U.S. Dairy Commercial Disappearance Update – Apr ’16

Executive Summary

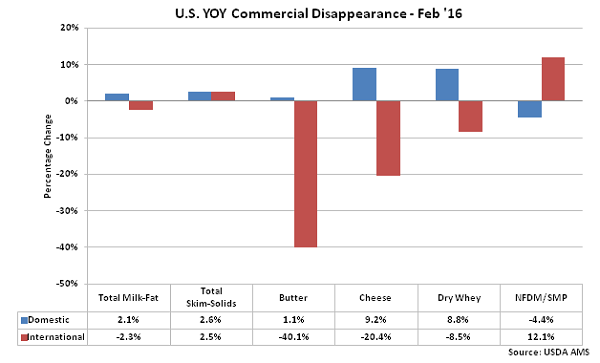

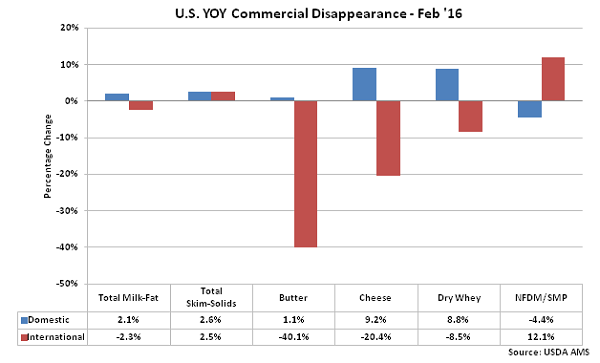

U.S. dairy commercial disappearance figures provided by USDA were recently updated with values spanning through Feb ’16. Highlights from the updated report include:

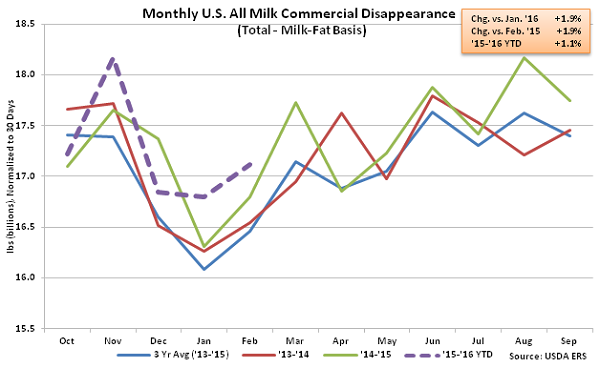

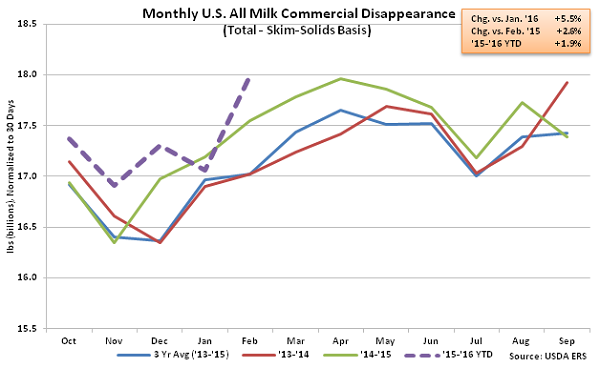

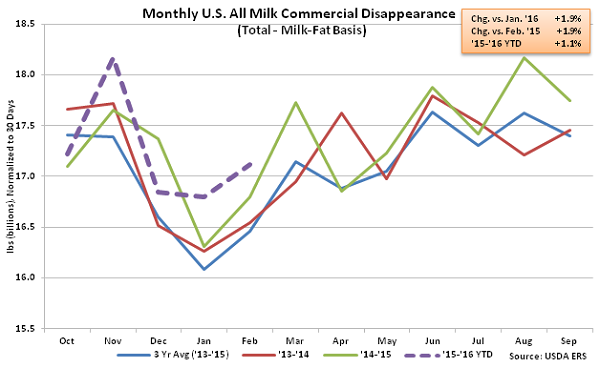

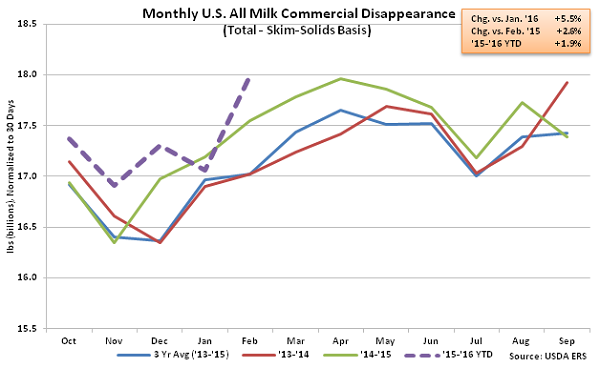

• Feb ’16 U.S. commercial disappearance for milk used in all products increased 1.9% YOY on a milk-fat basis and 2.6% YOY on a skim-solids basis, each finishing at new record high values for the month of February.

• Cheese disappearance figures increased on a YOY basis for the eighth consecutive month during Feb ’16, finishing at a record February high while Feb ’16 NFDM/SMP disappearance also finished at a record high for the month of February.

• U.S. fluid milk sales declined on a YOY basis for the 31st time in the past 33 months during Jan ’16, however, as sales of fat-free milk remained particularly weak.

Additional Report Details

All Milk – Disappearance Finishes at Record February Highs on both a Milk-Fat and Skim-Solids Basis

According to USDA, Feb ’16 U.S. commercial disappearance for milk used in all products increased 1.9% YOY on a milk-fat basis and 2.6% YOY on a skim-solids basis, each finishing at new record high values for the month of February when adjusting for leap day. Domestic demand outpaced international demand on both a milk-fat and skim-solids basis, increasing by 2.1% YOY and 2.6% YOY, respectively, throughout the month.

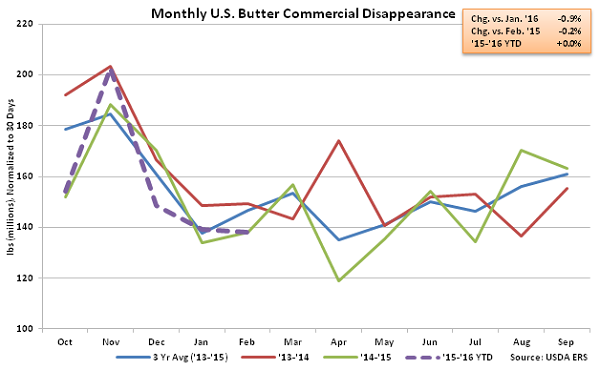

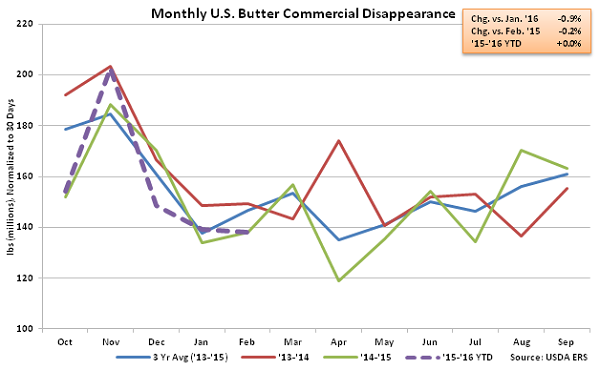

Butter – Disappearance Finishes Slightly Lower YOY as Export Volumes Remain Weak

Feb ’16 U.S. butter commercial disappearance declined 0.9% MOM on a daily average basis while also finishing 0.2% below the previous year consumption level. Feb ’16 domestic butter demand finished up 1.1% YOY however the increase in domestic consumption was more than offset by a 40.1% YOY decline in international demand. ’14-’15 annual U.S. butter commercial disappearance declined 5.2% YOY to a three year low as a 74.8% decline in export volumes more than offset a 1.6% increase in domestic demand. ’15-’16 YTD U.S. butter disappearance has been flat with the previous year figures throughout the first five months of the production season.

Butter – Disappearance Finishes Slightly Lower YOY as Export Volumes Remain Weak

Feb ’16 U.S. butter commercial disappearance declined 0.9% MOM on a daily average basis while also finishing 0.2% below the previous year consumption level. Feb ’16 domestic butter demand finished up 1.1% YOY however the increase in domestic consumption was more than offset by a 40.1% YOY decline in international demand. ’14-’15 annual U.S. butter commercial disappearance declined 5.2% YOY to a three year low as a 74.8% decline in export volumes more than offset a 1.6% increase in domestic demand. ’15-’16 YTD U.S. butter disappearance has been flat with the previous year figures throughout the first five months of the production season.

