U.S. Livestock & Meat Trade Update – Aug ’15

Pork – Imports Remain Strong, Net Trade Declines to Four Month Low

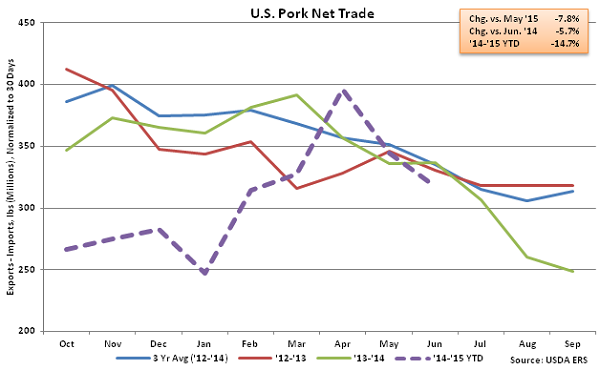

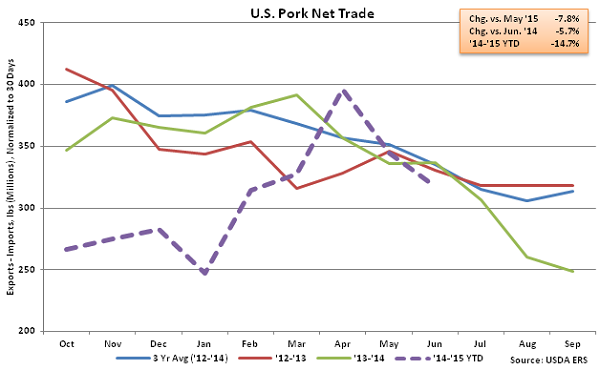

Jun ’15 U.S. pork export volumes continued to decline from the three year high experienced in Apr ’15, falling 0.3% YOY and 2.5% MOM on a daily average basis. U.S. pork exports destined to South Korea remained strong, increasing YOY for the 17th consecutive month and finishing 74.7% above the previous year, while export volumes destined to Mexico increased by 20.5%. U.S. pork export volumes to other major export destinations remained weak, however. Exports destined to Canada declined for the third consecutive month on a YOY basis, finishing 13.3% below the previous year while export volumes to Japan fell by 9.3% YOY. U.S. pork exports to Japan, Mexico, South Korea and Canada accounted for over three quarters of all pork export volumes in Jun ’15.

Jun ’15 U.S. pork imports remained strong, increasing by 23.1% YOY and 20.9% MOM on a daily average basis. The YOY increase in pork imports was consistent with the ’14-’15 YTD increase in import volumes of 22.7% over the first three quarters of the production season. Declining YOY pork exports, coupled with increasing YOY pork imports, resulted in Jun ’15 net pork trade declining to a four month low. Jun ’15 U.S. net pork trade finished down 5.7% YOY and 7.8% MOM on a daily average basis and is down 14.7% YTD through the first three quarters of the production season.

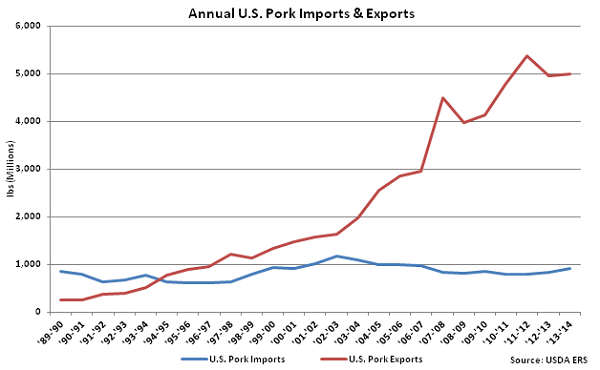

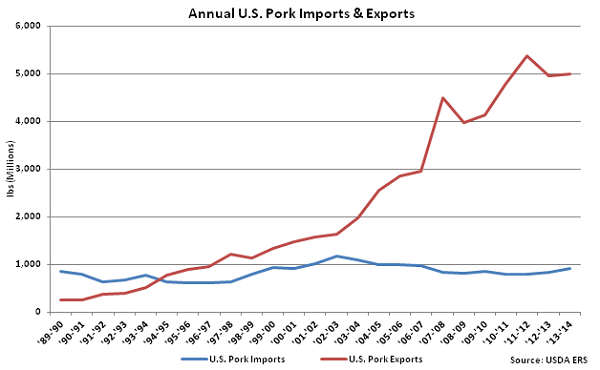

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes have remained over four times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes have remained over four times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

