Global Milk Production Update – May ’21

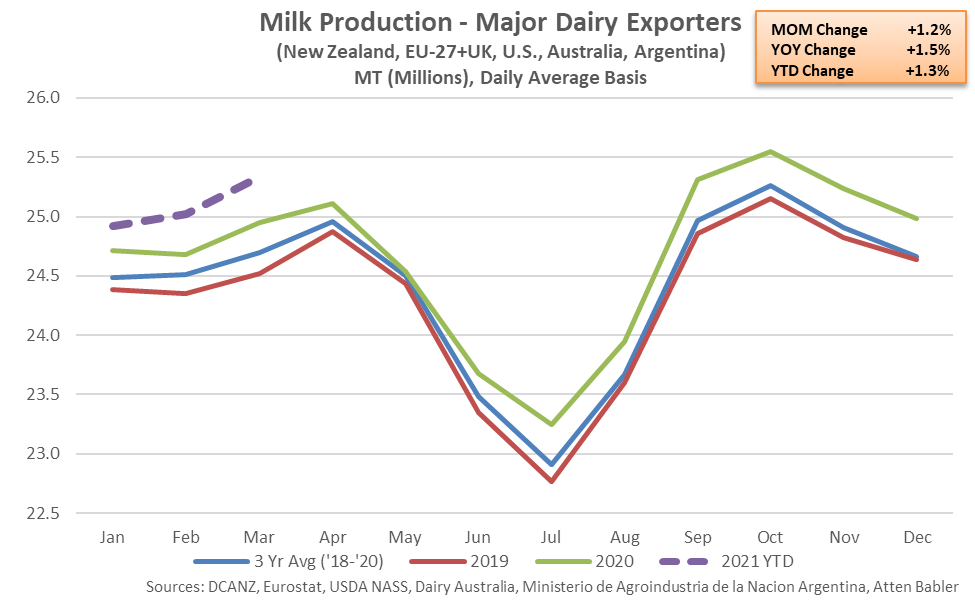

Combined milk production within the major dairy exporting regions of New Zealand, the EU-27+UK, the U.S., Australia and Argentina finished 1.5% higher on a YOY basis during Mar ’21, remaining at a record high seasonal level for the tenth consecutive month. The aforementioned regions combined to account for 90% of global butter, cheese, whole milk powder and nonfat dry milk export volumes throughout 2020.

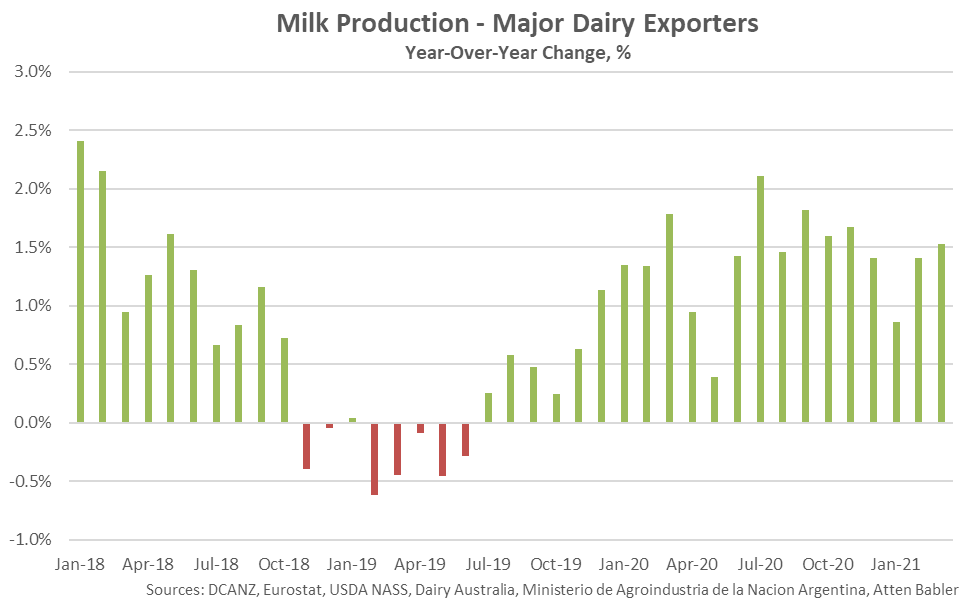

Combined milk production growth rates experienced throughout the major dairy exporting regions decelerated over much of 2018 but remained positive until Nov ’18, when production volumes declined on a YOY basis for the first time in the past 22 months. Combined milk production volumes finished largely flat or lower on a YOY basis over eight consecutive months through Jul ’19, prior to finishing higher throughout each of the past 21 months through Mar ’21.