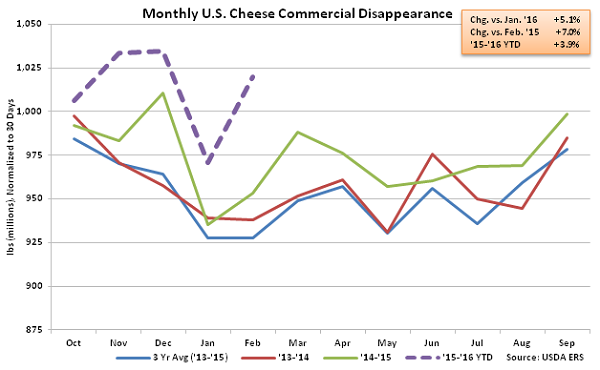

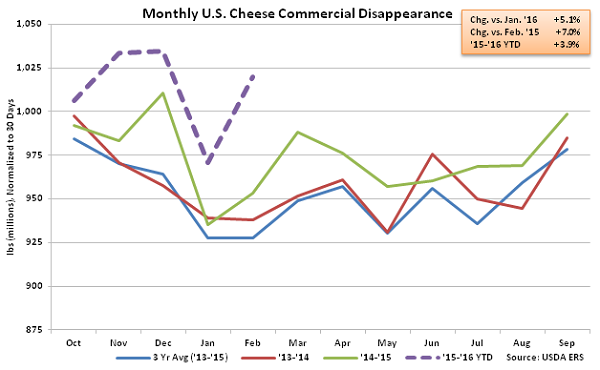

Cheese – Disappearance Remains Strong, Finishes at Record High for the Month of February

Feb ’16 U.S. cheese commercial disappearance remained strong, increasing by 5.1% MOM on a daily average basis and 7.0% YOY to a record high for the month of February. YOY increases in cheese disappearance have been exhibited throughout eight consecutive months through Feb ’16. Other-than-American cheese disappearance was particularly strong throughout February, increasing by 11.3% YOY while American cheese disappearance finished 6.0% above the previous year figures. Domestic cheese demand increased 9.2% YOY however export demand remained weak, declining 20.4% YOY. Cheese export volumes have declined YOY for 17 consecutive months while domestic demand has increased YOY for 16 consecutive months through February. ’14-’15 annual U.S. cheese commercial disappearance finished up 1.7% YOY to a new record annual high as a 2.9% increase in domestic demand more than offset a 14.1% decline in export demand. ’15-’16 YTD U.S. cheese disappearance is up an additional 3.9% YOY throughout the first five months of the production season.

Cheese – Disappearance Remains Strong, Finishes at Record High for the Month of February

Feb ’16 U.S. cheese commercial disappearance remained strong, increasing by 5.1% MOM on a daily average basis and 7.0% YOY to a record high for the month of February. YOY increases in cheese disappearance have been exhibited throughout eight consecutive months through Feb ’16. Other-than-American cheese disappearance was particularly strong throughout February, increasing by 11.3% YOY while American cheese disappearance finished 6.0% above the previous year figures. Domestic cheese demand increased 9.2% YOY however export demand remained weak, declining 20.4% YOY. Cheese export volumes have declined YOY for 17 consecutive months while domestic demand has increased YOY for 16 consecutive months through February. ’14-’15 annual U.S. cheese commercial disappearance finished up 1.7% YOY to a new record annual high as a 2.9% increase in domestic demand more than offset a 14.1% decline in export demand. ’15-’16 YTD U.S. cheese disappearance is up an additional 3.9% YOY throughout the first five months of the production season.

