U.S. Dairy Commercial Disappearance Update – Sep ’21

Executive Summary

U.S. dairy commercial disappearance figures provided by the USDA were recently updated with values spanning through Jul ’21. Highlights from the updated report include:

- U.S. commercial disappearance for milk used in all products reached record high seasonal levels on both a milk-fat and skim-solids basis throughout Jul ’21. Domestic demand increased 2.1% YOY on a milk-fat basis and 4.2% YOY on a skim-solids basis throughout the month.

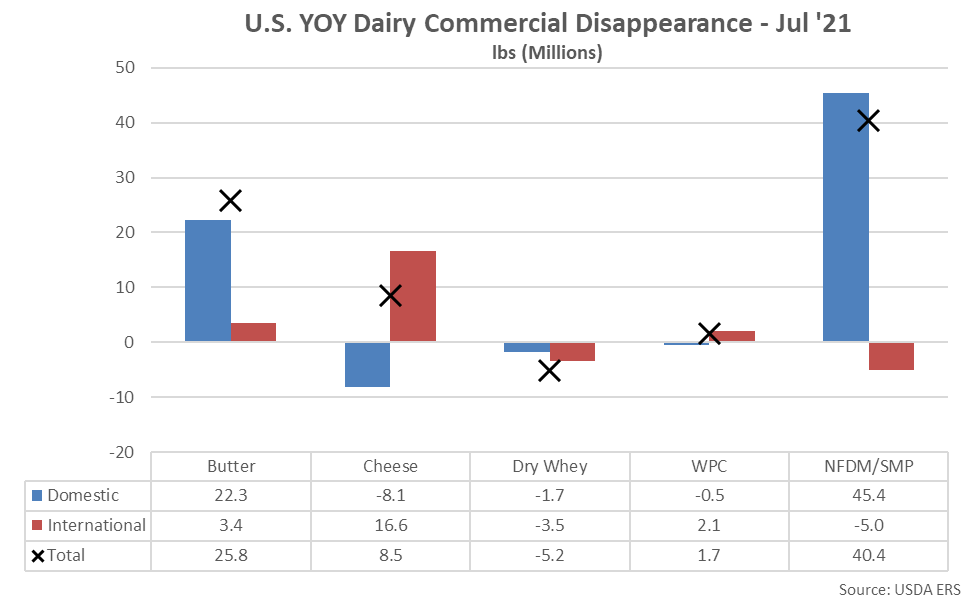

- U.S. butter, cheese and nonfat dry milk/skim milk powder commercial disappearance all reached record high seasonal levels throughout Jul ’21. Whey protein concentrate commercial disappearance reached a three year high seasonal level however dry whey commercial disappearance declined to a seven year low seasonal level throughout the month.

