U.S. Dairy Cold Storage Update – Nov ’15

Butter – Stocks Remain Significantly Higher on YOY Basis

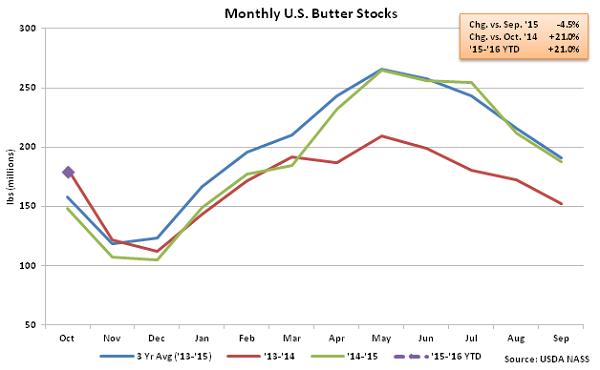

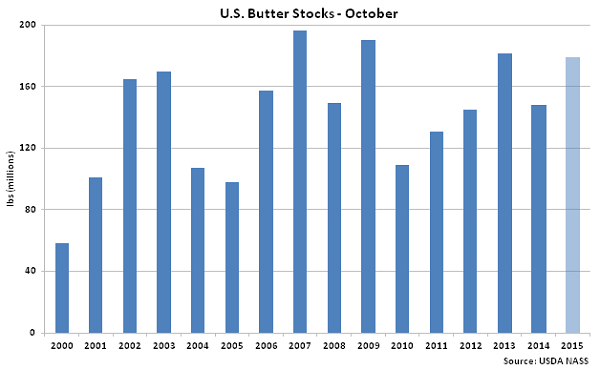

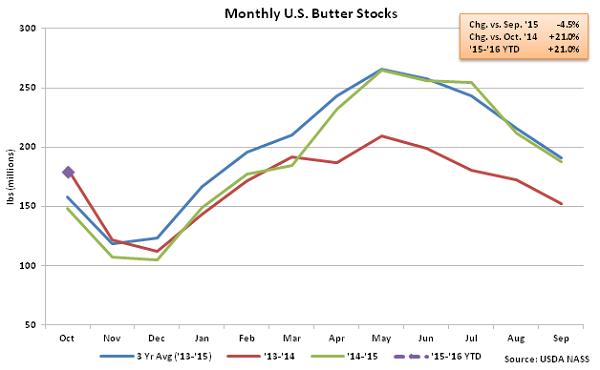

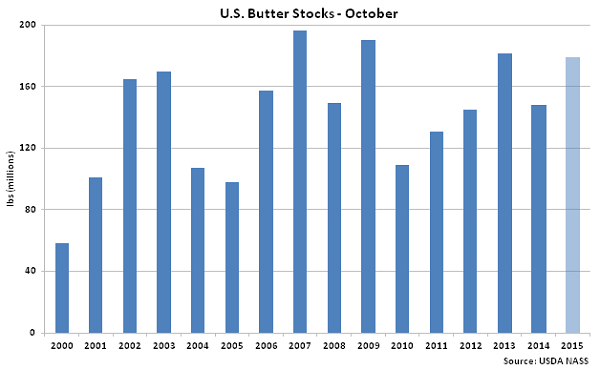

According to USDA, Oct ’15 U.S. butter stocks of 179.0 million pounds remained significantly higher on a YOY basis, finishing up 21.0%. Butter stocks declined by 8.5 million pounds, or 4.5%, from the previous month, however the decline was significantly less than the ten year average September – October seasonal decline of 32.5 million pounds, or 17.3%.

U.S. butter stocks typically reach their seasonal peak in May, followed by seasonal drawdowns until lows are reached during the winter months. The most recent seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Domestic butterfat exports remained weak through the early months of 2015, despite U.S. butter prices converging downwards towards international prices. More recently, the domestic butter price premium has once again increased, reaching a 12 month high in early Oct ’15. U.S. butterfat exports have declined YOY for 17 consecutive months through Sep ’15.

According to USDA, Oct ’15 U.S. butter stocks of 179.0 million pounds remained significantly higher on a YOY basis, finishing up 21.0%. Butter stocks declined by 8.5 million pounds, or 4.5%, from the previous month, however the decline was significantly less than the ten year average September – October seasonal decline of 32.5 million pounds, or 17.3%.