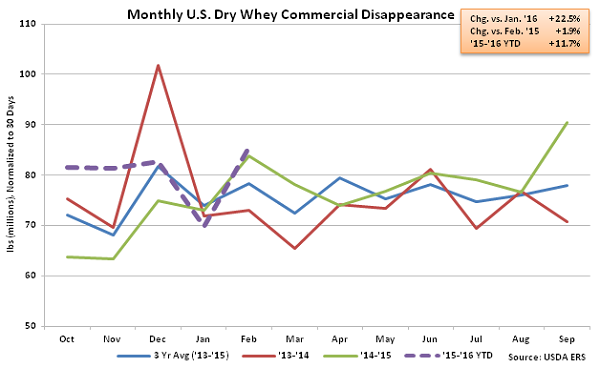

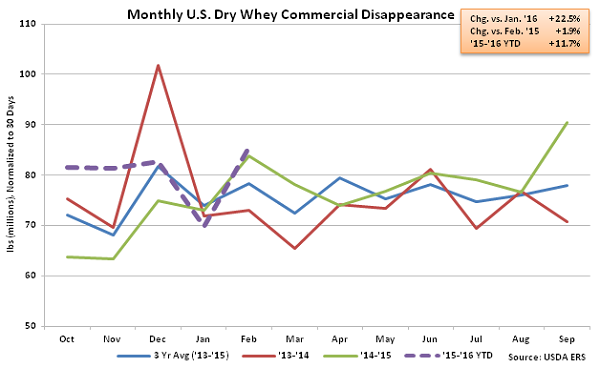

Dry Whey – Disappearance Increases on YOY Basis for Fifth Time in the Past Six Months

Feb ’16 U.S. dry whey commercial disappearance increased 22.5% MOM on a daily average basis from the 13 month low experienced during Jan ’16 while also finishing 1.9% higher on a YOY basis. The YOY increase in dry whey disappearance was the fifth experienced in the past six months. Domestic dry whey demand increased 8.8% YOY, more than offsetting an 8.5% decline in export volumes. ’14-’15 annual U.S. dry whey commercial disappearance increased 1.2% YOY as a 26.1% increase in domestic demand more than offset a 17.9% decline in export demand. ’15-’16 YTD U.S. dry whey disappearance has increased an additional 11.7% YOY throughout the first five months of the production season.

Dry Whey – Disappearance Increases on YOY Basis for Fifth Time in the Past Six Months

Feb ’16 U.S. dry whey commercial disappearance increased 22.5% MOM on a daily average basis from the 13 month low experienced during Jan ’16 while also finishing 1.9% higher on a YOY basis. The YOY increase in dry whey disappearance was the fifth experienced in the past six months. Domestic dry whey demand increased 8.8% YOY, more than offsetting an 8.5% decline in export volumes. ’14-’15 annual U.S. dry whey commercial disappearance increased 1.2% YOY as a 26.1% increase in domestic demand more than offset a 17.9% decline in export demand. ’15-’16 YTD U.S. dry whey disappearance has increased an additional 11.7% YOY throughout the first five months of the production season.

