Chinese Dairy Imports Update – Jun ’15

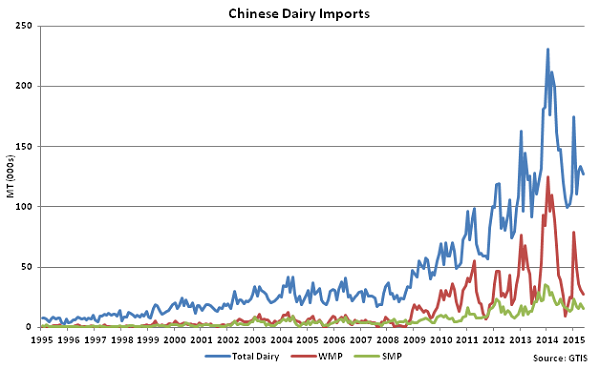

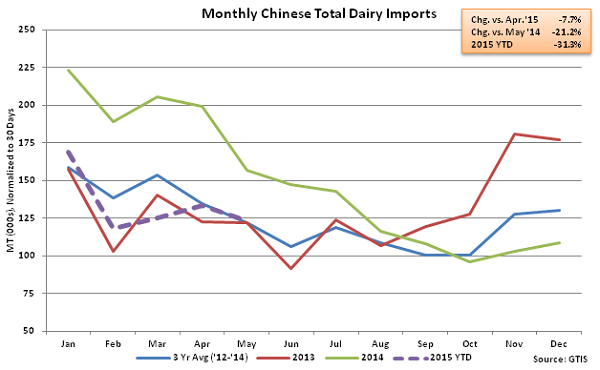

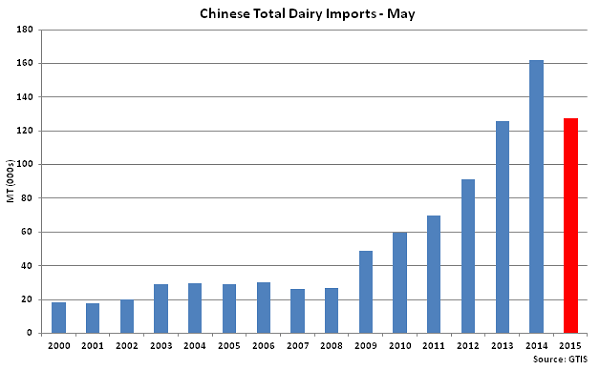

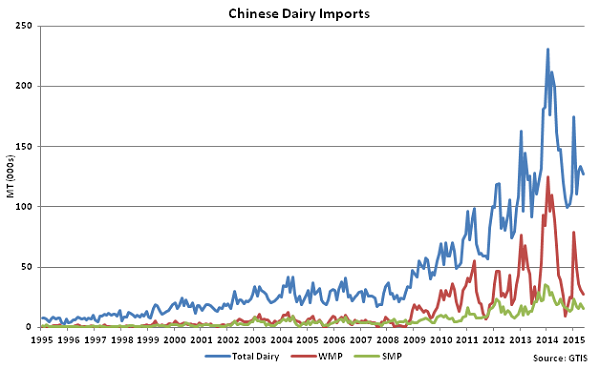

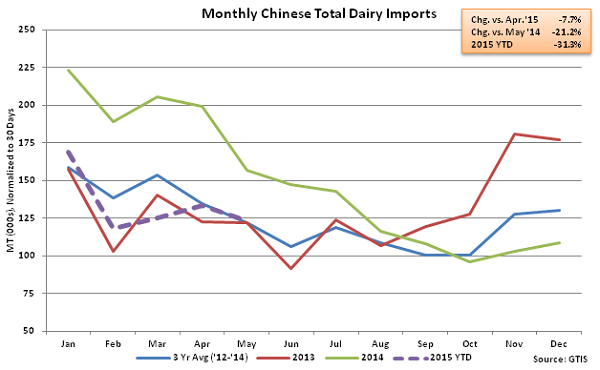

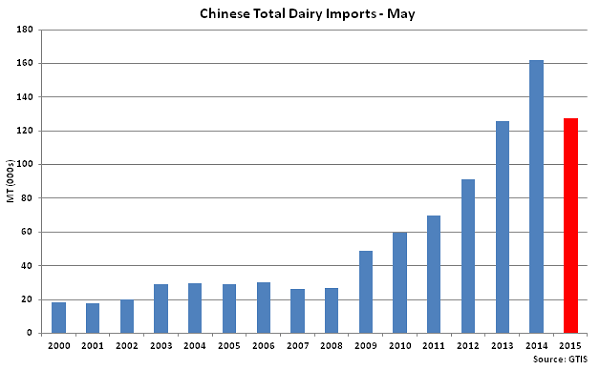

According to GTIS, May ’15 total Chinese dairy import volumes remained weak, finishing down 21.2% YOY. Total Chinese dairy import volumes have declined YOY for nine consecutive months at an average rate of 30.1% over the period. Total Chinese dairy import volumes also declined 7.7% MOM on a daily average basis, consistent with the ten year average April – May seasonal decline in total dairy import volumes of 7.1%. May ’15 total Chinese import volumes did, however, finish above three year average volumes for the first time in four months, finishing 0.9% above May ’12 – May ’14 average volumes.

