Chinese Dairy Imports Update – Nov ’15

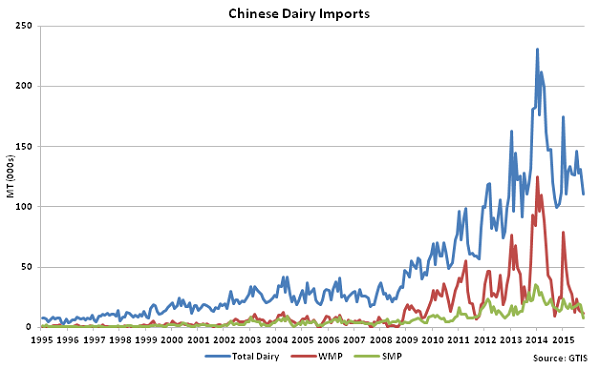

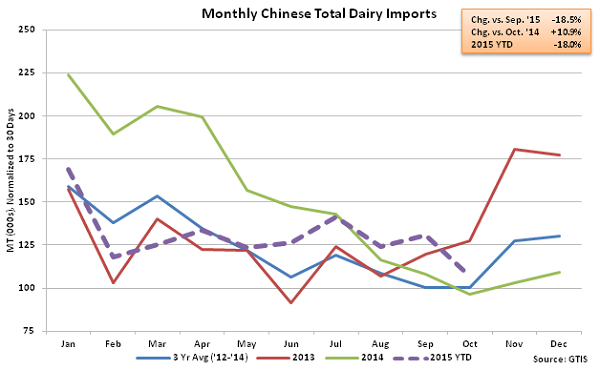

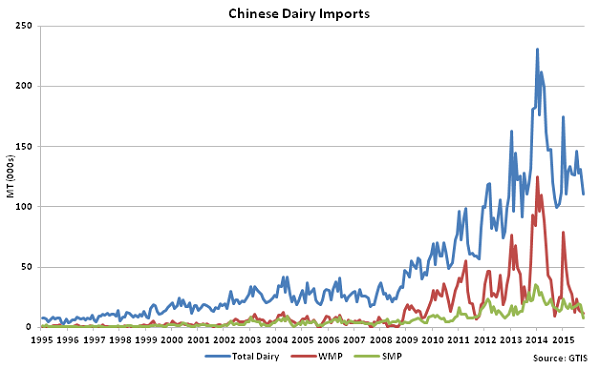

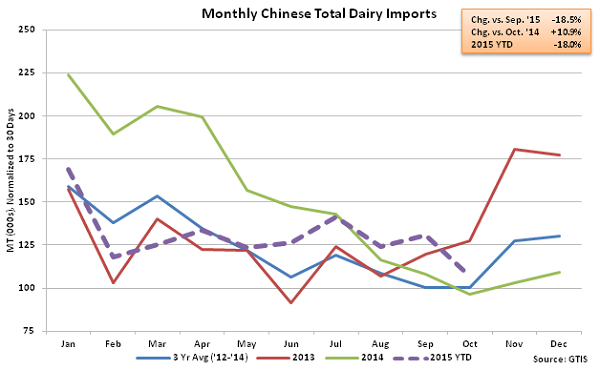

According to GTIS, Oct ’15 total Chinese dairy import volumes declined 18.5% MOM on a daily average basis but finished higher on a YOY basis for the third consecutive month, increasing 10.9%. Total dairy import volumes remain significantly below the peak levels experienced in early 2014 but finished at the second highest level on record for the month of October. Total Chinese dairy import volumes typically decline to seasonal lows throughout the late summer months prior to increasing again throughout the winter months.

