U.S. Dairy Product Production Update – Dec ’19

Executive Summary

U.S. dairy product production figures provided by USDA were recently updated with values spanning through Oct ’19. Highlights from the updated report include:

Cheese – Production Declines YOY for the First Time in Eight Months, Finishes Down 2.1%

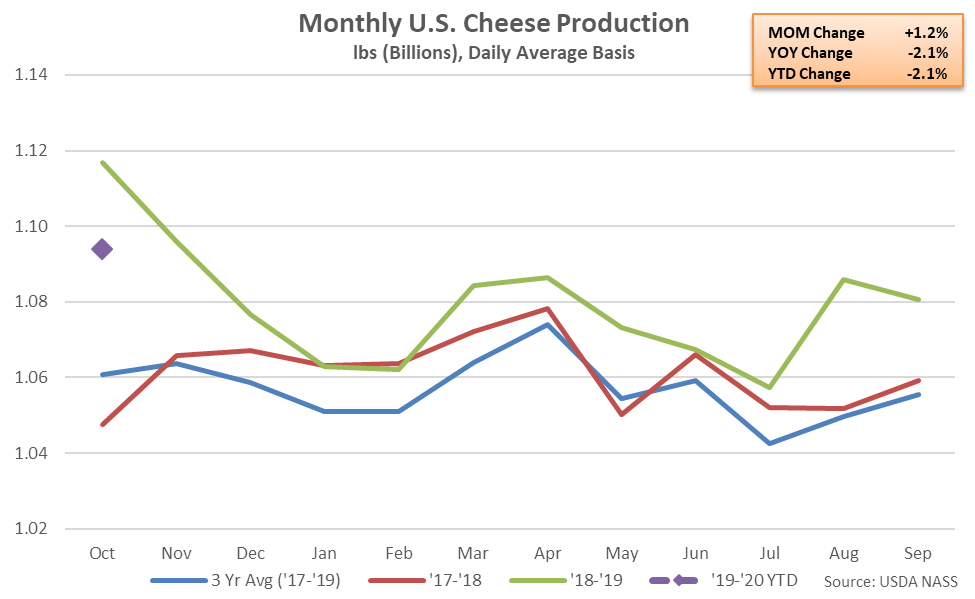

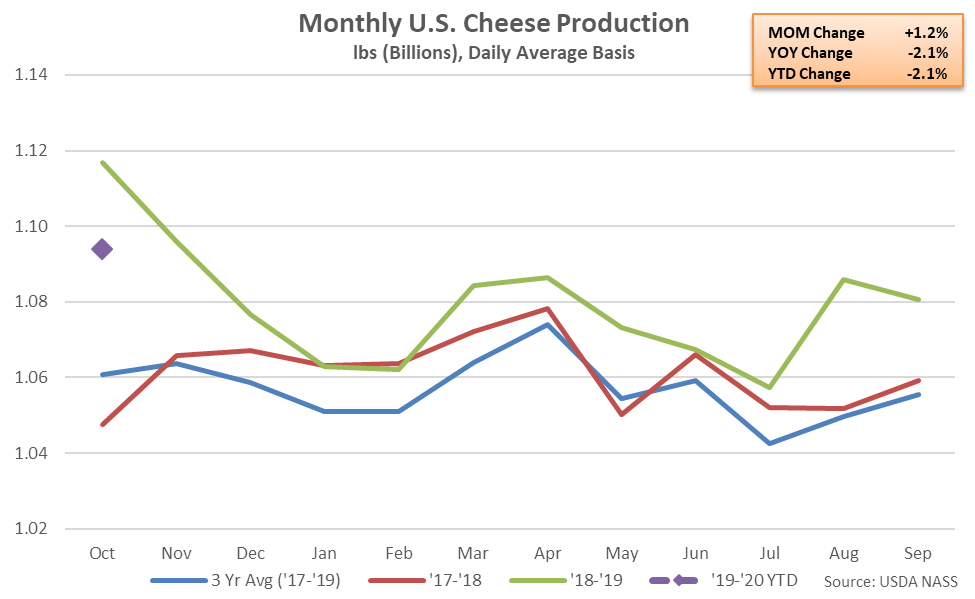

Oct ’19 total U.S. cheese production declined 2.1% YOY, finishing lower on a YOY basis for the first time in the past eight months. YOY declines in cheese production were widespread regionally and led by the Central U.S. (-3.4%), followed by the Atlantic U.S. (-1.5%) and the Western U.S. (-0.7%). Other-than-cheddar cheese production declined 1.2% on a YOY basis throughout the month while cheddar cheese production finished 4.2% lower. Despite declining on a YOY basis, Oct ’19 cheese production remained at the second highest seasonal level on record, finishing 3.1% above three year average seasonal figures.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however.

