New Zealand Milk Production Update – Nov ’19

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Oct ’19. Highlights from the updated report include:

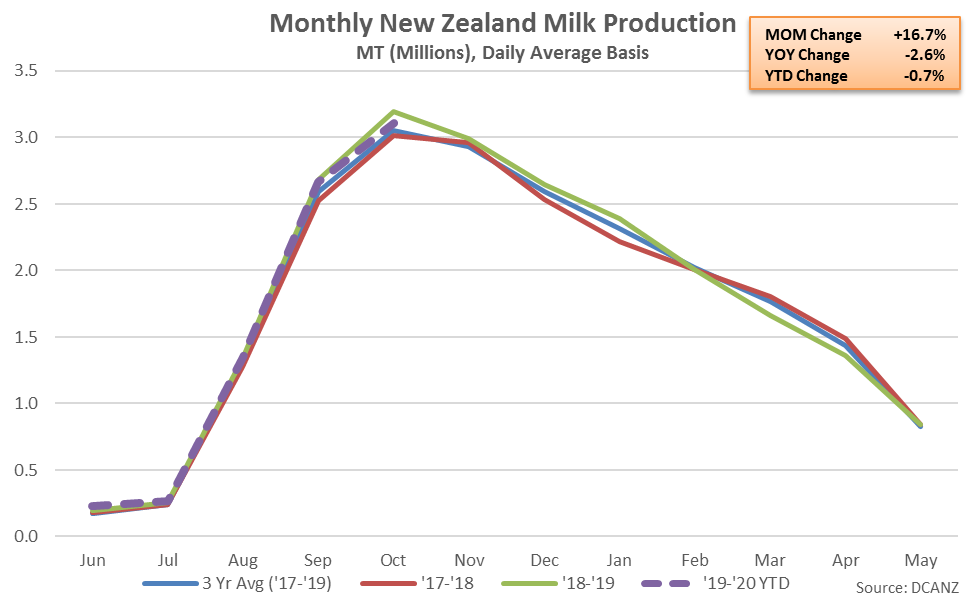

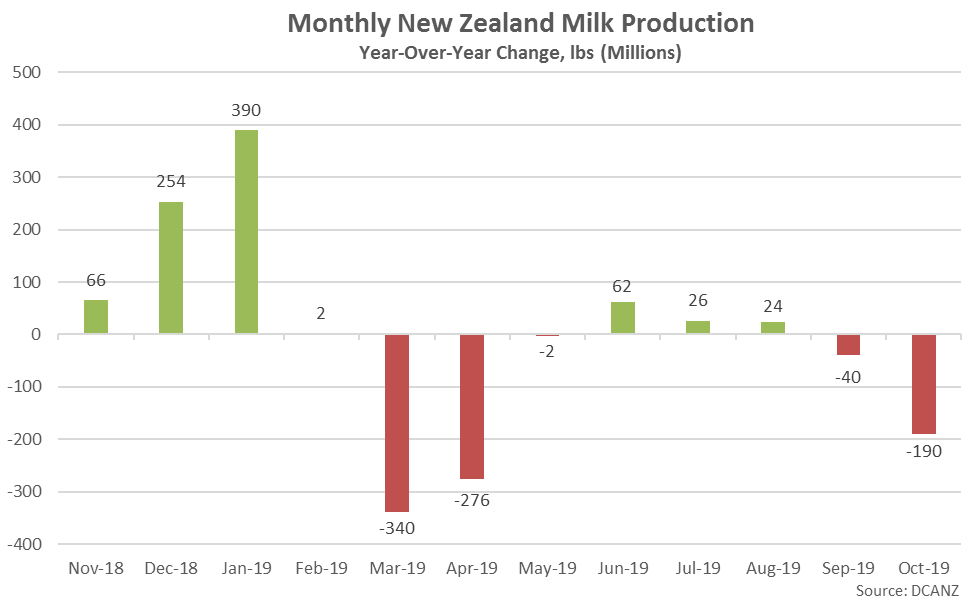

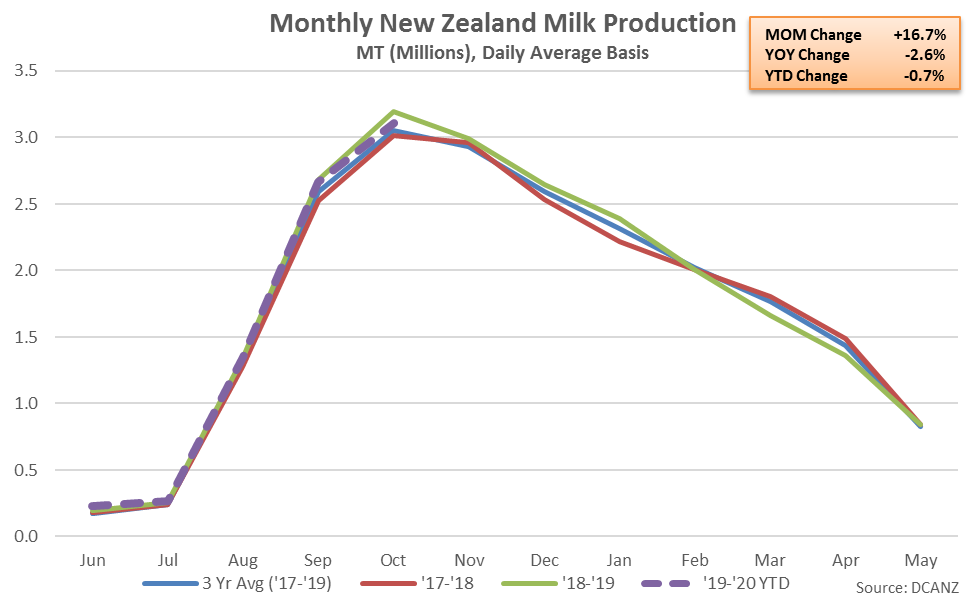

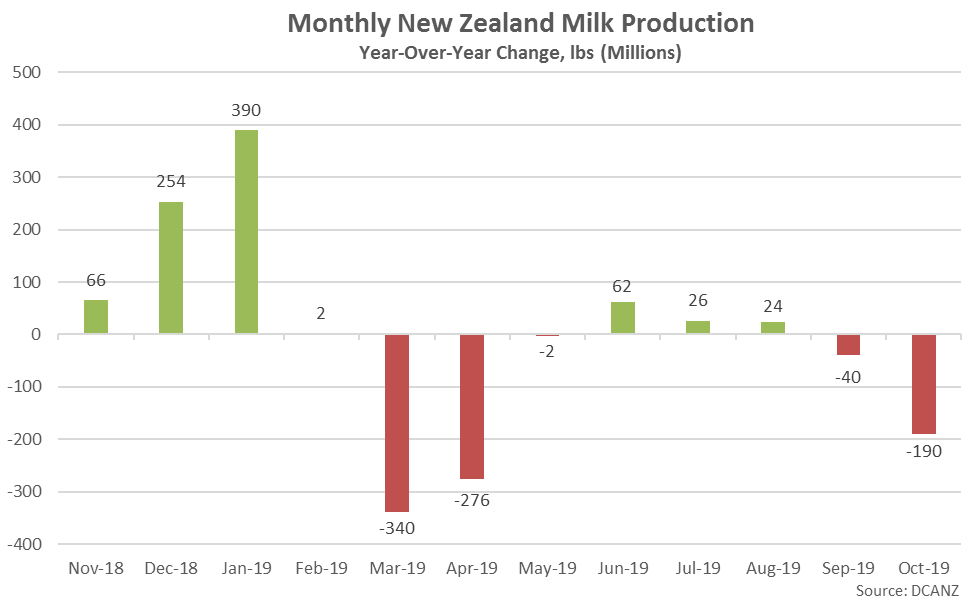

Mild winter weather conditions, coupled with growing popularity in winter milking, contributed to YOY increases in production growth experienced over the first quarter of the New Zealand milk production season. Heading into the New Zealand spring months, the expectation is for flat or reduced production figures, although spring weather can have a large influence on production prospects. The Oct ’19 YOY decline in New Zealand milk production volumes was the largest experienced throughout the past six months on an absolute basis. ’19-’20 YTD New Zealand milk production volumes have declined 0.7% on a YOY basis throughout the first five months of the production season.

Mild winter weather conditions, coupled with growing popularity in winter milking, contributed to YOY increases in production growth experienced over the first quarter of the New Zealand milk production season. Heading into the New Zealand spring months, the expectation is for flat or reduced production figures, although spring weather can have a large influence on production prospects. The Oct ’19 YOY decline in New Zealand milk production volumes was the largest experienced throughout the past six months on an absolute basis. ’19-’20 YTD New Zealand milk production volumes have declined 0.7% on a YOY basis throughout the first five months of the production season.

