U.S. Dairy Cold Storage Update – Dec ’21

Executive Summary

U.S. cold storage figures provided by the USDA were recently updated with values spanning through Nov ’21. Highlights from the updated report include:

- Nov ’21 U.S. butter stocks declined seasonally to a 23 month low level while finishing 15.9% below previous year levels. Despite declining on a YOY basis, butter stocks remained at the second highest seasonal level experienced throughout the past 28 years.

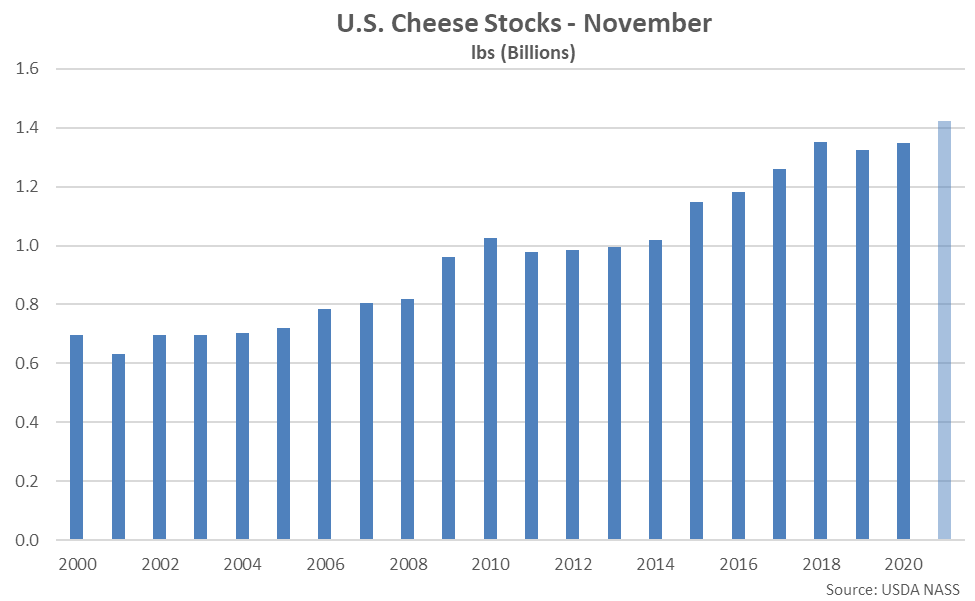

- Nov ’21 U.S. cheese stocks remained at a record high seasonal level for the seventh consecutive month, finishing 5.5% above previous year levels.

Additional Report Details

Butter – Stocks Remain Below Previous Year Levels for the Fourth Consecutive Month, Down 15.9%

