EU-28 Milk Production Update – Feb ’16

Executive Summary

EU-28 milk production figures provided by Eurostat were recently updated with values spanning through Dec ’15. Highlights from the updated report include:

• EU-28 milk production growth continues to remain strong, finishing up 4.9% YOY in Dec ’15.

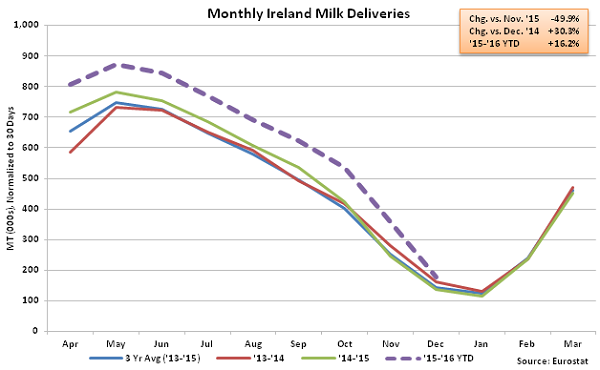

• YOY production gains were led by the Netherlands, followed by Germany and Poland. Ireland continued to lead all Member States in production gains on a percentage basis, finishing up 30.3%.

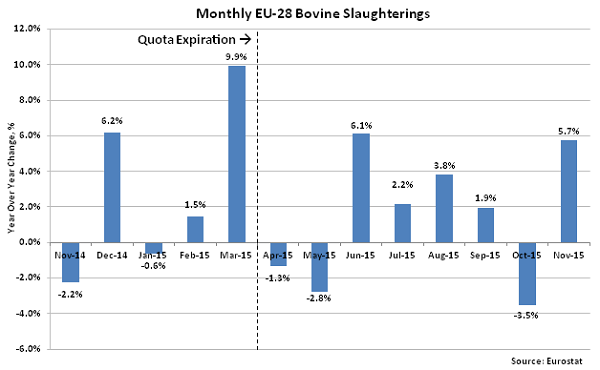

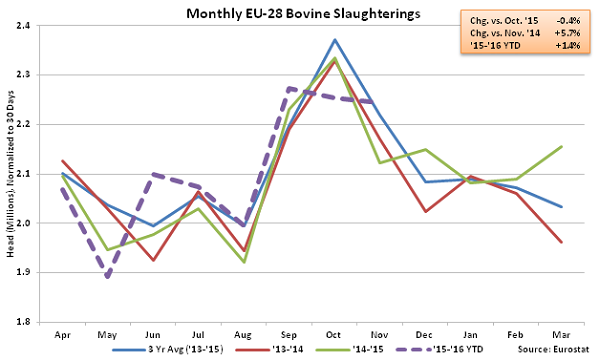

• Milk production continues to remain strong despite EU-28 bovine slaughter finishing higher on a YOY basis for the fifth time in the past six months, increasing by 5.7% YOY during Nov ’15.

