New Zealand Milk Production Update – Mar ’21

Executive Summary

New Zealand milk production figures provided by Dairy Companies Association of New Zealand (DCANZ) were recently updated with values spanning through Feb ’21. Highlights from the updated report include:

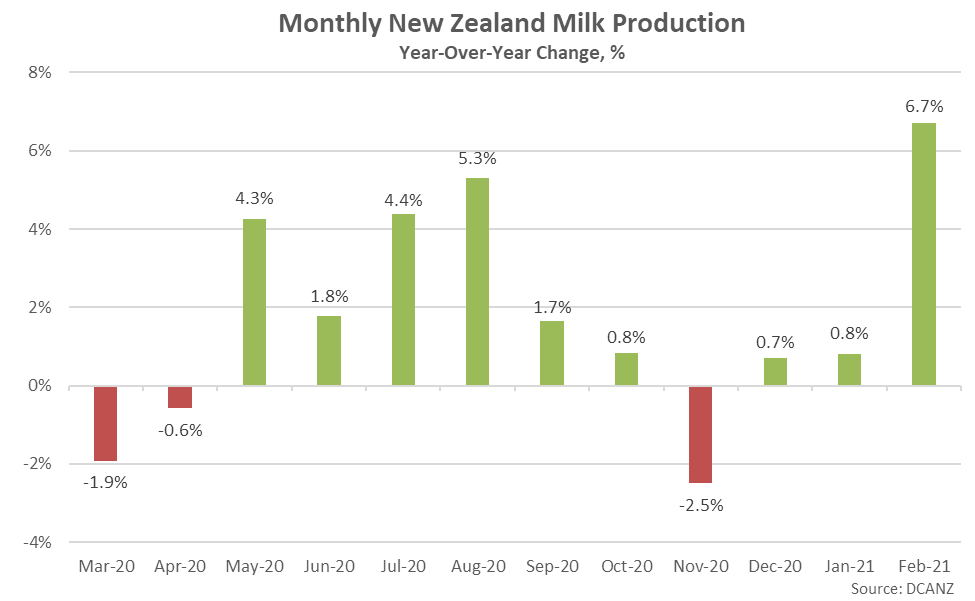

- New Zealand milk production volumes increased 6.7% on a YOY basis during Feb ’21, reaching a seven year high seasonal level. The YOY increase in New Zealand milk production volumes was the ninth experienced throughout the past ten months.

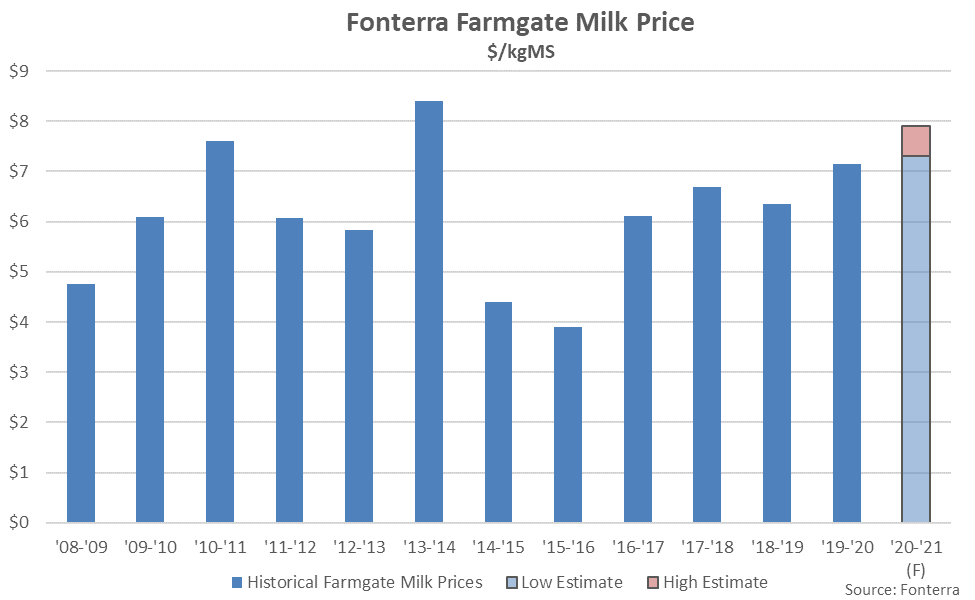

- Fonterra’s ’20-’21 farmgate milk price forecast of $7.30-$7.90/kgMS was revised $0.40/kgMS higher throughout Mar ’21 on strong Chinese and Southeast Asian powder demand. The ’20-’21 farmgate milk price forecast is on pace to reach a seven year high level at the midpoint of the estimate.