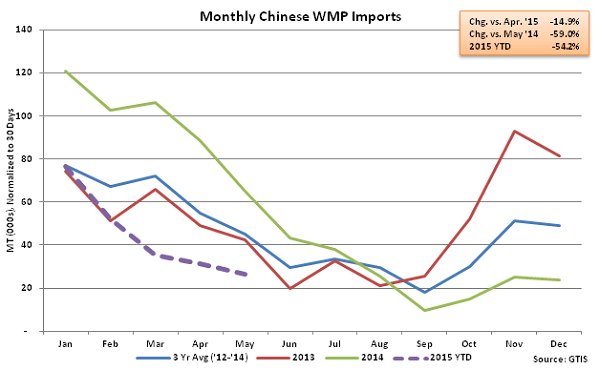

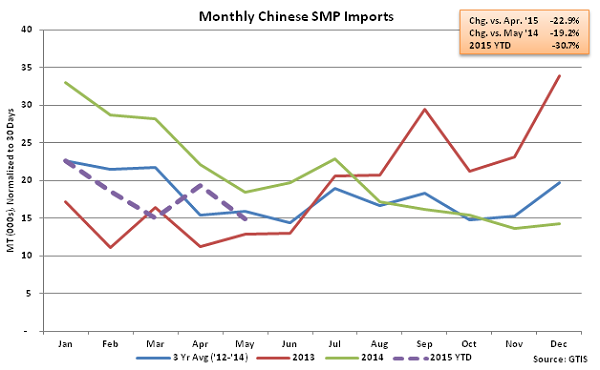

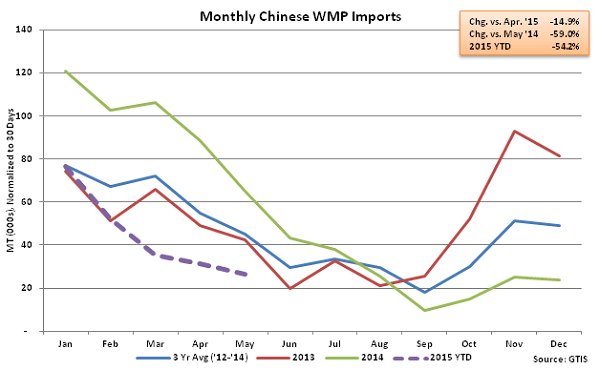

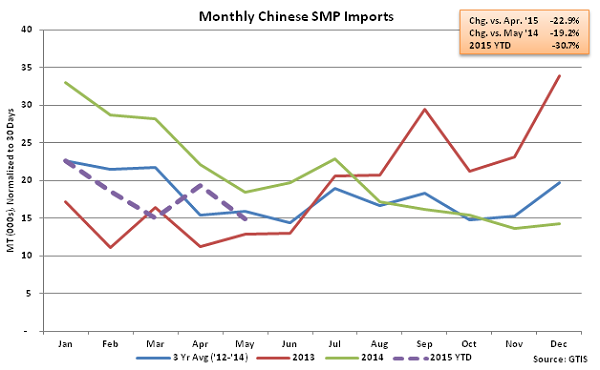

May ’15 whole milk powder (WMP) imports finished down 59.0% YOY and 14.9% MOM on a daily average basis while skim milk powder (SMP) imports finished down 19.2% YOY and 22.9% MOM on a daily average basis. Imported volumes for both products remained below three year average volumes, with WMP and SMP imports declining 40.7% and 6.3%, respectively, vs. May ’12 – May ’14 volumes.

May ’15 Total Chinese Dairy Import Volumes Remained Significantly Below Last Year’s Levels