Additional Report Details

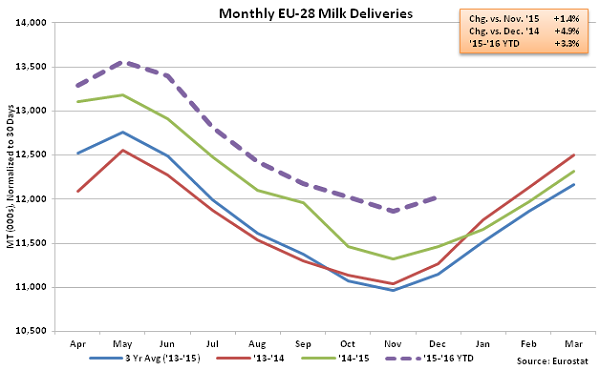

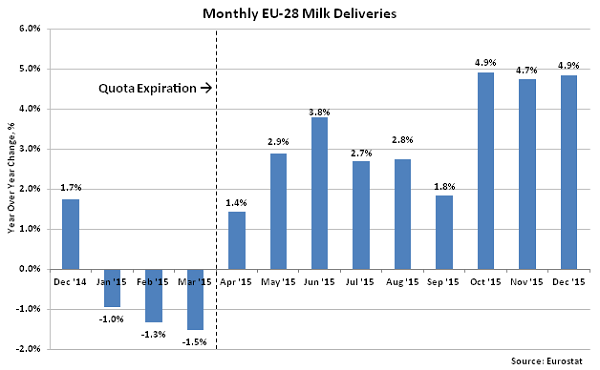

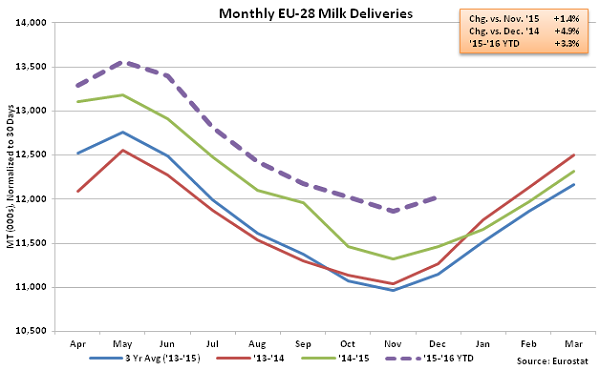

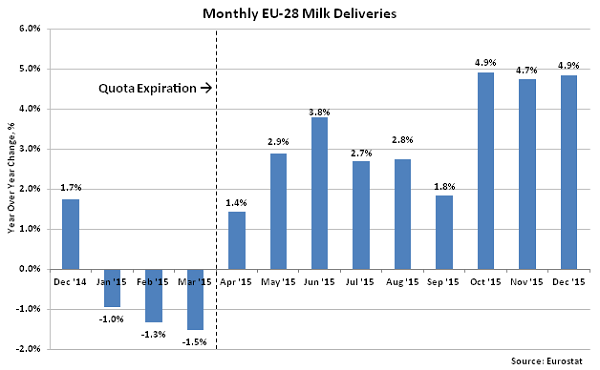

According to Eurostat, Dec ’15 EU-28 milk production increased YOY for the ninth consecutive month, finishing 4.9% above the previous year and setting a new production record for the month of December. The recent YOY increases in production have corresponded with the expiration of the EU-28 milk production quota system at the end of Mar ’15.

Monthly production growth had decelerated throughout the final months of the ’14-’15 production season as over-quota producers attempted to limit superlevy penalties for exceeding milk production quota levels. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season in the post-quota environment. The Dec ’15 YOY growth rate of 4.9% matched the 12 month high experienced during Oct ’15.

Monthly production growth had decelerated throughout the final months of the ’14-’15 production season as over-quota producers attempted to limit superlevy penalties for exceeding milk production quota levels. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season in the post-quota environment. The Dec ’15 YOY growth rate of 4.9% matched the 12 month high experienced during Oct ’15.

