U.S. Dairy Product Production Update – Mar ’21

Executive Summary

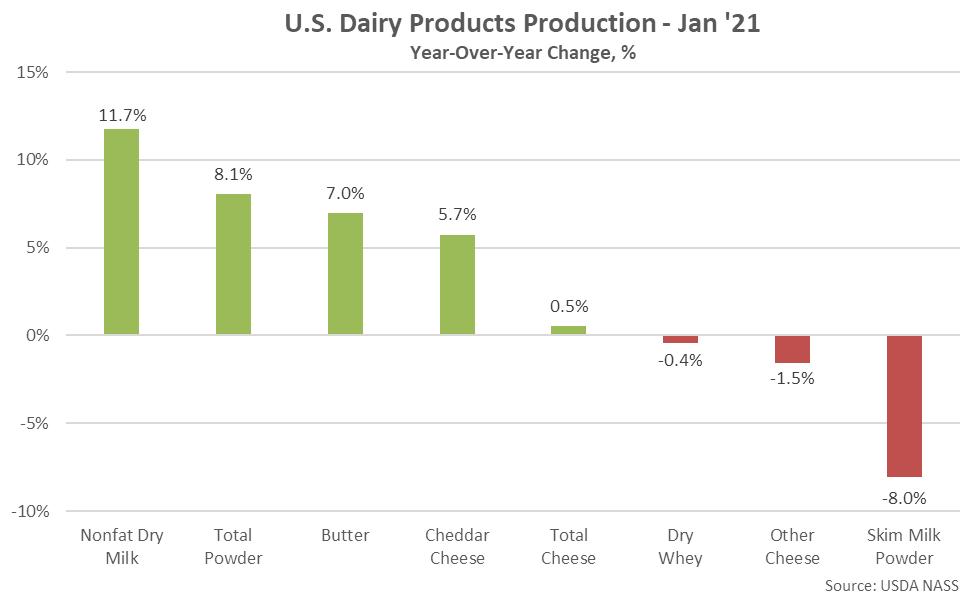

U.S. dairy product production figures provided by the USDA were recently updated with values spanning through Jan ’21. Highlights from the updated report include:

- U.S. butter production finished 7.0% higher on a YOY basis throughout Jan ’21, remaining at a record high seasonal level for the seventh consecutive month.

- U.S. cheese production finished 0.5% higher on a YOY basis throughout Jan ’21, remaining at a record high seasonal level for the third consecutive month, however dry whey production finished lower on a YOY basis for the fifth time in the past six months, declining 0.4%.

