Canadian Canola Update – Oct ’21

Executive Summary

Soybean meal has historically been the most widely used protein supplement in dairy cow rations, due in large part to its widespread availability, however canola provides an alternative source of high quality protein. The U.S. accounted for just three percent of global canola meal production throughout the past five production seasons, however an abundance of supply is located nearby in Canada, as canola is the major oilseed crop grown throughout the country. Important points to consider include:

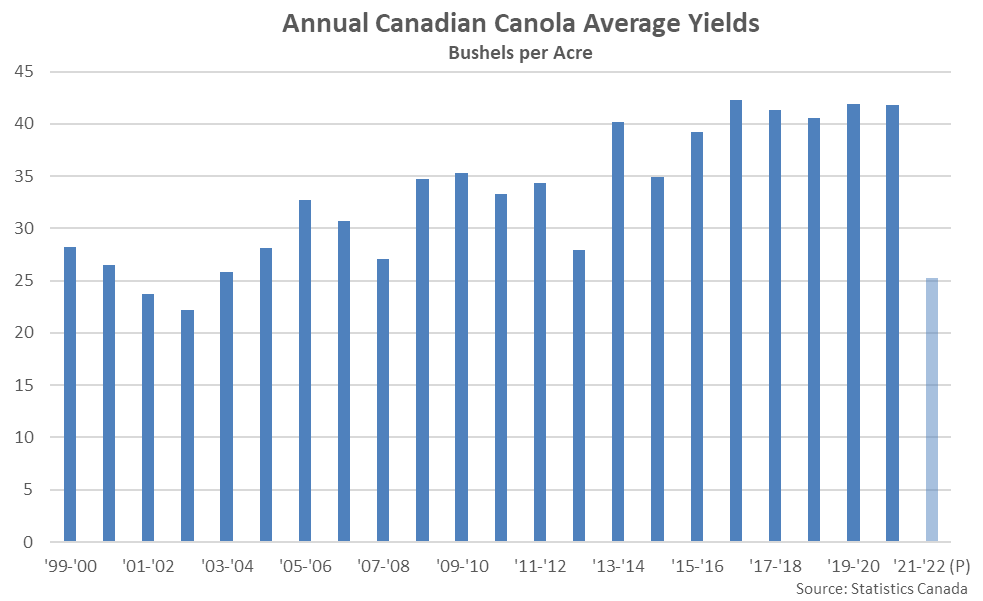

- The ’21-’22 Canadian canola crop is expected to decline to a 13 year low level, a result of a severe drought experienced across the majority of Canada’s major canola producing areas. Canadian canola yields are expected to decline to a 19 year low level throughout the ’21-’22 production season, more than offsetting higher seeded acres.

