U.S. Livestock & Meat Trade Update – Jan ’17

Executive Summary

U.S. livestock and meat trade figures provided by USDA were recently updated with values spanning through Nov ’16. Highlights from the updated report include:

Beef & Veal – Net Trade Finishes Positive for the Second Consecutive Month

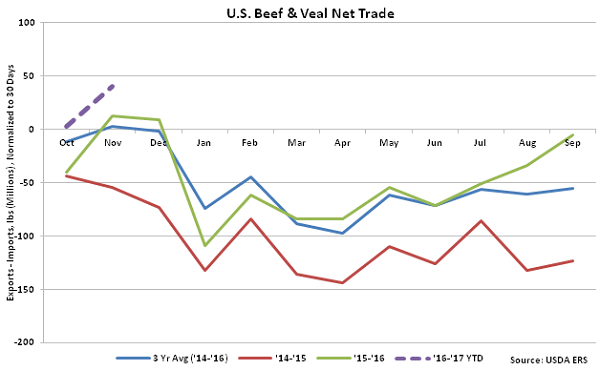

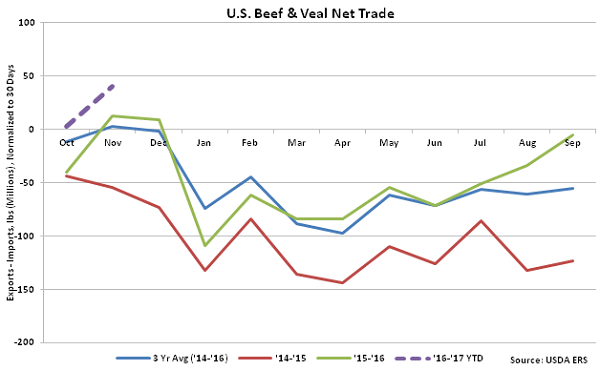

According to USDA, Nov ’16 U.S. beef & veal export volumes increased 14.2% MOM on a daily average basis to a new three year high while remaining higher on a YOY basis for the fifth consecutive month, finishing up 25.0%. Of the major export destinations, YOY increases in export volumes were widespread and led by shipments destined to Japan (+65.8%), followed by shipments destined to South Korea (+62.9%), Canada (+11.4%), Mexico (+8.8%) and combined shipments to Hong Kong, Taiwan and China (+0.1%). U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Nov ’16.

Nov ’16 U.S. beef & veal import volumes increased on a YOY basis for the first time in 14 months, finishing up 12.4%. Beef & veal export volumes continued to outpace import volumes throughout Nov ’16, however, resulting in net beef & veal trade finishing at a positive level for the second consecutive month. ’15-’16 annual beef & veal net trade finished negative for the third consecutive year despite export volumes increasing by 3.7% YOY and import volumes declining by 16.6% throughout the 12 month period.

Beef & Veal – Net Trade Finishes Positive for the Second Consecutive Month

According to USDA, Nov ’16 U.S. beef & veal export volumes increased 14.2% MOM on a daily average basis to a new three year high while remaining higher on a YOY basis for the fifth consecutive month, finishing up 25.0%. Of the major export destinations, YOY increases in export volumes were widespread and led by shipments destined to Japan (+65.8%), followed by shipments destined to South Korea (+62.9%), Canada (+11.4%), Mexico (+8.8%) and combined shipments to Hong Kong, Taiwan and China (+0.1%). U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Nov ’16.

Nov ’16 U.S. beef & veal import volumes increased on a YOY basis for the first time in 14 months, finishing up 12.4%. Beef & veal export volumes continued to outpace import volumes throughout Nov ’16, however, resulting in net beef & veal trade finishing at a positive level for the second consecutive month. ’15-’16 annual beef & veal net trade finished negative for the third consecutive year despite export volumes increasing by 3.7% YOY and import volumes declining by 16.6% throughout the 12 month period.

