U.S. Butterfat Imports Update – Oct ’16

U.S. butterfat imports exceeded export volumes for the 19th consecutive month during Aug ’16 as total butterfat import volumes finished at nearly five times the export volumes experienced throughout the month. Overall, U.S. butterfat net trade reached a nine and a half year low as import volumes finished at a 15 year seasonal high for the month of August.

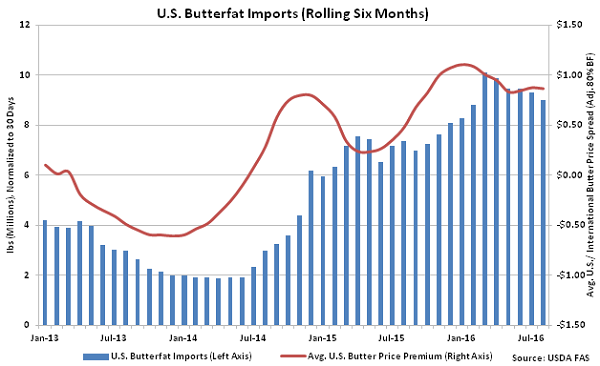

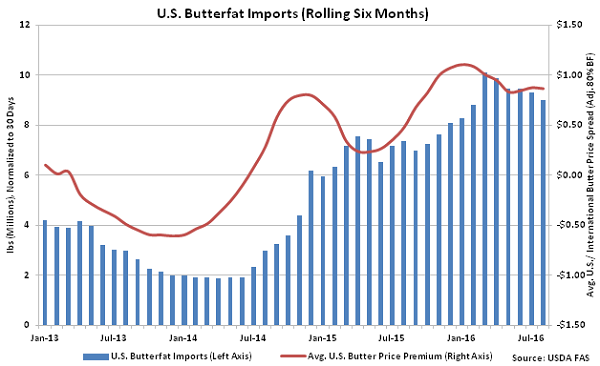

U.S. butterfat import volumes have increased as domestic butter prices have traded at a premium to international average prices since mid-2014. ’14-’15 annual U.S. butterfat import volumes reached a nine year high while ’15-’16 YTD butterfat imports have increased an additional 27.7% throughout the first 11 months of the production season, on pace to reach a record high annual level.

U.S. butterfat import volumes have increased as domestic butter prices have traded at a premium to international average prices since mid-2014. ’14-’15 annual U.S. butterfat import volumes reached a nine year high while ’15-’16 YTD butterfat imports have increased an additional 27.7% throughout the first 11 months of the production season, on pace to reach a record high annual level.

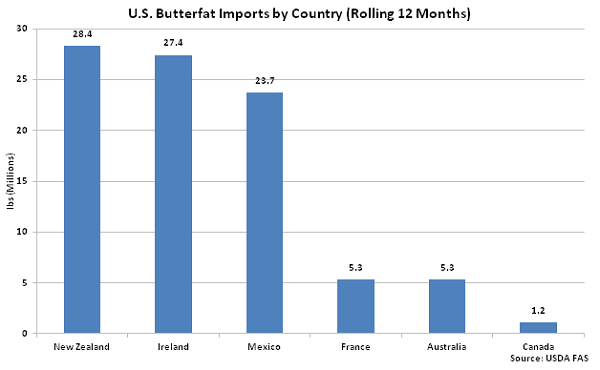

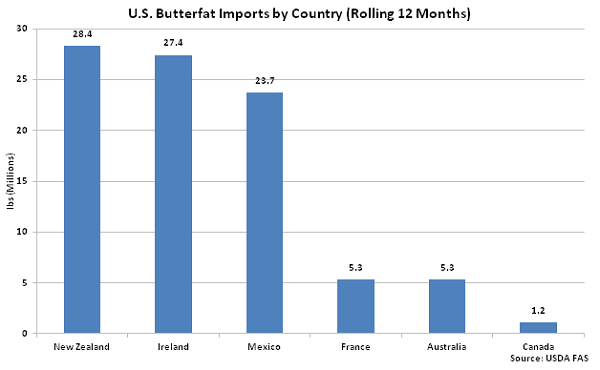

Growth in butterfat imports over the past 12 months has been led by product shipped from New Zealand, followed closely by imports of butterfat from Ireland and Mexico. The aforementioned countries have accounted for nearly three quarters of the total U.S. butterfat import volumes experienced throughout the past 12 months.