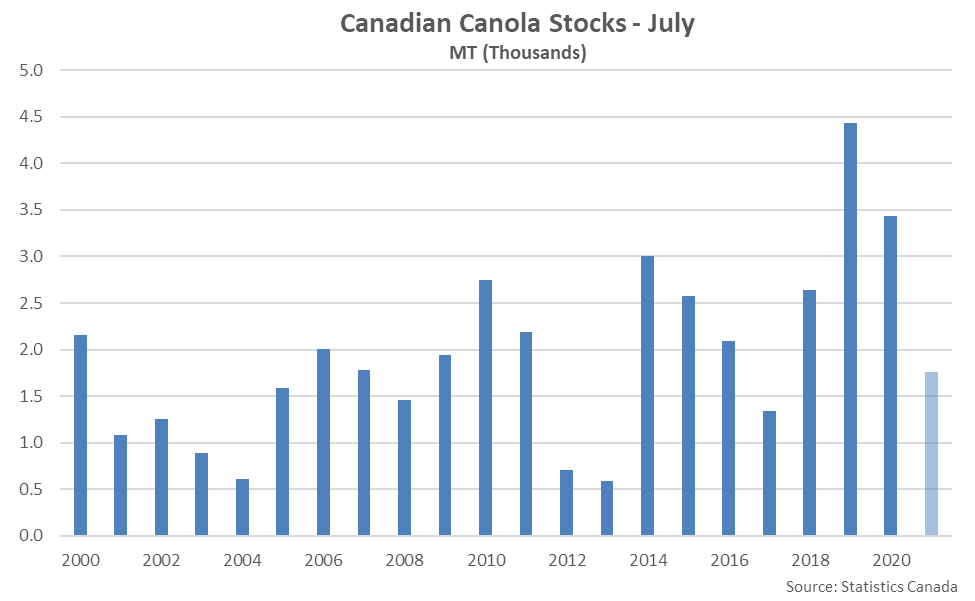

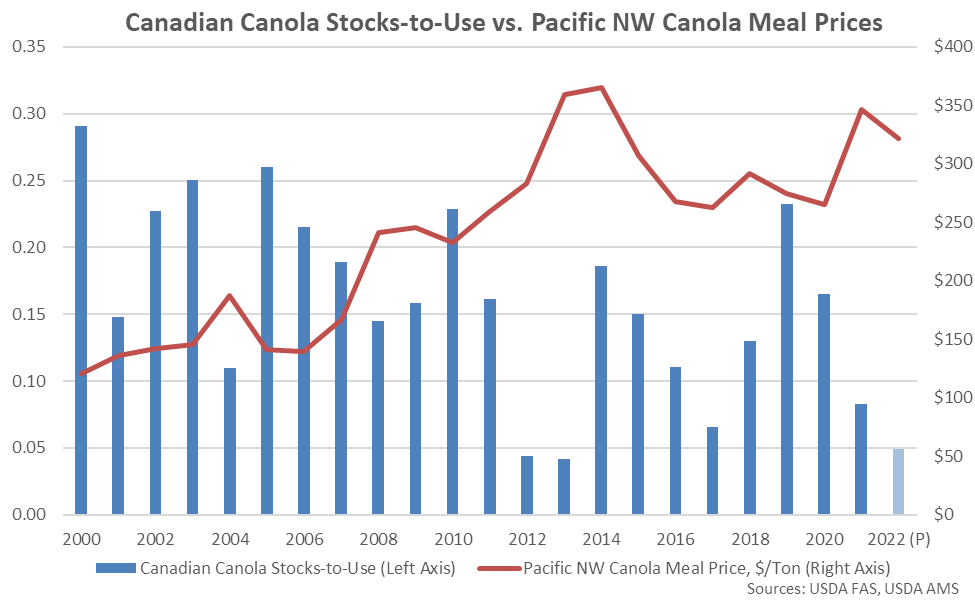

- Canadian canola ending stocks reached a four year low seasonal level throughout Jul ’21 and the second lowest seasonal level experienced throughout the past eight years. When normalized for usage, Canadian canola stocks and Pacific Northwest canola meal prices have exhibited a correlation coefficient of -0.66 since 2000, with canola meal prices reaching a record high level shortly after the Canadian canola stocks-to-use ratio declined to a record low level.

