U.S. Dairy Exports Remain Significantly Lower YOY – Nov…

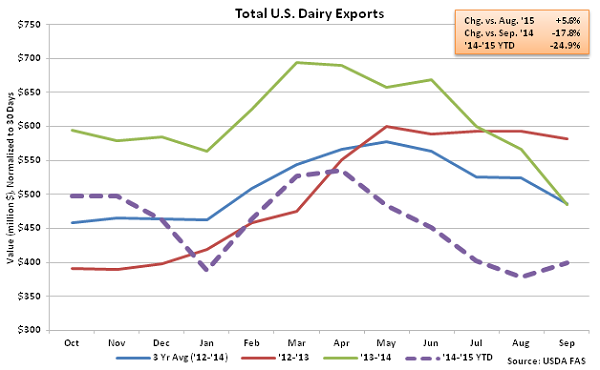

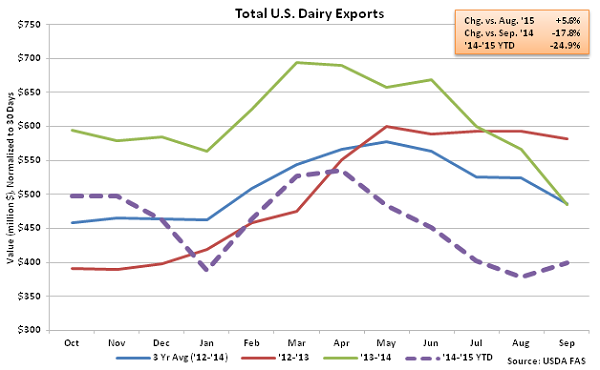

According to USDA, the total value of all U.S. dairy exports declined YOY for the 14th consecutive month in Sep ’15, finishing 17.8% below the previous year. The total value of all U.S. dairy exports did, however, increase by 5.6% MOM on a daily average basis from the four and a half year low experienced in Aug ’15. U.S. dairy product price premiums continued to increase throughout Sep ’15 while export volumes also continued to be negatively affected by a strengthening dollar relative to the currencies of traditional buyers of U.S. dairy products. A strengthening dollar results in less purchasing power for importing countries, and ultimately less foreign demand for U.S. products, all other factors being equal.

Butter – Exports Decline to New Eight and a Half Year Low

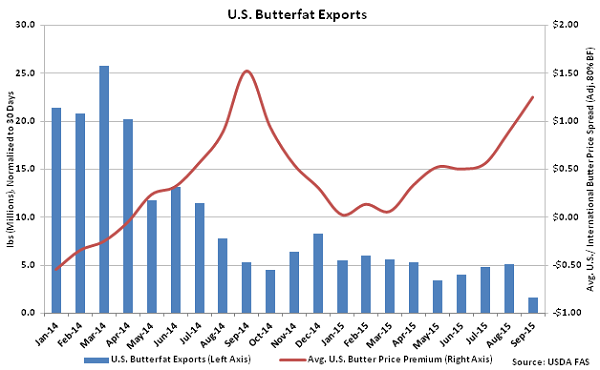

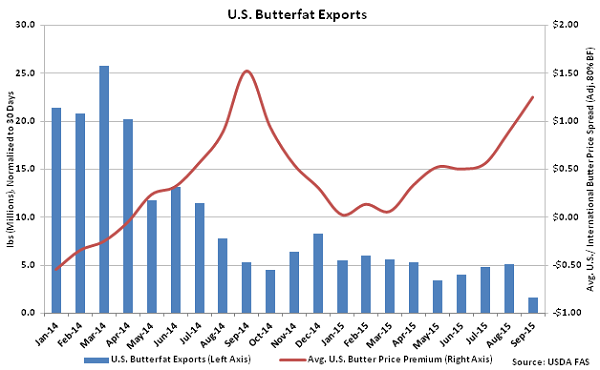

Sep ’15 export volumes of butterfat remained weak, declining 69.6% YOY and 68.2% MOM on a daily average basis to a new eight and a half year low. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 17 consecutive months, with total volumes down 62.5% over the period. The U.S. was a net importer of butter for the eighth consecutive month in Sep ’15, with total butterfat import volumes finishing nearly four times as large as total butterfat export volumes throughout the month.