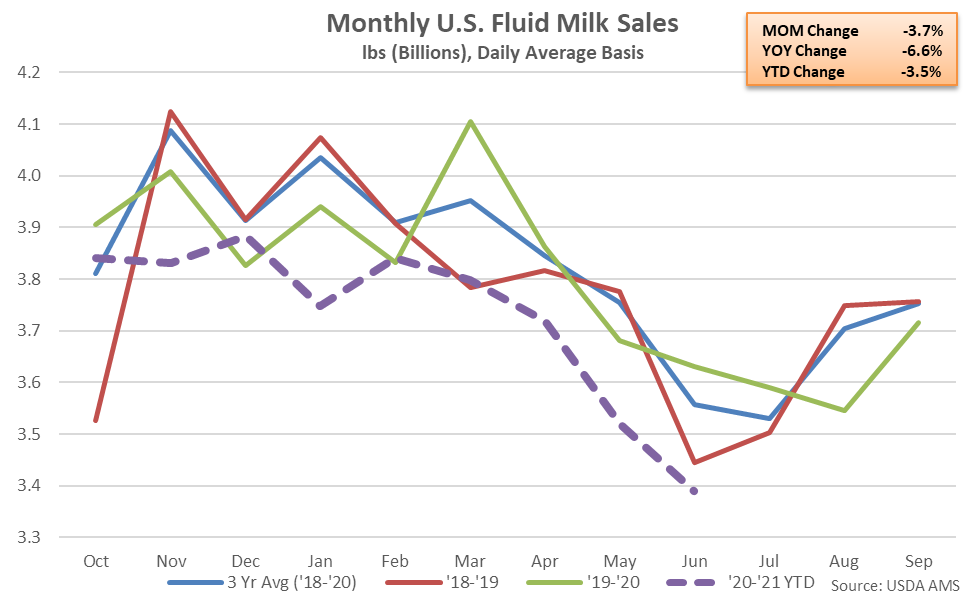

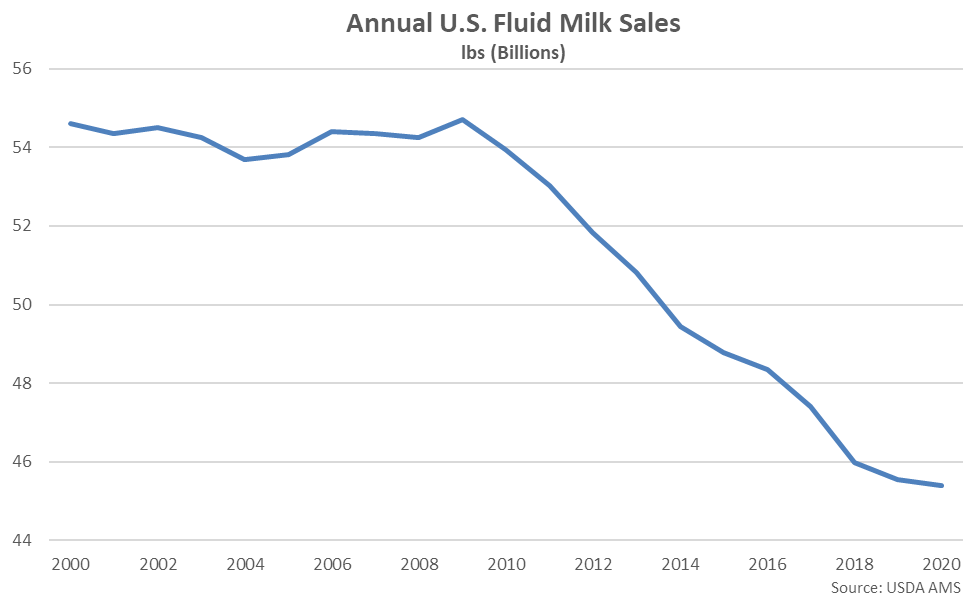

- U.S. fluid milk sales finished lower on a YOY basis for the ninth time in the past 11 months throughout Jun ’21, declining by 6.6% and reaching the lowest monthly level on record.

Additional Report Details

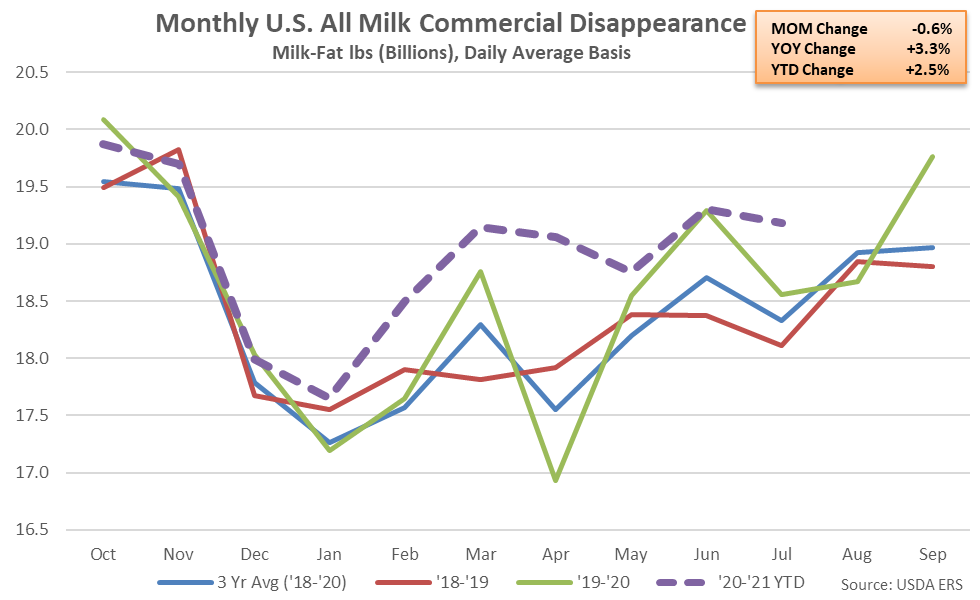

All Milk – Disappearance Reaches Record High Seasonal Levels on a Milk-Fat and Skim-Solids Basis

According to the USDA, U.S. commercial disappearance for milk used in all products on a milk-fat basis increased YOY for the seventh consecutive month throughout Jul ’21, finishing up 3.3% and reaching a record high seasonal level. Domestic demand increased 2.1% on a YOY basis throughout the month, while export demand finished 32.2% above previous year levels.

’19-’20 annual commercial disappearance for milk used in all products on a milk-fat basis increased 1.0% YOY, reaching a record high level. Domestic disappearance increased 1.1%, also reaching the highest annual figure on record. ’20-’21 YTD commercial disappearance for milk used in all products on a milk-fat basis has increased by an additional 2.5% on a YOY basis throughout the first ten months of the production season.

