New Zealand Milk Production Update – Jan ’16

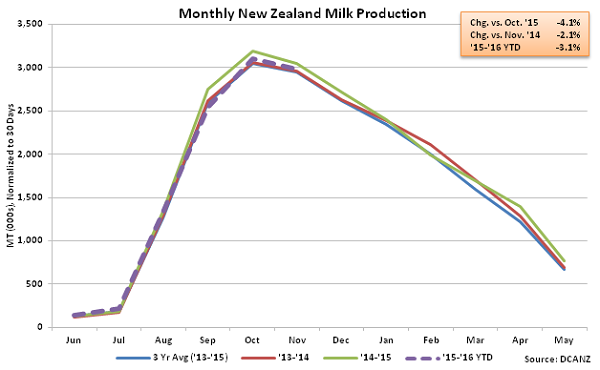

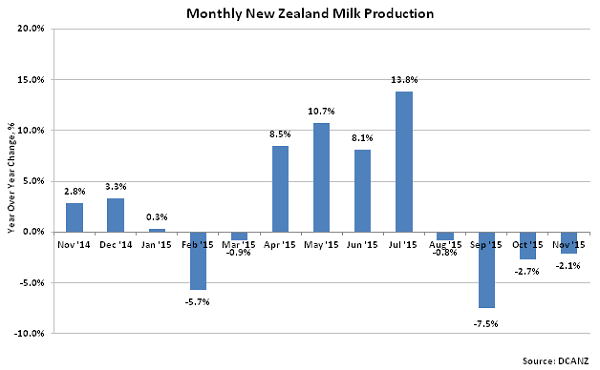

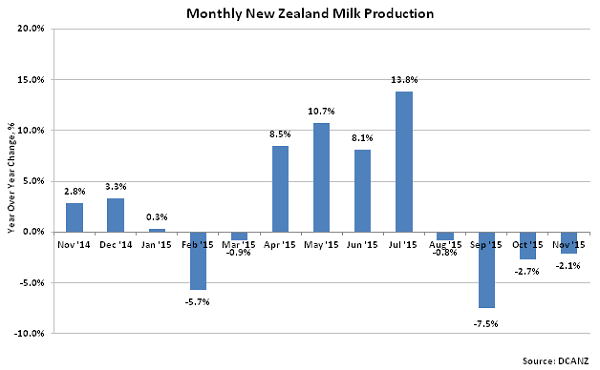

According to Dairy Companies Association of New Zealand (DCANZ), Nov ’15 New Zealand milk production declined YOY for the fourth consecutive month, finishing 2.1% below the previous year. The recently experienced YOY declines will likely have a significant effect on annual production totals, as September – November milk production has accounted for over 40% of annual New Zealand production on average throughout the past five years.

