Atten Babler Ethanol FX Indices – Dec ’15

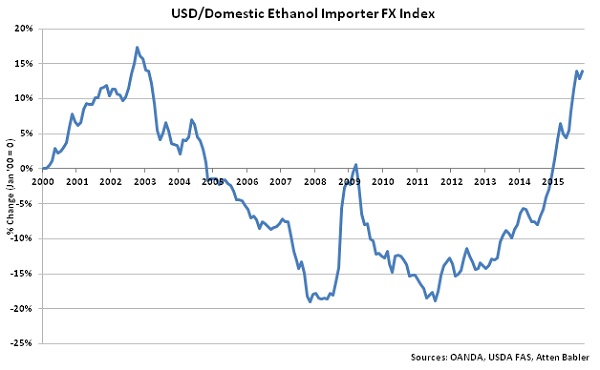

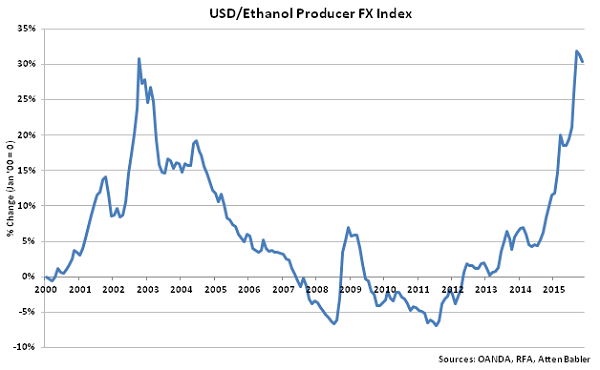

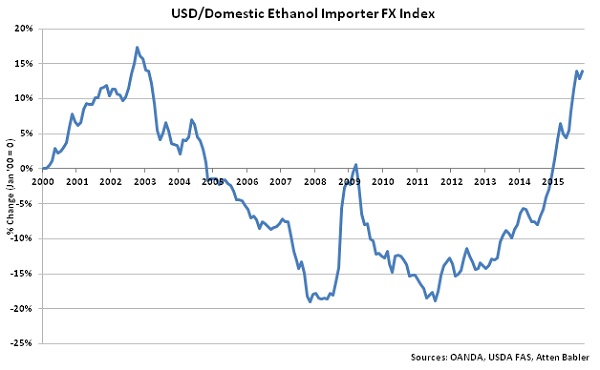

The Atten Babler Commodities Ethanol Foreign Exchange (FX) Indices remained at or near recent high levels during Nov ’15. The USD/Ethanol Producer FX Index declined slightly but remained at the third highest figure on record while the USD/Domestic Ethanol Importer FX Index increased to the highest figure experienced in the past 12 years.

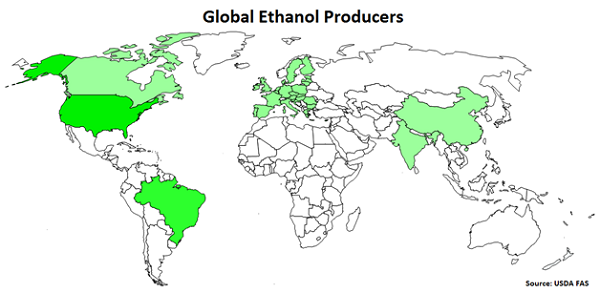

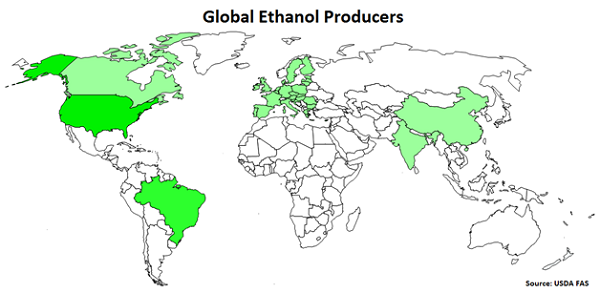

Global Ethanol Producers:

Major ethanol producers are led by the U.S., followed by Brazil, the EU-28, China, India and Canada.