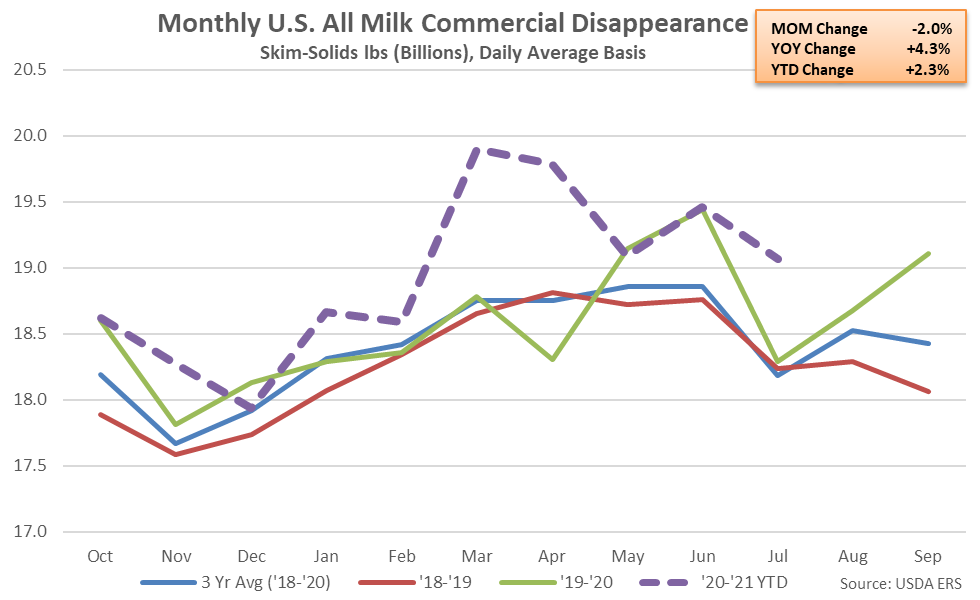

U.S. commercial disappearance for milk used in all products on a skim-solids basis increased by 4.3% on a YOY basis throughout Jul ’21, also reaching a record high seasonal level. Domestic demand increased 4.2% on a YOY basis throughout the month, while export demand finished 4.5% above previous year levels.

’19-’20 annual commercial disappearance for milk used in all products on a skim-solids basis increased 1.7% YOY, reaching a record high level, despite domestic demand declining by 1.4%. ’20-’21 YTD commercial disappearance for milk used in all products on a skim-solids basis has increased by an additional 2.3% on a YOY basis throughout the first ten months of the production season.