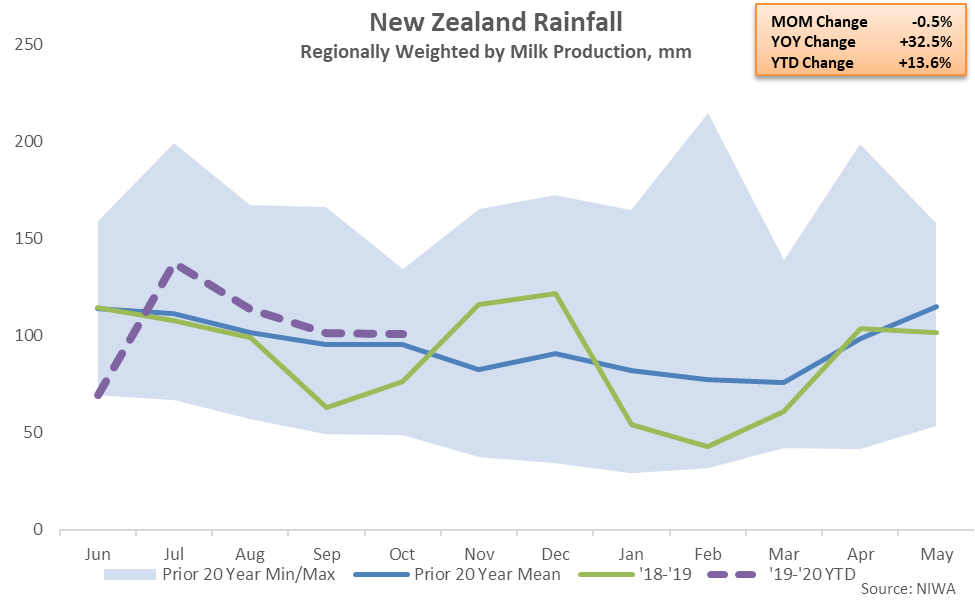

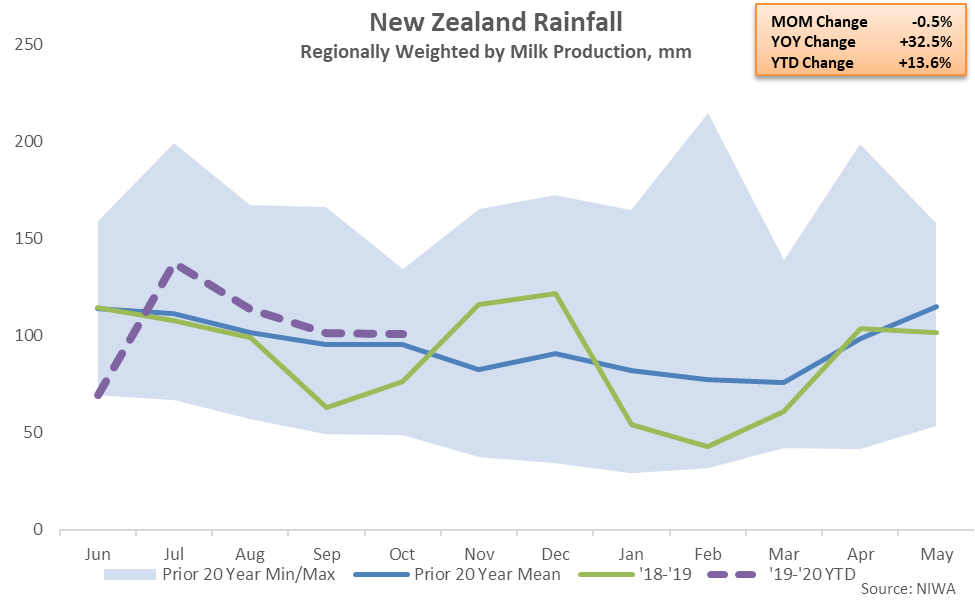

New Zealand rainfall levels reached a six year seasonal high level when regionally weighted by milk production during Oct ’19, finishing 5.5% above 20 year average seasonal levels.

New Zealand rainfall levels reached a six year seasonal high level when regionally weighted by milk production during Oct ’19, finishing 5.5% above 20 year average seasonal levels.