Beef & Veal – Net Trade Remains Down Significantly YOY on Strong Imports

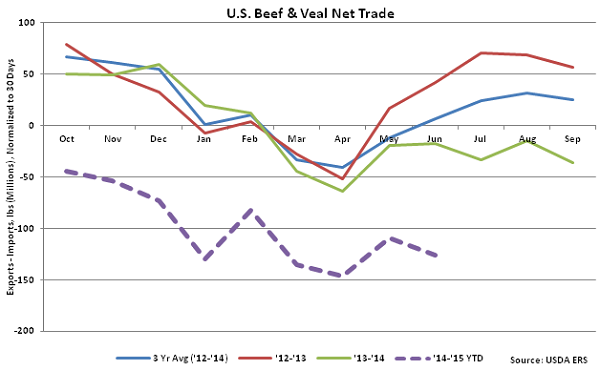

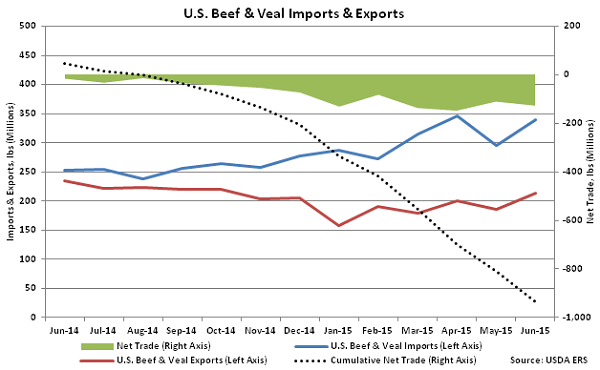

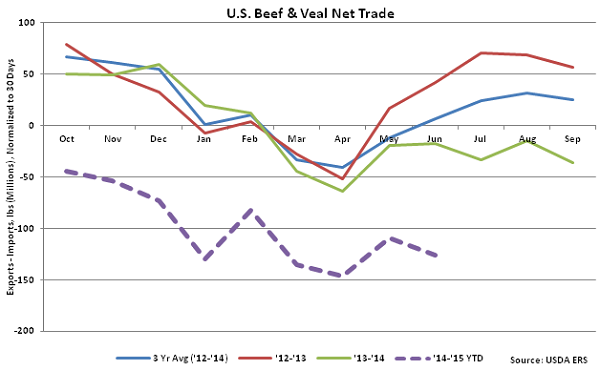

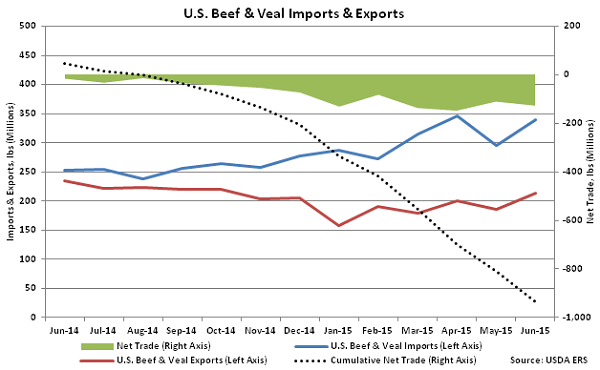

Jun ’15 U.S. beef & veal export volumes increased 14.8% MOM on a daily average basis but remained lower YOY, finishing 9.0% below the previous year. Beef & veal export volumes have declined YOY for 12 consecutive months through June. Of the major export destinations, YOY declines in export volumes were led by Mexico (-24.1%), followed by Japan (-13.2%), combined volumes to Hong Kong, Taiwan and China (-12.9%), and Canada (-12.4%). Export volumes to South Korea increased YOY for the fifth consecutive month, finishing 31.4% higher than the previous year. U.S. beef & veal exports to the aforementioned countries accounted for over 85% of all beef & veal export volumes in Jun ’15.

Jun ’15 U.S. beef & veal imports remained strong, increasing by 34.7% YOY and 14.9% MOM on a daily average basis. Beef & veal import volumes have increased YOY for 16 consecutive months through Jun ’15, exceeding export volumes by 34.4% over the period.

Beef & Veal – Net Trade Remains Down Significantly YOY on Strong Imports

Jun ’15 U.S. beef & veal export volumes increased 14.8% MOM on a daily average basis but remained lower YOY, finishing 9.0% below the previous year. Beef & veal export volumes have declined YOY for 12 consecutive months through June. Of the major export destinations, YOY declines in export volumes were led by Mexico (-24.1%), followed by Japan (-13.2%), combined volumes to Hong Kong, Taiwan and China (-12.9%), and Canada (-12.4%). Export volumes to South Korea increased YOY for the fifth consecutive month, finishing 31.4% higher than the previous year. U.S. beef & veal exports to the aforementioned countries accounted for over 85% of all beef & veal export volumes in Jun ’15.