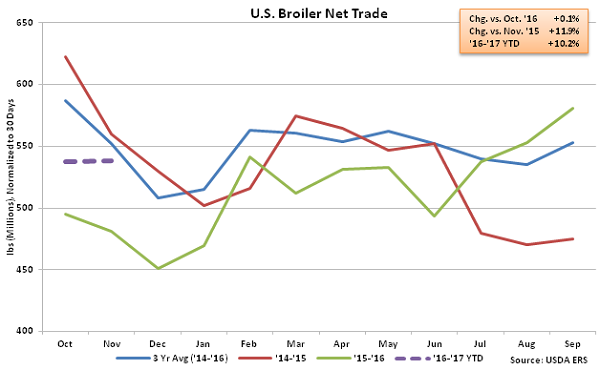

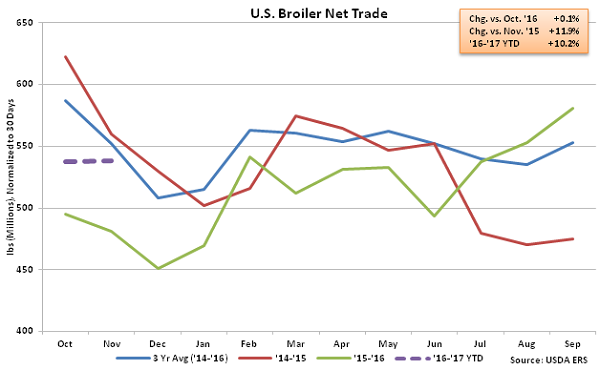

Chicken –Net Broiler Trade Increases on a YOY Basis for the Fifth Consecutive Month

Nov ’16 U.S. broiler export volumes increased 0.7% MOM on a daily average basis and 12.2% YOY, finishing higher on a YOY basis for the fifth consecutive month. Export volumes remained higher on a YOY basis despite declines experienced in volumes destined to Mexico (-2.5%), Canada (-10.4%) and combined shipments to Hong Kong, Taiwan and China (-6.8%). Broiler export volumes to all other destinations increased 23.7% throughout the month, led by product destined to Iraq.

U.S. broiler import volumes increased on a YOY basis for the first time in six months during Nov ’16, finishing up 25.4% to a new monthly record high. Broiler import volumes remain at insignificant levels relative to export volumes, however, as Nov ’16 imports amounted to just 2.5% of export volumes. The YOY increase in broiler export volumes more than offset the YOY gain in import volumes, resulting in U.S. broiler net trade finishing up 11.9% YOY during Nov ’16. Net broiler trade declined 3.3% throughout the ’15-’16 production season as export volumes fell 3.1% while import volumes increased 8.1%.

Chicken –Net Broiler Trade Increases on a YOY Basis for the Fifth Consecutive Month

Nov ’16 U.S. broiler export volumes increased 0.7% MOM on a daily average basis and 12.2% YOY, finishing higher on a YOY basis for the fifth consecutive month. Export volumes remained higher on a YOY basis despite declines experienced in volumes destined to Mexico (-2.5%), Canada (-10.4%) and combined shipments to Hong Kong, Taiwan and China (-6.8%). Broiler export volumes to all other destinations increased 23.7% throughout the month, led by product destined to Iraq.

U.S. broiler import volumes increased on a YOY basis for the first time in six months during Nov ’16, finishing up 25.4% to a new monthly record high. Broiler import volumes remain at insignificant levels relative to export volumes, however, as Nov ’16 imports amounted to just 2.5% of export volumes. The YOY increase in broiler export volumes more than offset the YOY gain in import volumes, resulting in U.S. broiler net trade finishing up 11.9% YOY during Nov ’16. Net broiler trade declined 3.3% throughout the ’15-’16 production season as export volumes fell 3.1% while import volumes increased 8.1%.