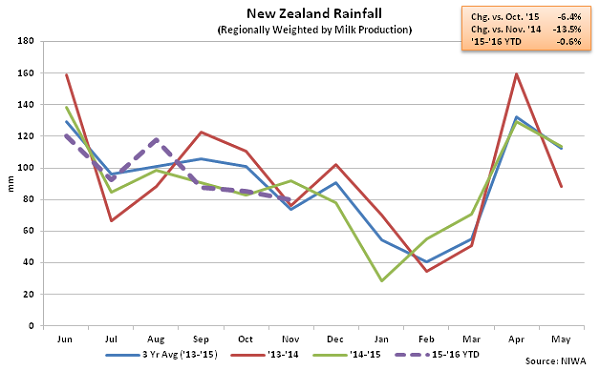

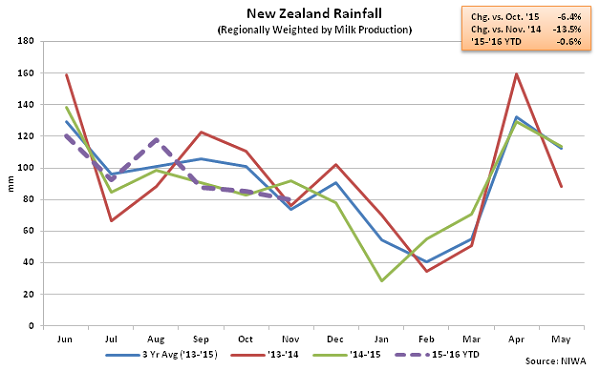

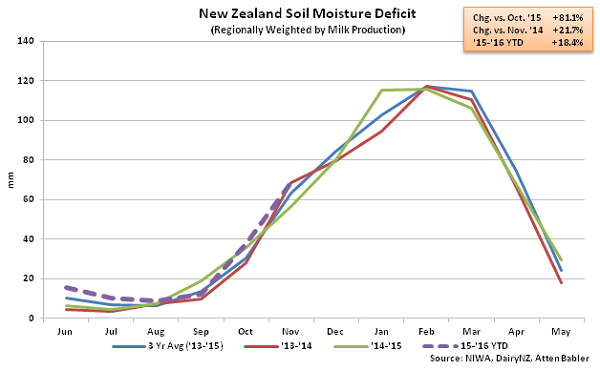

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather affected forage conditions across New Zealand over the early months of the ’15-’16 production season. More recently, rainfall levels across New Zealand have fallen lower on a YOY basis, contributing to increases in soil moisture deficits.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather affected forage conditions across New Zealand over the early months of the ’15-’16 production season. More recently, rainfall levels across New Zealand have fallen lower on a YOY basis, contributing to increases in soil moisture deficits.

When weighted based on levels of regional milk production, New Zealand rainfall levels declined 13.5% YOY during Nov ’15, contributing to soil moisture deficits increasing by 21.7% YOY.

When weighted based on levels of regional milk production, New Zealand rainfall levels declined 13.5% YOY during Nov ’15, contributing to soil moisture deficits increasing by 21.7% YOY.

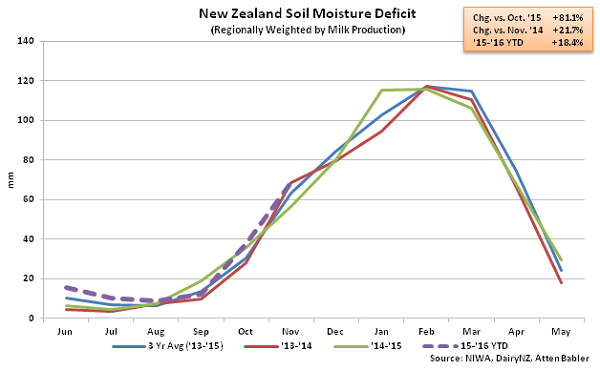

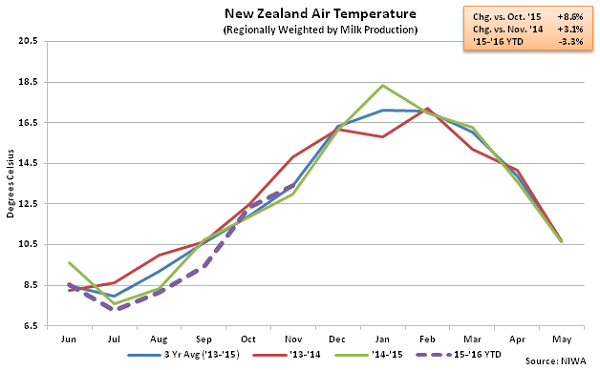

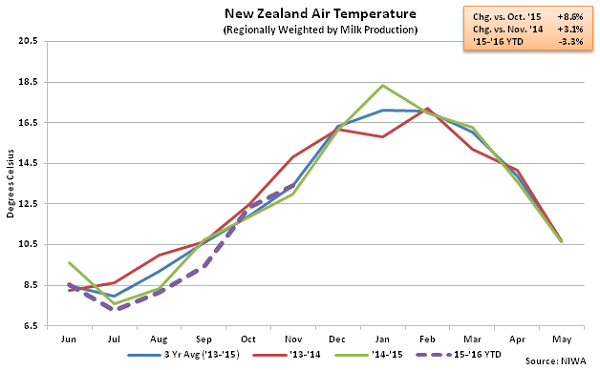

New Zealand soil moisture deficits continue to increase seasonally throughout the Southern Hemisphere’s summer months as average air temperatures increase. When weighted based on levels of regional milk production, New Zealand air temperatures have also trended higher on a YOY basis of late, finishing up 3.1% during Nov ’15.