U.S. butter stocks typically reach their seasonal peak in May, followed by seasonal drawdowns until lows are reached during the winter months. The most recent seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Domestic butterfat exports remained weak through the early months of 2015, despite U.S. butter prices converging downwards towards international prices. More recently, the domestic butter price premium has once again increased, reaching a 12 month high in early Oct ’15. U.S. butterfat exports have declined YOY for 17 consecutive months through Sep ’15.

Cheese – Stocks Remain Significantly Higher YOY, Reach 32 Year High for Month of October

Cheese – Stocks Remain Significantly Higher YOY, Reach 32 Year High for Month of October

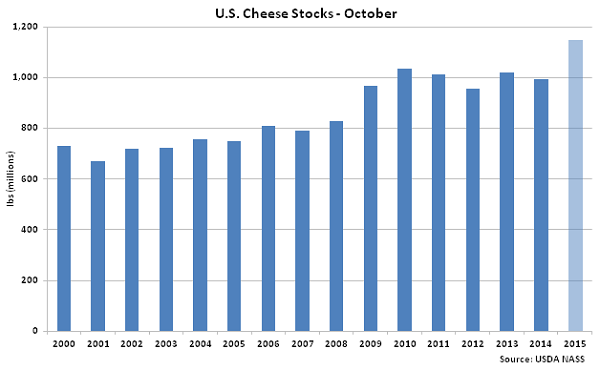

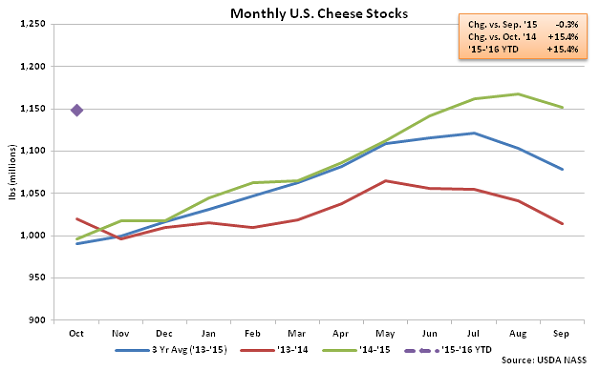

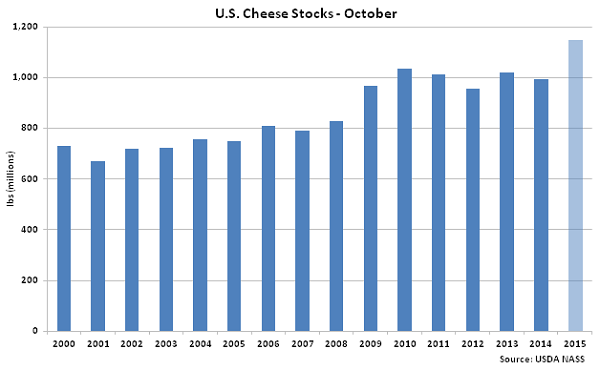

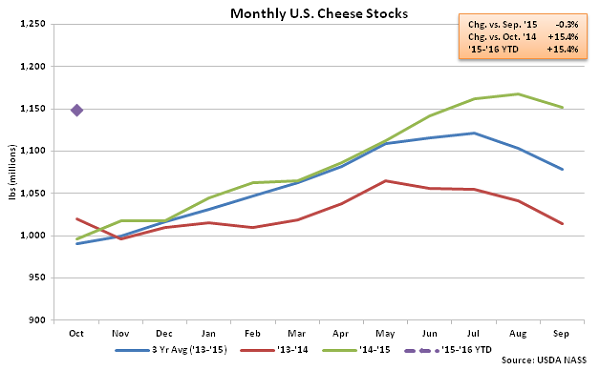

Oct ’15 U.S. cheese stocks of 1.15 billion pounds finished down 0.3% MOM but up 15.4% YOY. The monthly YOY increase in cheese stocks was the 12th experienced in a row and the largest in the past five and a half years on a percentage basis. Cheese stocks declined slightly MOM but remain at a 32 year high for the month of October. Cheese stocks have declined by an average of 2.7% from September – October over the past 10 years. Cheese stocks have remained higher YOY in recent months as milk production has strengthened in Midwestern cheese producing states while weakness in cheese export markets has continued. Strong cheese production has been partially offset by continued strong domestic demand, however cheese exports remained lower YOY for the 12th consecutive month in Sep ’15.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.