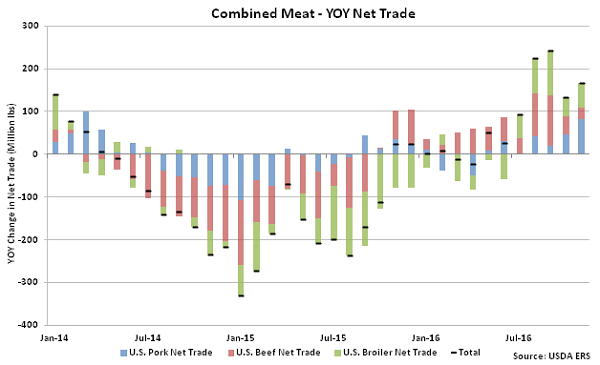

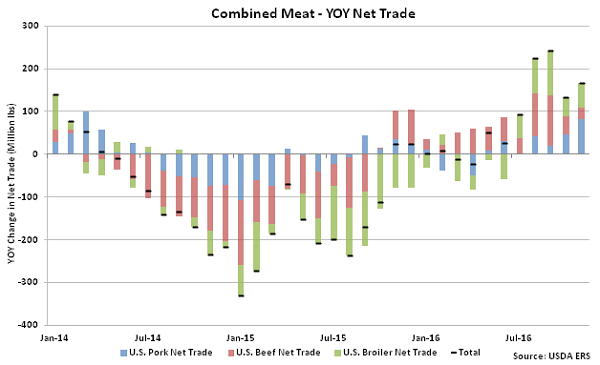

Combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the seventh consecutive month during Nov ’16. Combined net trade of pork, beef and broilers had declined over 18 consecutive months from May ’14 – Nov ’15 and finished down 21.5% YOY throughout the ’14-’15 production season prior to rebounding by 6.2% throughout the ’15-’16 production season.

Combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the seventh consecutive month during Nov ’16. Combined net trade of pork, beef and broilers had declined over 18 consecutive months from May ’14 – Nov ’15 and finished down 21.5% YOY throughout the ’14-’15 production season prior to rebounding by 6.2% throughout the ’15-’16 production season.

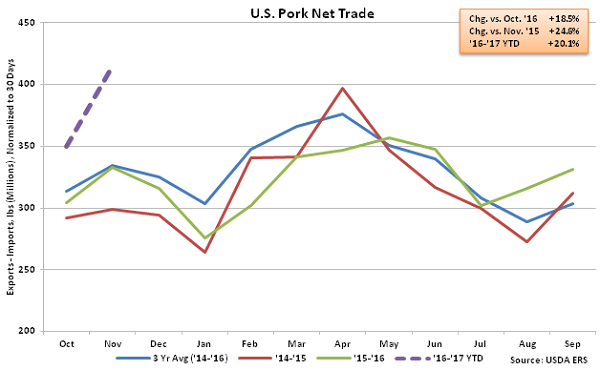

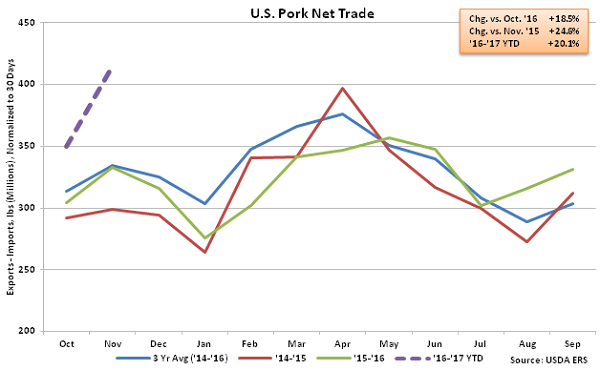

- Net pork trade increased on a YOY basis for the seventh consecutive month during Nov ’16, finishing up 24.6%, as export volumes reached a new monthly record high.

- Net beef & veal trade finished positive for the second consecutive month during Nov ’16 as export volumes reached a new three year high.

- Net broiler trade increased on a YOY basis for the fifth consecutive month during Nov ’16, finishing 11.9% above the previous year.

Beef & Veal – Net Trade Finishes Positive for the Second Consecutive Month

According to USDA, Nov ’16 U.S. beef & veal export volumes increased 14.2% MOM on a daily average basis to a new three year high while remaining higher on a YOY basis for the fifth consecutive month, finishing up 25.0%. Of the major export destinations, YOY increases in export volumes were widespread and led by shipments destined to Japan (+65.8%), followed by shipments destined to South Korea (+62.9%), Canada (+11.4%), Mexico (+8.8%) and combined shipments to Hong Kong, Taiwan and China (+0.1%). U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Nov ’16.

Nov ’16 U.S. beef & veal import volumes increased on a YOY basis for the first time in 14 months, finishing up 12.4%. Beef & veal export volumes continued to outpace import volumes throughout Nov ’16, however, resulting in net beef & veal trade finishing at a positive level for the second consecutive month. ’15-’16 annual beef & veal net trade finished negative for the third consecutive year despite export volumes increasing by 3.7% YOY and import volumes declining by 16.6% throughout the 12 month period.