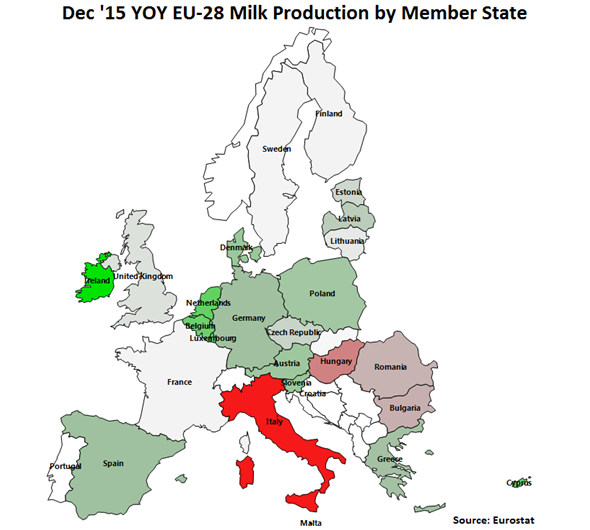

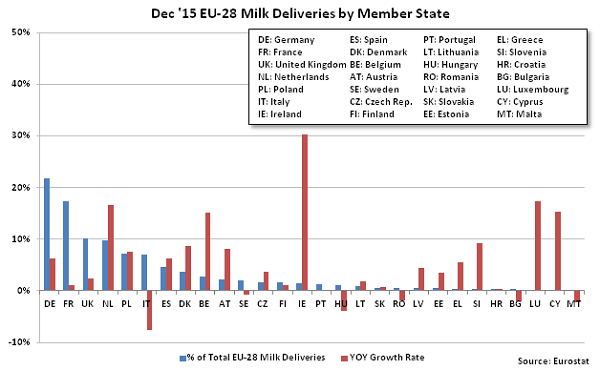

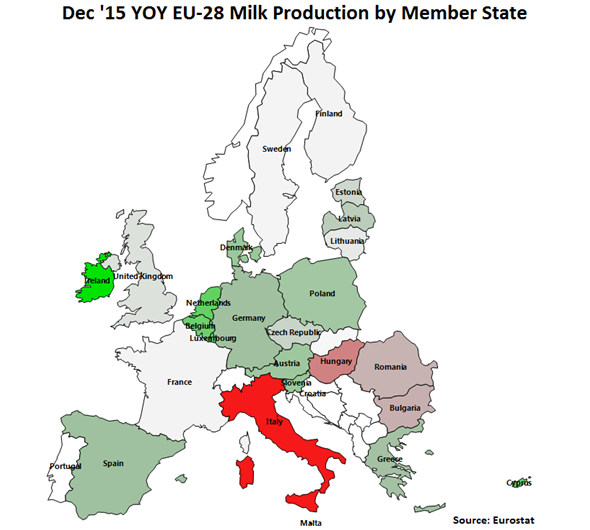

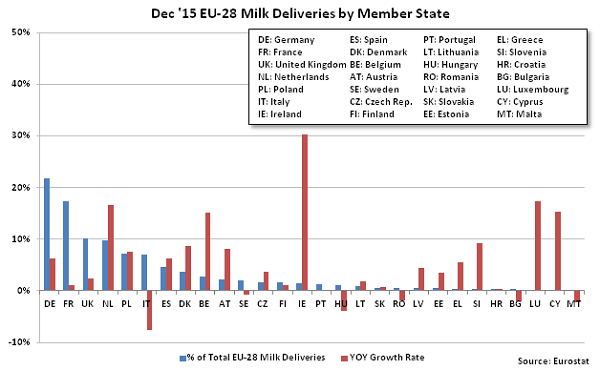

YOY increases in production were led by the Netherlands (+171,300 MT), followed by Germany (+157,920 MT) and Poland (+62,730 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Dec ’15. YOY increases in production on a percentage basis were led by Ireland (+30.3%), Luxembourg (+17.4%) and the Netherlands (+16.6%).

YOY increases in production were led by the Netherlands (+171,300 MT), followed by Germany (+157,920 MT) and Poland (+62,730 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Dec ’15. YOY increases in production on a percentage basis were led by Ireland (+30.3%), Luxembourg (+17.4%) and the Netherlands (+16.6%).

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Dec ’15, as production declined 7.6% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Dec ’15. Milk production increased by a weighted average of 5.4% YOY throughout the top ten milk producing Member States during the month of December.

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Dec ’15, as production declined 7.6% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Dec ’15. Milk production increased by a weighted average of 5.4% YOY throughout the top ten milk producing Member States during the month of December.

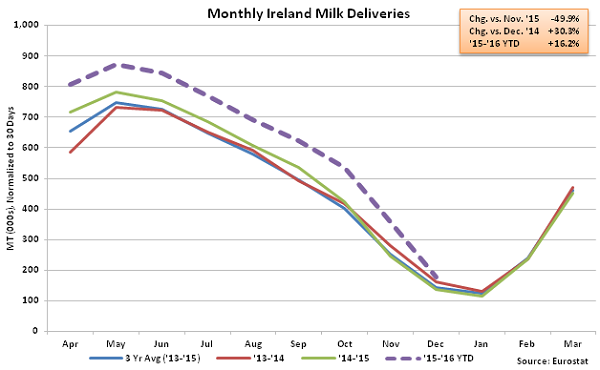

Ireland fell out of the top ten milk producing Member States during Dec ’15 as milk production approached seasonal lows typically experienced in January. The seasonality component of Ireland milk production is larger than the combined seasonal components of the four next largest EU-28 Member States (Lithuania, Romania, Latvia and Bulgaria), historically. EU-28 milk production growth excluding Ireland finished at a 15 month high during Dec ’15.