Cheese – Production Declines YOY for the First Time in Eight Months, Finishes Down 2.1%

Oct ’19 total U.S. cheese production declined 2.1% YOY, finishing lower on a YOY basis for the first time in the past eight months. YOY declines in cheese production were widespread regionally and led by the Central U.S. (-3.4%), followed by the Atlantic U.S. (-1.5%) and the Western U.S. (-0.7%). Other-than-cheddar cheese production declined 1.2% on a YOY basis throughout the month while cheddar cheese production finished 4.2% lower. Despite declining on a YOY basis, Oct ’19 cheese production remained at the second highest seasonal level on record, finishing 3.1% above three year average seasonal figures.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however.

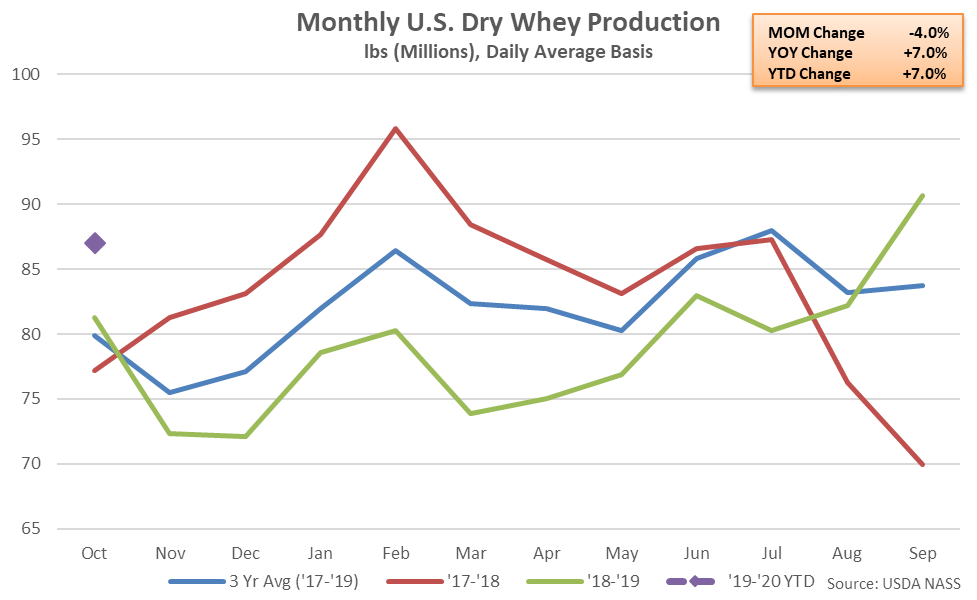

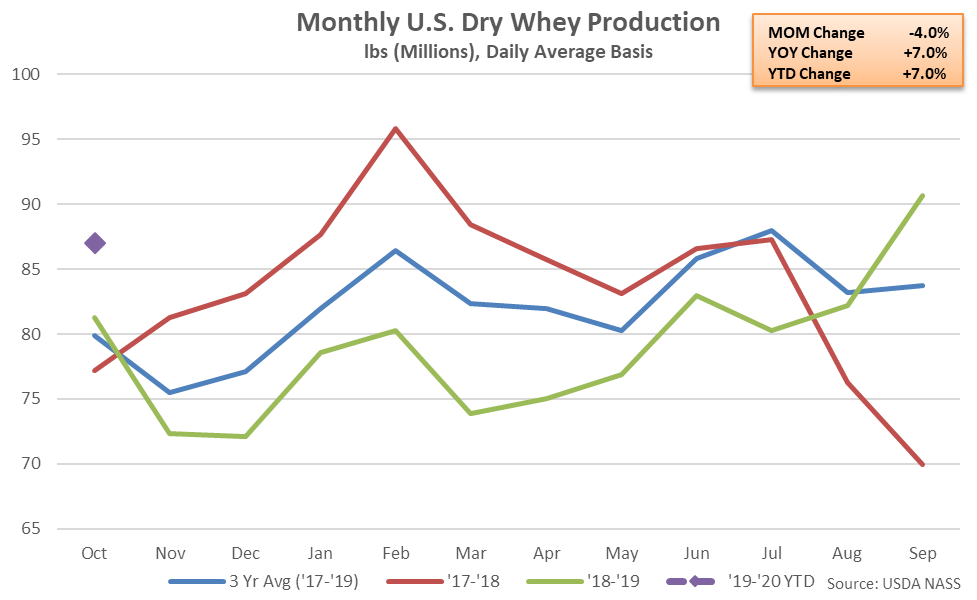

Dry Whey – Production Increases 7.0% YOY, Finishes at a 17 Year Seasonal High Level

Oct ’19 U.S. dry whey production increased 7.0% YOY, finishing higher on a YOY basis for the third consecutive month and reaching a 17 year seasonal high level. Oct ’19 YOY increases in dry whey production were widespread regionally and led by the Central U.S. (+12.5%), followed by the Western U.S. (+8.2%) and the Atlantic U.S. (+0.8%).

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the ninth consecutive month during Oct ’19, however, finishing down 6.3%. The YOY increase in dry whey production more than offset the YOY declines in WPC and WPI production experienced throughout Oct ’19, resulting in combined production increasing by 1.8%.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low.

Dry Whey – Production Increases 7.0% YOY, Finishes at a 17 Year Seasonal High Level

Oct ’19 U.S. dry whey production increased 7.0% YOY, finishing higher on a YOY basis for the third consecutive month and reaching a 17 year seasonal high level. Oct ’19 YOY increases in dry whey production were widespread regionally and led by the Central U.S. (+12.5%), followed by the Western U.S. (+8.2%) and the Atlantic U.S. (+0.8%).

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the ninth consecutive month during Oct ’19, however, finishing down 6.3%. The YOY increase in dry whey production more than offset the YOY declines in WPC and WPI production experienced throughout Oct ’19, resulting in combined production increasing by 1.8%.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low.