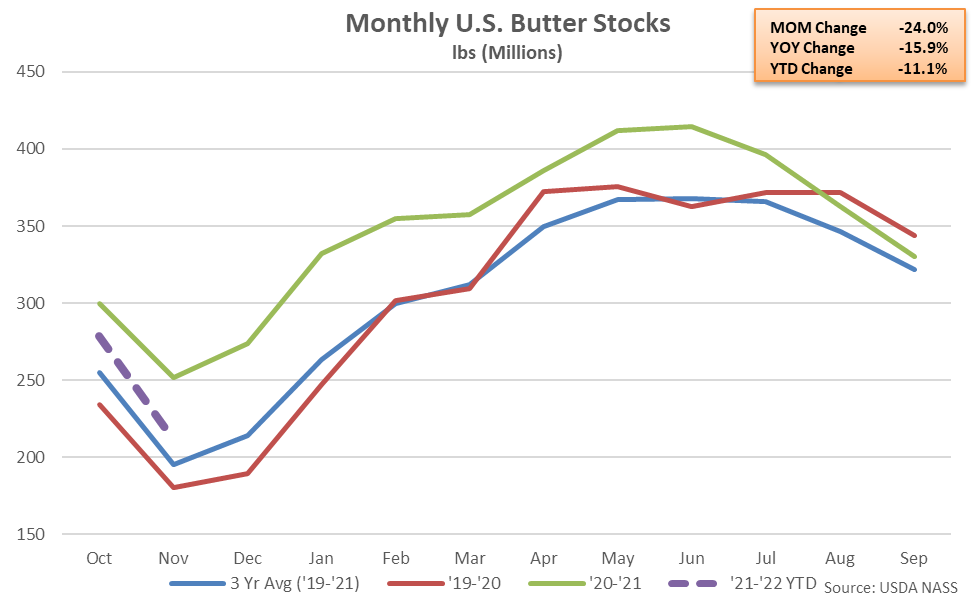

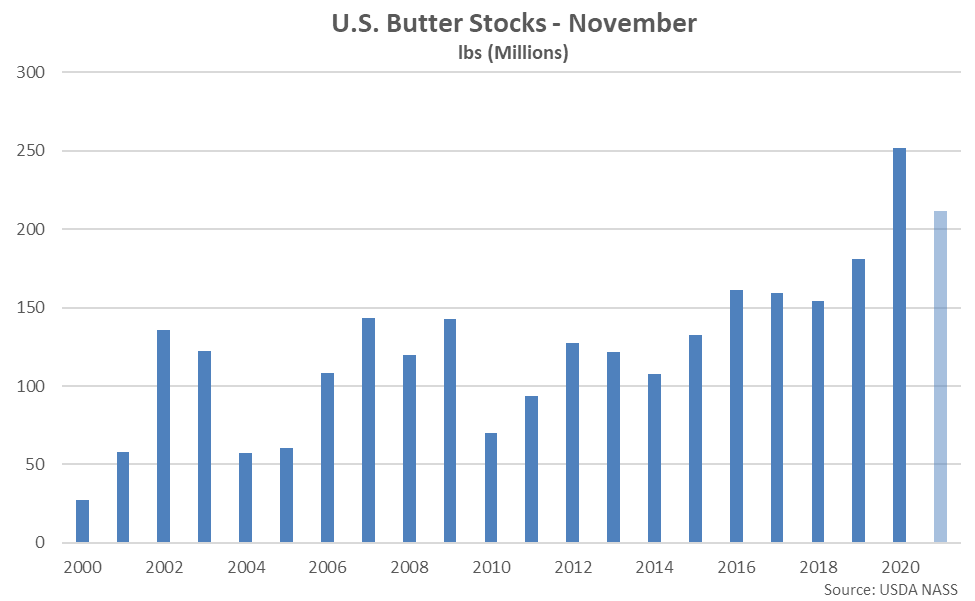

According to the USDA, Nov ’21 U.S. butter stocks declined seasonally to a 23 month low level while finishing 15.9% below previous year levels. The YOY decline in butter stocks was the fourth experienced in a row and the largest experienced throughout the past seven years on a percentage basis. Butter stocks had finished above previous year levels over 25 consecutive months through Jul ’21, prior to declining on a YOY basis over the four most recently available data points.

Despite declining on a YOY basis, butter stocks remained at the second highest seasonal level experienced throughout the past 28 years. The month-over-month decline in butter stocks of 67.0 million pounds, or 24.0%, was largely consistent with the ten year average October – November seasonal decline of 50.6 million pounds, or 25.5%. Butter stocks typically reach seasonal low levels throughout the month of November, prior to rebounding seasonally throughout the month of December and the first half of the following calendar year.