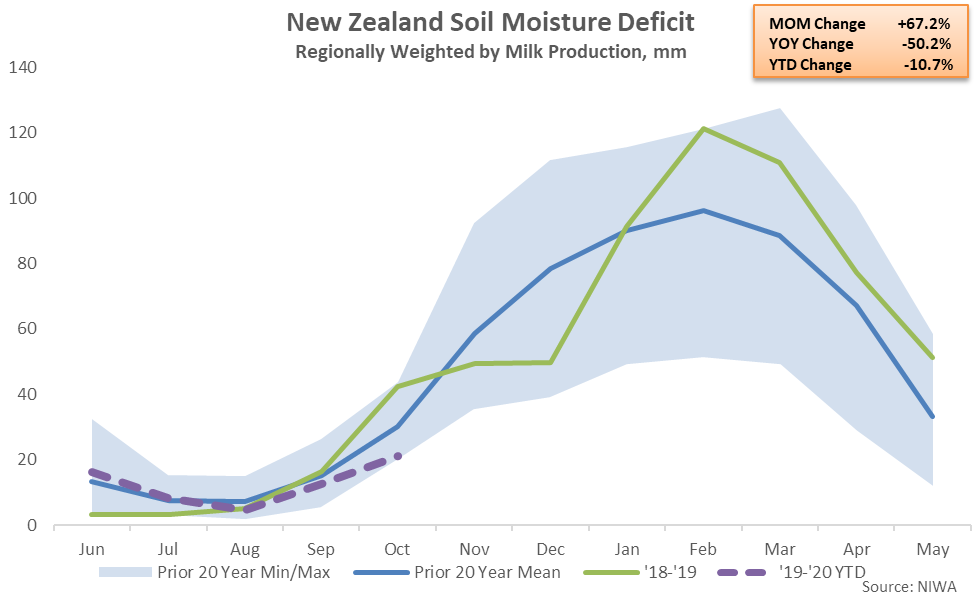

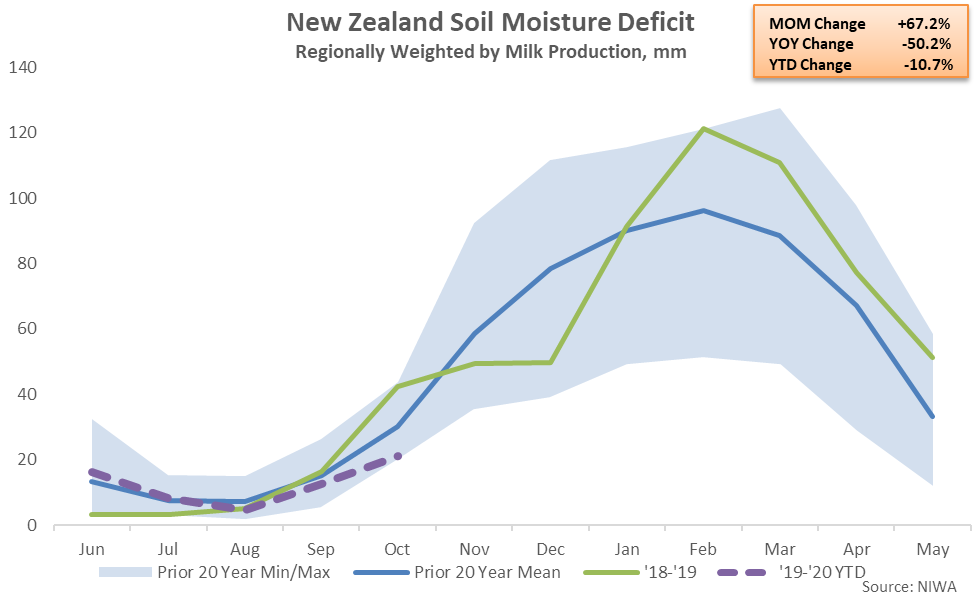

Above average rainfall levels have contributed to New Zealand soil moisture deficits remaining significantly below previous year figures. Oct ’19 New Zealand soil moisture deficits increased seasonally but remained at a ten year seasonal low level for the month of October when regionally weighted by milk production, finishing 30.3% below 20 year average seasonal levels.

Above average rainfall levels have contributed to New Zealand soil moisture deficits remaining significantly below previous year figures. Oct ’19 New Zealand soil moisture deficits increased seasonally but remained at a ten year seasonal low level for the month of October when regionally weighted by milk production, finishing 30.3% below 20 year average seasonal levels.