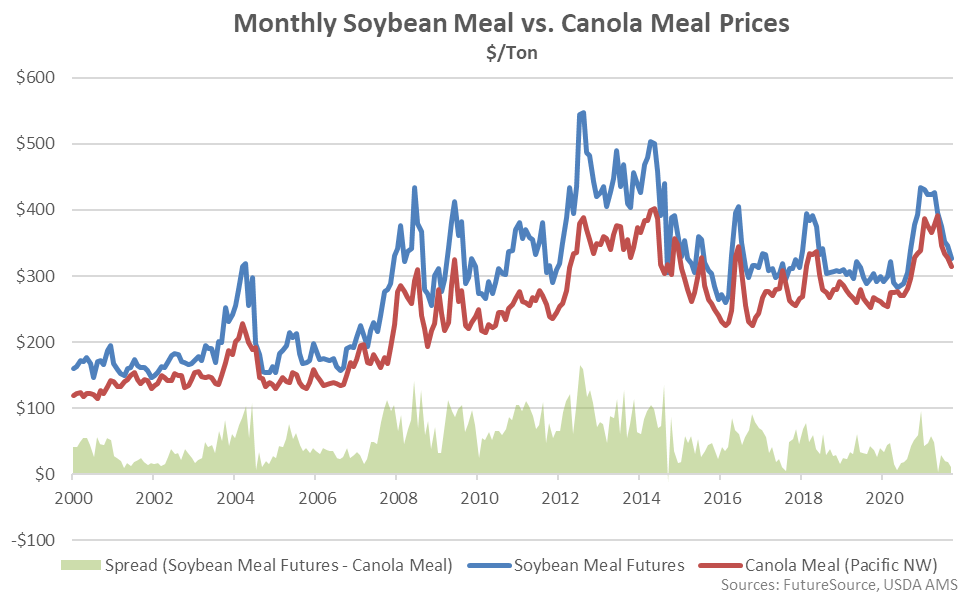

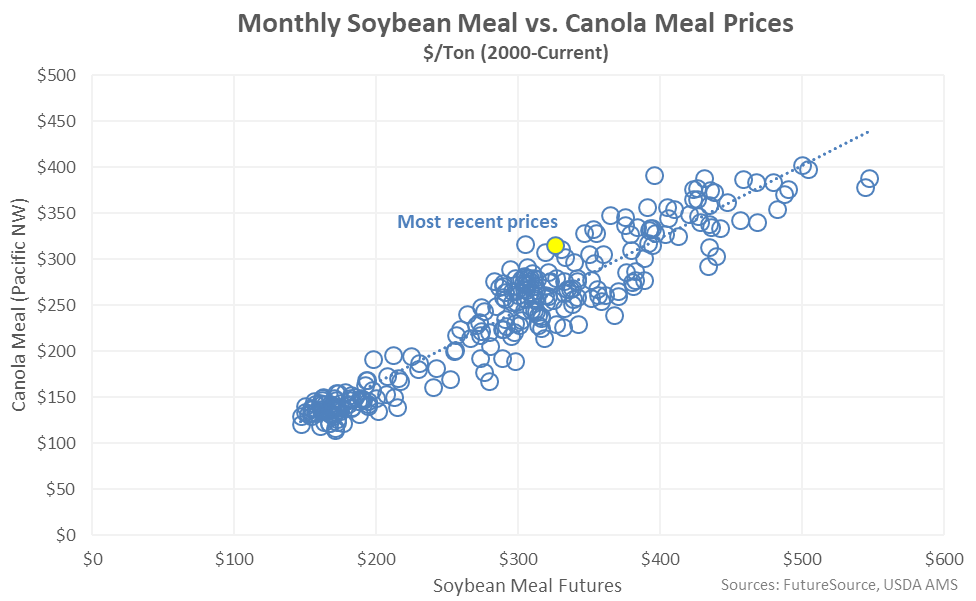

- Pacific Northwest canola meal prices correlate well with CME soybean meal prices for cross-hedging purposes. Monthly Pacific Northwest canola meal prices and CME soybean meal prices have exhibited a correlation coefficient of 0.95 since 2000.

Use in Dairy Cow Rations

Soybean meal has historically been the most widely used protein supplement in dairy cow rations, due in large part to its widespread availability, however canola provides an alternative source of high quality protein. The name “canola” is a contraction of Canadian Oil, Low Acid and is derived from low toxicity rapeseed. Canola is grown for its oil while the meal, which is a remaining byproduct after the oil is pressed from the seed, is used as a protein supplement. The majority of canola meal in the U.S. is fed to dairy cows because the high fat content of the meal enhances milk production.