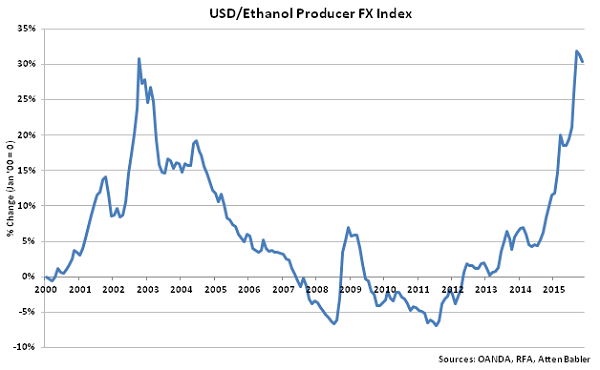

USD/Ethanol Producer FX Index:

The USD/Ethanol Producer FX Index declined 1.0 points in Nov ’15 a value of 130.4. The USD/Ethanol Producer FX remains at the third highest figure on record and has increased 24.1 points since the beginning of 2014 and 11.9 points throughout the past six months. A strengthening USD/Ethanol Producer FX Index reduces the competitiveness of U.S. ethanol relative to other major producing regions (represented in green in the Global Ethanol Producers chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

USD/Ethanol Producer FX Index:

The USD/Ethanol Producer FX Index declined 1.0 points in Nov ’15 a value of 130.4. The USD/Ethanol Producer FX remains at the third highest figure on record and has increased 24.1 points since the beginning of 2014 and 11.9 points throughout the past six months. A strengthening USD/Ethanol Producer FX Index reduces the competitiveness of U.S. ethanol relative to other major producing regions (represented in green in the Global Ethanol Producers chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

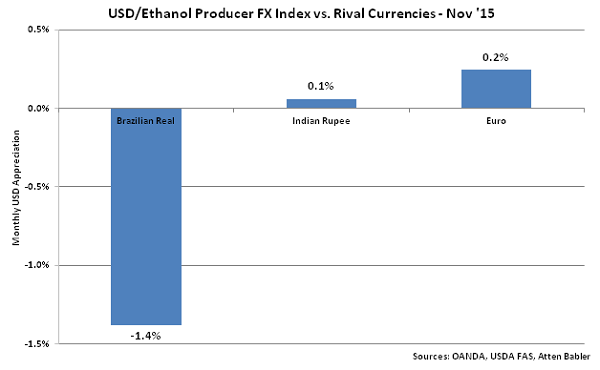

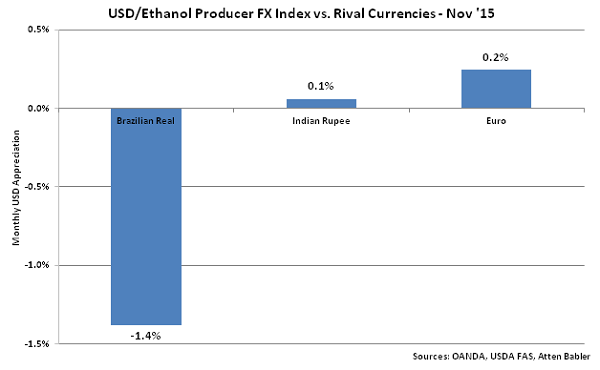

Appreciation against the USD within the USD/Ethanol Producer FX Index during Nov ’15 was led by gains by the Brazilian real. USD gains were exhibited against the Indian rupee and euro.

Appreciation against the USD within the USD/Ethanol Producer FX Index during Nov ’15 was led by gains by the Brazilian real. USD gains were exhibited against the Indian rupee and euro.