Farmgate Milk Prices

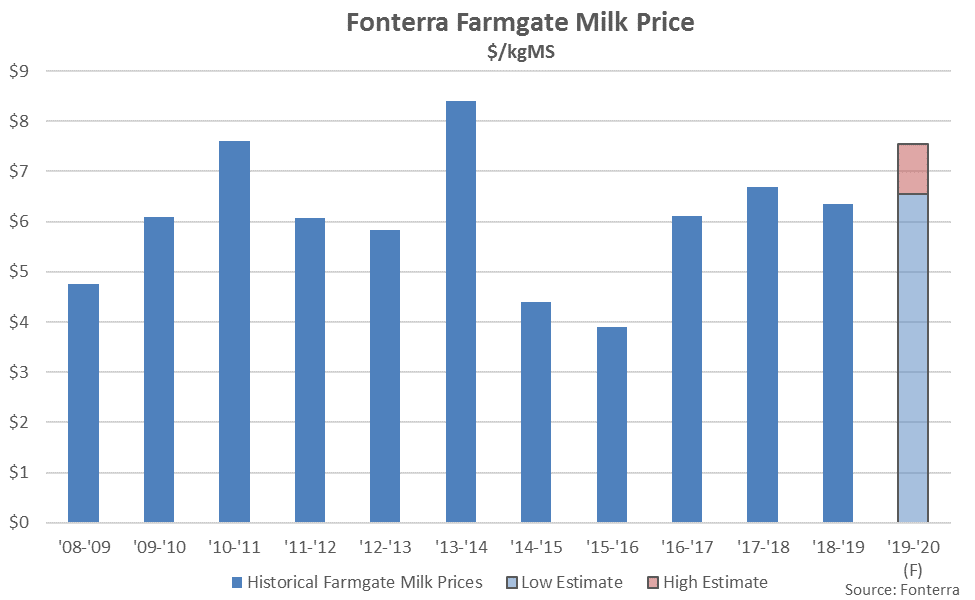

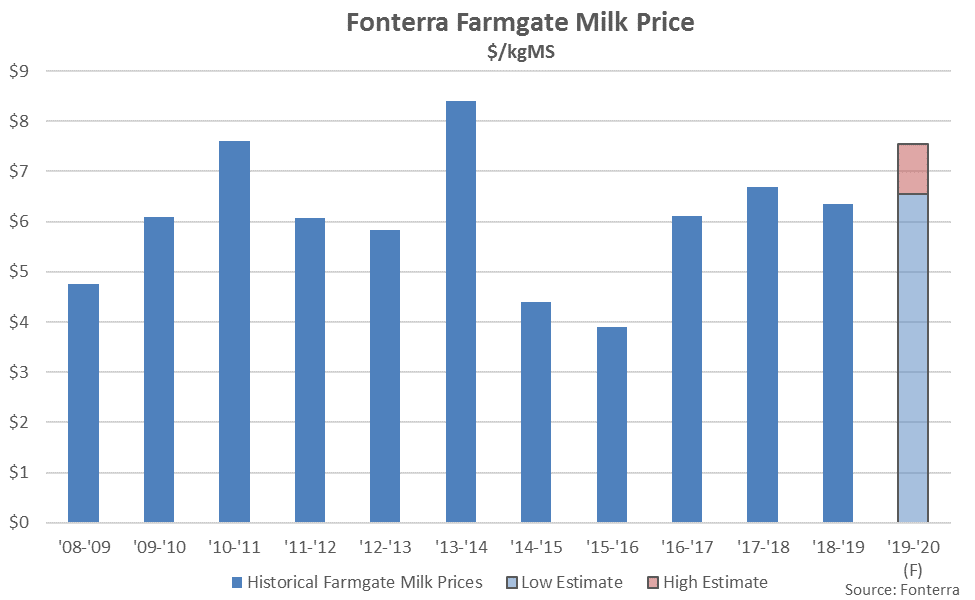

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels. Fonterra’s ’19-’20 farmgate milk price forecast of $6.55-$7.55/kgMS was raised by $0.30/kgMS in Oct ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted firm global demand for whole milk powder but kept a wide price range due to geopolitical uncertainty and the risk of weather developments later in the New Zealand production season.

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels. Fonterra’s ’19-’20 farmgate milk price forecast of $6.55-$7.55/kgMS was raised by $0.30/kgMS in Oct ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted firm global demand for whole milk powder but kept a wide price range due to geopolitical uncertainty and the risk of weather developments later in the New Zealand production season.

