New Zealand Milk Production Update – Jan ’16

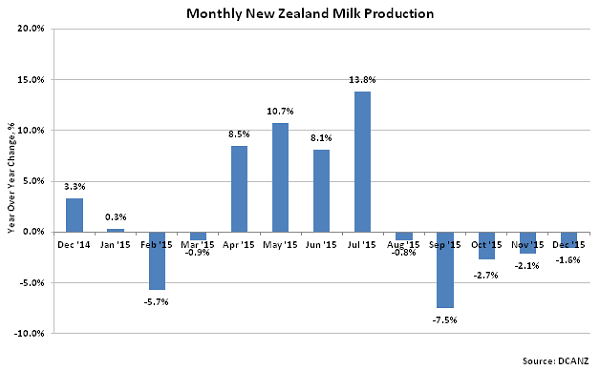

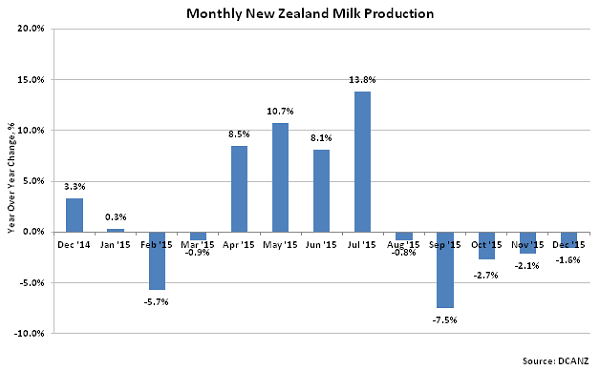

According to Dairy Companies Association of New Zealand (DCANZ), Dec ’15 New Zealand milk production declined YOY for the fifth consecutive month, finishing 1.6% below the previous year. Milk production also declined 10.2% MOM on a daily average basis as production continues to seasonally decline until lows are reached in the Northern Hemisphere summer months. The MOM decline was slightly less than the five year average November – December seasonal decline of 12.5%.

New Zealand milk production continues to trend lower on a YOY basis however the most recent decline of 1.6% was the smallest deficit experienced in the past five months. YOY declines in milk production have decelerated since Sep ’15 as concerns over the current significant El Niño event potentially adversely affecting production totals has dissipated. More recently, timely rainfall has provided relief from dry conditions across a large portion of New Zealand.

New Zealand milk production continues to trend lower on a YOY basis however the most recent decline of 1.6% was the smallest deficit experienced in the past five months. YOY declines in milk production have decelerated since Sep ’15 as concerns over the current significant El Niño event potentially adversely affecting production totals has dissipated. More recently, timely rainfall has provided relief from dry conditions across a large portion of New Zealand.

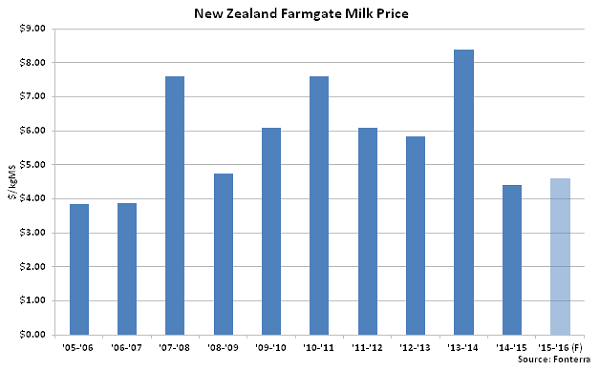

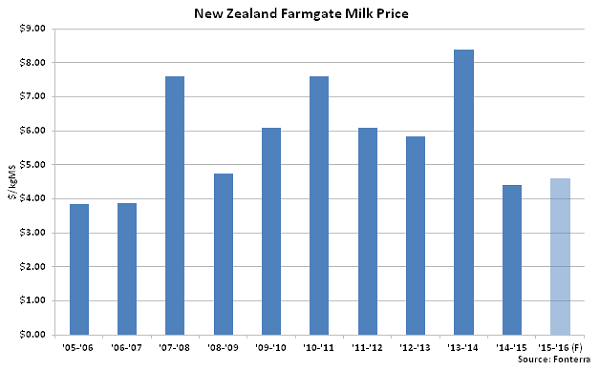

New Zealand Farmgate Milk Prices remain weak, however, contributing to the continued YOY declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. Fonterra is widely expected to revise their forecasted ’15-’16 Farmgate Milk Prices downward in coming months as whole milk powder prices reached a five month low during Jan ’16, however annual production deficits forecasted by Fonterra are unlikely to be met based on recent production figures. New Zealand milk production would need to decline by approximately 11.2% YOY over the final five months of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 2.8% YOY throughout the first seven months of the production season.

New Zealand Farmgate Milk Prices remain weak, however, contributing to the continued YOY declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. Fonterra is widely expected to revise their forecasted ’15-’16 Farmgate Milk Prices downward in coming months as whole milk powder prices reached a five month low during Jan ’16, however annual production deficits forecasted by Fonterra are unlikely to be met based on recent production figures. New Zealand milk production would need to decline by approximately 11.2% YOY over the final five months of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 2.8% YOY throughout the first seven months of the production season.