Butter – Exports Decline to New Eight and a Half Year Low

Sep ’15 export volumes of butterfat remained weak, declining 69.6% YOY and 68.2% MOM on a daily average basis to a new eight and a half year low. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 17 consecutive months, with total volumes down 62.5% over the period. The U.S. was a net importer of butter for the eighth consecutive month in Sep ’15, with total butterfat import volumes finishing nearly four times as large as total butterfat export volumes throughout the month.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads peaked in Sep ’14, with U.S. butter prices trading at an 80.6% premium to European prices and a 128.1% premium to Oceania prices. Domestic butter price premiums declined throughout the fourth quarter of 2014 and into 2015, but have begun to increase once again throughout recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads peaked in Sep ’14, with U.S. butter prices trading at an 80.6% premium to European prices and a 128.1% premium to Oceania prices. Domestic butter price premiums declined throughout the fourth quarter of 2014 and into 2015, but have begun to increase once again throughout recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

Cheese – Export Volumes Remain Significantly Lower on YOY Basis

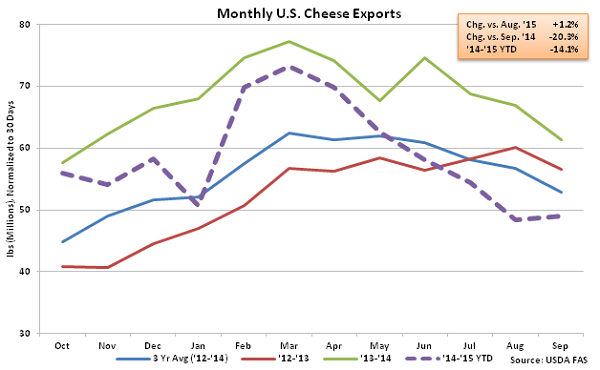

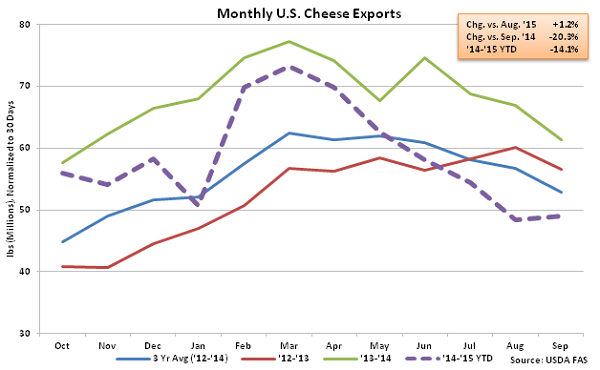

Sep ’15 U.S. cheese export volumes increased 1.2% MOM on a daily average basis from the two and a half year low experienced in Aug ’15 but remained lower on a YOY basis for the 12th consecutive month, finishing down 20.3%. Cheddar cheese exports remained particularly weak, declining 55.4% YOY. U.S. cheddar cheese prices traded at a premium to international cheddar cheese prices throughout Apr ’15 for the first time in five months, with the U.S. price premium continuing to strengthen throughout recent months. Sep ’15 cheese volumes destined to Mexico increased by 10.3% YOY however shipments to South Korea declined sharply, finishing 50.6% below the previous year. Cheese volumes destined to Mexico and South Korea consisted of nearly half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

Cheese – Export Volumes Remain Significantly Lower on YOY Basis

Sep ’15 U.S. cheese export volumes increased 1.2% MOM on a daily average basis from the two and a half year low experienced in Aug ’15 but remained lower on a YOY basis for the 12th consecutive month, finishing down 20.3%. Cheddar cheese exports remained particularly weak, declining 55.4% YOY. U.S. cheddar cheese prices traded at a premium to international cheddar cheese prices throughout Apr ’15 for the first time in five months, with the U.S. price premium continuing to strengthen throughout recent months. Sep ’15 cheese volumes destined to Mexico increased by 10.3% YOY however shipments to South Korea declined sharply, finishing 50.6% below the previous year. Cheese volumes destined to Mexico and South Korea consisted of nearly half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