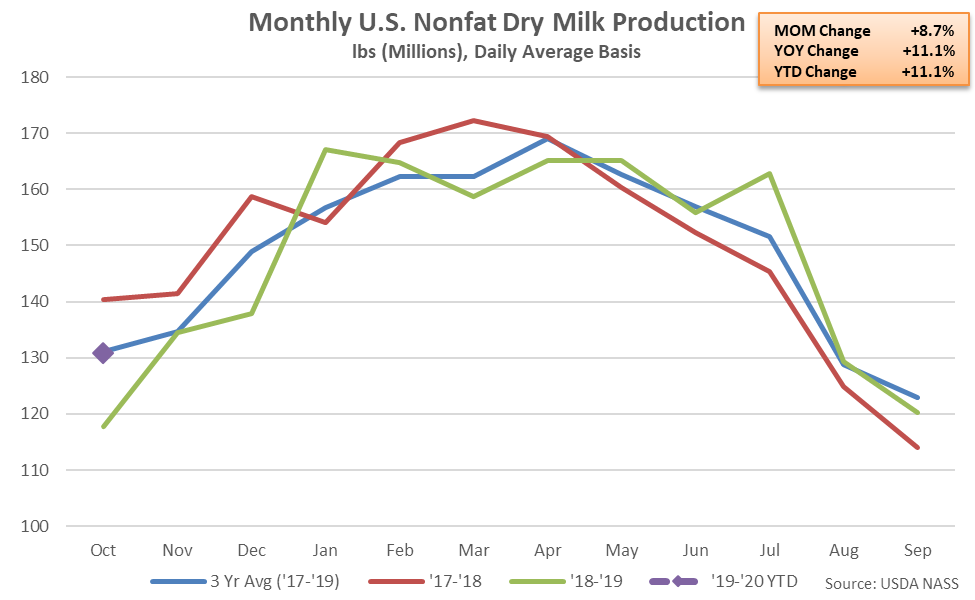

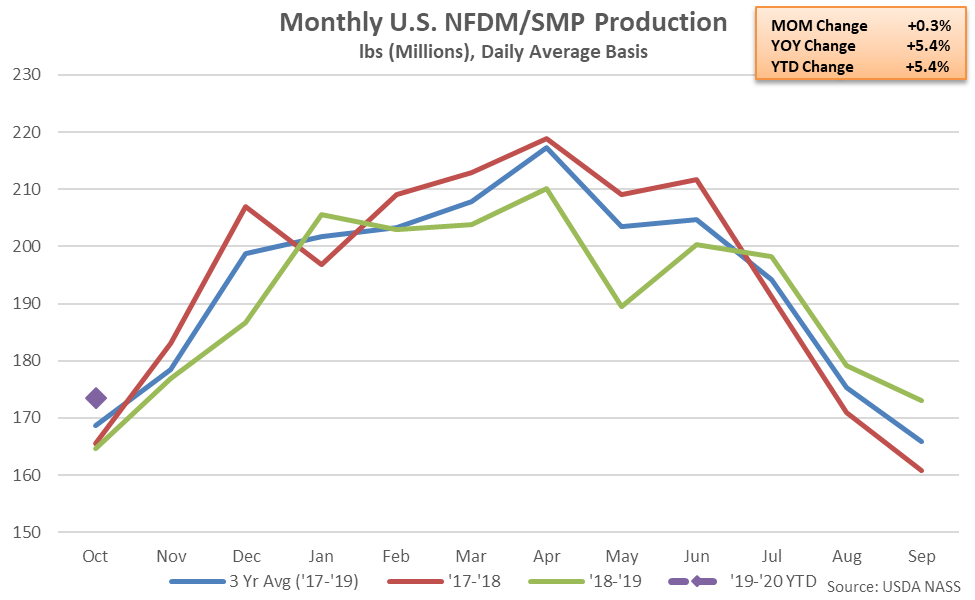

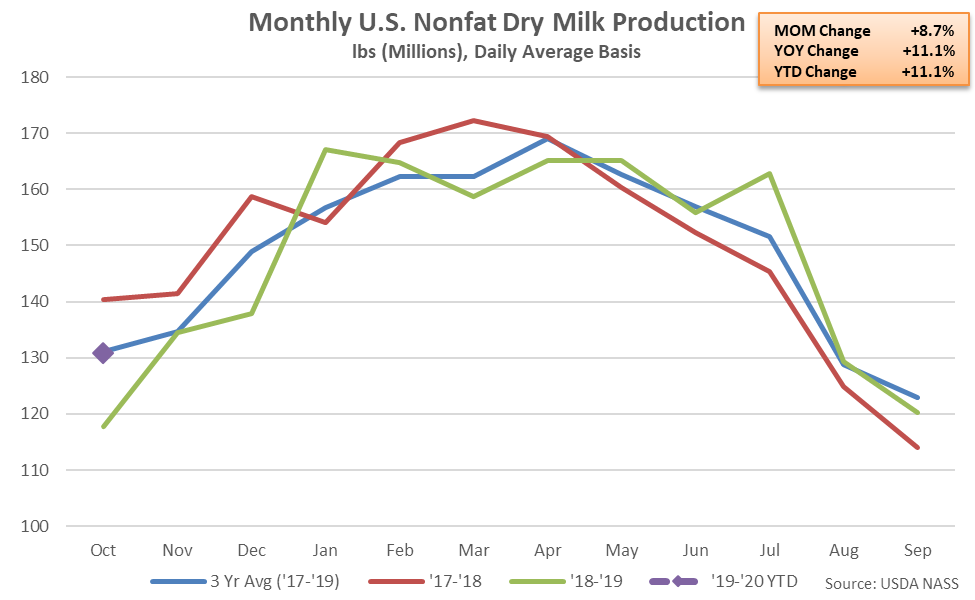

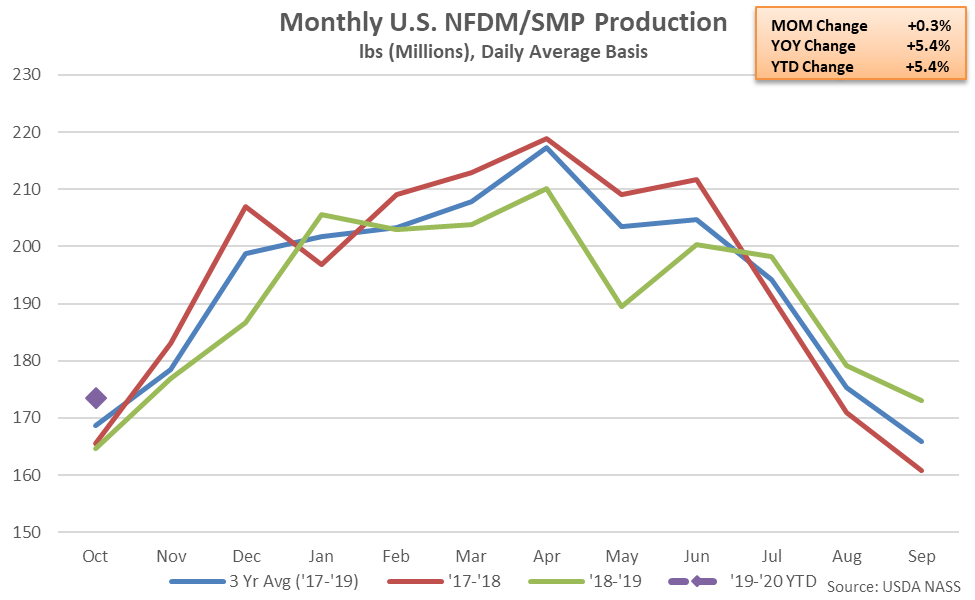

NFDM/SMP – Combined Production Higher YOY for the Fourth Consecutive Month, Finishes up 5.4%

Oct ’19 U.S. nonfat dry milk (NFDM) production remained higher on a YOY basis for the sixth consecutive month, finishing up 11.1%. Oct ’19 YOY increases in NFDM production were widespread regionally and led by the Atlantic U.S. (+28.0%), followed by the Central U.S. (+17.6%) and the Western U.S. (+4.8%). Despite increasing on a YOY basis, Oct ’19 NFDM production volumes remained 0.3% below three year average seasonal levels.

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished lower on a YOY basis for the first time in the past three months during Oct ’19, declining by 9.0%. The YOY increase in NFDM production more than offset the decline in SMP production, resulting in Oct ’19 combined production of NFDM and SMP increasing 5.4% on a YOY basis, finishing higher for fourth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. ’18-’19 annual production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period.

NFDM/SMP – Combined Production Higher YOY for the Fourth Consecutive Month, Finishes up 5.4%

Oct ’19 U.S. nonfat dry milk (NFDM) production remained higher on a YOY basis for the sixth consecutive month, finishing up 11.1%. Oct ’19 YOY increases in NFDM production were widespread regionally and led by the Atlantic U.S. (+28.0%), followed by the Central U.S. (+17.6%) and the Western U.S. (+4.8%). Despite increasing on a YOY basis, Oct ’19 NFDM production volumes remained 0.3% below three year average seasonal levels.

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished lower on a YOY basis for the first time in the past three months during Oct ’19, declining by 9.0%. The YOY increase in NFDM production more than offset the decline in SMP production, resulting in Oct ’19 combined production of NFDM and SMP increasing 5.4% on a YOY basis, finishing higher for fourth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. ’18-’19 annual production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period.