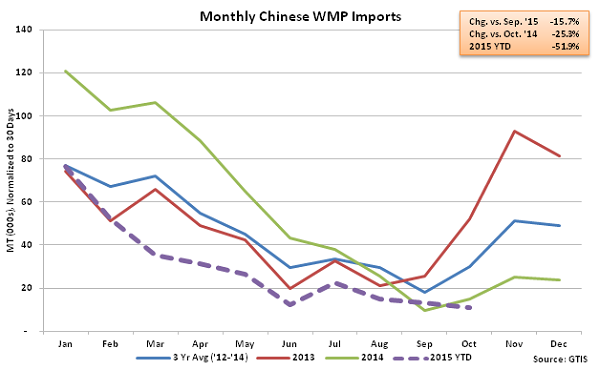

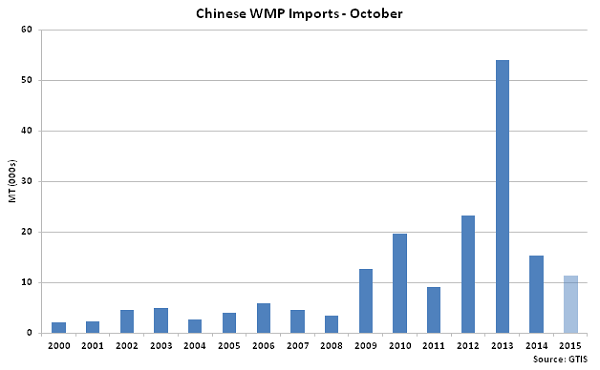

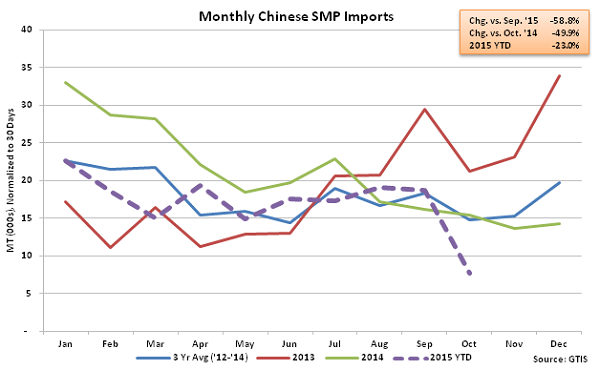

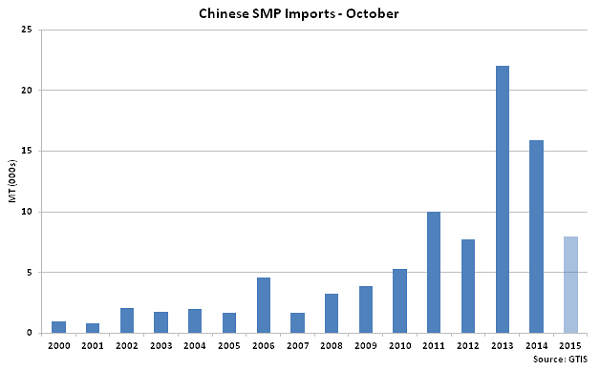

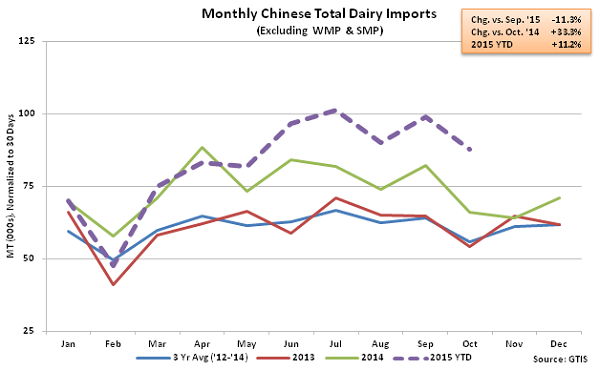

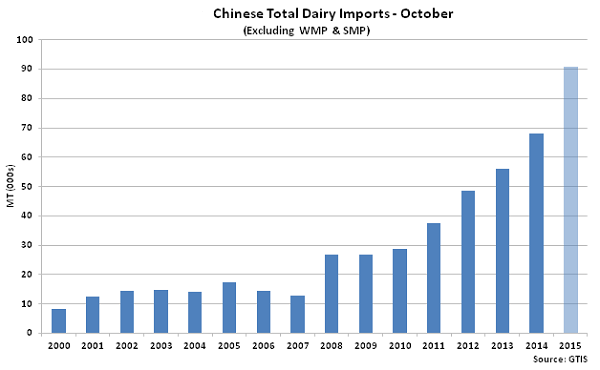

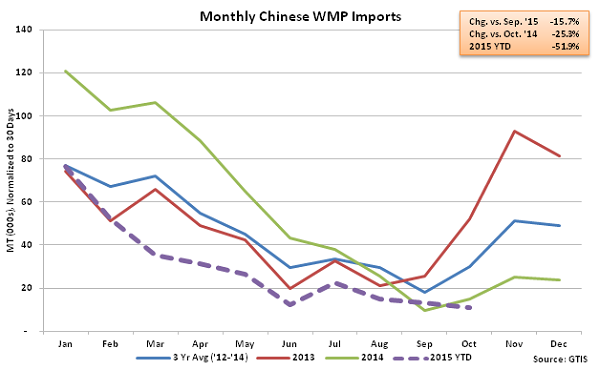

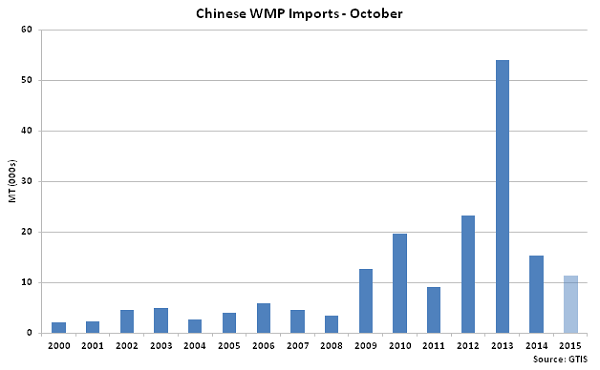

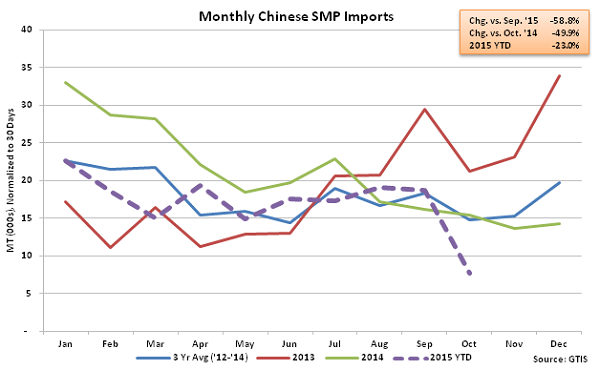

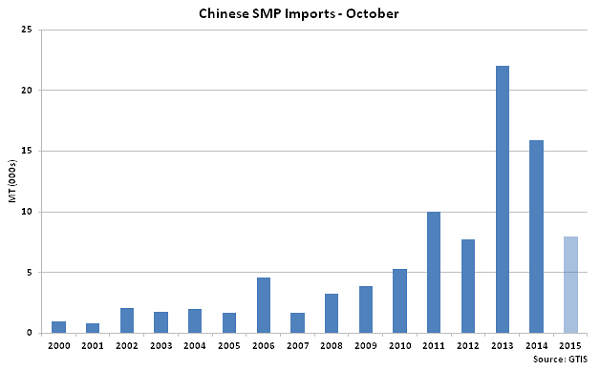

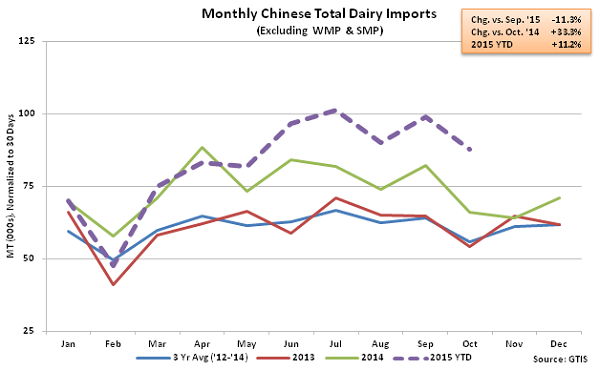

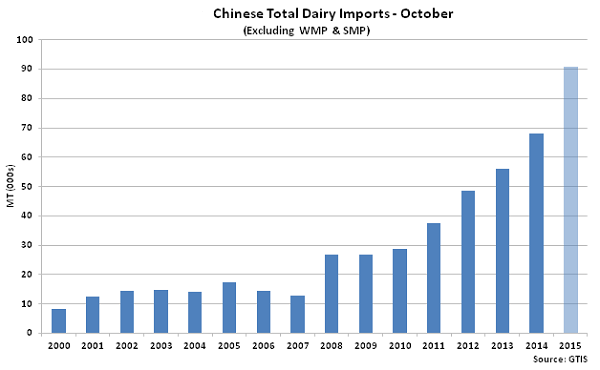

Oct ’15 Chinese whole milk powder (WMP) imports declined 25.3% YOY and 15.7% MOM on a daily average basis to a four year low for the month of October while Oct ’15 Chinese skim milk powder (SMP) imports declined 