New Zealand soil moisture deficits continue to increase seasonally throughout the Southern Hemisphere’s summer months as average air temperatures increase. When weighted based on levels of regional milk production, New Zealand air temperatures have also trended higher on a YOY basis of late, finishing up 3.1% during Nov ’15.

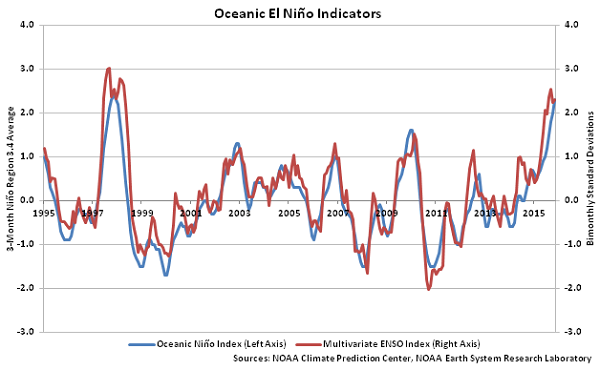

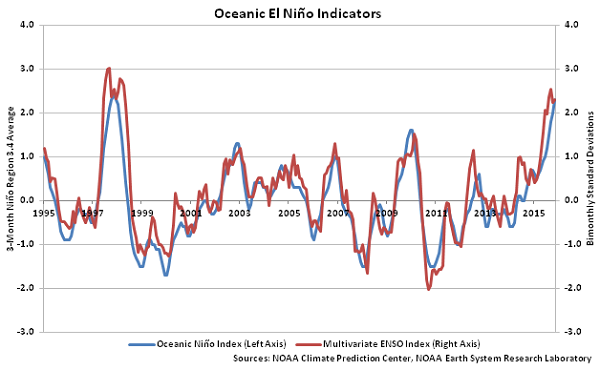

Lower rainfall levels, increases in soil moisture deficits and higher temperatures have occurred simultaneously with increases in key El Niño indicators. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each recently increased to new 17 year highs, indicating that a significant El Niño event likely remains in development. New Zealand weather authority MetService has forecasted January to be cooler than usual with a mix between dry and wet weeks but also expects rainfall levels to remain lower than normal in the eastern parts of the country.

Lower rainfall levels, increases in soil moisture deficits and higher temperatures have occurred simultaneously with increases in key El Niño indicators. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each recently increased to new 17 year highs, indicating that a significant El Niño event likely remains in development. New Zealand weather authority MetService has forecasted January to be cooler than usual with a mix between dry and wet weeks but also expects rainfall levels to remain lower than normal in the eastern parts of the country.