Growth in butterfat imports over the past 12 months has been led by product shipped from New Zealand, followed closely by imports of butterfat from Ireland and Mexico. The aforementioned countries have accounted for nearly three quarters of the total U.S. butterfat import volumes experienced throughout the past 12 months.

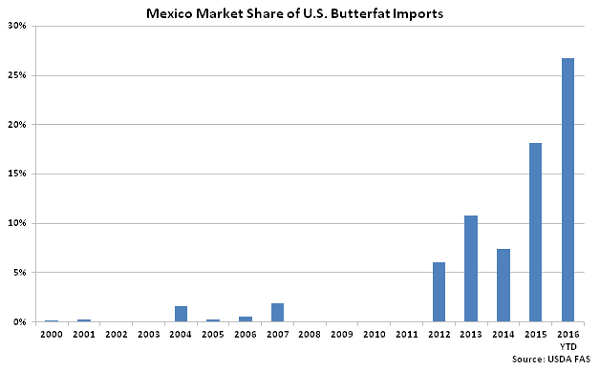

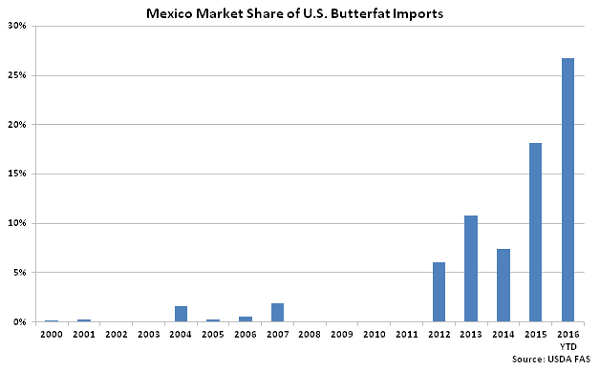

New Zealand has been the main source of U.S. butterfat imports, historically, accounting for over half of the total U.S. butterfat import volumes since 2000. Ireland was the second largest shipper of butterfat destined to the U.S. over the same period as volumes increased sharply following the announcement of the Russian dairy import ban. Growth in U.S. butterfat imports from Mexico has been minimal, however, until the most recent two years. Mexico accounted for less than two percent of total U.S. butterfat import volumes from 2000 – 2014 prior to gaining market share of over a quarter of total U.S. butterfat imports throughout the first two thirds of 2016.

New Zealand has been the main source of U.S. butterfat imports, historically, accounting for over half of the total U.S. butterfat import volumes since 2000. Ireland was the second largest shipper of butterfat destined to the U.S. over the same period as volumes increased sharply following the announcement of the Russian dairy import ban. Growth in U.S. butterfat imports from Mexico has been minimal, however, until the most recent two years. Mexico accounted for less than two percent of total U.S. butterfat import volumes from 2000 – 2014 prior to gaining market share of over a quarter of total U.S. butterfat imports throughout the first two thirds of 2016.

U.S. butterfat imports are regulated by a two-tiered tariff-rate quota system designed to protect domestic markets by reducing arbitrage opportunities across borders. Under the quota system, limited quantities of imports are applied a relatively low tariff rate while a higher tariff rate is applied to U.S. butterfat imports above a specific quantity. These higher tariff rates are often insurmountable, limiting import volumes.