49.9% YOY and 58.8% MOM on a daily average basis, finishing at a three year October low. Weak powder exports were partially offset by continued strong import demand for all other dairy products. Oct ’15 Chinese dairy imports excluding WMP and SMP declined 11.3% MOM on a daily average basis but increased on a YOY basis for the sixth consecutive month, finishing up 33.3% to a new record high for the month of October.

Oct ’15 Total Chinese Dairy Import Volumes Remain Below Highs Experienced in Early 2014

Oct ’15 Total Chinese Dairy Import Volumes Finished Down 18.5% MOM but up 10.9% YOY

Oct ’15 Total Chinese Dairy Import Volumes Finished Down 18.5% MOM but up 10.9% YOY

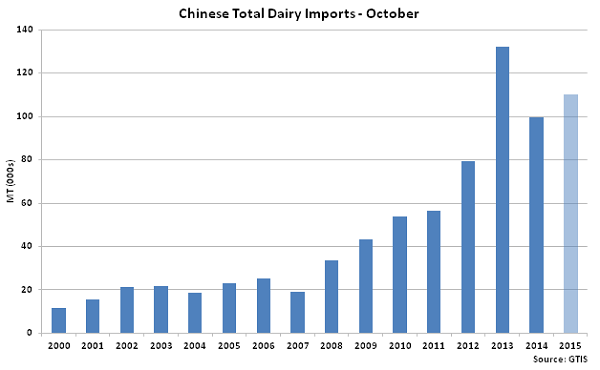