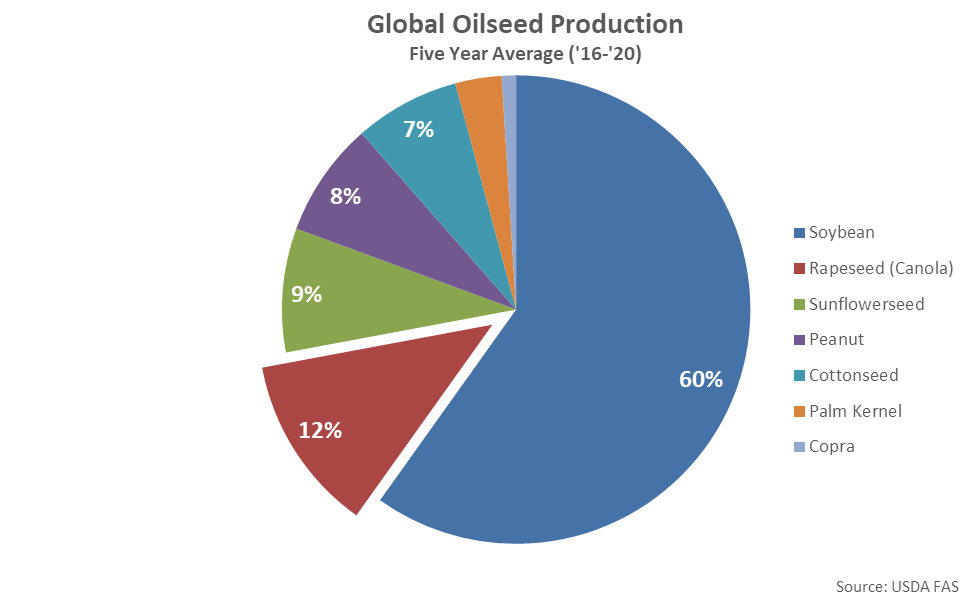

Soybeans have accounted for 60% of total global oilseed production over the past five years, whereas rapeseed (canola) accounted for only 12% of global oilseed production throughout the period. Despite the relatively small percentage of global oilseed production, canola remains among the largest oilseed protein feed sources for dairy cows after soybean meal.