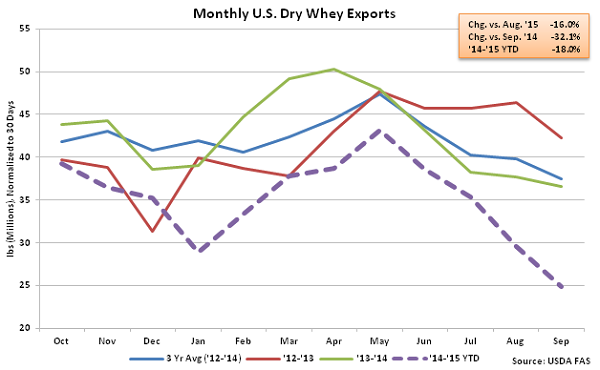

Dry Whey – Exports Decline to New 11 Year Low

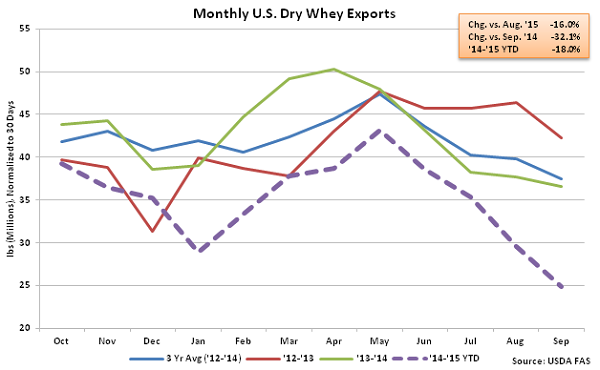

Sep ’15 dry whey export volumes remained lower on a YOY basis for the 16th consecutive month, finishing down 32.1% while also declining 16.0% MOM on a daily average basis to a new 11 year low. The MOM decline was significantly greater than the ten year average August – September seasonal decline of 1.1%, while export volumes reached a 12 year low for the month of September. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

Dry Whey – Exports Decline to New 11 Year Low

Sep ’15 dry whey export volumes remained lower on a YOY basis for the 16th consecutive month, finishing down 32.1% while also declining 16.0% MOM on a daily average basis to a new 11 year low. The MOM decline was significantly greater than the ten year average August – September seasonal decline of 1.1%, while export volumes reached a 12 year low for the month of September. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

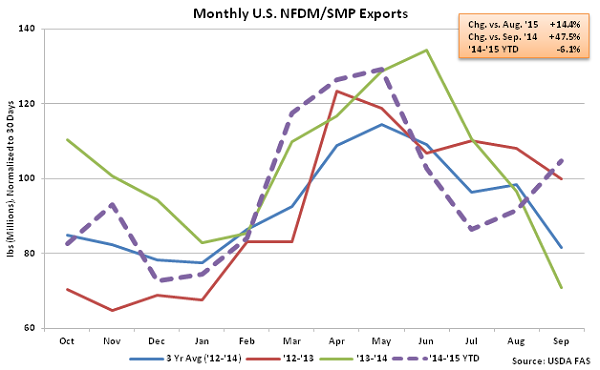

NFDM/SMP – Exports Increase Sharply to Record High for the Month of September

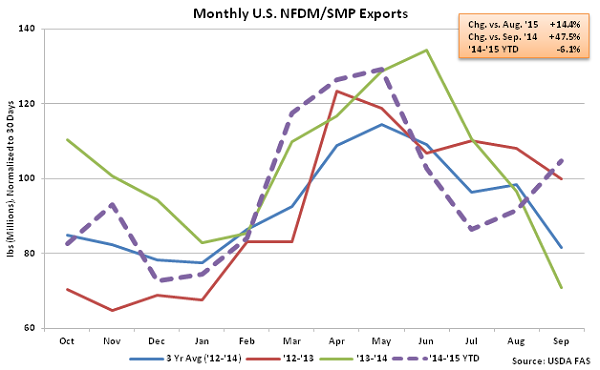

Sep ’15 export volumes of NFDM/SMP increased 47.5% YOY and 14.4% MOM on a daily average basis to a new record high for the month of September, driven higher by a significant increase in shipments to Mexico. U.S. NFDM/SMP exports to Mexico increased 127.3% YOY while volumes shipped to all other destinations declined by 0.4% YOY. Despite the sharp increase in total exports, ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY.

NFDM/SMP – Exports Increase Sharply to Record High for the Month of September

Sep ’15 export volumes of NFDM/SMP increased 47.5% YOY and 14.4% MOM on a daily average basis to a new record high for the month of September, driven higher by a significant increase in shipments to Mexico. U.S. NFDM/SMP exports to Mexico increased 127.3% YOY while volumes shipped to all other destinations declined by 0.4% YOY. Despite the sharp increase in total exports, ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY.