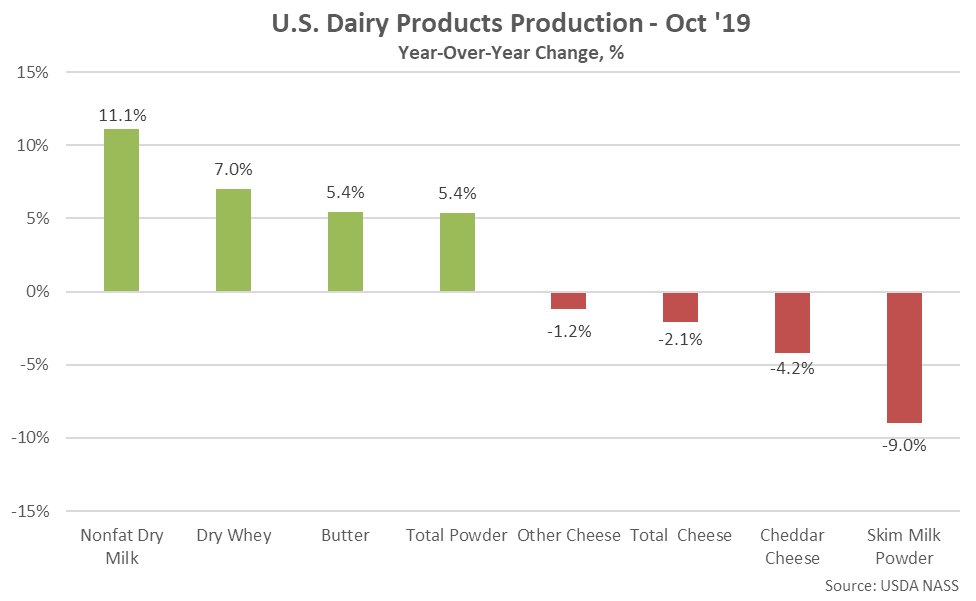

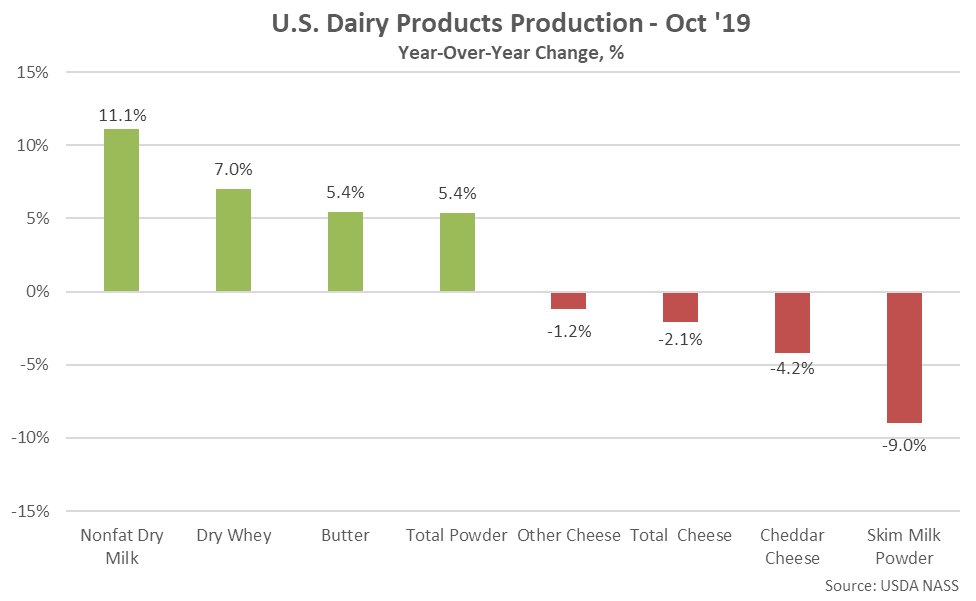

Overall, nonfat dry milk production increased most significantly YOY on a percentage basis during Oct ’19, followed by dry whey production, while skim milk powder production declined most significantly on a percentage basis throughout the month.

Overall, nonfat dry milk production increased most significantly YOY on a percentage basis during Oct ’19, followed by dry whey production, while skim milk powder production declined most significantly on a percentage basis throughout the month.