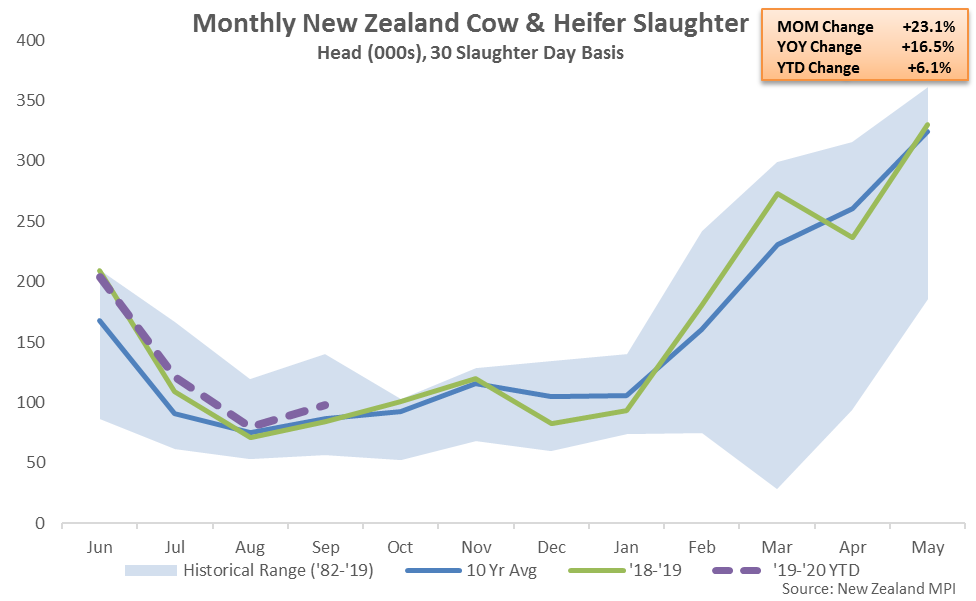

Cow & Heifer Slaughter

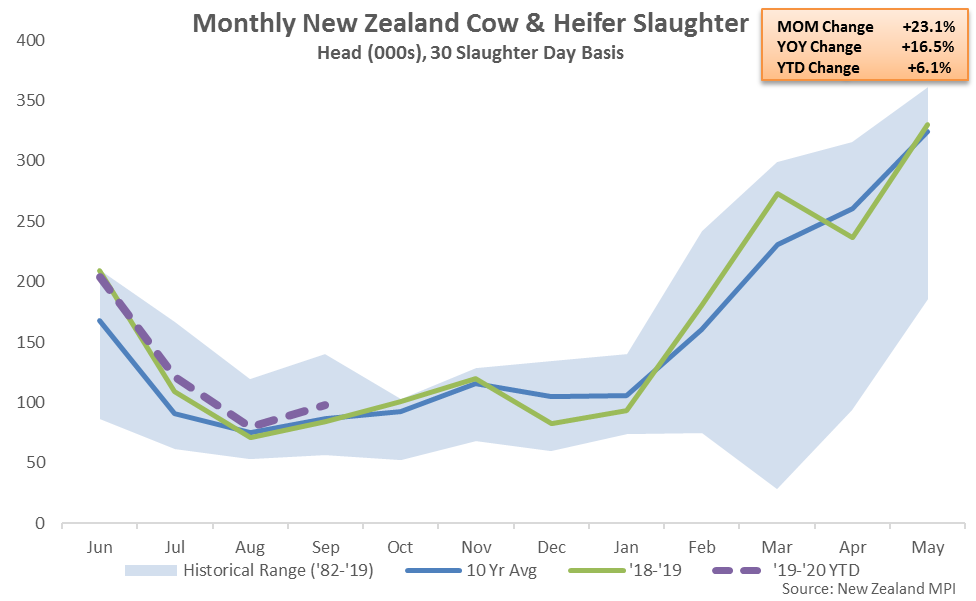

Sep ‘19 New Zealand cow & heifer slaughter rates finished 16.5% higher YOY when normalizing for slaughter days, increasing on a YOY basis for the third consecutive month. Sep ‘19 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the third consecutive month, finishing up 17.1%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 6.1% throughout the first third of the production season.

Cow & Heifer Slaughter

Sep ‘19 New Zealand cow & heifer slaughter rates finished 16.5% higher YOY when normalizing for slaughter days, increasing on a YOY basis for the third consecutive month. Sep ‘19 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the third consecutive month, finishing up 17.1%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 6.1% throughout the first third of the production season.