May ’15 Total Chinese Dairy Import Volumes Down 7.7% MOM and 21.2% YOY

May ’15 Total Chinese Dairy Import Volumes Down 7.7% MOM and 21.2% YOY

May ’15 Total Chinese Dairy Import Volumes Remained at the Second Highest May Level

May ’15 Total Chinese Dairy Import Volumes Remained at the Second Highest May Level

May ’15 Chinese WMP Import Volumes Down 14.9% MOM and 59.0% YOY

May ’15 Chinese WMP Import Volumes Down 14.9% MOM and 59.0% YOY

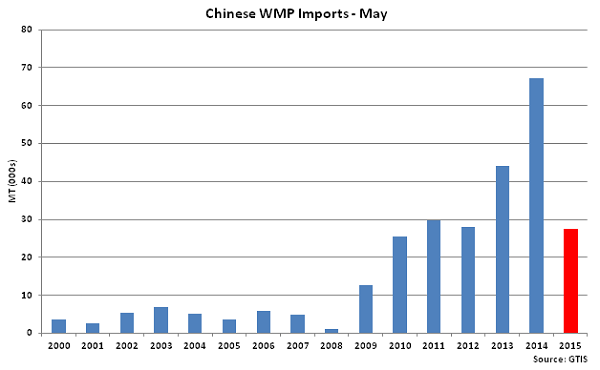

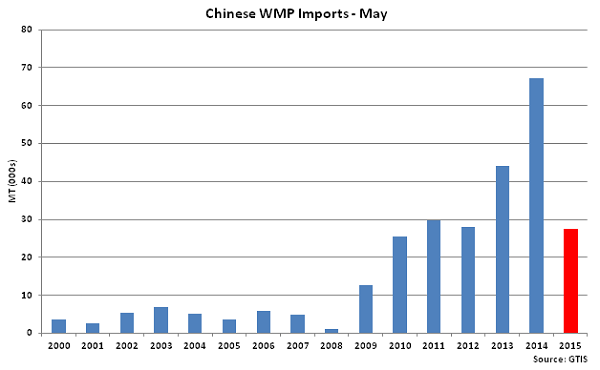

May ’15 Chinese WMP Import Volumes Declined to a Five Year Low for the Month of May

May ’15 Chinese WMP Import Volumes Declined to a Five Year Low for the Month of May