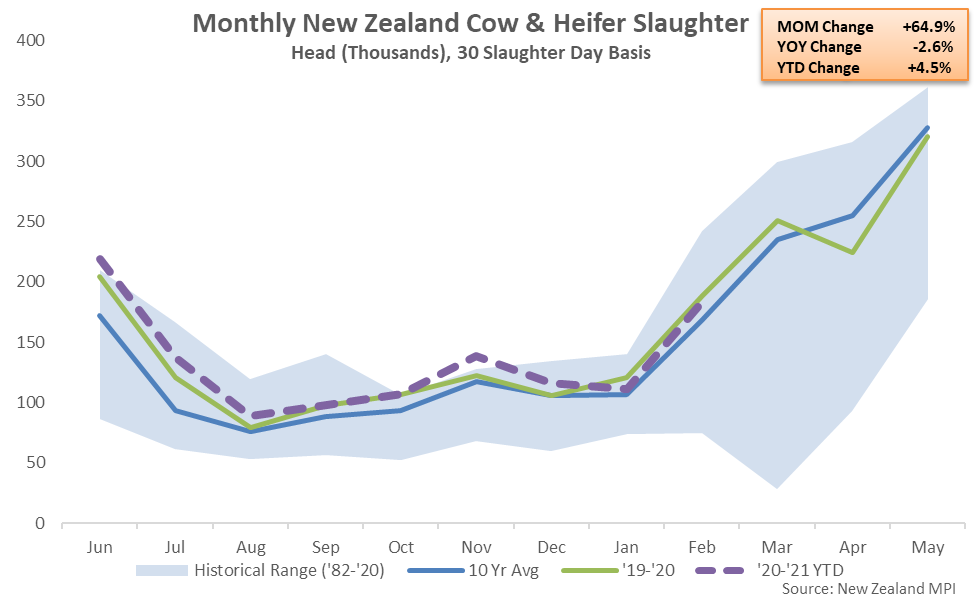

- New Zealand cow & heifer slaughter rates declined 2.6% on a YOY basis during Feb ’21 when normalizing for slaughter days, finishing lower for the second consecutive month.

Additional Report Details

Milk Production

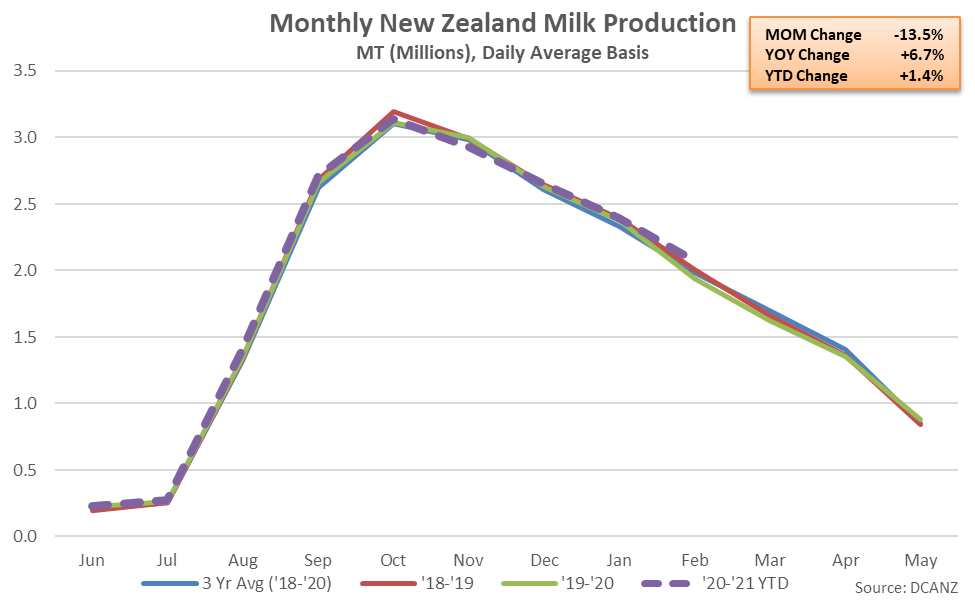

According to Dairy Companies Association of New Zealand (DCANZ), Feb ’21 New Zealand milk production volumes increased 6.7% on a YOY basis when accounting for the previous year’s leap year, reaching a seven year high seasonal level. On a milk-solids basis, production also increased 6.7% YOY, finishing at a seven year high seasonal level.