Global Canola Overview

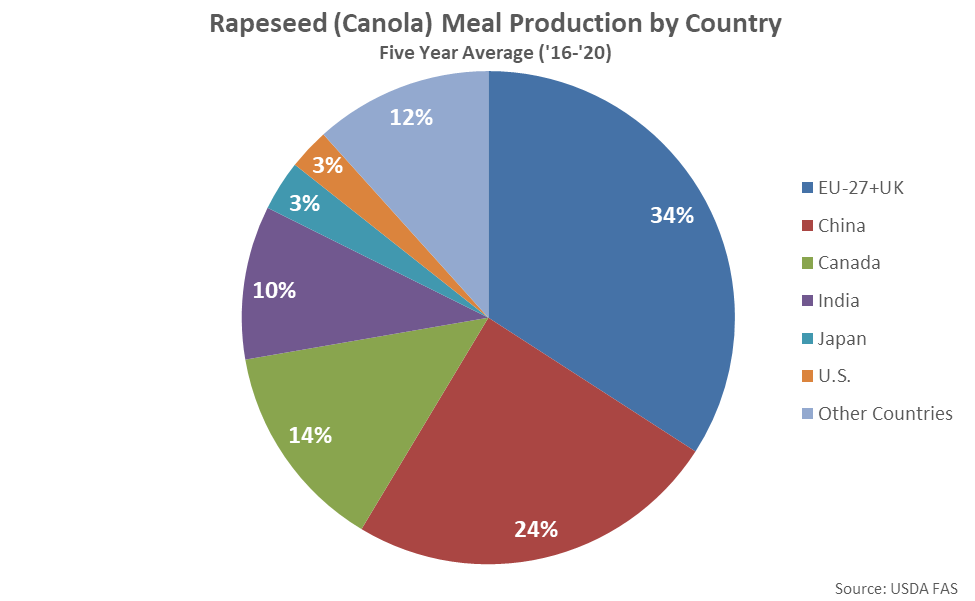

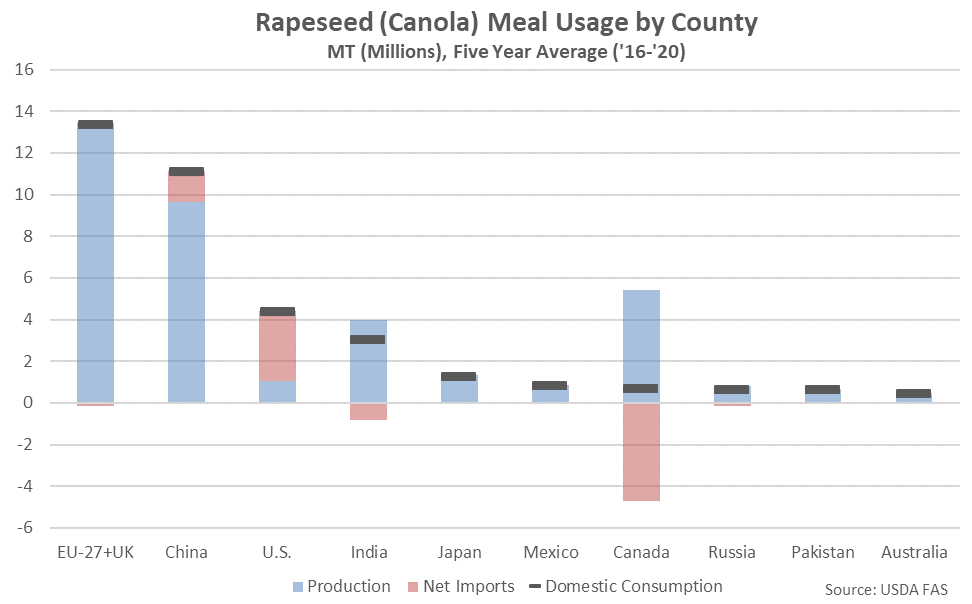

Global canola meal production is distributed among a few major producers, with the EU-27+UK, China, Canada and India combining to account for over 80% of total production throughout the past five production seasons. The U.S. accounted for just three percent of global canola meal production throughout the past five production seasons, however an abundance of supply is located nearby in Canada, as canola is the major oilseed crop grown throughout the country.

The EU-27+UK and China are not only the largest global producers of canola meal but are also the largest global consumers of the oilseed, combining to account for over 60% of total global consumption over the past five years. The U.S. is the third largest global consumer of canola meal, importing significant quantities from Canada. The U.S. is the primary importer of canola meal because of its proximity to Canada and the ease of cross-border trade. Canada has historically accounted for just under two-thirds of world trade in canola seed, meal and oil throughout the past five years and over 98% of all U.S. canola imports.

According to the Canola Council of Canada, canola generates one quarter of all farm cash receipts throughout Canada, with 90% of the product being exported outside of the country as seed, meal or oil. The U.S. is the largest importer of Canadian canola meal, accounting for over 80% of total Canadian canola meal export volumes throughout the past ten years.

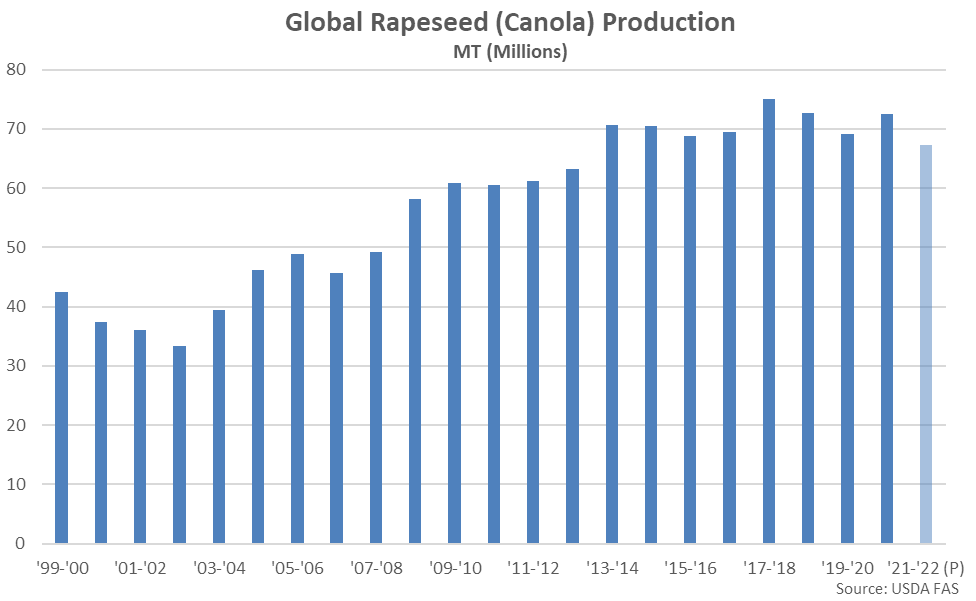

According to USDA projections, global canola production is expected to decline to a nine year low level throughout the ’21-’22 production season, driven lower by a reduction in the Canadian canola crop.