Ireland fell out of the top ten milk producing Member States during Dec ’15 as milk production approached seasonal lows typically experienced in January. The seasonality component of Ireland milk production is larger than the combined seasonal components of the four next largest EU-28 Member States (Lithuania, Romania, Latvia and Bulgaria), historically. EU-28 milk production growth excluding Ireland finished at a 15 month high during Dec ’15.

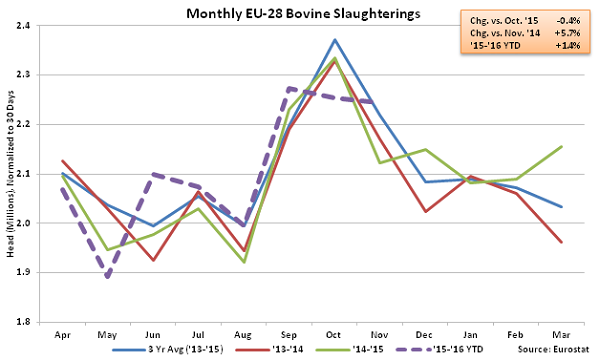

EU-28 culling rates have increased on a YOY basis in five of the past six months as the current low margin environment has encouraged producers to cull their lowest producing cows. Nov ’15 EU-28 beef & dairy cow slaughter declined 0.4% MOM on a daily average basis but increased 5.7% YOY, finishing at a three year high for the month of November. YOY increases in beef & dairy cow slaughter were led by Italy, followed by Poland and Spain. USDA expects the EU-28 dairy cow herd to be marginally lower heading into 2016 but recent culling is expected to have a positive impact on future per cow productivity as lower producing animals are culled. Total EU-28 beef & dairy cow slaughter is up 1.4% YOY throughout the first two thirds of the ’15-’16 production season.

EU-28 culling rates have increased on a YOY basis in five of the past six months as the current low margin environment has encouraged producers to cull their lowest producing cows. Nov ’15 EU-28 beef & dairy cow slaughter declined 0.4% MOM on a daily average basis but increased 5.7% YOY, finishing at a three year high for the month of November. YOY increases in beef & dairy cow slaughter were led by Italy, followed by Poland and Spain. USDA expects the EU-28 dairy cow herd to be marginally lower heading into 2016 but recent culling is expected to have a positive impact on future per cow productivity as lower producing animals are culled. Total EU-28 beef & dairy cow slaughter is up 1.4% YOY throughout the first two thirds of the ’15-’16 production season.

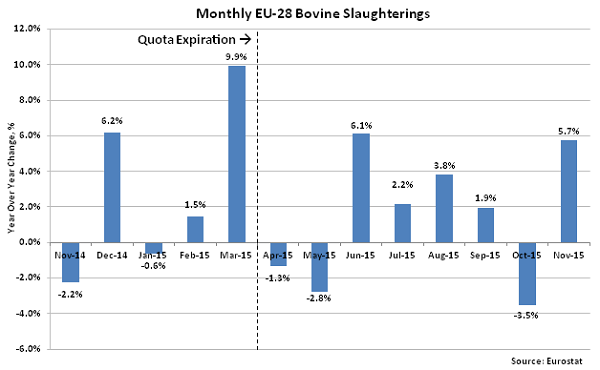

EU-28 bovine slaughter rates increased sharply prior to quota expiration, finishing up 9.9% YOY in Mar ‘15 as producers attempted to limit superlevy penalties. The Nov ’15 YOY increase in bovine slaughter of 5.7% was the second highest experienced since quota expiration.

EU-28 bovine slaughter rates increased sharply prior to quota expiration, finishing up 9.9% YOY in Mar ‘15 as producers attempted to limit superlevy penalties. The Nov ’15 YOY increase in bovine slaughter of 5.7% was the second highest experienced since quota expiration.

Monthly production growth had decelerated throughout the final months of the ’14-’15 production season as over-quota producers attempted to limit superlevy penalties for exceeding milk production quota levels. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season in the post-quota environment. The Dec ’15 YOY growth rate of 4.9% matched the 12 month high experienced during Oct ’15.