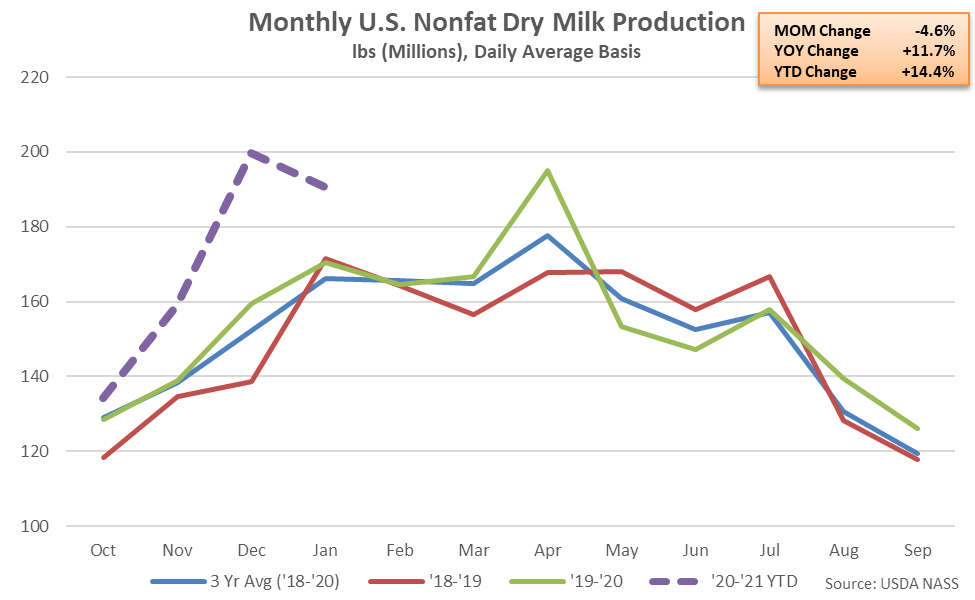

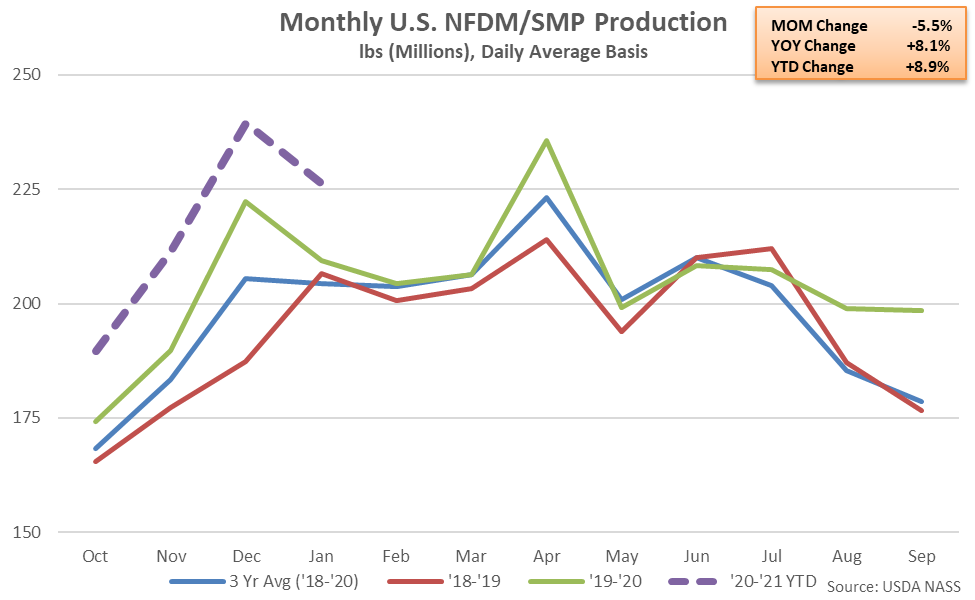

- Combined production of U.S. nonfat dry milk and skim milk powder increased 8.1% on a YOY basis throughout Jan ’21, reaching a record high seasonal level. Nonfat dry milk production increased 11.7% YOY throughout the month, more than offsetting an 8.0% YOY decline in skim milk powder production.

Additional Report Details

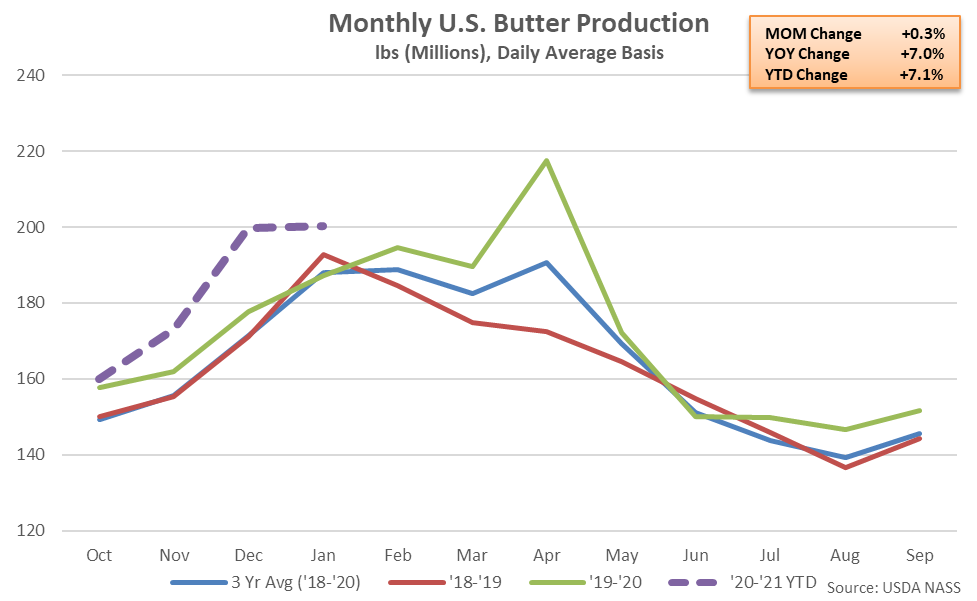

Butter – Production Remains at a Record High Seasonal Level, Finishes up 7.0% YOY

According to the USDA, U.S. butter production finished 7.0% higher on a YOY basis throughout Jan ’21, remaining at a record high seasonal level for the seventh consecutive month and reaching the second highest monthly figure on record. The YOY increase in butter production was the 18th experienced throughout the past 20 months. Higher butter production experienced throughout the Western U.S. (+16.5%) and Central U.S. (+2.3%) more than offset a reduction in Atlantic U.S. (-15.4%) production experienced throughout the month.