Jun ’15 U.S. beef & veal imports remained strong, increasing by 34.7% YOY and 14.9% MOM on a daily average basis. Beef & veal import volumes have increased YOY for 16 consecutive months through Jun ’15, exceeding export volumes by 34.4% over the period.

Recent strength in beef & veal imports resulted in ’13-’14 annual U.S. beef & veal imports finishing higher than annual U.S. beef & veal exports for the first time in four years, with this trend continuing into the ’14-’15 production season. Beef & veal net trade declined to a new seven and a half year low in Apr ’15, prior to increasing slightly over the most recent two months.

Recent strength in beef & veal imports resulted in ’13-’14 annual U.S. beef & veal imports finishing higher than annual U.S. beef & veal exports for the first time in four years, with this trend continuing into the ’14-’15 production season. Beef & veal net trade declined to a new seven and a half year low in Apr ’15, prior to increasing slightly over the most recent two months.

Chicken – Net Trade Remains Lower YOY on Weak Export Demand

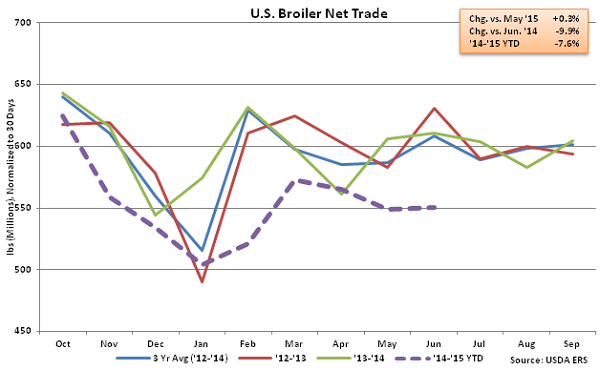

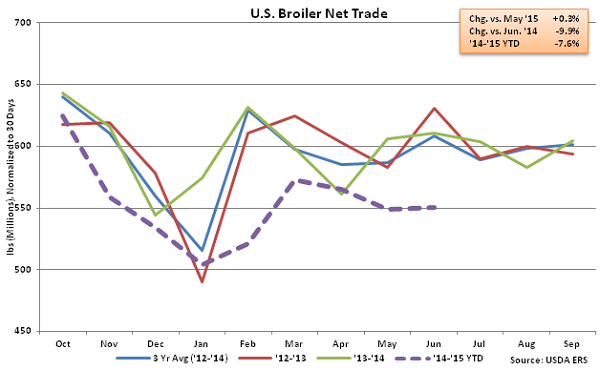

Jun ’15 U.S. broiler export volumes continued to decline on a YOY basis, falling 9.1%. Monthly export volumes have declined YOY throughout eight of the past nine months as the broiler export market continues to be negatively affected by the Russian import ban. Russia accounted for 8.2% of U.S. broiler export volumes throughout the ’12-’13 production season. Excluding Russia, Jun ’15 broiler export volumes increased 0.1% YOY, however declines were also experienced in other major U.S. broiler import markets. Combined broiler export volumes to Hong Kong, Taiwan and China finished down 5.2% YOY, while broiler export volumes to Mexico declined YOY for the second consecutive month, finishing down 14.9%. U.S. broiler export volumes destined to Mexico had increased YOY for 17 consecutive months from Dec ’13 – Apr ’15. Despite the recent declines, broiler export volumes to Mexico have accounted for over a fifth of total broiler export volumes over the past 12 months.

Jun ’15 U.S. broiler imports remained strong, increasing 50.7% YOY and 27.9% MOM on a daily average basis. Broiler imports remain at insignificant levels relative to export volumes, with Jun ’15 imports amounting to only 2.4% of export volumes. Declining broiler exports, coupled with increasing imports, resulted in Jun ’15 net broiler trade declining YOY for the eighth time in the past nine months, finishing down 9.9%. Net broiler trade is down 7.6% YTD YOY through the first three quarters of the ’14-’15 production season.

