of levee payments for exceeding milk production quota levels have resulted in decelerating milk production. Culling rates have increased in Europe as many producers are culling their lower producing cows. Germany, Belgium, the Netherlands, Denmark, Ireland and Poland have all trended over quota levels.

Despite the poor recent production growth, ’14-’15 annual EU-28 production finished up 2.6% YOY. EU-28 milk production quotas expired at the beginning on Apr ’15, likely resulting in continued growth in milk production throughout the ’15-’16 production season, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.

Despite the poor recent production growth, ’14-’15 annual EU-28 production finished up 2.6% YOY. EU-28 milk production quotas expired at the beginning on Apr ’15, likely resulting in continued growth in milk production throughout the ’15-’16 production season, however the current margin environment and ongoing Russian import ban may mitigate production gains in the near-term.