’19-’20 annual butter production increased 5.6% YOY, reaching the highest annual level on record for the third consecutive year. ’20-’21 YTD butter production has increased by an additional 7.1% on a YOY basis throughout the first third of the production season.

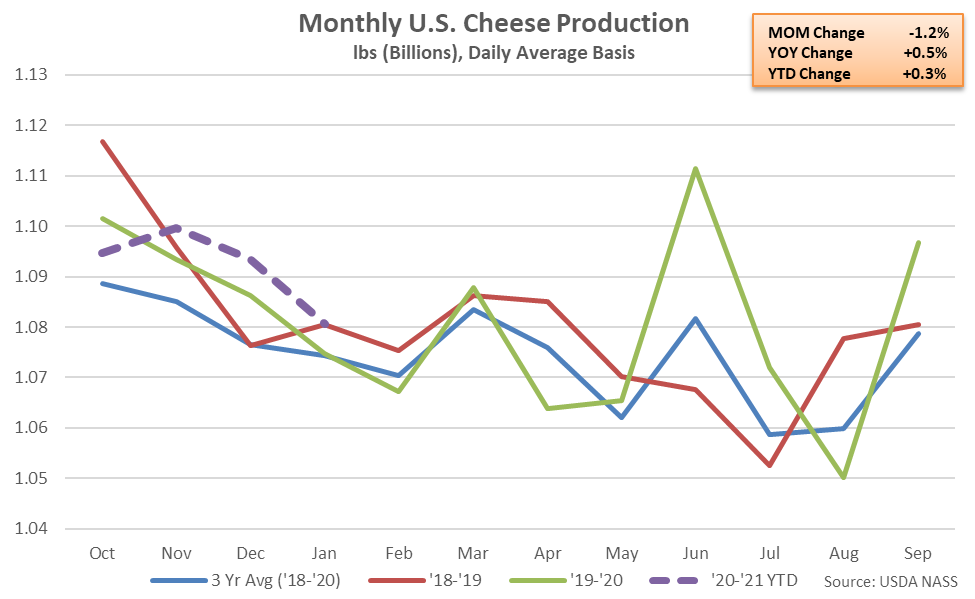

Cheese – Production Remains at a Record High Seasonal Level, Finishes up 0.5% YOY

U.S. cheese production finished 0.5% higher on a YOY basis throughout Jan ’21, remaining at a record high seasonal level for the third consecutive month. The YOY increase in cheese production was the sixth experienced throughout the past eight months. Higher cheese production experienced throughout the Central U.S. (+2.1%) and Western U.S. (+0.6%) more than offset a reduction in Atlantic U.S. (-5.3%) production experienced throughout the month.

Cheddar cheese production increased 5.7% on a YOY basis throughout the month, more than offsetting a 1.5% YOY decline in other-than-cheddar cheese production. The YOY increase in cheddar cheese production was the 11th experienced throughout the past 12 months while other-than-cheddar cheese production finished lower on a YOY basis for the fifth time in the past six months.

’19-’20 annual cheese production reached a record high annual level for the 19th consecutive year, although the production growth rate of <0.1% was the smallest experienced over the 19 year period. Cheddar cheese production increased 1.1% throughout the year, more than offsetting a 0.4% YOY decline in other-than-cheddar cheese production. ’20-’21 YTD cheese production has increased by an additional 0.3% on a YOY basis throughout the first third of the production season.