Monthly production growth had decelerated throughout the final months of the ’14-’15 production season as over-quota producers attempted to limit superlevy penalties for exceeding milk production quota levels. EU-28 milk production growth decelerated from Sep ’14 – Mar ’15 but has rebounded throughout the ’15-’16 production season in the post-quota environment. The Dec ’15 YOY growth rate of 4.9% matched the 12 month high experienced during Oct ’15.

YOY increases in production were led by the Netherlands (+171,300 MT), followed by Germany (+157,920 MT) and Poland (+62,730 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Dec ’15. YOY increases in production on a percentage basis were led by Ireland (+30.3%), Luxembourg (+17.4%) and the Netherlands (+16.6%).

YOY increases in production were led by the Netherlands (+171,300 MT), followed by Germany (+157,920 MT) and Poland (+62,730 MT). The aforementioned countries accounted for over a third of the total monthly EU-28 milk production and over half of the YOY production gains during Dec ’15. YOY increases in production on a percentage basis were led by Ireland (+30.3%), Luxembourg (+17.4%) and the Netherlands (+16.6%).

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Dec ’15, as production declined 7.6% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Dec ’15. Milk production increased by a weighted average of 5.4% YOY throughout the top ten milk producing Member States during the month of December.

Of the top ten milk producing Member States, Italy was the only Member State to experience a YOY decline in milk production during Dec ’15, as production declined 7.6% throughout the month. The top ten EU-28 milk producing Member States accounted for over 85% of the total EU-28 milk production during Dec ’15. Milk production increased by a weighted average of 5.4% YOY throughout the top ten milk producing Member States during the month of December.

Ireland fell out of the top ten milk producing Member States during Dec ’15 as milk production approached seasonal lows typically experienced in January. The seasonality component of Ireland milk production is larger than the combined seasonal components of the four next largest EU-28 Member States (Lithuania, Romania, Latvia and Bulgaria), historically. EU-28 milk production growth excluding Ireland finished at a 15 month high during Dec ’15.

Ireland fell out of the top ten milk producing Member States during Dec ’15 as milk production approached seasonal lows typically experienced in January. The seasonality component of Ireland milk production is larger than the combined seasonal components of the four next largest EU-28 Member States (Lithuania, Romania, Latvia and Bulgaria), historically. EU-28 milk production growth excluding Ireland finished at a 15 month high during Dec ’15.

EU-28 culling rates have increased on a YOY basis in five of the past six months as the current low margin environment has encouraged producers to cull their lowest producing cows. Nov ’15 EU-28 beef & dairy cow slaughter declined 0.4% MOM on a daily average basis but increased 5.7% YOY, finishing at a three year high for the month of November. YOY increases in beef & dairy cow slaughter were led by Italy, followed by Poland and Spain. USDA expects the EU-28 dairy cow herd to be marginally lower heading into 2016 but recent culling is expected to have a positive impact on future per cow productivity as lower producing animals are culled. Total EU-28 beef & dairy cow slaughter is up 1.4% YOY throughout the first two thirds of the ’15-’16 production season.

EU-28 culling rates have increased on a YOY basis in five of the past six months as the current low margin environment has encouraged producers to cull their lowest producing cows. Nov ’15 EU-28 beef & dairy cow slaughter declined 0.4% MOM on a daily average basis but increased 5.7% YOY, finishing at a three year high for the month of November. YOY increases in beef & dairy cow slaughter were led by Italy, followed by Poland and Spain. USDA expects the EU-28 dairy cow herd to be marginally lower heading into 2016 but recent culling is expected to have a positive impact on future per cow productivity as lower producing animals are culled. Total EU-28 beef & dairy cow slaughter is up 1.4% YOY throughout the first two thirds of the ’15-’16 production season.

EU-28 bovine slaughter rates increased sharply prior to quota expiration, finishing up 9.9% YOY in Mar ‘15 as producers attempted to limit superlevy penalties. The Nov ’15 YOY increase in bovine slaughter of 5.7% was the second highest experienced since quota expiration.

EU-28 bovine slaughter rates increased sharply prior to quota expiration, finishing up 9.9% YOY in Mar ‘15 as producers attempted to limit superlevy penalties. The Nov ’15 YOY increase in bovine slaughter of 5.7% was the second highest experienced since quota expiration.