The Feb ’21 YOY increase in New Zealand milk production volumes was the ninth experienced throughout the past ten months and the largest experienced throughout the past two years on an absolute basis. ’19-’20 annual milk production volumes declined 0.7% on a YOY basis however production on a milk-solids basis increased 0.3% YOY throughout the period. Drought conditions impacted the milk supply throughout the ’19-’20 production season. ‘20-’21 YTD New Zealand milk production volumes have rebounded by 1.4% on a YOY basis throughout the first three quarters of the production season.

Rainfall & Soil Moisture Deficits

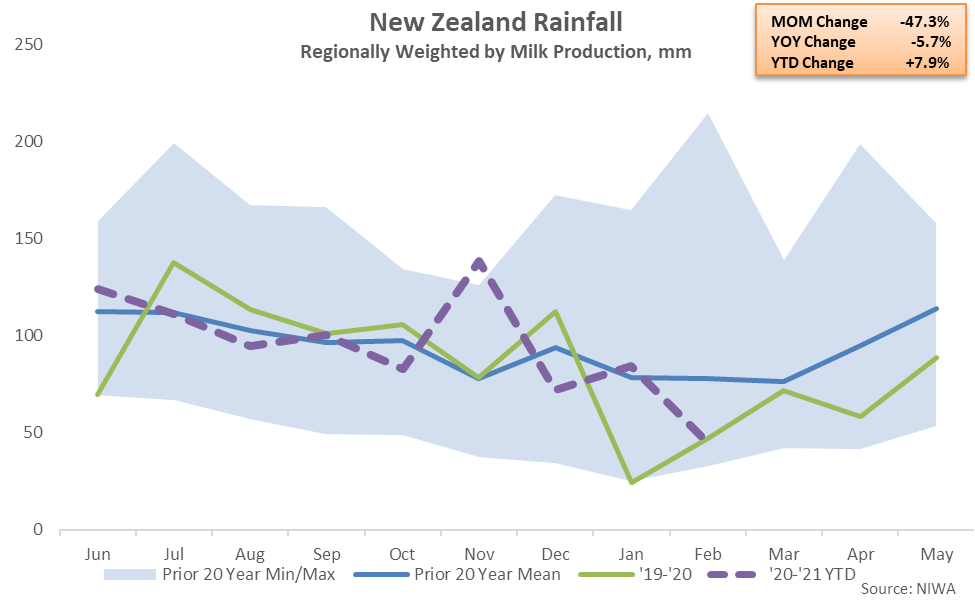

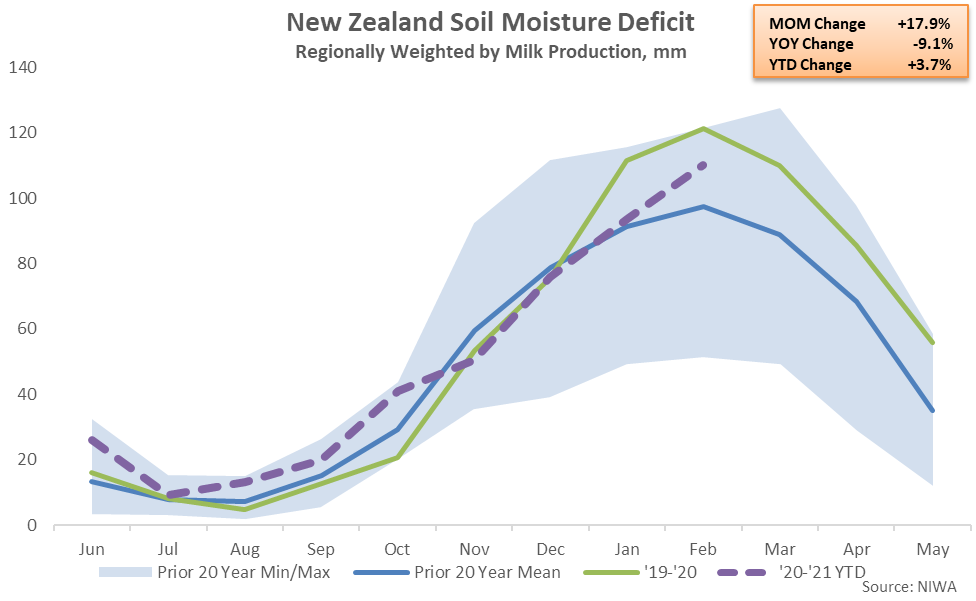

Feb ’21 New Zealand rainfall volumes declined to the second lowest seasonal level experienced throughout the past seven years when weighted regionally by milk production volumes, finishing 5.7% below previous year levels. Rainfall levels finished 43.0% below 20 year average seasonal levels for the month of February.