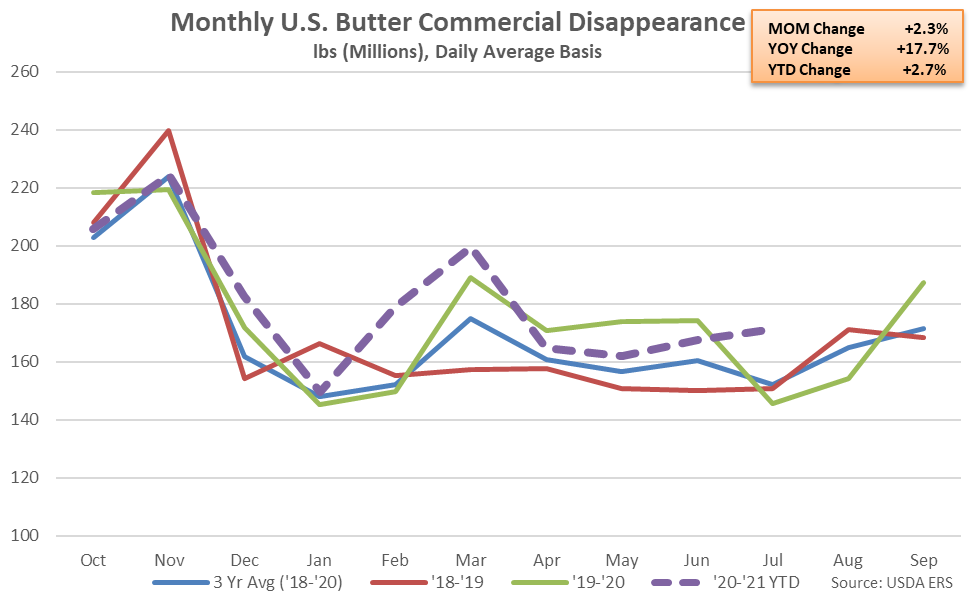

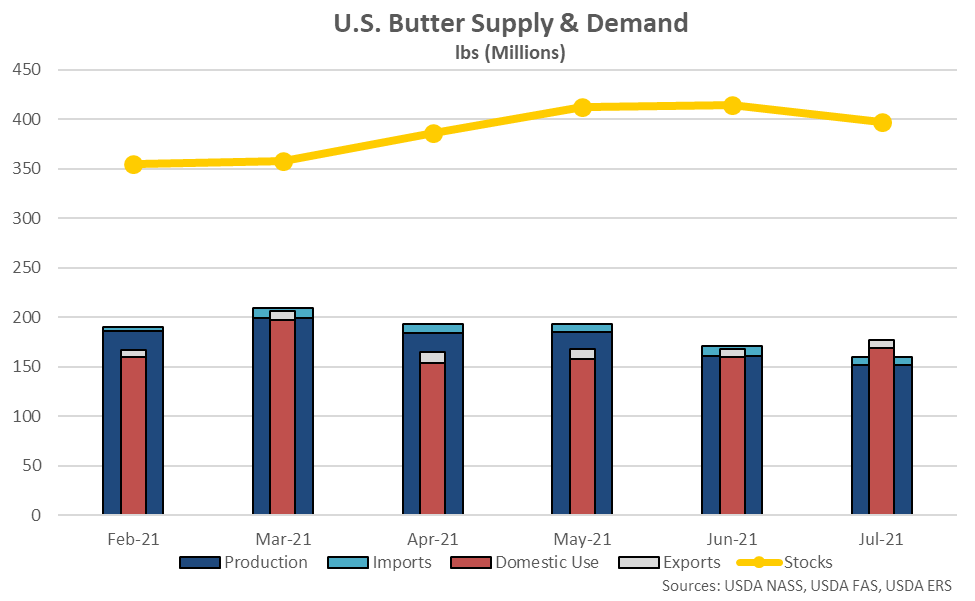

Butter – Disappearance Reaches a Record High Seasonal Level, up 17.7% YOY

U.S. butter commercial disappearance increased 17.7% on a YOY basis throughout Jul ’21, reaching a record high seasonal level. The YOY increase in butter commercial disappearance was the first experienced throughout the past four months. Domestic butter demand increased 15.8% on a YOY basis throughout the month, while export demand finished 80.0% above previous year levels.

’19-’20 annual butter disappearance finished 3.4% higher YOY, reaching a record high level. Domestic disappearance increased 3.6%, also reaching the highest annual figure on record. ’20-’21 YTD butter disappearance has increased by an additional 2.7% on a YOY basis throughout the first ten months of the production season.

U.S. butter domestic use and export figures outpaced production and import figures throughout Jul ’21, resulting in stocks declining seasonally from the 27 year high level experienced throughout the previous month. Butter stocks typically reach a seasonal peak throughout the month of May, prior to declining seasonally through the month of November.