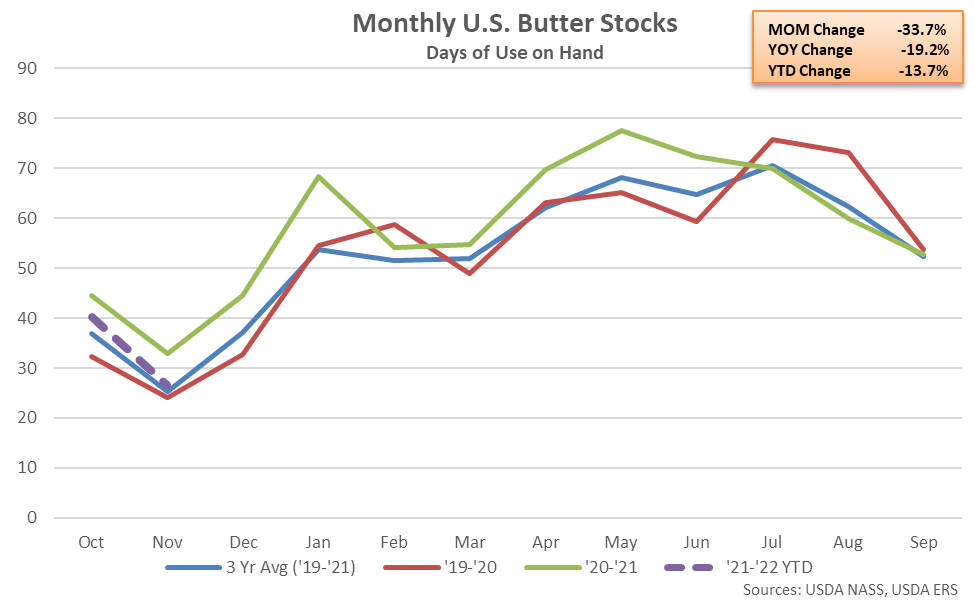

On a days of usage basis, Nov ’21 U.S. butter stocks also finished below previous year levels. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of Nov, butter stocks on a days of usage basis declined YOY for the fifth consecutive month, finishing down 19.2%.

Cheese – Stocks Remain at a Record High Seasonal Level, Finish 5.5% Higher YOY

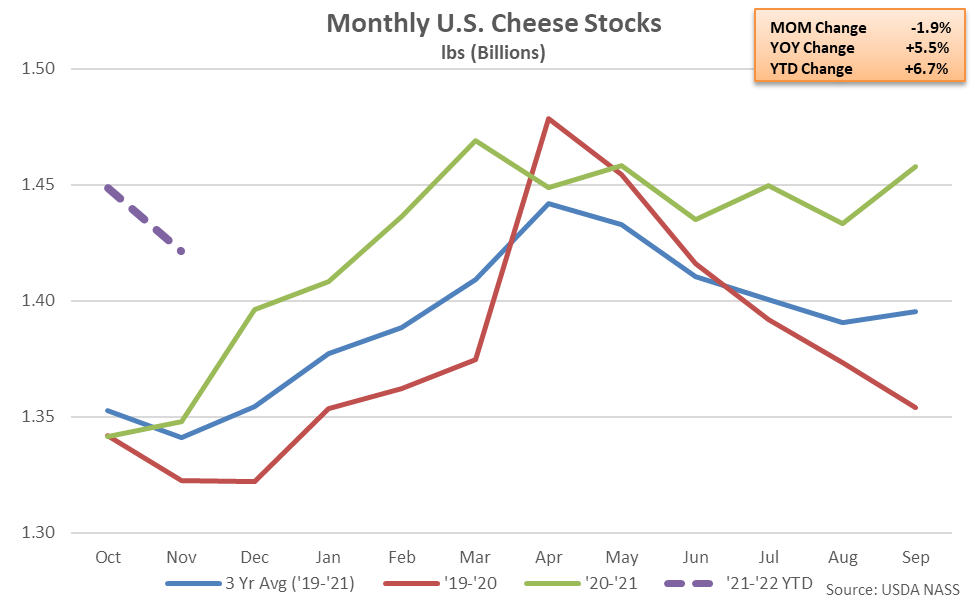

Nov ’21 U.S. cheese stocks declined seasonally to a ten month low level but remained 5.5% above previous year levels, reaching a record high seasonal level for the seventh consecutive month. The YOY increase in cheese stocks was the 12th experienced throughout the past 13 months but the smallest experienced throughout the past three months on a percentage basis.

American cheese stocks finished 9.6% higher on a YOY basis throughout the month while other-than-American cheese stocks finished 0.1% above previous year levels. The month-over-month decline in cheese stocks of 26.7 million pounds, or 1.9%, was slightly larger than the ten year average October – November seasonal decline of 13.3 million pounds, or 1.1%.