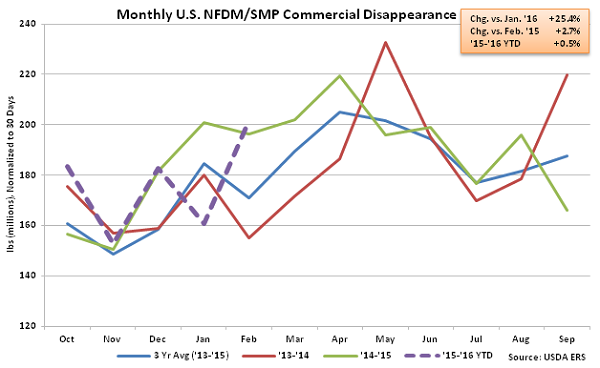

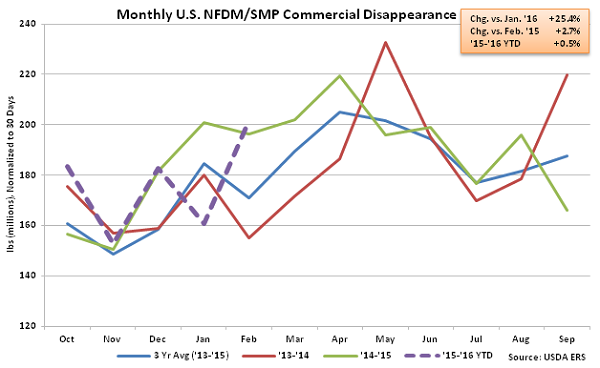

NFDM/SMP – Disappearance Finishes at Record High for the Month of February

Feb ’16 U.S. NFDM/SMP commercial disappearance increased 25.4% MOM on a daily average and 2.7% YOY, finishing at a new February record high. Feb ’16 U.S. NFDM/SMP export demand remained strong, increasing by 12.1% YOY and more than offsetting a 4.4% YOY decline in domestic disappearance. ’14-’15 annual U.S. NFDM/SMP commercial disappearance finished up 2.8% YOY as a 12.1% increase in domestic demand more than offset a 4.7% decline in export demand. ’15-’16 YTD U.S. NFDM/SMP disappearance up an additional 0.5% YOY throughout the first five months of the production season.

NFDM/SMP – Disappearance Finishes at Record High for the Month of February

Feb ’16 U.S. NFDM/SMP commercial disappearance increased 25.4% MOM on a daily average and 2.7% YOY, finishing at a new February record high. Feb ’16 U.S. NFDM/SMP export demand remained strong, increasing by 12.1% YOY and more than offsetting a 4.4% YOY decline in domestic disappearance. ’14-’15 annual U.S. NFDM/SMP commercial disappearance finished up 2.8% YOY as a 12.1% increase in domestic demand more than offset a 4.7% decline in export demand. ’15-’16 YTD U.S. NFDM/SMP disappearance up an additional 0.5% YOY throughout the first five months of the production season.

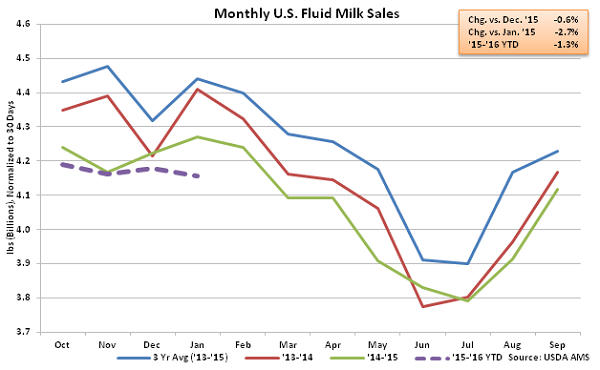

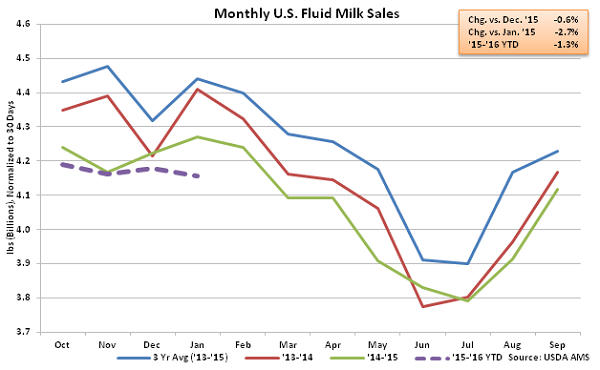

Fluid Milk Sales – Fat-Free Sales Continue to Weigh Down Overall Figures

Jan ’16 U.S. fluid milk sales of 4.29 billion pounds were lower on a YOY basis for the 31st time in the past 33 months, declining 2.7% and finishing at a record low for the month of January. Sales of whole milk remained strong, finishing up 2.3% YOY, while fat-free milk sales declined 12.8% YOY. ’14-’15 annual U.S. total fluid milk sales finished down 1.8% YOY to the lowest annual figure on record. Annual whole milk sales finished up 2.2% however annual fat-free milk sales declined 10.8%. ’15-’16 YTD U.S. fluid milk sales are down at additional 1.3% YOY throughout the first third of the production season.

Fluid Milk Sales – Fat-Free Sales Continue to Weigh Down Overall Figures

Jan ’16 U.S. fluid milk sales of 4.29 billion pounds were lower on a YOY basis for the 31st time in the past 33 months, declining 2.7% and finishing at a record low for the month of January. Sales of whole milk remained strong, finishing up 2.3% YOY, while fat-free milk sales declined 12.8% YOY. ’14-’15 annual U.S. total fluid milk sales finished down 1.8% YOY to the lowest annual figure on record. Annual whole milk sales finished up 2.2% however annual fat-free milk sales declined 10.8%. ’15-’16 YTD U.S. fluid milk sales are down at additional 1.3% YOY throughout the first third of the production season.