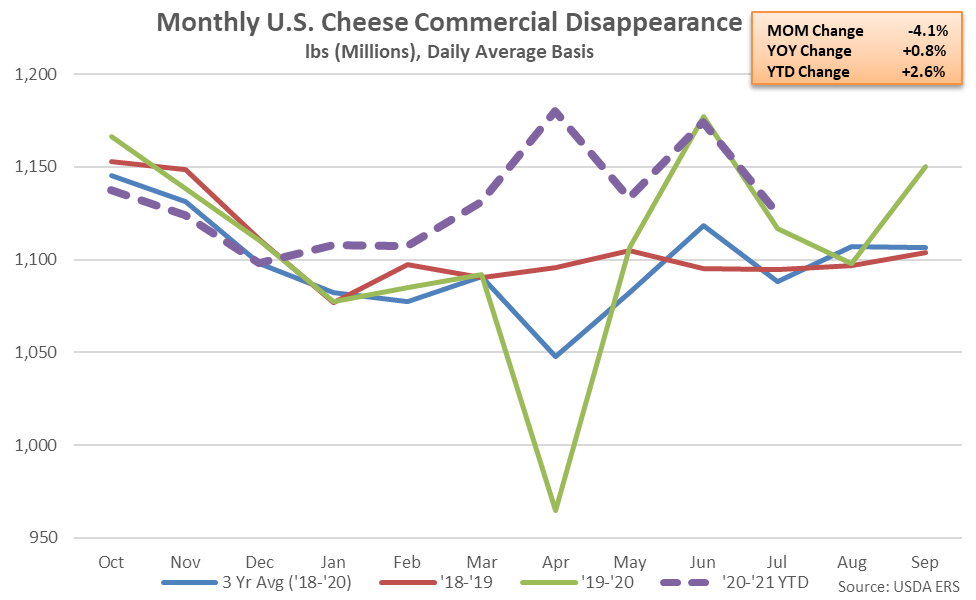

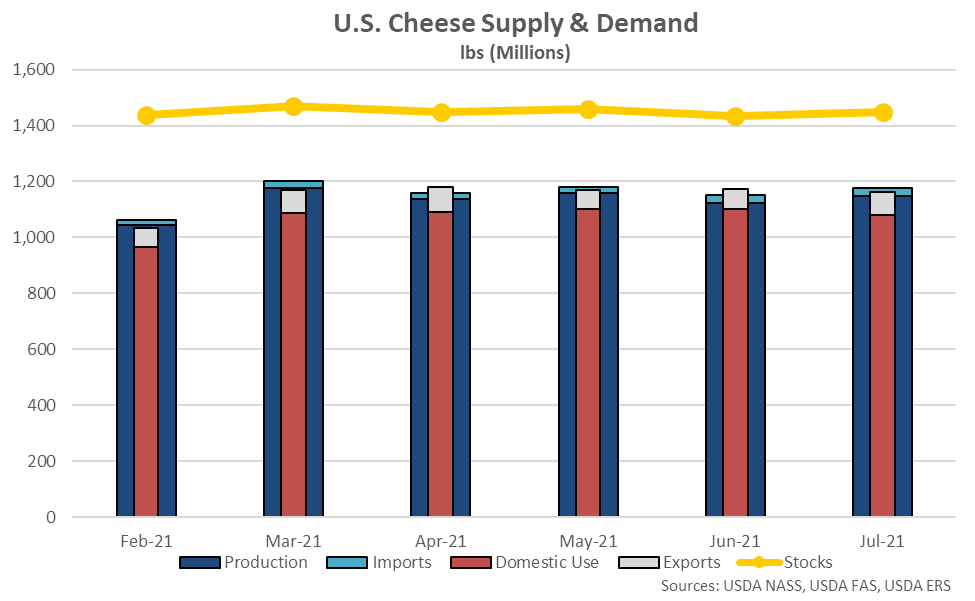

Cheese – Disappearance Reaches a Record High Seasonal Level, up 0.8% YOY

U.S. cheese commercial disappearance increased 0.8% on a YOY basis throughout Jul ’21, reaching a record high seasonal level. The YOY increase in butter commercial disappearance was the sixth experienced throughout the past seven months. Other-than-American cheese disappearance increased 1.8% on a YOY basis throughout the month, more than offsetting a 0.7% YOY decline in American cheese disappearance. Cheese export demand increased 26.8% on a YOY basis throughout the month, more than offsetting a 0.8% YOY decline in domestic cheese demand.

’19-’20 annual cheese disappearance finished 0.1% above the previous year, reaching a record high level for the 25th consecutive year. ’20-’21 YTD cheese disappearance has increased by an additional 2.6% on a YOY basis throughout the first ten months of the production season.

U.S. cheese production and import figures outpaced domestic use and export figures throughout Jul ’21, resulting in stocks rebounding from the previous month.