Chicken – Net Trade Remains Lower YOY on Weak Export Demand

Jun ’15 U.S. broiler export volumes continued to decline on a YOY basis, falling 9.1%. Monthly export volumes have declined YOY throughout eight of the past nine months as the broiler export market continues to be negatively affected by the Russian import ban. Russia accounted for 8.2% of U.S. broiler export volumes throughout the ’12-’13 production season. Excluding Russia, Jun ’15 broiler export volumes increased 0.1% YOY, however declines were also experienced in other major U.S. broiler import markets. Combined broiler export volumes to Hong Kong, Taiwan and China finished down 5.2% YOY, while broiler export volumes to Mexico declined YOY for the second consecutive month, finishing down 14.9%. U.S. broiler export volumes destined to Mexico had increased YOY for 17 consecutive months from Dec ’13 – Apr ’15. Despite the recent declines, broiler export volumes to Mexico have accounted for over a fifth of total broiler export volumes over the past 12 months.

Jun ’15 U.S. broiler imports remained strong, increasing 50.7% YOY and 27.9% MOM on a daily average basis. Broiler imports remain at insignificant levels relative to export volumes, with Jun ’15 imports amounting to only 2.4% of export volumes. Declining broiler exports, coupled with increasing imports, resulted in Jun ’15 net broiler trade declining YOY for the eighth time in the past nine months, finishing down 9.9%. Net broiler trade is down 7.6% YTD YOY through the first three quarters of the ’14-’15 production season.

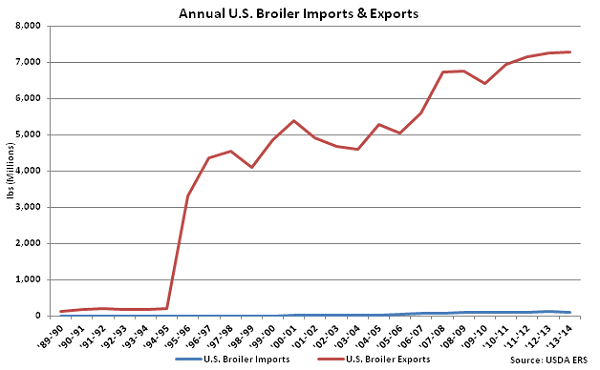

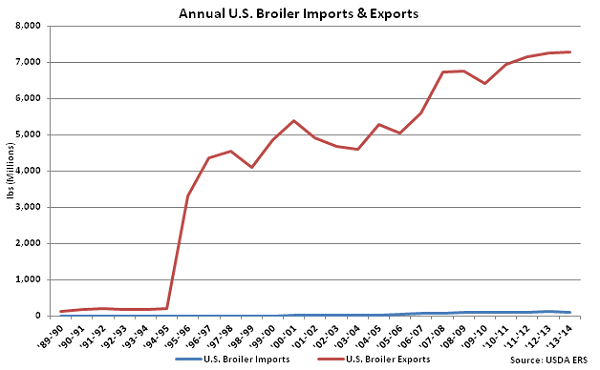

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes have remained 56 times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes have remained 56 times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes have remained over four times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

U.S. pork export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 13.2%, while U.S. pork imports have remained fairly flat, increasing at a CAGR of 0.3% over the same time period. ’13-’14 annual pork imports experienced much stronger growth, finishing 10.5% higher than the previous year, the largest YOY percentage gain in 11 years. Despite the increase in pork imports, ’13-’14 annual pork exports volumes remained over five times as large as import volumes. Pork export volumes have remained over four times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

Beef & Veal – Net Trade Remains Down Significantly YOY on Strong Imports

Jun ’15 U.S. beef & veal export volumes increased 14.8% MOM on a daily average basis but remained lower YOY, finishing 9.0% below the previous year. Beef & veal export volumes have declined YOY for 12 consecutive months through June. Of the major export destinations, YOY declines in export volumes were led by Mexico (-24.1%), followed by Japan (-13.2%), combined volumes to Hong Kong, Taiwan and China (-12.9%), and Canada (-12.4%). Export volumes to South Korea increased YOY for the fifth consecutive month, finishing 31.4% higher than the previous year. U.S. beef & veal exports to the aforementioned countries accounted for over 85% of all beef & veal export volumes in Jun ’15.

Jun ’15 U.S. beef & veal imports remained strong, increasing by 34.7% YOY and 14.9% MOM on a daily average basis. Beef & veal import volumes have increased YOY for 16 consecutive months through Jun ’15, exceeding export volumes by 34.4% over the period.

Beef & Veal – Net Trade Remains Down Significantly YOY on Strong Imports

Jun ’15 U.S. beef & veal export volumes increased 14.8% MOM on a daily average basis but remained lower YOY, finishing 9.0% below the previous year. Beef & veal export volumes have declined YOY for 12 consecutive months through June. Of the major export destinations, YOY declines in export volumes were led by Mexico (-24.1%), followed by Japan (-13.2%), combined volumes to Hong Kong, Taiwan and China (-12.9%), and Canada (-12.4%). Export volumes to South Korea increased YOY for the fifth consecutive month, finishing 31.4% higher than the previous year. U.S. beef & veal exports to the aforementioned countries accounted for over 85% of all beef & veal export volumes in Jun ’15.