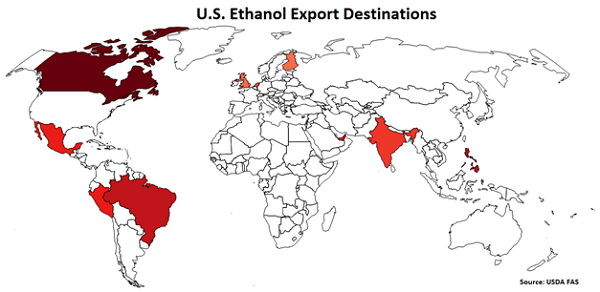

U.S. Ethanol Export Destinations:

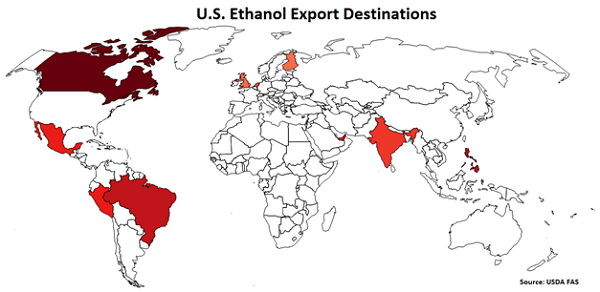

Major destinations for U.S. dairy exports are led by Canada, followed by the Philippines, Brazil, the United Arab Emirates, Peru and Mexico.

U.S. Ethanol Export Destinations:

Major destinations for U.S. dairy exports are led by Canada, followed by the Philippines, Brazil, the United Arab Emirates, Peru and Mexico.

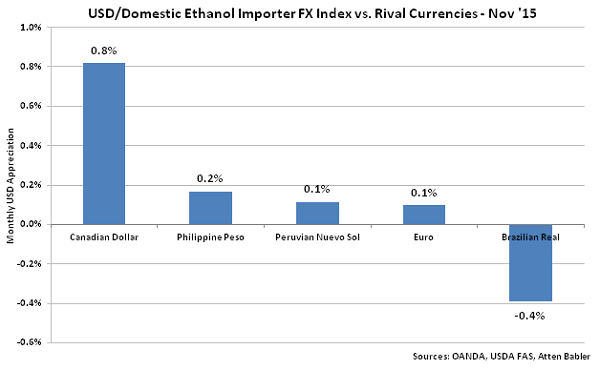

USD/Domestic Ethanol Importer FX Index:

The USD/Domestic Ethanol Importer FX Index increased 1.1 points in Nov ’15 to a value of 113.9, which was the highest figure experienced in the past 12 years. The USD/Domestic Ethanol Importer FX has increased 21.9 points since the beginning of 2014 and 9.5 points throughout the past six months. A strengthening USD/Domestic Ethanol Importer FX Index results in less purchasing power for the traditional buyers of U.S. ethanol (represented in red in the U.S. Ethanol Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Canadian dollar and the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Ethanol Importer FX Index:

The USD/Domestic Ethanol Importer FX Index increased 1.1 points in Nov ’15 to a value of 113.9, which was the highest figure experienced in the past 12 years. The USD/Domestic Ethanol Importer FX has increased 21.9 points since the beginning of 2014 and 9.5 points throughout the past six months. A strengthening USD/Domestic Ethanol Importer FX Index results in less purchasing power for the traditional buyers of U.S. ethanol (represented in red in the U.S. Ethanol Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Canadian dollar and the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

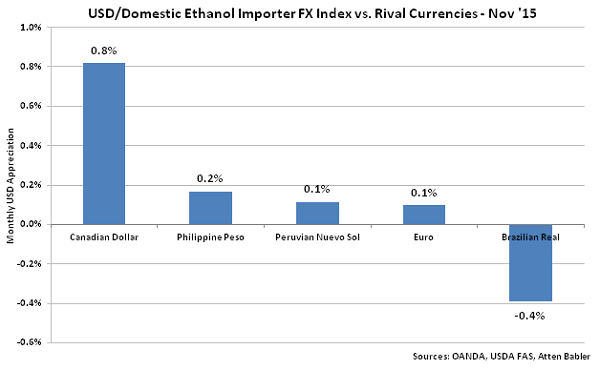

USD appreciation within the USD/Domestic Ethanol Importer FX Index during Nov ’15 was led by gains against the Canadian dollar, followed by USD appreciated against the Philippine peso, Peruvian nuevo sol and euro. USD declines were exhibited against the Brazilian real.