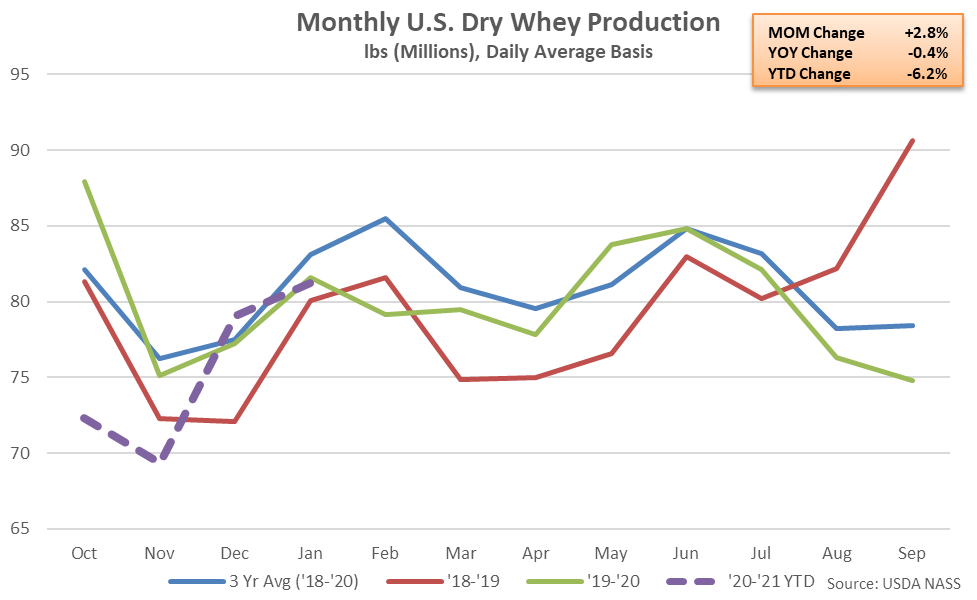

Dry Whey – Production Remains Lower YOY for the Fifth Time in Six Months, Down 0.4%

U.S. dry whey production declined 0.4% on a YOY basis throughout Jan ’21, finishing below previous year levels for the fifth time in the past six months. Lower dry whey production experienced throughout the Central U.S. (-1.2%) more than offset increases in Atlantic U.S. (+2.4%) and Western U.S. (+0.8%) production experienced throughout the month.

Combined whey protein concentrate (WPC) and whey protein isolate (WPI) production finished higher on a YOY basis for the second consecutive month during Jan ’21, increasing by 7.5%. Combined WPC and WPI production had finished lower on a YOY basis over 17 of the 18 months through Nov ’20, prior to finishing higher on a YOY basis over the two most recent months of available data. Combined production of dry whey, WPC and WPI finished 2.6% higher on a YOY basis throughout the month.

’19-’20 annual dry whey production rebounded 1.1% YOY from the four year low level experienced throughout the previous production season. ’20-’21 YTD dry whey production has declined by 6.2% on a YOY basis throughout the first third of the production season, however, and is on pace to reach a six year low level.

NFDM/SMP – Combined Production Remains at a Record High Seasonal Level, up 8.1% YOY

U.S. nonfat dry milk (NFDM) production declined from the record high monthly level experienced throughout the previous month but remained 11.7% higher on a YOY basis throughout Jan ’21, reaching a record high seasonal level for the third consecutive month. The YOY increase in NFDM production was the sixth experienced in a row. Higher NFDM production experienced throughout the Western U.S. (+21.5%) more than offset declines in Central U.S. (-7.7%) and Atlantic U.S. (-3.0%) production experienced throughout the month.

Production of skim milk powder (SMP), which is more suited to the requirements of most global markets, finished lower on a YOY basis for the second consecutive month during Jan ’21, declining by 8.0%. Combined production of NFDM and SMP remained 8.1% above previous year levels, reaching a record high seasonal level, as the increase in NFDM production more than offset the reduction in SMP volumes. The YOY increase in combined production of NFDM and SMP was the sixth experienced in a row

’19-’20 annual combined production of NFDM and SMP increased 5.2% YOY, reaching a record high level for the fourth consecutive year. NFDM production increased 3.2% YOY but remained slightly below historical highs, while SMP increased 11.7%, reaching a record high annual level. ’20-’21 YTD combined production of NFDM and SMP has increased by an additional 8.9% on a YOY basis throughout the first third of the production season as a 14.4% YOY increase in NFDM production has more than offset a 7.6% YOY decline in SMP production.

Overall, nonfat dry milk production remained most significantly higher YOY on a percentage basis throughout Jan ’21, while skim milk powder production declined most significantly on a percentage basis throughout the month.