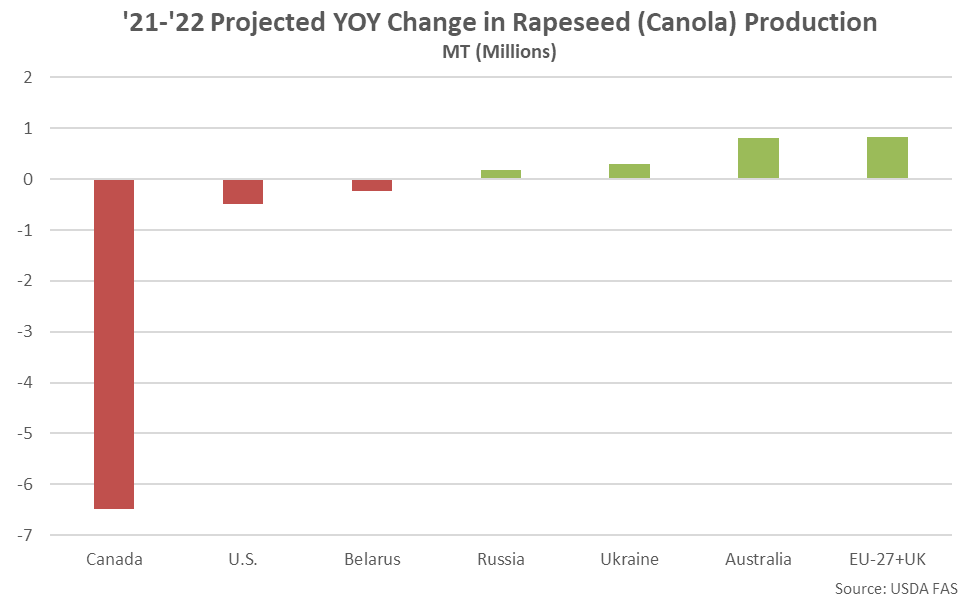

A 6.5 million MT YOY reduction in the ’21-’22 Canadian canola crop is expected to more than offset a 1.3 million MT YOY increase in the ’21-’22 canola crops experienced throughout all other countries. ’21-’22 canola production is projected to finish most significantly above previous year levels throughout the EU-27+UK and Australia.

Canadian Crop Update

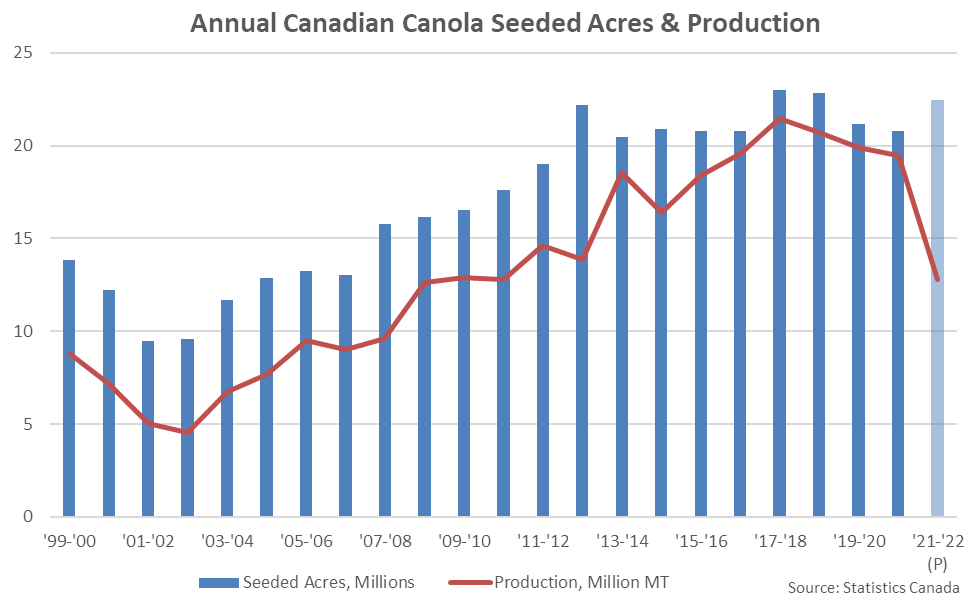

According to the Statistics Canada, ’21-’22 Canadian canola production is expected to reach a 13 year low level, finishing 34.4% below previous year levels. Seeded acres finished 8.2% above previous year levels, reaching the third highest annual level on record, however canola yields were significantly reduced throughout the ’21-’22 production season, a result of a severe drought experienced across the majority of Canada’s major canola producing areas.