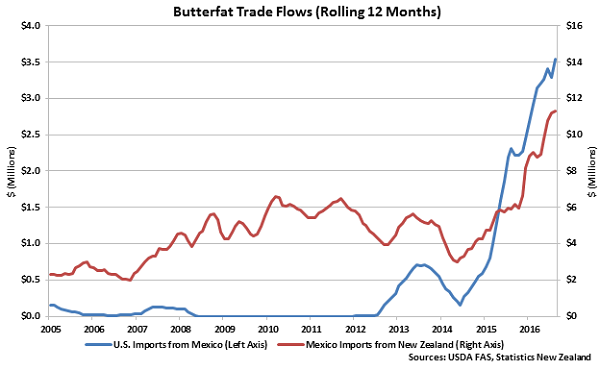

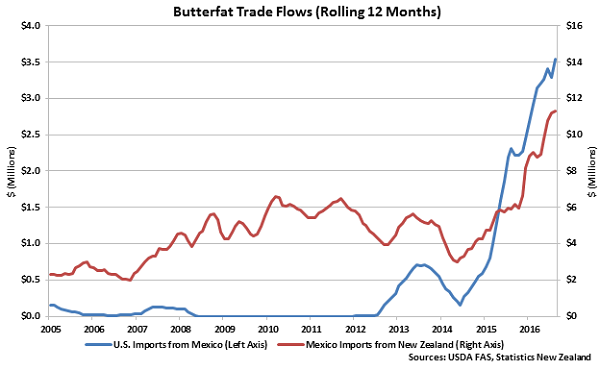

Mexico manufacturers have the ability to import butterfat duty free to the U.S. under the North American Free Trade Agreement (NAFTA), however. In addition, Mexico may import anhydrous milkfat (AMF) from New Zealand duty free to use domestically and then export Mexican produced AMF to the U.S. under NAFTA terms. That dynamic appears to be playing out recently as an increase in Mexico butterfat imports from New Zealand have coincided with the increase in U.S. butterfat imports from Mexico. Over the past six months, the equivalent of 57% of Mexico butterfat imports from New Zealand went to the U.S. as butterfat trade flows between the countries reached record highs.

U.S. butterfat imports are regulated by a two-tiered tariff-rate quota system designed to protect domestic markets by reducing arbitrage opportunities across borders. Under the quota system, limited quantities of imports are applied a relatively low tariff rate while a higher tariff rate is applied to U.S. butterfat imports above a specific quantity. These higher tariff rates are often insurmountable, limiting import volumes.

Mexico manufacturers have the ability to import butterfat duty free to the U.S. under the North American Free Trade Agreement (NAFTA), however. In addition, Mexico may import anhydrous milkfat (AMF) from New Zealand duty free to use domestically and then export Mexican produced AMF to the U.S. under NAFTA terms. That dynamic appears to be playing out recently as an increase in Mexico butterfat imports from New Zealand have coincided with the increase in U.S. butterfat imports from Mexico. Over the past six months, the equivalent of 57% of Mexico butterfat imports from New Zealand went to the U.S. as butterfat trade flows between the countries reached record highs.

This exploitation of trade agreements has elevated domestic butterfat imports, contributing to volumes reaching 15 year seasonal highs. U.S. butter price premiums have declined over recent months, which may result in a decline in butterfat imports doing forward, however the U.S. will likely remain a net importer of butterfat until domestic prices approach parity with average international prices.

This exploitation of trade agreements has elevated domestic butterfat imports, contributing to volumes reaching 15 year seasonal highs. U.S. butter price premiums have declined over recent months, which may result in a decline in butterfat imports doing forward, however the U.S. will likely remain a net importer of butterfat until domestic prices approach parity with average international prices.

U.S. butterfat import volumes have increased as domestic butter prices have traded at a premium to international average prices since mid-2014. ’14-’15 annual U.S. butterfat import volumes reached a nine year high while ’15-’16 YTD butterfat imports have increased an additional 27.7% throughout the first 11 months of the production season, on pace to reach a record high annual level.

U.S. butterfat import volumes have increased as domestic butter prices have traded at a premium to international average prices since mid-2014. ’14-’15 annual U.S. butterfat import volumes reached a nine year high while ’15-’16 YTD butterfat imports have increased an additional 27.7% throughout the first 11 months of the production season, on pace to reach a record high annual level.