Reduced rainfall levels experienced throughout the month of February contributed to soil moisture deficits rebounding to a 12 month high level. Feb ’21 New Zealand soil moisture deficits remained 9.1% below previous year levels but finished 13.3% above 20 year average seasonal levels for the month of February.

Farmgate Milk Prices

Fonterra’s farmgate milk price reached a six year high level of $7.14/kgMS throughout the ’19-’20 production season. Fonterra’s ’20-’21 farmgate milk price forecast was revised $0.40/kgMS higher during Mar ’21, reaching a range of $7.30-$7.90/kgMS. Fonterra stated the ’20-’21 farmgate milk price forecast was revised higher largely due to strong whole milk powder and skim milk powder demand from China and Southeast Asia. The ’20-’21 farmgate milk price forecast is on pace to reach a seven year high level at the midpoint of the estimate.

Cow & Heifer Slaughter

New Zealand cow & heifer slaughter rates declined 2.6% on a YOY basis during Feb ’21 when normalizing for slaughter days, finishing lower for the second consecutive month. Feb ’21 dairy cow & heifer slaughter, which has more limited historical data available, also declined on a YOY basis for the second consecutive month, finishing down 11.3%.

’19-’20 annual New Zealand cow & heifer slaughter rates rebounded 2.7% from the previous year, reaching a four year high level. ’20-’21 YTD New Zealand cow & heifer slaughter rates have increased by an additional 4.5% on a YOY basis throughout the first three quarters of the production season and are on pace to reach a record high annual level, despite the recently experienced declines.

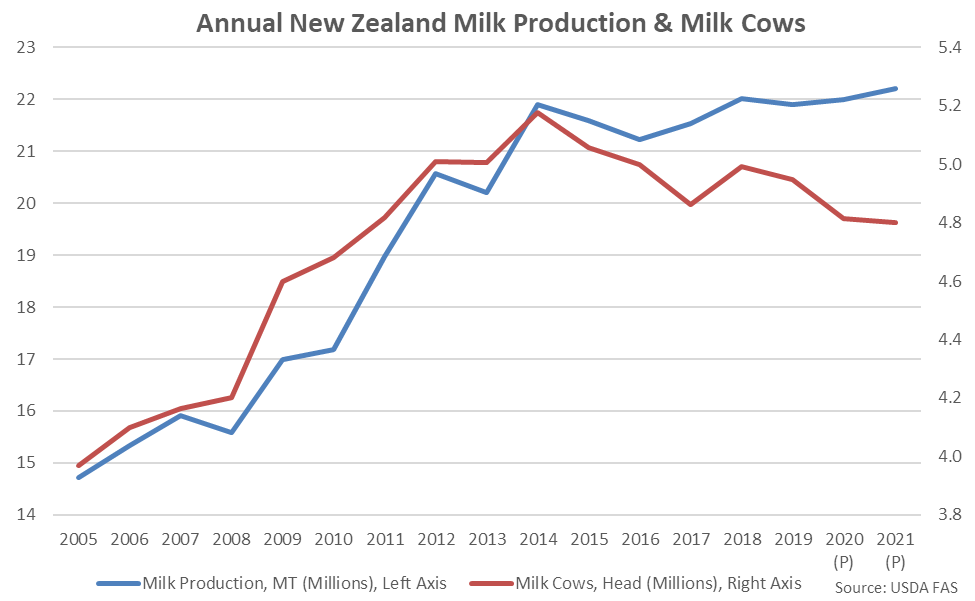

New Zealand milk production volumes increased at a compound annual growth rate of 4.2% over the ten year period ending during the ’14-’15 record production season but have trended flat-to-lower over the five most recent production seasons as farmgate milk prices declined from the ’13-’14 record high levels and the New Zealand milk cow herd was reduced. USDA is projecting the New Zealand milk cow herd will decline 2.6% on a YOY basis throughout 2020 and an additional 0.3% YOY throughout 2021, reaching an 11 year low level.