USD appreciation within the USD/Domestic Ethanol Importer FX Index during Nov ’15 was led by gains against the Canadian dollar, followed by USD appreciated against the Philippine peso, Peruvian nuevo sol and euro. USD declines were exhibited against the Brazilian real.

USD/Ethanol Producer FX Index:

The USD/Ethanol Producer FX Index declined 1.0 points in Nov ’15 a value of 130.4. The USD/Ethanol Producer FX remains at the third highest figure on record and has increased 24.1 points since the beginning of 2014 and 11.9 points throughout the past six months. A strengthening USD/Ethanol Producer FX Index reduces the competitiveness of U.S. ethanol relative to other major producing regions (represented in green in the Global Ethanol Producers chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

USD/Ethanol Producer FX Index:

The USD/Ethanol Producer FX Index declined 1.0 points in Nov ’15 a value of 130.4. The USD/Ethanol Producer FX remains at the third highest figure on record and has increased 24.1 points since the beginning of 2014 and 11.9 points throughout the past six months. A strengthening USD/Ethanol Producer FX Index reduces the competitiveness of U.S. ethanol relative to other major producing regions (represented in green in the Global Ethanol Producers chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

Appreciation against the USD within the USD/Ethanol Producer FX Index during Nov ’15 was led by gains by the Brazilian real. USD gains were exhibited against the Indian rupee and euro.

Appreciation against the USD within the USD/Ethanol Producer FX Index during Nov ’15 was led by gains by the Brazilian real. USD gains were exhibited against the Indian rupee and euro.

U.S. Ethanol Export Destinations:

Major destinations for U.S. dairy exports are led by Canada, followed by the Philippines, Brazil, the United Arab Emirates, Peru and Mexico.

U.S. Ethanol Export Destinations:

Major destinations for U.S. dairy exports are led by Canada, followed by the Philippines, Brazil, the United Arab Emirates, Peru and Mexico.

USD/Domestic Ethanol Importer FX Index:

The USD/Domestic Ethanol Importer FX Index increased 1.1 points in Nov ’15 to a value of 113.9, which was the highest figure experienced in the past 12 years. The USD/Domestic Ethanol Importer FX has increased 21.9 points since the beginning of 2014 and 9.5 points throughout the past six months. A strengthening USD/Domestic Ethanol Importer FX Index results in less purchasing power for the traditional buyers of U.S. ethanol (represented in red in the U.S. Ethanol Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Canadian dollar and the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

USD/Domestic Ethanol Importer FX Index:

The USD/Domestic Ethanol Importer FX Index increased 1.1 points in Nov ’15 to a value of 113.9, which was the highest figure experienced in the past 12 years. The USD/Domestic Ethanol Importer FX has increased 21.9 points since the beginning of 2014 and 9.5 points throughout the past six months. A strengthening USD/Domestic Ethanol Importer FX Index results in less purchasing power for the traditional buyers of U.S. ethanol (represented in red in the U.S. Ethanol Export Destinations chart), ultimately resulting in less foreign demand, all other factors being equal. USD appreciation against the Canadian dollar and the Brazilian real has accounted for the majority of the gains since the beginning of 2014.

USD appreciation within the USD/Domestic Ethanol Importer FX Index during Nov ’15 was led by gains against the Canadian dollar, followed by USD appreciated against the Philippine peso, Peruvian nuevo sol and euro. USD declines were exhibited against the Brazilian real.

USD appreciation within the USD/Domestic Ethanol Importer FX Index during Nov ’15 was led by gains against the Canadian dollar, followed by USD appreciated against the Philippine peso, Peruvian nuevo sol and euro. USD declines were exhibited against the Brazilian real.