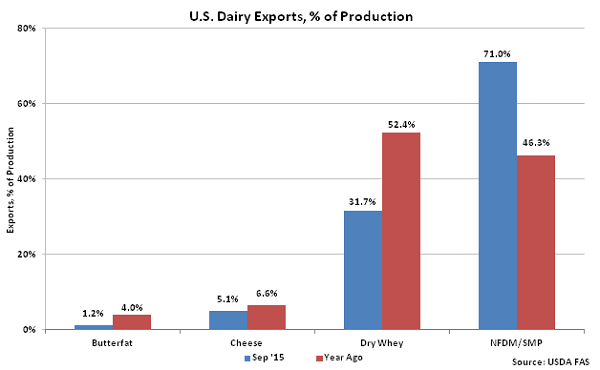

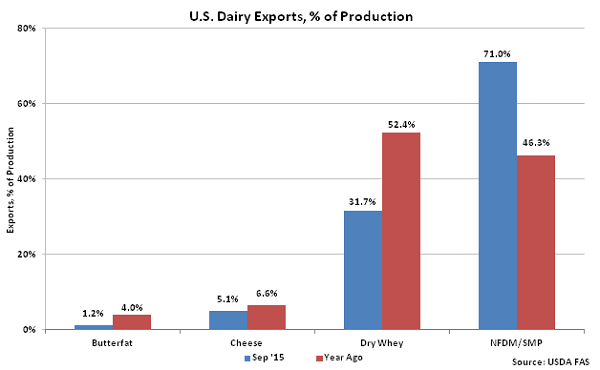

Sep ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production increased to a 23 month high.

Sep ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production increased to a 23 month high.

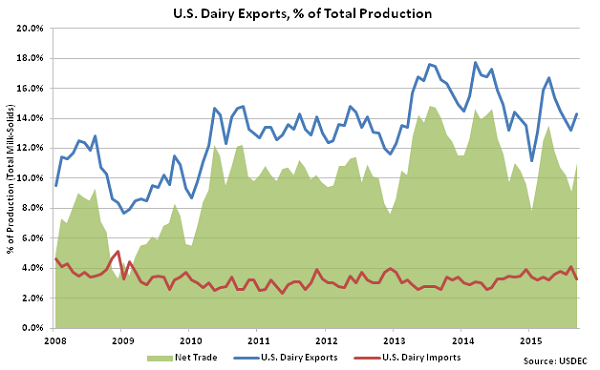

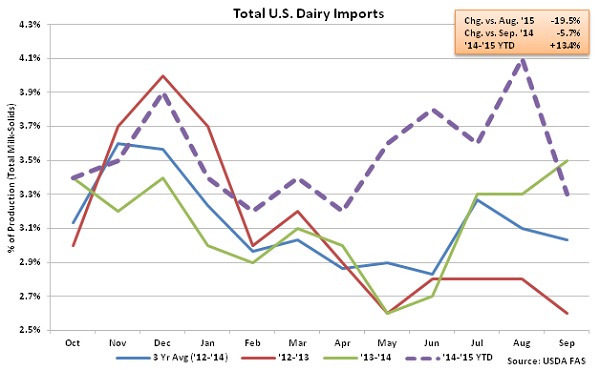

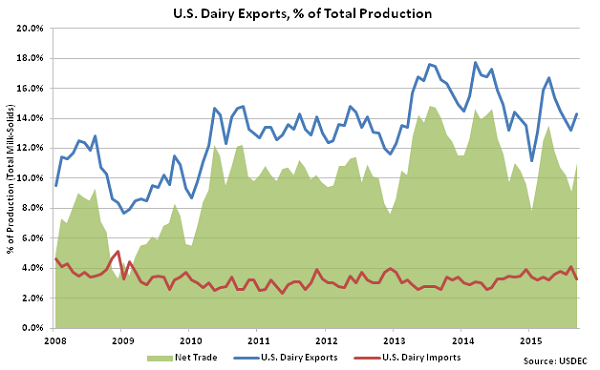

Overall, U.S. dairy export volumes were equivalent to 14.3% of total U.S. milk solids production in Sep ’15, rebounding slightly from the six month low experienced in Aug ’15. Total dairy import volumes were equivalent to 3.3% of total U.S. milk solids production, which was a five month low.

Overall, U.S. dairy export volumes were equivalent to 14.3% of total U.S. milk solids production in Sep ’15, rebounding slightly from the six month low experienced in Aug ’15. Total dairy import volumes were equivalent to 3.3% of total U.S. milk solids production, which was a five month low.