Overall, Feb ’16 YOY increases in domestic commercial disappearance were widespread with the exception of NFDM/SMP while YOY international disappearance remained lower throughout high milk-fat dairy products.

Overall, Feb ’16 YOY increases in domestic commercial disappearance were widespread with the exception of NFDM/SMP while YOY international disappearance remained lower throughout high milk-fat dairy products.

Butter – Disappearance Finishes Slightly Lower YOY as Export Volumes Remain Weak

Feb ’16 U.S. butter commercial disappearance declined 0.9% MOM on a daily average basis while also finishing 0.2% below the previous year consumption level. Feb ’16 domestic butter demand finished up 1.1% YOY however the increase in domestic consumption was more than offset by a 40.1% YOY decline in international demand. ’14-’15 annual U.S. butter commercial disappearance declined 5.2% YOY to a three year low as a 74.8% decline in export volumes more than offset a 1.6% increase in domestic demand. ’15-’16 YTD U.S. butter disappearance has been flat with the previous year figures throughout the first five months of the production season.

Butter – Disappearance Finishes Slightly Lower YOY as Export Volumes Remain Weak

Feb ’16 U.S. butter commercial disappearance declined 0.9% MOM on a daily average basis while also finishing 0.2% below the previous year consumption level. Feb ’16 domestic butter demand finished up 1.1% YOY however the increase in domestic consumption was more than offset by a 40.1% YOY decline in international demand. ’14-’15 annual U.S. butter commercial disappearance declined 5.2% YOY to a three year low as a 74.8% decline in export volumes more than offset a 1.6% increase in domestic demand. ’15-’16 YTD U.S. butter disappearance has been flat with the previous year figures throughout the first five months of the production season.

Cheese – Disappearance Remains Strong, Finishes at Record High for the Month of February

Feb ’16 U.S. cheese commercial disappearance remained strong, increasing by 5.1% MOM on a daily average basis and 7.0% YOY to a record high for the month of February. YOY increases in cheese disappearance have been exhibited throughout eight consecutive months through Feb ’16. Other-than-American cheese disappearance was particularly strong throughout February, increasing by 11.3% YOY while American cheese disappearance finished 6.0% above the previous year figures. Domestic cheese demand increased 9.2% YOY however export demand remained weak, declining 20.4% YOY. Cheese export volumes have declined YOY for 17 consecutive months while domestic demand has increased YOY for 16 consecutive months through February. ’14-’15 annual U.S. cheese commercial disappearance finished up 1.7% YOY to a new record annual high as a 2.9% increase in domestic demand more than offset a 14.1% decline in export demand. ’15-’16 YTD U.S. cheese disappearance is up an additional 3.9% YOY throughout the first five months of the production season.

Cheese – Disappearance Remains Strong, Finishes at Record High for the Month of February

Feb ’16 U.S. cheese commercial disappearance remained strong, increasing by 5.1% MOM on a daily average basis and 7.0% YOY to a record high for the month of February. YOY increases in cheese disappearance have been exhibited throughout eight consecutive months through Feb ’16. Other-than-American cheese disappearance was particularly strong throughout February, increasing by 11.3% YOY while American cheese disappearance finished 6.0% above the previous year figures. Domestic cheese demand increased 9.2% YOY however export demand remained weak, declining 20.4% YOY. Cheese export volumes have declined YOY for 17 consecutive months while domestic demand has increased YOY for 16 consecutive months through February. ’14-’15 annual U.S. cheese commercial disappearance finished up 1.7% YOY to a new record annual high as a 2.9% increase in domestic demand more than offset a 14.1% decline in export demand. ’15-’16 YTD U.S. cheese disappearance is up an additional 3.9% YOY throughout the first five months of the production season.

Dry Whey – Disappearance Increases on YOY Basis for Fifth Time in the Past Six Months

Feb ’16 U.S. dry whey commercial disappearance increased 22.5% MOM on a daily average basis from the 13 month low experienced during Jan ’16 while also finishing 1.9% higher on a YOY basis. The YOY increase in dry whey disappearance was the fifth experienced in the past six months. Domestic dry whey demand increased 8.8% YOY, more than offsetting an 8.5% decline in export volumes. ’14-’15 annual U.S. dry whey commercial disappearance increased 1.2% YOY as a 26.1% increase in domestic demand more than offset a 17.9% decline in export demand. ’15-’16 YTD U.S. dry whey disappearance has increased an additional 11.7% YOY throughout the first five months of the production season.