May ’15 Chinese SMP Import Volumes Down 22.9% MOM and 19.2% YOY

May ’15 Chinese SMP Import Volumes Down 22.9% MOM and 19.2% YOY

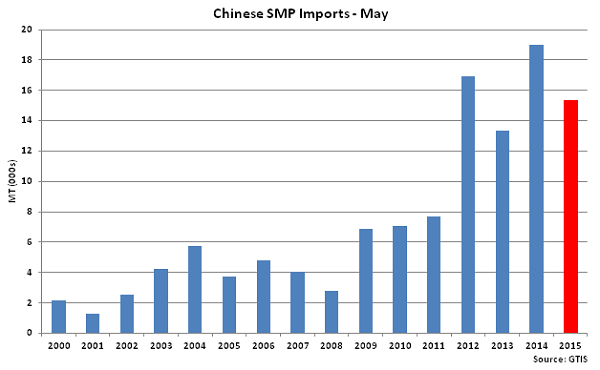

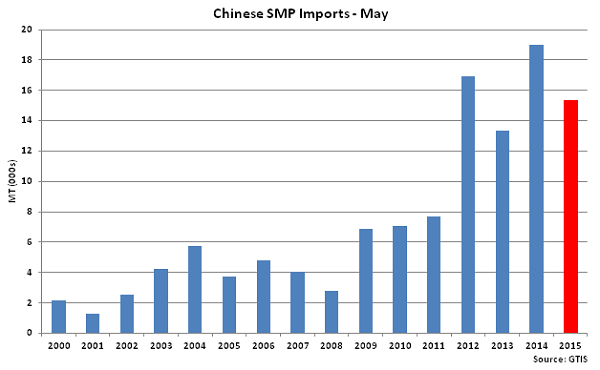

May ’15 Chinese SMP Import Volumes Remained at the Third Highest May Level

May ’15 Chinese SMP Import Volumes Remained at the Third Highest May Level

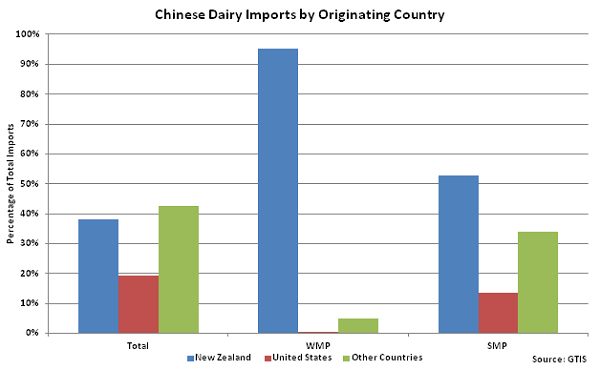

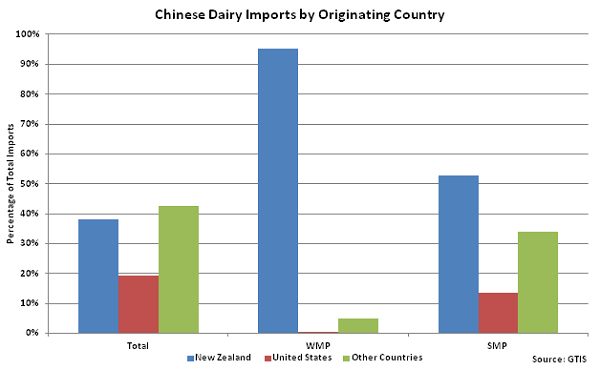

New Zealand Accounted for Nearly 40% of the Total May ’15 Chinese Dairy Import Volumes

New Zealand Accounted for Nearly 40% of the Total May ’15 Chinese Dairy Import Volumes

May ’15 Total Chinese Dairy Import Volumes Down 7.7% MOM and 21.2% YOY

May ’15 Total Chinese Dairy Import Volumes Down 7.7% MOM and 21.2% YOY

May ’15 Total Chinese Dairy Import Volumes Remained at the Second Highest May Level

May ’15 Total Chinese Dairy Import Volumes Remained at the Second Highest May Level

May ’15 Chinese WMP Import Volumes Down 14.9% MOM and 59.0% YOY

May ’15 Chinese WMP Import Volumes Down 14.9% MOM and 59.0% YOY

May ’15 Chinese WMP Import Volumes Declined to a Five Year Low for the Month of May

May ’15 Chinese WMP Import Volumes Declined to a Five Year Low for the Month of May

May ’15 Chinese SMP Import Volumes Down 22.9% MOM and 19.2% YOY

May ’15 Chinese SMP Import Volumes Down 22.9% MOM and 19.2% YOY

May ’15 Chinese SMP Import Volumes Remained at the Third Highest May Level

May ’15 Chinese SMP Import Volumes Remained at the Third Highest May Level

New Zealand Accounted for Nearly 40% of the Total May ’15 Chinese Dairy Import Volumes

New Zealand Accounted for Nearly 40% of the Total May ’15 Chinese Dairy Import Volumes