Quarterly Argentina Milk Production Update – Dec ’21

Executive Summary

Argentine milk production figures provided by the Argentina Ministry of Agriculture were recently updated with values spanning through the end of the first half of the ’21-’22 production season. Highlights from the updated report include:

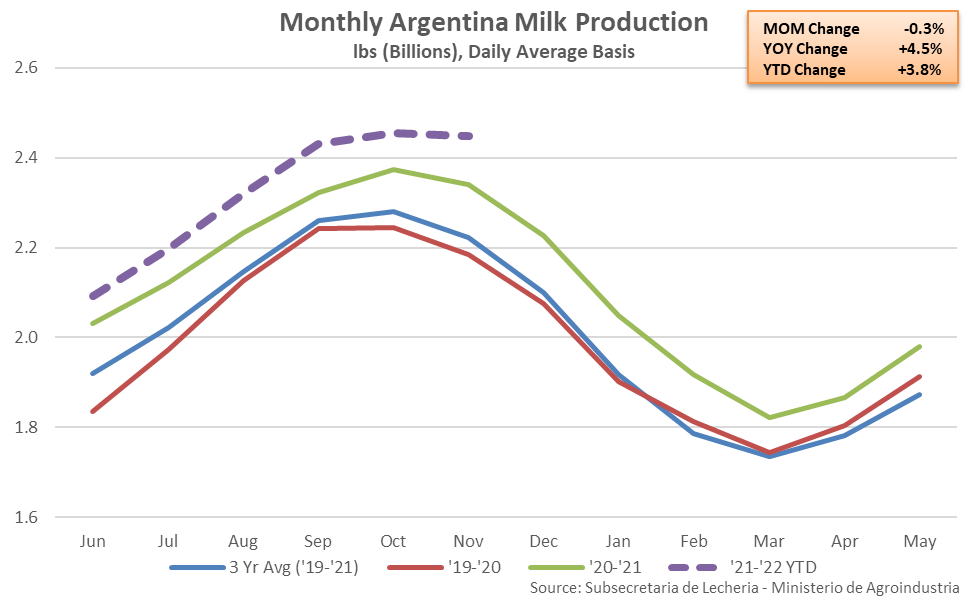

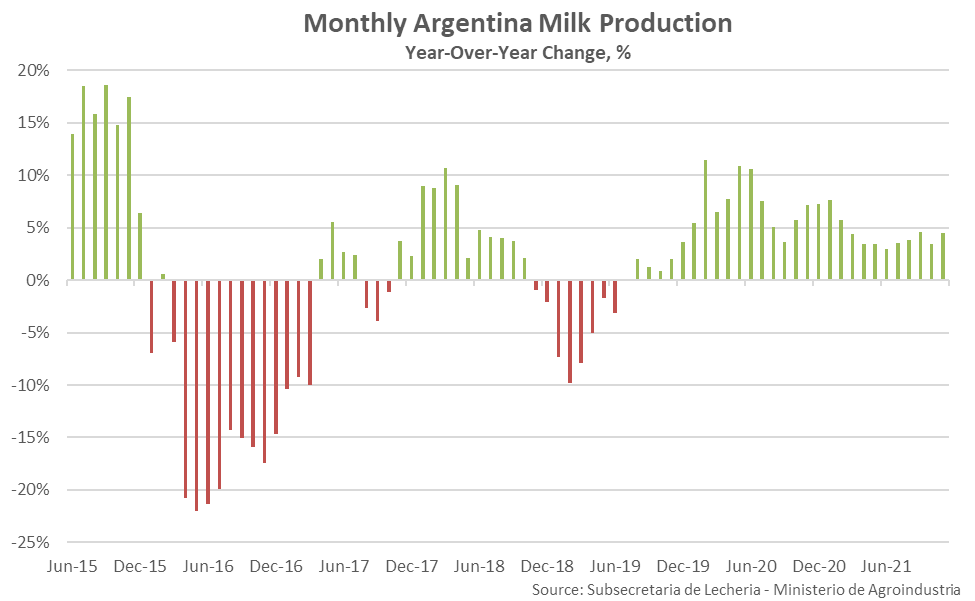

- Argentine milk production increased on a YOY basis for the 29th consecutive month during Nov ’21, finishing up 4.5% and reaching a six year high seasonal level.