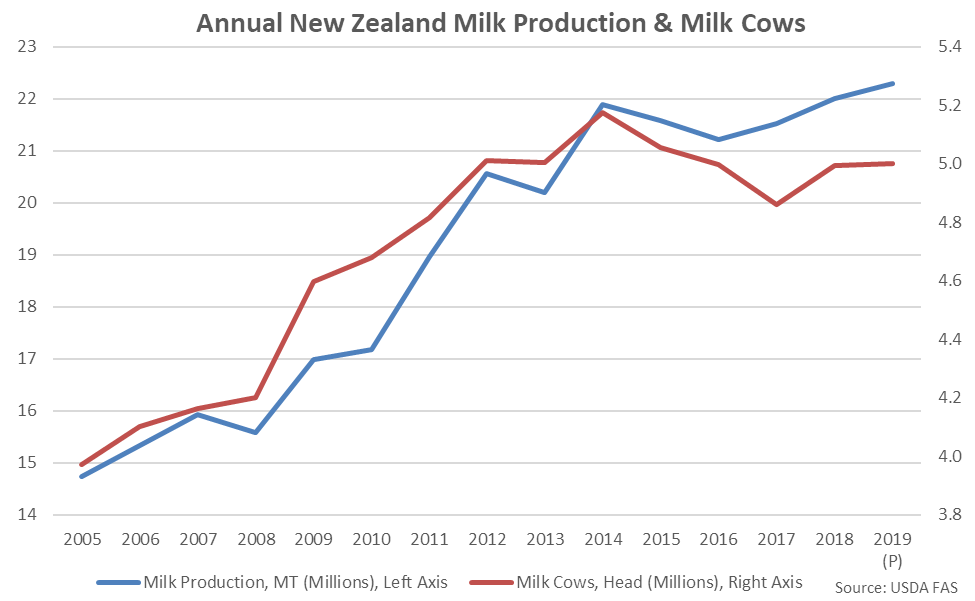

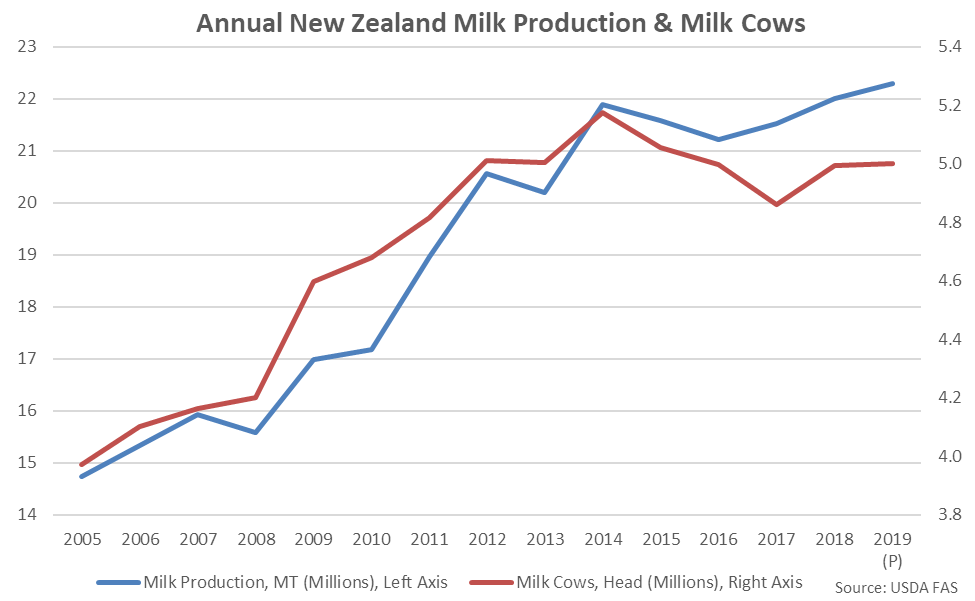

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will rebound slightly on a YOY basis throughout 2019, however, increasing 0.1% to a four year high level.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will rebound slightly on a YOY basis throughout 2019, however, increasing 0.1% to a four year high level.

- Oct ’19 New Zealand milk production volumes increased seasonally to a 12 month high level but remained lower on a YOY basis for the second consecutive month, finishing down 2.6%. Production on a milk-solids basis declined 1.5% YOY, finishing lower for the first time in the past five months.

- Fonterra’s ’19-’20 farmgate milk price forecast of $6.55-$7.55/kgMS was raised by $0.30/kgMS in Oct ’19 and is on pace to reach a six year high at the midpoint of the forecast.