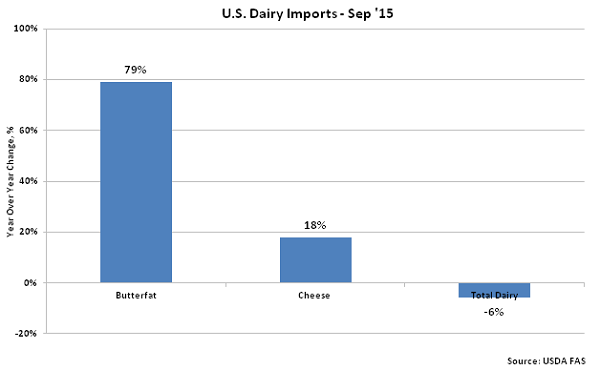

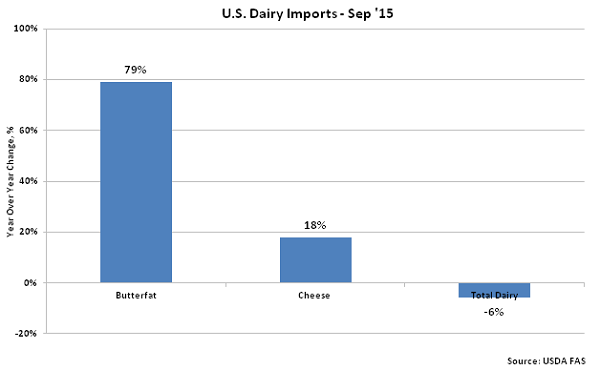

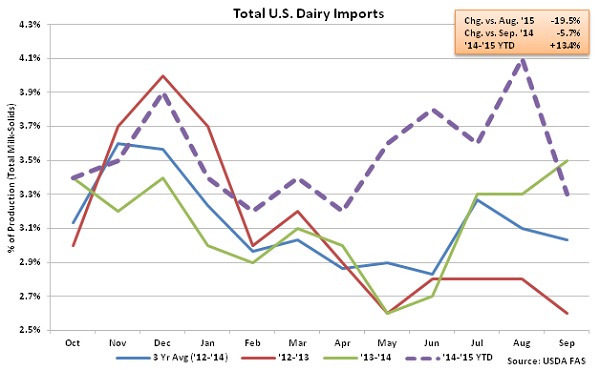

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 79.0% YOY and 17.9% YOY, respectively during Sep ’15. Total dairy import volumes declined by 5.7% YOY throughout the month.

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 79.0% YOY and 17.9% YOY, respectively during Sep ’15. Total dairy import volumes declined by 5.7% YOY throughout the month.

Butter – Exports Decline to New Eight and a Half Year Low

Sep ’15 export volumes of butterfat remained weak, declining 69.6% YOY and 68.2% MOM on a daily average basis to a new eight and a half year low. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 17 consecutive months, with total volumes down 62.5% over the period. The U.S. was a net importer of butter for the eighth consecutive month in Sep ’15, with total butterfat import volumes finishing nearly four times as large as total butterfat export volumes throughout the month.

Butter – Exports Decline to New Eight and a Half Year Low

Sep ’15 export volumes of butterfat remained weak, declining 69.6% YOY and 68.2% MOM on a daily average basis to a new eight and a half year low. Butterfat exports began to slow in the second quarter of 2014 and have remained lower YOY for 17 consecutive months, with total volumes down 62.5% over the period. The U.S. was a net importer of butter for the eighth consecutive month in Sep ’15, with total butterfat import volumes finishing nearly four times as large as total butterfat export volumes throughout the month.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads peaked in Sep ’14, with U.S. butter prices trading at an 80.6% premium to European prices and a 128.1% premium to Oceania prices. Domestic butter price premiums declined throughout the fourth quarter of 2014 and into 2015, but have begun to increase once again throughout recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

U.S. butter prices have traded at a premium to Europe and New Zealand butter prices when adjusted to 80% butterfat since May ’14, reducing export demand. The spreads peaked in Sep ’14, with U.S. butter prices trading at an 80.6% premium to European prices and a 128.1% premium to Oceania prices. Domestic butter price premiums declined throughout the fourth quarter of 2014 and into 2015, but have begun to increase once again throughout recent months. ’14-’15 annual butterfat exports finished down 69.9% YOY while annual butterfat imports finished up 172.5%. Overall, ’14-’15 annual U.S. imported butterfat reached a new nine year high.