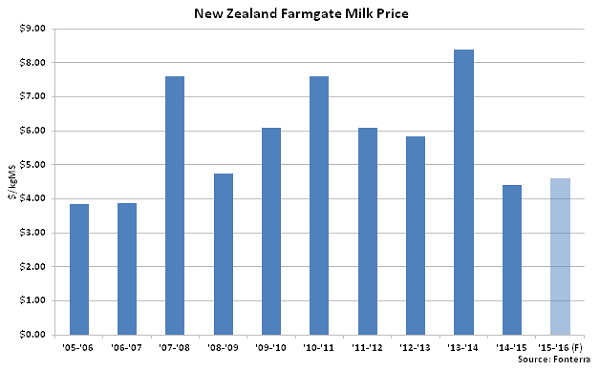

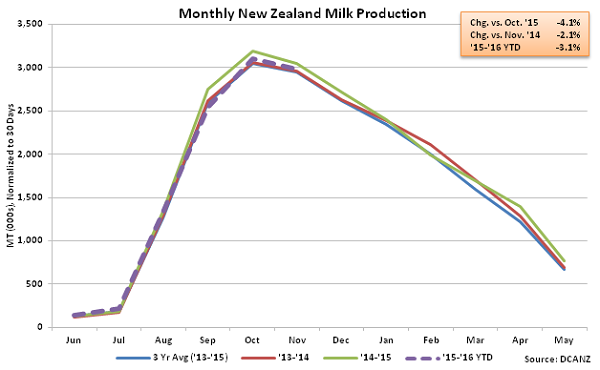

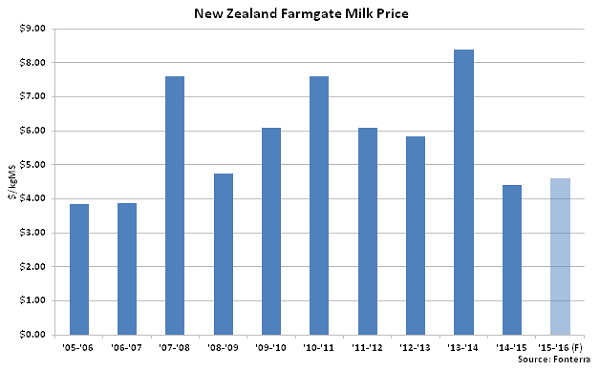

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. New Zealand milk production would need to decline by approximately 8.7% YOY over the final half of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 3.1% YOY throughout the first half of the production season.

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. New Zealand milk production would need to decline by approximately 8.7% YOY over the final half of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 3.1% YOY throughout the first half of the production season.

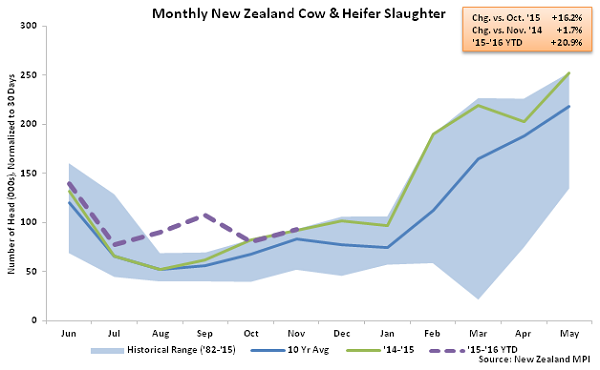

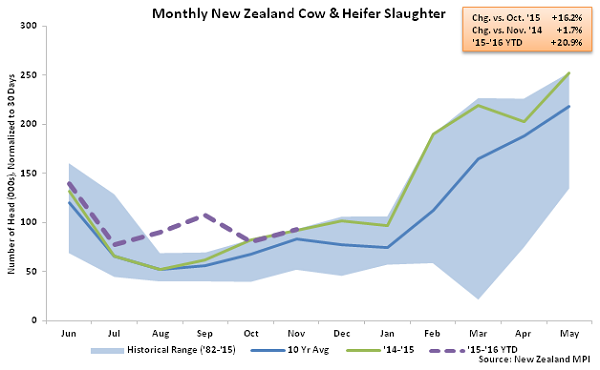

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Nov ’15 New Zealand cow & heifer slaughter rates finished 1.7% above the previous year, setting a record high for the month of November.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Nov ’15 New Zealand cow & heifer slaughter rates finished 1.7% above the previous year, setting a record high for the month of November.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past four months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past four months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

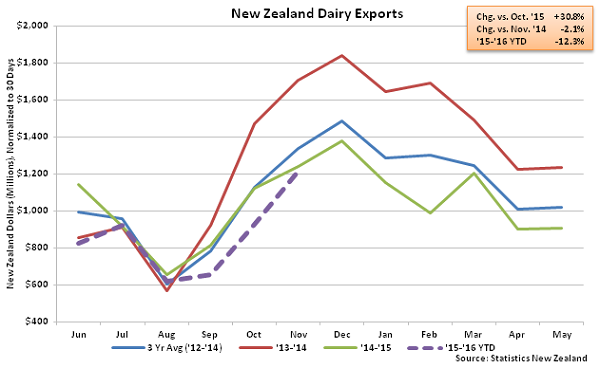

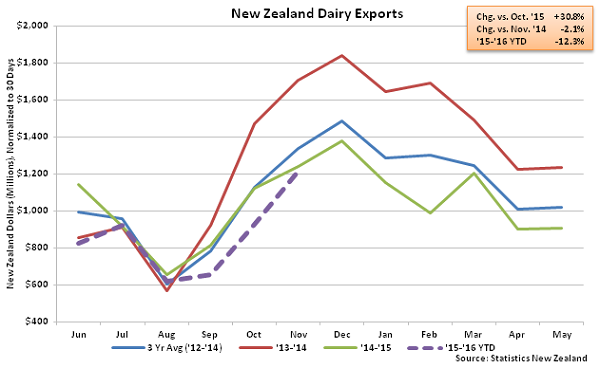

Weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fourth consecutive month in Nov ’15, finishing 2.1% below the previous year.

Weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fourth consecutive month in Nov ’15, finishing 2.1% below the previous year.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather affected forage conditions across New Zealand over the early months of the ’15-’16 production season. More recently, rainfall levels across New Zealand have fallen lower on a YOY basis, contributing to increases in soil moisture deficits.

Despite warnings of an El Niño event potentially resulting in dry conditions across New Zealand, cold, wet weather affected forage conditions across New Zealand over the early months of the ’15-’16 production season. More recently, rainfall levels across New Zealand have fallen lower on a YOY basis, contributing to increases in soil moisture deficits.

When weighted based on levels of regional milk production, New Zealand rainfall levels declined 13.5% YOY during Nov ’15, contributing to soil moisture deficits increasing by 21.7% YOY.

When weighted based on levels of regional milk production, New Zealand rainfall levels declined 13.5% YOY during Nov ’15, contributing to soil moisture deficits increasing by 21.7% YOY.

New Zealand soil moisture deficits continue to increase seasonally throughout the Southern Hemisphere’s summer months as average air temperatures increase. When weighted based on levels of regional milk production, New Zealand air temperatures have also trended higher on a YOY basis of late, finishing up 3.1% during Nov ’15.

New Zealand soil moisture deficits continue to increase seasonally throughout the Southern Hemisphere’s summer months as average air temperatures increase. When weighted based on levels of regional milk production, New Zealand air temperatures have also trended higher on a YOY basis of late, finishing up 3.1% during Nov ’15.

Lower rainfall levels, increases in soil moisture deficits and higher temperatures have occurred simultaneously with increases in key El Niño indicators. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each recently increased to new 17 year highs, indicating that a significant El Niño event likely remains in development. New Zealand weather authority MetService has forecasted January to be cooler than usual with a mix between dry and wet weeks but also expects rainfall levels to remain lower than normal in the eastern parts of the country.

Lower rainfall levels, increases in soil moisture deficits and higher temperatures have occurred simultaneously with increases in key El Niño indicators. The National Oceanic and Atmospheric Administration Oceanic Niño Index and Multivariate ENSO Index, measures used to identify the intensity of El Niño events, each recently increased to new 17 year highs, indicating that a significant El Niño event likely remains in development. New Zealand weather authority MetService has forecasted January to be cooler than usual with a mix between dry and wet weeks but also expects rainfall levels to remain lower than normal in the eastern parts of the country.

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. New Zealand milk production would need to decline by approximately 8.7% YOY over the final half of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 3.1% YOY throughout the first half of the production season.

In addition to the potential for continued adverse weather conditions, New Zealand Farmgate Milk Prices remain weak, contributing to the recent declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. New Zealand milk production would need to decline by approximately 8.7% YOY over the final half of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 3.1% YOY throughout the first half of the production season.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Nov ’15 New Zealand cow & heifer slaughter rates finished 1.7% above the previous year, setting a record high for the month of November.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates. New Zealand dairy producers have recently culled at a record heavy pace, sending low-producing cows to slaughter in order to mitigate costs and provide a near-term injection of cash. Nov ’15 New Zealand cow & heifer slaughter rates finished 1.7% above the previous year, setting a record high for the month of November.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past four months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

The recent increases in New Zealand cow & heifer slaughter have corresponded with the YOY decline in milk production exhibited throughout the past four months. Additional heavy culling is expected to continue to reduce milk production in coming months as, according to Fonterra, New Zealand dairy producers continue to reduce stocking rates and supplementary feed to help reduce costs in the low milk price environment.

Weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fourth consecutive month in Nov ’15, finishing 2.1% below the previous year.

Weaker export demand for New Zealand dairy products has also become a concern for New Zealand dairy producers over recent months. New Zealand dairy exports remained lower on a YOY basis for the fourth consecutive month in Nov ’15, finishing 2.1% below the previous year.