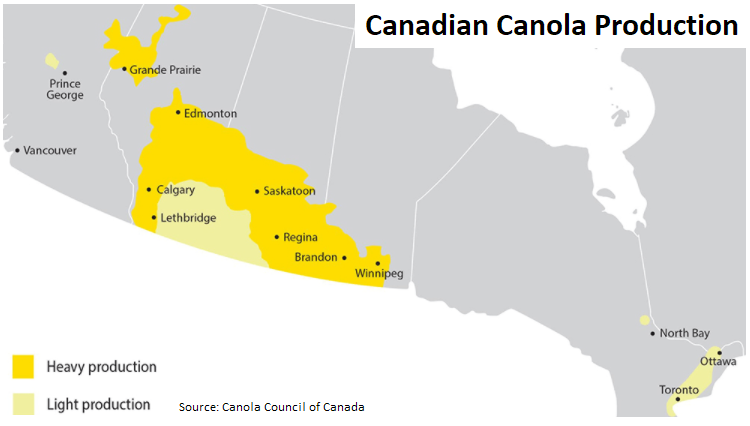

According to the Canola Council of Canada, Canadian canola is primarily grown in the western providences of Alberta, Saskatchewan and Manitoba, with minimal amounts grown in British Columbia, Ontario and Quebec.

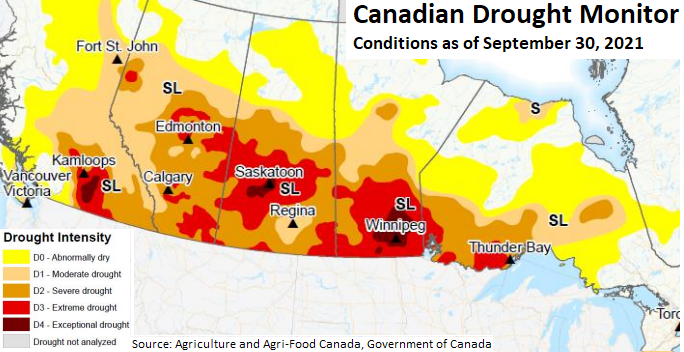

An overlay of regional Canadian drought monitor conditions show the majority of the heavy canola production areas remaining in a severe-to-extreme drought state as of the end of Sep ’21.

The drought conditions experienced throughout the Canadian canola growing season contributed to canola yields declining to a 19 year low level throughout the ’21-’22 production season. ’21-’22 Canadian canola yields finished 39.5% below previous year levels.

Canadian Canola Ending Stocks

According to Statistics Canada, Jul ’21 Canadian canola stocks declined to a four year low seasonal level and the second lowest seasonal level experienced throughout the past eight years, finishing 48.9% below previous year levels. The USDA projects ’21-’22 Canadian canola ending stocks will decline to a nine year low level.

When normalized for usage, Canadian canola stocks and Pacific Northwest canola meal prices provided by USDA AMS have exhibited a correlation coefficient of -0.66 since 2000. Pacific Northwest canola meal prices reached a record high level shortly after the Canadian canola stocks-to-use ratio declined to a record low level throughout the ’12-’13 production season. More recently, canola meal prices have once again rallied in line with a tight Canadian canola stocks-to-use ratio. The USDA expects the Canadian canola stocks-to-use ratio to decline to a nine year low level throughout the ’21-’22 production season.

Canola Meal vs. Soybean Meal Prices

Monthly Pacific Northwest canola meal prices have been strongly correlated to monthly CME soybean meal futures prices, historically, exhibiting a correlation coefficient of 0.95 since 2000. CME soybean meal prices have traded at a $54/ton average premium to Pacific Northwest canola meal prices over the period.

Summary

The U.S. accounts for just three percent of global canola production but is the largest global canola meal net importer, with the vast majority of imports originating from within Canada. North American canola supplies will likely be tight going forward as a severe drought experienced across the majority of Canada’s major canola producing areas is expected to result in yields declining to a 19 year low level. ’21-’22 Canadian canola production is expected to decline to a 13 low level as the reduction in yields is projected to more than offset higher seeded acres.

Pacific Northwest canola meal prices have historically exhibited a significant negative correlation with Canadian canola stocks-to-use ratios, strengthening when stocks are tight relative to usage. Canadian canola stocks reached a four year low seasonal level as of Jul ’21 and the second lowest seasonal level experienced throughout the past eight years. Pacific Northwest canola meal prices correlate well with CME soybean meal prices for cross-hedging purposes.