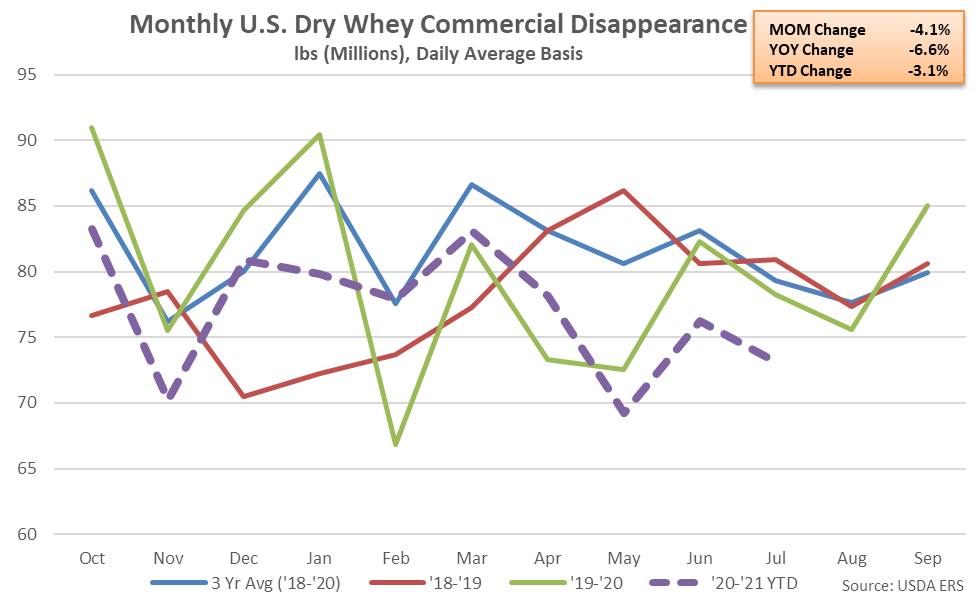

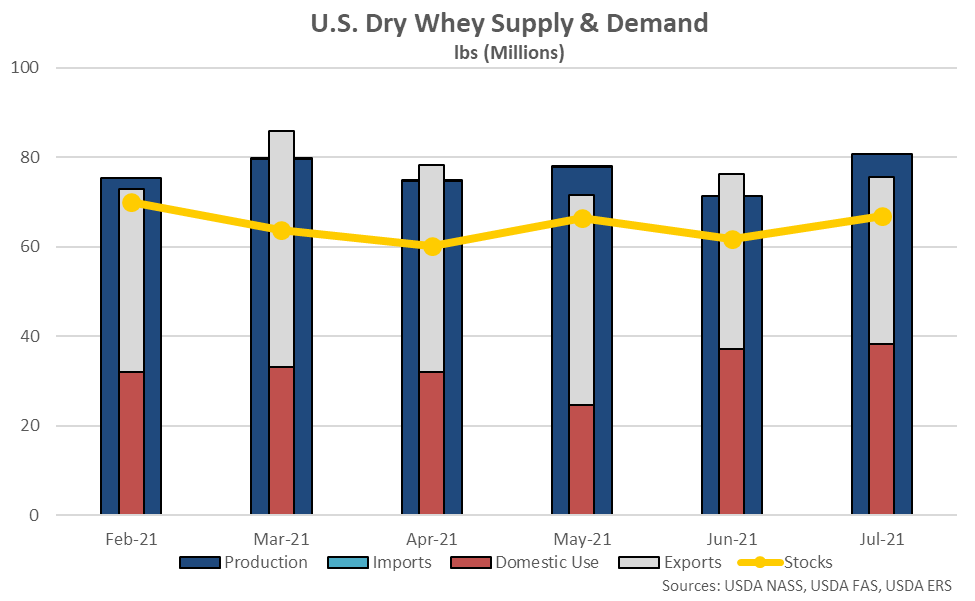

Dry Whey – Disappearance Declines to a Seven Year Low Seasonal Level, Down 6.6% YOY

U.S. dry whey commercial disappearance declined 6.6% on a YOY basis throughout Jul ’21, reaching a seven year low seasonal level. The YOY decline in dry whey commercial disappearance was the third experienced in a row. Domestic dry whey demand declined 4.5% on a YOY basis throughout the month while dry whey export demand finished 8.7% below previous year levels. Dry whey export volumes have finished lower on a YOY basis over 15 of the past 16 months through Jul ’21.

’19-’20 annual dry whey disappearance increased 2.1% on a YOY basis from the four year low level experienced throughout the previous production season, despite domestic demand declining by 6.3%. ’20-’21 YTD dry whey disappearance has declined by 3.1% on a YOY basis throughout the first ten months of the production season, however, and is on pace to reach a six year low level.

U.S. dry whey production and import figures outpaced domestic use and export figures throughout Jul ’21, resulting in stocks rebounding to a five month high level.