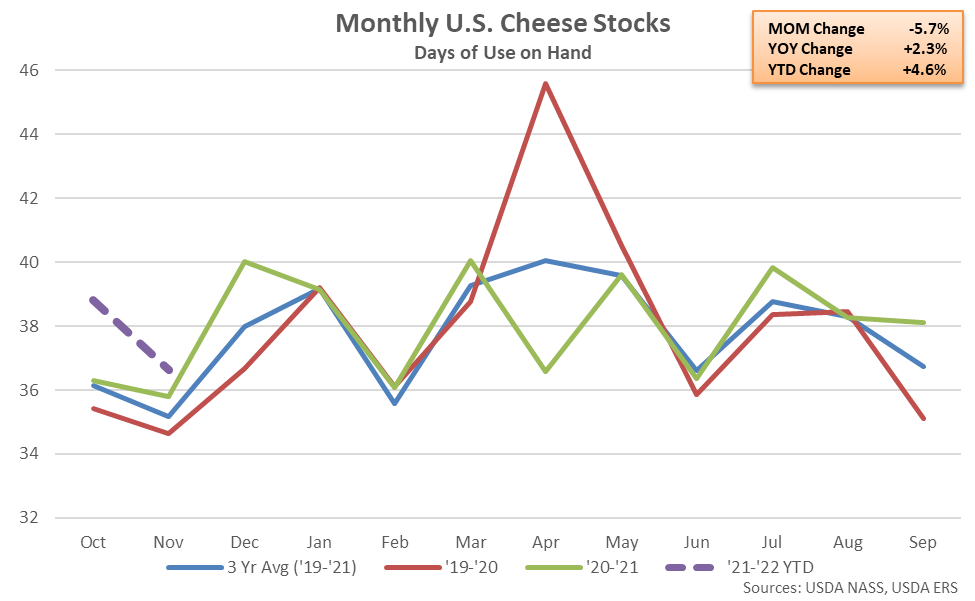

On a days of usage basis, Nov ’21 U.S. cheese stocks also finished above previous year levels. When assuming 12-month rolling average YOY changes in usage rates and known stock values for the month of November, cheese stocks on a days of usage basis increased YOY for the fifth time in the past six months, finishing up 2.3%.

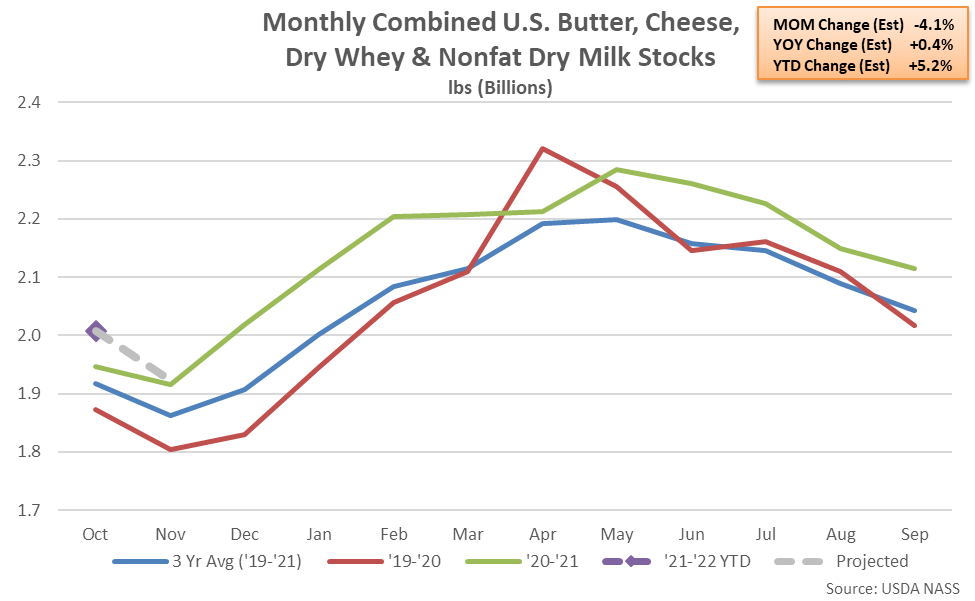

Combined Dairy Product Stocks – Nov ’21 Stocks Projected to Remain at a Record High Seasonal Level

Combined stocks of butter, cheese, dry whey and nonfat dry milk finished 3.2% above previous year levels throughout Oct ’21, remaining at a record high seasonal level for the 20th time in the past 21 months. Combined stocks of butter, cheese, dry whey and nonfat dry milk are projected to remain at a record high seasonal level throughout Nov ’21 when using actual butter and cheese stock figures and previous month YOY changes in dry whey and nonfat dry milk stocks, increasing by an estimated 0.4% on a YOY basis. A 2.1% YOY increase in butter and cheese stocks is expected to more than offset an estimated 8.0% YOY decline in dry whey and nonfat dry milk stocks throughout the month of November. Nov ’21 dry whey and nonfat dry milk stock figures are scheduled to be available Jan 6th.