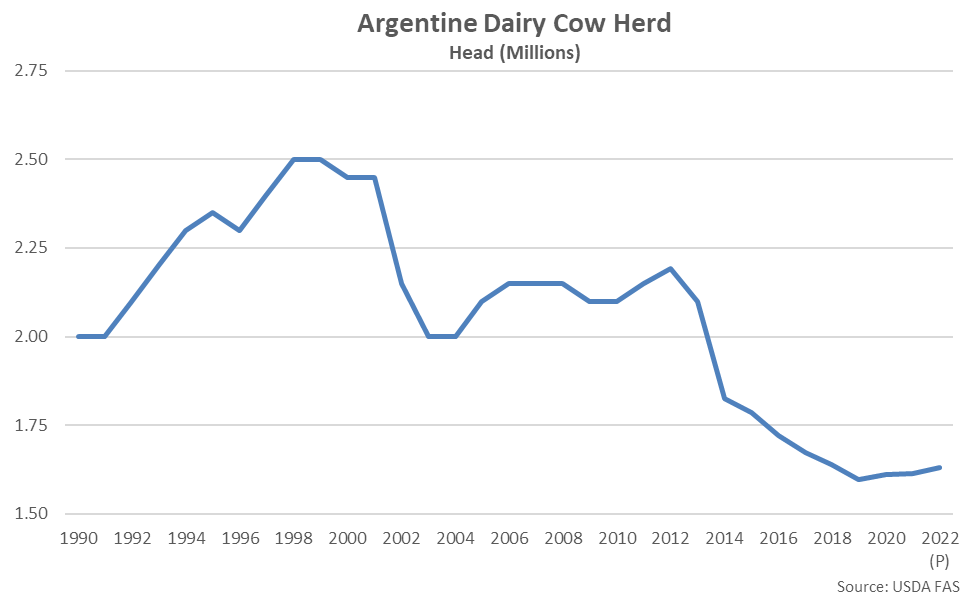

- The Argentine dairy cow herd is projected to increase by 0.9% on a YOY basis throughout 2022, rebounding to a four year high level. The Argentine dairy cow herd had reached the lowest level on record throughout 2019, prior to finishing higher throughout the past two years.