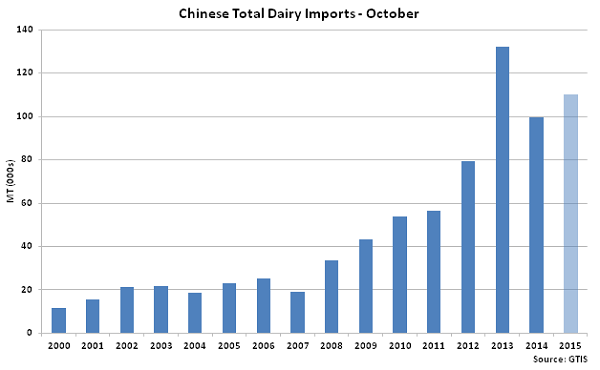

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of October

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of October

Oct ’15 Chinese WMP Import Volumes Finished Down 15.7% MOM and 25.3% YOY

Oct ’15 Chinese WMP Import Volumes Finished Down 15.7% MOM and 25.3% YOY

Oct ’15 Chinese WMP Imports Declined to a Four Year Low for the Month of October

Oct ’15 Chinese WMP Imports Declined to a Four Year Low for the Month of October

Oct ’15 Chinese SMP Import Volumes Finished Down 58.8% MOM and 49.9% YOY

Oct ’15 Chinese SMP Import Volumes Finished Down 58.8% MOM and 49.9% YOY

Oct ’15 Chinese SMP Imports Declined to a Three Year Low for the Month of October