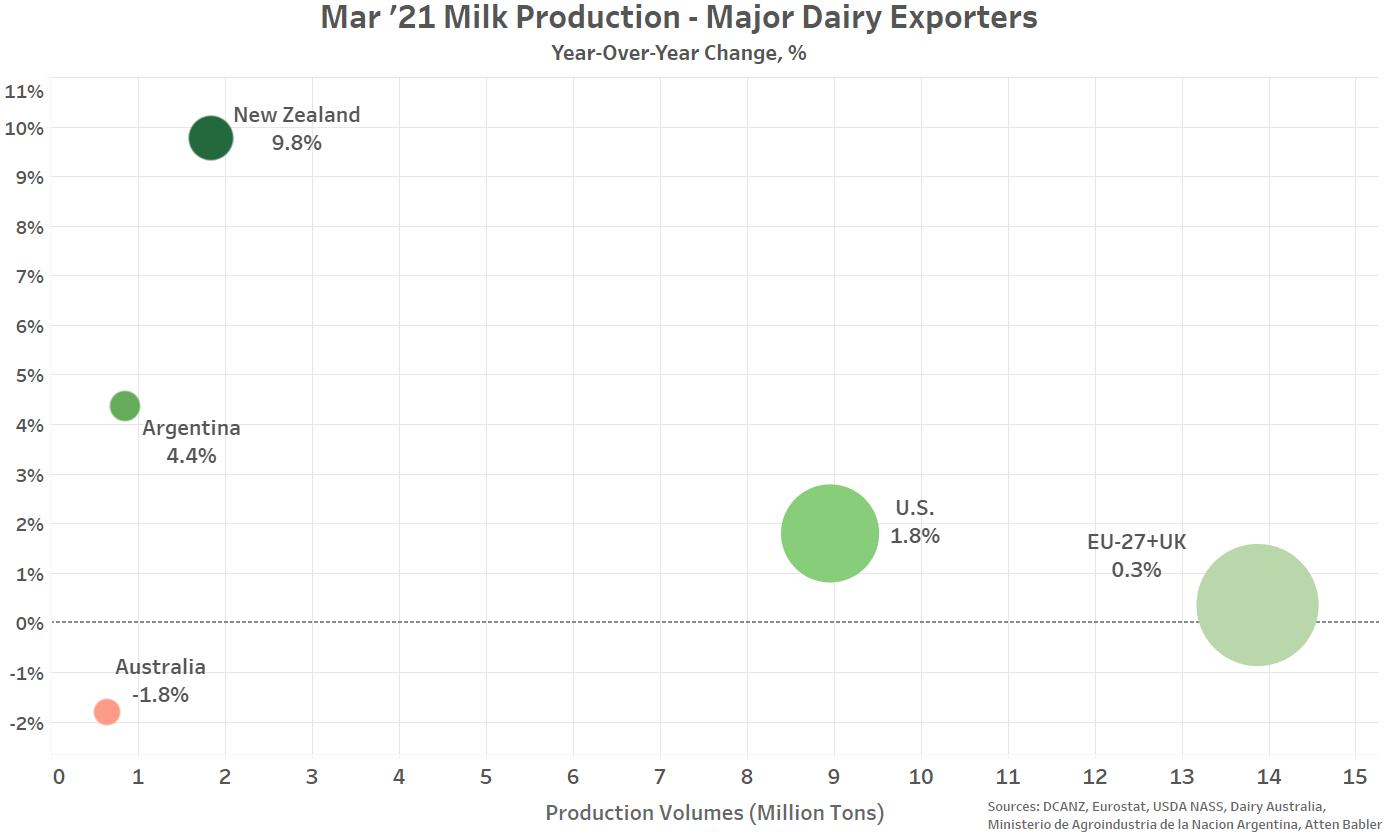

Mar ’21 YOY increases in milk production on a percentage basis were led by New Zealand (+9.8%), followed by Argentina (+4.4%), the U.S. (+1.8%) and the EU-27+UK (+0.3%). Production finished lower on a YOY basis throughout the Australia (-1.8%). The EU-27+UK produces significantly more milk than the other dairy exporting regions, accounting for over half of the combined production within the five exporting regions throughout Mar ’21.

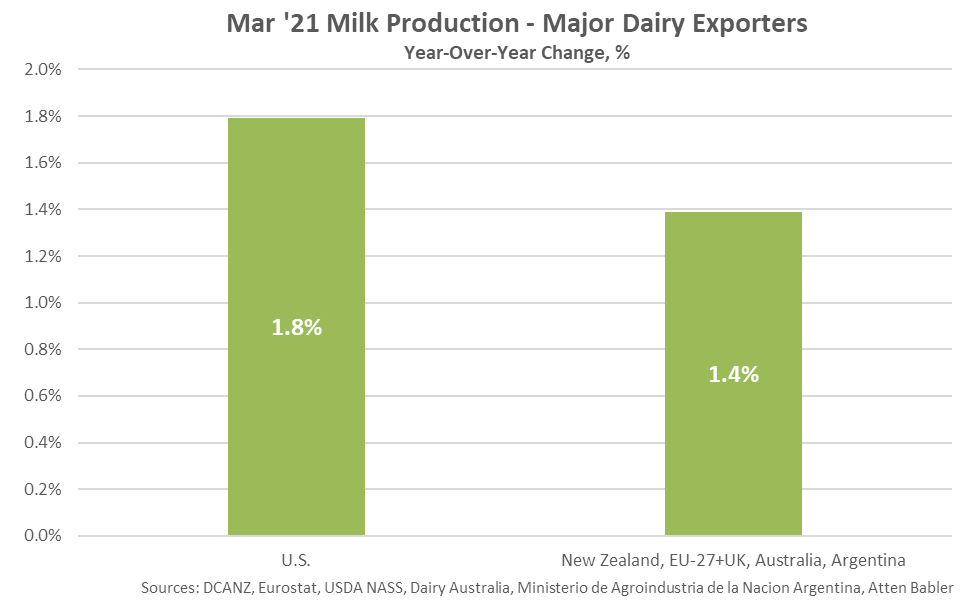

Excluding the U.S., milk production within the major dairy exporting regions increased by 1.4% on a YOY basis throughout the month of March, finishing below the growth rate exhibited within the U.S. for the eighth consecutive month.