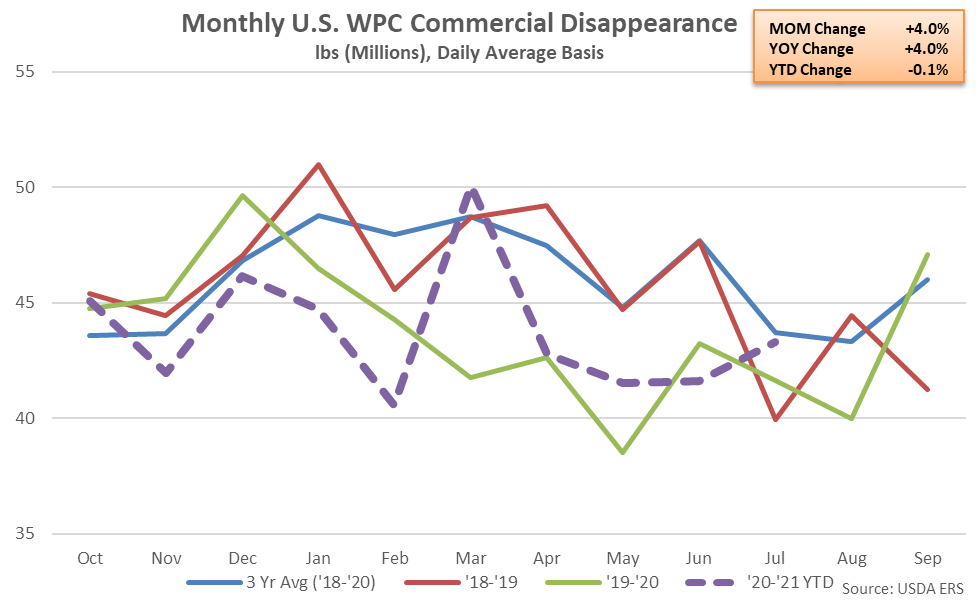

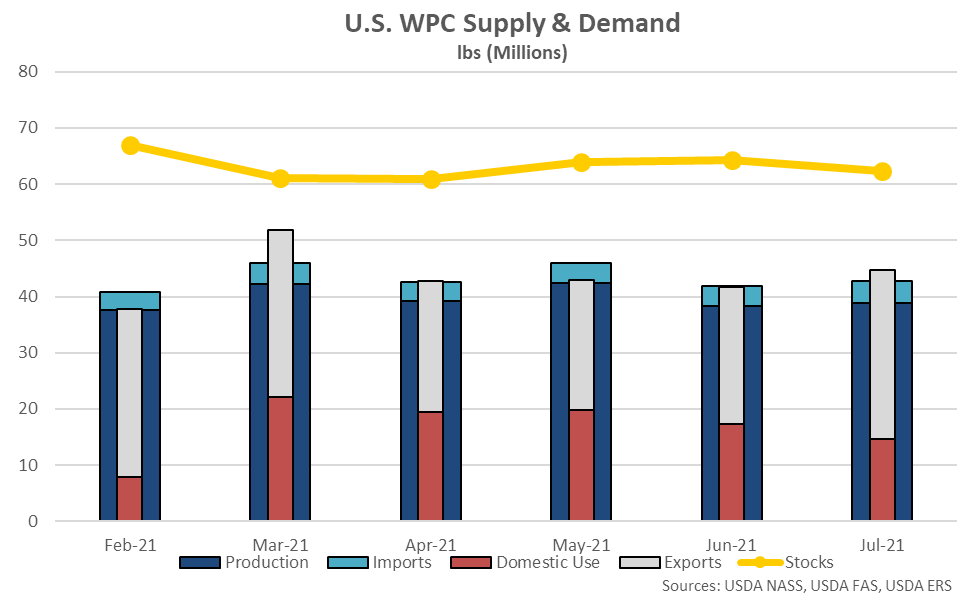

WPC – Disappearance Reaches a Three Year High Seasonal Level, up 4.0% YOY

U.S. whey protein concentrate (WPC) commercial disappearance increased 4.0% on a YOY basis throughout Jul ’21, reaching a three year high seasonal level. The YOY increase in WPC commercial disappearance was the third experienced throughout the past four months. WPC export demand increased 8.0% on a YOY basis throughout the month, more than offsetting a 3.2% YOY decline in domestic demand.

’19-’20 annual WPC disappearance declined 4.4% on a YOY basis, reaching a seven year low level. Domestic demand declined 24.4%, reaching an eight year low level. ’20-’21 YTD WPC disappearance has declined by an additional 0.1% on a YOY basis throughout the first ten months of the production season, despite the most recent increase.

U.S. WPC domestic use and export figures outpaced production and import figures throughout Jul ’21, resulting in stocks declining to a three month low level.