Oct ’15 Chinese SMP Imports Declined to a Three Year Low for the Month of October

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Down 11.3% MOM but up 33.3% YOY

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Down 11.3% MOM but up 33.3% YOY

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Finished at a Record October High

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Finished at a Record October High

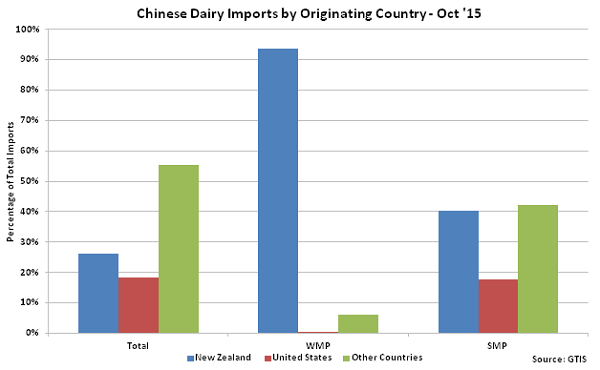

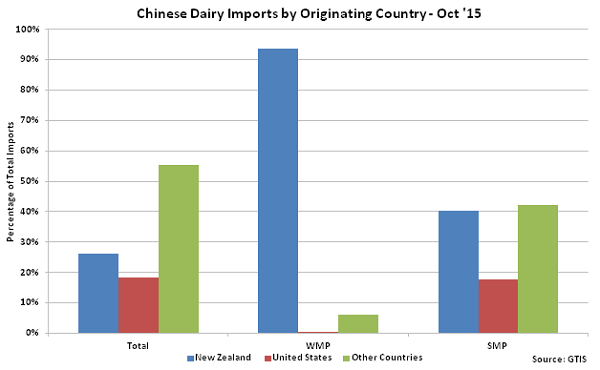

New Zealand Accounted Over a Quarter of Total Oct ’15 Chinese Dairy Import Volumes

New Zealand Accounted Over a Quarter of Total Oct ’15 Chinese Dairy Import Volumes

Oct ’15 Total Chinese Dairy Import Volumes Finished Down 18.5% MOM but up 10.9% YOY

Oct ’15 Total Chinese Dairy Import Volumes Finished Down 18.5% MOM but up 10.9% YOY

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of October

Chinese Dairy Import Volumes Were the Second Largest on Record for the Month of October

Oct ’15 Chinese WMP Import Volumes Finished Down 15.7% MOM and 25.3% YOY

Oct ’15 Chinese WMP Import Volumes Finished Down 15.7% MOM and 25.3% YOY

Oct ’15 Chinese WMP Imports Declined to a Four Year Low for the Month of October

Oct ’15 Chinese WMP Imports Declined to a Four Year Low for the Month of October

Oct ’15 Chinese SMP Import Volumes Finished Down 58.8% MOM and 49.9% YOY

Oct ’15 Chinese SMP Import Volumes Finished Down 58.8% MOM and 49.9% YOY

Oct ’15 Chinese SMP Imports Declined to a Three Year Low for the Month of October

Oct ’15 Chinese SMP Imports Declined to a Three Year Low for the Month of October

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Down 11.3% MOM but up 33.3% YOY

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Down 11.3% MOM but up 33.3% YOY

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Finished at a Record October High

Oct ’15 Chinese Dairy Imports Excluding WMP & SMP Finished at a Record October High

New Zealand Accounted Over a Quarter of Total Oct ’15 Chinese Dairy Import Volumes

New Zealand Accounted Over a Quarter of Total Oct ’15 Chinese Dairy Import Volumes