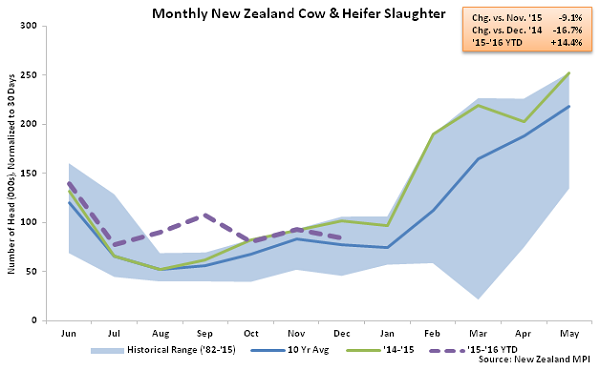

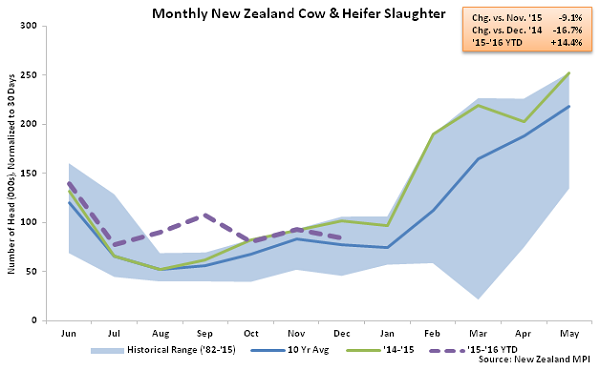

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates over recent months. New Zealand dairy producers culled at record high seasonal levels from Aug ’15 to Nov ’15, however Dec ’15 New Zealand cow & heifer slaughter rates finished 16.7% below the previous year. Despite the recent YOY decline, ’15-’16 YTD New Zealand cow & heifer slaughter rates remain up 14.4% YOY throughout the first seven months of the production season.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates over recent months. New Zealand dairy producers culled at record high seasonal levels from Aug ’15 to Nov ’15, however Dec ’15 New Zealand cow & heifer slaughter rates finished 16.7% below the previous year. Despite the recent YOY decline, ’15-’16 YTD New Zealand cow & heifer slaughter rates remain up 14.4% YOY throughout the first seven months of the production season.

New Zealand milk production continues to trend lower on a YOY basis however the most recent decline of 1.6% was the smallest deficit experienced in the past five months. YOY declines in milk production have decelerated since Sep ’15 as concerns over the current significant El Niño event potentially adversely affecting production totals has dissipated. More recently, timely rainfall has provided relief from dry conditions across a large portion of New Zealand.

New Zealand milk production continues to trend lower on a YOY basis however the most recent decline of 1.6% was the smallest deficit experienced in the past five months. YOY declines in milk production have decelerated since Sep ’15 as concerns over the current significant El Niño event potentially adversely affecting production totals has dissipated. More recently, timely rainfall has provided relief from dry conditions across a large portion of New Zealand.

New Zealand Farmgate Milk Prices remain weak, however, contributing to the continued YOY declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. Fonterra is widely expected to revise their forecasted ’15-’16 Farmgate Milk Prices downward in coming months as whole milk powder prices reached a five month low during Jan ’16, however annual production deficits forecasted by Fonterra are unlikely to be met based on recent production figures. New Zealand milk production would need to decline by approximately 11.2% YOY over the final five months of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 2.8% YOY throughout the first seven months of the production season.

New Zealand Farmgate Milk Prices remain weak, however, contributing to the continued YOY declines in milk production. In early Dec ’15, Fonterra reaffirmed its forecasted ’15-’16 Farmgate Milk Price of $4.60/kgMS but revised the projected annual New Zealand milk production forecast downward from a 5.0% YOY decline to a 6.0% YOY decline for the season. The current price forecast would be $0.20/kgMS higher than the ’14-’15 pay price but $1.25/kgMS, or 21.3%, below the ten year average price. Fonterra is widely expected to revise their forecasted ’15-’16 Farmgate Milk Prices downward in coming months as whole milk powder prices reached a five month low during Jan ’16, however annual production deficits forecasted by Fonterra are unlikely to be met based on recent production figures. New Zealand milk production would need to decline by approximately 11.2% YOY over the final five months of the ’15-’16 production season to reach Fonterra’s projected 6.0% annual decline. ’15-’16 annual New Zealand milk production has declined by 2.8% YOY throughout the first seven months of the production season.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates over recent months. New Zealand dairy producers culled at record high seasonal levels from Aug ’15 to Nov ’15, however Dec ’15 New Zealand cow & heifer slaughter rates finished 16.7% below the previous year. Despite the recent YOY decline, ’15-’16 YTD New Zealand cow & heifer slaughter rates remain up 14.4% YOY throughout the first seven months of the production season.

Lower Farmgate Milk Prices have resulted in tight cashflows and an increase in slaughter rates over recent months. New Zealand dairy producers culled at record high seasonal levels from Aug ’15 to Nov ’15, however Dec ’15 New Zealand cow & heifer slaughter rates finished 16.7% below the previous year. Despite the recent YOY decline, ’15-’16 YTD New Zealand cow & heifer slaughter rates remain up 14.4% YOY throughout the first seven months of the production season.