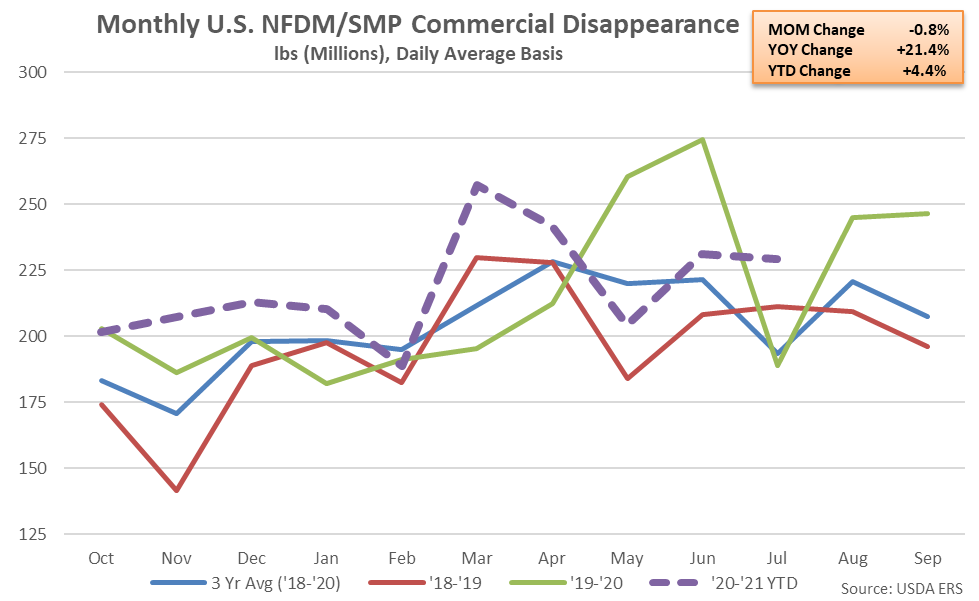

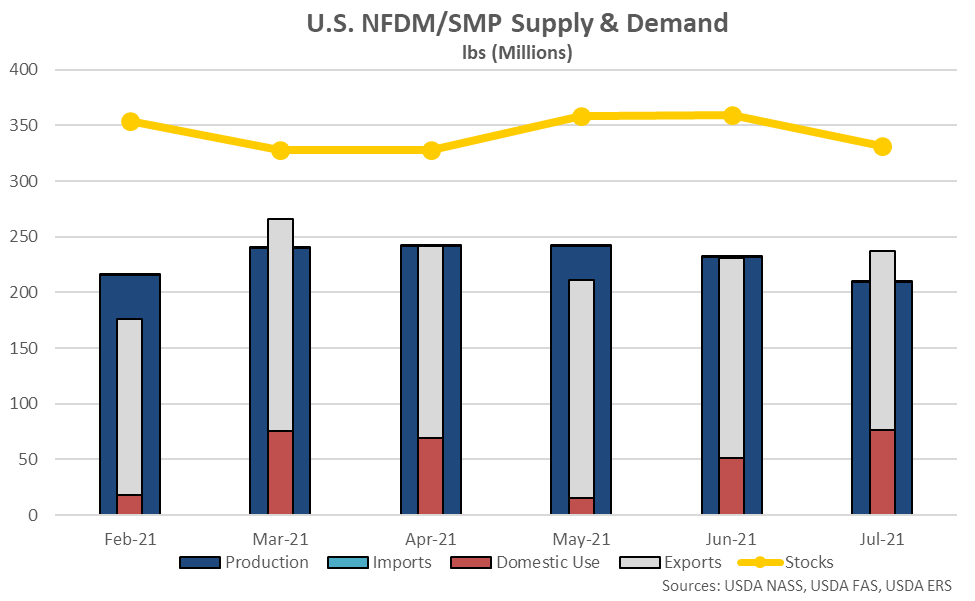

NFDM/SMP – Disappearance Reaches a Record High Seasonal Level, up 21.4% YOY

U.S. nonfat dry milk (NFDM) and skim milk powder (SMP) commercial disappearance increased 21.4% on a YOY basis throughout Jul ’21, reaching a record high seasonal level. The YOY increase in NFDM/SMP commercial disappearance was the first experienced throughout the past three months. Domestic NFDM/SMP demand increased 161.3% on a YOY basis throughout the month, more than offsetting a 3.1% YOY decline in export demand.

’19-’20 annual NFDM/SMP disappearance increased 9.9% on a YOY basis, reaching a record high level. Domestic demand declined 13.1%, however, reaching an 18 year low level. ’20-’21 YTD NFDM/SMP disappearance has increased by an additional 4.4% on a YOY basis throughout the first ten months of the production season.

U.S. NFDM/SMP domestic use and export figures outpaced production and import figures throughout Jul ’21, resulting in stocks declining to a three month low level.

Jul ’21 increases in domestic commercial disappearance were led by NFDM/SMP, followed by butter, while declines were most significant for cheese. YOY increases in international commercial disappearance were led by cheese, while declines were most significant for NFDM/SMP.

Fluid Milk – Total Milk Sales Reach the Lowest Monthly Level on Record, Down 6.6% YOY

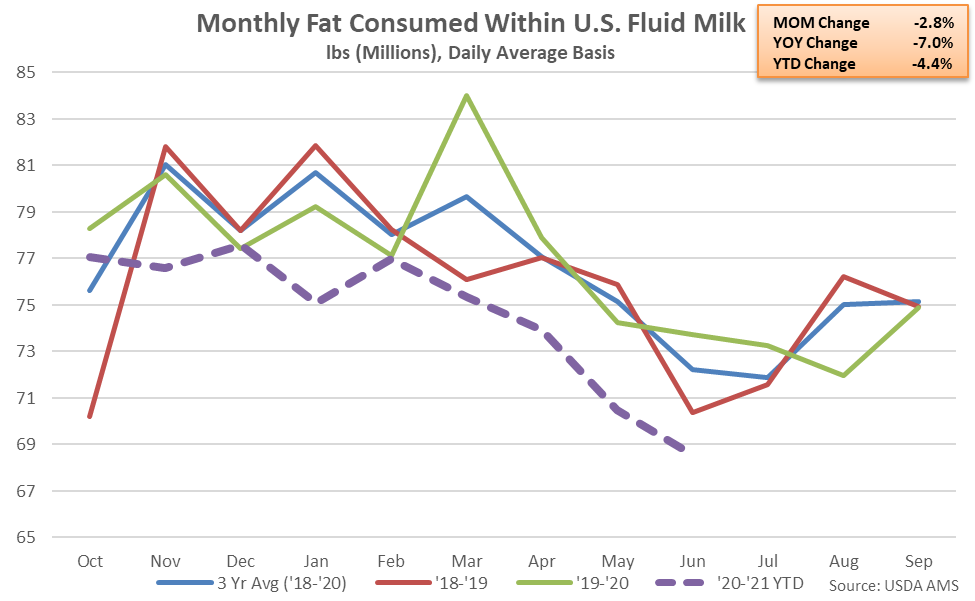

U.S. fluid milk sales finished lower on a YOY basis for the ninth time in the past 11 months during Jun ’21, declining by 6.6% and reaching the lowest monthly level on record. Sales of fat-free milk remained particularly weak, declining by 12.5% on a YOY basis.

’19-’20 annual total fluid milk sales finished 0.6% above the record low level experienced throughout the previous production season, increasing on a YOY basis for the first time in the past 11 years. Annual fluid milk sales remained 0.2% below previous year levels throughout the 2020 calendar year, however. ’20-’21 YTD fluid milk sales have declined by 3.5% on a YOY basis throughout the first three quarters of the production season and are on pace to reach a record low annual level.

Fat consumed within U.S. fluid milk declined on a YOY basis for the tenth time in the past 11 months during Jun ’21, finishing down 7.0% and reaching the lowest monthly figure on record. ’19-’20 annual total fat consumed within fluid milk rebounded 1.4% from the four year low level experienced throughout the previous production season, reaching a three year high level. ’20-’21 YTD fat consumed within fluid milk has declined by 4.4% on a YOY basis throughout the first three quarters of the production season, however, and is on pace to reach the lowest annual level on record.