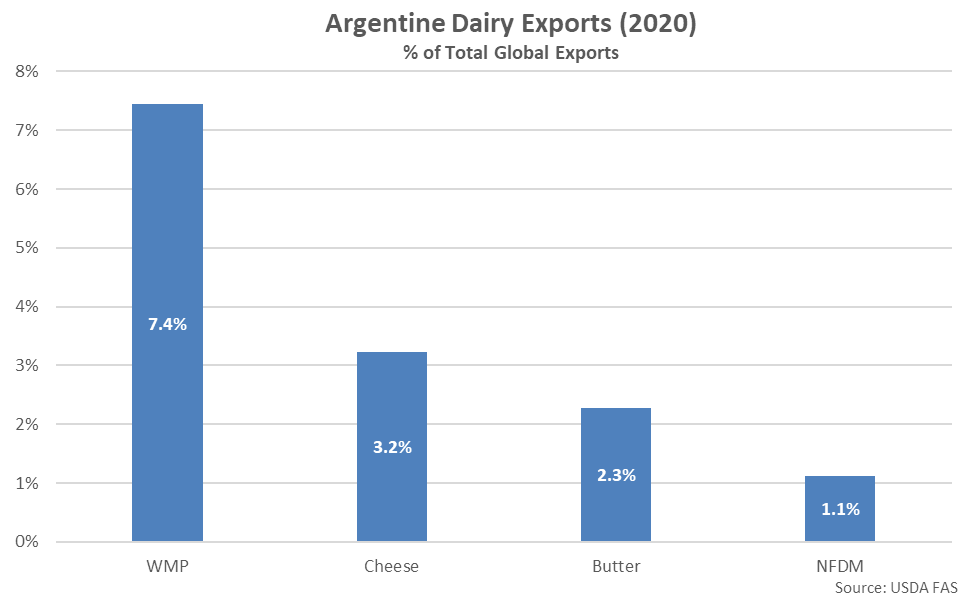

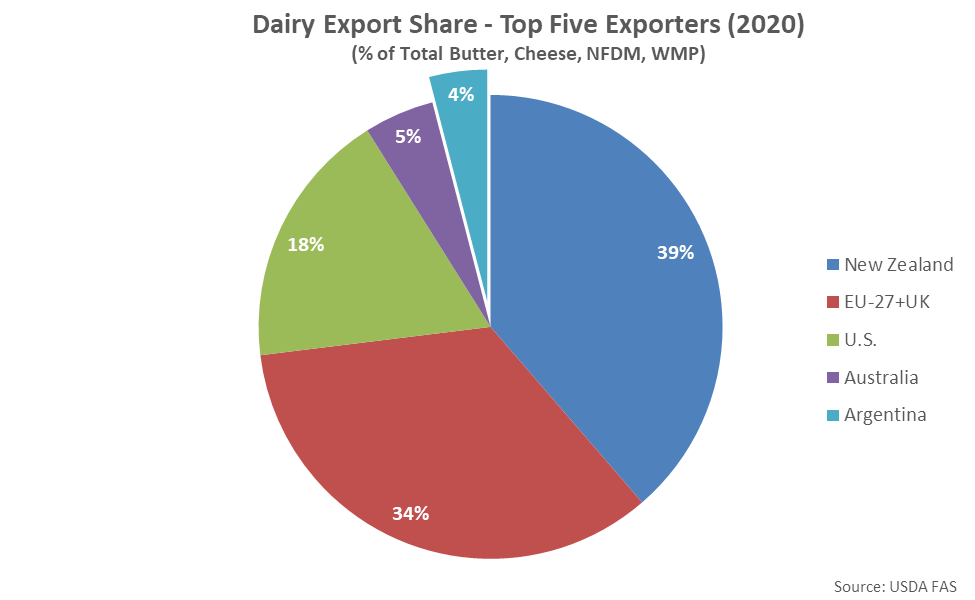

- Argentina is the fifth largest global dairy exporter, accounting for 4.0% of combined butter, cheese, nonfat dry milk and whole milk powder exports throughout 2020. The bulk of Argentine dairy exports are in the form of whole milk powder and cheese.

Additional Report Details

According to the Argentina Ministry of Agriculture, Nov ’21 Argentine milk production finished 4.5% above previous year levels, reaching a six year high seasonal level. The YOY increase in Argentine milk production volumes was the 29th experienced in a row.

’20-’21 annual Argentine milk production volumes finished 6.0% above previous year levels, reaching a five year high level. The annual YOY increase in Argentine milk production volumes was the largest experienced throughout the past nine years. ’21-’22 YTD Argentine milk production volumes have increased by an additional 3.8% on a YOY basis throughout the first half of the production season.

The USDA is projecting Argentine milk production will increase by 4.0% on a YOY basis throughout the 2021 calendar year as continued herd consolidation is expected to maintain positive margins for large-size dairies, despite increased feed costs and flat to slowly-rising milk prices. 2022 annual Argentine milk production volumes are expected to increase an additional 1.7%, reaching a record high annual level for the second consecutive year.

Recently experienced adverse conditions contributed to the Argentine dairy cow herd declining to a long-term record low level throughout 2019, finishing lower for the seventh consecutive year. The Argentine dairy cow herd rebounded by 0.8% throughout 2020, however, while the Argentine dairy cow herd is projected to increase by 0.3% on a YOY basis throughout 2021 and an additional 0.9% throughout 2022, rebounding to a four year high level. Recent declines in the Argentine dairy cow herd resulted in a consolidation of operations along with a culling of the lowest producing cows. The USDA expects the consolidation trend to continue throughout 2021 as margins for smaller dairies are currently negative, while mid-size and large dairies have positive margins.

Argentina is the second largest milk producing country in South America, trailing only Brazil, and the fifth largest global dairy exporter, trailing only New Zealand, the EU-27+UK, the U.S. and Australia. Of the aforementioned major dairy exporting regions, Argentina accounted for 3.7% of total combined milk production and 4.0% of combined butter, cheese, nonfat dry milk (NFDM) and whole milk powder (WMP) export volumes throughout 2020.

The bulk of Argentine dairy exports are in the form of WMP and cheese. Argentina was the third largest exporter of WMP throughout 2020, trailing only New Zealand and the EU-27+UK and accounting for 7.4% of global WMP export volumes. From a global perspective, WMP markets may be most affected by a continued rebound in Argentine milk production.