Growth in butterfat imports over the past 12 months has been led by product shipped from New Zealand, followed closely by imports of butterfat from Ireland and Mexico. The aforementioned countries have accounted for nearly three quarters of the total U.S. butterfat import volumes experienced throughout the past 12 months.

Growth in butterfat imports over the past 12 months has been led by product shipped from New Zealand, followed closely by imports of butterfat from Ireland and Mexico. The aforementioned countries have accounted for nearly three quarters of the total U.S. butterfat import volumes experienced throughout the past 12 months.

New Zealand has been the main source of U.S. butterfat imports, historically, accounting for over half of the total U.S. butterfat import volumes since 2000. Ireland was the second largest shipper of butterfat destined to the U.S. over the same period as volumes increased sharply following the announcement of the Russian dairy import ban. Growth in U.S. butterfat imports from Mexico has been minimal, however, until the most recent two years. Mexico accounted for less than two percent of total U.S. butterfat import volumes from 2000 – 2014 prior to gaining market share of over a quarter of total U.S. butterfat imports throughout the first two thirds of 2016.

New Zealand has been the main source of U.S. butterfat imports, historically, accounting for over half of the total U.S. butterfat import volumes since 2000. Ireland was the second largest shipper of butterfat destined to the U.S. over the same period as volumes increased sharply following the announcement of the Russian dairy import ban. Growth in U.S. butterfat imports from Mexico has been minimal, however, until the most recent two years. Mexico accounted for less than two percent of total U.S. butterfat import volumes from 2000 – 2014 prior to gaining market share of over a quarter of total U.S. butterfat imports throughout the first two thirds of 2016.

U.S. butterfat imports are regulated by a two-tiered tariff-rate quota system designed to protect domestic markets by reducing arbitrage opportunities across borders. Under the quota system, limited quantities of imports are applied a relatively low tariff rate while a higher tariff rate is applied to U.S. butterfat imports above a specific quantity. These higher tariff rates are often insurmountable, limiting import volumes.

Mexico manufacturers have the ability to import butterfat duty free to the U.S. under the North American Free Trade Agreement (NAFTA), however. In addition, Mexico may import anhydrous milkfat (AMF) from New Zealand duty free to use domestically and then export Mexican produced AMF to the U.S. under NAFTA terms. That dynamic appears to be playing out recently as an increase in Mexico butterfat imports from New Zealand have coincided with the increase in U.S. butterfat imports from Mexico. Over the past six months, the equivalent of 57% of Mexico butterfat imports from New Zealand went to the U.S. as butterfat trade flows between the countries reached record highs.

U.S. butterfat imports are regulated by a two-tiered tariff-rate quota system designed to protect domestic markets by reducing arbitrage opportunities across borders. Under the quota system, limited quantities of imports are applied a relatively low tariff rate while a higher tariff rate is applied to U.S. butterfat imports above a specific quantity. These higher tariff rates are often insurmountable, limiting import volumes.

Mexico manufacturers have the ability to import butterfat duty free to the U.S. under the North American Free Trade Agreement (NAFTA), however. In addition, Mexico may import anhydrous milkfat (AMF) from New Zealand duty free to use domestically and then export Mexican produced AMF to the U.S. under NAFTA terms. That dynamic appears to be playing out recently as an increase in Mexico butterfat imports from New Zealand have coincided with the increase in U.S. butterfat imports from Mexico. Over the past six months, the equivalent of 57% of Mexico butterfat imports from New Zealand went to the U.S. as butterfat trade flows between the countries reached record highs.

This exploitation of trade agreements has elevated domestic butterfat imports, contributing to volumes reaching 15 year seasonal highs. U.S. butter price premiums have declined over recent months, which may result in a decline in butterfat imports doing forward, however the U.S. will likely remain a net importer of butterfat until domestic prices approach parity with average international prices.

This exploitation of trade agreements has elevated domestic butterfat imports, contributing to volumes reaching 15 year seasonal highs. U.S. butter price premiums have declined over recent months, which may result in a decline in butterfat imports doing forward, however the U.S. will likely remain a net importer of butterfat until domestic prices approach parity with average international prices.