Cheese – Export Volumes Remain Significantly Lower on YOY Basis

Sep ’15 U.S. cheese export volumes increased 1.2% MOM on a daily average basis from the two and a half year low experienced in Aug ’15 but remained lower on a YOY basis for the 12th consecutive month, finishing down 20.3%. Cheddar cheese exports remained particularly weak, declining 55.4% YOY. U.S. cheddar cheese prices traded at a premium to international cheddar cheese prices throughout Apr ’15 for the first time in five months, with the U.S. price premium continuing to strengthen throughout recent months. Sep ’15 cheese volumes destined to Mexico increased by 10.3% YOY however shipments to South Korea declined sharply, finishing 50.6% below the previous year. Cheese volumes destined to Mexico and South Korea consisted of nearly half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

Cheese – Export Volumes Remain Significantly Lower on YOY Basis

Sep ’15 U.S. cheese export volumes increased 1.2% MOM on a daily average basis from the two and a half year low experienced in Aug ’15 but remained lower on a YOY basis for the 12th consecutive month, finishing down 20.3%. Cheddar cheese exports remained particularly weak, declining 55.4% YOY. U.S. cheddar cheese prices traded at a premium to international cheddar cheese prices throughout Apr ’15 for the first time in five months, with the U.S. price premium continuing to strengthen throughout recent months. Sep ’15 cheese volumes destined to Mexico increased by 10.3% YOY however shipments to South Korea declined sharply, finishing 50.6% below the previous year. Cheese volumes destined to Mexico and South Korea consisted of nearly half of the total U.S. cheese shipments throughout the month. ’14-’15 annual total cheese exports finished down 14.1% YOY, with cheddar cheese exports finishing down 49.4% YOY and other-than-cheddar cheese finishing down 4.6% YOY.

Dry Whey – Exports Decline to New 11 Year Low

Sep ’15 dry whey export volumes remained lower on a YOY basis for the 16th consecutive month, finishing down 32.1% while also declining 16.0% MOM on a daily average basis to a new 11 year low. The MOM decline was significantly greater than the ten year average August – September seasonal decline of 1.1%, while export volumes reached a 12 year low for the month of September. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

Dry Whey – Exports Decline to New 11 Year Low

Sep ’15 dry whey export volumes remained lower on a YOY basis for the 16th consecutive month, finishing down 32.1% while also declining 16.0% MOM on a daily average basis to a new 11 year low. The MOM decline was significantly greater than the ten year average August – September seasonal decline of 1.1%, while export volumes reached a 12 year low for the month of September. ’14-’15 annual dry whey exports finished down 18.0% YOY to a new 11 year low.

NFDM/SMP – Exports Increase Sharply to Record High for the Month of September

Sep ’15 export volumes of NFDM/SMP increased 47.5% YOY and 14.4% MOM on a daily average basis to a new record high for the month of September, driven higher by a significant increase in shipments to Mexico. U.S. NFDM/SMP exports to Mexico increased 127.3% YOY while volumes shipped to all other destinations declined by 0.4% YOY. Despite the sharp increase in total exports, ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY.

NFDM/SMP – Exports Increase Sharply to Record High for the Month of September

Sep ’15 export volumes of NFDM/SMP increased 47.5% YOY and 14.4% MOM on a daily average basis to a new record high for the month of September, driven higher by a significant increase in shipments to Mexico. U.S. NFDM/SMP exports to Mexico increased 127.3% YOY while volumes shipped to all other destinations declined by 0.4% YOY. Despite the sharp increase in total exports, ’14-’15 annual NFDM/SMP exports finished down 6.1% YOY.

Sep ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production increased to a 23 month high.

Sep ’15 U.S. butterfat, cheese and dry whey exports as a percentage of production remained lower than the previous year, however U.S. NFDM/SMP exports as a percentage of production increased to a 23 month high.

Overall, U.S. dairy export volumes were equivalent to 14.3% of total U.S. milk solids production in Sep ’15, rebounding slightly from the six month low experienced in Aug ’15. Total dairy import volumes were equivalent to 3.3% of total U.S. milk solids production, which was a five month low.

Overall, U.S. dairy export volumes were equivalent to 14.3% of total U.S. milk solids production in Sep ’15, rebounding slightly from the six month low experienced in Aug ’15. Total dairy import volumes were equivalent to 3.3% of total U.S. milk solids production, which was a five month low.

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 79.0% YOY and 17.9% YOY, respectively during Sep ’15. Total dairy import volumes declined by 5.7% YOY throughout the month.

U.S. butterfat and cheese import volumes continue to outpace overall dairy import volumes on a YOY percentage basis, increasing by 79.0% YOY and 17.9% YOY, respectively during Sep ’15. Total dairy import volumes declined by 5.7% YOY throughout the month.