Dry Whey – Disappearance Increases on YOY Basis for Fifth Time in the Past Six Months

Feb ’16 U.S. dry whey commercial disappearance increased 22.5% MOM on a daily average basis from the 13 month low experienced during Jan ’16 while also finishing 1.9% higher on a YOY basis. The YOY increase in dry whey disappearance was the fifth experienced in the past six months. Domestic dry whey demand increased 8.8% YOY, more than offsetting an 8.5% decline in export volumes. ’14-’15 annual U.S. dry whey commercial disappearance increased 1.2% YOY as a 26.1% increase in domestic demand more than offset a 17.9% decline in export demand. ’15-’16 YTD U.S. dry whey disappearance has increased an additional 11.7% YOY throughout the first five months of the production season.

NFDM/SMP – Disappearance Finishes at Record High for the Month of February

Feb ’16 U.S. NFDM/SMP commercial disappearance increased 25.4% MOM on a daily average and 2.7% YOY, finishing at a new February record high. Feb ’16 U.S. NFDM/SMP export demand remained strong, increasing by 12.1% YOY and more than offsetting a 4.4% YOY decline in domestic disappearance. ’14-’15 annual U.S. NFDM/SMP commercial disappearance finished up 2.8% YOY as a 12.1% increase in domestic demand more than offset a 4.7% decline in export demand. ’15-’16 YTD U.S. NFDM/SMP disappearance up an additional 0.5% YOY throughout the first five months of the production season.

NFDM/SMP – Disappearance Finishes at Record High for the Month of February

Feb ’16 U.S. NFDM/SMP commercial disappearance increased 25.4% MOM on a daily average and 2.7% YOY, finishing at a new February record high. Feb ’16 U.S. NFDM/SMP export demand remained strong, increasing by 12.1% YOY and more than offsetting a 4.4% YOY decline in domestic disappearance. ’14-’15 annual U.S. NFDM/SMP commercial disappearance finished up 2.8% YOY as a 12.1% increase in domestic demand more than offset a 4.7% decline in export demand. ’15-’16 YTD U.S. NFDM/SMP disappearance up an additional 0.5% YOY throughout the first five months of the production season.

Fluid Milk Sales – Fat-Free Sales Continue to Weigh Down Overall Figures

Jan ’16 U.S. fluid milk sales of 4.29 billion pounds were lower on a YOY basis for the 31st time in the past 33 months, declining 2.7% and finishing at a record low for the month of January. Sales of whole milk remained strong, finishing up 2.3% YOY, while fat-free milk sales declined 12.8% YOY. ’14-’15 annual U.S. total fluid milk sales finished down 1.8% YOY to the lowest annual figure on record. Annual whole milk sales finished up 2.2% however annual fat-free milk sales declined 10.8%. ’15-’16 YTD U.S. fluid milk sales are down at additional 1.3% YOY throughout the first third of the production season.

Fluid Milk Sales – Fat-Free Sales Continue to Weigh Down Overall Figures

Jan ’16 U.S. fluid milk sales of 4.29 billion pounds were lower on a YOY basis for the 31st time in the past 33 months, declining 2.7% and finishing at a record low for the month of January. Sales of whole milk remained strong, finishing up 2.3% YOY, while fat-free milk sales declined 12.8% YOY. ’14-’15 annual U.S. total fluid milk sales finished down 1.8% YOY to the lowest annual figure on record. Annual whole milk sales finished up 2.2% however annual fat-free milk sales declined 10.8%. ’15-’16 YTD U.S. fluid milk sales are down at additional 1.3% YOY throughout the first third of the production season.

Overall, Feb ’16 YOY increases in domestic commercial disappearance were widespread with the exception of NFDM/SMP while YOY international disappearance remained lower throughout high milk-fat dairy products.

Overall, Feb ’16 YOY increases in domestic commercial disappearance were widespread with the exception of NFDM/SMP while YOY international disappearance remained lower throughout high milk-fat dairy products.