Jun ’15 U.S. beef & veal imports remained strong, increasing by 34.7% YOY and 14.9% MOM on a daily average basis. Beef & veal import volumes have increased YOY for 16 consecutive months through Jun ’15, exceeding export volumes by 34.4% over the period.

Recent strength in beef & veal imports resulted in ’13-’14 annual U.S. beef & veal imports finishing higher than annual U.S. beef & veal exports for the first time in four years, with this trend continuing into the ’14-’15 production season. Beef & veal net trade declined to a new seven and a half year low in Apr ’15, prior to increasing slightly over the most recent two months.

Recent strength in beef & veal imports resulted in ’13-’14 annual U.S. beef & veal imports finishing higher than annual U.S. beef & veal exports for the first time in four years, with this trend continuing into the ’14-’15 production season. Beef & veal net trade declined to a new seven and a half year low in Apr ’15, prior to increasing slightly over the most recent two months.

Chicken – Net Trade Remains Lower YOY on Weak Export Demand

Jun ’15 U.S. broiler export volumes continued to decline on a YOY basis, falling 9.1%. Monthly export volumes have declined YOY throughout eight of the past nine months as the broiler export market continues to be negatively affected by the Russian import ban. Russia accounted for 8.2% of U.S. broiler export volumes throughout the ’12-’13 production season. Excluding Russia, Jun ’15 broiler export volumes increased 0.1% YOY, however declines were also experienced in other major U.S. broiler import markets. Combined broiler export volumes to Hong Kong, Taiwan and China finished down 5.2% YOY, while broiler export volumes to Mexico declined YOY for the second consecutive month, finishing down 14.9%. U.S. broiler export volumes destined to Mexico had increased YOY for 17 consecutive months from Dec ’13 – Apr ’15. Despite the recent declines, broiler export volumes to Mexico have accounted for over a fifth of total broiler export volumes over the past 12 months.

Jun ’15 U.S. broiler imports remained strong, increasing 50.7% YOY and 27.9% MOM on a daily average basis. Broiler imports remain at insignificant levels relative to export volumes, with Jun ’15 imports amounting to only 2.4% of export volumes. Declining broiler exports, coupled with increasing imports, resulted in Jun ’15 net broiler trade declining YOY for the eighth time in the past nine months, finishing down 9.9%. Net broiler trade is down 7.6% YTD YOY through the first three quarters of the ’14-’15 production season.

Chicken – Net Trade Remains Lower YOY on Weak Export Demand

Jun ’15 U.S. broiler export volumes continued to decline on a YOY basis, falling 9.1%. Monthly export volumes have declined YOY throughout eight of the past nine months as the broiler export market continues to be negatively affected by the Russian import ban. Russia accounted for 8.2% of U.S. broiler export volumes throughout the ’12-’13 production season. Excluding Russia, Jun ’15 broiler export volumes increased 0.1% YOY, however declines were also experienced in other major U.S. broiler import markets. Combined broiler export volumes to Hong Kong, Taiwan and China finished down 5.2% YOY, while broiler export volumes to Mexico declined YOY for the second consecutive month, finishing down 14.9%. U.S. broiler export volumes destined to Mexico had increased YOY for 17 consecutive months from Dec ’13 – Apr ’15. Despite the recent declines, broiler export volumes to Mexico have accounted for over a fifth of total broiler export volumes over the past 12 months.

Jun ’15 U.S. broiler imports remained strong, increasing 50.7% YOY and 27.9% MOM on a daily average basis. Broiler imports remain at insignificant levels relative to export volumes, with Jun ’15 imports amounting to only 2.4% of export volumes. Declining broiler exports, coupled with increasing imports, resulted in Jun ’15 net broiler trade declining YOY for the eighth time in the past nine months, finishing down 9.9%. Net broiler trade is down 7.6% YTD YOY through the first three quarters of the ’14-’15 production season.

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes have remained 56 times as large as import volumes throughout the first three quarters of the ’14-’15 production season.

U.S. broiler export volumes have strengthened considerably over the past 25 years, increasing at a compound annual growth rate (CAGR) of 18.3%. U.S. broiler import volumes have increased at a CAGR of 21.6% over the same time period but remain significantly lower. ’13-’14 annual broiler exports volumes were over 60 times as large as import volumes. Broiler export volumes have remained 56 times as large as import volumes throughout the first three quarters of the ’14-’15 production season.