Beef & Veal – Net Trade Finishes Positive for the Second Consecutive Month

According to USDA, Nov ’16 U.S. beef & veal export volumes increased 14.2% MOM on a daily average basis to a new three year high while remaining higher on a YOY basis for the fifth consecutive month, finishing up 25.0%. Of the major export destinations, YOY increases in export volumes were widespread and led by shipments destined to Japan (+65.8%), followed by shipments destined to South Korea (+62.9%), Canada (+11.4%), Mexico (+8.8%) and combined shipments to Hong Kong, Taiwan and China (+0.1%). U.S. beef & veal export volumes destined to the aforementioned countries accounted for over 85% of all beef & veal export volumes during Nov ’16.

Nov ’16 U.S. beef & veal import volumes increased on a YOY basis for the first time in 14 months, finishing up 12.4%. Beef & veal export volumes continued to outpace import volumes throughout Nov ’16, however, resulting in net beef & veal trade finishing at a positive level for the second consecutive month. ’15-’16 annual beef & veal net trade finished negative for the third consecutive year despite export volumes increasing by 3.7% YOY and import volumes declining by 16.6% throughout the 12 month period.

Chicken –Net Broiler Trade Increases on a YOY Basis for the Fifth Consecutive Month

Nov ’16 U.S. broiler export volumes increased 0.7% MOM on a daily average basis and 12.2% YOY, finishing higher on a YOY basis for the fifth consecutive month. Export volumes remained higher on a YOY basis despite declines experienced in volumes destined to Mexico (-2.5%), Canada (-10.4%) and combined shipments to Hong Kong, Taiwan and China (-6.8%). Broiler export volumes to all other destinations increased 23.7% throughout the month, led by product destined to Iraq.

U.S. broiler import volumes increased on a YOY basis for the first time in six months during Nov ’16, finishing up 25.4% to a new monthly record high. Broiler import volumes remain at insignificant levels relative to export volumes, however, as Nov ’16 imports amounted to just 2.5% of export volumes. The YOY increase in broiler export volumes more than offset the YOY gain in import volumes, resulting in U.S. broiler net trade finishing up 11.9% YOY during Nov ’16. Net broiler trade declined 3.3% throughout the ’15-’16 production season as export volumes fell 3.1% while import volumes increased 8.1%.

Chicken –Net Broiler Trade Increases on a YOY Basis for the Fifth Consecutive Month

Nov ’16 U.S. broiler export volumes increased 0.7% MOM on a daily average basis and 12.2% YOY, finishing higher on a YOY basis for the fifth consecutive month. Export volumes remained higher on a YOY basis despite declines experienced in volumes destined to Mexico (-2.5%), Canada (-10.4%) and combined shipments to Hong Kong, Taiwan and China (-6.8%). Broiler export volumes to all other destinations increased 23.7% throughout the month, led by product destined to Iraq.

U.S. broiler import volumes increased on a YOY basis for the first time in six months during Nov ’16, finishing up 25.4% to a new monthly record high. Broiler import volumes remain at insignificant levels relative to export volumes, however, as Nov ’16 imports amounted to just 2.5% of export volumes. The YOY increase in broiler export volumes more than offset the YOY gain in import volumes, resulting in U.S. broiler net trade finishing up 11.9% YOY during Nov ’16. Net broiler trade declined 3.3% throughout the ’15-’16 production season as export volumes fell 3.1% while import volumes increased 8.1%.

Combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the seventh consecutive month during Nov ’16. Combined net trade of pork, beef and broilers had declined over 18 consecutive months from May ’14 – Nov ’15 and finished down 21.5% YOY throughout the ’14-’15 production season prior to rebounding by 6.2% throughout the ’15-’16 production season.

Combined net trade of U.S. pork, beef and broilers increased on a YOY basis for the seventh consecutive month during Nov ’16. Combined net trade of pork, beef and broilers had declined over 18 consecutive months from May ’14 – Nov ’15 and finished down 21.5% YOY throughout the ’14-’15 production season prior to rebounding by 6.2% throughout the ’15-’16 production season.