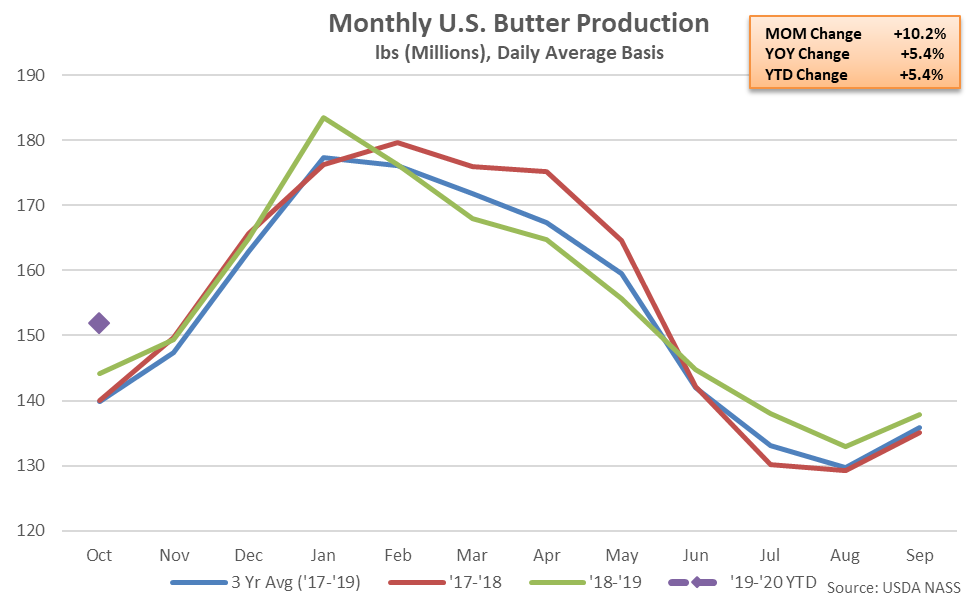

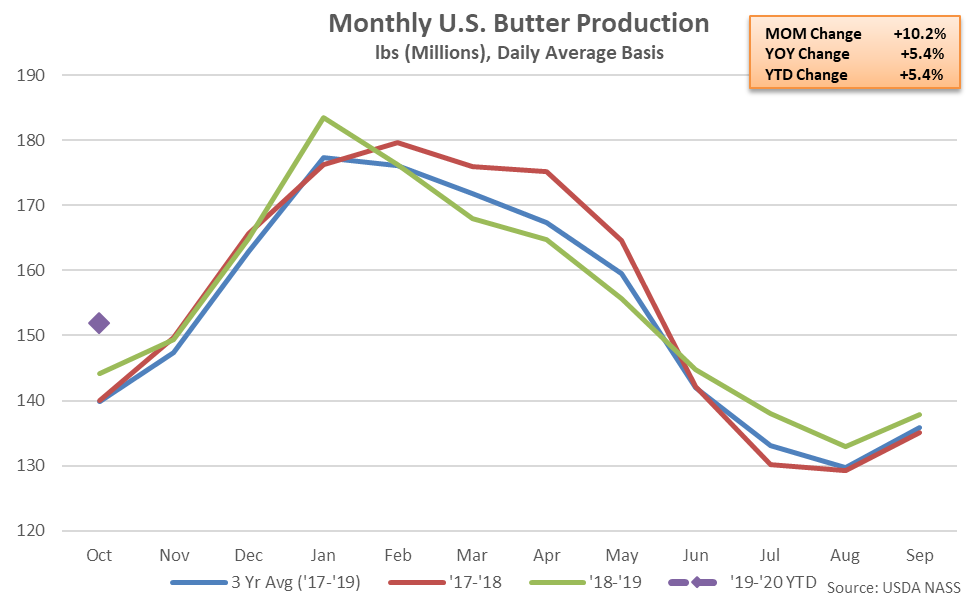

- Oct ’19 U.S. butter production increased on a YOY basis for the fifth consecutive month, finishing up 5.4% and reaching a record high seasonal level.

- Oct ’19 U.S. cheese production declined on a YOY basis for the first time in the past eight months, finishing down 2.1%, however U.S. dry whey production remained higher on a YOY basis for the third consecutive month, increasing 7.0% and reaching a 17 year high seasonal level.

- Oct ’19 combined production of U.S. nonfat dry milk and skim milk powder increased 5.4% on a YOY basis, finishing higher for the fourth consecutive month. Nonfat dry milk production increased 11.1% YOY throughout the month, more than offsetting a 9.0% YOY decline in skim milk powder production.

Cheese – Production Declines YOY for the First Time in Eight Months, Finishes Down 2.1%

Oct ’19 total U.S. cheese production declined 2.1% YOY, finishing lower on a YOY basis for the first time in the past eight months. YOY declines in cheese production were widespread regionally and led by the Central U.S. (-3.4%), followed by the Atlantic U.S. (-1.5%) and the Western U.S. (-0.7%). Other-than-cheddar cheese production declined 1.2% on a YOY basis throughout the month while cheddar cheese production finished 4.2% lower. Despite declining on a YOY basis, Oct ’19 cheese production remained at the second highest seasonal level on record, finishing 3.1% above three year average seasonal figures.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however.

Cheese – Production Declines YOY for the First Time in Eight Months, Finishes Down 2.1%

Oct ’19 total U.S. cheese production declined 2.1% YOY, finishing lower on a YOY basis for the first time in the past eight months. YOY declines in cheese production were widespread regionally and led by the Central U.S. (-3.4%), followed by the Atlantic U.S. (-1.5%) and the Western U.S. (-0.7%). Other-than-cheddar cheese production declined 1.2% on a YOY basis throughout the month while cheddar cheese production finished 4.2% lower. Despite declining on a YOY basis, Oct ’19 cheese production remained at the second highest seasonal level on record, finishing 3.1% above three year average seasonal figures.