Oct ’15 U.S. cheese stocks of 1.15 billion pounds finished down 0.3% MOM but up 15.4% YOY. The monthly YOY increase in cheese stocks was the 12th experienced in a row and the largest in the past five and a half years on a percentage basis. Cheese stocks declined slightly MOM but remain at a 32 year high for the month of October. Cheese stocks have declined by an average of 2.7% from September – October over the past 10 years. Cheese stocks have remained higher YOY in recent months as milk production has strengthened in Midwestern cheese producing states while weakness in cheese export markets has continued. Strong cheese production has been partially offset by continued strong domestic demand, however cheese exports remained lower YOY for the 12th consecutive month in Sep ’15.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.

According to USDA, Oct ’15 U.S. butter stocks of 179.0 million pounds remained significantly higher on a YOY basis, finishing up 21.0%. Butter stocks declined by 8.5 million pounds, or 4.5%, from the previous month, however the decline was significantly less than the ten year average September – October seasonal decline of 32.5 million pounds, or 17.3%.

U.S. butter stocks typically reach their seasonal peak in May, followed by seasonal drawdowns until lows are reached during the winter months. The most recent seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Domestic butterfat exports remained weak through the early months of 2015, despite U.S. butter prices converging downwards towards international prices. More recently, the domestic butter price premium has once again increased, reaching a 12 month high in early Oct ’15. U.S. butterfat exports have declined YOY for 17 consecutive months through Sep ’15.

According to USDA, Oct ’15 U.S. butter stocks of 179.0 million pounds remained significantly higher on a YOY basis, finishing up 21.0%. Butter stocks declined by 8.5 million pounds, or 4.5%, from the previous month, however the decline was significantly less than the ten year average September – October seasonal decline of 32.5 million pounds, or 17.3%.

U.S. butter stocks typically reach their seasonal peak in May, followed by seasonal drawdowns until lows are reached during the winter months. The most recent seasonal drawdown in butter stocks of 104.7 million pounds was less than half of the prior year’s seasonal drawdown due to a significant reduction in export demand. Throughout the period, YOY U.S. butterfat exports declined by 89.1 million pounds, or 55.9%, as domestic butter prices traded at a significant premium to international butter prices. Domestic butterfat exports remained weak through the early months of 2015, despite U.S. butter prices converging downwards towards international prices. More recently, the domestic butter price premium has once again increased, reaching a 12 month high in early Oct ’15. U.S. butterfat exports have declined YOY for 17 consecutive months through Sep ’15.

Cheese – Stocks Remain Significantly Higher YOY, Reach 32 Year High for Month of October

Cheese – Stocks Remain Significantly Higher YOY, Reach 32 Year High for Month of October

Oct ’15 U.S. cheese stocks of 1.15 billion pounds finished down 0.3% MOM but up 15.4% YOY. The monthly YOY increase in cheese stocks was the 12th experienced in a row and the largest in the past five and a half years on a percentage basis. Cheese stocks declined slightly MOM but remain at a 32 year high for the month of October. Cheese stocks have declined by an average of 2.7% from September – October over the past 10 years. Cheese stocks have remained higher YOY in recent months as milk production has strengthened in Midwestern cheese producing states while weakness in cheese export markets has continued. Strong cheese production has been partially offset by continued strong domestic demand, however cheese exports remained lower YOY for the 12th consecutive month in Sep ’15.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.

Oct ’15 U.S. cheese stocks of 1.15 billion pounds finished down 0.3% MOM but up 15.4% YOY. The monthly YOY increase in cheese stocks was the 12th experienced in a row and the largest in the past five and a half years on a percentage basis. Cheese stocks declined slightly MOM but remain at a 32 year high for the month of October. Cheese stocks have declined by an average of 2.7% from September – October over the past 10 years. Cheese stocks have remained higher YOY in recent months as milk production has strengthened in Midwestern cheese producing states while weakness in cheese export markets has continued. Strong cheese production has been partially offset by continued strong domestic demand, however cheese exports remained lower YOY for the 12th consecutive month in Sep ’15.

U.S. cheese stocks typically exhibit a smaller degree of MOM and YOY variation than U.S. butter stocks. Cheese stocks do not have as large of a seasonal build as butter stocks, with the five year average Nov – Jul seasonal build in cheese stocks representing a 12.7% increase in stocks vs. a 121.1% increase in butter stocks. The reduced seasonality exhibited in U.S. cheese stocks has led to less volatile YOY variation, with cheese stocks having a five year average absolute YOY change of 5.3% compared to 26.3% for U.S. butter stocks.