- Sep ’19 New Zealand cow & heifer slaughter rates increased 16.5% YOY when normalizing for slaughter days, finishing higher on a YOY basis for the third consecutive month.

Mild winter weather conditions, coupled with growing popularity in winter milking, contributed to YOY increases in production growth experienced over the first quarter of the New Zealand milk production season. Heading into the New Zealand spring months, the expectation is for flat or reduced production figures, although spring weather can have a large influence on production prospects. The Oct ’19 YOY decline in New Zealand milk production volumes was the largest experienced throughout the past six months on an absolute basis. ’19-’20 YTD New Zealand milk production volumes have declined 0.7% on a YOY basis throughout the first five months of the production season.

Mild winter weather conditions, coupled with growing popularity in winter milking, contributed to YOY increases in production growth experienced over the first quarter of the New Zealand milk production season. Heading into the New Zealand spring months, the expectation is for flat or reduced production figures, although spring weather can have a large influence on production prospects. The Oct ’19 YOY decline in New Zealand milk production volumes was the largest experienced throughout the past six months on an absolute basis. ’19-’20 YTD New Zealand milk production volumes have declined 0.7% on a YOY basis throughout the first five months of the production season.

New Zealand rainfall levels reached a six year seasonal high level when regionally weighted by milk production during Oct ’19, finishing 5.5% above 20 year average seasonal levels.

New Zealand rainfall levels reached a six year seasonal high level when regionally weighted by milk production during Oct ’19, finishing 5.5% above 20 year average seasonal levels.

Above average rainfall levels have contributed to New Zealand soil moisture deficits remaining significantly below previous year figures. Oct ’19 New Zealand soil moisture deficits increased seasonally but remained at a ten year seasonal low level for the month of October when regionally weighted by milk production, finishing 30.3% below 20 year average seasonal levels.

Above average rainfall levels have contributed to New Zealand soil moisture deficits remaining significantly below previous year figures. Oct ’19 New Zealand soil moisture deficits increased seasonally but remained at a ten year seasonal low level for the month of October when regionally weighted by milk production, finishing 30.3% below 20 year average seasonal levels.

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels. Fonterra’s ’19-’20 farmgate milk price forecast of $6.55-$7.55/kgMS was raised by $0.30/kgMS in Oct ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted firm global demand for whole milk powder but kept a wide price range due to geopolitical uncertainty and the risk of weather developments later in the New Zealand production season.

Farmgate Milk Prices

Fonterra farmgate milk prices reached a nine year low during the ’15-’16 production season as concerns over a potential El Niño event mounted while global milk supplies expanded significantly, particularly from within the EU-28. Fonterra farmgate milk prices rebounded throughout the ’16-’17 and ’17-’18 production seasons as a gradual rebalancing of global supply and demand took place, while Fonterra’s ’18-’19 final farmgate milk price forecast of $6.35/kgMS declined 5.1% from the previous production season but remained above break-even levels. Fonterra’s ’19-’20 farmgate milk price forecast of $6.55-$7.55/kgMS was raised by $0.30/kgMS in Oct ’19 and is on pace to reach a six year high at the midpoint of the forecast. Fonterra noted firm global demand for whole milk powder but kept a wide price range due to geopolitical uncertainty and the risk of weather developments later in the New Zealand production season.

Cow & Heifer Slaughter

Sep ‘19 New Zealand cow & heifer slaughter rates finished 16.5% higher YOY when normalizing for slaughter days, increasing on a YOY basis for the third consecutive month. Sep ‘19 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the third consecutive month, finishing up 17.1%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 6.1% throughout the first third of the production season.

Cow & Heifer Slaughter

Sep ‘19 New Zealand cow & heifer slaughter rates finished 16.5% higher YOY when normalizing for slaughter days, increasing on a YOY basis for the third consecutive month. Sep ‘19 dairy cow & heifer slaughter, which has more limited historical data available, also increased on a YOY basis for the third consecutive month, finishing up 17.1%.

’18-’19 annual New Zealand cow & heifer slaughter rates declined 0.7% YOY while finishing 2.3% below three year average figures, however ’19-’20 YTD slaughter figures have rebounded by 6.1% throughout the first third of the production season.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will rebound slightly on a YOY basis throughout 2019, however, increasing 0.1% to a four year high level.

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the four most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will rebound slightly on a YOY basis throughout 2019, however, increasing 0.1% to a four year high level.