’18-’19 annual cheese production increased 1.7% YOY to a record annual high as a 2.8% YOY increase in other-than-cheddar cheese more than offset a 1.1% YOY decline in cheddar cheese production. Cheddar cheese production remained at the second highest annual level on record, however.

Dry Whey – Production Increases 7.0% YOY, Finishes at a 17 Year Seasonal High Level

Oct ’19 U.S. dry whey production increased 7.0% YOY, finishing higher on a YOY basis for the third consecutive month and reaching a 17 year seasonal high level. Oct ’19 YOY increases in dry whey production were widespread regionally and led by the Central U.S. (+12.5%), followed by the Western U.S. (+8.2%) and the Atlantic U.S. (+0.8%).

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the ninth consecutive month during Oct ’19, however, finishing down 6.3%. The YOY increase in dry whey production more than offset the YOY declines in WPC and WPI production experienced throughout Oct ’19, resulting in combined production increasing by 1.8%.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low.

Dry Whey – Production Increases 7.0% YOY, Finishes at a 17 Year Seasonal High Level

Oct ’19 U.S. dry whey production increased 7.0% YOY, finishing higher on a YOY basis for the third consecutive month and reaching a 17 year seasonal high level. Oct ’19 YOY increases in dry whey production were widespread regionally and led by the Central U.S. (+12.5%), followed by the Western U.S. (+8.2%) and the Atlantic U.S. (+0.8%).

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production remained lower on a YOY basis for the ninth consecutive month during Oct ’19, however, finishing down 6.3%. The YOY increase in dry whey production more than offset the YOY declines in WPC and WPI production experienced throughout Oct ’19, resulting in combined production increasing by 1.8%.

’18-’19 annual dry whey production declined 5.6% YOY, reaching a four year low level, while combined production of dry whey, WPC and WPI declined 4.5%, finishing at a three year low.

NFDM/SMP – Combined Production Higher YOY for the Fourth Consecutive Month, Finishes up 5.4%

Oct ’19 U.S. nonfat dry milk (NFDM) production remained higher on a YOY basis for the sixth consecutive month, finishing up 11.1%. Oct ’19 YOY increases in NFDM production were widespread regionally and led by the Atlantic U.S. (+28.0%), followed by the Central U.S. (+17.6%) and the Western U.S. (+4.8%). Despite increasing on a YOY basis, Oct ’19 NFDM production volumes remained 0.3% below three year average seasonal levels.

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished lower on a YOY basis for the first time in the past three months during Oct ’19, declining by 9.0%. The YOY increase in NFDM production more than offset the decline in SMP production, resulting in Oct ’19 combined production of NFDM and SMP increasing 5.4% on a YOY basis, finishing higher for fourth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. ’18-’19 annual production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period.

NFDM/SMP – Combined Production Higher YOY for the Fourth Consecutive Month, Finishes up 5.4%

Oct ’19 U.S. nonfat dry milk (NFDM) production remained higher on a YOY basis for the sixth consecutive month, finishing up 11.1%. Oct ’19 YOY increases in NFDM production were widespread regionally and led by the Atlantic U.S. (+28.0%), followed by the Central U.S. (+17.6%) and the Western U.S. (+4.8%). Despite increasing on a YOY basis, Oct ’19 NFDM production volumes remained 0.3% below three year average seasonal levels.

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished lower on a YOY basis for the first time in the past three months during Oct ’19, declining by 9.0%. The YOY increase in NFDM production more than offset the decline in SMP production, resulting in Oct ’19 combined production of NFDM and SMP increasing 5.4% on a YOY basis, finishing higher for fourth consecutive month.

’18-’19 annual combined production of NFDM and SMP declined 2.0% from the record high level experienced throughout the previous production season. ’18-’19 annual production of NFDM and SMP declined by 1.2% and 4.4%, respectively, throughout the 12 month period.

Overall, nonfat dry milk production increased most significantly YOY on a percentage basis during Oct ’19, followed by dry whey production, while skim milk powder production declined most significantly on a percentage basis throughout the month.

Overall, nonfat dry milk production increased most significantly YOY on a percentage basis during Oct ’19, followed by dry whey production, while skim milk powder production declined most significantly on a percentage basis throughout the month.